Global Peptide Antibiotics Market By Product Type (Ribosomal Synthesized and Non-Ribosomal Synthesized), By Route of Administration (Injectable and Oral), By Application (Skin Infection, Bloodstream Infections, HABP/VABP and Others), By Distribution Channel (Hospital Pharmacies, Online Pharmacies and Retail Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173539

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Route Of Administration Analysis

- Application Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

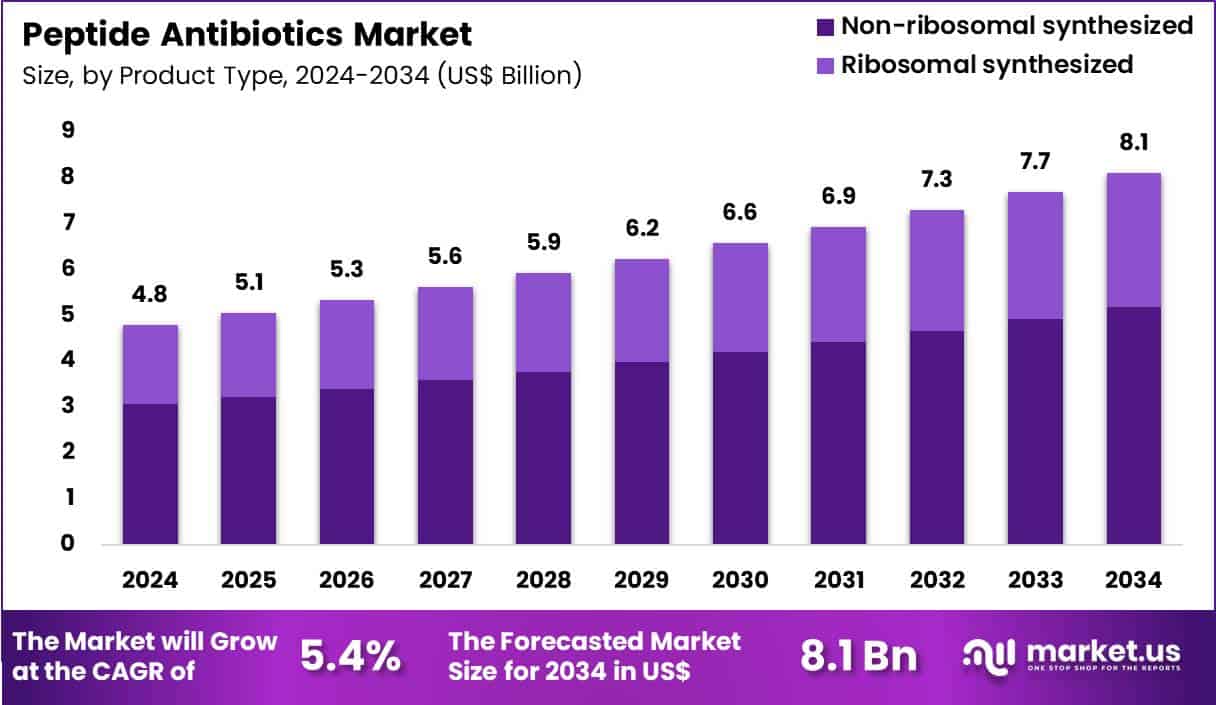

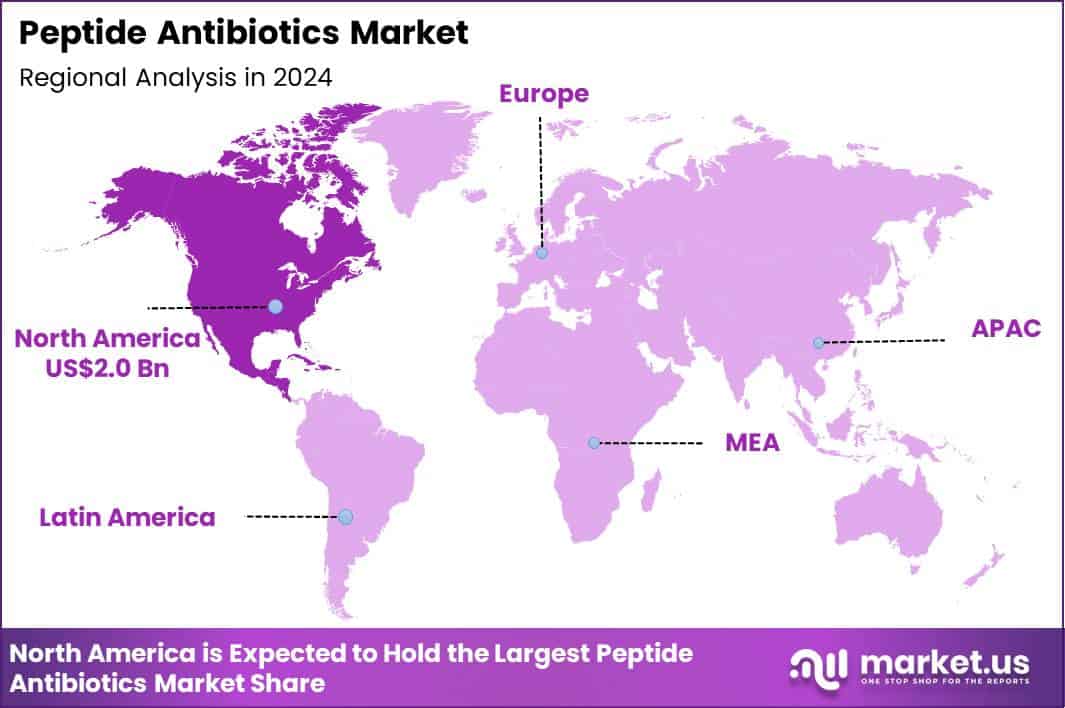

Global Peptide Antibiotics Market size is expected to be worth around US$ 8.1 Billion by 2034 from US$ 4.8 Billion in 2024, growing at a CAGR of 5.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.3% share with a revenue of US$ 2.0 Billion.

Rising incidence of multidrug-resistant bacterial infections accelerates the adoption of peptide antibiotics that disrupt microbial membranes through unique mechanisms distinct from conventional small-molecule agents. Clinicians increasingly administer these compounds for complicated urinary tract infections caused by extended-spectrum beta-lactamase-producing Enterobacterales, achieving rapid bacterial clearance where standard therapies fail.

These agents demonstrate efficacy against carbapenem-resistant Pseudomonas aeruginosa in hospital-acquired pneumonia, restoring therapeutic options in critically ill patients. Healthcare providers utilize peptide antibiotics for skin and soft tissue infections involving methicillin-resistant Staphylococcus aureus, leveraging their bactericidal action to reduce tissue destruction. These therapies also support treatment of intra-abdominal infections driven by resistant Acinetobacter baumannii, providing reliable coverage in polymicrobial settings.

In February 2025, AbbVie received US FDA clearance for Emblaveo (aztreonam avibactam) for the treatment of multidrug-resistant Gram-negative infections. This approval highlights sustained clinical demand for advanced anti-infective therapies capable of addressing resistance gaps. As multidrug-resistant pathogens continue to rise, interest in peptide antibiotics grows due to their rapid bactericidal properties and unconventional mechanisms, reinforcing R&D momentum and positioning peptides as a viable next-generation approach within the global antibiotics market.

Pharmaceutical developers pursue opportunities to engineer synthetic cyclic peptides that enhance stability and penetration into biofilms, broadening applications in chronic wound infections and device-related endocarditis. Companies advance lipopeptide derivatives with reduced nephrotoxicity profiles, enabling prolonged courses for osteomyelitis caused by vancomycin-resistant enterococci. These innovations facilitate combination regimens with traditional antibiotics, restoring susceptibility in polymyxin-resistant Gram-negative isolates.

Opportunities emerge in developing inhalable peptide formulations for cystic fibrosis patients colonized with resistant Burkholderia species, improving lung penetration and clinical outcomes. Firms explore peptide conjugates that target intracellular pathogens, expanding utility in tuberculosis and atypical mycobacterial infections refractory to standard regimens. Enterprises invest in high-throughput screening platforms to identify novel peptide scaffolds, accelerating discovery of agents effective against hypervirulent Klebsiella pneumoniae strains.

Industry specialists refine structure-activity relationships to produce peptides with narrower spectra, minimizing disruption of commensal microbiota during treatment of Clostridioides difficile-associated diarrhea. Developers prioritize formulations that overcome efflux-mediated resistance, restoring activity against Acinetobacter baumannii in ventilator-associated pneumonia.

Market participants advance topical peptide preparations for diabetic foot infections, delivering localized concentrations that eradicate resistant biofilms while preserving systemic safety. Innovators incorporate machine learning-guided design to predict membrane disruption potency, streamlining lead optimization for emerging resistant pathogens.

Companies emphasize pharmacokinetic enhancements that extend half-life, supporting less frequent dosing in outpatient management of complicated intra-abdominal infections. Ongoing research focuses on dual-action peptides that combine membrane permeabilization with intracellular target inhibition, elevating efficacy across diverse resistant bacterial populations.

Key Takeaways

- In 2024, the market generated a revenue of US$ 4.8 Billion, with a CAGR of 5.4%, and is expected to reach US$ 8.1 Billion by the year 2034.

- The product type segment is divided into ribosomal synthesized and non-ribosomal synthesized, with non-ribosomal synthesized taking the lead in 2024 with a market share of 63.8%.

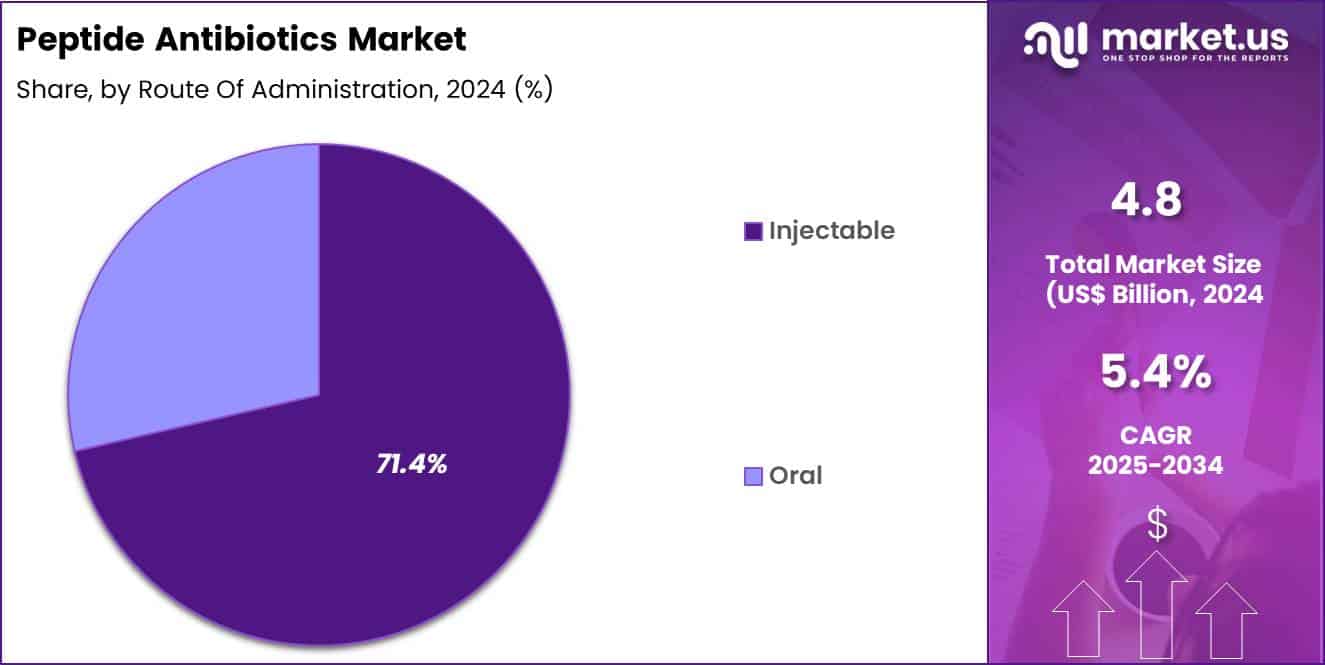

- Considering route of administration, the market is divided into injectable and oral. Among these, injectable held a significant share of 71.4%.

- Furthermore, concerning the application segment, the market is segregated into skin infection, bloodstream infections, HABP/VABP and others. The skin infection sector stands out as the dominant player, holding the largest revenue share of 39.7% in the market.

- The distribution channel segment is segregated into hospital pharmacies, online pharmacies and retail pharmacies, with the hospital pharmacies segment leading the market, holding a revenue share of 58.6%.

- North America led the market by securing a market share of 41.3% in 2024.

Product Type Analysis

Non-ribosomal synthesized peptides accounted for 63.8% of growth within the product type category and dominate the Peptide Antibiotics market. These peptides exhibit broad-spectrum antimicrobial activity against resistant pathogens. Complex molecular structures enhance stability and potency. Manufacturers favor non-ribosomal synthesis for structural diversity. Resistance mitigation remains a key driver for adoption. Clinicians increasingly rely on these agents for severe infections.

Non-ribosomal peptides target novel bacterial pathways. This mechanism reduces cross-resistance risks. Pharmaceutical pipelines emphasize non-ribosomal candidates for unmet needs. Higher efficacy supports clinical preference. Manufacturing scalability improves through advanced fermentation technologies. Regulatory agencies prioritize innovation addressing antimicrobial resistance.

Hospital usage concentrates on advanced peptide antibiotics. Research funding supports non-ribosomal development programs. Improved pharmacokinetics enhance therapeutic outcomes. Non-ribosomal peptides demonstrate consistent activity in multidrug-resistant cases. Global AMR burden reinforces demand growth. Specialty antibiotics command premium pricing. Healthcare systems prioritize effective last-line therapies. The segment is projected to maintain leadership due to clinical superiority and resistance coverage.

Route Of Administration Analysis

Injectable formulations represented 71.4% of growth within the route of administration category and lead the Peptide Antibiotics market. Severe bacterial infections require rapid systemic exposure. Injectable delivery ensures immediate bioavailability. Hospitals prefer injectables for critical care settings. Peptide stability remains higher in parenteral formulations. Oral bioavailability challenges favor injectable development. ICU protocols emphasize intravenous antibiotic administration.

Injectable peptides achieve precise dosing control. Treatment of resistant infections often mandates parenteral therapy. Clinicians rely on injectables for bloodstream and deep tissue infections. Hospital stewardship programs guide injectable antibiotic use. Injectable routes support controlled monitoring. Reduced variability improves clinical outcomes. Pharmaceutical companies prioritize injectable peptide pipelines.

Regulatory approvals favor injectable safety profiles. Injectable therapies integrate into existing hospital workflows. Acute infection management drives demand. Improved formulation technologies enhance shelf stability. Injectable peptides address unmet needs in severe cases. Reimbursement frameworks support hospital-based injectables. The segment is anticipated to remain dominant due to clinical urgency and effectiveness.

Application Analysis

Skin infection accounted for 39.7% of growth within the application category and represent the largest indication in the Peptide Antibiotics market. Rising incidence of resistant skin pathogens increases demand. Community and hospital-acquired infections drive volume. Peptide antibiotics offer targeted antimicrobial action. Clinicians adopt peptides for complicated skin infections. Reduced resistance potential strengthens confidence. Topical and injectable combinations support treatment flexibility.

Surgical site infections contribute to demand growth. Dermatology and surgical practices increase utilization. Faster resolution improves patient outcomes. Skin infections often serve as first-line peptide indications. Hospital admission rates support inpatient treatment. Treatment guidelines emphasize effective antimicrobial coverage.

Peptide antibiotics reduce recurrence rates. Increased awareness of AMR supports peptide adoption. Urbanization increases infection exposure risks. Improved diagnostic rates identify severe cases earlier. Healthcare providers prioritize safe and potent options. Reimbursement stability supports therapy uptake. Clinical trials reinforce efficacy in skin infections. The segment is projected to grow due to prevalence and therapeutic effectiveness.

Distribution Channel Analysis

Hospital pharmacies captured 58.6% of growth within the distribution channel category and dominate the Peptide Antibiotics market. Severe infections concentrate treatment within hospitals. Injectable peptide antibiotics require controlled dispensing. Hospital stewardship programs regulate antibiotic use. Pharmacy oversight ensures appropriate dosing and duration. Hospitals manage complex resistant infections.

Multidisciplinary care supports peptide antibiotic utilization. Cold-chain and storage requirements favor hospital settings. Hospital pharmacies integrate lab diagnostics with treatment decisions. Formularies prioritize advanced antimicrobials. Emergency preparedness reinforces hospital reliance. Inpatient treatment protocols support high utilization.

Hospitals manage critically ill patients requiring peptide antibiotics. Centralized procurement improves supply reliability. Clinical pharmacists guide therapy optimization. Monitoring adverse effects requires hospital infrastructure. Teaching hospitals accelerate adoption through protocols. Referral pathways funnel severe cases to hospitals. Regulatory compliance aligns with hospital governance. Hospital-based initiation improves adherence. The segment is expected to retain dominance due to care complexity and stewardship control.

Key Market Segments

By Product Type

- Ribosomal synthesized

- Non ribosomal synthesized

By Route of Administration

- Injectable

- Oral

By Application

- Skin infection

- Bloodstream infections

- HABP/VABP

- Others

By Distribution Channel

- Hospital pharmacies

- Online pharmacies

- Retail pharmacies

Drivers

Antimicrobial resistance is driving the market

Antimicrobial resistance represents a critical driver in the peptide antibiotics market, as it necessitates the development of alternative therapies to combat bacteria that no longer respond to conventional antibiotics. Healthcare professionals increasingly turn to peptide antibiotics for their unique mechanisms of action, which disrupt bacterial membranes and reduce the likelihood of resistance development.

Regulatory agencies emphasize the urgency of addressing resistance through innovative peptides, supporting research and clinical trials in this area. Pharmaceutical companies invest in peptide-based solutions to fill gaps in treatment options for multidrug-resistant infections. Clinical protocols incorporate peptides for conditions like skin infections and sepsis, where traditional drugs fail.

Global health surveillance highlights the escalating threat, prompting collaborations for peptide advancement. Academic institutions conduct studies on peptide efficacy against resistant strains, driving industry innovation. Patient outcomes improve with peptides offering targeted antimicrobial activity with lower toxicity.

Economic burdens from resistant infections further justify market expansion for peptide alternatives. According to the Centers for Disease Control and Prevention, in the US, over 2.8 million antimicrobial-resistant infections occur every year.

Restraints

Regulatory challenges for novel peptide approvals are restraining the market

Regulatory challenges pose a significant restraint in the peptide antibiotics market, as stringent requirements for demonstrating safety and efficacy delay approvals and increase development costs. Manufacturers must navigate complex validation processes to ensure peptides meet standards for antimicrobial activity without toxicity. Healthcare adoption slows due to limited approved options, restricting clinical use to specific indications.

Pharmaceutical firms face prolonged timelines for peptide trials, deterring investment in new candidates. Clinical practices rely on existing antibiotics while awaiting regulatory clearance for peptides. Global inconsistencies in approval criteria complicate international market entry for peptide products.

Academic research highlights bureaucratic hurdles that hinder translation from lab to clinic. Patient access to innovative peptides is limited by conservative regulatory stances on novel mechanisms. Economic pressures from high compliance costs reduce profitability for peptide developers. These factors collectively impede rapid market growth and innovation in peptide antibiotics.

Opportunities

Technological advancements in peptide synthesis are creating growth opportunities

Technological advancements in peptide synthesis offer substantial growth opportunities in the peptide antibiotics market, enabling the production of more stable and effective compounds for combating infections. Developers can explore modified peptides with enhanced antimicrobial properties, targeting unmet needs in resistant bacterial strains. Regulatory pathways may accelerate for synthesized peptides demonstrating superior performance in preclinical models.

Healthcare integration of these advancements allows for broader applications in wound care and systemic infections. Pharmaceutical collaborations focus on scaling synthesis methods to reduce costs and improve yield. Clinical research benefits from synthesized peptides enabling combination therapies with existing antibiotics. Global adoption in emerging markets aligns with advancements providing affordable production techniques.

Academic partnerships refine synthesis protocols to minimize immunogenicity in peptide designs. Patient therapies gain from advancements facilitating rapid customization for individual infections. The U.S. Food and Drug Administration approved 50 novel drugs in 2024, including peptides that leverage synthesis innovations for antimicrobial use.

Impact of Macroeconomic / Geopolitical Factors

Buoyant international economies funnel resources into antimicrobial resistance research, spurring the peptide antibiotics market with heightened procurement for novel therapies like bacitracin derivatives. Stakeholders capitalize on affluent consumer bases in Europe and North America, where preventive healthcare drives steady uptake of advanced infection controls.

Regrettably, rampant global inflation jacks up biotech reagent prices, squeezing margins for developers in high-cost environments. Aggravated border disputes in biotech-exporting nations thwart peptide synthesis deliveries, hampering timelines for clinical-grade production worldwide. Innovators counter these pitfalls through localized biotech clusters, which sharpens efficiency and sparks cross-industry synergies.

Today’s US tariffs, slapping 100% duties on branded pharmaceutical imports effective October 2025, saddle foreign suppliers with prohibitive entry barriers. Stateside enterprises seize this shift to ramp up proprietary manufacturing, which ignites venture funding and bolsters intellectual property safeguards. Visionary leaps in targeted delivery mechanisms invariably uplift the domain, charting paths to amplified efficacy and prosperous market evolution.

Latest Trends

AI-guided design of antimicrobial peptides is a recent trend

In 2025, the peptide antibiotics market has exhibited a prominent trend toward AI-guided design of antimicrobial peptides, which accelerates the discovery of novel sequences with optimized activity against resistant pathogens. Manufacturers utilize AI algorithms to predict peptide structures that enhance membrane disruption while minimizing host toxicity. Healthcare research incorporates AI models to screen vast libraries for peptides effective in clinical settings.

Regulatory evaluations are adapting to validate AI-derived peptides for faster development cycles. Clinical trials are evaluating AI-designed peptides for conditions like bacterial pneumonia and sepsis. Academic studies are exploring AI integration with genomics to tailor peptides for specific bacterial strains. Global collaborations are advancing AI platforms for multi-drug resistant infections.

Patient therapies benefit from AI enabling rapid iteration of peptide candidates for personalized medicine. Ethical protocols ensure AI applications prioritize safety in design processes. According to a 2025 publication on recent advances in peptide research, AI-guided design is a key breakthrough in antimicrobial peptide development.

Regional Analysis

North America is leading the Peptide Antibiotics Market

In 2024, North America held a 41.3% share of the global peptide antibiotics market, energized by intensifying antimicrobial resistance crises and the critical role of these agents in treating severe infections from multidrug-resistant bacteria, where conventional therapies fail. Clinicians expanded prescriptions for daptomycin and vancomycin in hospital settings to combat gram-positive pathogens like methicillin-resistant Staphylococcus aureus, supported by guideline updates that prioritize these options for skin and bloodstream infections.

Innovations in peptide design improved spectrum and reduced toxicity, aligning with federal efforts to curb hospital-acquired infections through stewardship programs. Rising chronic conditions in obese and diabetic populations heightened vulnerability to resistant strains, prompting integrated care models that incorporate peptide regimens for endocarditis and pneumonia.

Pharmaceutical firms refined manufacturing for high-purity formulations, ensuring availability for compassionate use in rare cases. Collaborative surveillance tracked resistance patterns, fostering targeted development for gram-negative threats like Pseudomonas. Supply adaptations guaranteed sterile vial stability, facilitating rapid deployment in intensive care units.

The Centers for Disease Control and Prevention reported that reported clinical cases of Candida auris increased nearly five-fold from 2019 to 2022, underscoring the broader antimicrobial resistance landscape driving peptide utilization.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders forecast accelerated expansion of peptide antibiotics in Asia Pacific over the forecast period, as escalating resistance burdens compel healthcare systems to adopt potent alternatives for endemic bacterial threats. Specialists deploy these agents in sepsis protocols, customizing treatments for carbapenem-resistant Enterobacteriaceae prevalent in overcrowded wards.

Authorities fund local synthesis of colistin analogs through subsidies, equipping district hospitals to manage ventilator-associated pneumonias amid humid conditions. Biotech innovators engineer cyclic peptides with enhanced membrane penetration, tailoring them to regional strain diversities in urinary tract infections. Cross-border consortia evaluate combination therapies through trials, optimizing outcomes for tuberculosis co-infections in vulnerable migrants.

Pharmaceutical manufacturers localize production of bacitracin variants, complying with pharmacopeial norms to sustain supply chains. Community drives train nurses on infusion techniques, extending coverage to peripheral facilities facing diagnostic hurdles. In 2021, Asia accounted for more than half of the global 4.71 million deaths associated with antimicrobial resistance.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Peptide Antibiotics market drive growth by advancing novel mechanisms of action that target multidrug-resistant pathogens and reduce cross-resistance with conventional antibiotics. Companies strengthen pipelines through investment in synthetic optimization, stability enhancement, and scalable manufacturing processes that address historical cost and degradation challenges.

Commercial strategies focus on hospital-centric positioning, antimicrobial stewardship alignment, and prioritization of severe and hard-to-treat infections where clinical value remains high. Innovation efforts emphasize next-generation formulations and delivery approaches that improve pharmacokinetics and safety profiles.

Market expansion targets regions facing rising antimicrobial resistance and increasing regulatory support for novel anti-infectives. Pfizer operates as a key participant through its global anti-infectives expertise, strong clinical development capabilities, and established hospital relationships that support the development and responsible deployment of peptide-based antibacterial therapies.

Top Key Players

- Xellia Pharmaceuticals

- The Menarini Group

- Teva Pharmaceuticals Industries Limited

- Sanofi

- Pfizer Inc.

- NPS Pharmaceuticals

- Merck & Co., Inc.

- GSK Plc.

- Eli Lilly and Company

- AbbVie Inc.

Recent Developments

- In March 2025, GSK secured US FDA approval for Blujepa (gepotidacin), a novel triazaacenaphthylene bacterial topoisomerase inhibitor indicated for uncomplicated urinary tract infections. Although gepotidacin is not a peptide-based therapy, its approval validates regulatory openness to nontraditional antibacterial mechanisms at a time of escalating resistance. This shift in regulatory sentiment indirectly supports the peptide antibiotics market by encouraging broader investment into alternative antimicrobial platforms, including peptides that offer precise target engagement, lower resistance development, and strong activity against drug-resistant organisms.

- In March 2025, AstraZeneca disclosed plans to build a USD 2.5 billion research and development hub in Beijing, with a strategic emphasis on macrocyclic peptide innovation. This expansion directly strengthens the peptide antibiotics market by increasing discovery capacity for structurally complex peptide and macrocyclic compounds with antibacterial potential. Enhanced infrastructure, combined with regional academic and industry partnerships, accelerates peptide design, optimization, and manufacturability, supporting faster progression of peptide-based antimicrobials into clinical development.

Report Scope

Report Features Description Market Value (2024) US$ 4.8 Billion Forecast Revenue (2034) US$ 8.1 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Ribosomal Synthesized and Non-Ribosomal Synthesized), By Route of Administration (Injectable and Oral), By Application (Skin Infection, Bloodstream Infections, HABP/VABP and Others), By Distribution Channel (Hospital Pharmacies, Online Pharmacies and Retail Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Xellia Pharmaceuticals, The Menarini Group, Teva Pharmaceuticals Industries Limited, Sanofi, Pfizer Inc., NPS Pharmaceuticals, Merck & Co., Inc., GSK Plc., Eli Lilly and Company, AbbVie Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Xellia Pharmaceuticals

- The Menarini Group

- Teva Pharmaceuticals Industries Limited

- Sanofi

- Pfizer Inc.

- NPS Pharmaceuticals

- Merck & Co., Inc.

- GSK Plc.

- Eli Lilly and Company

- AbbVie Inc.