Global Para Nitrochlorobenzene Market Size, Share, And Business Benefits By Purity Grade (Standard Grade, Higher Purity Grade, Ultra Pure Grade), By Form (Liquid, Solid), By Application (Dyes, Pesticides, Rubber Chemicals, Others), By End-use (Agriculture, Pharmaceuticals, Chemicals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152199

- Number of Pages: 347

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

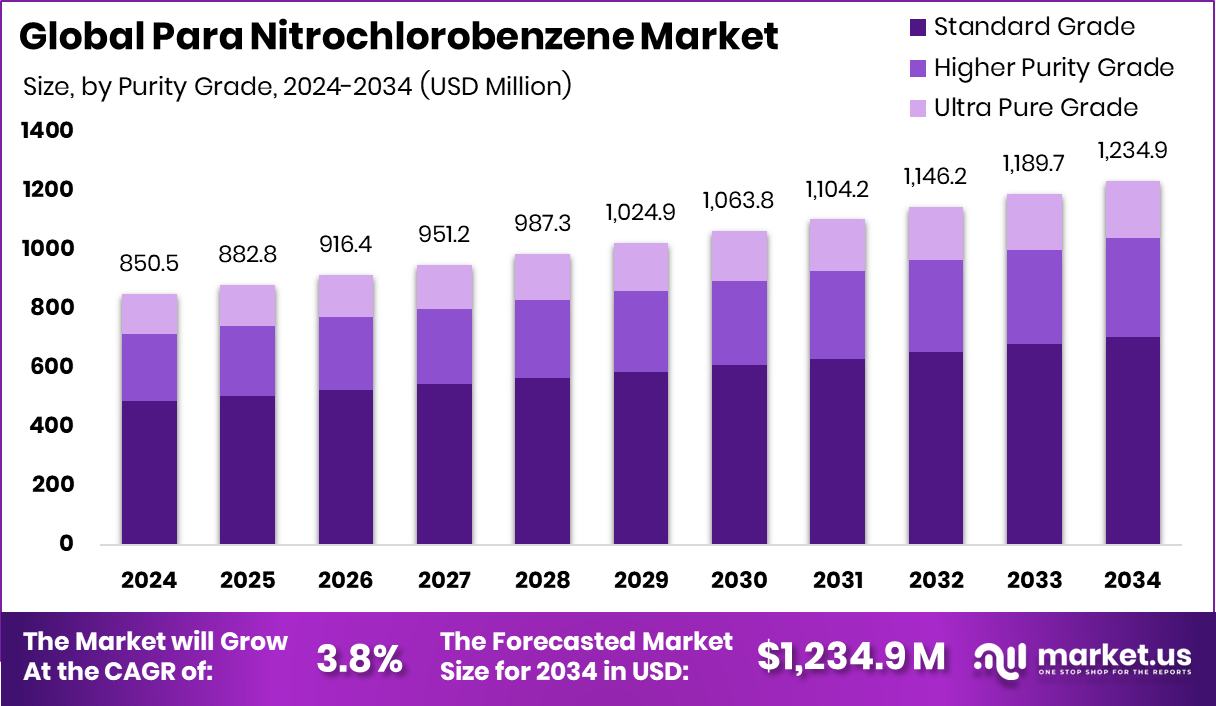

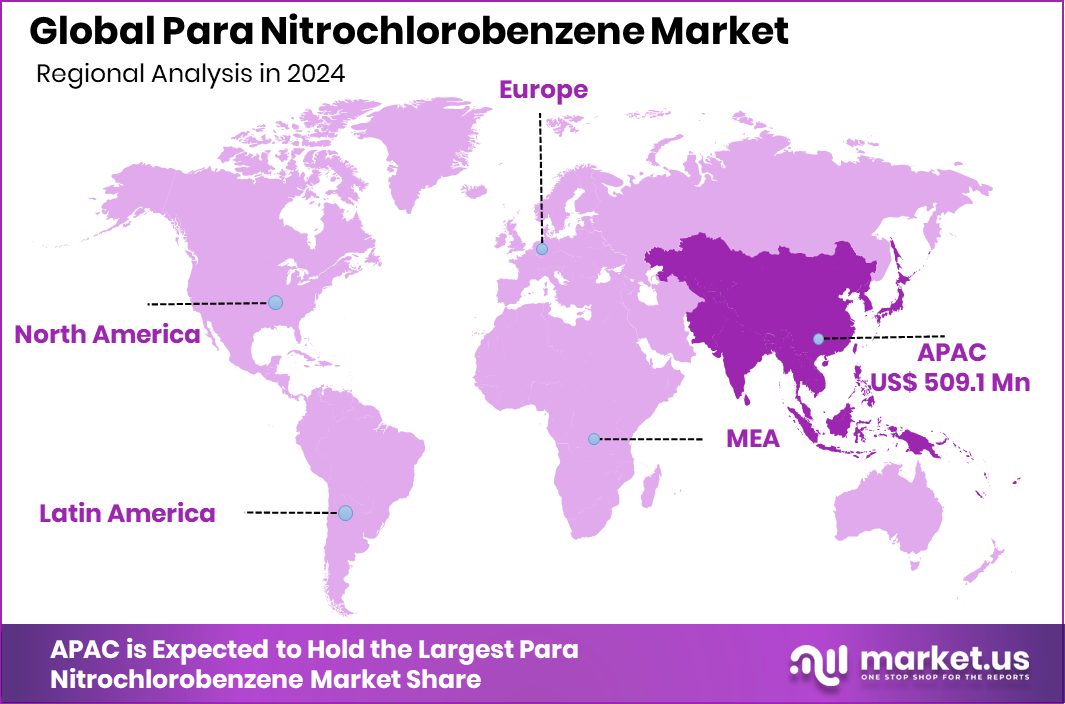

Global Para Nitrochlorobenzene Market is expected to be worth around USD 1,234.9 Million by 2034, up from USD 850.5 Million in 2024, and grow at a CAGR of 3.8% from 2025 to 2034. Strong chemical manufacturing and agrochemical demand supported Asia-Pacific’s USD 509.1 million market value.

Para-Nitrochlorobenzene (PNCB) is an organic compound with the chemical formula C₆H₄ClNO₂. It appears as a pale yellow crystalline solid and is primarily used as an intermediate in the synthesis of dyes, pigments, pharmaceuticals, and agrochemicals. The molecule features both nitro and chloro groups positioned opposite each other on a benzene ring, making it highly reactive for further chemical transformations.

The Para-Nitrochlorobenzene market refers to the global trade and production activities surrounding the use of this compound in downstream industries. The market’s growth is largely driven by its application in chemical manufacturing processes that feed into the pharmaceuticals, dyes, and agrochemical sectors. According to an industry report, BiocSol has successfully raised €5.2 million in seed funding to advance its work on microbial-based pesticides.

The growth of the Para-Nitrochlorobenzene market is closely linked to the increasing demand for chemical intermediates in the dye and agrochemical industries. As the need for synthetic dyes in textiles and rubber accelerates, so does the demand for PNCB, which is a precursor in their production. According to an industry report, Researchers at Florida State University have been awarded nearly $1.5 million in EPA grants to investigate the impact of precipitation, pesticide use, and pollution on South Florida’s water systems.

The demand for Para-Nitrochlorobenzene is being fueled by its broad applications in sectors that are witnessing global expansion, such as pharmaceuticals, where it serves as a raw material for synthesizing drug intermediates. Furthermore, the textile industry continues to be a major consumer of dyes, indirectly driving PNCB use. According to an industry report, Agrim, based in India, has secured $17.3 million in funding to simplify access to agricultural inputs such as seeds and pesticides for farmers.

Key Takeaways

- Global Para Nitrochlorobenzene Market is expected to be worth around USD 1,234.9 Million by 2034, up from USD 850.5 Million in 2024, and grow at a CAGR of 3.8% from 2025 to 2034.

- In the Para-Nitrochlorobenzene market, standard grade accounts for 57.2% due to industrial preference.

- Liquid form dominates with a 68.3% share, offering better handling and processing in chemical manufacturing.

- Dyes lead application use at 48.8%, driven by consistent demand from the textile and rubber industries.

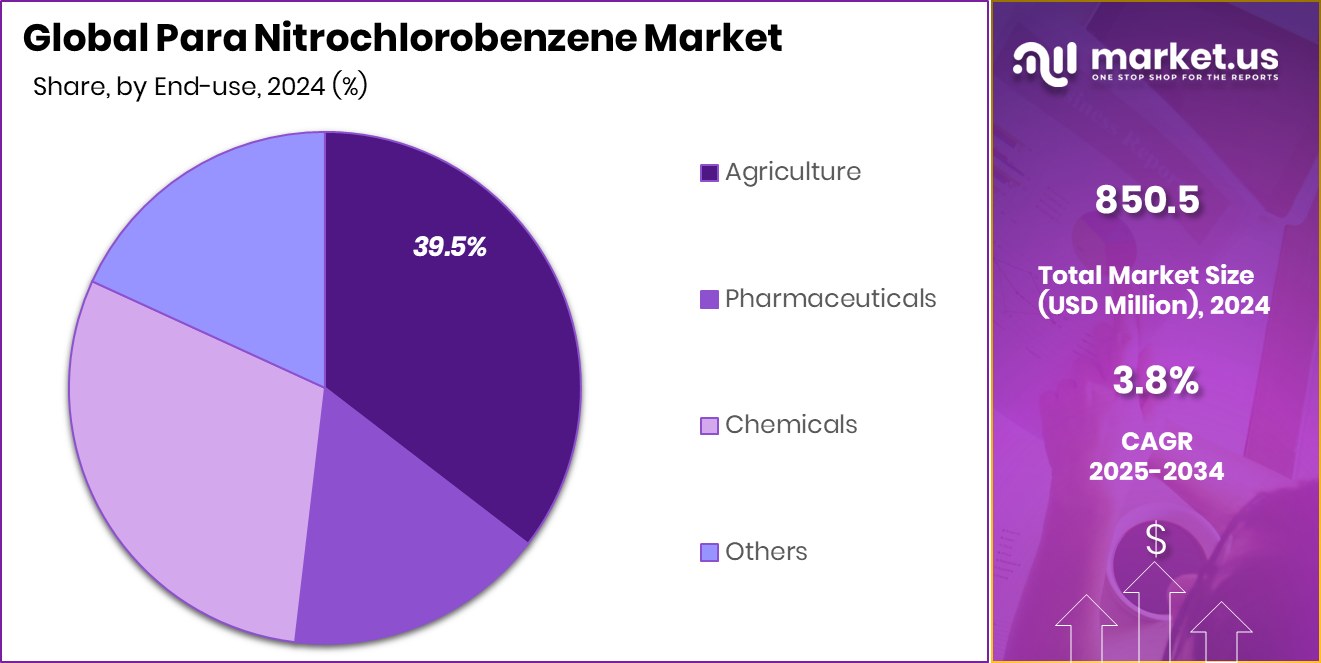

- Agriculture holds a 39.5% end-use share, supported by PNCB’s role in pesticide and herbicide production.

- The Asia-Pacific market value reached approximately USD 509.1 million during the same year.

By Purity Grade Analysis

Standard grade accounts for 57.2% of the Para Nitrochlorobenzene market.

In 2024, Standard Grade held a dominant market position in the By Purity Grade segment of the Para-Nitrochlorobenzene Market, with a 57.2% share. This leading position can be attributed to its widespread application across key industrial sectors, particularly in dye intermediates, rubber chemicals, and agrochemical formulations. The Standard Grade offers the necessary chemical purity required for consistent performance in large-scale production processes, making it the preferred choice for manufacturers seeking cost-effective yet reliable input materials.

The dominance of this grade is further supported by its high adaptability in downstream chemical synthesis, where exacting purity standards are less critical than efficiency and volume. Industries in developing economies have increasingly leaned on Standard Grade Para-Nitrochlorobenzene due to its availability and compatibility with existing processing systems. This has ensured stable demand from bulk chemical producers, contributing to its leading market share.

Moreover, favorable industrial expansion and steady growth in chemical processing hubs have reinforced the market position of Standard Grade. The rising consumption of synthetic dyes and agrochemicals in emerging regions has also played a vital role in sustaining its demand. As industrial applications continue to evolve, Standard Grade is expected to maintain its strong foothold due to its economic viability and process efficiency across multiple use cases.

By Form Analysis

Liquid form dominates with a 68.3% share in the global market.

In 2024, Liquid held a dominant market position in the By Form segment of the Para-Nitrochlorobenzene Market, with a 68.3% share. This substantial market share highlights the preference for the liquid form due to its ease of handling, efficient reactivity, and compatibility with continuous processing systems used in industrial chemical synthesis. The liquid form of Para-Nitrochlorobenzene enables better mixing, faster reaction rates, and reduced operational complexities, making it highly suitable for high-volume manufacturing environments.

Industries involved in the production of dyes, agrochemicals, and rubber processing chemicals have consistently favored liquid PNCB for its uniformity and adaptability in automated processing lines. The handling efficiency of the liquid form also contributes to lower material losses during transfer and storage, offering economic and operational advantages to manufacturers. Its dominance in 2024 reflects the industrial trend toward flexible and scalable formulations that can support large-scale production with minimal interruption.

Furthermore, the infrastructure supporting liquid chemical logistics—such as bulk storage tanks, piping systems, and fluid transfer equipment—has become increasingly standardized, especially in regions focused on chemical exports and industrial production. These factors collectively reinforced the leading position of liquid Para-Nitrochlorobenzene in the market, establishing it as the form of choice for most large-scale industrial applications.

By Application Analysis

Dye application leads with 48.8% demand across industries.

In 2024, Dyes held a dominant market position in the By Application segment of the Para-Nitrochlorobenzene Market, with a 48.8% share. This strong market presence reflects the extensive use of Para-Nitrochlorobenzene as a key intermediate in the synthesis of dye compounds, particularly in the production of azo and sulfur dyes. Its chemical structure, which includes both nitro and chloro functional groups, enables efficient downstream reactions that are essential in forming vibrant and durable colorants used in textiles, leather, and paper industries.

The dominance of the Dyes segment is driven by consistent global demand for synthetic dyes, especially from regions with strong textile manufacturing bases. Para-Nitrochlorobenzene plays a vital role in enhancing dye quality, improving color fastness, and supporting large-scale production efficiency. These properties have ensured its sustained preference in dye manufacturing facilities.

Moreover, the expansion of textile exports and rising consumption of colored fabrics in both fashion and industrial applications have further elevated the requirement for reliable dye intermediates. This continuous demand, paired with the compound’s effectiveness in dye formulation, solidifies the Dyes segment’s leading position in the market. As the global textile sector continues to evolve, Para-Nitrochlorobenzene remains integral to meeting the industry’s performance and quality standards.

By End-use Analysis

The agriculture sector holds a 39.5% share in end-use consumption.

In 2024, Agriculture held a dominant market position in the By End-use segment of the Para-Nitrochlorobenzene Market, with a 39.5% share. This leadership is attributed to the compound’s crucial role as an intermediate in the production of agrochemicals such as herbicides, pesticides, and plant growth regulators. Para-Nitrochlorobenzene is widely utilized in synthesizing active ingredients that are essential for crop protection and yield enhancement, making it a foundational input in modern agricultural practices.

The segment’s dominance is also supported by the growing emphasis on maximizing agricultural productivity to meet the rising global food demand. With increasing cultivation across developing economies and expanding commercial farming operations, the demand for efficient agrochemical formulations continues to rise. This has directly influenced the uptake of Para-Nitrochlorobenzene in agriculture-related chemical manufacturing.

Its chemical structure allows for precise modifications during synthesis, resulting in tailored agrochemical products that meet specific pest and crop requirements. The reliability and effectiveness of these formulations have reinforced the preference for Para-Nitrochlorobenzene within the agriculture sector. The 39.5% market share in 2024 reflects its indispensable role in supporting agrochemical innovation and large-scale agricultural sustainability, positioning it as a key enabler of modern farming efficiency.

Key Market Segments

By Purity Grade

- Standard Grade

- Higher Purity Grade

- Ultra Pure Grade

By Form

- Liquid

- Solid

By Application

- Dyes

- Pesticides

- Rubber Chemicals

- Others

By End-use

- Agriculture

- Pharmaceuticals

- Chemicals

- Others

Driving Factors

Rising Demand from the Agrochemical Sector Drives Growth

One of the main driving factors behind the growth of the Para-Nitrochlorobenzene market is the rising demand from the agrochemical industry. Para-Nitrochlorobenzene is widely used as an intermediate in the production of pesticides, herbicides, and other crop protection chemicals. As global agriculture expands to meet the growing food needs of a rising population, the need for effective agrochemicals has increased steadily.

Farmers are focusing on boosting crop yield and protecting crops from pests, which leads to higher consumption of these chemicals. Para-Nitrochlorobenzene plays a critical role in this supply chain. Its versatility and compatibility with a wide range of agrochemical formulations make it a preferred choice among manufacturers, thus significantly driving the overall market demand and expansion.

Restraining Factors

Health and Environmental Risks Limit Market Expansion

A key restraining factor in the Para-Nitrochlorobenzene market is the health and environmental risks linked to its production and usage. Para-Nitrochlorobenzene is classified as a hazardous chemical, and prolonged exposure can pose serious health risks such as skin irritation, respiratory issues, and toxic effects on internal organs. Additionally, improper disposal or accidental release into the environment can lead to soil and water contamination, affecting ecosystems.

These concerns have led to stricter government regulations regarding its handling, transport, and storage. Compliance with these safety norms increases operational costs for manufacturers and can slow down production. As environmental awareness rises and regulations become tighter, these safety-related challenges are expected to continue limiting the growth of the market.

Growth Opportunity

Expanding Chemical Manufacturing in Emerging Markets Globally

A major growth opportunity for the Para-Nitrochlorobenzene market lies in the rapid expansion of chemical manufacturing industries in emerging markets such as India, China, and Southeast Asia. These regions are experiencing increased industrialization, supported by government initiatives, low production costs, and rising demand for agrochemicals and dyes. As local manufacturing capacities grow, the need for intermediate chemicals like Para-Nitrochlorobenzene is also rising.

Many global companies are setting up production units or forming partnerships in these regions to tap into this growth. This shift not only opens new demand channels but also reduces dependency on imports for domestic industries. As infrastructure and technology improve in these areas, the Para-Nitrochlorobenzene market is well-positioned to benefit from long-term growth opportunities.

Latest Trends

Shift Toward Cleaner and Safer Production Methods

One of the latest trends in the Para-Nitrochlorobenzene market is the growing shift toward cleaner and safer production methods. As environmental regulations tighten and awareness of chemical safety rises, manufacturers are increasingly focusing on adopting eco-friendly technologies. Efforts are being made to reduce hazardous waste, improve chemical handling systems, and adopt processes that lower emissions.

This shift is not only helping companies meet safety standards but also improving their operational efficiency and public image. Cleaner production also supports worker safety and helps companies avoid penalties linked to pollution. As sustainability becomes a core focus across the chemical industry, this trend is expected to gain more momentum and influence the long-term direction of Para-Nitrochlorobenzene manufacturing practices.

Regional Analysis

In 2024, Asia-Pacific led the Para-Nitrochlorobenzene market with 59.9% share.

In 2024, Asia-Pacific emerged as the dominant region in the Para-Nitrochlorobenzene market, accounting for 59.9% of the global share and reaching a market value of USD 509.1 million. The region’s leadership position is strongly supported by its expanding chemical manufacturing base, growing agrochemical consumption, and increasing demand for dye intermediates.

Countries within Asia-Pacific, particularly those with large-scale industrial operations, have driven consistent procurement of Para-Nitrochlorobenzene for use in various downstream applications. Favorable production economics and growing investments in chemical infrastructure further enhanced the region’s market strength.

North America also represented a significant regional market, supported by steady demand from the pharmaceutical and agrochemical sectors. Europe maintained a moderate share, driven by the need for high-quality chemical intermediates and stringent compliance with manufacturing standards.

In the Middle East & Africa, the market remained relatively smaller but showed signs of gradual growth with improving industrial activities. Latin America witnessed demand largely from the agricultural sector, reflecting its reliance on crop protection chemicals.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Aarti Industries Limited, Hefei TNJ Chemical Industry Co., Ltd., and Panoli Intermediates India Private Limited emerged as key players in the global Para‑Nitrochlorobenzene market. From an analyst’s perspective, each company contributed uniquely to the market’s structure and performance.

Aarti Industries Limited maintains a strong position through established production capabilities and integrated value chains. The company benefits from robust manufacturing infrastructure and vertically integrated operations, enabling it to efficiently supply high-quality Para‑Nitrochlorobenzene to downstream industries. This integration supports consistent product availability and contributes to cost competitiveness, reinforcing its position in key markets.

Hefei TNJ Chemical Industry Co., Ltd. demonstrated its strength in process optimization and regulatory compliance. The company’s emphasis on cleaner production processes and refined quality control systems has enhanced its appeal in regions with strict environmental standards. By implementing advanced process technologies, Hefei TNJ achieved production efficiency and reduced emissions, furthering its foothold in mature markets.

Panoli Intermediates India Private Limited focused on niche customer segments and responded dynamically to regional demand patterns. With agile production profiles, the company efficiently met short‑lead time requirements for agrochemical and dye intermediate customers. This operational flexibility allowed Panoli Intermediates to capture growing demand, especially from local buyers.

Top Key Players in the Market

- Aarti Industries Limited

- Hefei TNJ Chemical Industry Co., Ltd

- Panoli Intermediates India Private Limited

- Chemdyes Corporation

- Sarna Chemicals

- Seya Industries Ltd.

- Shandong Jinling

Recent Developments

- In February 2025, Sarna Chemicals commenced commercial imports of meta‑Nitrochlorobenzene (with 99–99.5% purity)—approximately 80 tonnes from multiple Chinese suppliers—to supplement its Gujarat facility. This expansion supports its work in producing specialty intermediates for dyes, pigments, pharmaceuticals, and agrochemicals.

- In March 2024, Panoli Intermediates operates two main production units in Gujarat (Nandesari and Jhagadia). These facilities focus on benzene derivatives such as MCB, PNCB, ONCB, dye intermediates, sulfuric acid, and other inorganic chemicals.

Report Scope

Report Features Description Market Value (2024) USD 850.5 Million Forecast Revenue (2034) USD 1,234.9 Million CAGR (2025-2034) 3.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity Grade (Standard Grade, Higher Purity Grade, Ultra Pure Grade), By Form (Liquid, Solid), By Application (Dyes, Pesticides, Rubber Chemicals, Others), By End-use (Agriculture, Pharmaceuticals, Chemicals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Aarti Industries Limited, Hefei TNJ Chemical Industry Co., Ltd, Panoli Intermediates India Private Limited, Chemdyes Corporation, Sarna Chemicals, Seya Industries Ltd., Shandong Jinling Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Para Nitrochlorobenzene MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Para Nitrochlorobenzene MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aarti Industries Limited

- Hefei TNJ Chemical Industry Co., Ltd

- Panoli Intermediates India Private Limited

- Chemdyes Corporation

- Sarna Chemicals

- Seya Industries Ltd.

- Shandong Jinling