Global Peracetic Acid Market By Purity (Solution and Distilled) By Application (Sterilizer, Sanitizer, Disinfectant, and Other Applications), By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 18945

- Number of Pages: 361

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

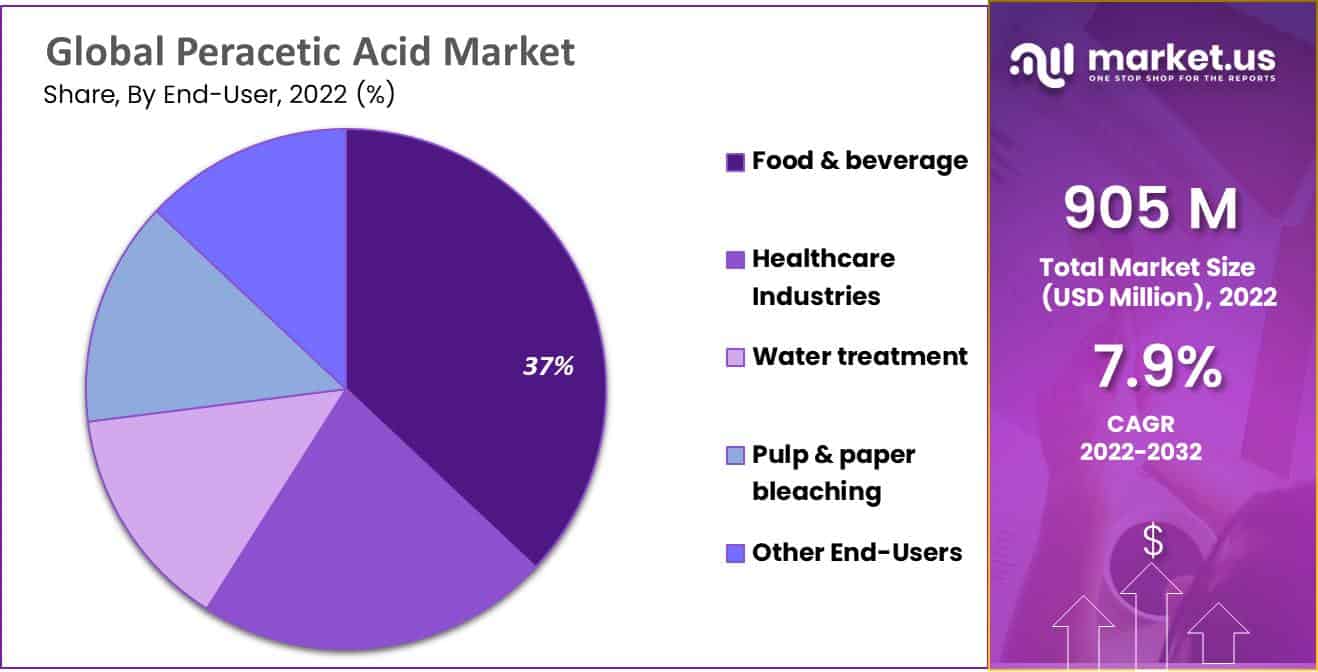

In 2022, the Global Peracetic Acid Market was valued at USD 905 million, and is projected to reach USD 1,899 Million in 2032 Between 2023 and 2032, this market is estimated to register the highest CAGR of 7.9%.

Peracetic acid is a liquid chemical that is highly acidic. Its production is done by using acetic acid and hydrogen peroxide. After the ozone, it is considered one of the most effective agents. It is widely used in different industries, especially food, for equipment cleaning and sterilizing applications.

Peracetic is also known as peroxyacetic acid. With a distinctive pungent odor reminiscent of acetic acid, it is a colorless liquid that can be very corrosive. The global peracetic acid market is proliferating and is anticipated to grow significantly with increasing demand from the end-use industries during the forecast period.

Product development, as per the needs of specific applications in numerous industries, will likely be an essential factor in expanding the peracetic acid market in the coming years.

Key Takeaways

Market Growth: By 2032, the Peracetic Acid Market is projected to reach USD 76.9 billion with an impressive compound annual growth rate of 7.9%.

Rising Demand: Peracetic acid has seen its demand skyrocket due to various reasons, such as its effectiveness as a biocide, disinfectant, and sterility across industries like food and beverage production, healthcare provisioning, water treatment services, and agriculture.

Peracetic Acid’s Rising Trend: Since its invention, peracetic acid has experienced exponential growth in terms of usage.

Peracetic Acid’s Surge in Popularity: Peracetic acid has seen increasing adoption across various industries due to its ability to effectively eliminate pathogens, viruses, and bacteria; driving its use both industrially and commercially. Media coverage detailing its eco-friendliness further propelled its rise.

Drivers: Key factors driving growth in the peracetic acid market include increasing concerns for hygiene and sanitation, strict regulations surrounding disinfection and water treatment methods, as well as its rising use by food and beverage businesses to increase food safety.

Restraints: Obstacles to the growth of the peracetic acid market include safety concerns when handling and storing concentrated peracetic acid solutions; and regulatory restrictions regarding maximum permissible concentration levels across applications.

Opportunity: The peracetic acid market presents significant growth potential due to an increasing need for effective disinfectants and sanitizers in light of the COVID-19 pandemic. Focusing on eco-friendly disinfection solutions further augments this market’s expansion potential.

Trends: In terms of trends within the peracetic acid market, key considerations include an increasing focus on eco-friendly disinfectants as well as innovation with peracetic acid formulations to increase efficacy, as well as research and development initiatives geared at expanding its applications.

Purity Analysis: Of these categories, the solution segment is projected to generate the greatest revenue throughout its forecast period.

Application Analysis: In 2022, disinfectants held the largest market share and are expected to remain dominant during this forecast period due to the widespread adoption of peracetic acid as a disinfectant in water treatment, food & beverage manufacturing, and healthcare environments.

End User Analysis: Of these end-use industries, food and beverage topped the global market and is projected to generate significant revenues during its forecast period.

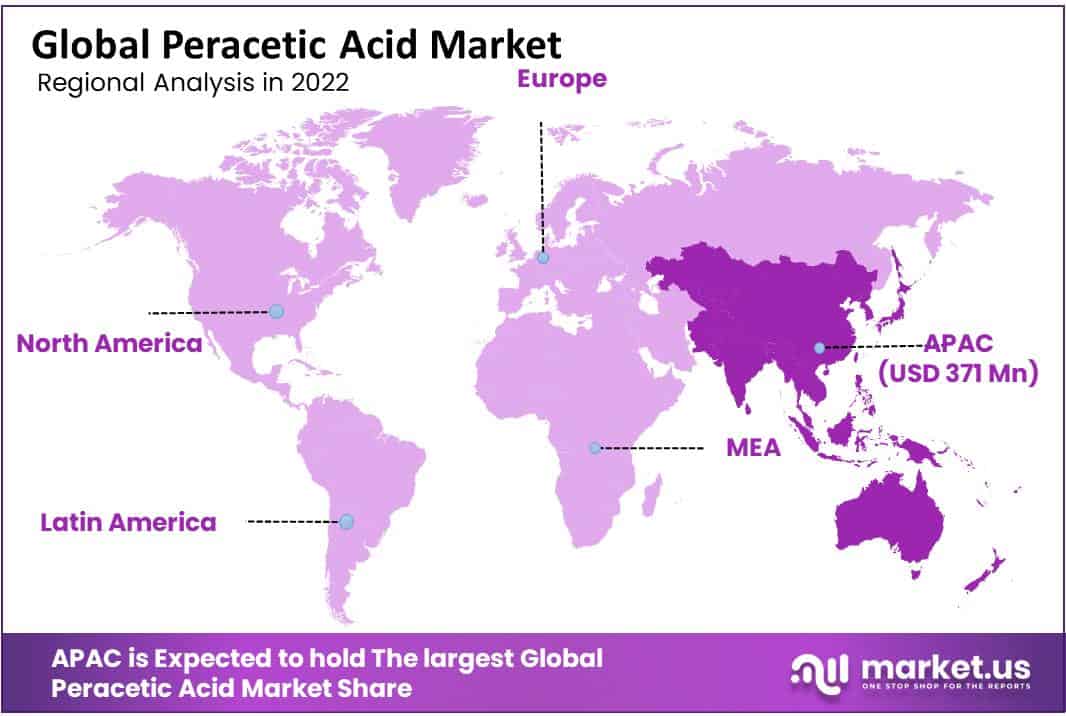

Regional Analysis: As reported, Asia Pacific held the greatest revenue share for peracetic acid on the global market.

Key Players: Key players in the global peracetic acid market include companies such as Evonik Industries AG, Kemira Oyj, Solvay S.A., Mitsubishi Gas Chemical Company, Inc., Airedale Chemical Company Ltd., Ecolab Inc., Jubilant Life Sciences Ltd, Hydrite Chemical, Other Key Players

Market Scope

Purity Analysis

The solution segment held the largest revenue share in 2022

The market for peracetic acid is segmented into solution and distilled based on type. Among these types, the solution segment held the largest share in the peracetic acid market and is projected to generate maximum revenue during the forecast period.

The solution is mainly used in the food and beverage industry to disinfect factories, tanks, pipes, packaging materials, and equipment and in animal health applications to disinfect surfaces and stables. It is also used in agricultural applications for the treatment of wastewater and for water treatment applications to reduce microbial growth.

Application Analysis

The disinfectant segment dominated the market in 2022

By application, the market for peracetic acid is further divided into sterilizers, sanitizers, disinfectants, and other applications. The disinfectant segment dominated the market in 2022 and is projected to account for the largest market share during the forecast period, owing to the high adoption of peracetic acid used as a disinfectant chemical in the water treatment, food and beverage, and healthcare industries.

It is used widely to deactivate pathogenic microorganisms, disinfect medical supplies, render viruses and spores inactive, and prevent the formation of biofilms in pulp mills. During water purification, the peracetic acid can be used as a plumbing disinfectant and disinfectant. It is very highly effective at killing the microscopic organisms found on surfaces.

Additionally, it can kill bacteria, viruses, fungi, yeasts, and spores in minutes, which creates a higher demand for peracetic acid as a disinfectant chemical in the food processing industry and hospitals.

End-User Analysis

The food and beverage industry accounted as the dominant segment with the largest market share in 2022

The market is bifurcated into food and beverage, healthcare industries, water treatment, pulp and paper bleaching, and other end-users based on end-users. Among these end-users, the food beverage industry dominated the global market and is anticipated to generate significant revenue during the forecast period.

Peracetic acid is used mainly in the food and beverage industry due to its environmental-friendly characteristics and excellent benefits. They sterilize equipment or disinfect reservoirs, surfaces, plastic bottles, and pipes. In the food and beverage packaging applications, several types of products are packaged in plastic bottles of PE or PET.

The peracetic acid solutions sterilize the packaging materials to protect beverages during production. The increased food and beverage industry applications are expected to boost the global peracetic acid market growth over the forecast period.

Key Market Segments

Based on Purity

- Solution

- Distilled

Based on Application

- Sterilizer

- Sanitizer

- Disinfectant

- Other Applications

Based on End-User

- Food and beverage

- Healthcare Industries

- Water treatment

- Pulp and Paper bleaching

- Other End-Users

Drivers

Peracetic acid has advantages over other substitute biocides to boost market growth.

Disinfectants, chemical sterilizers, sanitizers, and other biocide chemicals play a vital role in preventing microbial growth. Peracetic acid is the most effective environment-friendly product used for wastewater treatment as an alternative to chlorine. It is also an ideal replacement for chlorine as a disinfectant and bleach.

Peracetic acid is the most innovative development in the biocide industry because of its performance benefits over other biocides. The favorable features and product awareness (longer shelf life, safe by-products, slower thermal degradation, and optimum performance) of peracetic acid increasingly attract end users to prefer using this product in different applications.

The rising demand for peracetic acid in several applications is positively driving the growth of the global market for peracetic acid.

Restraints

Health complications associated with exposure to peracetic acid hamper the market growth.

Peracetic acid is highly corrosive and has a highly pungent odor. Numerous hazards can be caused by long-term or short-term exposure to the chemical. In short-term exposure, peracetic acid potentially harms the eyes, skin, and respiratory tract.

While in the more severe instances, large-scale hazards, such as fires, explosions, and reactivity issues, are probable. The compound is well-known for its violent reaction with soft metals, including copper, iron, brass, and zinc.

Moreover, the amount of damage caused by exposure to such a compound is a significant factor responsible for slowing the revenue growth of the peracetic acid market.

Low awareness of benefits and high cost

The lack of awareness about the product is the major restraint for the market growth of peracetic acid. The consumers have limited knowledge regarding this product and its benefits in different application areas.

In addition, peracetic acid is more expensive than its substitutes, such as chlorine, hydrogen peroxide, calcium hypochlorite, and sodium hypochlorite. This is also expected to hinder the market growth.

Opportunity

High growth potential in Asia Pacific

Major end-use industries of peracetic acid are food and beverage, pulp and paper, healthcare, and water treatment, expanding fastest in Asia Pacific. In these industries, peracetic acid has been used since its development and is still a substantial segment of the biocides industry.

It is primarily used in the food industry, mainly in food processing products such as milk, soft drinks, juices, and tea. Peracetic acid is also highly used in life sciences, hospitals, pharmaceuticals, and other sectors, owing to the rising infrastructure of the healthcare sector.

It exhibits a potential for more robust oxidation than other competitive products. Leading pharmaceutical companies are involved in establishing their plants in the Asia Pacific region because of the increasing demand for medicinal products from emerging countries of the region.

The pharmaceutical industry is exhibiting a significant growth rate in Asia. Thus, the rising demand in the Asia Pacific region is expected to be a significant driver for the expansion of the global peracetic acid market in the near future.

Trends

High demand for processed food

Peracetic acid is primarily used in food and beverage industries to provide freshness to the food for an extended period and improve the taste. Peracetic acid is also used as a bleaching and antimicrobial agent for vegetables and fruits.

Increasing hygiene awareness and rapid growth in the processed food industry positively drive the peracetic acid market. The sanitizers and disinfectants play an essential role in preventing the bacterial growth.

As a result, there is an increase in the use of peracetic acid. Peracetic acid also ensures the safety of the product’s band, increases the shelf life, and slows thermal degradation. The usage of peracetic acid in various applications is likely to fuel the growth of the peracetic acid market.

Regional Analysis

Asia Pacific dominated the global market for peracetic acid in 2022

Based on region, the global peracetic acid market is classified into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. Among these regions, The Asia Pacific held the largest revenue share for peracetic acid in the global market.

The region’s increasing awareness and concern about health and hygiene. As individuals become more educated about the importance of sanitized food and clean water, the demand for effective disinfectants such as peracetic acid has grown correspondingly.

This market is projected to register the fastest CAGR over the forecast period owing to the rising industrialization and growing hygiene awareness among individuals in countries of this region, especially in India, China, and Japan.

Additionally, the development of the food and beverage industry and water treatment solutions in this region results in a high demand for peracetic acid. After Asia-Pacific, the European market held the largest market share.

This is mainly due to the increasing adoption of peracetic acid in water treatment, food, beverage, and healthcare industries in countries across this region, especially in the United Kingdom, France, and Germany.

Additionally, the increasing development of these industries is creating a high demand for peracetic acid in this region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Major market players are focused on investing more in R&D to raise their product lines, which will likely help the peracetic acid market expand even more.

Market key players are also implementing numerous strategic initiatives to increase their presence worldwide, with key developments such as new product launches, increased investments, mergers and acquisitions, contractual agreements, and collaborations.

Competitive pricing is a significant strategy for key players to expand their portfolio and market presence.

Market Key Players

- Evonik Industries AG

- Kemira Oyj

- Solvay S.A.

- Mitsubishi Gas Chemical Company, Inc.

- Airedale Chemical Company Ltd.

- Ecolab Inc.

- Jubilant Life Sciences Ltd

- Hydrite Chemical

- Other Key Players

Recent Developments

- In January 2023, Kemira announced the acquisition of Ecolab’s peracetic acid business. This acquisition makes Kemira a leading player in the global peracetic acid market.

- In March 2023, Hydrite Chemical Co., a leading manufacturer of peracetic acid, announced that it is expanding its production capacity by 20%. This expansion is expected to be completed in 2024.

Report Scope

Report Features Description Market Value (2022) US$ 905 Mn Forecast Revenue (2032) US$ 1,899 Mn CAGR (2023-2032) 7.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Purity – Solution and Distilled; By Application – Sterilizer, Sanitizer, Disinfectant, and Other Applications; By End-User Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape Evonik Industries AG, Kemira Oyj, Solvay S.A., Mitsubishi Gas Chemical Company, Inc., Airedale Chemical Company Ltd., Ecolab Inc., Jubilant Life Sciences Ltd, Hydrite Chemical, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is peracetic acid?Peracetic acid is a chemical compound with strong oxidizing properties. It is commonly used as a disinfectant, sanitizer, and sterilizing agent in various industries.

How is peracetic acid produced?Peracetic acid is typically produced by reacting acetic acid with hydrogen peroxide in the presence of a catalyst. The reaction results in the formation of peracetic acid, water, and other byproducts.

What are the applications of peracetic acid?Peracetic acid is used in a wide range of applications, including water treatment, food and beverage processing, healthcare, agriculture, and pulp and paper industries. It is employed as a disinfectant for surfaces, equipment, and instruments, as well as for wastewater treatment and crop protection.

What are the advantages of using peracetic acid as a disinfectant?Peracetic acid offers several advantages as a disinfectant, including its broad-spectrum antimicrobial activity, fast-acting nature, ability to break down into harmless byproducts, effectiveness against biofilms, and low potential for developing resistance in microorganisms.

Is peracetic acid safe to use?When used according to the recommended guidelines and concentrations, peracetic acid is considered safe for its intended applications. However, it is a strong oxidizer and can cause skin, eye, and respiratory irritation if mishandled. Proper safety precautions should be followed during handling and storage.

-

-

- Evonik Industries AG

- Kemira Oyj

- Solvay S.A.

- Mitsubishi Gas Chemical Company, Inc.

- Airedale Chemical Company Ltd.

- Ecolab Inc.

- Jubilant Life Sciences Ltd

- Hydrite Chemical

- Other Key Players