Global PC/ABS Market By Type(Virgin, Recycled), By Grade(General Grade, Flame Retardant Grade, Reinforced Grade, High Heat Grade, Others), By Processing Method(Extrusion Molding, Injection Molding, Blow Molding, Thermoforming, 3D Printing, Others), By End-use(Automotive, Electrical and Electronics, Consumer Appliance, Aerospace and Defense, Building and Construction, Healthcare, Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: March 2024

- Report ID: 14502

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

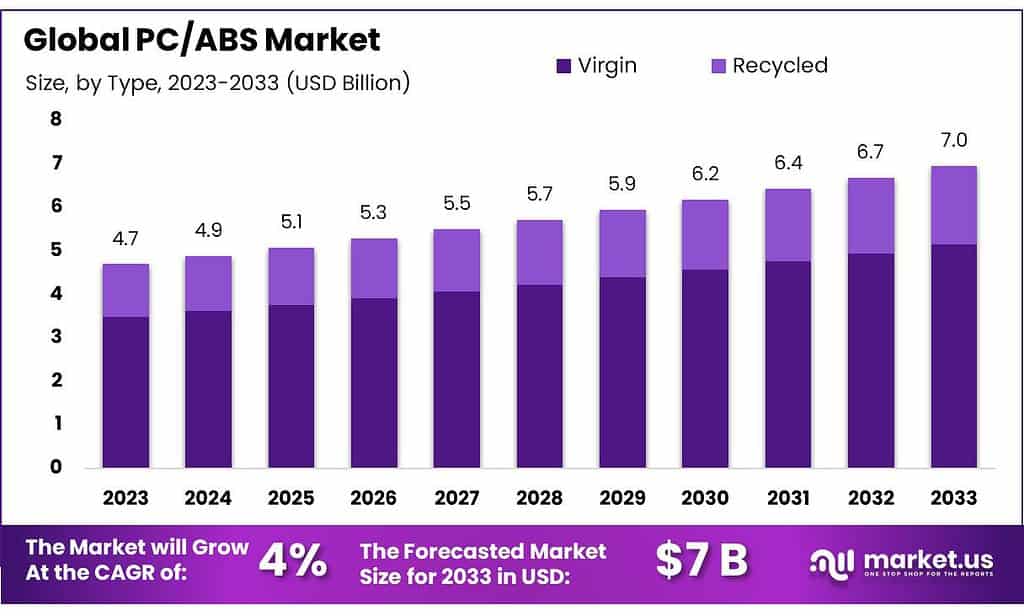

The global PC/ABS Market size is expected to be worth around USD 7 billion by 2033, from USD 4.7 billion in 2023, growing at a CAGR of 4% during the forecast period from 2023 to 2033.

The PC/ABS (Polycarbonate/Acrylonitrile Butadiene Styrene) market pertains to the industry focused on the production, distribution, and application of PC/ABS alloy, a thermoplastic polymer that combines the excellent mechanical properties of polycarbonate (PC) with the superior processing ability and flexibility of acrylonitrile butadiene styrene (ABS).

This blend results in a material that offers outstanding toughness, high impact resistance, good heat resistance, and an excellent aesthetic appearance after processing. Due to its balanced attributes, PC/ABS finds extensive use in various industries, including automotive, electronics, consumer goods, and healthcare.

The demand for PC/ABS is driven by its adaptability to a wide range of manufacturing processes, including injection molding, extrusion, and thermoforming, making it a versatile choice for complex parts and components.

Its application in the automotive industry for interior and exterior parts, in the electronics sector for enclosures for laptops, smartphones, and other devices, and in consumer goods for durable and high-quality products, underscores the material’s broad utility. The healthcare sector also benefits from PC/ABS’s compliance with stringent safety and hygiene standards, making it suitable for medical devices and housings.

The market for PC/ABS is characterized by ongoing research and development efforts aimed at enhancing the material’s properties, such as flame retardancy, UV stability, and resistance to chemicals, to meet the evolving requirements of end-use industries.

Sustainability initiatives focusing on the recyclability and environmental impact of PC/ABS also play a significant role in shaping market trends and consumer preferences.

Key Takeaways

- Market Growth: PC/ABS market is projected to reach USD 7 billion by 2033, growing steadily at a 4% CAGR from 2023.

- Material Characteristics: PC/ABS blend known for toughness, impact resistance, heat resistance, and aesthetic appeal.

- Dominant Type: Virgin PC/ABS holds over 74.5% market share due to superior quality.

- Top Processing Method: Extrusion Molding dominates with a 45.6% market share.

- Major End-use Industry: The Automotive sector holds the largest market share, followed by Electrical & Electronics.

- The dielectric strength of PC/ABS can reach up to 15-20 kV/mm, making it suitable for electrical applications.

- PC/ABS can have a Shore D hardness of 70-90, providing good resistance to indentation and wear.

By Type

In 2024, the PC/ABS market was distinctly segmented into two types: Virgin and Recycled. Virgin PC/ABS maintained a dominant position within the market, capturing more than a 74.5% share. This considerable market share can be attributed to its superior quality and performance characteristics, which are highly valued across various industries such as automotive, electronics, and consumer goods. Virgin PC/ABS is preferred for applications requiring high impact resistance, dimensional stability, and aesthetic appeal, driving its demand significantly higher than its recycled counterpart.

On the other hand, the Recycled segment, while smaller, demonstrated a growing interest, driven by increasing environmental concerns and the push for sustainable manufacturing practices. Despite holding a lesser share of the market, recycled PC/ABS has been gaining traction, particularly in industries looking to reduce their carbon footprint and adhere to stricter environmental regulations. The demand for recycled materials is expected to rise, influenced by evolving consumer preferences towards sustainability and the implementation of global policies favoring recycling and the circular economy.

while Virgin PC/ABS leads the market with its extensive application across industries due to its unmatched quality, the Recycled segment is poised for growth, reflecting the shifting dynamics towards sustainability and eco-friendly materials.

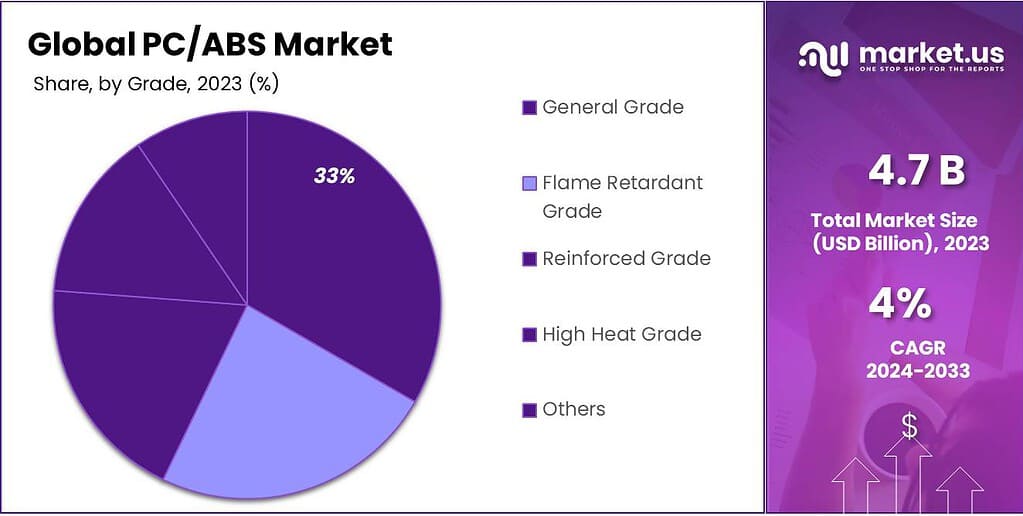

By Grade

In 2024, the PC/ABS market was categorized into several grades: General Grade, Flame Retardant Grade, Reinforced Grade, High Heat Grade, and Others. General Grade held a dominant market position, capturing more than a 34.5% share. This prominence is due to its widespread applicability in various industries, including automotive, consumer electronics, and household appliances, where its balanced properties of durability and cost-effectiveness are highly valued.

Flame Retardant Grade, designed to meet stringent safety standards, accounted for a significant portion of the market. Its demand is driven by sectors such as electronics, construction, and transportation, where material fire safety is critical. This grade’s ability to inhibit or resist the spread of fire while maintaining the material’s mechanical properties has made it a preferred choice for safety-conscious applications.

Reinforced Grade, known for its enhanced mechanical strength and stiffness, has found extensive use in applications requiring robust materials that can withstand heavy loads and harsh conditions. Industries such as automotive and machinery significantly contribute to its market share, valuing the material’s reinforced characteristics for parts subject to high stress.

High Heat Grade, tailored for applications requiring resistance to extreme temperatures, has carved its niche in the market. This grade is particularly relevant in the automotive under-the-hood components and industrial equipment, where materials must maintain performance integrity in high-temperature environments.

By Processing Method

In 2024, the PC/ABS market was segmented based on processing methods, including Extrusion Molding, Injection Molding, Blow Molding, Thermoforming, 3D Printing, and Others. Extrusion Molding held a dominant market position, capturing more than a 45.6% share. This method’s popularity stems from its versatility and efficiency in producing continuous shapes like pipes, sheets, and profiles, which are essential in automotive, construction, and packaging industries.

Injection Molding followed closely, favored for its precision and ability to produce complex shapes with high-quality finishes. This method is crucial in manufacturing components for consumer electronics, automotive parts, and medical devices, where dimensional accuracy and aesthetic appearance are paramount.

Blow Molding, although occupying a smaller market share, is indispensable in creating hollow parts such as bottles, containers, and other packaging solutions. Its demand is underscored by the food and beverage and pharmaceutical sectors, which require reliable and cost-effective packaging options.

Thermoforming marked its presence in the market by offering a flexible shaping process for larger and more intricately designed parts. Industries such as automotive and appliances leverage thermoforming for its ability to produce lightweight and structurally sound components.

3D Printing emerged as a rapidly growing segment, driven by the increasing adoption of additive manufacturing technologies. This processing method is gaining traction for its ability to prototype and manufacture parts with complex geometries, opening new avenues in custom manufacturing and rapid prototyping across various sectors.

By End-use

In 2024, the PC/ABS market was segmented by end-use industries such as Automotive, Electrical & Electronics, Consumer Appliance, Aerospace & Defense, Building & Construction, Healthcare, and Others. Automotive held a dominant market position, capturing more than a 45.6% share. This industry’s demand for PC/ABS is driven by the material’s durability, lightweight nature, and aesthetic versatility, crucial for manufacturing interior and exterior vehicle components, contributing to fuel efficiency and design flexibility.

The Electrical & Electronics sector followed, with PC/ABS being integral for producing a wide range of products, from consumer gadgets to industrial equipment. The material’s excellent electrical insulation properties and heat resistance make it ideal for housing electronic devices, ensuring safety and longevity.

Consumer Appliance is another significant segment, where PC/ABS’s impact resistance and aesthetic qualities are valued for manufacturing durable and visually appealing household appliances. This segment benefits from the material’s adaptability to various design requirements, enhancing the functional and aesthetic appeal of consumer goods.

Aerospace & Defense showed a growing interest in PC/ABS for its high performance in demanding environments. The material’s combination of strength and lightweight contributes to the manufacturing of components that can withstand extreme conditions while offering weight reduction, a critical factor in this sector.

Building & Construction industry utilizes PC/ABS in applications requiring robust, durable materials for fixtures and fittings, demonstrating the material’s versatility and durability in diverse environments.

Healthcare has become an increasingly important segment, with PC/ABS being used for medical devices and equipment. The material’s biocompatibility and ability to be sterilized make it suitable for healthcare applications, where safety and reliability are paramount.

Key Market Segments

By Type

- Virgin

- Recycled

By Grade

- General Grade

- Flame Retardant Grade

- Reinforced Grade

- High Heat Grade

- Others

By Processing Method

- Extrusion Molding

- Injection Molding

- Blow Molding

- Thermoforming

- 3D Printing

- Others

By End-use

- Automotive

- Electrical & Electronics

- Consumer Appliance

- Aerospace & Defense

- Building & Construction

- Healthcare

- Others

Driving Factors

Increasing Demand for Lightweight Materials in Automotive Industry

The automotive industry is undergoing a significant transformation driven by the growing demand for lightweight materials to enhance fuel efficiency and reduce emissions. As automotive manufacturers strive to meet stringent regulatory standards and consumer preferences for more fuel-efficient vehicles, the adoption of lightweight materials has become imperative. In this context, PC/ABS (polycarbonate/acrylonitrile butadiene styrene) blends emerge as a major driver for the automotive industry due to their unique combination of properties, including high impact resistance, dimensional stability, and lightweight characteristics.

The push towards lightweight in the automotive sector is primarily motivated by regulatory requirements aimed at reducing greenhouse gas emissions and improving fuel economy. Governments worldwide have implemented stringent emission standards, such as Corporate Average Fuel Economy (CAFE) regulations in the United States and Euro emission standards in Europe, which incentivize automakers to invest in lightweight materials that contribute to overall vehicle weight reduction. PC/ABS materials offer a compelling solution for automotive manufacturers seeking to achieve weight savings without compromising on performance or safety.

Moreover, the increasing consumer demand for vehicles with better fuel efficiency and lower environmental impact is driving automakers to explore innovative materials and design strategies. PC/ABS blends enable designers and engineers to create lightweight, yet robust automotive components such as interior trim, instrument panels, door panels, and exterior body parts. By replacing traditional materials like metal and engineering plastics with PC/ABS, automakers can achieve significant weight savings, thereby improving fuel economy and reducing emissions over the vehicle’s lifecycle.

Another factor driving the adoption of PC/ABS materials in the automotive industry is the ongoing trend toward electrification and hybridization of vehicles. Electric and hybrid vehicles require lightweight materials to offset the weight of batteries and improve overall energy efficiency. PC/ABS blends offer a viable solution for lightweight electric vehicle components while providing the necessary mechanical properties and design flexibility required for automotive applications.

Furthermore, advancements in manufacturing technologies, such as injection molding and advanced processing techniques, have made it easier and more cost-effective to produce complex automotive parts from PC/ABS materials. This has further fueled the adoption of PC/ABS in the automotive sector, as manufacturers can achieve higher levels of design freedom, part integration, and overall efficiency in the production process.

Restraining Factors

Supply Chain Disruptions Causing Raw Material Shortages

One of the significant restraining factors impacting the PC/ABS (polycarbonate/acrylonitrile butadiene styrene) market is supply chain disruptions leading to raw material shortages. The PC/ABS industry relies heavily on the steady supply of raw materials, including polycarbonate (PC), acrylonitrile butadiene styrene (ABS), and various additives. However, disruptions in the global supply chain, influenced by factors such as geopolitical tensions, trade disputes, natural disasters, and the ongoing COVID-19 pandemic, have resulted in challenges related to raw material availability, pricing volatility, and production instability.

Geopolitical tensions and trade disputes between major economies have led to fluctuations in tariffs, trade restrictions, and export controls on key raw materials used in PC/ABS production. These uncertainties in international trade relations can disrupt the supply chain, causing delays in raw material shipments, increased costs, and supply shortages for PC/ABS manufacturers. Moreover, trade barriers and geopolitical uncertainties can disrupt the flow of raw materials from key manufacturing regions to PC/ABS production facilities, leading to supply chain bottlenecks and operational challenges.

Natural disasters, such as hurricanes, floods, and earthquakes, can also disrupt the production and transportation of raw materials essential for PC/ABS manufacturing. Severe weather events can damage infrastructure, disrupt logistics networks, and cause temporary shutdowns of raw material extraction and processing facilities, leading to supply shortages and production delays. Additionally, the impact of climate change-related events, such as extreme weather patterns and environmental degradation, poses long-term risks to raw material availability and supply chain resilience in the PC/ABS market.

The ongoing COVID-19 pandemic has further exacerbated supply chain disruptions in the PC/ABS market. The pandemic-induced lockdowns, travel restrictions, and workforce shortages have disrupted manufacturing operations, logistics networks, and international trade flows, leading to delays in raw material procurement and production slowdowns. Additionally, the pandemic-driven demand fluctuations and shifting consumer preferences have created uncertainties in market demand forecasts, making it challenging for PC/ABS manufacturers to plan and manage their supply chains effectively.

Furthermore, fluctuations in oil prices, currency exchange rates, and energy costs can impact the pricing of raw materials used in PC/ABS production, affecting the overall profitability and competitiveness of PC/ABS manufacturers. Price volatility in raw material markets can lead to margin pressures, inventory management challenges, and increased production costs, further exacerbating the impact of supply chain disruptions on the PC/ABS market.

Growth Opportunity

Growing Demand for Electric Vehicles (EVs)

The increasing global demand for electric vehicles (EVs) presents a significant growth opportunity for the PC/ABS (polycarbonate/acrylonitrile butadiene styrene) market. As countries worldwide intensify efforts to reduce greenhouse gas emissions and combat climate change, there has been a notable shift towards electric mobility, with EVs emerging as a promising alternative to traditional internal combustion engine vehicles. This transition towards electrification of the automotive industry is expected to drive substantial demand for PC/ABS materials, which offer a compelling solution for lightweighting and enhancing the performance of EV components.

EVs require lightweight materials to offset the weight of batteries and improve overall energy efficiency, driving the adoption of advanced materials such as PC/ABS blends in vehicle design and manufacturing. PC/ABS materials offer a unique combination of properties, including high impact resistance, dimensional stability, and design flexibility, making them well-suited for various EV applications such as battery housings, interior components, charging infrastructure, and exterior body parts. By leveraging PC/ABS materials, EV manufacturers can achieve significant weight savings without compromising on safety, durability, or aesthetic appeal.

Furthermore, the expanding EV market offers opportunities for innovation and customization in PC/ABS materials to meet the specific requirements of electric vehicle manufacturers. As EV technology continues to evolve, there is a growing need for advanced materials that can withstand the unique challenges posed by electric drivetrains, battery systems, and charging infrastructure. PC/ABS manufacturers can capitalize on this demand by developing specialized formulations and grades tailored to the evolving needs of the electric vehicle industry, including improved thermal management, flame retardancy, and electrical conductivity properties.

Moreover, government incentives, subsidies, and regulatory policies aimed at promoting EV adoption and reducing carbon emissions are expected to drive the demand for electric vehicles globally. Countries and regions around the world are implementing ambitious targets and initiatives to accelerate the transition towards electric mobility, offering incentives such as tax credits, rebates, and infrastructure investments to support EV manufacturing, sales, and deployment. This favorable policy environment creates a conducive market ecosystem for PC/ABS manufacturers to capitalize on the growing demand for lightweight materials in the EV sector.

Additionally, the increasing consumer awareness and acceptance of electric vehicles, coupled with advancements in battery technology, charging infrastructure, and range capabilities, are expected to further fuel the growth of the EV market in the coming years. As EVs become more mainstream and affordable, the demand for PC/ABS materials in electric vehicle applications is poised to experience significant expansion, presenting a lucrative growth opportunity for PC/ABS manufacturers worldwide.

Latest Trends

Integration of Recycled Content in PC/ABS Blends

One of the latest trends shaping the PC/ABS (polycarbonate/acrylonitrile butadiene styrene) market is the integration of recycled content in PC/ABS blends, driven by increasing sustainability initiatives, regulatory requirements, and consumer demand for eco-friendly materials. As the global focus on environmental conservation and circular economy principles intensifies, manufacturers are exploring innovative ways to incorporate recycled materials into their products, including PC/ABS compounds, to reduce waste, conserve resources, and minimize environmental impact.

The integration of recycled content in PC/ABS blends offers several benefits, including reduced reliance on virgin materials, energy savings, and lower carbon footprint throughout the product lifecycle. By utilizing post-consumer or post-industrial recycled plastics as feedstock, PC/ABS manufacturers can divert plastic waste from landfills and incineration, contributing to resource conservation and waste reduction efforts. Moreover, incorporating recycled content in PC/ABS compounds can help mitigate the environmental impact associated with plastic production, including greenhouse gas emissions, water consumption, and pollution.

Furthermore, the adoption of recycled content in PC/ABS blends aligns with sustainability goals and regulatory frameworks aimed at promoting the use of recycled materials and reducing plastic pollution. Governments and regulatory bodies worldwide are implementing policies, mandates, and incentives to encourage the adoption of recycled content in products, including automotive components, electronic devices, and consumer goods. For instance, initiatives such as Extended Producer Responsibility (EPR) schemes, eco-labeling programs, and product stewardship regulations incentivize manufacturers to incorporate recycled materials into their products and demonstrate environmental stewardship.

In addition to regulatory drivers, consumer preferences and market dynamics play a significant role in driving the trend towards recycled content in PC/ABS materials. There is a growing awareness and demand among consumers for sustainable products and packaging solutions that minimize environmental impact and support a circular economy. As a result, brand owners, OEMs, and retailers are increasingly seeking suppliers and partners that offer PC/ABS compounds with recycled content to meet sustainability goals, enhance brand reputation, and appeal to environmentally conscious consumers.

Moreover, advancements in recycling technologies, material science, and process engineering are enabling PC/ABS manufacturers to achieve higher levels of recycled content while maintaining product performance, quality, and consistency. Innovations such as mechanical recycling, chemical recycling, and compatibilization techniques are facilitating the production of recycled PC/ABS blends with properties comparable to virgin materials, thus expanding the application potential and market acceptance of recycled content in PC/ABS products.

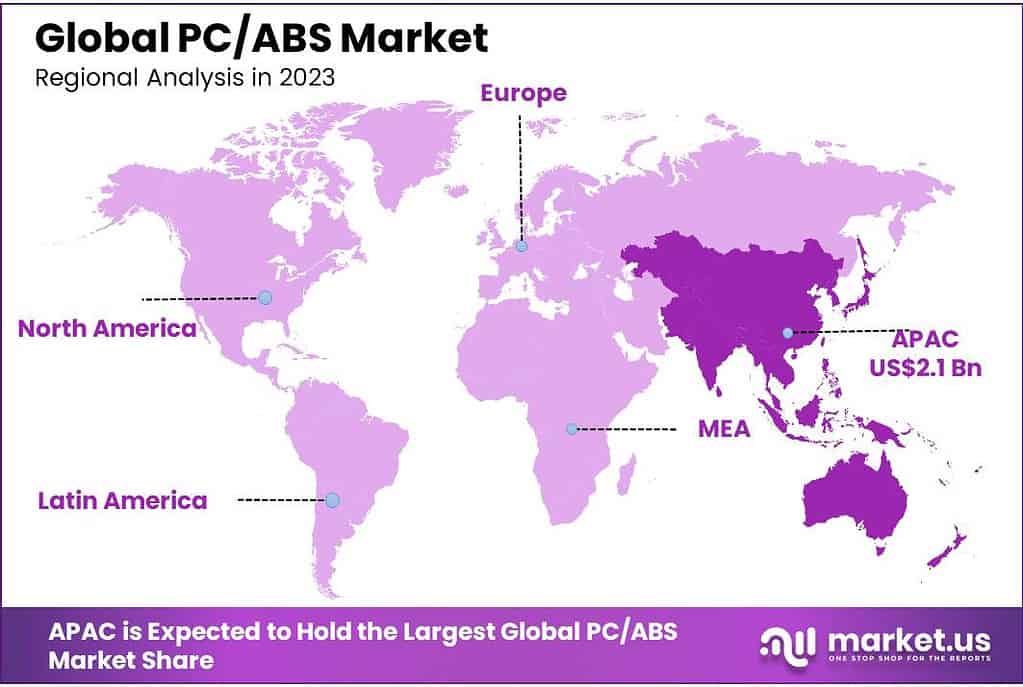

Regional Analysis

By region, the market is segmented into North America, Europe, Asia Pacific, South America, and Middle East & Africa.

Based on the region, North America is estimated to account for a major revenue share. It is projected to dominate the global PC/ABS market owing to emerging economies and rising demand for material advancements.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The PC/ABS (polycarbonate/acrylonitrile butadiene styrene) market is characterized by the presence of several key players that contribute significantly to its growth and development. Among these key players, Nippon Steel & Sumikin Chemical Co., Ltd., Covestro AG, LG Chem Ltd., and Chi Mei Corporation emerge as prominent entities shaping the competitive landscape of the PC/ABS market.

Nippon Steel & Sumikin Chemical Co., Ltd., a subsidiary of Nippon Steel Corporation, is a leading manufacturer of engineering plastics, including PC/ABS blends, renowned for their high performance, reliability, and versatility.

Market Key Players

- Covestro AG

- SABIC

- LG Chem

- Trinseo

- Chi Mei Corporation

- Teijin Limited

- Trinseo

- Chi Mei Corporation

- Formosa Chemicals & Fibre Corporation

- Denka Company Limited

- RTP Company

- Lotus International

- Kingfa Sci. & Tech. Co., Ltd.

- ELIX Polymers

- Mitsubishi Engineering-Plastics Corporation

Recent Developments

- 2024: Covestro AG introduced a new range of sustainable PC/ABS compounds made from recycled post-consumer plastics, aligning with the company’s commitment to circular economy principles and environmental sustainability.

- 2024: SABIC launched a new grade of PC/ABS blend optimized for 3D printing applications, providing enhanced processability and mechanical performance for additive manufacturing processes.

Report Scope

Report Features Description Market Value (2023) USD 4.7 Bn Forecast Revenue (2033) USD 7 Bn CAGR (2023-2033) 4.0% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Virgin, Recycled), By Grade(General Grade, Flame Retardant Grade, Reinforced Grade, High Heat Grade, Others), By Processing Method(Extrusion Molding, Injection Molding, Blow Molding, Thermoforming, 3D Printing, Others), By End-use(Automotive, Electrical & Electronics, Consumer Appliance, Aerospace & Defense, Building & Construction, Healthcare, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Covestro AG, SABIC, LG Chem, Trinseo, Chi Mei Corporation, Teijin Limited, Trinseo, Chi Mei Corporation, Formosa Chemicals & Fibre Corporation, Denka Company Limited, RTP Company, Lotus International, Kingfa Sci. & Tech. Co., Ltd., ELIX Polymers, Mitsubishi Engineering-Plastics Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Size of PC/ABS Market?PC/ABS Market size is expected to be worth around USD 7 billion by 2033, from USD 4.7 billion in 2023

What is the CAGR for the PC/ABS Market?The PC/ABS Market expected to grow at a CAGR of 4% during 2023-2032.Who are the key players in the PC/ABS Market?Covestro AG, SABIC, LG Chem, Trinseo, Chi Mei Corporation, Teijin Limited, Trinseo , Chi Mei Corporation, Formosa Chemicals & Fibre Corporation, Denka Company Limited, RTP Company, Lotus International, Kingfa Sci. & Tech. Co., Ltd., ELIX Polymers, Mitsubishi Engineering-Plastics Corporation

-

-

- Saudi Basic Industries Corporation

- Covestro AG

- Teijin Limited

- Trinseo S.A

- Mitsubishi Engineering-Plastics Corporation

- Samsung SDI Co. (Lotte Advanced Materials Co.Ltd)

- Chi Mei Corporation

- LG Chem Ltd.

- Daicel Corporation

- Celanese Corporation

- RTP Company Inc.

- Formosa Chemicals & Fibre Corporation

- Shanghai Kumho Sunny Plastics Co. Ltd.

- PolyOne Corporation

- Polymer Compounder Ltd.

- Kingfa Science & Technology (India) Limited