Global Passenger Vehicle Autonomous Driving Market Size, Share, Growth Analysis By Level (Level 1, Level 2, Level 3, Level 4 & 5), By Application (Transportation, Defense), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 174625

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

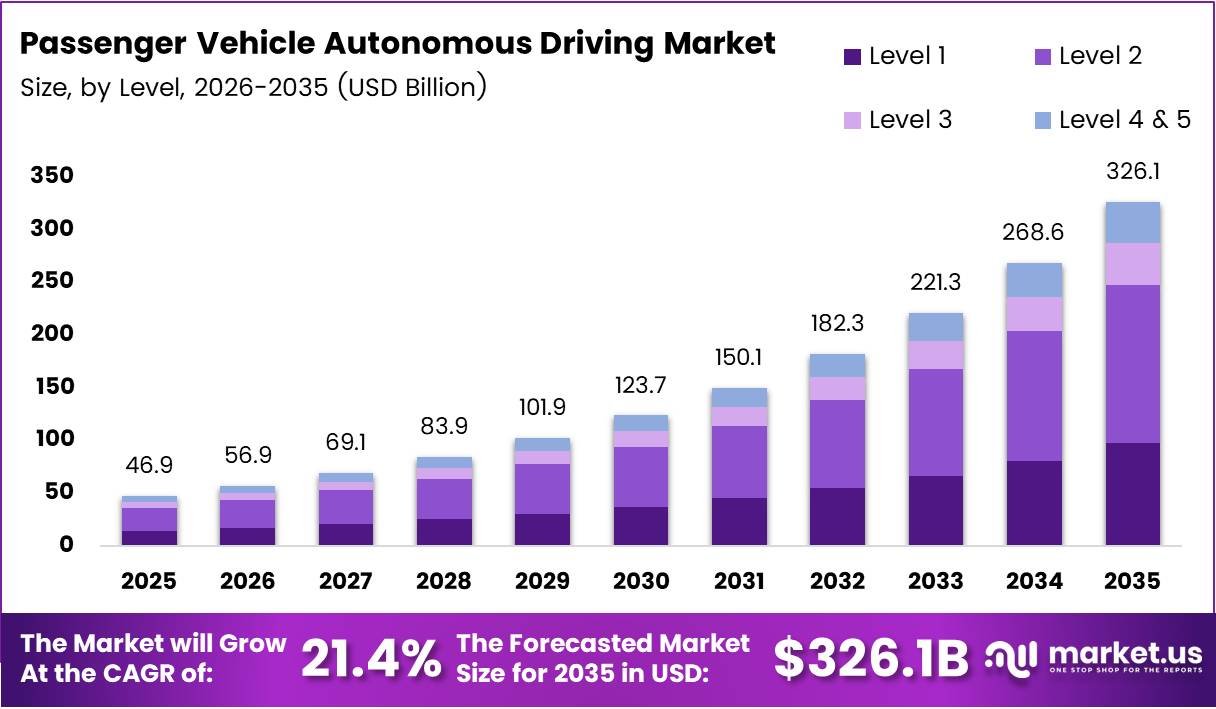

The global Passenger Vehicle Autonomous Driving Market size is expected to be worth around USD 326.1 Billion by 2035 from USD 46.9 Billion in 2025, growing at a CAGR of 21.4% during the forecast period 2026 to 2035.

Autonomous driving technology represents a transformative shift in passenger vehicle innovation, integrating artificial intelligence, sensor fusion, and advanced driver assistance systems. Moreover, this convergence enables vehicles to navigate, perceive environments, and make real-time decisions with minimal human intervention. The market encompasses various automation levels, from partial assistance to full autonomy.

Consumer expectations around road safety continue driving market momentum significantly. Additionally, growing urbanization and traffic congestion create demand for intelligent mobility solutions that reduce accidents and improve transportation efficiency. Consequently, automakers are prioritizing autonomous features as core differentiators in competitive passenger vehicle segments.

Government initiatives supporting smart infrastructure development accelerate autonomous vehicle deployment across regions. However, regulatory frameworks remain complex and vary substantially between markets. Therefore, manufacturers must navigate evolving compliance requirements while advancing technological capabilities and ensuring cybersecurity standards for connected vehicle ecosystems.

Investment in research and development has intensified as technology companies partner with traditional automakers. Furthermore, the integration of 5G connectivity and vehicle-to-everything communication systems enhances real-time data processing capabilities. These advancements enable more sophisticated autonomous driving functions across diverse driving conditions and environments.

According to the NHTSA-backed PARTS study from January 2025, automatic emergency braking systems have led to a 49% reduction in front-to-rear crashes across model years 2015–2023. Moreover, systems with pedestrian detection showed a 9% reduction in single-vehicle frontal crashes with non-motorists. Waymo reports its fleet has surpassed 25 million miles on public roadways, consistently outperforming human drivers across major safety metrics.

Consumer confidence remains a critical factor influencing adoption rates for autonomous vehicles. According to J.D. Power’s 2024 Study, 83% of consumers want more safety statistics before riding in autonomous vehicles, while 86% demand manual control capability. Additionally, China’s Ministry of Industry and Information Technology approved two passenger vehicle models with Level 3 autonomous driving capabilities in December 2024, marking a significant regulatory milestone.

Key Takeaways

- Global Passenger Vehicle Autonomous Driving Market projected to reach USD 326.1 Billion by 2035 from USD 46.9 Billion in 2025

- Market expected to grow at a CAGR of 21.4% during forecast period 2026-2035

- Level 2 automation dominates with 46.2% market share in 2025

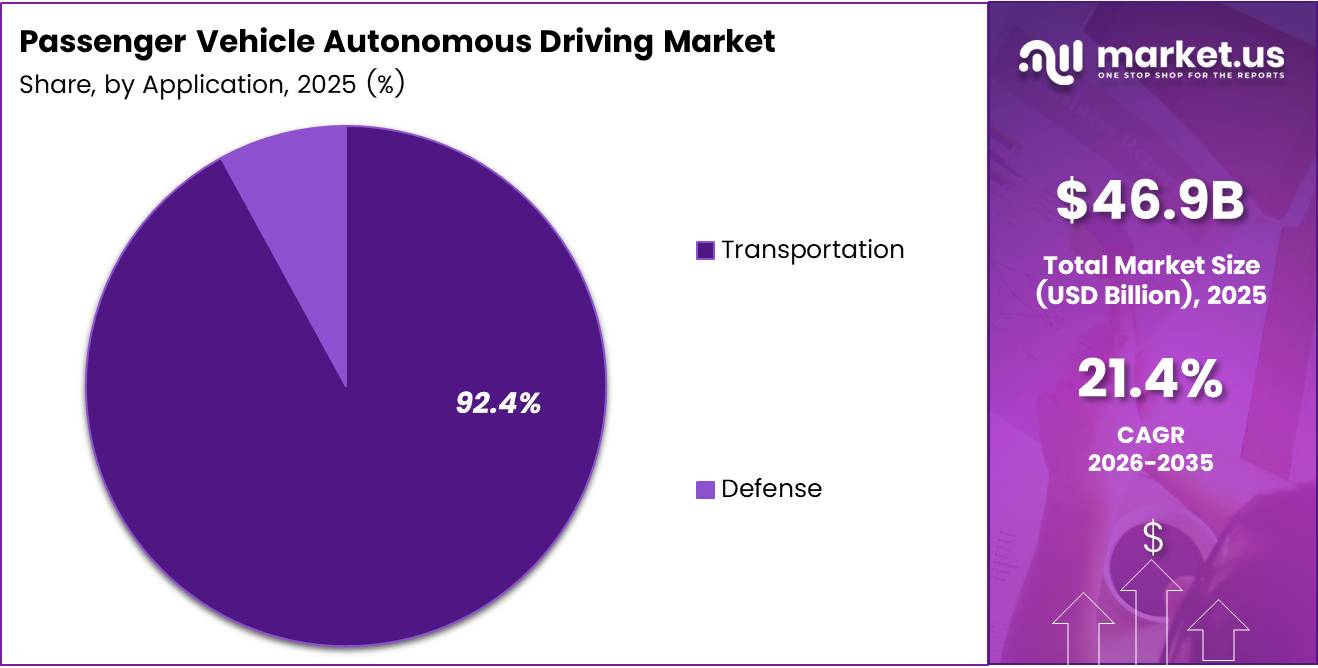

- Transportation application segment holds 92.4% market share

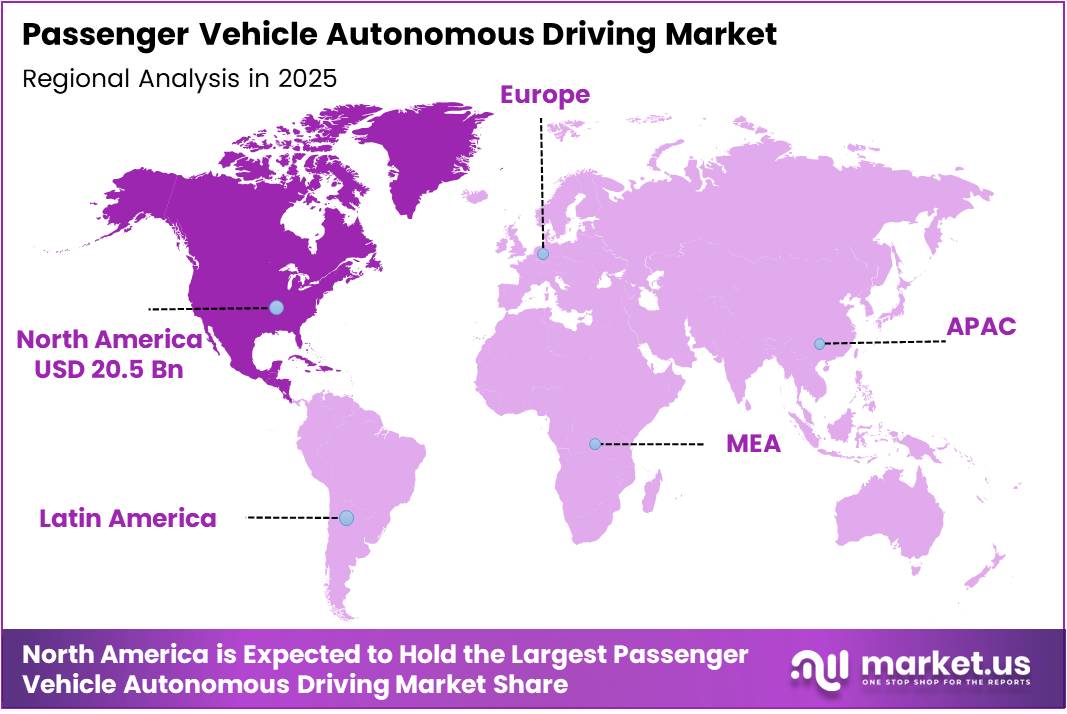

- North America leads regional market with 43.80% share, valued at USD 20.5 Billion

- Automatic emergency braking systems reduced front-to-rear crashes by 49% according to NHTSA study

- 83% of consumers demand more safety data before autonomous vehicle adoption

Level Analysis

Level 2 dominates with 46.2% due to widespread commercial availability and regulatory acceptance.

In 2025, Level 2 held a dominant market position in the By Level Analysis segment of Passenger Vehicle Autonomous Driving Market, with a 46.2% share. This automation level combines adaptive cruise control with lane-keeping assistance, requiring driver supervision but offering significant convenience benefits. Moreover, Level 2 systems have achieved mass-market penetration across multiple vehicle segments. Consequently, automakers prioritize these features as standard or optional equipment in mainstream passenger vehicles.

Level 1 represents the foundational automation tier, providing single-function driver assistance such as adaptive cruise control or lane centering independently. Additionally, this entry-level technology offers cost-effective safety enhancements for budget-conscious consumers. However, limited functionality compared to higher automation levels restricts growth potential. Therefore, manufacturers increasingly bundle Level 1 features within more comprehensive assistance packages.

Level 3 enables conditional automation where vehicles handle driving tasks under specific conditions while drivers remain available for intervention. Furthermore, regulatory approvals for Level 3 systems are expanding gradually across select markets. China’s recent approval of two Level 3 passenger vehicles demonstrates growing acceptance. Consequently, premium automakers are investing heavily in Level 3 commercialization strategies.

Level 4 and Level 5 represent high and full automation respectively, eliminating driver intervention requirements within defined operational domains or all conditions. Moreover, these advanced systems remain primarily in testing and limited deployment phases currently. Companies like Waymo operate Level 4 robotaxi services in controlled environments. However, technological complexity and regulatory barriers continue limiting widespread commercial availability.

Application Analysis

Transportation dominates with 92.4% due to consumer passenger vehicle focus and urban mobility demands.

In 2025, Transportation held a dominant market position in the By Application Analysis segment of Passenger Vehicle Autonomous Driving Market, with a 92.4% share. Personal mobility and commercial ride-hailing services drive this segment’s overwhelming dominance as autonomous technology targets mainstream passenger transportation. Additionally, urbanization trends and traffic congestion amplify demand for intelligent mobility solutions. Consequently, automakers and technology companies prioritize transportation applications in development roadmaps.

Defense applications represent a specialized niche focusing on military vehicle automation for tactical operations and logistics support. Furthermore, defense sectors require enhanced security protocols and ruggedized systems for challenging operational environments. However, limited procurement volumes and specialized requirements constrain market share significantly. Therefore, defense applications remain a minor contributor compared to civilian transportation dominance.

Key Market Segments

By Level

- Level 1

- Level 2

- Level 3

- Level 4 & 5

By Application

- Transportation

- Defense

Drivers

Rapid Advancements in AI and Machine Learning Enhance Real-Time Decision-Making Capabilities

Artificial intelligence and machine learning technologies have revolutionized autonomous vehicle perception and decision-making systems significantly. Moreover, deep learning algorithms enable vehicles to interpret complex traffic scenarios, recognize objects, and predict pedestrian behavior accurately. Consequently, automakers integrate sophisticated neural networks that continuously improve through data collection and model refinement processes.

Real-time processing capabilities allow autonomous systems to analyze sensor data from multiple sources simultaneously and instantaneously. Additionally, edge computing architectures reduce latency in critical safety functions, ensuring rapid response to dynamic road conditions. Therefore, AI-driven autonomous vehicles demonstrate improving reliability and safety performance across diverse operational environments and challenging weather conditions.

Investment in AI research continues accelerating as technology companies and automakers compete for autonomous driving leadership. Furthermore, simulation platforms enable extensive virtual testing before real-world deployment, reducing development costs and accelerating time-to-market. Consequently, rapid AI advancements remain the fundamental driver enabling higher automation levels in passenger vehicles.

Restraints

High Development and Integration Costs Limit Autonomous Technology Accessibility

Developing autonomous driving systems requires substantial capital investment in sensors, computing hardware, software development, and extensive testing programs. Moreover, LiDAR systems, high-performance computing units, and redundant safety architectures significantly increase vehicle production costs. Consequently, autonomous features remain concentrated in premium vehicle segments, limiting mass-market adoption rates.

Integration challenges arise when retrofitting autonomous capabilities into existing vehicle platforms not originally designed for such systems. Additionally, automakers must balance cost considerations against consumer willingness to pay premium prices for autonomous features. Therefore, achieving cost parity with conventional vehicles remains a critical challenge for widespread market penetration and adoption.

Complex regulatory frameworks and uncertain legal liability standards create additional barriers for autonomous vehicle commercialization. Furthermore, inconsistent regulations across different markets require manufacturers to develop region-specific solutions, multiplying compliance costs. Consequently, regulatory uncertainty delays deployment timelines and constrains investment decisions across the autonomous driving industry.

Growth Factors

Expansion of Autonomous Ride-Hailing Platforms Creates New Revenue Opportunities

Mobility-as-a-Service platforms leveraging autonomous vehicles are transforming urban transportation models and creating new business opportunities. Moreover, robotaxi services eliminate driver costs, potentially reducing ride-hailing prices while improving service availability significantly. Consequently, companies like Waymo are expanding autonomous ride-hailing operations in multiple cities, demonstrating commercial viability.

Integration of 5G connectivity enables vehicle-to-everything communication, enhancing autonomous vehicle situational awareness and coordination capabilities. Additionally, low-latency 5G networks support real-time data exchange between vehicles, infrastructure, and cloud-based computing resources. Therefore, V2X communication represents a critical enabler for advanced autonomous driving functions and cooperative traffic management systems.

Strategic partnerships between traditional automakers and technology companies accelerate autonomous vehicle development through complementary expertise and resource sharing. Furthermore, collaborative approaches reduce individual development costs while accelerating innovation cycles in software, hardware, and systems integration. Consequently, industry consolidation and partnership activity continue intensifying across the autonomous driving ecosystem.

Emerging Trends

Over-the-Air Software Updates Enable Continuous Feature Enhancement and Capability Expansion

Over-the-air update capabilities allow manufacturers to remotely enhance autonomous driving features, fix bugs, and improve system performance after vehicle delivery. Moreover, this approach extends vehicle functional lifespan and enables incremental feature rollouts based on regulatory approvals and validation testing. Consequently, automakers are adopting software-defined vehicle architectures that support continuous improvement throughout ownership lifecycles.

Sensor fusion technology combining LiDAR, radar, and camera systems provides redundant perception capabilities that enhance reliability under diverse conditions. Additionally, multi-sensor approaches compensate for individual sensor limitations, ensuring robust performance during adverse weather or challenging lighting scenarios. Therefore, integrated sensor suites have become standard in advanced autonomous driving system architectures.

Autonomous parking and highway pilot systems represent near-term commercialization opportunities that address specific use cases with defined operational boundaries. Furthermore, these applications provide tangible consumer benefits while operating within manageable risk parameters and regulatory frameworks. Consequently, automakers prioritize development of these transitional autonomous features as stepping stones toward full autonomy.

Regional Analysis

North America Dominates the Passenger Vehicle Autonomous Driving Market with a Market Share of 43.80%, Valued at USD 20.5 Billion

North America leads the global autonomous driving market with a 43.80% share, valued at USD 20.5 Billion in 2025. The region benefits from strong technology infrastructure, substantial venture capital investment, and supportive regulatory frameworks in select jurisdictions. Moreover, major autonomous vehicle developers including Waymo, Tesla, and traditional automakers maintain significant research and testing operations across North American markets. Consequently, the region continues driving global innovation in autonomous passenger vehicle technologies.

Europe Passenger Vehicle Autonomous Driving Market Trends

Europe demonstrates strong autonomous vehicle development activity, supported by stringent safety regulations and ambitious emissions reduction targets. Moreover, German automakers lead European autonomous technology development, integrating advanced driver assistance systems across premium vehicle segments. Additionally, the European Union actively develops harmonized regulatory frameworks to facilitate cross-border autonomous vehicle deployment. Therefore, Europe represents a significant growth market for autonomous passenger vehicle technologies.

Asia Pacific Passenger Vehicle Autonomous Driving Market Trends

Asia Pacific exhibits rapid autonomous vehicle adoption, particularly in China where government support and infrastructure investment accelerate deployment timelines. Moreover, Chinese automakers and technology companies aggressively pursue autonomous driving capabilities to compete in domestic and international markets. Japan and South Korea contribute advanced sensor technologies and component manufacturing expertise. Consequently, Asia Pacific is emerging as a critical region for autonomous vehicle innovation and commercialization.

Latin America Passenger Vehicle Autonomous Driving Market Trends

Latin America represents an emerging market for autonomous vehicle technologies, though adoption remains limited by infrastructure constraints and economic factors. Moreover, urbanization and traffic congestion in major cities create potential demand for intelligent mobility solutions. However, regulatory frameworks and consumer awareness require further development. Therefore, Latin America presents long-term growth opportunities as technologies mature and become more cost-accessible.

Middle East & Africa Passenger Vehicle Autonomous Driving Market Trends

Middle East and Africa demonstrate growing interest in autonomous vehicle technologies, particularly within Gulf Cooperation Council countries investing in smart city initiatives. Moreover, these regions benefit from modern infrastructure development and government support for innovation. However, market penetration remains limited by high technology costs and varying regulatory maturity. Consequently, adoption is concentrated in specific urban centers with advanced transportation infrastructure.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Passenger Vehicle Autonomous Driving Company Insights

Waymo LLC continues leading the autonomous ride-hailing sector with its extensive real-world testing program and commercial robotaxi operations. The company’s fleet has accumulated over 25 million miles on public roads, consistently demonstrating superior safety performance compared to human drivers. Moreover, Waymo secured a $5.6 billion Series C funding round in October 2024, enabling expansion into Austin and Atlanta markets. Consequently, Waymo maintains its position as the most advanced autonomous driving technology provider.

Tesla pursues a distinct vision-based autonomous driving approach, leveraging extensive fleet data collection from millions of customer vehicles worldwide. The company’s Full Self-Driving software receives continuous improvements through over-the-air updates, incrementally enhancing capabilities. Moreover, Tesla’s vertically integrated manufacturing model enables rapid iteration and cost optimization. However, regulatory scrutiny regarding marketing claims and safety validation continues challenging the company’s autonomous driving timeline.

Mercedes-Benz Group achieved significant regulatory milestones with Level 3 autonomous driving certification in multiple markets, including Germany and select U.S. states. The company’s Drive Pilot system enables conditional automation on approved highway sections under specific conditions. Moreover, Mercedes-Benz focuses on premium segment deployment, where consumers demonstrate higher willingness to adopt advanced technologies. Consequently, the automaker positions itself as a luxury autonomous driving pioneer.

Ford Motor Company restructured its autonomous vehicle strategy, pivoting from robotaxi development toward integrating advanced driver assistance systems across mainstream vehicle portfolios. The company invests heavily in BlueCruise hands-free highway driving technology for consumer vehicles. Moreover, Ford emphasizes commercial applications including autonomous delivery and fleet services. Therefore, the automaker pursues a pragmatic approach balancing near-term commercialization with long-term autonomy goals.

Key Companies

- AUDI AG.

- Ford Motor Company

- Mercedes-Benz Group

- Nuro, Inc.

- Pony.ai

- Tesla

- Toyota Kirloskar Motor

- Volkswagen Group

- Waymo LLC

- Zoox, Inc.

Recent Developments

- In June 2025, U.S. Mobility Tech OEM indiGO Tech acquired unmanned delivery innovator Clevon to accelerate its electric vehicle, autonomous vehicle, and transport service offerings. This strategic acquisition enhances indiGO Tech’s capabilities in last-mile autonomous delivery solutions.

- In October 2024, Waymo successfully closed a $5.6 billion Series C funding round led by Alphabet, intended for expansion of its robotaxi service in Austin and Atlanta. This substantial investment demonstrates continued confidence in autonomous ride-hailing commercialization potential.

- In December 2025, HARMAN announced plans to acquire ZF’s ADAS business, strengthening its portfolio of advanced driver assistance systems and autonomous driving technologies. This acquisition positions HARMAN as a more comprehensive supplier of autonomous vehicle solutions.

- In November 2025, self-driving trucks startup Einride announced plans to go public via a SPAC transaction. This development reflects growing investor interest in autonomous commercial vehicle applications and alternative public listing strategies.

Report Scope

Report Features Description Market Value (2025) USD 46.9 Billion Forecast Revenue (2035) USD 326.1 Billion CAGR (2026-2035) 21.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Level (Level 1, Level 2, Level 3, Level 4 & 5), By Application (Transportation, Defense) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape AUDI AG., Ford Motor Company, Mercedes-Benz Group, Nuro, Inc., Pony.ai, Tesla, Toyota Kirloskar Motor, Volkswagen Group, Waymo LLC, Zoox, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Passenger Vehicle Autonomous Driving MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Passenger Vehicle Autonomous Driving MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- AUDI AG.

- Ford Motor Company

- Mercedes-Benz Group

- Nuro, Inc.

- Pony.ai

- Tesla

- Toyota Kirloskar Motor

- Volkswagen Group

- Waymo LLC

- Zoox, Inc.