Global Pay-As-You-Go Insurance Market Size, Share, Industry Analysis Report By Insurance Type (Auto Insurance, Health Insurance, Travel Insurance, Commercial Insurance, Equipment Insurance, Others), By Technology (Telematics, Mobile Apps, IoT Sensors, Blockchain, Others), By End-User (Individual Consumers, Small Businesses, Fleet Operators, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 166185

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

- PAYG Market Size

- Quick Market Facts

- Overview

- US Market Size

- By Insurance Type: Auto Insurance

- By Technology: IoT Sensors

- By End-User: Fleet Operators

- Emerging Trends

- Role of Generative AI

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

PAYG Market Size

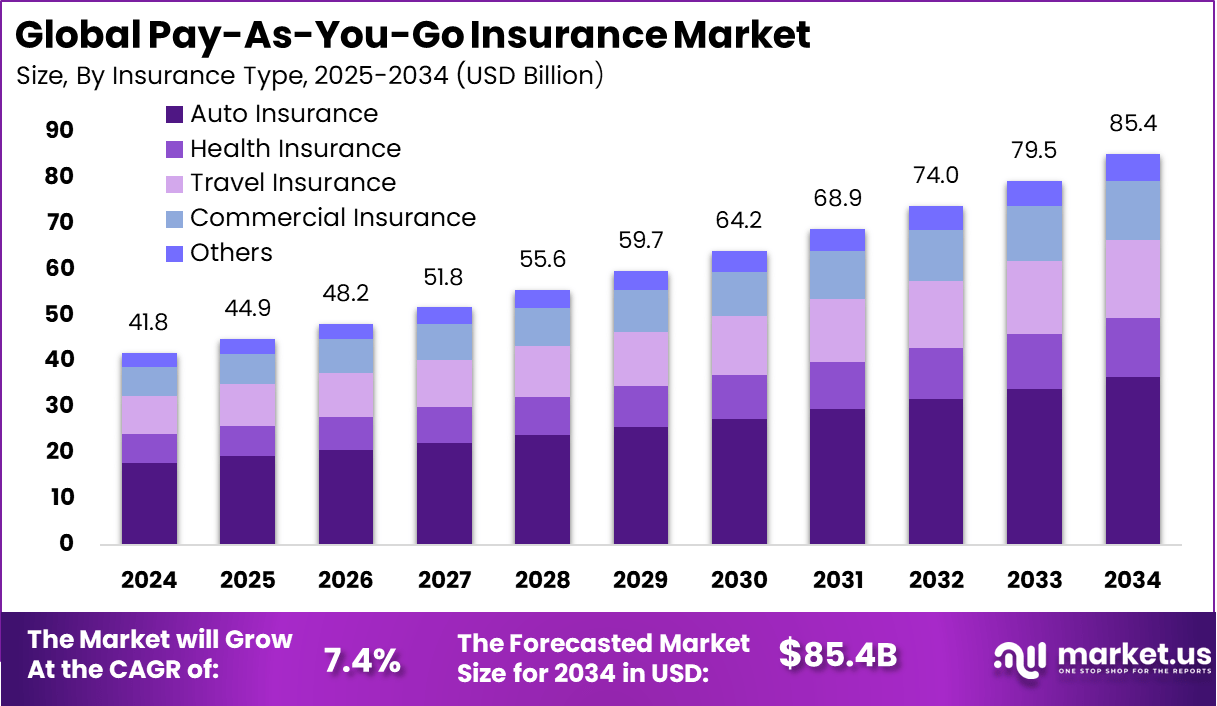

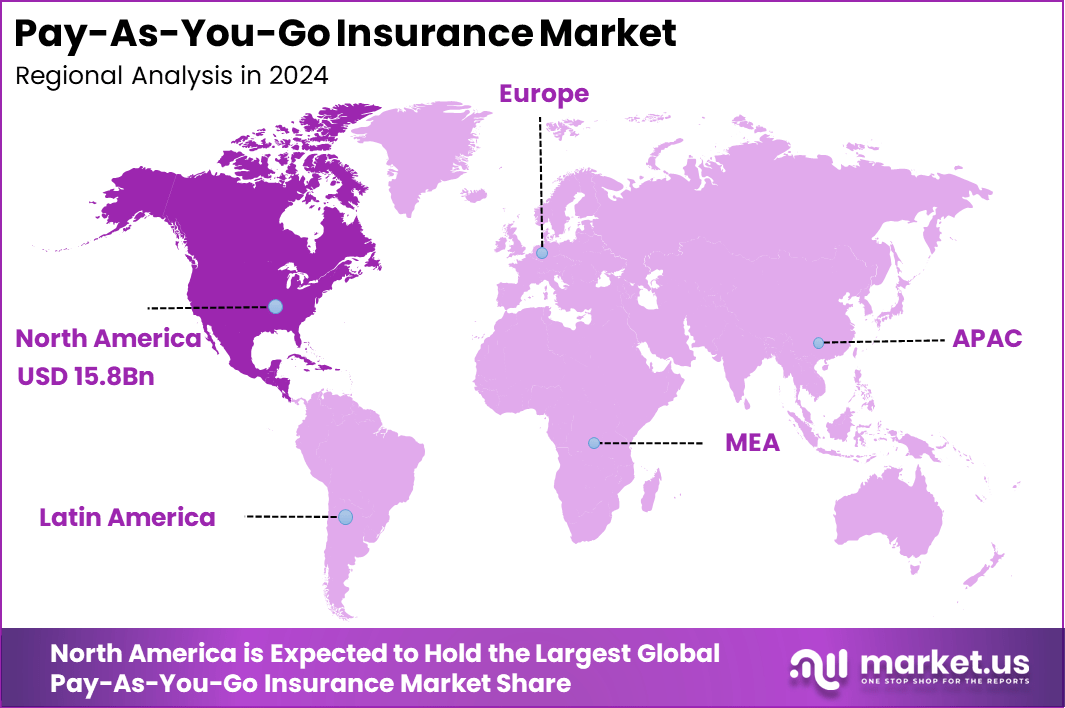

The Global Pay-As-You-Go Insurance Market generated USD 41.8 billion in 2024 and is predicted to register growth from USD 44.9 billion in 2025 to about USD 85.4 billion by 2034, recording a CAGR of 7.4% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 38.0% share, holding USD 15.8 Billion revenue.

Quick Market Facts

- Auto Insurance led the market with a 42.9% share, reflecting strong adoption of usage-based and distance-based premium models among drivers and mobility services.

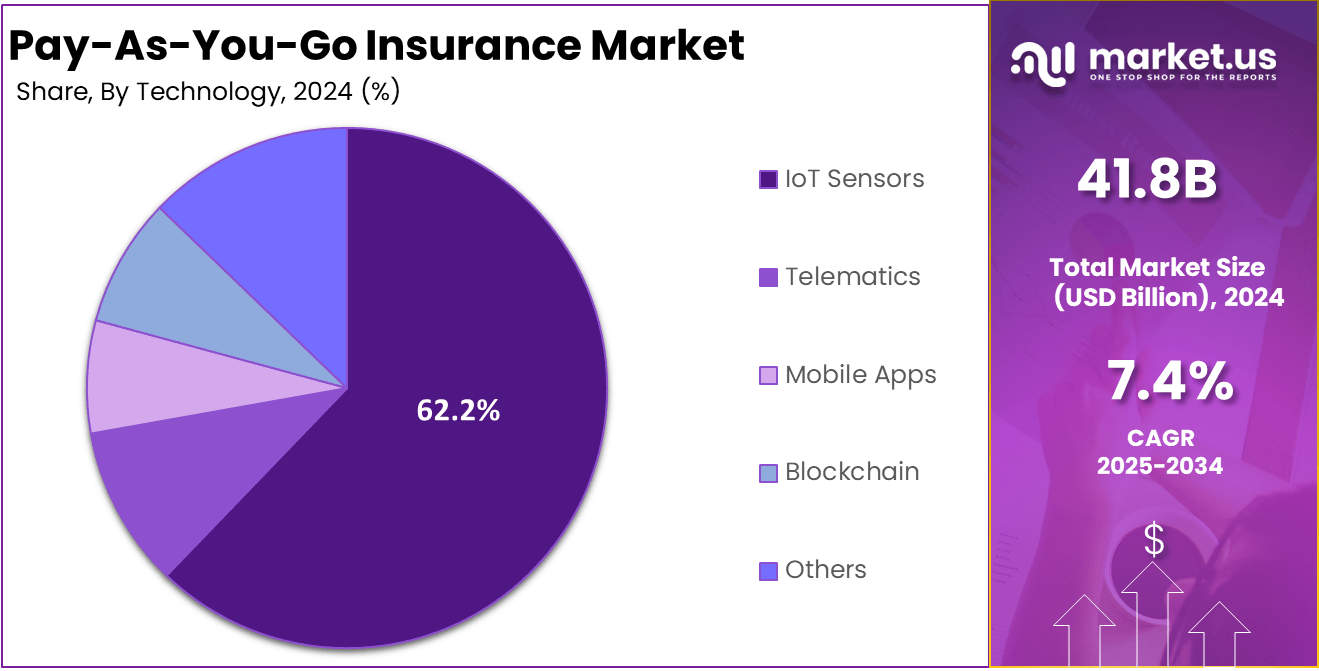

- IoT Sensors dominated the technology landscape with 62.2%, supported by the growing use of telematics, onboard diagnostics, and real-time vehicle tracking to assess risk accurately.

- Fleet Operators held a leading 52.9% share, driven by demand for cost-efficient, pay-per-use insurance models across logistics, delivery, and commercial transport.

- North America accounted for 38%, benefiting from mature telematics ecosystems and regulatory support for usage-based insurance models.

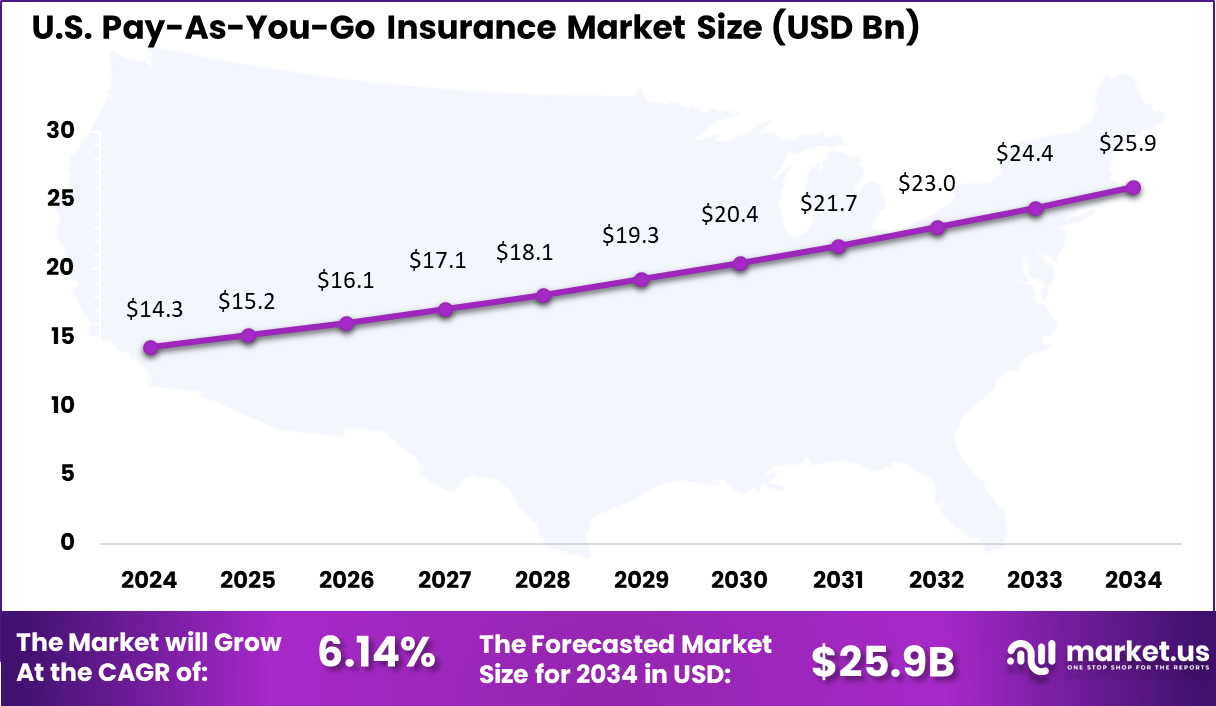

- The U.S. market reached USD 14.3 billion in 2024, expanding at a steady 6.14% CAGR, driven by large fleet networks and rising consumer acceptance of behavior-based insurance pricing.

Overview

The pay as you go insurance market has expanded as consumers and businesses move toward flexible coverage models that adjust premiums based on actual usage or real time behaviour. Growth reflects the shift from traditional fixed premium policies to more dynamic, data driven insurance products. The market has gained visibility across motor, health, property and micro-insurance segments where consumption patterns vary widely among users.

Top Driving Factors for PAYG insurance include the growing demand for cost savings among low-mileage drivers and increased customer desire for flexibility. For example, the rise of remote work and hybrid working models has driven a 25% increase in demand for these plans, as users look for insurance that better matches their reduced driving frequencies. Awareness of affordability and customization options also drives consumer interest, enabling tailored policies based on mileage and lifestyle.

PAYG insurance significantly improves market participation, particularly among drivers who struggled with traditional insurance due to upfront payments or liquidity constraints. Experimental studies demonstrated that a pay-as-you-go contract raised insurance uptake by nearly 11% points (89%) and increased days covered by almost 5 days (27%) in a three-month period. This indicates strong consumer preference for manageable, pay-per-use insurance models, especially among drivers with fluctuating financial liquidity.

US Market Size

The United States is a major contributor within North America, with a market value of approximately USD 14.3 billion and a steady CAGR of 6.14%. The US market’s growth is fueled by the expansion of digital platforms and increasing demand from both individual drivers and commercial fleet operators.

The country’s regulatory environment and technological advancement make it a favorable landscape for telematics-based insurance solutions. Key trends include the rise of gig economy platforms, which create flexible insurance needs that pay-as-you-go models effectively address. Strong venture capital investment and strategic partnerships between insurers and technology firms further accelerate market adoption in the US.

North America holds a significant 38% share of the global pay-as-you-go insurance market. This leadership stems from the region’s advanced digital infrastructure and a mature insurtech ecosystem that supports innovations in insurance offerings. The region benefits from widespread adoption of telematics and IoT-based insurance models, which enable flexible, usage-based policies across various insurance types.

By Insurance Type: Auto Insurance

Auto insurance dominates the pay-as-you-go insurance market with a substantial 42.9% share. This large share shows that pay-as-you-go models are especially attractive to drivers looking for flexible policies based on actual mileage or usage. It encourages safer driving and cost savings by charging customers according to how much they use their vehicles rather than fixed premiums.

This insurance type benefits both drivers and insurers by reducing risk exposure and claims. It also aligns well with rising demand for personalized insurance coverage that reflects individual driving habits and patterns, making auto insurance the most prominent segment in this space.

By Technology: IoT Sensors

IoT sensors are the technology backbone for pay-as-you-go insurance, capturing a dominant 62.2% share. These sensors track real-time driving behavior, vehicle location, speed, and mileage, providing insurers with accurate data to price premiums dynamically. IoT technology enables a more precise assessment of risk, resulting in fairer pricing and better risk management.

The adoption of IoT sensors also supports the growth of telematics-based insurance offerings. It brings transparency to both insurers and customers and facilitates automated claims processing and fraud detection, which enhances overall operational efficiency.

By End-User: Fleet Operators

Fleet operators hold a commanding 52.9% share of the pay-as-you-go insurance market. This reflects the insurers’ focus on commercial fleets that benefit greatly from usage-based insurance models. Fleet operators can monitor driver behavior across their vehicles, optimize routes, reduce costs, and improve safety compliance with these tailored policies.

Usage-based insurance provides fleet managers with tools to effectively manage risk and control insurance expenses through data-driven insights. It supports growing demand for cost-efficient and flexible insurance coverage in logistics, delivery, and transportation sectors.

Emerging Trends

Hyper-Personalized Pay-As-You-Go Insurance

A major emerging trend in Pay-As-You-Go insurance is hyper-personalization, fueled by data from telematics, wearables, and connected devices. Insurers are moving beyond generic pricing to deliver tailored coverage models and premium adjustments based on precise customer behavior and lifestyle data. This trend allows real-time dynamic pricing where premiums fluctuate with usage patterns, health metrics, or driving habits.

It creates insurance products that better align with individual needs, lifestyles, and risk profiles, thus increasing policyholder satisfaction and engagement. Personalized micro-policies, short-term task-focused coverage, and wellness-linked insurance are examples gaining traction in 2025. This hyper-personalization supports flexible payment options converging with broader digital ecosystems, enabling seamless customer journeys from quote to claim.

Insurers also leverage this trend to tap into emerging markets such as gig workers and low-mileage drivers, expanding access and affordability without compromising underwriting rigor. The growing willingness among consumers to share data in exchange for relevant benefits accelerates this shift toward data-driven, pay-as-you-go offerings.

Role of Generative AI

Generative AI is playing a transformative role in enhancing Pay-As-You-Go insurance by automating complex risk assessments, underwriting, and claims management processes. It enables insurers to analyze vast, diverse data sources, including telematics and external behavioral data, to generate personalized policies and dynamic pricing models efficiently.

AI-powered virtual assistants provide real-time customer support, simplifying policy purchase, usage tracking, and claims filing. This reduces operational costs and improves turnaround times for claims settlement. Moreover, generative AI supports advanced fraud detection and continuous risk monitoring, increasing accuracy and trust in pay-as-you-go pricing.

By automating routine administrative tasks, generative AI frees up human resources to focus on strategic customer engagement, improving overall service quality. The integration of generative AI with usage-based insurance models not only drives operational agility but also deepens personalization that consumers now expect in insurance products.

Key Market Segments

By Insurance Type

- Auto Insurance

- Health Insurance

- Travel Insurance

- Commercial Insurance

- Equipment Insurance

- Others

By Technology

- IoT Sensors

- Telematics

- Mobile Apps

- Blockchain

- Others

By End-User

- Individual Consumers

- Small Businesses

- Fleet Operators

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Real-Time Usage Data Enhances Pricing Accuracy

One key driver for Pay-As-You-Go (PAYG) insurance growth is the availability of real-time usage data through telematics and connected devices. This allows insurers to price premiums more accurately based on actual miles driven or hours used, which appeals to consumers who drive less frequently or variably.

It creates a fairer system where policyholders only pay for what they use, reducing the burden of fixed high premiums, especially for those with irregular driving patterns. By matching risk more closely with actual behavior, insurers can also reduce losses caused by overestimating risk, which improves profitability and competitive pricing.

Moreover, this driver supports consumer demand for more flexible and personalized insurance products. For example, households with multiple cars or hybrid workers benefit significantly from paying based on task-specific usage instead of broad coverage periods they don’t fully utilize. This development has led to increased adoption among these segments, highlighting how usage data is reshaping consumer expectations and insurer offerings in the PAYG model.

Restraint Analysis

Liquidity Constraints Limit Purchase Flexibility

A major restraint for PAYG insurance is the challenge posed by liquidity constraints among some consumers. While the model offers smaller, periodic payments aligned with usage, not all customers can manage frequent transactions or smaller premium amounts effectively.

Evidence shows that a notable portion of drivers attempting to purchase coverage on a pay-as-you-go basis face payment rejections due to insufficient funds. This situation is especially prevalent among low-income or credit-constrained consumers, limiting their ability to sustain continuous coverage despite the model’s intended flexibility.

These liquidity issues can undermine the model’s effectiveness by increasing lapses, reducing take-up rates, and possibly pushing vulnerable drivers toward uninsured driving, which increases overall risk. Payment timing flexibility helps a bit, but liquidity constraints remain a significant barrier to broader adoption of PAYG insurance, particularly in markets with less financial inclusion or where consumers manage tight budgets closely.

Opportunity Analysis

Generative AI Enhances Personalization and Efficiency

Generative AI presents a significant opportunity for PAYG insurance by enabling more personalized customer interactions and improving operational efficiency. It facilitates tailored policy options and pricing adjustments based on individual behavior and risk profiles extracted from complex data sets.

In claims processing, generative AI can automate and speed up document review, fraud detection, and underwriting decisions, resulting in faster settlements and more accurate risk assessments. Additionally, AI-driven virtual assistants and chatbots offer 24/7 customer support, helping users to manage policies, file claims, and understand coverage terms easily.

This deeper personalization and smoother customer experience foster greater loyalty and retention, driving higher satisfaction among policyholders who expect more customized, on-demand insurance services. Overall, generative AI’s role in smart automation and data analysis strengthens the PAYG insurance model’s value proposition for both insurers and customers.

Challenge Analysis

Data Privacy and Security Concerns

A critical challenge facing PAYG insurance is managing data privacy and security risks associated with collecting and processing large amounts of real-time usage and behavior data. Because PAYG relies heavily on telematics devices and mobile apps that continuously gather detailed personal and vehicle information, consumers often worry about how their data is stored, shared, and protected from breaches or misuse.

Insurers must invest in robust cybersecurity measures and transparent data governance policies to build trust and comply with evolving regulations. Failure to address these concerns adequately can result in customer hesitation, regulatory penalties, and reputational damage. Balancing the benefits of high-resolution data for risk assessment with strong privacy protections remains a key operational and strategic challenge for PAYG providers

Competitive Analysis

Progressive, Allstate, Liberty Mutual, State Farm, and Nationwide play a central role in the pay-as-you-go insurance market. Their strategies focus on usage-based pricing, real-time telematics, and more accurate risk assessment. These insurers use driving data, mileage tracking, and behavior analytics to deliver fairer premiums. Adoption is supported by demand for flexible insurance costs, especially among low-mileage drivers.

Global providers such as AXA, Generali, and Zurich strengthen the competitive landscape through wider geographic reach and advanced telematics ecosystems. Their platforms integrate mobile sensors, connected car data, and automated claims tools to improve service quality. These companies focus on improving transparency, enhancing customer experience, and lowering fraud risks.

Root Insurance, Metromile, Lemonade, Cuvva, By Miles, Trov, Slice Labs, and others expand the market with fully digital, app-driven experiences. Their offerings prioritize quick onboarding, flexible micro-policies, and transparent pay-per-mile billing. These companies appeal to tech-savvy users seeking lower premiums and high control over coverage. Advanced data analytics and automated claims processing support operational efficiency.

Top Key Players in the Market

- Progressive

- Allstate

- Liberty Mutual

- State Farm

- Nationwide

- AXA

- Generali

- Zurich

- Root Insurance

- Metromile

- Lemonade

- Cuvva

- By Miles

- Trov

- Slice Labs

- Others

Recent Developments

- June 2025, Central Bank of India acquired a roughly 25% stake in Future Generali India and its life insurance arm, signaling increased investment activity among insurers, which could drive growth and innovation including in flexible Pay-As-You-Go offerings.

- April 2025, Experian expanded its Experian Marketplace to include Root Insurance, enhancing consumer access to personalized, affordable car insurance with a seamless digital experience that enables coverage in as little as 60 seconds. This partnership aims to simplify insurance shopping and provide competitive rates through an integrated platform.

Report Scope

Report Features Description Market Value (2024) USD 41.8 Bn Forecast Revenue (2034) USD 85.4 Bn CAGR(2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Insurance Type (Auto Insurance, Health Insurance, Travel Insurance, Commercial Insurance, Equipment Insurance, Others), By Technology (Telematics, Mobile Apps, IoT Sensors, Blockchain, Others), By End-User (Individual Consumers, Small Businesses, Fleet Operators, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Progressive, Allstate, Liberty Mutual, State Farm, Nationwide, AXA, Generali, Zurich, Root Insurance, Metromile, Lemonade, Cuvva, By Miles, Trov, Slice Labs, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pay-As-You-Go Insurance MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Pay-As-You-Go Insurance MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Progressive

- Allstate

- Liberty Mutual

- State Farm

- Nationwide

- AXA

- Generali

- Zurich

- Root Insurance

- Metromile

- Lemonade

- Cuvva

- By Miles

- Trov

- Slice Labs

- Others