Global Password Management Market Size, Share and Analysis Report By Component (Software, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs), Individual Users), By Application (Privileged Access Management (PAM), User Password Management, Self-Service Password Reset, Others), By End-User Industry (IT & Telecommunications, Banking, Financial Services, and Insurance (BFSI), Healthcare, Government & Education, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 176881

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

- Password Management Market Size

- Key Takeaway

- Top Password Statistics

- Drivers Impact Analysis

- Restraint Impact Analysis

- By Component

- By Deployment Mode

- By Organization Size

- By Application

- By End User Industry

- Regional Perspective

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Increasing Adoption Technologies

- Investment and Business Benefits

- Regulatory Environment

- Emerging Trends Analysis

- Growth Factors Analysis

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Password Management Market Size

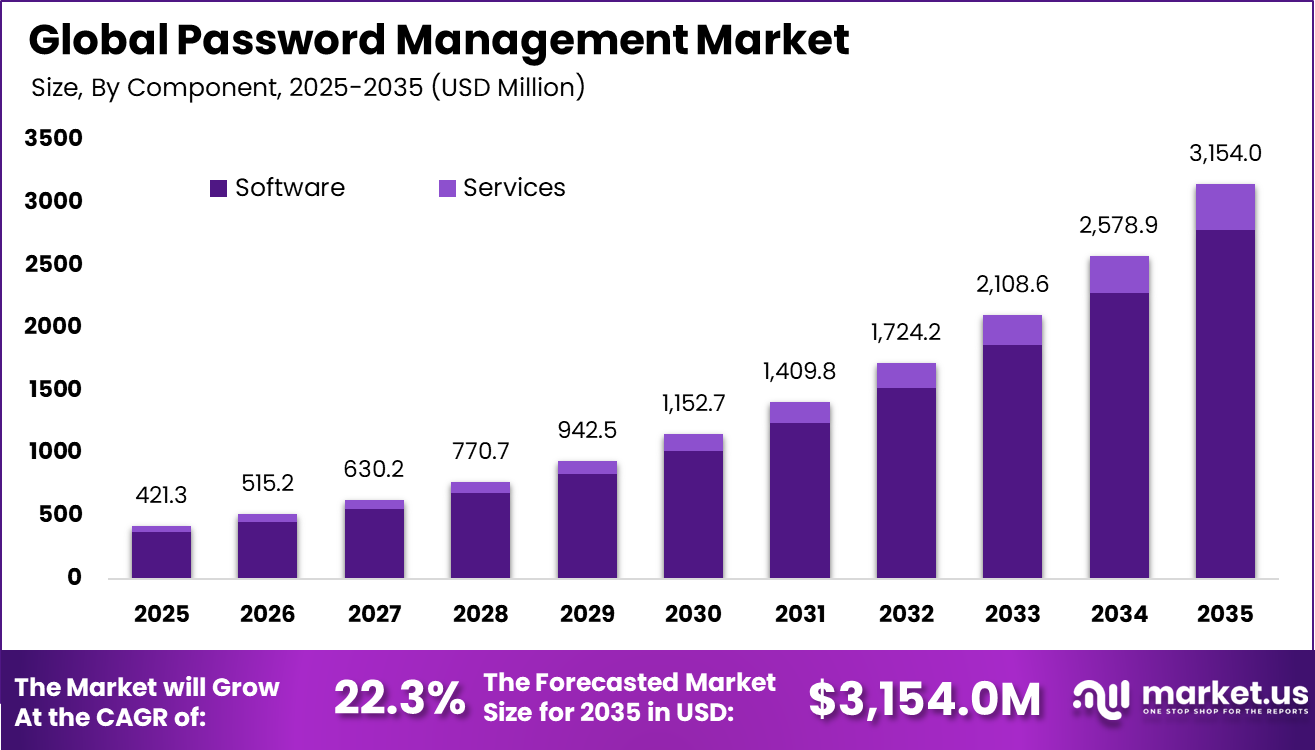

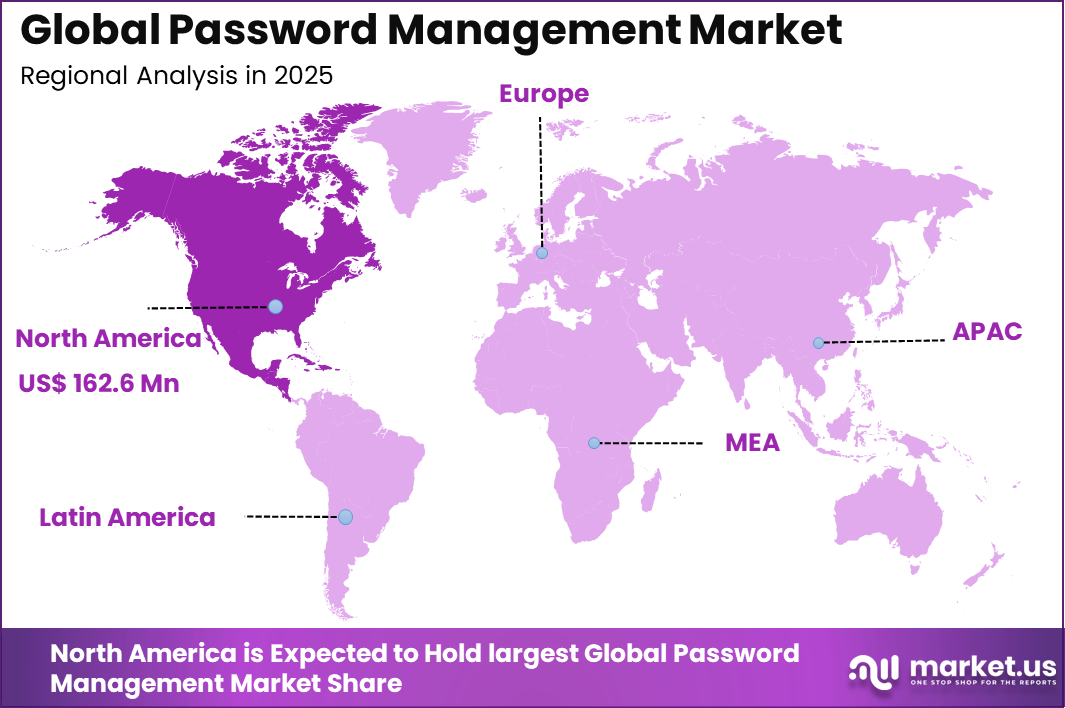

The Global Password Management Market size is expected to be worth around USD 3,154.0 million by 2035, from USD 421.3 million in 2025, growing at a CAGR of 22.3% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 38.6% share, holding USD 162.6 million in revenue.

The Password Management Market refers to software and services designed to securely store, generate, manage, and monitor user passwords across digital systems. These solutions are used by individuals and organizations to reduce the risks associated with weak, reused, or compromised credentials. The market has gained relevance as digital accounts, cloud platforms, and remote work tools continue to expand across industries. Password management is increasingly treated as a core cybersecurity control rather than a convenience feature.

The market includes enterprise grade platforms, consumer focused tools, and integrated identity solutions that support password vaulting, access controls, and audit visibility. Adoption is driven by the growing volume of credentials managed by a single user and the rising cost of account compromise incidents. Industry data shows that more than 80% of confirmed data breaches are linked to stolen or weak passwords, highlighting the structural need for secure credential management.

One of the main drivers of the Password Management Market is the rapid increase in cyberattacks that target login credentials as the primary entry point. Phishing, credential stuffing, and brute force attacks have become more frequent due to the availability of leaked passwords on underground forums. As a result, organizations are prioritizing tools that reduce human dependency on memory based passwords. This shift has increased demand for automated password generation and secure storage systems.

Demand for password management solutions is growing steadily among small businesses, large enterprises, and individual users. Organizations with regulated data environments are adopting these tools to reduce audit risk and improve access accountability. Surveys indicate that employees reuse passwords across an average of 60% of their work accounts, which directly increases breach exposure. This behavior continues to push security teams toward centralized password controls.

For instance, in October 2025, ManageEngine updated Password Manager Pro with periodic integrity checks, SHA-256 SAML support, and enhanced access controls per account. These tweaks make compliance and automation easier for IT teams worldwide.

Key Takeaway

- By component: Software dominated with an 88.4% share, reflecting strong reliance on digital platforms for secure credential storage and access control.

- By deployment mode: Cloud-based solutions accounted for 82.7%, driven by ease of access, scalability, and centralized security management.

- By organization size: Individual users represented 48.3%, highlighting growing awareness of personal data security and password hygiene.

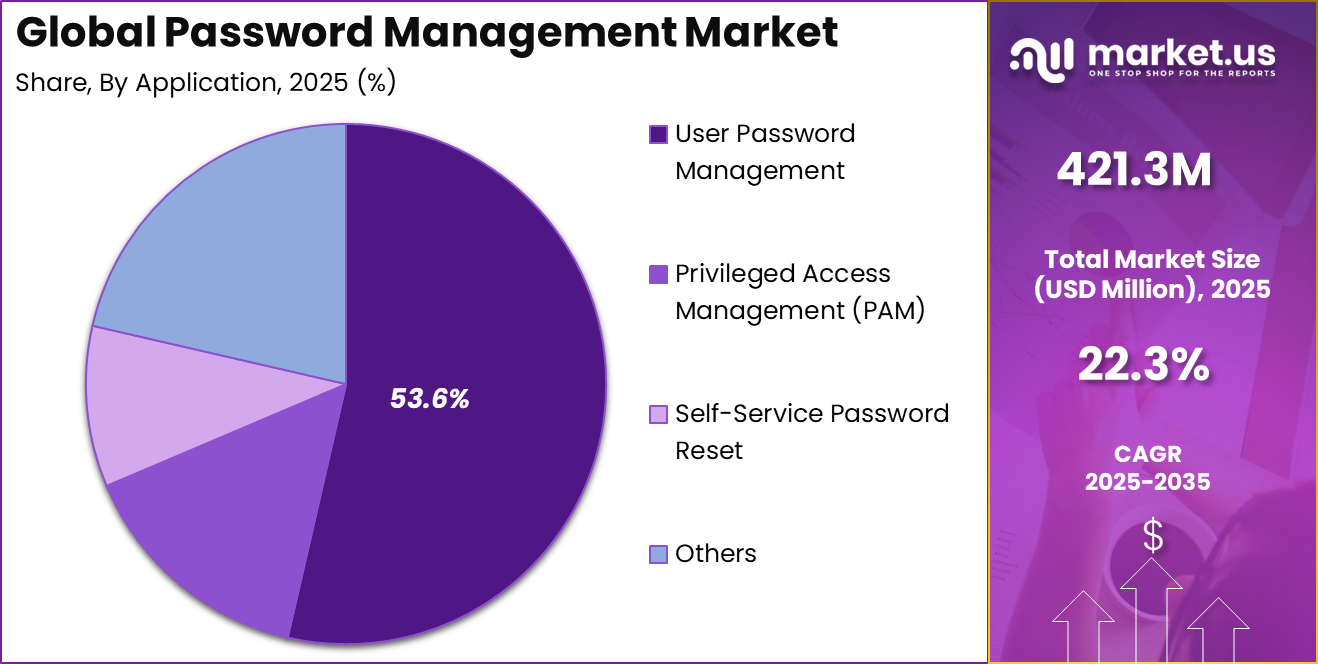

- By application: User password management led with 53.6%, as consumers and enterprises focus on reducing password reuse and credential-related risks.

- By end-user industry: BFSI held 36.2%, supported by strict regulatory requirements and high exposure to cyber threats.

- Regional insight: North America captured 38.6% of the global market, supported by early adoption of cybersecurity tools and high digital penetration.

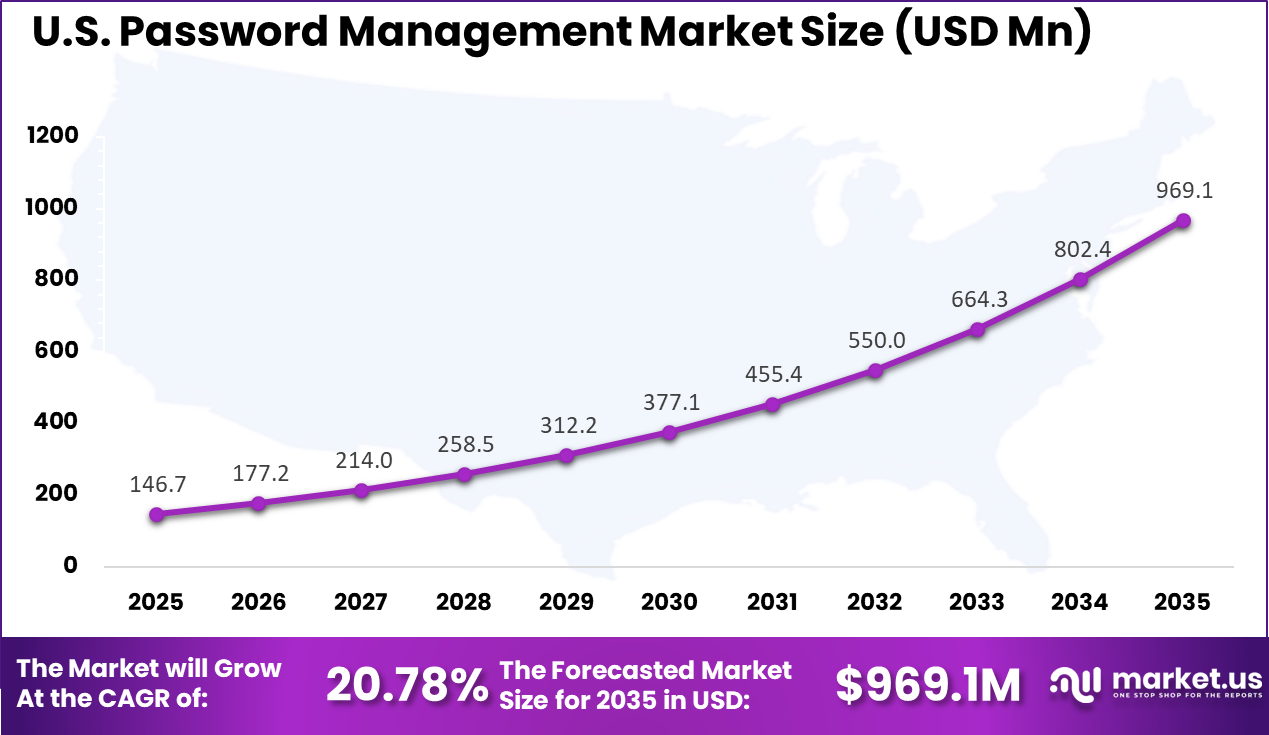

- U.S. market: Valued at USD 146.7 million, growing at a 20.78% CAGR, driven by rising cyber incidents and increased adoption of cloud-based security solutions.

Top Password Statistics

- According to spacelift.io, Automated password-guessing attacks now occur globally about once every 39 seconds, highlighting the constant pressure on login security.

- The average individual manages more than 250 passwords, up sharply from around 100 in 2020, which increases the risk of weak and reused credentials.

- Global revenue from password management solutions is projected to grow from under USD 2 billion in the early 2020s to over USD 7 billion by 2030, reflecting rising demand for secure credential handling.

- Only 27% of U.S. adults use random password generators, while about 79% rely on simple combinations of words and numbers that reduce overall security strength.

- Around 57% of users admit to reusing variations of old passwords across multiple accounts, significantly increasing exposure to credential-stuffing attacks.

- Website password rules often weaken protection, as 30% of sites do not allow special characters and 17% have no minimum length requirement.

- Nearly 24 billion usernames and passwords were reported compromised in 2022, showing the scale of global credential exposure.

- About 90% of dark web listings offering system access involve stolen login credentials, frequently bundled with IP address data.

- Valid credentials were used in roughly 36% of reported cloud data breaches, making credential theft one of the most common attack vectors.

- More than 300 billion passwords are currently in use worldwide across human users and machine identities, emphasizing the growing complexity of password management.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~)% Geographic Relevance Impact Timeline Rising frequency of cyberattacks and credential-based breaches +6.1% Global Short term Widespread adoption of remote work and cloud applications +5.0% North America, Europe Short to medium term Growing regulatory focus on data protection and access controls +4.3% Europe, North America Medium term Increasing enterprise demand for centralized identity security +3.7% Global Medium term Rising adoption among SMEs and individual users +3.2% Asia Pacific, North America Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~)% Geographic Relevance Impact Timeline User resistance to adopting new authentication tools -3.2% Global Short term Perceived complexity in enterprise deployment and integration -2.7% Global Medium term Competition from password-less and biometric authentication -2.3% North America, Europe Medium term Data privacy concerns related to cloud-based vaults -1.9% Europe Medium term Limited cybersecurity awareness among small organizations -1.6% Emerging Markets Medium to long term By Component

Software accounts for 88.4% of overall adoption in the Password Management Market. This dominance reflects strong reliance on application based solutions that securely store, generate, and manage credentials across multiple platforms. Software tools offer rapid deployment and frequent security updates, which are essential in dynamic digital environments.

The leadership of software is reinforced by its compatibility with operating systems, browsers, and enterprise applications. Automated password creation and encrypted storage improve both security and user experience. These capabilities continue to position software as the primary component choice.

For Instance, in May 2025, Google LLC. Chrome’s built-in password manager now auto-changes compromised passwords on supported sites, easing user fixes. This boosts software appeal by handling breach alerts and strong password generation without extra steps. Developers get tools for seamless integration, cutting drop-offs during security updates.

By Deployment Mode

Cloud based deployment represents 82.7% of total adoption. Cloud platforms enable secure access to credentials from any device while maintaining centralized control. This flexibility supports remote work and multi device usage patterns.

Cloud deployment also reduces maintenance responsibility for users and organizations. Security patches, backups, and updates are managed centrally. These benefits sustain cloud based models as the dominant deployment approach.

For instance, in November 2025, NordPass added a Sharing Hub and built-in authenticator to its cloud platform, letting teams track shares and mask emails securely. These cloud perks cut sprawl and phishing risks, perfect for remote setups. The features make cloud deployment even more appealing for quick, anywhere access without heavy setup.

By Organization Size

Individual users account for 48.3% of market demand by organization size. This segment includes consumers managing numerous personal and professional accounts. Increased awareness of cyber risks has accelerated adoption among individuals. Convenience and security are key drivers for this segment. Password reuse and weak credentials expose users to threats. Password management tools help mitigate these risks efficiently.

For Instance, in September 2025, Bitwarden, Inc. Praised for open-source, low-cost cloud vaults in personal manager rankings. Free tiers with AES-256 suit solo users handling many logins, self-host options add control. It fuels individual uptake by offering pro features without fees, ideal for personal breach protection.

By Application

User password management represents 53.6% of application based demand. This application focuses on secure credential storage, autofill features, and password strength monitoring. These functions reduce the likelihood of unauthorized access. Growth in this area is supported by the expansion of digital services. Users require centralized visibility and control over credentials. This sustains strong demand for user focused password management solutions.

Growth in this area reflects the steady rise of scams that target basic login details. Solutions now offer alerts, quick recovery options, and background checks that fit smoothly into normal workflows. As more activities move online, these tools help users build safer habits without feeling burdened.

For Instance, in May 2025, Google LLC. Rolled out auto-password change in Chrome for user credentials post-breach detection. It prompts strong replacements during sign-ins, simplifying routine management. This advances user apps by reducing manual fixes, helping non-tech folks stay safe effortlessly.

By End User Industry

The banking, financial services, and insurance sector accounts for 36.2% of end user adoption. This sector faces high exposure to cyber threats and operates under strict compliance requirements. Secure access control is a critical operational priority.

Password management solutions support regulatory compliance and fraud prevention in financial environments. Protecting sensitive data and systems remains essential. This maintains strong demand from the BFSI sector.

For Instance, in October 2025, ManageEngine updated Password Manager Pro with HSM encryption support and YubiKey 2FA, strengthening vault security for finance pros under strict compliance. These tweaks help BFSI handle sensitive logins with hardware-grade safety and easy audits. The release fits the sector’s need for robust, rule-ready tools.

Regional Perspective

In 2025, North America held a dominant market position in the Global Password Management Market, capturing more than a 38.6% share, holding USD 162.6 million in revenue. This edge stems from advanced tech infrastructure, rapid cloud uptake, and strict mandates like NIST and CISA pushing zero-trust security.

Frequent ransomware and phishing hits on finance, healthcare, and key sectors spur investments, while giants like CyberArk and 1Password innovate locally. Remote work and multi-cloud setups heighten needs for seamless credential controls.

For instance, in December 2025, Keeper Security’s 2025 retrospective showcased KeeperPAM launch, KeeperAI threat detection, and iOS updates with passphrase generators. These advancements strengthen zero-trust password protection, solidifying North American innovation.

United States Market Overview

The United States represents the largest contributor within North America, with a market value of USD 146.7 Mn and a growth rate of 20.78% CAGR. Growth is supported by increasing online account usage and heightened concern over data breaches. Password management tools are increasingly viewed as essential digital utilities.

Adoption in the U.S. is influenced by regulatory compliance needs and rising consumer awareness. Both individual users and financial institutions prioritize credential security. These factors collectively support strong growth in the U.S. market segment.

Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Cybersecurity software providers Very High Medium Global Strong recurring SaaS revenue Enterprise IT and IAM platform vendors High Medium North America, Europe Strategic security portfolio expansion Cloud service and productivity platform investors Medium Low to Medium Global Indirect but stable demand Private equity firms Medium Medium North America, Europe Platform scaling and consolidation Venture capital investors High High North America Innovation in zero-trust and identity security Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~) % Primary Function Geographic Relevance Adoption Timeline Encrypted password vaults with zero-knowledge architecture +5.4% Secure credential storage Global Short term Integration with single sign-on and IAM platforms +4.6% Unified access management North America, Europe Medium term AI-based threat detection and compromised credential alerts +4.0% Proactive breach prevention Global Medium term Cloud-native password management platforms +3.6% Scalability and remote access Global Medium to long term Support for password-less and multi-factor authentication +3.1% Enhanced security posture Europe, North America Long term Increasing Adoption Technologies

The market is seeing increased adoption of zero knowledge encryption architectures that ensure stored passwords cannot be viewed even by service providers. These technologies improve trust and reduce liability concerns associated with centralized credential storage. Encryption standards combined with device level security controls have strengthened the overall reliability of password management platforms. This technological foundation supports wider enterprise deployment.

Another important adoption trend is the integration of password managers with identity and access management systems. Single sign on compatibility, directory synchronization, and policy based access controls are being embedded into password tools. These integrations help security teams enforce password policies at scale. Automation reduces manual oversight and improves compliance consistency across user groups.

Organizations adopt advanced password management technologies to reduce the human error factor in cybersecurity incidents. Automated password generation eliminates predictable patterns that attackers exploit. Secure vaults also prevent unsafe storage methods such as spreadsheets or browsers without encryption. These benefits directly lower the probability of credential based breaches.

Another reason for adoption is operational efficiency. Password resets account for nearly 30% of IT helpdesk requests in many enterprises. Password management tools reduce reset frequency by enabling self service access recovery. This leads to lower support costs and improved employee productivity without compromising security controls.

Investment and Business Benefits

Investment opportunities in this market exist in enterprise focused platforms that address privileged access and high risk user roles. As organizations map digital access more carefully, tools that manage administrative credentials are gaining strategic value. Investors are also showing interest in solutions that combine password management with broader identity governance features. These platforms are positioned to serve long term security infrastructure needs.

Opportunities are also emerging in region specific compliance driven deployments. Markets with strong data protection regulations are encouraging adoption of secure credential management practices. Vendors that localize compliance support and data residency controls are better positioned for expansion. This creates room for targeted investment in compliance aligned password management technologies.

For businesses, password management delivers measurable reductions in security incidents and operational disruptions. Centralized credential control improves visibility into who has access to critical systems. This visibility supports faster incident response and more accurate risk assessments. Over time, improved access discipline strengthens overall security posture.

From a financial perspective, reduced breach exposure lowers potential legal, regulatory, and reputational costs. Studies show that credential related breaches are among the most expensive to remediate. Password management acts as a preventive control that protects digital assets at relatively low implementation cost. This makes it a cost effective security investment.

Regulatory Environment

The regulatory environment strongly supports adoption of password management solutions, even when not explicitly mandated. Data protection regulations require organizations to implement reasonable security safeguards for access control. Weak or reused passwords are often cited as control failures during audits. Password management tools help demonstrate proactive compliance efforts.

In regulated sectors such as finance and healthcare, access logging and credential protection are closely scrutinized. Regulators expect organizations to limit unauthorized access and reduce internal misuse risks. Password management platforms support these expectations by enforcing strong password policies and maintaining audit trails. This alignment increases regulatory confidence and reduces enforcement risk.

Emerging Trends Analysis

An emerging trend in the password management market is increased focus on enterprise governance features. Centralized policy enforcement, audit logging, and role based access controls are becoming standard expectations. These features support compliance and internal security oversight. Enterprise readiness is shaping product design priorities.

Another trend is enhanced automation and risk detection. Password managers are increasingly incorporating breach monitoring and weak password alerts. These proactive capabilities help users respond to threats before damage occurs. Automation strengthens the preventive role of password management tools.

Growth Factors Analysis

One of the key growth factors for the password management market is sustained growth in remote and hybrid work models. Distributed workforces increase reliance on secure digital access. Password managers provide a scalable way to manage credentials outside traditional network boundaries. This structural shift supports long term demand.

Another growth factor is increasing regulatory emphasis on access control and data protection. Organizations must demonstrate reasonable safeguards against unauthorized access. Password management solutions help meet these expectations by standardizing credential practices. Compliance driven demand continues to support steady market expansion.

Key Market Segments

By Component

- Software

- Services

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- Individual Users

By Application

- User Password Management

- Privileged Access Management (PAM)

- Self-Service Password Reset

- Others

By End-User Industry

- IT & Telecommunications

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Government & Education

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading consumer and business-focused providers such as 1Password, LastPass, and Dashlane, Inc. dominate the password management market through strong encryption and user-friendly design. Their solutions support secure credential storage, password generation, and cross-device synchronization. Cloud-based deployment and browser integration improve accessibility. These players benefit from strong brand recognition and wide adoption among individuals and small teams.

Enterprise and privileged access management specialists such as CyberArk Software, Ltd., BeyondTrust Corporation, and Delinea, Inc. focus on advanced access control and compliance. Ivanti, Inc., ManageEngine, and Hitachi ID Systems, Inc. support large organizations with centralized policy enforcement. These players address regulatory requirements and insider threat risks. Adoption is strong in sectors with high security and audit needs.

Open-source and ecosystem-driven providers such as Bitwarden, Inc., RoboForm, and NordPass expand choice through flexible pricing and transparency. Platform vendors including Microsoft Corporation and Google LLC embed password management into broader identity ecosystems. Other vendors add regional depth and innovation. This competitive landscape supports steady growth as organizations shift toward zero-trust and passwordless strategies.

Top Key Players in the Market

- 1Password

- LastPass

- Dashlane, Inc.

- Keeper Security, Inc.

- Bitwarden, Inc.

- RoboForm

- NordPass

- Ivanti, Inc.

- CyberArk Software, Ltd.

- BeyondTrust Corporation

- Delinea, Inc.

- ManageEngine

- Hitachi ID Systems, Inc.

- Microsoft Corporation

- Google LLC

- Others

Recent Developments

- In November 2025, Dashlane pushed its premium vaults with unlimited storage and 1GB file space, plus PIN/fingerprint logins alongside YubiKey. Standing out against rivals like Bitwarden, it’s winning users who need extra 2FA layers and seamless imports from browsers.

- In September 2025, Keeper sharpened its edge in the personal password manager space with beefed-up MFA support for hardware keys and better dark web alerts on premium plans. It’s gaining traction for open audits and emergency access, proving reliable for folks wanting solid protection without the fluff.

Report Scope

Report Features Description Market Value (2025) USD 421.3 Million Forecast Revenue (2035) USD 3,154.0 Million CAGR(2025-2035) 22.3% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs), Individual Users), By Application (Privileged Access Management (PAM), User Password Management, Self-Service Password Reset, Others), By End-User Industry (IT & Telecommunications, Banking, Financial Services, and Insurance (BFSI), Healthcare, Government & Education, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 1Password, LastPass, Dashlane, Inc., Keeper Security, Inc., Bitwarden, Inc., RoboForm, NordPass, Ivanti, Inc., CyberArk Software, Ltd., BeyondTrust Corporation, Delinea, Inc., ManageEngine, Hitachi ID Systems, Inc., Microsoft Corporation, Google LLC, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Password Management MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Password Management MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- 1Password

- LastPass

- Dashlane, Inc.

- Keeper Security, Inc.

- Bitwarden, Inc.

- RoboForm

- NordPass

- Ivanti, Inc.

- CyberArk Software, Ltd.

- BeyondTrust Corporation

- Delinea, Inc.

- ManageEngine

- Hitachi ID Systems, Inc.

- Microsoft Corporation

- Google LLC

- Others