Global Passive Authentication Market Size, Share, Growth Analysis By Offering (Solution, Services [Professional Services, Managed Services]), By Business Function (Compliance Management, Marketing Management, Risk Management, Others), By Deployment (On-premises, Cloud), By Organization Size (Small & Medium Enterprises (SMEs), Large Enterprises), By Industry Vertical (BFSI, Government, IT & Telecommunications, Retail and consumer goods, Healthcare, Media and Entertainment, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161594

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- AI Adoption by Industry

- Analysts’ Viewpoint

- Role of Generative AI

- US Market Size

- By Offering

- By Business Function

- By Deployment

- By Organization Size

- By Industry Vertical

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraints

- Growth Opportunities

- Challenging Factors

- Competitive Analysis

- Major Developments

- Report Scope

Report Overview

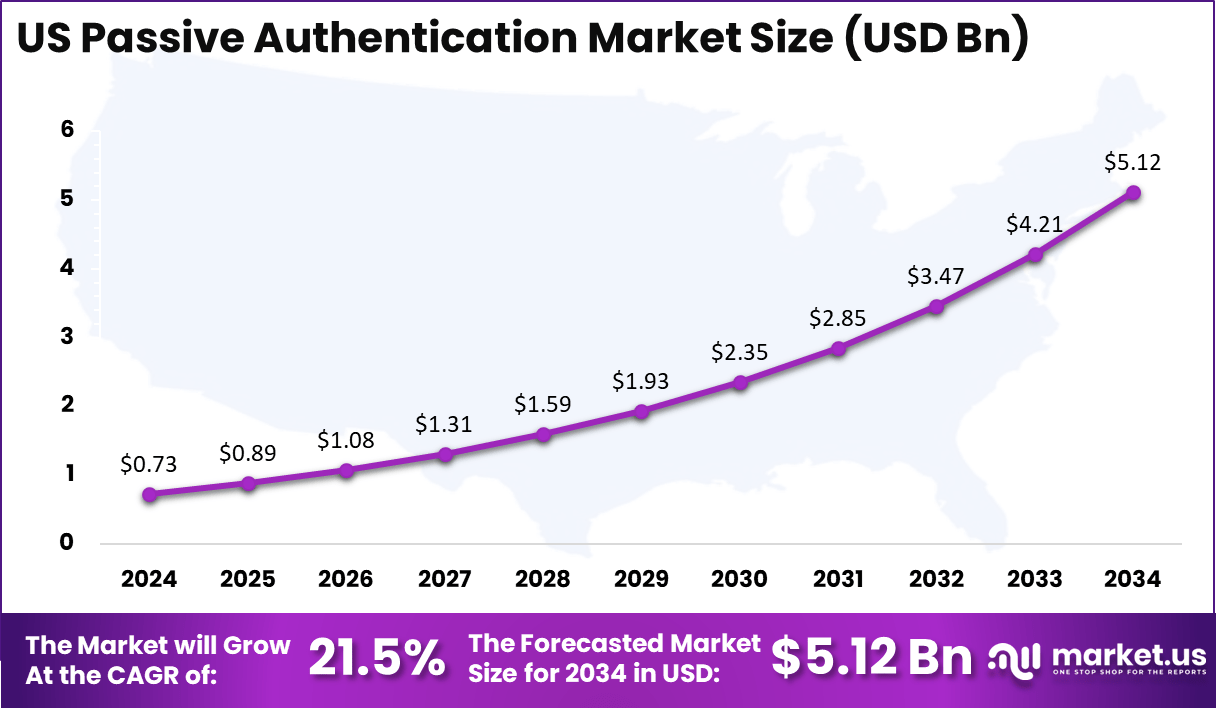

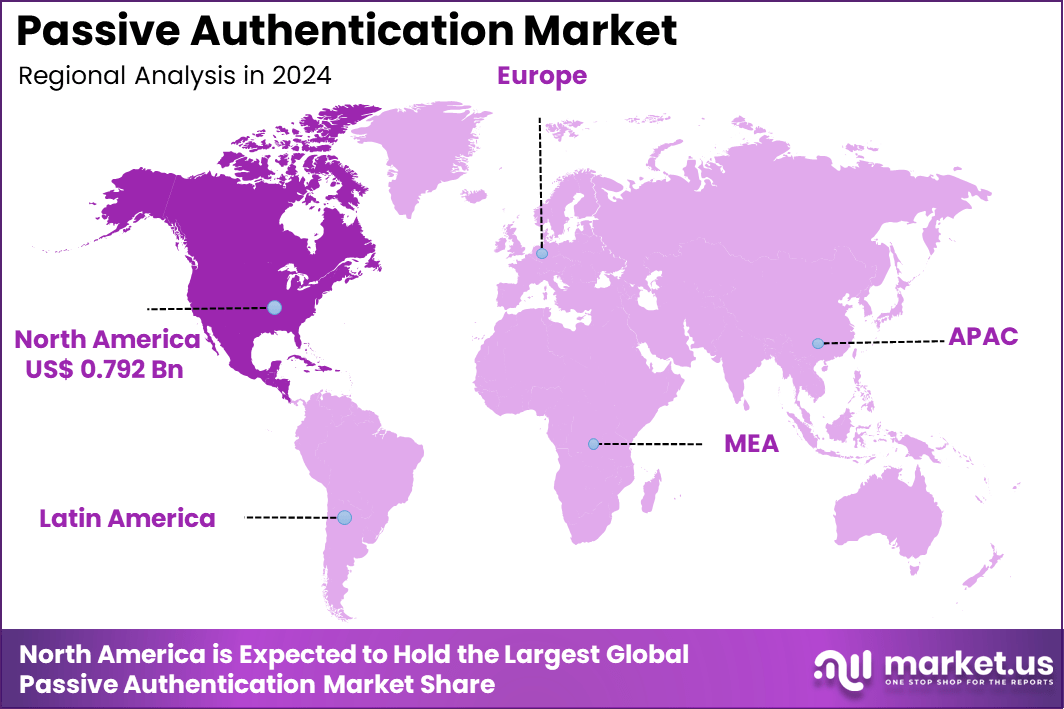

The Global Passive Authentication Market was valued at USD 1.98 billion in 2024 and is projected to expand substantially, reaching approximately USD 15.82 billion by 2034, reflecting a strong CAGR of 23.10% during the forecast period. North America continues to dominate the global landscape, holding a 40.2% market share with a valuation of USD 0.79 billion in 2024. The US accounted for USD 0.73 billion of this figure and is expected to record a healthy CAGR of 21.5% throughout the forecast period.

The passive authentication market is witnessing accelerated growth driven by several key factors. One major contributor is the rapid rise in AI-driven deepfake fraud, which adds approximately +6.2% to the overall CAGR as organizations increasingly adopt multi-layered authentication to combat synthetic identity and voice spoofing fraud.

The ongoing digital banking boom across Asia adds another +5.8%, as fintech innovators deploy frictionless verification systems to handle high transaction volumes securely. Regulatory initiatives such as PSD2 Strong Customer Authentication (SCA) contribute +4.1%, compelling financial institutions in the EU and other regions to enhance identity verification measures.

Additionally, API-first embedded finance platforms are fueling about +4.2% of market growth as they demand “invisible” authentication methods that integrate seamlessly into user experiences. Lastly, the surge in call-center account-takeover attacks contributes nearly +3.7%, pushing global enterprises to implement continuous behavioral monitoring and passive voice verification solutions to detect threats without disrupting customer interactions.

Top Market Takeaways

- By offering, the solution segment leads with 65.4%, driven by the increasing adoption of AI-driven security tools for seamless identity verification and threat prevention.

- By business function, risk management and fraud detection dominate with 45.8%, supported by the rising need for real-time behavioral analysis to mitigate cyber risks.

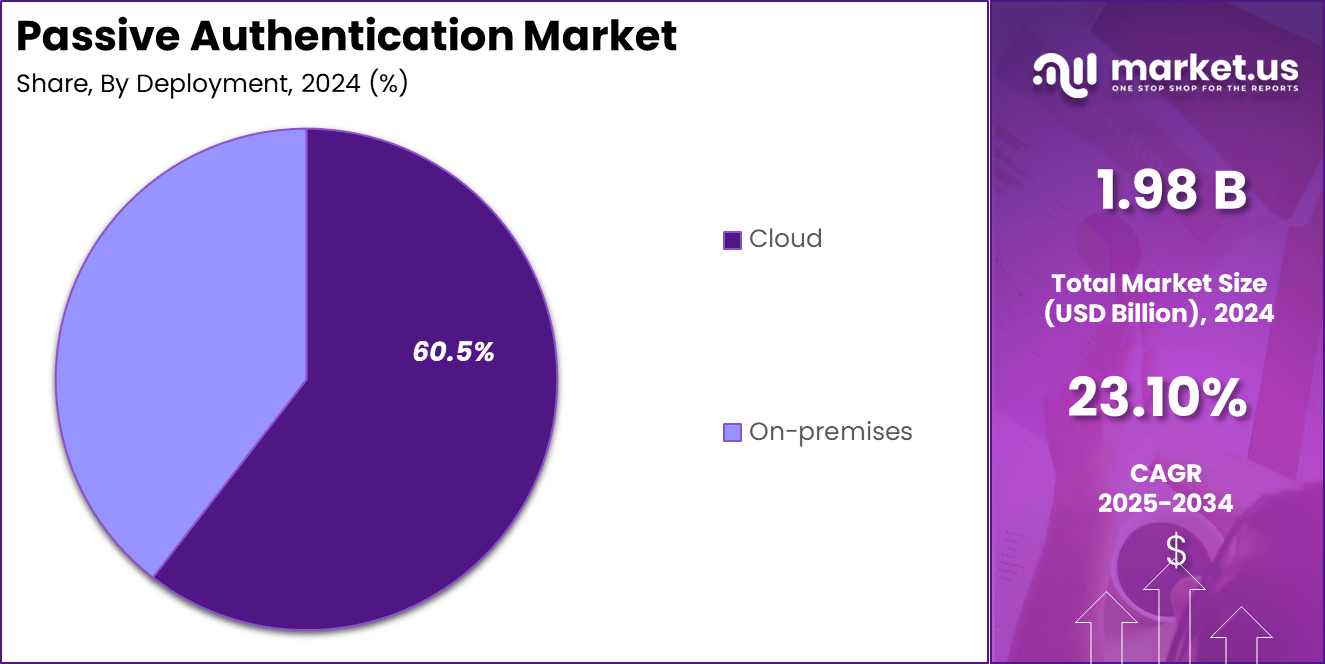

- By deployment, the cloud segment captures 60.5%, reflecting the shift toward scalable and cost-efficient authentication frameworks across enterprises.

- By organization size, large enterprises hold a dominant 70.3%, owing to higher investments in advanced cybersecurity infrastructure and compliance solutions.

- By industry vertical, the BFSI sector leads with 31.7%, driven by stringent regulatory mandates and the increasing demand for secure, frictionless digital banking experiences.

- North America accounts for 40.2% of the global market share, with a market size of USD 0.79 billion in 2024.

- The US market contributed USD 0.73 billion and is projected to grow at a CAGR of 21.5%, underscoring its technological maturity and strong enterprise adoption rate.

- The global passive authentication market was valued at USD 1.98 billion in 2024 and is anticipated to reach USD 15.82 billion by 2034, registering a robust CAGR of 23.10% over the forecast period.

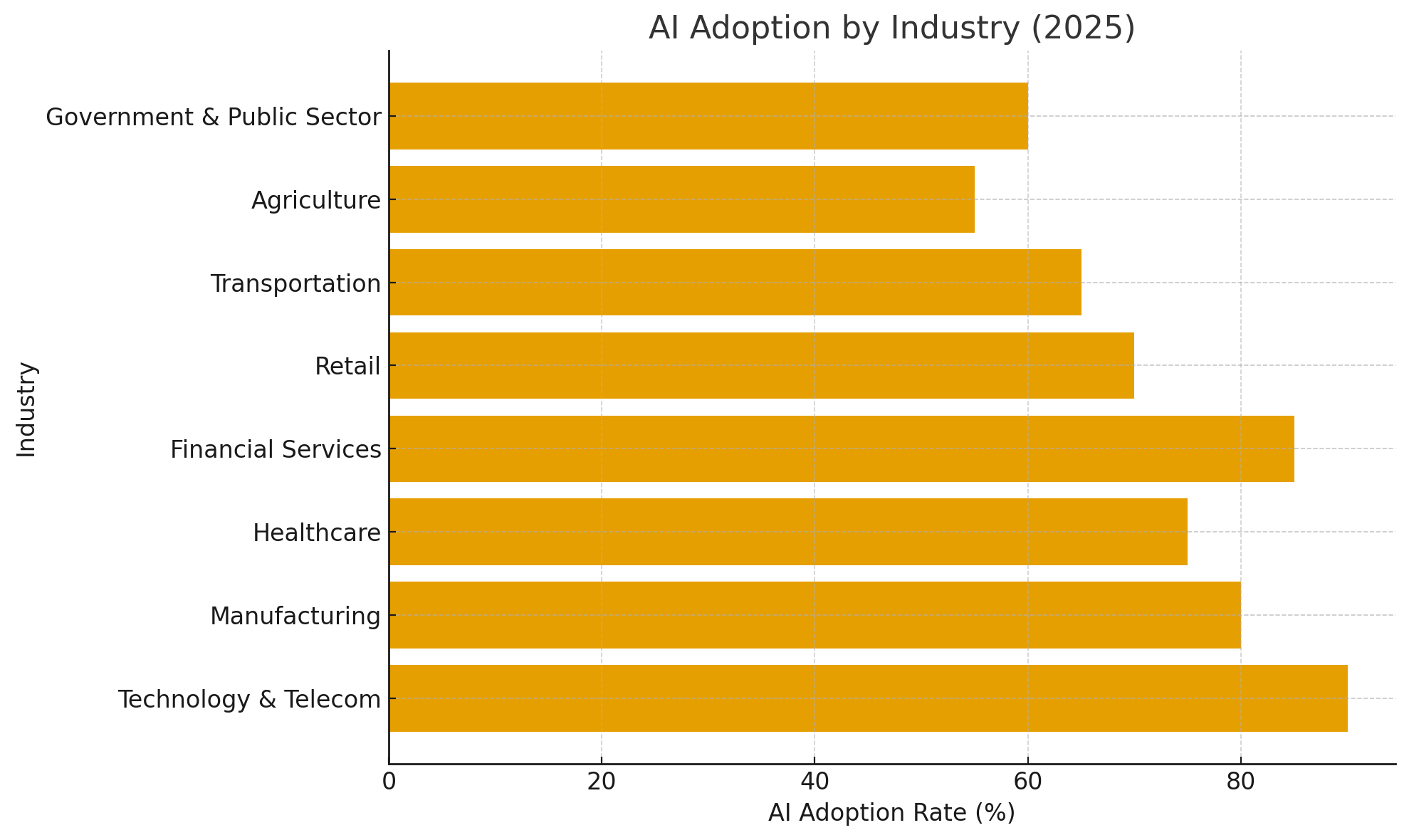

AI Adoption by Industry

AI adoption across industries is reshaping global business operations, productivity, and innovation. In the technology and telecom sector, AI drives automation, predictive analytics, and network optimization, enabling faster service delivery and improved customer experiences. The manufacturing industry is integrating AI for predictive maintenance, process automation, and quality control, helping reduce downtime and operational costs.

In the healthcare sector, AI supports diagnostics, drug discovery, and patient monitoring, with applications like AI-powered imaging and personalized treatment plans improving care efficiency. Financial services leverage AI for fraud detection, algorithmic trading, and risk management, enhancing security and decision-making accuracy.

Retail is witnessing the transformative use of AI in demand forecasting, dynamic pricing, and personalized shopping experiences, leading to higher customer satisfaction and reduced inventory waste. The transportation sector employs AI for autonomous driving, logistics optimization, and predictive maintenance of fleets, improving safety and cost efficiency.

Agriculture benefits from AI-based crop monitoring, weather prediction, and automated irrigation, ensuring sustainable yield improvement. Government and public sectors are also increasingly using AI for citizen services, surveillance, and smart city initiatives. Overall, AI adoption across industries is accelerating digital transformation, driving competitive advantage, and shaping a more data-driven, efficient, and intelligent global economy.

Analysts’ Viewpoint

Analysts view the AI adoption landscape as a transformative force redefining industrial competitiveness and global productivity. The rapid integration of AI across diverse sectors signifies a structural shift toward data-driven decision-making and intelligent automation. In technology and telecom, AI’s maturity in cloud computing and generative models is driving faster innovation cycles. Manufacturing is experiencing a digital renaissance, with predictive maintenance and robotics optimizing production efficiency. Healthcare analysts emphasize that AI’s growing role in diagnostics and precision medicine enhances patient outcomes while addressing workforce shortages.

In finance, AI’s evolution in fraud analytics and algorithmic trading is improving trust and operational accuracy. Retail analysts note that consumer behavior insights powered by AI are fueling personalized shopping and inventory optimization. The transportation industry continues to embrace AI for smart mobility, with autonomous driving systems and AI-based logistics shaping the future of mobility ecosystems.

Agriculture and public sectors are slower adopters but are showing steady gains through smart farming and AI-enabled governance. Overall, analysts foresee sustained investment momentum, fueled by rising data availability, government AI strategies, and industry partnerships. The consensus is clear: AI is no longer optional—it is a core enabler of innovation, efficiency, and long-term growth across global industries.

Role of Generative AI

Generative AI is playing a pivotal role in accelerating digital transformation across industries by enabling machines to create, simulate, and optimize complex outputs once limited to human intelligence. In the technology sector, generative AI enhances software development, content creation, and design automation through tools that generate code, images, and simulations with remarkable accuracy.

Manufacturing industries are leveraging generative AI for product design optimization, predictive maintenance, and supply chain efficiency, reducing time-to-market and production costs. In healthcare, generative AI supports drug discovery, medical imaging, and personalized treatment modeling by generating synthetic datasets and simulating molecular interactions.

In the financial sector, generative AI is transforming risk assessment and fraud detection through scenario modeling and anomaly simulation. Retailers use generative AI to develop virtual store layouts, personalized marketing campaigns, and dynamic pricing strategies based on real-time consumer data. The media and entertainment industry benefits from automated video editing, scriptwriting, and digital avatar creation.

In education, generative AI enhances personalized learning and curriculum design. Analysts highlight that as generative AI evolves, its ability to create synthetic data, automate creativity, and enhance decision-making will make it indispensable for innovation, productivity, and competitiveness across global industries while also driving new ethical and governance challenges.

US Market Size

The US passive authentication market accounted for a significant portion of the North American share, with a valuation of USD 0.73 billion in 2024. This reflects the country’s strong adoption of AI-driven identity verification solutions across industries such as banking, telecommunications, and government services. The US market is projected to expand at a CAGR of 21.5% throughout the forecast period, supported by rising concerns over digital fraud and identity theft. Major financial institutions and enterprises are rapidly integrating behavioral biometrics and continuous authentication technologies to strengthen cybersecurity frameworks.

The growing number of digital transactions, coupled with stringent regulatory frameworks such as NIST and CISA cybersecurity guidelines, is further accelerating adoption. North America, holding 40.2% of the global market with a value of USD 0.79 billion in 2024, remains the leading region due to its advanced technological infrastructure and early investment in AI and machine learning-based security systems.

Investments in the passive authentication market are gaining momentum as enterprises prioritize advanced security infrastructure to combat growing cyber threats and ensure seamless user experiences. Businesses across sectors such as banking, e-commerce, and telecommunications are increasingly investing in AI and behavioral analytics to enable continuous authentication without user friction.

Venture capital firms and technology investors are channeling substantial funding into startups specializing in behavioral biometrics, machine learning algorithms, and cloud-based security frameworks. These investments are accelerating product innovation, improving accuracy, and reducing false-positive rates in authentication systems.

The business benefits are multifaceted—passive authentication enhances fraud prevention, strengthens compliance with data protection laws, and improves customer satisfaction by eliminating repetitive password prompts. Cloud deployment models offer scalability and cost efficiency, allowing organizations to implement authentication solutions across multiple platforms with minimal infrastructure costs.

Furthermore, large enterprises adopting these technologies report significant reductions in operational risks and data breaches. As a result, organizations are not only improving cybersecurity resilience but also gaining competitive advantages by fostering customer trust and operational efficiency. The integration of AI and behavioral analytics into authentication ecosystems is thus expected to yield strong returns on investment and long-term business sustainability across global markets.

By Offering

The solution segment accounted for 65.4% of the global passive authentication market in 2024, making it the dominant offering category. This growth is driven by the rising need for advanced identity verification systems that minimize user friction while maintaining strong security standards. AI-powered behavioral analytics, machine learning algorithms, and biometric recognition tools are increasingly being deployed by enterprises to detect anomalies and prevent fraud in real time. Organizations are adopting these solutions to enhance compliance with global data protection laws such as GDPR and CCPA while ensuring seamless digital user experiences across platforms.

The services segment, comprising professional and managed services, is also gaining significant traction. Professional services include consulting, system integration, and training—helping enterprises efficiently deploy and optimize authentication technologies. Managed services provide continuous monitoring, maintenance, and support to ensure system reliability and threat mitigation.

With the growing complexity of cyber threats, many businesses are outsourcing these functions to specialized providers for cost efficiency and expertise. The combination of scalable AI-based solutions and tailored service offerings is expected to fuel long-term growth, enabling organizations to strengthen cybersecurity frameworks, reduce operational risks, and deliver a frictionless authentication experience for customers and employees alike across diverse industry verticals.

By Business Function

Risk management and fraud detection accounted for 45.8% of the global passive authentication market in 2024, emerging as the leading business function. The dominance of this segment stems from the rising frequency of cyberattacks, data breaches, and identity theft incidents across industries such as banking, e-commerce, and telecommunications. Organizations are prioritizing AI-driven risk analytics and behavioral biometrics to detect anomalies in user behavior, enabling proactive threat prevention without disrupting user experience. Advanced algorithms continuously monitor login patterns, transaction anomalies, and device fingerprints, helping companies identify fraudulent activities in real time.

Compliance management is another key functional area, as enterprises strive to meet stringent data privacy regulations and industry-specific standards. Marketing management applications of passive authentication are also expanding, focusing on securing customer data while personalizing digital interactions. The “others” category includes HR management and IT operations, where passive authentication ensures secure access to internal systems and resources.

The increasing integration of AI and machine learning is transforming how businesses manage risks and compliance simultaneously, creating a unified approach to cybersecurity. As digital transformation accelerates, risk management and fraud detection are expected to remain central to enterprise authentication strategies, offering measurable security, transparency, and operational resilience.

By Deployment

The cloud segment held 60.5% of the global passive authentication market in 2024, reflecting its dominance as enterprises increasingly migrate to scalable and flexible deployment models. Cloud-based authentication enables real-time data processing, seamless updates, and integration with existing enterprise systems without the need for heavy on-premises infrastructure.

Organizations favor cloud deployment for its cost efficiency, ease of maintenance, and faster implementation timelines. Additionally, the surge in remote work and the expansion of digital ecosystems have heightened the demand for cloud-native security frameworks that provide continuous authentication and monitoring from any location.

The on-premises segment, though smaller, continues to serve enterprises with strict data privacy or regulatory compliance requirements, such as government agencies and financial institutions. These organizations prefer on-premises systems to maintain full control over sensitive data and internal security protocols.

However, the ongoing advancements in cloud encryption and hybrid deployment models are gradually bridging this trust gap. As more businesses adopt multi-cloud strategies and AI-driven security solutions, the cloud deployment segment is anticipated to expand rapidly, offering greater agility, scalability, and resilience against evolving cyber threats, thereby positioning it as the preferred choice for future authentication infrastructure worldwide.

By Organization Size

Large enterprises accounted for 70.3% of the global passive authentication market in 2024, establishing themselves as the primary adopters of advanced cybersecurity and identity management solutions. Their dominance is driven by the scale of digital operations, the complexity of data networks, and the increasing need to secure customer interactions across multiple platforms.

These organizations are heavily investing in AI-based behavioral analytics, continuous authentication, and biometric technologies to safeguard against sophisticated cyber threats and ensure compliance with global data protection regulations. Additionally, large enterprises benefit from dedicated cybersecurity budgets and in-house expertise, enabling seamless integration of passive authentication systems with existing IT infrastructure.

Small and medium enterprises (SMEs), though smaller in market share, are rapidly adopting passive authentication technologies as digital transformation accelerates. Cloud-based and subscription models have made these solutions more accessible and affordable for smaller businesses. SMEs are leveraging passive authentication to improve operational security and customer trust without compromising user convenience.

The growing availability of managed security services is further helping SMEs bridge the technological gap with larger corporations. Over the coming years, both segments are expected to expand, with large enterprises continuing to lead in innovation and SMEs driving incremental growth through agile implementation.

By Industry Vertical

The BFSI sector accounted for 31.7% of the global passive authentication market in 2024, making it the leading industry vertical. This dominance is primarily driven by the rising volume of digital transactions, the growing threat of financial fraud, and stringent regulatory mandates such as PCI DSS, PSD2, and GDPR.

Banks and financial institutions are rapidly deploying AI-driven behavioral biometrics, device intelligence, and continuous authentication tools to safeguard customer accounts without introducing friction into user experiences. The integration of passive authentication with mobile banking and digital payment systems enhances real-time fraud detection and reduces false positives, strengthening customer trust and operational security.

Government agencies are increasingly implementing passive authentication to secure citizen data, manage digital identities, and prevent unauthorized access to e-governance platforms. The IT and telecommunications sector is adopting these technologies to ensure network integrity and protect customer information from data breaches. Retail and consumer goods companies are leveraging passive authentication to secure e-commerce platforms and enable smooth customer journeys.

Healthcare organizations are deploying it to safeguard patient records and meet HIPAA compliance requirements, while media and entertainment players use it for content protection and secure access control. Collectively, these sectors reflect a widespread transition toward intelligent, user-friendly, and compliance-driven authentication ecosystems.

Key Market Segments

By Offering

- Solution

- Services

- Professional Services

- Managed Services

By Business Function

- Compliance Management

- Marketing Management

- Risk Management

- Others

By Deployment

- On-premises

- Cloud

By Organization Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Industry Vertical

- BFSI

- Government

- IT & Telecommunications

- Retail and consumer goods

- Healthcare

- Media and Entertainment

- Others

Regional Analysis

North America dominated the global passive authentication market in 2024, holding 40.2% of the total share, valued at USD 0.79 billion. The US contributed USD 0.73 billion, driven by strong enterprise adoption of AI-powered security systems and regulatory frameworks promoting advanced digital identity solutions. Europe followed, supported by stringent GDPR and rapid digital banking growth across countries such as Germany, the UK, and France. The Asia-Pacific region is witnessing the fastest growth, fueled by expanding fintech ecosystems, e-commerce platforms, and government digital initiatives in countries like India, China, and Japan.

Latin America and the Middle East & Africa are gradually embracing passive authentication technologies, primarily in banking, telecom, and government sectors, as cybersecurity awareness increases. The global market is projected to experience consistent regional expansion, with technological innovation, data protection laws, and increasing digital transformation acting as key drivers shaping the future landscape of passive authentication worldwide.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

- Rising digital fraud and identity theft — As cyberattacks surge, enterprises are seeking more robust, non-intrusive authentication mechanisms to detect anomalies and unauthorized access in real time.

- Demand for frictionless UX — Organizations want authentication that doesn’t require extra steps from users (e.g. passwords, OTPs), driving passive methods (behavioral biometrics, device telemetry).

- Growth in digital banking & online transactions — The expansion of mobile banking, e-commerce, and fintech increases the need for continuous, seamless identity verification.

- Regulatory push & compliance mandates — Regulations around strong customer authentication (e.g. PSD2 in Europe) and data protection standards push financial institutions toward more advanced authentication solutions.

- Advances in AI & ML enabling accuracy — The maturation of AI/ML algorithms for behavioral profiling, anomaly detection, and adaptive risk scoring enhances the effectiveness of passive systems.

Restraints

- Privacy & data protection concerns — Collection and processing of behavioral and biometric data raise privacy risks; users and regulators may resist pervasive tracking and profiling.

- Regulatory & compliance complexity — Laws like GDPR, CCPA, or region-specific biometric regulations complicate data handling, storage, user consent, and cross-border deployments.

- Integration challenges with legacy systems — Enterprises often have outdated infrastructure, making it difficult to seamlessly integrate passive authentication into existing architecture.

- False positives / false negatives & reliability — Behavioral models can misclassify user deviations (due to device change, behavior drift) leading to friction or rejection.

- Limited awareness and technical expertise — Some enterprises lack in-house skills or understanding of passive methods, slowing adoption especially in emerging markets.

Growth Opportunities

- Expansion into non-banking verticals — Sectors such as healthcare, education, logistics, and government (beyond just BFSI) are yet under-penetrated and present new adoption avenues.

- Hybrid / multi-modal authentication systems — Combining behavioral, device, voice, face, and contextual signals enhances security, offering vendors differentiation.

- SME / small business market growth — Simplified, SaaS or subscription-based passive authentication offerings tailored for SMEs can tap a broad, underserved market.

- Geographic expansion (emerging markets) — Regions such as Asia Pacific, Latin America, and Africa show increasing digital adoption and rising fraud, creating demand for such security solutions.

- Embedding in mobile & IoT ecosystems — As devices proliferate (wearables, smart home, automotive), passive authentication can be integrated natively to secure device-user linkages. (Inferred from trend drivers)

Challenging Factors

- User trust & perception issues — Users may resist systems that “monitor” behavior continuously, fearing misuse or surveillance, unless transparency and opt-in consent are strong.

- Model robustness across contexts — Behavioral patterns vary by device, environment, time, geography; models must adapt to drift and edge cases without degrading experience.

- Adversarial attacks & spoofing — Sophisticated attackers may attempt to mimic behavior, inject adversarial signals, or exploit model weaknesses to bypass passive checks.

- Latency, performance & resource constraints — Real-time inference across many users/devices demands efficient, low-latency models; constraints in edge devices may limit feasibility.

- Cost vs ROI justifications for smaller players — For smaller businesses or low transaction volumes, the cost of implementation, tuning, and maintenance must be justified by risk reduction benefits.

Competitive Analysis

In today’s passive authentication market, established tech and security firms are fiercely competing with agile specialists in behavioral biometrics and identity orchestration. For example, IBM, Cisco, Thales (Gemalto), and NEC leverage their legacies in enterprise security, biometrics, and identity management to integrate passive authentication modules into broad security suites. These incumbents benefit from strong brand recognition, large sales channels, and deep customer relationships in regulated industries like finance and government.

Meanwhile, niche players such as BioCatch, BehavioSec, TypingDNA, Zighra, ID R&D, Incognia, and Pindrop differentiate themselves through specialized algorithms, behavioral modeling, and lightweight deployment. These firms often emphasize low-latency performance, high accuracy, explainability, and modular integration—traits that make them attractive to fintechs, mobile-first companies, and cloud-native platforms. Larger data and credit/risk analytics firms like Experian, LexisNexis Risk Solutions, and Kount (Equifax) also enter the passive authentication space by embedding behavioral signals into existing fraud scoring, leveraging proprietary datasets and domain expertise in risk.

In sum, the competitive landscape is a mix of heavyweight legacy players embedding passive solutions into full-stack products, alongside agile specialists pushing innovation in behavioral modeling, low-friction deployment, and vertical-specific customization.

Top Key Players in the Market

- IBM Corporation

- Cisco Systems Inc.

- Thales Group (Gemalto)

- NEC Corporation

- OneSpan Inc.

- Verint Systems Inc.

- Aware Inc.

- Pindrop Security Inc.

- Transmit Security

- Nuance Communications Inc.

- BioCatch Ltd.

- ID RandD Inc.

- Fortress Identity

- BehavioSec AB

- Experian plc

- LexisNexis Risk Solutions

- TypingDNA Inc.

- Zighra Inc.

- Incognia

- Signicat AS

- Kount (Equifax)

- Others

Major Developments

- October 2025:

BioCatch Partners with Nasdaq Verafin to Strengthen Global Fraud Prevention Network

BioCatch announced a strategic partnership with Nasdaq Verafin to enhance global fraud detection and prevention using behavioral biometrics.- September 2025:

Macquarie Bank Joins BioCatch Trust™ Network to Combat Digital Fraud

Macquarie Bank became the latest member of the BioCatch Trust™ interbank network, a consortium focused on sharing behavioral and device intelligence to detect financial crime.- August 2025:

Frost & Sullivan Recognizes BioCatch for Leadership in Fraud Detection and Prevention

Frost & Sullivan honored BioCatch with the 2025 Global Competitive Strategy Leadership Award for its excellence in passive authentication and fraud prevention technologies. The recognition acknowledges BioCatch’s innovation in continuous behavioral biometrics and its role in advancing digital security frameworks worldwide.Report Scope

Report Features Description Market Value (2024) USD 1.98 Billion Forecast Revenue (2034) USD 15.82 Billion CAGR(2025-2034) 23.10% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Offering (Solution, Services [Professional Services, Managed Services]), By Business Function (Compliance Management, Marketing Management, Risk Management, Others), By Deployment (On-premises, Cloud), By Organization Size (Small & Medium Enterprises (SMEs), Large Enterprises), By Industry Vertical (BFSI, Government, IT & Telecommunications, Retail and consumer goods, Healthcare, Media and Entertainment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Cisco Systems Inc., Thales Group (Gemalto), NEC Corporation, OneSpan Inc., Verint Systems Inc., Aware Inc., Pindrop Security Inc., Transmit Security, Nuance Communications Inc., BioCatch Ltd., ID RandD Inc., Fortress Identity, BehavioSec AB, Experian plc, LexisNexis Risk Solutions, TypingDNA Inc., Zighra Inc., Incognia, Signicat AS, Kount (Equifax), Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Passive Authentication MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Passive Authentication MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Cisco Systems Inc.

- Thales Group (Gemalto)

- NEC Corporation

- OneSpan Inc.

- Verint Systems Inc.

- Aware Inc.

- Pindrop Security Inc.

- Transmit Security

- Nuance Communications Inc.

- BioCatch Ltd.

- ID RandD Inc.

- Fortress Identity

- BehavioSec AB

- Experian plc

- LexisNexis Risk Solutions

- TypingDNA Inc.

- Zighra Inc.

- Incognia

- Signicat AS

- Kount (Equifax)

- Others