Global Payment Tokenization Market Size, Share Report By Component (Solutions, Services), By Tokenization Technique (API-Based Tokenization, Gateway-Based Tokenization, Others), By Deployment Mode (Cloud-based, On-premises), By Application (In-app Payments, In-browser Payments, POS/In-store Payments, Others), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By End-User Industry (Retail & E-commerce, Banking, Financial Services and Insurance (BFSI), Healthcare, Travel & Hospitality, IT & Telecommunications, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 169118

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Statistics

- Component Segment

- Tokenization Technique Segment

- Deployment Mode Segment

- Application Segment

- Organization Size Segment

- End-User Industry

- Regional Segment: North America

- Emerging Trends

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

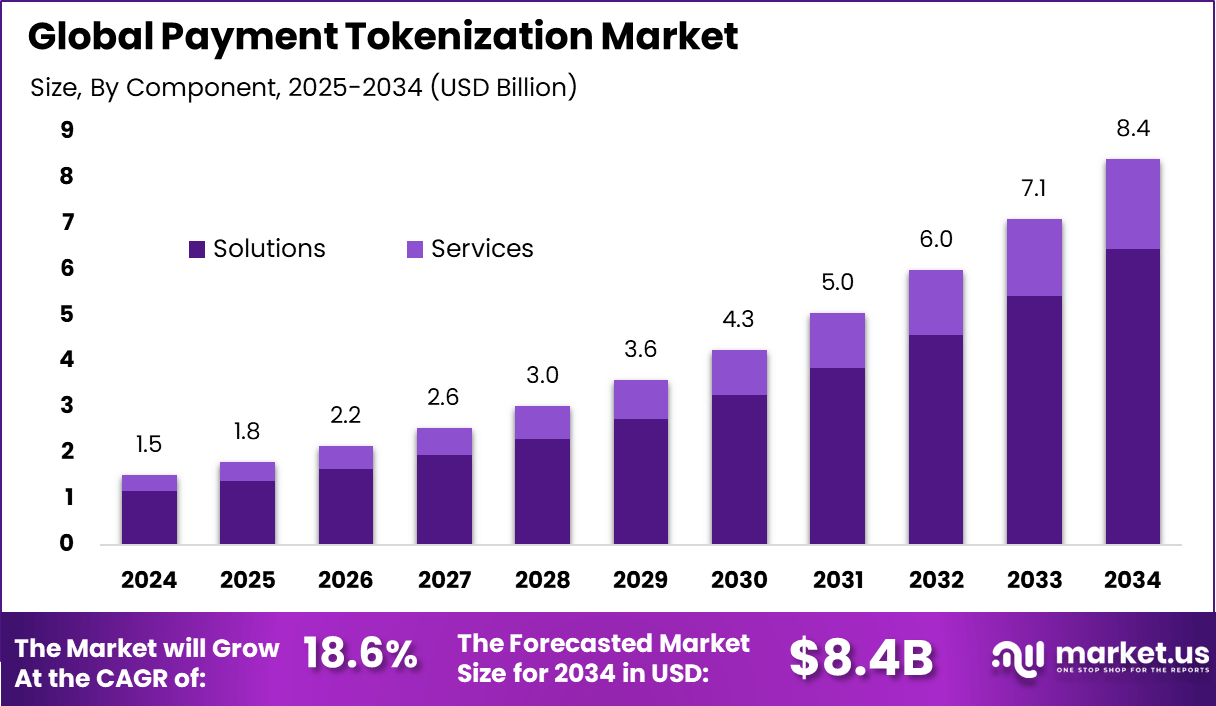

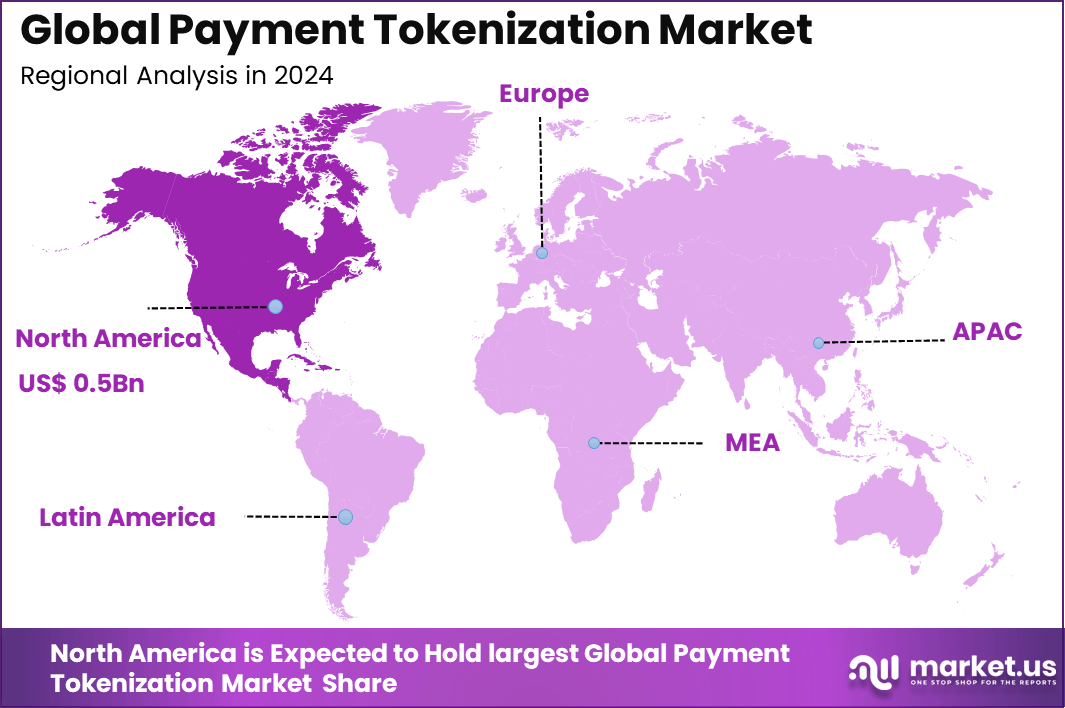

The Global Payment Tokenization Market generated USD 1.5 billion in 2024 and is projected to expand steadily at a CAGR of 18.6% from 2025 to 2034, reaching approximately USD 8.4 billion by 2034. In 2024, North America held a dominant market position, capturing more than a USD 0.5 billion share of global revenue, reflecting the region’s strong adoption of secure digital payment technologies.

The payment tokenization market has expanded as digital payment ecosystems adopt secure methods to protect card data and reduce fraud exposure. Growth reflects rising online transactions, increasing mobile wallet use and stronger regulatory expectations for secure payment processing. Tokenization replaces sensitive card numbers with non sensitive tokens, allowing consumers and businesses to transact without exposing underlying account information.

The growth of the market can be attributed to rising cyber threats, increased fraud attempts and broader industry demand for compliance with global payment security standards. E commerce expansion and mobile commerce adoption also intensify the need for secure transactions. Merchants, processors and financial institutions depend on tokenization to safeguard customer trust and prevent data breaches.

An estimated 35% of all transactions are expected to be tokenized in 2025, reflecting the rapid shift toward secure digital payment methods. Adoption among businesses continues to rise, with about 60% of merchants using tokenization to strengthen payment security and streamline customer authentication.

Financial institutions have also reported meaningful benefits, with more than 70% confirming lower fraud levels after adopting tokenized systems. Tokenized transaction volumes are projected to surpass 1 trillion globally by 2026, showing how security needs, regulatory alignment, and growing digital commerce activity are accelerating the transition from traditional payment credentials to token-based infrastructures.

Top Market Takeaways

- Solutions accounted for 76.5%, showing that businesses prefer complete tokenization frameworks that cover encryption, lifecycle management, and secure transaction workflows.

- API-based tokenization held 48.9%, reflecting strong adoption of integration-ready models that fit modern digital payment architectures.

- Cloud-based deployment reached 69.3%, indicating that firms continue to shift toward scalable and flexible security infrastructure for high-volume transactions.

- In-app payments represented 32.8%, supported by growing mobile commerce activity and demand for seamless checkout experiences.

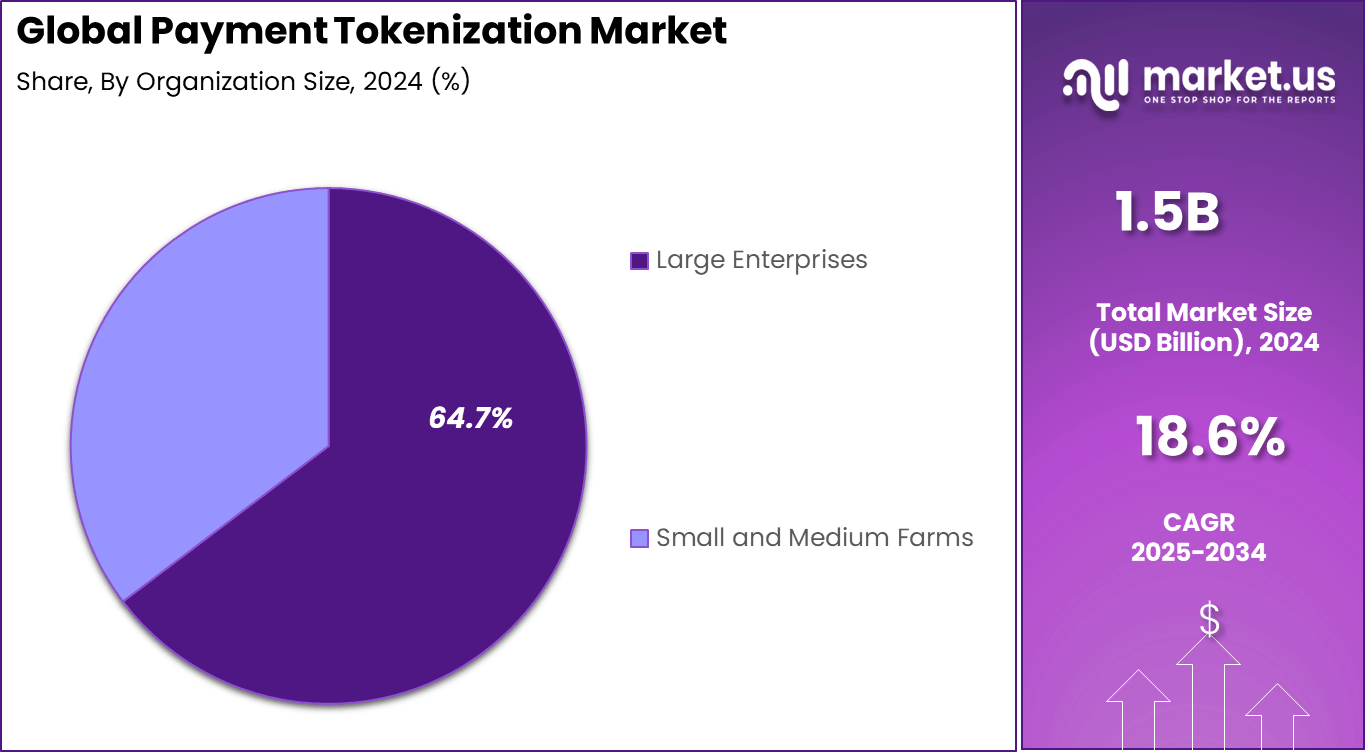

- Large enterprises captured 64.7%, showing that organizations with complex payment networks rely heavily on tokenization to reduce fraud and protect sensitive data.

- Retail and e-commerce accounted for 35.2%, driven by rising digital purchases and broader adoption of secure payment flows.

- North America held 36.5%, supported by strong regulatory frameworks and early adoption of advanced payment security.

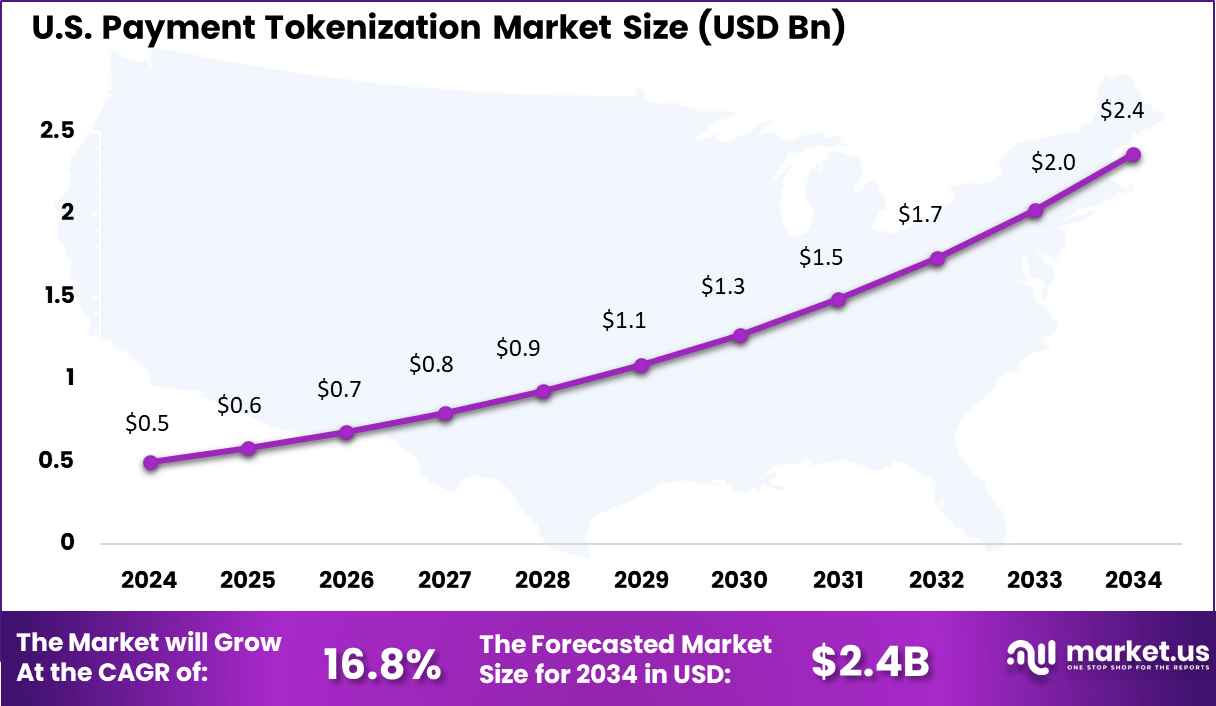

- The U.S. market reached USD 0.50 billion and grew at a 16.8% CAGR, reflecting robust investment in safeguarding cardholder information across digital channels.

Key Statistics

Adoption and Usage

- Around 60% of merchants are using tokenization in 2025 to secure customer payment data.

- An estimated 35% of all transactions in 2025 are projected to be tokenized.

- Apple Pay and Google Pay together account for 60% of all mobile tokenized payments.

- Tokenization secures 89% of all NFC-based contactless payments worldwide.

- Visa reports that 50% of its global e-commerce volume is now protected by network tokens.

- Mastercard processes over 4 billion tokenized transactions per month, equal to about 30% of all Mastercard transactions.

- Mastercard aims to tokenize 100% of online transactions by 2030.

Impact on Security and Fraud

- More than 70% of financial institutions report lower payment fraud after adopting tokenization.

- Tokenization helps reduce PCI DSS scope by removing sensitive cardholder data from merchant systems, lowering compliance exposure.

Component Segment

Solutions accounted for approximately 76.5% of the Payment Tokenization market, indicating strong demand for comprehensive tools that secure payment data. These solutions encompass encryption, token generation, and management systems that protect sensitive customer information during transactions. They help businesses reduce fraud and meet compliance requirements effectively.

Organizations prefer ready-to-deploy solutions as they simplify integration with existing payment systems and enhance operational efficiency. Continuous updates and support further drive adoption, especially among companies looking for reliable and scalable security frameworks.

Tokenization Technique Segment

API-based tokenization held around 48.9% of the market share, reflecting its flexibility and ease of integration into digital payment systems. This technique allows real-time token generation across various platforms, including mobile wallets, websites, and point-of-sale systems. Its adaptability supports multi-channel payment experiences without compromising security.

API-based tokenization is popular among developers and financial institutions due to its scalability and compatibility with modern software architectures. The ability to customize and automate token processes also accelerates adoption in fintech and retail industries.

Deployment Mode Segment

Cloud-based deployment captured about 69.3% of the market, favored for its scalability, cost-effectiveness, and ease of management. Cloud platforms enable businesses to implement tokenization services without investing heavily in physical infrastructure. They also facilitate faster updates and better handling of peak transaction loads.

The cloud model supports improved data security through centralized management and automated compliance checks. Companies embracing digital transformation prefer cloud deployment to keep pace with evolving payment security demands efficiently.

Application Segment

In-app payments accounted for nearly 32.8% of the market, highlighting the growing importance of secure mobile transactions. As customers increasingly shop and pay through mobile applications, protecting payment credentials during these interactions becomes critical. Tokenization helps minimize fraud risks in mobile environments.

The rise of smartphone usage and app-based commerce encourages retailers and service providers to prioritize secure in-app payment options. Tokenization techniques support seamless customer experiences while safeguarding sensitive data against breaches.

Organization Size Segment

Large enterprises represented about 64.7% of the Payment Tokenization market, driven by their extensive transaction volumes and stringent security needs. These organizations require robust tokenization solutions to protect customer payment information across multiple channels and geographies. Their investment in security infrastructure supports regulatory compliance and risk management.

Large firms also benefit from scalable solutions that can integrate with existing enterprise systems and support digital innovation. As cyber threats grow more sophisticated, large enterprises focus heavily on advanced tokenization technologies to safeguard their operations.

End-User Industry

The retail and e-commerce industry made up around 35.2% of the market share, reflecting the sector’s strong need for secure payment practices. With the continuous growth of online shopping, protecting consumer data is paramount to maintaining trust and compliance. Tokenization offers an effective way to reduce fraud and enhance payment security for online retailers.

This sector’s rapid digitalization and volume of transactions make tokenization essential for smooth and secure payment processing. Retailers are investing in these technologies to improve customer satisfaction and reduce losses from payment card fraud.

Regional Segment: North America

In 2024, North America held approximately 36.5% of the Payment Tokenization market, driven by advanced financial infrastructure and early technology adoption. The region benefits from a well-established digital payments ecosystem and strict regulations that promote data security and privacy. Innovation in payment security solutions is highly active, fostering market growth.

The United States leads this trend, reaching a market value of USD 0.50 Bn with a steady 16.8% CAGR. Strong regulatory frameworks and demand for secure transactions in e-commerce and mobile payments contribute to consistent expansion and development in this key market.

Emerging Trends

Merchant specific tokens are gaining attention because they limit the use of a token to a single retailer, reducing fraud exposure in cases of data breaches. This approach improves trust and encourages repeat purchases within the same merchant ecosystem.

Tokenization is also expanding beyond card payments. It is now used for bank account numbers, digital wallets, subscription billing, and in some markets even for online identity verification. As more industries adopt digital transactions, tokenization is moving into broader areas of financial and non financial applications.

Key Market Segments

By Component

- Solutions

- Services

By Tokenization Technique

- API-Based Tokenization

- Gateway-Based Tokenization

- Others

By Deployment Mode

- Cloud-based

- On-premises

By Application

- In-app Payments

- In-browser Payments

- POS/In-store Payments

- Others

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By End-User Industry

- Retail & E-commerce

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Travel & Hospitality

- IT & Telecommunications

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising need for secure digital payments

Growth in online and mobile payments has increased the need for stronger protection of sensitive card information. Payment tokenization replaces card details with a secure token that cannot be used outside the intended transaction path. This reduces the risk of theft during payment processing and supports wider adoption across banks, merchants, and payment platforms.

Consumers have become more aware of fraud risks, and payment providers now focus on reducing exposure to card data. Publicly available statistics show steady growth in digital transactions, which has increased the importance of token based security. This rising awareness strengthens demand for tokenization solutions across all major payment channels.

Restraint

Complex integration with legacy payment systems

Many retailers and financial institutions still depend on older processing systems that were not designed for token based payments. Integrating tokenization into these systems often requires upgrades, custom development, or third party support. This raises implementation costs and slows adoption, especially in sectors with low technology maturity.

Some businesses avoid major changes due to concerns about downtime or disruption during migration. The need for new infrastructure or compliance checks adds further pressure. These integration challenges remain a restraint in regions where legacy systems dominate payment networks.

Opportunity

Expansion of mobile wallets and contactless payment adoption

Mobile wallets and contactless payments continue to grow across global markets. These payment methods rely on tokenization to secure transactions without exposing card numbers. As smartphone penetration rises and more consumers shift to touch free payments, demand for tokenization services is expected to increase.

Governments and regulators in several countries encourage digital payments for transparency and efficiency. This shift creates conditions for tokenization to expand into transit payments, retail commerce, peer to peer payments, and recurring subscriptions. The spread of digital identity systems also supports new use cases for secure token based transactions.

Challenge

Managing token lifecycle and interoperability across platforms

Tokenization introduces the need for consistent token lifecycle management, including creation, storage, renewal, and deletion. Ensuring that tokens remain valid and synchronized across different platforms can be difficult in large networks. Any failure in token mapping can result in declined transactions or disrupted customer experience.

Interoperability also varies between card networks, processors, and merchant platforms. Tokens created by one system may not work seamlessly in another without additional integration layers. This lack of uniform standards slows adoption and creates ongoing technical challenges for global payment ecosystems.

Competitive Analysis

Visa, Mastercard, American Express, Fiserv, and FIS lead the payment tokenization market with large-scale infrastructures that replace sensitive card data with secure tokens across digital transactions. Their platforms support mobile wallets, e-commerce payments, and in-store authentication. These companies focus on enhanced fraud prevention, global interoperability, and rapid token provisioning.

PayPal, Thales, Broadcom (Symantec), Micro Focus, TokenEx, Lookout, and Futurex strengthen the competitive landscape with advanced token vaults, encryption engines, and threat-prevention frameworks. Their solutions help merchants and financial institutions reduce PCI compliance burdens while protecting customer information. These providers emphasize scalable architectures, strong key management, and seamless integration with payment gateways.

HelpSystems, Marqeta, Bluefin Payment Systems, and other participants expand the market with specialized tokenization layers for fintech platforms, payment processors, and emerging digital commerce environments. Their offerings include network tokenization, gateway tokenization, and hardware-secured token generation. These companies support flexible deployment and multi-channel security.

Top Key Players in the Market

- Visa, Inc.

- Mastercard, Inc.

- American Express Company

- Fiserv, Inc.

- Fidelity National Information Services, Inc. (FIS)

- PayPal Holdings, Inc.

- Thales Group

- Broadcom, Inc. (Symantec)

- Micro Focus International plc

- TokenEx, Inc.

- Lookout, Inc.

- Futurex, LP

- HelpSystems, LLC

- Marqeta, Inc.

- Bluefin Payment Systems, LLC

- Others

Recent Developments

- December, 2025: Visa teamed up with AWS to roll out new infrastructure supporting AI-driven commerce, which ties into safer payment flows through better token handling. This move helps merchants handle tokenized transactions more smoothly in real-time setups.

- October, 2025: Mastercard worked with PhonePe to bring device tokenization live at the Global Fintech Fest, letting merchants use network tokens for quicker, secure checkouts. The setup cuts down on card entry hassles and boosts approval rates for online buys.

- June, 2025: Fiserv kicked off its FIUSD stablecoin, partnering with PayPal and Mastercard to weave it into payment networks for tokenized stablecoin use at millions of spots. Banks get a fresh way to settle with tokens that speed up cross-border work.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Bn Forecast Revenue (2034) USD 8.4 Bn CAGR(2025-2034) 18.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions, Services), By Tokenization Technique (API-Based Tokenization, Gateway-Based Tokenization, Others), By Deployment Mode (Cloud-based, On-premises), By Application (In-app Payments, In-browser Payments, POS/In-store Payments, Others), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By End-User Industry (Retail & E-commerce, Banking, Financial Services and Insurance (BFSI), Healthcare, Travel & Hospitality, IT & Telecommunications, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Visa, Inc., Mastercard, Inc., American Express Company, Fiserv, Inc., Fidelity National Information Services, Inc. (FIS), PayPal Holdings, Inc., Thales Group, Broadcom, Inc. (Symantec), Micro Focus International plc, TokenEx, Inc., Lookout, Inc., Futurex, LP, HelpSystems, LLC, Marqeta, Inc., Bluefin Payment Systems, LLC, Others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Payment Tokenization MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Payment Tokenization MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Visa, Inc.

- Mastercard, Inc.

- American Express Company

- Fiserv, Inc.

- Fidelity National Information Services, Inc. (FIS)

- PayPal Holdings, Inc.

- Thales Group

- Broadcom, Inc. (Symantec)

- Micro Focus International plc

- TokenEx, Inc.

- Lookout, Inc.

- Futurex, LP

- HelpSystems, LLC

- Marqeta, Inc.

- Bluefin Payment Systems, LLC

- Others