Global PCB Manufacturer Insurance Market By Insurance Type (General Liability Insurance, Product Liability Insurance, Others), By Provider (Insurance Companies, Brokers/Agents, Others), By End-User (Small and Medium Enterprises, Large Enterprises), By Distribution Channel (Direct, Brokers/Agents, Online), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 169257

- Number of Pages: 318

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

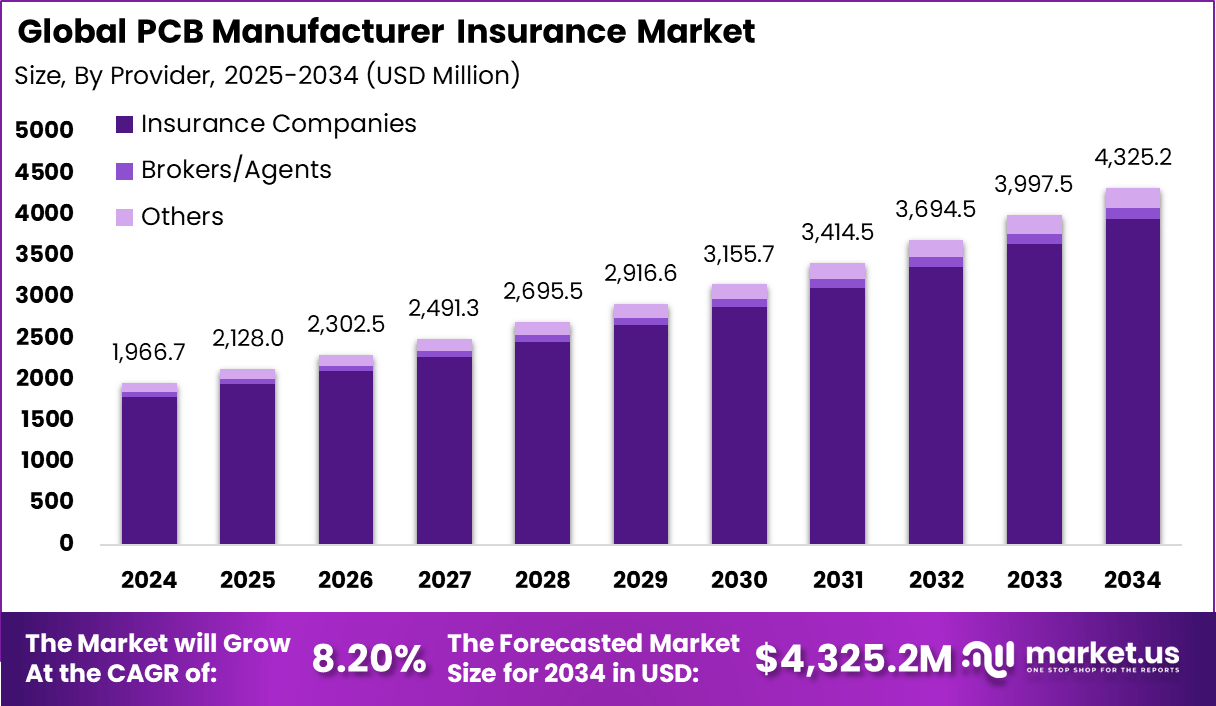

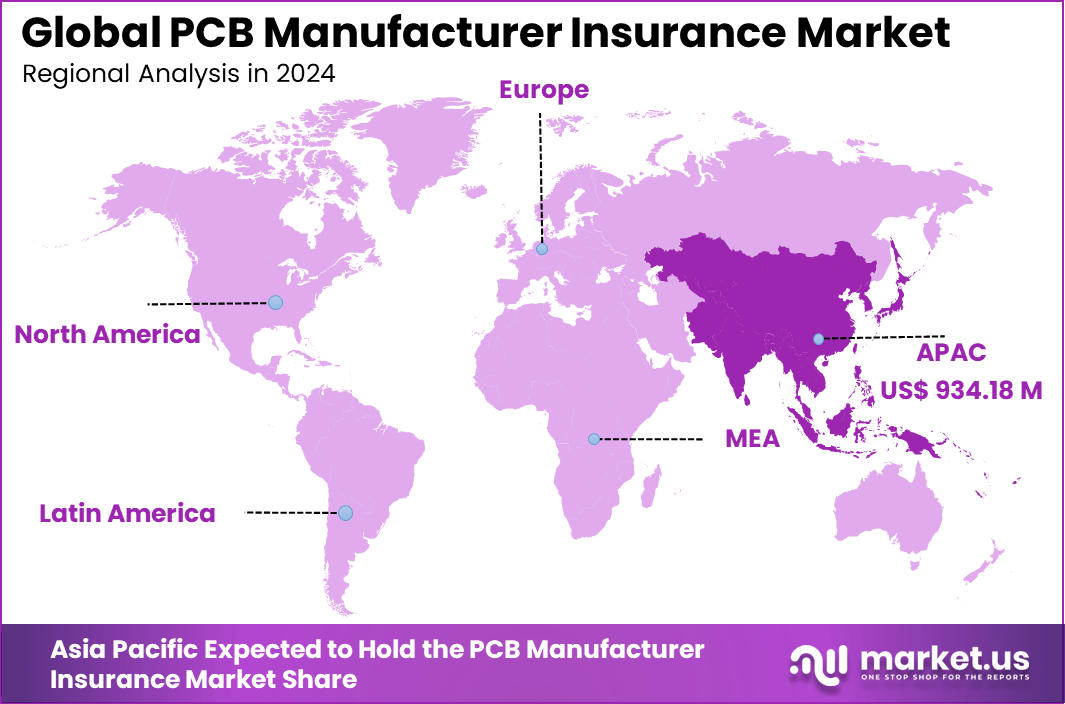

The Global PCB Manufacturer Insurance Market generated USD 1,966.7 million in 2024 and is predicted to register growth from USD 2,128.0 million in 2025 to about USD 4325.2 million by 2034, recording a CAGR of 8.20% throughout the forecast span. In 2024, Asia Pacific held a dominan market position, capturing more than 47.5% share, holding USD 934.18 Million revenue.

PCB Manufacturer Insurance Market focuses on insurance policies tailored for companies producing printed circuit boards, which are critical components in electronics. These policies cover risks such as equipment damage, product liability, supply chain disruptions, and environmental hazards. With manufacturing operations often involving delicate and costly machinery, insurance helps protect these businesses against financial losses and operational downtime.

Top driving factors include the high value of manufacturing equipment and the complexity of supply chains used in PCB production. Manufacturers face risks from equipment breakdowns, natural disasters, and liability claims due to faulty products. Growing awareness of these risks, along with regulatory pressure to maintain safety and environmental standards, encourages manufacturers to invest in comprehensive insurance coverage.

The increasing demand for electronics in various industries pushes manufacturers to safeguard continuous production. Demand comes from PCB makers operating in highly regulated environments like automotive, aerospace, and medical sectors. These industries require strict quality and safety standards, making insurance important to cover potential defects, recalls, and compliance violations.

Top Market Takeaways

- By insurance type, property insurance leads with 32.5% share, covering risks such as fire, theft, natural disasters, and damage to buildings, equipment, and inventory critical for PCB manufacturing operations.

- By provider, insurance companies dominate with 91.3% share, offering specialized policies tailored to the unique risks faced by PCB manufacturers, including property, liability, and workers’ compensation coverage.

- By end-user, large enterprises account for 73.2% of the market, prioritizing comprehensive insurance to protect high-value assets, complex supply chains, and cross-border operations.

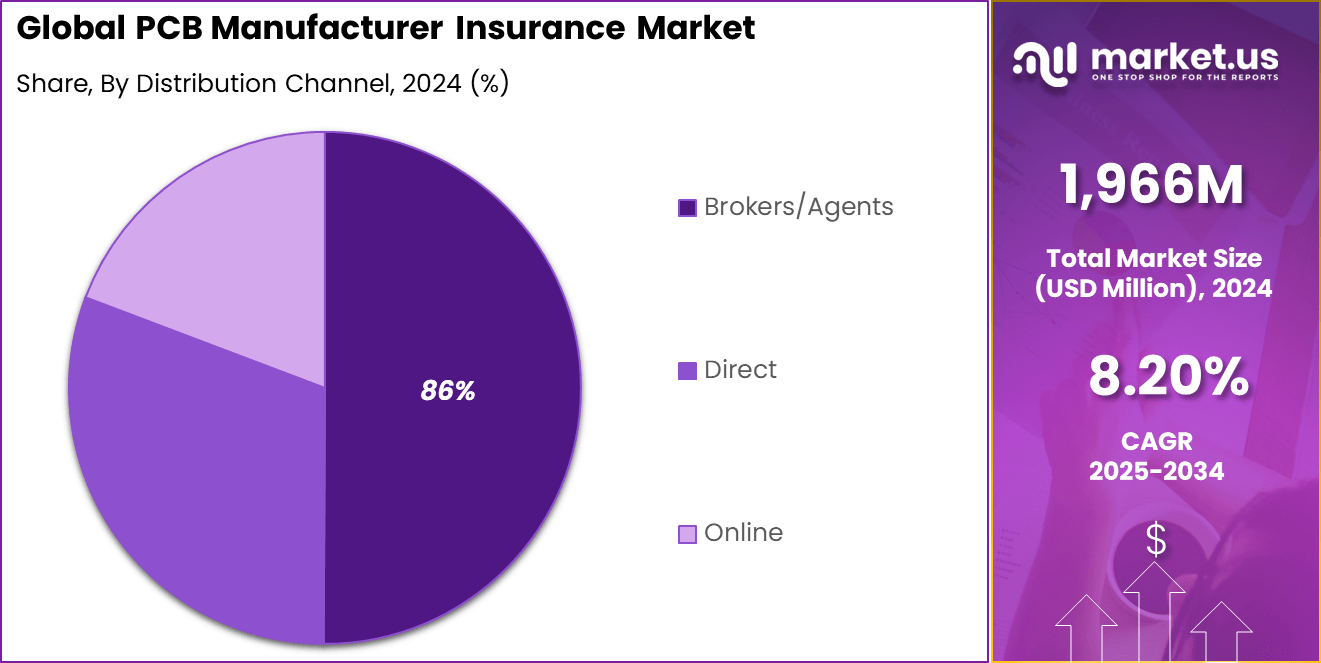

- By distribution channel, brokers/agents hold 85.9% share, providing expert advice, personalized service, and access to a wide range of insurance products for PCB manufacturers.

- Regionally, Asia Pacific commands about 47.5% market share.

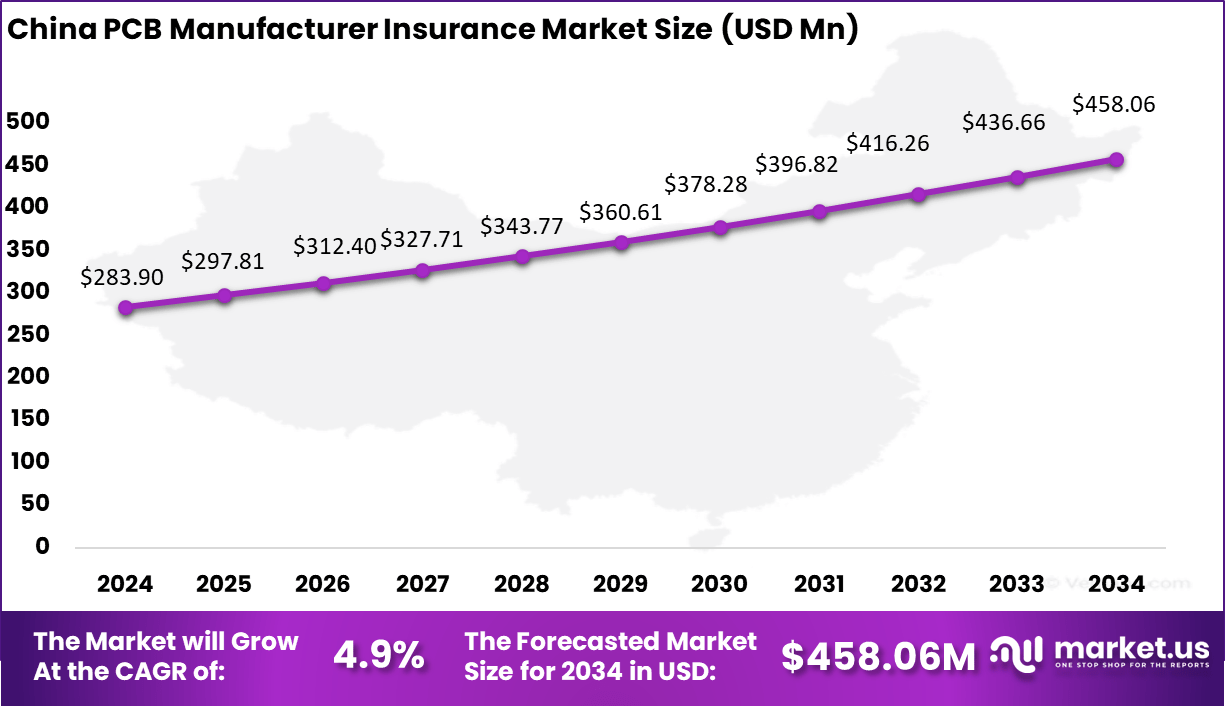

- The China market is valued at approximately USD 283.9 million in 2025.

- The market grows at a CAGR of 4.9%, driven by industrial expansion, regulatory compliance, and increasing awareness of risk management in PCB manufacturing.

By Insurance Type

Property insurance holds a notable 32.5% share in the PCB manufacturer insurance market. This coverage protects manufacturers against losses related to physical assets such as buildings, machinery, and inventory, which are vital for uninterrupted production.

PCB manufacturing facilities are exposed to risks like fire, equipment breakdown, and natural disasters, making property insurance a fundamental safeguard. The coverage ensures financial recovery and business continuity in the event of unexpected damage or loss.

Property insurance is especially critical for large PCB manufacturers with high-value equipment and extensive facilities. As production scales up and facilities become more automated, the need for robust property protection grows, supporting manufacturers in maintaining operational stability and meeting contractual obligations.

By Provider

Insurance companies dominate the provider segment with a commanding 91.3% share. These providers design and underwrite specialized policies tailored to the unique risks faced by PCB manufacturers. Their expertise in risk assessment, claims management, and compliance ensures manufacturers receive comprehensive coverage that addresses both traditional and emerging threats, such as cyber incidents and supply chain disruptions.

Insurance companies also offer value-added services like risk consulting, loss prevention training, and customized policy options, helping manufacturers optimize their risk management strategies. Their established networks and financial strength make them the preferred choice for both large enterprises and SMEs seeking reliable protection.

By End-User

Large enterprises represent 73.2% of the PCB manufacturer insurance market. These organizations operate extensive production facilities and manage complex supply chains, exposing them to a wide range of operational, legal, and financial risks. Their insurance needs are more sophisticated, requiring multi-line coverage that addresses property, liability, cyber, and environmental risks.

Large enterprises benefit from economies of scale in insurance procurement and often negotiate bespoke policy terms, premium discounts, and value-added services. Their focus on comprehensive risk management frameworks drives demand for tailored insurance solutions, supporting business continuity and regulatory compliance.

By Distribution Channel

Brokers and agents hold a dominant 85.9% share of the distribution channel segment. These intermediaries play a crucial role in connecting PCB manufacturers with suitable insurance providers, leveraging their industry expertise to recommend optimal coverage and policy terms. Brokers and agents offer personalized service, and claims support, helping manufacturers navigate complex insurance products and regulatory requirements.

The broker/agent channel’s prominence is reinforced by its ability to provide tailored solutions, streamline policy issuance, and expedite claims settlement. As the PCB manufacturing sector grows, brokers and agents continue to facilitate access to innovative insurance products and foster relationships between insurers and insureds.

Key Reasons for Adoption

- Rising demand for electronics in automotive, medical, and consumer sectors means PCB manufacturers are producing more boards, increasing exposure to risks like product defects and supply chain disruptions.

- Stricter global regulations around product safety and environmental compliance require manufacturers to have insurance to avoid penalties and legal claims.

- Increased investment in advanced manufacturing facilities and automation brings higher asset values, making insurance essential to protect against equipment breakdowns and property damage.

- Product liability risks are growing as faulty PCBs can cause device failures, recalls, or even safety incidents, prompting manufacturers to secure liability coverage.

- Cyber threats and data breaches are more common as digital manufacturing expands, so insurers offer policies covering digital risks and business interruption.

Benefits

- Insurance protects against costly claims from product defects, accidents, or property damage, reducing financial risk for PCB manufacturers.

- Comprehensive policies cover a range of risks, including equipment failure, supply chain disruptions, and cyber incidents, helping businesses recover faster after losses.

- Coverage for product liability and recalls safeguards a manufacturer’s reputation and customer trust, minimizing long-term brand damage.

- Insurers often provide risk assessment and safety guidance, helping manufacturers improve operational safety and reduce incidents.

- Insurance makes it easier to secure contracts and partnerships, as clients and suppliers feel more confident about risk management.

Usage

- Insurance is used for protecting manufacturing facilities, equipment, and raw materials from fire, theft, or natural disasters.

- Policies are purchased to cover liability claims arising from defective PCBs, including recalls and lawsuits.

- Coverage extends to cyber risks, such as data breaches and digital fraud, which are increasingly relevant for digital manufacturing processes.

- Insurance is required for compliance with industry standards and regulations, ensuring manufacturers can operate legally and meet client requirements.

- Risk management support from insurers helps manufacturers implement safety protocols and reduce accidents or operational disruptions.

Emerging Trends

Key Trends Description Digital Transformation in Underwriting Adoption of digital platforms and AI for faster, more accurate risk assessment and policy customization. Specialized Coverage for Advanced Risks Development of policies tailored for emerging risks like cyber threats, supply chain disruptions, and product recalls. Focus on Supply Chain Insurance Increased coverage for global supply chain vulnerabilities, including raw material sourcing and logistics. Expansion of Product Liability Insurance Growing emphasis on product liability coverage due to rising complexity and quality standards in PCB manufacturing. Integration of IoT and Data Analytics Use of IoT-enabled monitoring and real-time data analytics to assess risk and automate claims processing. Growth Factors

Key Factors Description Rising Demand for Electronics Surge in consumer electronics, automotive, and medical device production driving PCB manufacturing growth. Evolving Regulatory Requirements Stricter regulations on quality, safety, and environmental compliance increasing demand for specialized insurance. Expansion of Manufacturing in Asia-Pacific Rapid industrialization and electronics manufacturing growth in Asia-Pacific fueling insurance adoption. Increasing Complexity of PCB Designs Advanced and miniaturized PCBs require robust insurance against manufacturing defects and recalls. Strategic Government Initiatives Government incentives and support for electronics manufacturing boosting investment and insurance penetration. Key Market Segments

By Insurance Type

- General Liability Insurance

- Product Liability Insurance

- Property Insurance

- Workers’ Compensation Insurance

- Professional Liability Insurance

- Others

By Provider

- Insurance Companies

- Brokers/Agents

- Others

By End-User

- Small and Medium Enterprises

- Large Enterprises

- By Distribution Channel

- Direct

- Brokers/Agents

- Online

Regional Analysis

Asia Pacific accounted for 47.5% of the PCB Manufacturer Insurance Market. This dominant position is supported by the extensive concentration of PCB fabrication facilities across China, Taiwan, South Korea, and Japan. The region has been influenced by steady expansion in consumer electronics, automotive electronics, and telecommunications manufacturing, which increases the exposure of PCB producers to operational, equipment, and liability risks.

The adoption of insurance solutions has grown as firms in the region invest in sophisticated production lines where even minor disruptions can lead to significant financial losses. The market presence is further strengthened by the rising need for coverage related to product defects, equipment breakdown, and supply chain interruptions.

China generated USD 283.9 million with a CAGR of 4.9%. This performance reflects China’s central role in the global PCB supply chain, where high production volumes create consistent demand for specialized insurance products. The growth has been driven by stringent quality requirements across export markets, prompting manufacturers to seek insurance protection that reduces exposure to recall costs and compliance failures.

The sector has also been shaped by increasing automation in factories, intensifying the need for coverage linked to machine failures and cyber risks. The steady CAGR indicates that insurance adoption is becoming more structured as Chinese PCB manufacturers expand their global footprint and face more complex operational contingencies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growth in the PCB manufacturer insurance market is supported by rising demand for electronic products across industries such as consumer electronics, automotive systems, medical devices, and industrial machinery. As production scales up, manufacturers face higher exposure to risks such as defects, equipment failure, and supply disruptions.

These risks can lead to costly losses, so many manufacturers seek insurance to protect their operations. Industry sources note that increased complexity in PCB designs has also raised the need for stronger financial protection. Another driver comes from the manufacturing environment itself. PCB production involves chemicals, solvents, heat treatments, and precision machinery.

Even small lapses can cause contamination, damage to property, or safety incidents. Standard business insurance often does not provide full protection for these issues, so dedicated insurance plans for PCB manufacturers have gained importance. This alignment with sector-specific risk encourages wider adoption of specialized coverage.

Restraint

A major restraint in this market is the high cost of obtaining complete insurance protection. Coverage for property, liability, equipment, workers, and environmental exposure can be expensive, especially for smaller PCB producers. Many businesses operate with tight margins, so they may hesitate to invest in broad insurance coverage even when risks are clear. This cost concern limits the adoption of specialized insurance among smaller facilities.

Another restraint is the difficulty insurers face when assessing PCB manufacturing risks. Production methods vary across firms, and material choices differ depending on product type. This variation makes it hard to set clear pricing models. Insurers sometimes respond with higher premiums or narrow policy terms, reducing the appeal of insurance for manufacturers who already manage complex processes.

Opportunity

There is a strong opportunity to provide insurance packages tailored to different scales of PCB manufacturing. Smaller facilities may need simple protection focused on liability and property damage, while larger manufacturers may require combined coverage for environmental exposure, equipment breakdown, and production interruptions. Offering flexible packages can help insurers reach a wider part of the market.

Another opportunity lies in linking insurance with risk-prevention support. Many PCB manufacturers face challenges in handling chemicals, maintaining clean production environments, and preventing defects. Insurers who offer safety guidance, compliance checks, and preventive audits alongside insurance can attract clients who want both protection and operational support. This approach can improve risk outcomes for both insurers and manufacturers.

Challenge

A key challenge is the lack of detailed historical data on incidents specific to PCB manufacturing. Without reliable information on defect rates, equipment failures, or contamination events, insurers may struggle to model risks accurately. This uncertainty can lead to higher premiums and limited coverage options, making it harder for manufacturers to access suitable insurance.

Another challenge is the evolving regulatory landscape. PCB production often involves hazardous materials that must be stored, used, and disposed of carefully. Regulations related to environmental safety and worker protection continue to change, creating compliance pressure for manufacturers. Insurance plans must adapt to these changes, which increases complexity for insurers and may raise costs for policyholders.

Competitive Analysis

AIG, Chubb, Zurich Insurance Group, Allianz, and AXA XL lead the PCB manufacturer insurance market with comprehensive coverage designed to protect against equipment damage, product liability, supply chain disruption, and operational risks. Their policies support manufacturers facing high-precision production demands and stringent quality requirements. These companies focus on tailored underwriting, strong risk assessment models, and global claims support.

Travelers, Liberty Mutual, The Hartford, Tokio Marine HCC, Sompo International, Munich Re, Berkshire Hathaway, CNA Financial, and Markel strengthen the competitive landscape with specialized coverage for manufacturing exposures such as fire risks, contamination, recall losses, and business interruption. Their offerings help PCB producers maintain operational resilience and meet customer reliability expectations. These providers emphasize flexible policy structures, industry-specific endorsements, and proactive loss-prevention services.

Hanover Insurance Group, Assurant, QBE Insurance Group, Swiss Re, and other participants broaden the market by offering scalable insurance solutions for small to mid-sized PCB manufacturers. Their products address property protection, cyber liability, and equipment breakdown risks. These companies focus on affordability, streamlined claims processes, and risk advisory services. Rising adoption of automation, tighter tolerances in PCB production, and globalized supply chains continue to drive demand for dedicated insurance coverage in this sector.

Top Key Players in the Market

- AIG

- Chubb

- Zurich Insurance Group

- Allianz

- AXA XL

- Travelers Insurance

- Liberty Mutual

- The Hartford

- Tokio Marine HCC

- Sompo International

- Munich Re

- Berkshire Hathaway

- CNA Financial

- Markel Corporation

- Hanover Insurance Group

- Assurant

- QBE Insurance Group

- Swiss Re

- Others

Future Outlook

The PCB manufacturer insurance market looks set for steady change ahead. As electronics production grows worldwide, makers will face more complex risks from smart factories, global supply lines, and new tech like automation and connected devices. Insurers plan to offer tailored plans that cover cyber threats, gear breakdowns, and product flaws better, while rules on safety and the environment tighten up. Smaller firms and those in fast-growing areas will find easier access to basic coverage through online tools, helping them handle bigger operations without big worries.

Opportunities lie in

- Tailored plans for new risks like cyber attacks and supply chain breaks in high-tech plants.

- Easier coverage for small firms expanding into electric vehicles and smart devices.

- Bundled options linking PCB work with related fields like chip making and automation.

Recent Developments

- November, 2025, Zurich Insurance Group reported strong growth in its property and casualty segment in the first nine months of 2025. The company highlighted a record increase in P and C premiums, which reflects a stable underwriting environment for industrial and manufacturing risks. This performance indicates sustained demand for specialty coverage categories that include PCB production facilities.

- May, 2025, Allianz published its Global Insurance Industry Report for 2025, stating that the overall insurance sector recorded growth of 8.6% in 2024. The study noted that commercial and industrial lines continued to attract higher premium volumes. This trend supports insurers that provide tailored policies for electronics and PCB manufacturers, as demand for risk protection remained strong during the period.

Report Scope

Report Features Description Market Value (2024) USD 1,966.7 Mn Forecast Revenue (2034) USD 4,325.2 Mn CAGR(2025-2034) 8.20% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Insurance Type (General Liability Insurance, Product Liability Insurance, Others), By Provider (Insurance Companies, Brokers/Agents, Others), By End-User(Small and Medium Enterprises, Large Enterprises) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AIG, Chubb, Zurich Insurance Group, Allianz, AXA XL, Travelers Insurance, Liberty Mutual, The Hartford, Tokio Marine HCC, Sompo International, Munich Re, Berkshire Hathaway, CNA Financial, Markel Corporation, Hanover Insurance Group, Assurant, QBE Insurance Group, Swiss Re, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  PCB Manufacturer Insurance MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

PCB Manufacturer Insurance MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AIG

- Chubb

- Zurich Insurance Group

- Allianz

- AXA XL

- Travelers Insurance

- Liberty Mutual

- The Hartford

- Tokio Marine HCC

- Sompo International

- Munich Re

- Berkshire Hathaway

- CNA Financial

- Markel Corporation

- Hanover Insurance Group

- Assurant

- QBE Insurance Group

- Swiss Re

- Others