Global Pen Needles Market Analysis By Product Type (Standard Pen Needles, Safety Pen Needles), By Needle Length (4 mm, 5 mm, 6 mm, 8 mm, 10 mm, 12 mm), By Therapy (Insulin, Glucagon-like-Peptide-1 (GLP-1), Growth Hormone) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2023

- Report ID: 20487

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

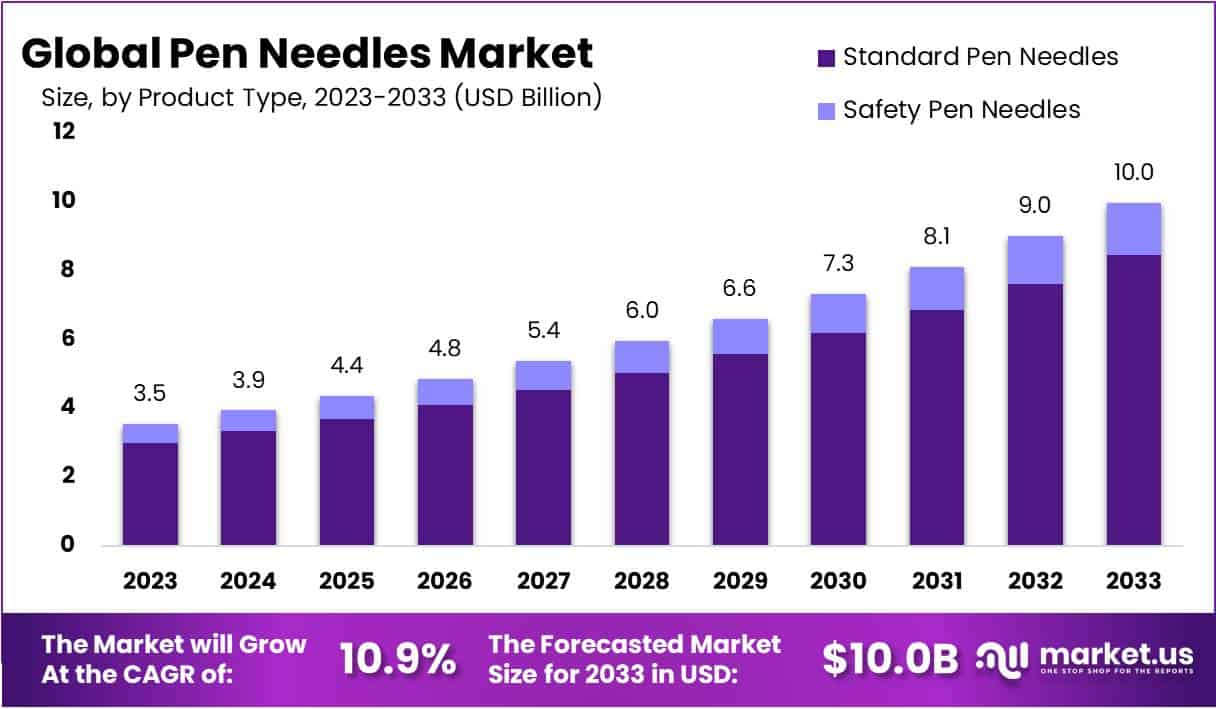

The Pen Needles Market Size is anticipated to reach approximately USD 10 billion by the year 2033, exhibiting substantial growth compared to its value of USD 3.5 billion in 2023. This expansion is projected to occur at a Compound Annual Growth Rate (CAGR) of 10.9% throughout the forecast period spanning from 2024 to 2033.

Pen needles are small, thin needles used with injection pens to deliver medication, such as insulin, to people with diabetes. These needles are designed for easy and convenient self-administration of medication.

The pen needles market refers to the business and trade related to these small needles. It includes the manufacturing, sale, and distribution of pen needles worldwide. As the number of people diagnosed with diabetes increases, the demand for pen needles has grown, making it a significant part of the healthcare industry. The market involves various companies producing and supplying pen needles to meet the needs of individuals managing their health conditions through regular injections.

Market segmentation, encompassing product types, applications, and regions, provides a comprehensive understanding of its dynamics. This section introduces the reader to the fundamental concepts, setting the stage for a detailed exploration of the pen needles market.

Drivers, like the increasing diabetic population, clash with challenges such as regulatory hurdles and cost concerns. Penetrative insights into applications, from diabetes management to growth hormone therapy, showcase the breadth of the market. Regional breakdowns unravel geographical influences, while a deep dive into the competitive landscape unveils major players’ strategies and recent developments. Technological trends and the regulatory framework are scrutinized, paving the way for a nuanced understanding. The report concludes by addressing challenges, outlining future trends, and projecting the trajectory of the pen needles market.

Key Takeaways

- Market Growth Projection: Pen needles market to reach USD 10 billion by 2033, with a projected CAGR of 10.9% from 2024 to 2033.

- Product Dominance: Standard Pen Needles hold 84.6% market share in 2023, favored for simplicity and user-friendly insulin delivery.

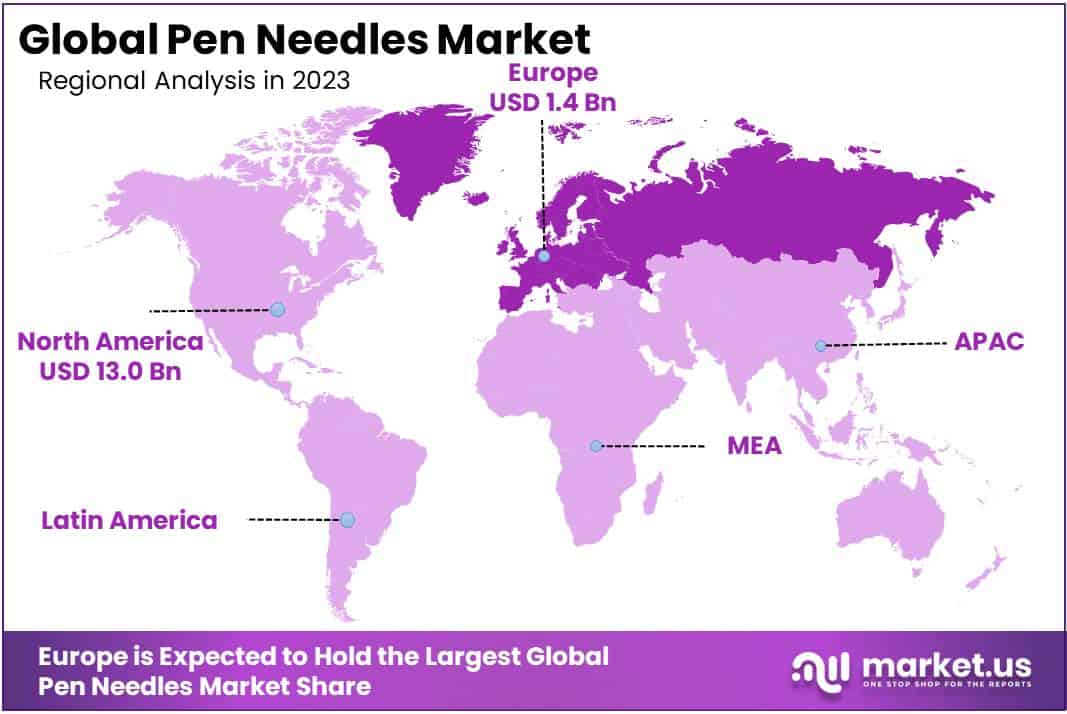

- Regional Leadership: Europe dominates with a 38.9% market share in 2023, driven by robust healthcare infrastructure and regulatory excellence.

- Therapy Market Share: Insulin Therapy commands over 75% market share in 2023, reflecting its crucial role in diabetes management.

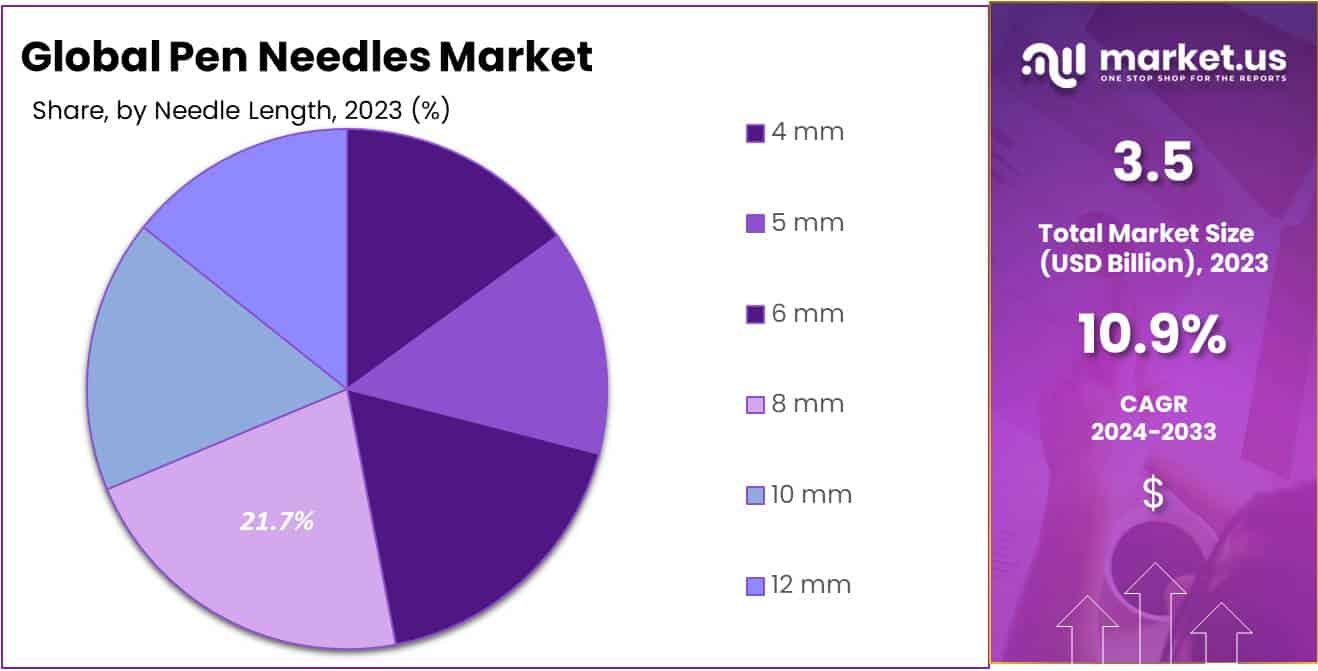

- Needle Length Preferences: 8mm needle length leads with 21.7% market share in 2023, striking a balance between effectiveness and patient comfort.

- Key Market Drivers: Global diabetes prevalence drives demand; technological advancements and government support foster market growth.

- Challenges and Concerns: High costs of advanced devices and needlestick injury concerns pose restraints; competition from alternative insulin delivery methods is notable.

Product Type Analysis

In 2023, Standard Pen Needles held a dominant market position, capturing more than a 84.6% share. These pen needles are widely preferred for their simplicity and ease of use, making them a popular choice among patients and healthcare providers alike.

Safety Pen Needles, on the other hand, accounted for the remaining market share, showcasing a steady presence in the market. Although comprising a smaller portion, Safety Pen Needles have gained traction due to their enhanced safety features, addressing concerns related to needlestick injuries and ensuring a secure user experience.

The preference for Standard Pen Needles can be attributed to their familiarity and established usage in diabetes management. Patients often find these needles user-friendly and efficient in delivering insulin doses. Moreover, healthcare professionals appreciate the straightforward design and ease of training patients on the correct usage of Standard Pen Needles.

Safety Pen Needles, while constituting a smaller market share, cater to users who prioritize safety measures in injection procedures. The growing awareness regarding needlestick injuries and the importance of minimizing healthcare-associated risks contribute to the gradual adoption of Safety Pen Needles in the market.

Looking ahead, the market dynamics may witness shifts influenced by advancements in needle technology, user preferences, and regulatory considerations. Both Standard and Safety Pen Needles play vital roles in meeting the diverse needs of individuals managing various medical conditions, contributing to the overall growth and evolution of the Pen Needles market.

Needle Length Analysis

In 2023, the pen needles market exhibited a noteworthy segmentation based on needle length, with various sizes catering to diverse patient needs. Among these, the 8mm needle length emerged as a frontrunner, securing a dominant market position by capturing more than a 21.7% share.

The 8mm needle’s popularity can be attributed to its versatility, striking a balance between effective insulin delivery and patient comfort. Its widespread adoption underscores the significance of accommodating diverse patient preferences and injection site requirements.

Following closely, the 6mm and 5mm needle lengths demonstrated substantial market presence, each contributing significantly to the overall market landscape with their respective shares. These shorter needle lengths gained traction for their ease of use and reduced anxiety during injections, particularly among individuals who may be apprehensive about needle-related procedures.

Meanwhile, the 10mm and 12mm needle lengths, though holding a smaller market share, carved out their niche by meeting the needs of patients requiring deeper subcutaneous injections. This segment caters to specific medical conditions where precise insulin dosage at greater depths is crucial for optimal therapeutic outcomes.

The 4mm needle length, while representing a smaller market share, plays a vital role in addressing the demand for shorter needles among certain patient demographics, emphasizing the industry’s commitment to customization and patient-centric care.

As the pen needles market continues to evolve, these segmented needle lengths reflect a strategic response to the diverse requirements of patients, ensuring that the market remains dynamic and responsive to the ever-changing landscape of healthcare preferences.

Therapy Analysis

In 2023, Insulin Therapy emerged as the frontrunner in the Pen Needles market, commanding a robust market share of over 75%. This dominance can be attributed to the indispensable role insulin plays in managing diabetes, a condition affecting millions globally. As a primary therapy for diabetes, the demand for pen needles in insulin administration has soared, driving significant market growth.

Following closely is the Glucagon-like-Peptide-1 (GLP-1) Therapy segment, marking its presence with a notable share in the market landscape. GLP-1, known for its efficacy in blood sugar regulation, has become a preferred choice for many patients. Its steady rise in pen needles market share reflects the growing recognition of GLP-1 as a valuable therapeutic option, particularly for individuals seeking alternatives to traditional insulin-based treatments.

Simultaneously, the Growth Hormone Therapy segment has carved its niche in the Pen Needles market. Although holding a comparatively smaller share, the growth hormone therapy segment demonstrates a promising trajectory. This growth can be attributed to the increasing prevalence of growth hormone-related disorders and a rising awareness of the therapeutic benefits associated with this form of treatment.

In conclusion, the Pen Needles market exhibits a dynamic landscape with insulin therapy leading the way, capturing a substantial market share. The coexistence of GLP-1 and Growth Hormone therapies signifies the diverse and evolving needs of patients, contributing to a multifaceted growth story within the market. As healthcare continues to advance, these distinct segments are expected to play pivotal roles in shaping the future landscape of pen needle utilization.

Key Market Segments

Product Type

- Standard Pen Needles

- Safety Pen Needles

Needle Length

- 4 mm

- 5 mm

- 6 mm

- 8 mm

- 10 mm

- 12 mm

Therapy

- Insulin

- Glucagon-like-Peptide-1 (GLP-1)

- Growth Hormone

Drivers

Rising Diabetes Prevalence

The increasing global prevalence of diabetes is a primary driver for the pen needles market. As more individuals are diagnosed with diabetes, the demand for insulin delivery devices, including pen needles, continues to grow.

Advancements in Technology

Ongoing technological advancements in pen needle design and manufacturing contribute to the market’s growth. Features such as ultra-thin needles, ergonomic designs, and compatibility with various insulin pens enhance patient comfort and drive the adoption of pen needles.

Patient Preference for Self-administration

The trend towards self-administration of insulin by patients favors the adoption of pen needles. The convenience, ease of use, and reduced pain associated with pen injections compared to traditional syringes make them a preferred choice among individuals with diabetes.

Government Initiatives and Support

Initiatives and policies by governments and healthcare organizations promoting the use of modern insulin delivery devices, including pen needles, stimulate market growth. Subsidies, awareness campaigns, and reimbursement policies can positively impact the adoption of pen needles.

Restraints

High Cost of Advanced Devices

The cost associated with technologically advanced pen needles may hinder market growth, particularly in regions with limited healthcare budgets. Affordability remains a key concern for patients and healthcare providers, affecting the widespread adoption of premium pen needle products.

Limited Access to Healthcare in Developing Regions

Inadequate access to healthcare facilities and resources in certain developing regions can restrict the market’s growth. Lack of awareness and education about diabetes management, as well as limited availability of insulin delivery devices, including pen needles, pose challenges.

Concerns Regarding Needlestick Injuries

Despite advancements in needle safety features, concerns about needlestick injuries persist. Healthcare professionals and patients may exhibit reluctance in adopting pen needles due to anxiety or fear associated with accidental needlestick incidents.

Competition from Alternative Insulin Delivery Methods

The pen needles market faces competition from alternative insulin delivery methods such as insulin pumps and inhalers. The availability and preference for these alternatives among specific patient groups can impact the market share of pen needles.

Opportunities

Expansion in Emerging Markets

There is a significant growth opportunity in untapped emerging markets where the prevalence of diabetes is rising. Pen needle manufacturers can explore partnerships, collaborations, and market expansion strategies to reach a broader patient base in these regions.

Customization and Personalization of Devices

The trend towards personalized healthcare creates opportunities for pen needle manufacturers to develop customizable and patient-specific devices. Offering a range of needle lengths, gauges, and additional features can cater to individual preferences and enhance market penetration.

Focus on Pediatric Population

The pediatric population with diabetes represents an underserved market. Pen needle manufacturers can develop child-friendly designs, smaller needle sizes, and educational materials to address the unique needs of children with diabetes and their caregivers.

Integration of Digital Health Technologies

The integration of digital health technologies, such as smart insulin pens with connectivity features, presents a growth avenue. Developing pen needles that can sync with mobile apps, track insulin usage, and provide real-time data can enhance patient engagement and adherence.

Trends

Shift Towards Disposable Pen Needles

There is a noticeable trend in the market towards the adoption of disposable pen needles. Disposable options offer convenience, eliminate the need for manual needle changes, and reduce the risk of contamination, driving their popularity among patients and healthcare providers.

Innovations in Needle Safety Features

Continuous innovations in needle safety features, including retractable needles and shields, are prevalent trends. Manufacturers are focusing on enhancing user safety and addressing concerns related to accidental needlestick injuries.

Environmentally Friendly Designs

With growing environmental awareness, there is a trend towards developing pen needles with eco-friendly materials and designs. Manufacturers are exploring options to reduce plastic waste and promote sustainable practices in the production of insulin delivery devices.

Telehealth Integration for Diabetes Management

The integration of pen needle usage data into telehealth platforms is emerging as a trend. This allows healthcare providers to remotely monitor and adjust insulin regimens based on real-time data, improving patient outcomes and management of diabetes.

Regional Analysis

In 2023, Europe held a dominant market position among all the regions, and capturing more than a 38.9% share. The region’s dominance is further underscored by its substantial market value, which reached USD 1.4 billion for the year 2023. This significant market presence can be attributed to a confluence of factors that collectively position Europe as a key player in the pen needles industry.

Europe boasts a well-established and robust healthcare infrastructure, characterized by advanced medical facilities and a high level of accessibility. This facilitates the widespread adoption of pen needles, contributing to the region’s dominant market share.

The increasing prevalence of diabetes in Europe has driven a surge in demand for diabetic care products, including pen needles. As a result, the region has witnessed a heightened need for efficient and patient-friendly insulin delivery systems, further fueling the market’s growth.

Europe maintains stringent regulatory standards and compliance requirements for medical devices, ensuring the safety and efficacy of pen needles. This commitment to regulatory excellence enhances consumer confidence and positions European products favorably in the global market.

The European market actively engages in continuous innovation and research initiatives, leading to the development of cutting-edge pen needle technologies. This commitment to advancement allows Europe to stay ahead in terms of product offerings and technological sophistication.

The collaborative landscape within Europe’s healthcare sector has played a pivotal role in the dominance of the pen needles market. Partnerships between pharmaceutical companies, healthcare providers, and research institutions have fostered an environment conducive to product development and market expansion.

Europe has been proactive in implementing patient education and awareness programs, promoting the benefits of pen needles and encouraging their adoption. This concerted effort has contributed to a higher level of acceptance and usage among patients with diabetes.

Europe benefits from an extensive network of distribution channels and effective market access strategies. This facilitates the seamless distribution of pen needles, ensuring widespread availability across the region.

As Europe continues to exhibit a strong grip on the pen needles market, stakeholders and industry participants are advised to closely monitor evolving trends, regulatory developments, and technological innovations within the region. The European dominance is not merely a consequence of current market dynamics but is also indicative of a sustained commitment to excellence and innovation in diabetic care solutions.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Novo Nordisk A/S, a prominent player in the pen needles market, has consistently demonstrated a strong market presence owing to its innovative and high-quality products. With a focus on diabetes care, Novo Nordisk’s pen needles have gained widespread acceptance for their user-friendly design and precision, contributing significantly to the overall market growth.

Becton, Dickinson and Company (BD), another key player, has established itself as a leading contributor to the pen needles market. BD’s commitment to healthcare solutions is evident in its technologically advanced pen needle offerings. The company’s emphasis on safety and ease of use has positioned its products favorably in the market, catering to the evolving needs of healthcare professionals and patients alike.

Terumo Corp., a significant player in the pen needles sector, has been instrumental in shaping the market landscape. Terumo’s focus on product development and strategic collaborations has enabled it to provide pen needles that meet the highest standards of quality and performance. The company’s contributions to the market underscore its commitment to enhancing the patient experience and advancing diabetes care.

Owen Mumford Ltd. has carved a niche in the pen needles market with its innovative solutions. The company’s emphasis on patient-centric design and continuous improvement reflects in its range of pen needles. Owen Mumford’s ability to combine functionality with user comfort has positioned it as a key player, driving positive outcomes for both healthcare providers and patients.

In addition to these key players, various other contributors play a crucial role in the pen needles market. These players, through their distinct product offerings and market strategies, collectively contribute to the market’s dynamism. Their efforts to address diverse customer needs and enhance the overall quality of pen needles further enrich the competitive landscape.

As the pen needles market evolves, collaboration and competition among these key players are expected to intensify, fostering innovation and driving advancements in diabetes care. The collective impact of these companies is pivotal in shaping the future trajectory of the pen needles market, ensuring that patients receive optimal solutions for their healthcare needs.

Market Key Players

- Novo Nordisk A/S

- Becton

- Dickinson and Company

- Terumo Corp.

- Owen Mumford Ltd.

- B. Braun Melsungen AG

- HTL-STREFA

- UltiMed Inc.

- Allison Medical Inc.

- Artsana S.p.A.

Recent Developments

- In July 2023, Terumo Corporation, a global leader in medical technology, announced the acquisition of certain assets of Amstelveen Medical Devices B.V. (AMD), a Dutch company specializing in the development and manufacturing of pen needles for insulin delivery. This acquisition is expected to strengthen Terumo’s position in the pen needles market and expand its product portfolio.

- In August 2023, Novo Nordisk, a leading Danish pharmaceutical company, announced the launch of its new NovoFine 6mm pen needle, the thinnest pen needle currently available on the market. The NovoFine 6mm pen needle is designed to provide a more comfortable injection experience for people with diabetes.

- In September 2023, Becton, Dickinson and Company (BD), a leading global medical technology company, announced that it has received FDA approval for its new BD Ultra-Fine Pen Needle 32G x 5mm. The BD Ultra-Fine Pen Needle 32G x 5mm is designed to provide a more comfortable and discreet injection experience for people with diabetes.

- In October 2023, Owen Mumford, a leading global provider of diabetes care products, announced the launch of its new Ultratouch 4mm pen needle, the shortest pen needle currently available on the market. The Ultratouch 4mm pen needle is designed to provide a more comfortable injection experience for people with diabetes who prefer shorter needles.

Report Scope

Report Features Description Market Value (2023) USD 3.5 Bn Forecast Revenue (2033) USD 10.0 Bn CAGR (2024-2033) 10.9% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Product Type (Standard Pen Needles, Safety Pen Needles), Needle Length (4 mm, 5 mm, 6 mm, 8 mm, 10 mm, 12 mm), Therapy (Insulin, Glucagon-like-Peptide-1 (GLP-1), Growth Hormone) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Novo Nordisk A/S, Becton, Dickinson and Company, Terumo Corp., Owen Mumford Ltd., B. Braun Melsungen AG, HTL-STREFA, UltiMed Inc., Allison Medical Inc., Artsana S.p.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the pen needles market size in 2023?The pen needles market size is USD 3.4 Billion in 2023.

What is the CAGR for the pen needles market?The pen needles market is expected to grow at a CAGR of 10.9% during 2024-2033.

What are the segments covered in the pen needles market report?Market.US has segmented the Global pen needles Market Value (US$ Mn) Analysis by Region, 2023 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, market has been segmented into standard pen needles and safety pen needles. By Needle Length, market has been further divided into 5 mm, 6 mm, 8mm, 10 mm, and other needle length. By Therapy, market has been further divided into Insulin, Growth hormone, and Glucagon-like-Peptide-1 (GLP-1).

Who are the key players in the pen needles market?Novo Nordisk A/S, Becton, Dickinson and Company, Terumo Corp., Owen Mumford Ltd., B. Braun Melsungen AG, HTL-STREFA, UltiMed Inc., Allison Medical Inc., Artsana S.p.A. Other Key Players are the key vendors in the Pen needles market.

Which region is more attractive for vendors in the pen needles market?Europe is expected to account for the highest revenue share of 38.9% among the other regions and reached USD 1.4 billion for the year 2023. Therefore, the pen needles market in Europe is expected to garner significant business opportunities for the vendors during the forecast period.

What are the key markets for pen needles?Key markets for pen needles are the U.S., Canada, the U.K., Germany, Japan, India, China, Brazil, Mexico, and South Africa.

Which segment has the largest share in the pen needles market?In the pen needles market, vendors should focus on grabbing business opportunities from the 8 mm Needle length segment as it accounted for the largest market share in the base year.

-

-

- Novo Nordisk A/S

- Becton

- Dickinson and Company

- Terumo Corp.

- Owen Mumford Ltd.

- B. Braun Melsungen AG

- HTL-STREFA

- UltiMed Inc.

- Allison Medical Inc.

- Artsana S.p.A.