Global Perimeter Video Analytics Market Size, Share Report By Component (Software, Services), By Deployment Mode (On-Premises, Cloud-Based), By Application (Intrusion Detection, People Counting, License Plate Recognition, Facial Recognition, Motion Detection, Others), By End-User (Commercial, Industrial, Government & Defense, Transportation, Critical Infrastructure, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec.2025

- Report ID: 169200

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- U.S. Market Size

- Component Analysis

- Deployment Mode Analysis

- Application Analysis

- End-User Analysis

- Emerging Trends

- Growth Factors

- Investment and Business Benefits

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

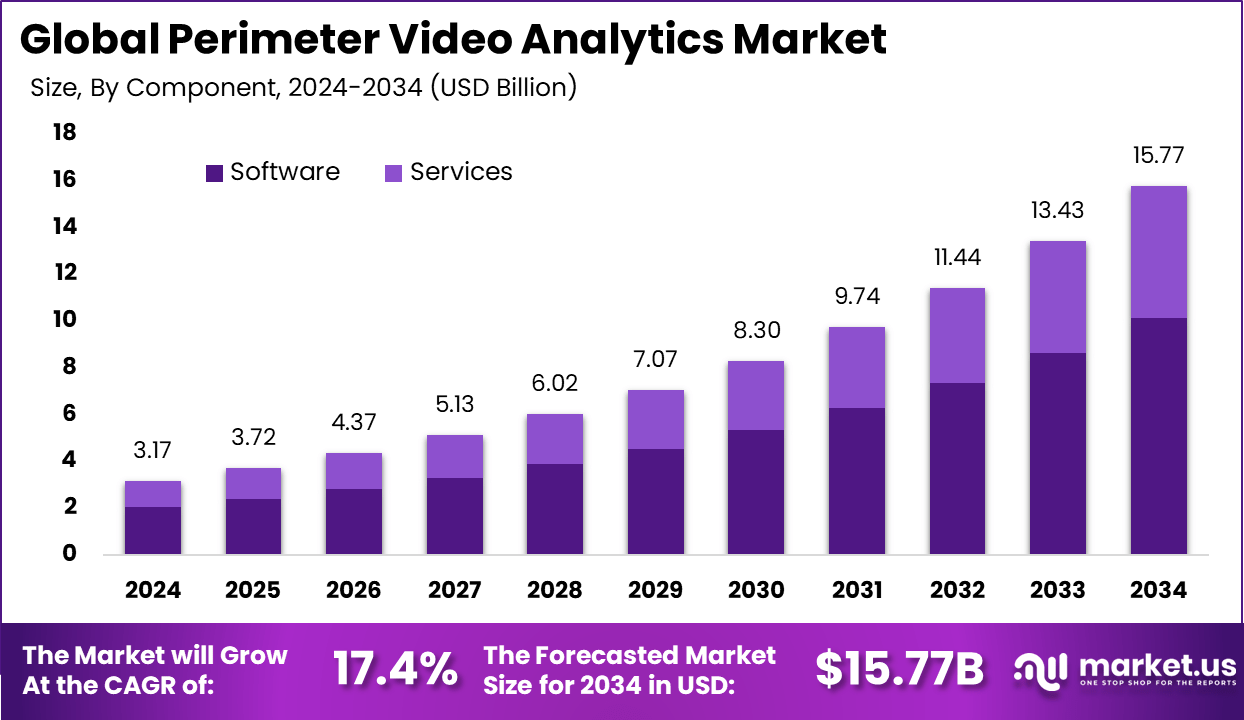

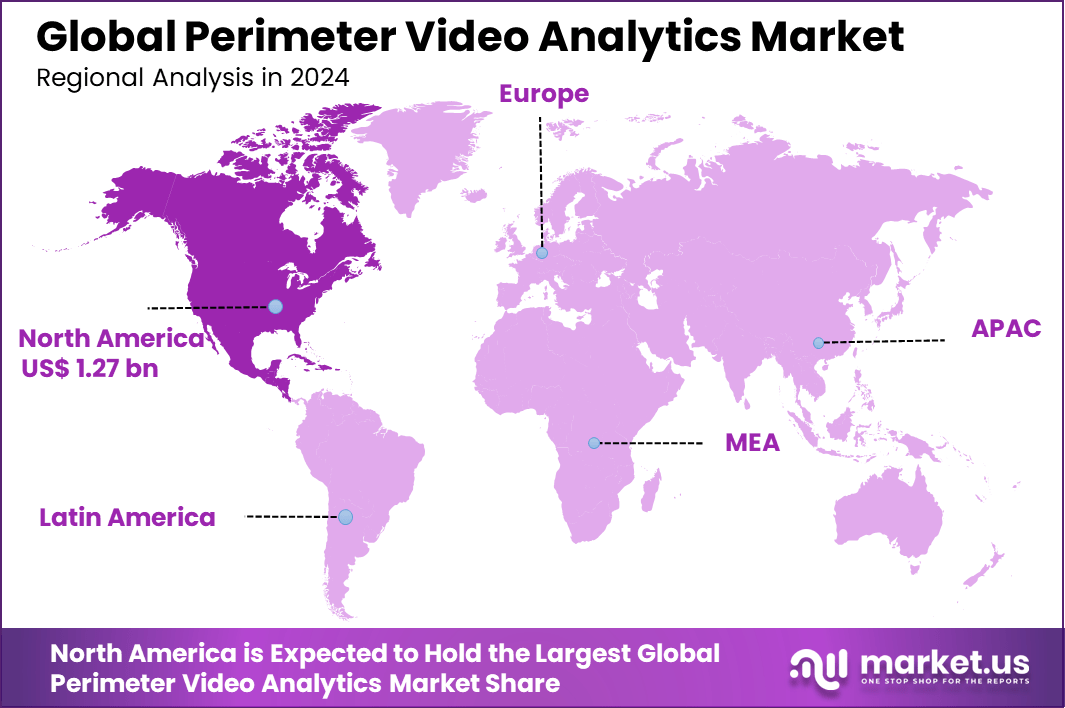

The Global Perimeter Video Analytics Market size is expected to be worth around USD 15.77 billion by 2034, from USD 3.17 billion in 2024, growing at a CAGR of 17.4% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 40.2% share, holding USD 1.27 billion in revenue.

The perimeter video analytics market has expanded as organisations adopt intelligent monitoring systems to secure boundaries around industrial sites, commercial facilities and public infrastructure. Growth reflects rising threats to physical assets, increased investment in surveillance automation and the need for accurate detection of intrusions without relying on manual monitoring. Video analytics technology now strengthens perimeter protection across a wide range of environments.

Top driving factors for perimeter video analytics include the growing need for better security against rising incidents of theft, vandalism, and illegal intrusions. Increasing concerns around protecting critical infrastructure, commercial properties, and industrial sites push demand for automated and intelligent surveillance solutions. Improved accuracy in detecting genuine threats while minimizing false alarms is a critical factor, supported by advancements in AI and machine learning technologies.

Growing incidents in public spaces and high value environments have reinforced the importance of early threat detection and rapid response. Intelligent video analytics support this by processing activities in real time and generating timely alerts, helping strengthen safety across sectors such as transportation, retail, and government facilities.

For instance, in April 2025, Bosch Security showed off its boosted IVA Pro Perimeter analytics at ISC West, layering AI detectors on top of motion tracking for long-range people detection. The tech picks up crawlers, rollers, or hidden intruders early, feeding guards real-time details like speed and spot to react faster. Teams get more heads-up time, which really matters at big fences.

Key Takeaway

- The software segment accounted for 64.3% in 2024, showing strong reliance on advanced analytics engines to detect threats across perimeter environments.

- On-premises deployment held 60.7%, reflecting organizations’ preference for tighter control over sensitive surveillance data.

- Intrusion detection and classification captured 43.5%, highlighting its role as the primary application for real-time perimeter monitoring.

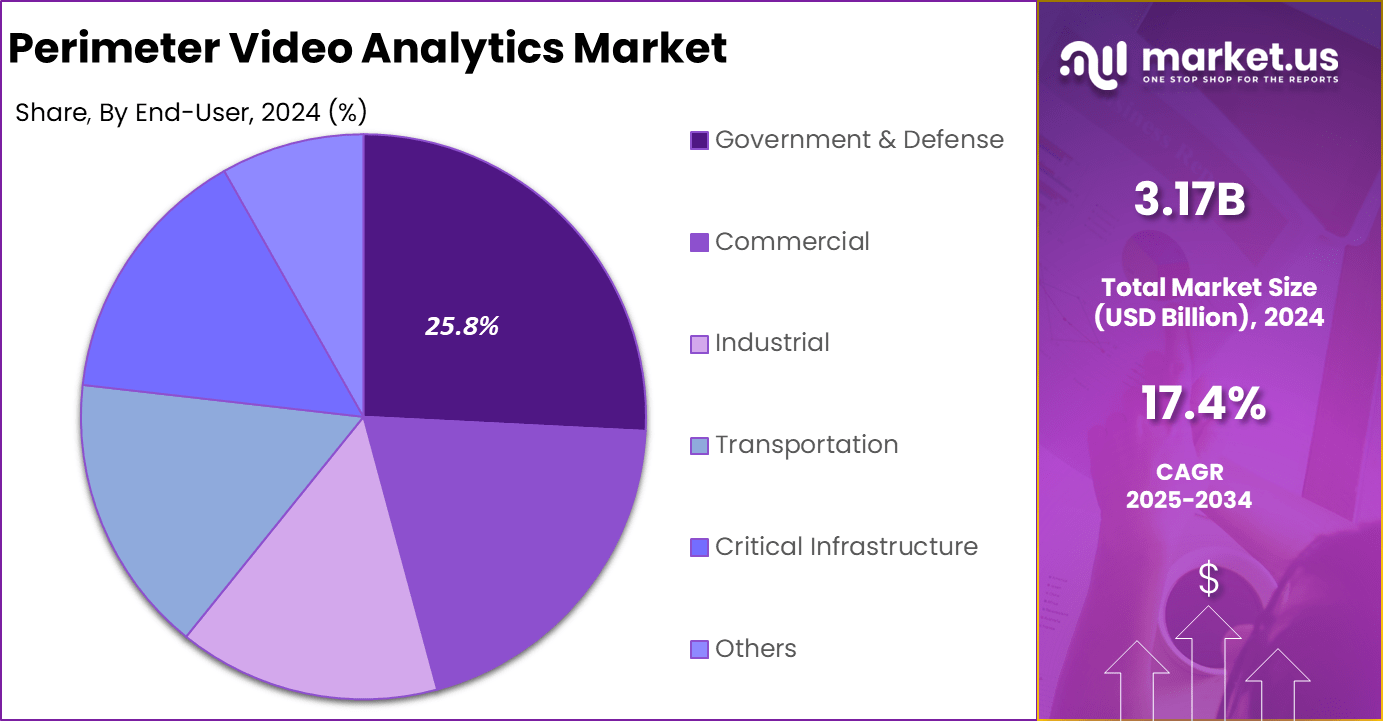

- The government and defense sector held 25.8%, supported by rising investment in secure border protection, public infrastructure surveillance, and critical asset monitoring.

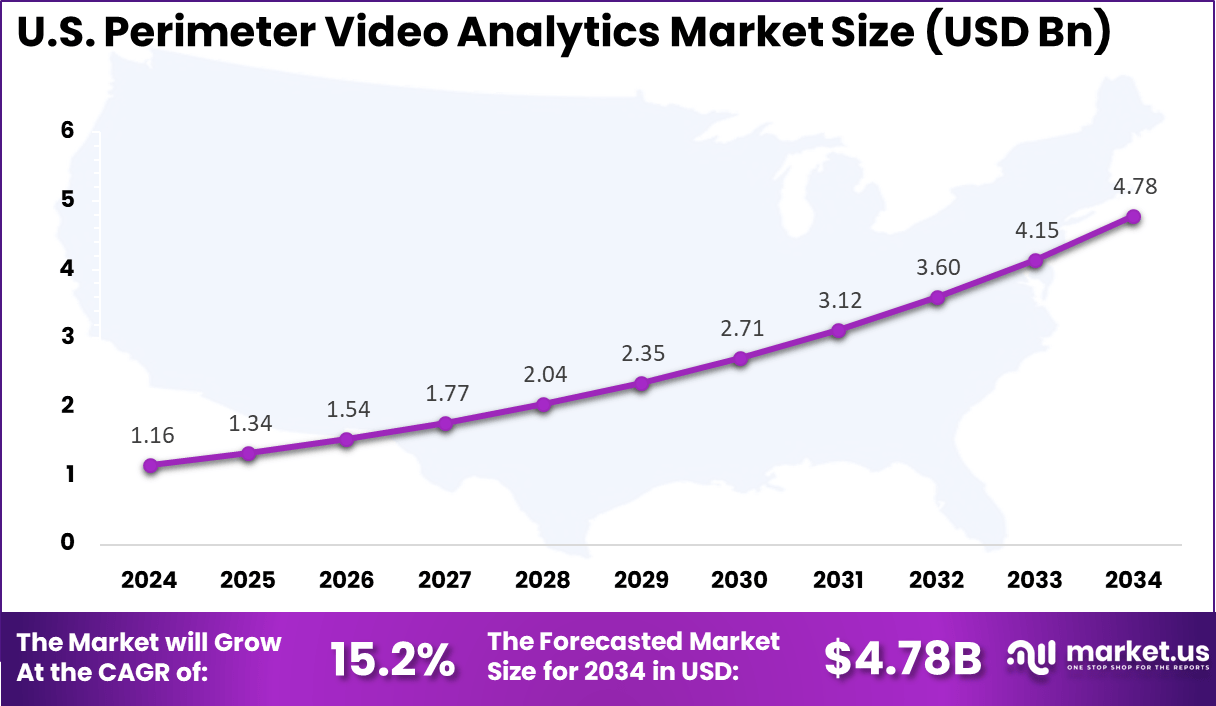

- The U.S. market reached USD 1.16 billion with a 15.2% CAGR, indicating sustained spending on intelligent perimeter security systems.

- North America accounted for 40.2%, driven by mature security deployments and continued modernization of surveillance infrastructure.

Role of Generative AI

Generative AI is transforming perimeter video analytics by enabling systems to understand complex environments with greater context and temporal awareness. It can automatically detect critical events, such as unauthorized access or equipment failure, and respond instantly by triggering alerts or predefined actions.

This makes video surveillance smarter and more proactive, increasing the effectiveness of perimeter security by providing real-time, actionable insights without needing deep technical knowledge from users. Studies show that generative AI agents are set to automate incident detection and resolution completely, enhancing security efficiency.

Additionally, generative AI enables video systems to connect multiple camera feeds into a single, clear view of a property. This integration helps security teams see the bigger picture and respond more effectively to threats. Improvements in AI accuracy now allow systems to better track movements and behaviors, reducing false alarms. This makes perimeter protection more dependable, especially in large or high-risk environments where quick decision-making is essential.

U.S. Market Size

The market for Perimeter Video Analytics within the U.S. is growing tremendously and is currently valued at USD 1.16 billion, the market has a projected CAGR of 15.2%. The market is growing due to rising security concerns across critical infrastructure, government facilities, and commercial properties.

Increasing adoption of advanced AI-powered video analytics software enhances real-time intrusion detection and threat classification, boosting operational efficiency. Heightened regulatory focus on safety and stringent compliance requirements also fuel demand. Additionally, the preference for on-premises deployment models, offering greater data control and low latency, supports robust market expansion.

For instance, in June 2025, BriefCam introduced its BriefCam 2024 M1 video analytics platform, enabling multi-site businesses to centralize video intelligence for better visibility and alert management. The platform aggregates video data across locations, supporting actionable business insights and operational efficiency.

In 2024, North America held a dominant market position in the Global Perimeter Video Analytics Market, capturing more than a 40.2% share, holding USD 1.27 billion in revenue. The market is driven by early technology adoption and strong government investment. The region emphasizes securing critical infrastructure and national borders, boosting demand for advanced perimeter surveillance solutions.

Supportive regulatory frameworks and increasing public-private partnerships further accelerate technology deployment. Additionally, North America’s mature security industry, combined with ongoing innovation in AI and edge computing, strengthens its leadership position in the perimeter video analytics market.

For instance, in October 2025, Genetec maintained its global leadership in video surveillance and analytics software, according to industry reports released in late 2025. The company further expanded its market share by enhancing its AI-driven perimeter detection and access control solutions. Genetec’s platform is widely used across diverse sectors, reinforcing North America’s dominance in advanced video analytics technology.

Component Analysis

In 2024, The Software segment held a dominant market position, capturing a 64.3% share of the Global Perimeter Video Analytics Market. This dominance is driven by the increasing demand for intelligent video processing capabilities that enhance security detection, classification, and response activities. Software solutions offer flexibility in integrating with various surveillance hardware, enabling real-time analytics and automated alerts, which are critical for timely threat identification.

Software’s appeal also lies in its continuous advancements in AI and machine learning, which improve precision in detecting intrusions while reducing false alarms. Given its central role in the operation and management of perimeter surveillance systems, software remains the key growth driver for this market segment.

For Instance, in December 2025, Axis Communications launched AI-powered bullet cameras with edge analytics built on the ARTPEC-9 chipset. These cameras handle object detection and classification right at the source for faster perimeter monitoring. The software supports AV1 encoding to cut storage needs while keeping high image quality. This move strengthens software’s lead in real-time threat processing.

Deployment Mode Analysis

In 2024, the On-Premises segment held a dominant market position, capturing a 60.7% share of the Global Perimeter Video Analytics Market. Many organizations, especially those with critical infrastructure and sensitive data environments, prefer storing and processing video analytics on their own servers to mitigate concerns about data breaches and latency.

On-premises solutions enable faster processing speeds and allow customization according to organizational requirements, making them especially suitable for government, defense, and large enterprises. Despite the growing adoption of cloud platforms, on-premises remains the dominant model for perimeter video analytics.

For instance, in August 2025, Bosch enhanced its IVA Pro analytics for on-premises cameras focused on long-range perimeter protection. The software runs edge AI to track objects and ignore false triggers in crowded scenes. It provides GPS coordinates for precise mapping. On-premises deployment keeps data secure for high-stakes environments.

Application Analysis

In 2024, the Intrusion Detection & Classification segment held a dominant market position, capturing a 43.5% share of the Global Perimeter Video Analytics Market. This reflects the vital importance of identifying unauthorized access or suspicious activities along protected perimeters. Analytics systems focus on distinguishing between real threats and benign movements to minimize false alarms and improve response efficiency.

This application underpins many security operations across commercial, industrial, and government sites. Advanced algorithms combining video analytics with sensors allow quick categorization of potential intrusions, strengthening overall perimeter defense.

For Instance, in September 2025, Hikvision released Intelligent Perimeter Protection with DeepinView cameras using large AI models. The system combines video analytics and radar for accurate intrusion classification day or night. It links PTZ cameras for detailed tracking of threats. This boosts classification accuracy and cuts response times.

End-User Analysis

In 2024, The Government & Defense segment held a dominant market position, capturing a 25.8% share of the Global Perimeter Video Analytics Market. These sectors demand robust surveillance solutions to protect critical assets, borders, and high-security facilities.

The priority is often on reliability, real-time threat identification, and integration with broader security infrastructures. Public sector investments in advanced surveillance technologies continue to bolster demand for perimeter video analytics, driven by increasing geopolitical tensions and emphasis on national security.

For Instance, in November 2025, BriefCam added advanced analytics to its platform for government investigations with real-time intrusion alerts. The software handles perimeter events with object tracking and watchlist matching. It integrates with VMS for quick evidence review. This supports defense needs for proactive security.

Emerging Trends

Emerging trends in perimeter video analytics include moving more data processing nearer to the cameras, known as edge computing. This shift allows video systems to analyze information faster and react in real time without waiting to send data to central servers.

Increasing use of multiple types of sensors combined in a single system is also becoming common. These new setups bring richer data and more precise detection, especially useful in complex areas like transport hubs or industrial sites.

Another trend is integrating location tracking technologies with video analytics to map events in real time on digital maps. This helps security teams coordinate their response with better situational awareness. Combining video with other technologies like access controls and communication tools is growing, creating a more connected and thorough security system. This makes it easier to manage risks across wide and complex perimeters.

Growth Factors

Growth in perimeter video analytics comes from the rising demand for automatic threat detection and faster security responses. Many organizations want systems that can spot dangers without delay and reduce the number of false alarms.

Advances in AI and video technologies have enabled this level of performance, helping facilities secure assets effectively. Linking perimeter cameras with other smart devices has also increased, improving overall security network reliability and responsiveness.

The changes in global security threats also push more organizations to invest in smarter video surveillance. New AI techniques help systems learn and adapt to changing risk patterns, keeping pace with evolving threats. Improvements in combining different sensor inputs, like motion and thermal detection, help create a clearer picture of possible breaches, making perimeter security more robust and adaptive.

Investment and Business Benefits

Investment in perimeter video analytics is expanding in areas like improving AI for better threat recognition and extending edge computing to handle data faster at the camera level. Developing systems that integrate with other security tools, such as access control, opens new opportunities.

Key sectors for these investments include infrastructure, industry, and smart cities, where perimeter safety is critical. These investments aim to create more efficient and comprehensive security solutions that meet increasing protection demands and adapt quickly to emerging threats.

Perimeter video analytics provides many business benefits, including fewer false alarms, faster responses to threats, and better use of security staff thanks to automation. By offering improved situational awareness, organizations can better understand and manage security risks.

This technology also helps streamline operations, cutting costs linked to manual surveillance and unnecessary dispatch of personnel. These advantages make it attractive for various industries needing reliable, cost-efficient perimeter protection to safeguard assets and ensure safety.

Key Market Segments

By Component

- Software

- Services

- Professional Services

- Managed Services

- Support & Maintenance

By Deployment Mode

- On-Premises

- Cloud-Based

By Application

- Intrusion Detection

- People Counting

- License Plate Recognition

- Facial Recognition

- Motion Detection

- Others

By End-User

- Commercial

- Industrial

- Government & Defense

- Transportation

- Critical Infrastructure

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Security Threats Boost Demand

The market is being driven by growing concerns over unauthorized entry, theft, and vandalism, particularly in retail environments and critical infrastructure. As criminal activity becomes more frequent, organizations require surveillance systems that can identify threats quickly and reduce dependence on manual monitoring. Perimeter video analytics support this need by providing real time detection and timely alerts that strengthen overall response.

Increasing reports of criminal activities like shoplifting and trespassing have highlighted the need for reliable security technologies. By identifying intrusions and suspicious behaviors with fewer false alarms, perimeter video analytics provide significant value for security personnel and monitoring centers. This surge in security challenges across various industries is a key factor propelling market growth.

For instance, in November 2024, Bosch introduced IVA Pro Perimeter at ISC West, using AI to spot people approaching fences from afar, even if crawling or hidden. It gives security teams extra time with details like speed and location, directly tackling higher intrusion rates. This fits the push for proactive defenses amid climbing crime stats.

Restraint

High Implementation Costs and Privacy Concerns

One major restraint on the perimeter video analytics market is the high cost associated with implementation. Advanced analytics solutions need investment in high-resolution cameras, AI-driven software, servers, and integration, which can be prohibitive, especially for smaller organizations. Ongoing costs, including maintenance, upgrades, and licensing, can also limit widespread adoption.

Privacy and data protection issues further complicate the deployment of perimeter video analytics. Regulations on surveillance and concerns about misuse of personal data require organizations to invest in secure data handling, anonymization, and compliance efforts. These costs and legal challenges can slow down adoption rates, particularly in regions with strict surveillance laws.

For instance, in February 2025, Avigilon updated audio analytics integration, yet combining with existing systems demands big investments in upgrades and training. High costs for AI features deter budget-limited users, while data privacy in audio-video setups needs extra safeguards. This slows rollout for many mid-size operations.

Opportunities

Integration with AI and IoT Technologies

The perimeter video analytics market has significant opportunities through the integration of artificial intelligence and Internet of Things (IoT) platforms. AI enhances analytics capabilities to more accurately detect threats, reduce false alarms, and automate responses. IoT connectivity enables real-time data sharing between sensors, cameras, and central monitoring systems for comprehensive security coverage.

As AI-powered video analytics evolve, markets are expanding for smart, adaptive security systems that can learn and improve over time. Additionally, IoT integration supports scalable security frameworks suitable for large industrial, government, and transportation infrastructures, opening new avenues for market expansion.

For instance, in August 2025, Dahua unveiled Xinghan AI models with WizSeek for natural language searches on video feeds, tying into IoT for quick threat spotting. It boosts accuracy in crowds or vehicles, creating chances in transport and retail via connected ecosystems. Such advances fuel expansion in adaptive security networks.

Challenges

Technical Complexity and System Integration

A key challenge in perimeter video analytics is the technical complexity of deploying and maintaining these systems. Integrating advanced video analytics with existing infrastructure, including legacy camera networks, can be difficult. Ensuring seamless operation across different sites requires continuous software updates, calibration, and monitoring.

Operational efficiency may be affected by the need for skilled technicians to manage complex AI algorithms and hardware setups. Any lapses can lead to reduced system performance or gaps in security coverage. Overcoming these technical barriers is critical for industry players aiming to deliver reliable and user-friendly perimeter video analytics solutions.

For instance, in June 2025, Genetec partnered with Hanwha Vision for public safety video analytics, facing challenges in merging object detection with existing networks for Thames Valley Police. Skilled setup and updates remain key hurdles for reliable operation.

Key Players Analysis

One of the leading players in December 2025, Axis Communications rolled out fresh AI-powered cameras, including a thermal-visual PTZ unit and tough bullet models built for sharp perimeter monitoring. These edge devices cut through false alarms with smart object spotting, giving security teams clearer views even in bad weather or at night. It’s the kind of practical upgrade that keeps sites safer without constant human watching.

Top Key Players in the Market

- Axis Communications

- Bosch Security Systems

- Honeywell International Inc.

- Avigilon (Motorola Solutions)

- Hikvision Digital Technology

- Dahua Technology

- FLIR Systems

- Genetec Inc.

- Agent Video Intelligence (Agent Vi)

- BriefCam

- Qognify

- VIVOTEK Inc.

- Hanwha Techwin

- Others

Recent Developments

- In April 2025, Bosch Security showed off its boosted IVA Pro Perimeter analytics at ISC West, layering AI detectors on top of motion tracking for long-range people detection. The tech picks up crawlers, rollers, or hidden intruders early, feeding guards real-time details like speed and spot to react faster. Teams get more heads-up time, which really matters at big fences.

- In November 2025, Avigilon, now under Motorola Solutions, sharpened its AI analytics for perimeter alerts, tying object tracking to radio systems for instant responder pings. Real-time flags for line breaks or odd moves help cut response lags, especially in busy or open areas. It’s a solid step for tying video straight into action.

Report Scope

Report Features Description Market Value (2024) USD 3.17 Bn Forecast Revenue (2034) USD 15.7 Bn CAGR(2025-2034) 17.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment Mode (On-Premises, Cloud-Based), By Application (Intrusion Detection, People Counting, License Plate Recognition, Facial Recognition, Motion Detection, Others), By End-User (Commercial, Industrial, Government & Defense, Transportation, Critical Infrastructure, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Axis Communications, Bosch Security Systems, Honeywell International Inc., Avigilon (Motorola Solutions), Hikvision Digital Technology, Dahua Technology, FLIR Systems, Genetec Inc., Agent Video Intelligence (Agent Vi), BriefCam, Qognify, VIVOTEK Inc., Hanwha Techwin, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Perimeter Video Analytics MarketPublished date: Dec.2025add_shopping_cartBuy Now get_appDownload Sample

Perimeter Video Analytics MarketPublished date: Dec.2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Axis Communications

- Bosch Security Systems

- Honeywell International Inc.

- Avigilon (Motorola Solutions)

- Hikvision Digital Technology

- Dahua Technology

- FLIR Systems

- Genetec Inc.

- Agent Video Intelligence (Agent Vi)

- BriefCam

- Qognify

- VIVOTEK Inc.

- Hanwha Techwin

- Others