Global Payment Security Systems Market Size, Share Analysis Report By Solution (Encryption, Tokenization, Fraud Detection & Prevention), By Platform (Web Based, POS Based/Mobile Based), By Enterprise Size (Small & Medium-Sized Enterprises (SMEs), Large Enterprises), By Vertical (Retail & E-commerce, Travel & Hospitality, Healthcare, Telecom & IT, Education, Media & Entertainment, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: January 2025

- Report ID: 137602

- Number of Pages: 359

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- U.S. Payment Security Systems Market

- Solution Analysis

- Platform Analysis

- Enterprise Size Analysis

- Vertical Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

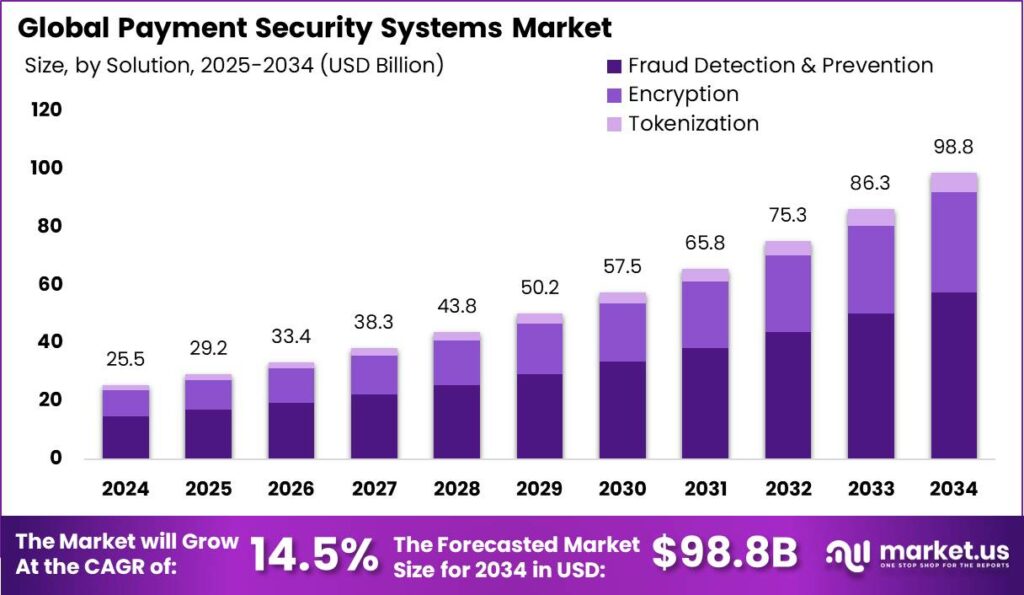

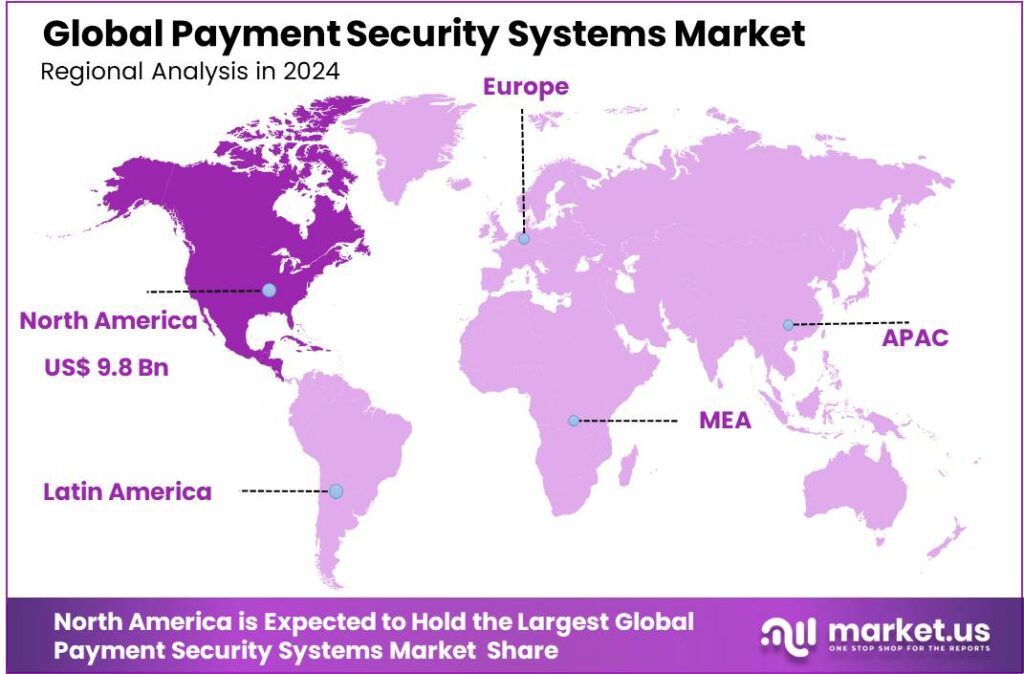

The Global Payment Security Systems Market size is expected to be worth around USD 98.8 Billion By 2034, from USD 25.5 Billion in 2024, growing at a CAGR of 14.50% during the forecast period from 2025 to 2034. In 2024, North America led the payment security systems market with over 38.6% share and USD 9.8 billion in revenue. The U.S. market is projected to reach USD 7.67 billion, growing at a CAGR of 14.5%.

Payment security systems encompass technologies and protocols designed to protect financial transactions from fraud, theft, and unauthorized access. These systems are integral to maintaining the integrity and confidentiality of payment data, especially in online and mobile transactions. Advanced security measures such as encryption, tokenization, and fraud detection algorithms are commonly employed to safeguard sensitive payment information.

The market for payment security systems is experiencing significant growth, driven by the increasing prevalence of digital transactions and the corresponding rise in cyber threats. Businesses across various sectors are investing in robust security solutions to protect customer data and comply with regulatory requirements. The integration of technologies such as AI and ML is enhancing the effectiveness of fraud detection systems, making real-time threat analysis and response feasible

Additionally, regulatory compliance standards, such as PCI DSS (Payment Card Industry Data Security Standard), mandate businesses to adopt secure payment processes, further bolstering the demand for advanced security solutions. The adoption of new payment technologies like mobile payments and digital wallets, which present unique security challenges, also contributes to the expansion of the payment security systems market.

Payment security systems are gaining popularity as businesses prioritize data security to enhance customer relationships. Payment security systems are increasingly used across various industries, including retail and healthcare, driven by rising consumer demand for transparency and security in financial transactions.

According to Integrated Research, global cashless payment volumes are set to grow by over 80% between 2020 and 2025, driven by increasing consumer preference for digital transactions. The Asia-Pacific region is expected to see the fastest growth, with cashless transaction volumes surging by 109% by 2025, and continuing to rise by 76% between 2025 and 2030.

Africa is predicted to follow with impressive growth of 78% by 2025 and 64% through to 2030, while Europe is projected to expand by 64% and 39%, respectively. In contrast, the US and Canada are likely to experience more modest growth of 43% by 2025 and 35% by 2030, as traditional payment methods like credit and debit cards remain dominant.

Similarly, the B2B payments sector is poised for significant growth. Analyst firm FXC Intelligence highlights that the B2B cross-border payments market is expected to grow by 43% by 2030, rising from $39.3 trillion to $56.1 trillion within seven years. Globally, total B2B payments are projected to climb from $190 trillion today to $290 trillion by 2030, positioning fintech companies to capture a substantial share of this expanding market

Innovations such as blockchain technology and artificial intelligence are opening new avenues for securing payments. As technology evolves, there is a significant potential for the development of more sophisticated, user-friendly security solutions that can cater to a broader range of industries and transaction types.

The market is also experiencing rapid expansion globally, with significant growth potential in emerging economies where digital payment infrastructures are still developing. As these regions embrace online and mobile banking, the need for effective payment security systems escalates, offering abundant opportunities for market players to introduce innovative solutions tailored to diverse market needs.

Key Takeaways

- The Global Payment Security Systems Market is expected to reach a value of USD 98.8 Billion by 2034, up from USD 25.5 Billion in 2024, growing at a CAGR of 14.50% from 2025 to 2034.

- In 2024, the Fraud Detection & Prevention segment held a dominant position within the payment security systems market, capturing more than 58.4% share.

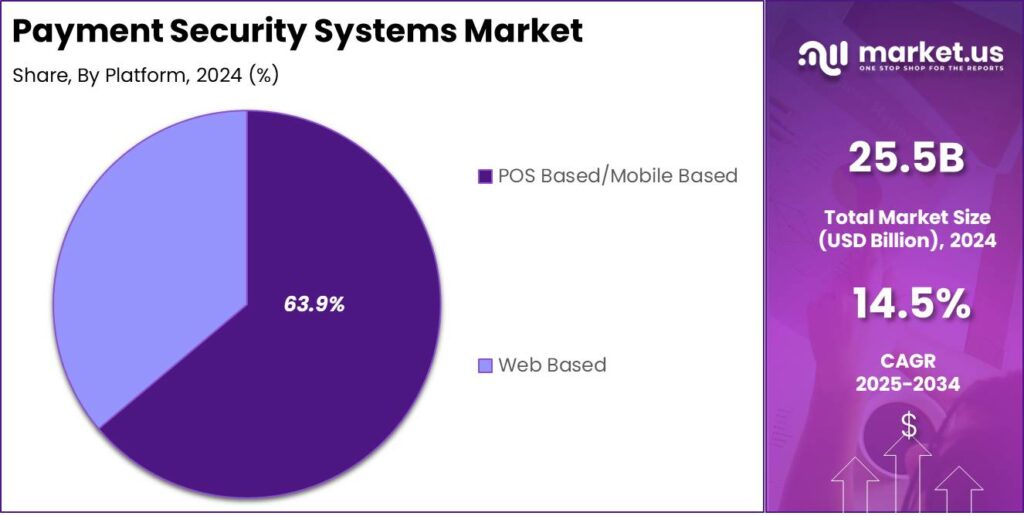

- The POS-based/mobile-based segment also led the market in 2024, capturing over 63.9% of the market share.

- The Large Enterprises segment dominated the payment security systems market in 2024, accounting for more than 69.1% of the market share.

- The Retail & E-commerce segment held a significant market share in 2024, capturing over 29.9% of the total market.

- North America had a dominant position in the global payment security systems market in 2024, accounting for more than 38.6% of the market share, with a revenue of USD 9.8 billion.

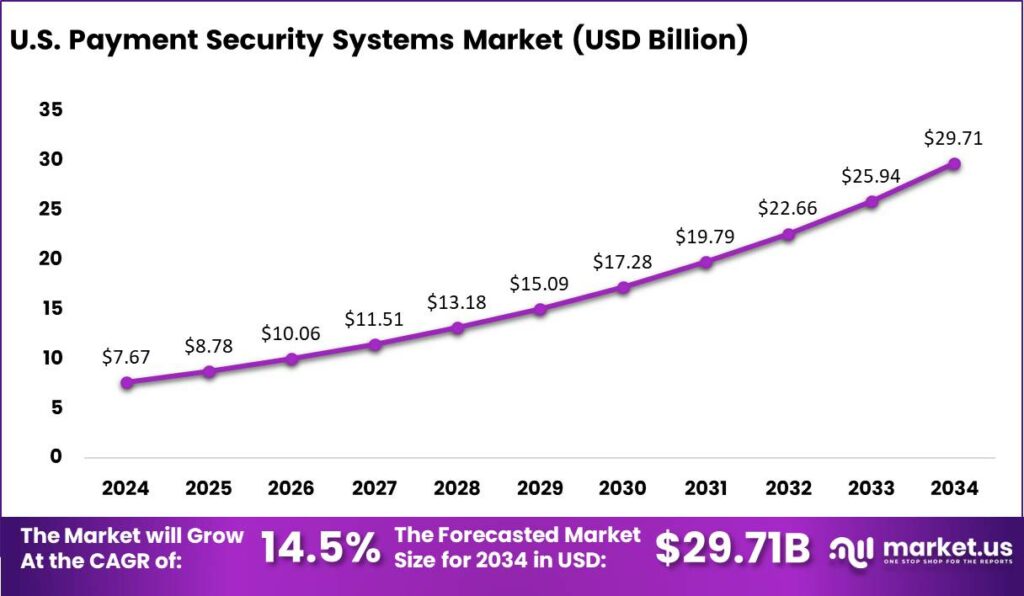

- The U.S. payment security systems market is projected to grow significantly, with a valuation expected to reach USD 7.67 billion, expanding at a CAGR of 14.5%.

U.S. Payment Security Systems Market

The Payment Security Systems Market in the U.S. is on a robust growth trajectory, with projections indicating it will achieve a valuation of USD 7.67 billion. This expansion is expected to occur at a compound annual growth rate (CAGR) of 14.5%. The rapid growth is driven by the rise of digital transactions and growing awareness of cybersecurity risks among both consumers and businesses.

Market growth is driven by advancements in payment security technologies like encryption, tokenization, and AI-driven fraud detection, which enhance real-time transaction data protection and boost consumer confidence in digital payment platforms.

Additionally, regulatory policies that mandate stringent data protection standards are pushing companies to adopt high-grade security measures, driving continuous investment in the payment security sector. Together, these factors are catalyzing the rapid growth of the U.S. payment security systems market, positioning it as a critical component of the national cybersecurity infrastructure.

In 2024, North America held a dominant market position in the payment security systems market, capturing more than a 38.6% share with revenue amounting to USD 9.8 billion. This leadership can be attributed to several factors that underscore the region’s pioneering role in the development and implementation of payment security technologies.

North America is home to many of the world’s leading financial institutions and tech companies, which not only contribute to but also drive the innovation within the payment security sector. The presence of these market leaders facilitates the early adoption and widespread integration of advanced security solutions across commercial platforms.

Moreover, North America’s market dominance is bolstered by its stringent regulatory landscape. In the United States and Canada, regulations such as the Payment Card Industry Data Security Standard (PCI DSS) and various federal and state data protection laws mandate robust security measures for companies handling payment data.

As e-commerce and mobile payments continue to grow, so does the potential vulnerability to cyber-attacks, driving the demand for sophisticated payment security solutions. The widespread consumer awareness about cyber risks and the demand for secure transaction processes further support the development of this market.

Solution Analysis

In 2024, the Fraud Detection & Prevention segment held a dominant market position within the payment security systems market, capturing more than a 58.4% share. This segment’s leadership is primarily attributed to its critical role in identifying and mitigating fraudulent activities across various payment channels.

With the rise of digital transactions, businesses increasingly rely on sophisticated fraud detection and prevention tools that can pinpoint irregular patterns and prevent potentially costly breaches before they occur. The demand for these systems has surged as they are essential in maintaining consumer trust and ensuring transaction integrity.

The prominence of the Fraud Detection & Prevention segment also stems from the continuous evolution of fraud tactics. Cybercriminals are constantly developing new methods to breach security measures, requiring adaptive and advanced solutions that can keep pace with these threats.

A layered security strategy boosts defense against cyber threats, driving demand for comprehensive solutions with strong fraud detection. This integrated approach prevents fraud at all transaction points, reinforcing the dominance of this segment in the payment security market.

Platform Analysis

In 2024, the POS-based/mobile-based segment held a dominant position in the payment security systems market, capturing more than a 63.9% share. This segment’s leadership stems primarily from the widespread adoption of mobile devices and POS systems across retail and service industries.

Mobile and POS transactions offer instant payment processing, greatly enhancing the customer experience. The integration of advanced security features like biometric authentication and end-to-end encryption has further increased their reliability and trust among consumers.

The growth of the POS-based/mobile-based segment is also fueled by the increasing penetration of smartphones and the expansion of wireless internet access. Consumers are rapidly shifting towards mobile banking and contactless payments, which are perceived as both convenient and secure.

Retailers and service providers are investing in mobile-based payment security solutions to meet demand, streamlining transactions while enhancing security, making them appealing to businesses seeking to improve safety without sacrificing user experience.

Enterprise Size Analysis

In 2024, the Large Enterprises segment held a dominant position in the Payment Security Systems market, capturing more than a 69.1% share. This segment’s leadership is primarily due to its significant investment capabilities and the strategic necessity to protect extensive transaction volumes, which are typically higher than those handled by smaller enterprises.

Large Enterprises also benefit from the ability to integrate complex payment security systems with their existing infrastructure, which often includes multiple layers of technology across various regions. This ability to seamlessly integrate helps in managing and mitigating risks more effectively at a global scale.

Furthermore, these enterprises are usually more equipped to handle the upfront costs associated with advanced security technologies, including state-of-the-art encryption and tokenization systems, making them more adept at warding off potential security breaches.

Regulatory compliance drives large enterprises to adopt payment security systems, as they must meet strict regulations across countries. These systems help avoid fines, protect sensitive data, and strengthen customer trust, essential for business continuity and growth.

Vertical Analysis

In 2024, the Retail & E-commerce segment held a dominant market position within the Payment Security Systems market, capturing more than a 29.9% share. This leadership is attributed to the exponential growth in online shopping, driven by consumer preferences for convenience and the proliferation of digital payment methods.

Retail and e-commerce businesses, facing the need to secure a growing volume of transactions, have thus prioritized robust payment security solutions to protect against data breaches and fraud, which are increasingly common in the sector.

The nature of the Retail & E-commerce industry, which involves a high frequency of monetary transactions, also necessitates advanced security measures. This segment deals with sensitive customer data, including credit card information and personal identifiers, making it a prime target for cybercriminals.

Additionally, the compliance with international data protection regulations such as GDPR in Europe and CCPA in California has further propelled the adoption of stringent security measures in the Retail & E-commerce sector. These regulations mandate the protection of consumer information, prompting businesses to enhance their cybersecurity measures.

Key Market Segments

By Solution

- Encryption

- Tokenization

- Fraud Detection & Prevention

By Platform

- Web Based

- POS Based/Mobile Based

By Enterprise Size

- Small & Medium-Sized Enterprises (SMEs)

- Large Enterprises

By Vertical

- Retail & E-commerce

- Travel & Hospitality

- Healthcare

- Telecom & IT

- Education

- Media & Entertainment

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rise in Digital Payment Adoption

The increasing use of digital payment methods is a significant factor propelling the payment security systems market. As consumers and businesses shift from cash to digital transactions, the demand for secure payment solutions has surged. This transition is driven by the convenience, speed, and efficiency that digital payments offer.

However, it also brings heightened risks of cyber threats and fraud, necessitating robust security measures. Consequently, organizations are investing in advanced payment security systems to protect sensitive financial data and maintain customer trust. This trend is expected to continue, further driving the growth of the payment security market.

Restraint

Dependence on Traditional Banking Infrastructure

The reliance on conventional banking systems poses a challenge to the payment security market. In regions where banking infrastructure is underdeveloped or lacks technological advancement, implementing modern payment security solutions becomes difficult.

This dependency can lead to inefficiencies, slower transaction times, and limited accessibility, hindering the adoption of secure payment methods. To overcome this restraint, collaboration between payment security providers and financial institutions is essential to modernize banking infrastructure and support the integration of advanced security solutions.

Opportunity

Integration of Blockchain and Cryptocurrencies

The incorporation of blockchain technology and cryptocurrencies presents a significant opportunity for the payment security market. Blockchain’s decentralized and transparent nature offers enhanced security features, reducing the risk of fraud and unauthorized transactions.

Additionally, the growing acceptance of cryptocurrencies as a payment method necessitates secure processing solutions. Payment security providers can capitalize on this opportunity by developing systems that support blockchain transactions and cryptocurrency payments, catering to a broader range of financial activities and attracting tech-savvy consumers.

Challenge

Ensuring Customer Trust and Data Privacy

Maintaining customer trust and ensuring data privacy remain significant challenges in the payment security market. With the increasing frequency of cyber-attacks and data breaches, consumers are becoming more concerned about the security of their financial information.

Payment security providers must implement stringent security measures, comply with regulatory standards, and maintain transparency to build and retain customer trust. Failure to do so can result in reputational damage and loss of business, making it imperative for companies to prioritize data privacy and robust security protocols.

Emerging Trends

Using unique physical traits like fingerprints or facial recognition, biometric authentication ensures that only you can access your accounts. This method is becoming more common in payment systems, providing an extra layer of security that’s hard for fraudsters to bypass.

Digital IDs are simplifying verification by eliminating the need for physical documents, speeding up transactions and reducing identity theft risk, as they are more difficult to forge. Meanwhile, tokenization replaces sensitive payment data with unique tokens, safeguarding your account details and minimizing the risk of data breaches.

Real-time payment systems are becoming more popular, allowing instant transfers. To ensure these quick transactions are secure, advanced encryption and authentication methods are being implemented, protecting users from potential fraud.

Business Benefits

- Enhanced Customer Trust: When customers know their payment information is protected through measures like encryption and tokenization, they feel more confident making purchases, leading to increased sales and loyalty.

- Reduced Fraud and Chargebacks: By utilizing technologies such as EMV chips and multi-factor authentication, businesses can significantly decrease fraudulent transactions, minimizing financial losses from chargebacks.

- Regulatory Compliance: Adhering to standards like the Payment Card Industry Data Security Standard (PCI DSS) ensures businesses meet legal requirements, avoiding hefty fines and legal complications.

- Operational Efficiency: Automated payment systems streamline transaction processes, reducing manual errors and freeing up resources to focus on core business activities.

- Competitive Advantage: Businesses that prioritize payment security can differentiate themselves in the market, attracting security-conscious consumers and establishing a reputation for reliability.

Key Player Analysis

As digital payments grow, the demand for robust security solutions has led to the emergence of several key players in the market.

- Elavon Inc. is a leading player in the payment security systems industry, known for offering secure payment solutions for businesses of all sizes. With a strong presence in North America and Europe, Elavon focuses on providing end-to-end encryption, tokenization, and fraud prevention services.

- Ingenico, a global leader in payment solutions, is another prominent player in the payment security systems market. Known for its secure point-of-sale (POS) terminals, Ingenico has expanded its offerings to include cloud-based payment security solutions. The company’s solutions utilize encryption and tokenization to protect transaction data, providing businesses with peace of mind.

- Utimaco Management GmbH specializes in providing high-performance security solutions for the payment industry. Known for its hardware security modules (HSMs), Utimaco ensures that transaction data is encrypted and protected at all times. The company offers scalable solutions that cater to both small businesses and large enterprises.

Top Key Players in the Market

- Elavon Inc.

- Ingenico

- Utimaco Management GmbH

- Shift4 Payments Inc.

- Mastercard

- Intelligent Payment Solutions Pvt Ltd.

- TokenEx, LLC

- Paypal Holdings, Inc.

- Bluefin Payment Systems

- Visa Inc.

- Others

Top Opportunities Awaiting for Players

- Expansion of Digital Payment Platforms: With the rise of digital transactions, the demand for secure payment systems is growing. Innovations in encryption, malware protection, and data loss prevention are essential for safeguarding online financial transactions, especially in sectors like healthcare, banking, and retail.

- Integration of AI and Machine Learning: AI and machine learning are becoming integral in combating fraud. These technologies enhance real-time fraud detection systems, allowing for the identification of suspicious patterns and behaviors quickly. The application of predictive analytics to proactively block fraudulent transactions presents a significant growth area for the industry.

- Adoption of Biometric Authentication: The shift towards biometric authentication methods such as fingerprint scanning, facial recognition, and voice recognition is set to replace traditional security measures like passwords. This trend not only enhances security but also improves the user experience by offering a frictionless transaction process.

- Compliance with Global Security Standards: Staying compliant with evolving global cybersecurity regulations, such as PCI DSS 4.0, GDPR, and regional privacy laws, is becoming increasingly important. Companies need to adapt to these standards to avoid fines and maintain customer trust, creating opportunities for compliance-focused solutions.

- Cross-border Payment Innovations: The payment security market can also capitalize on the growing need for secure and efficient cross-border transactions. Innovations that reduce transaction times and enhance security in international payments will be crucial. Standardizing legislation and utilizing technologies like cloud services and real-time analytics will play a key role in streamlining these payments.

Recent Developments

- In October 2024, Bluefin and Sycurio have partnered to enhance payment security by integrating Bluefin’s PCI-validated encryption with Sycurio’s multi-channel solutions, ensuring secure, compliant, and seamless payment experiences.

- In December 2024, Visa completed its acquisition of Featurespace, a company specializing in real-time artificial intelligence (AI) technology designed to prevent and mitigate payment fraud and financial crime risks. This acquisition aims to enhance Visa’s fraud protection capabilities and improve security for its customers worldwide.

- In December 2024, Mastercard finalized its acquisition of Recorded Future, a leading threat intelligence company. This move is intended to bolster Mastercard’s cybersecurity services by integrating AI-driven threat intelligence.

Report Scope

Report Features Description Market Value (2024) USD 25.5 Bn Forecast Revenue (2034) USD 98.8 Bn CAGR (2025-2034) 14.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Solution (Encryption, Tokenization, Fraud Detection & Prevention), By Platform (Web Based, POS Based/Mobile Based), By Enterprise Size (Small & Medium-Sized Enterprises (SMEs), Large Enterprises), By Vertical (Retail & E-commerce, Travel & Hospitality, Healthcare, Telecom & IT, Education, Media & Entertainment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Elavon Inc., Ingenico, Utimaco Management GmbH, Shift4 Payments Inc., Mastercard, Intelligent Payment Solutions Pvt Ltd., TokenEx, LLC, Paypal Holdings, Inc., Bluefin Payment Systems, Visa Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Payment Security Systems MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample

Payment Security Systems MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Elavon Inc.

- Ingenico

- Utimaco Management GmbH

- Shift4 Payments Inc.

- Mastercard

- Intelligent Payment Solutions Pvt Ltd.

- TokenEx, LLC

- Paypal Holdings, Inc.

- Bluefin Payment Systems

- Visa Inc.

- Others