Global Pancreatic Stone Protein Testing Market By Product Type (PSP Testing Kits, Point of Care (POC) PSP Devices, and Laboratory-based PSP Assays), By Application (Sepsis Diagnosis, Acute Pancreatitis Monitoring, and Critical Care), By End-user (Hospitals, Specialty Clinics, and Diagnostic Laboratories), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170276

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

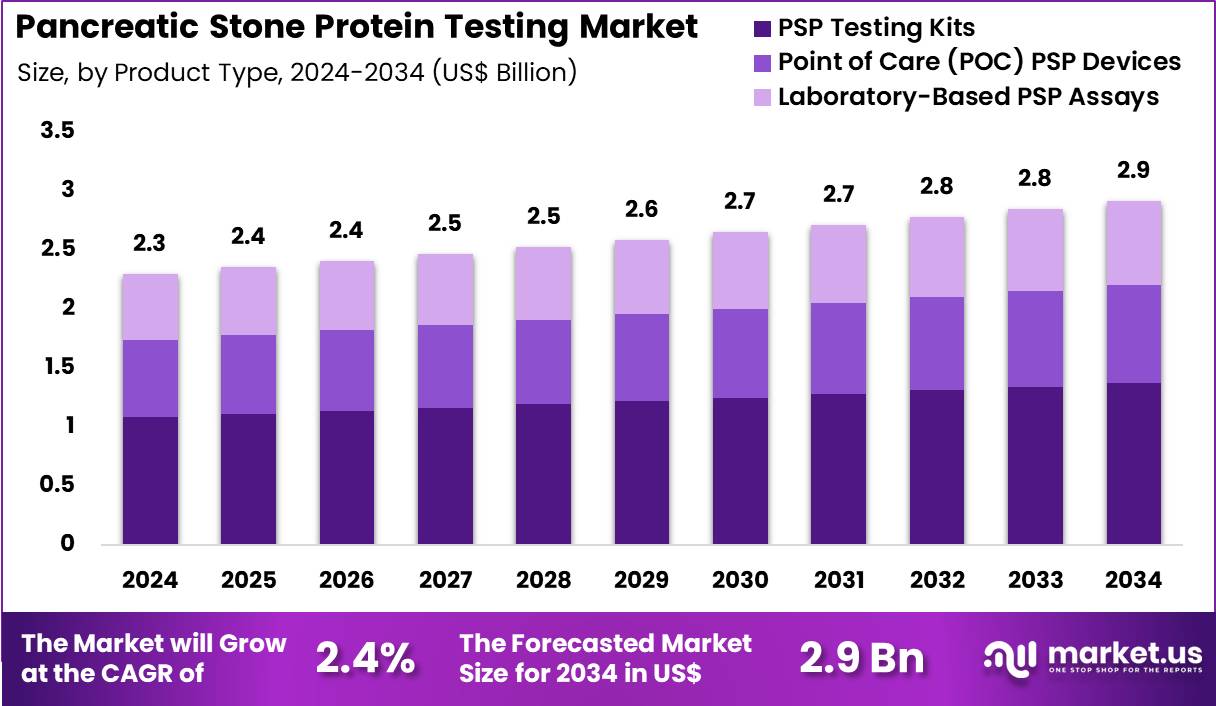

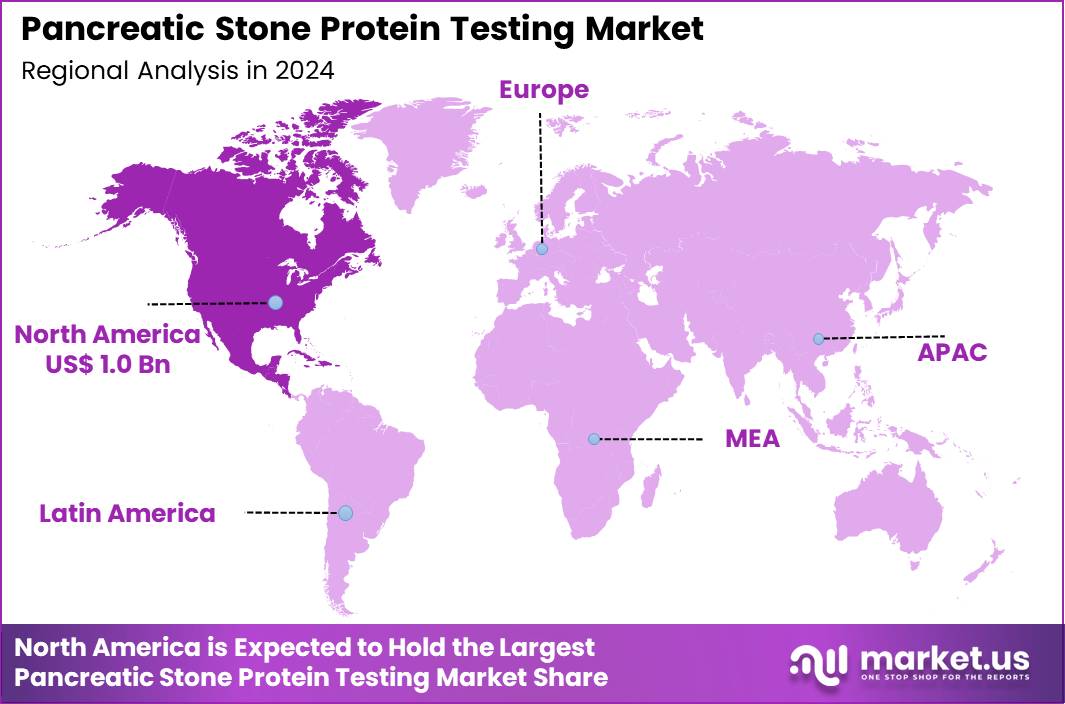

The Global Pancreatic Stone Protein Testing Market size is expected to be worth around US$ 2.9 Billion by 2034 from US$ 2.3 Billion in 2024, growing at a CAGR of 2.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.1% share with a revenue of US$ 1.0 Billion.

Increasing recognition of sepsis as a leading cause of mortality in critical care settings propels the Pancreatic Stone Protein Testing market, as clinicians seek early biomarkers to identify high-risk patients before irreversible organ damage occurs. Diagnostic developers refine immunoassays that quantify PSP levels in plasma with rapid turnaround, outperforming traditional markers like C-reactive protein in prognostic accuracy.

These tests enable risk stratification upon intensive care admission for timely escalation of supportive therapies, serial monitoring in postoperative patients to detect incipient infections, differentiation of sepsis from systemic inflammatory response syndrome, and outcome prediction in ventilated individuals with pneumonia.

Advanced instrumentation supports opportunities for ultrasensitive detection that enhances clinical decision-making. On June 2, 2025, Thermo Fisher Scientific introduced its next-generation Orbitrap Astral Zoom mass spectrometer at the ASMS conference, delivering superior sensitivity and throughput that accelerates validation and commercialization of precise PSP assays. This launch directly empowers researchers to refine biomarker applications and strengthens market confidence in PSP as a reliable sepsis indicator.

Growing emphasis on antimicrobial stewardship programs accelerates the Pancreatic Stone Protein Testing market, as hospitals implement PSP-guided protocols to de-escalate broad-spectrum antibiotics when infection likelihood remains low. Biotechnology firms optimize point-of-care platforms that integrate PSP measurement with procalcitonin for complementary diagnostic insights.

Applications encompass emergency department triage for suspected bacteremia to avoid unnecessary admissions, pediatric intensive care evaluation of febrile neutropenia in oncology cases, trauma unit assessments for secondary infectious complications, and burn ward surveillance to guide prophylactic regimens. Combined biomarker strategies open avenues for reduced healthcare-associated infections and shorter hospital stays. Clinical laboratories increasingly adopt these tests to align with value-based care models that reward efficient resource utilization.

Rising integration of multimodal biomarker panels invigorates the Pancreatic Stone Protein Testing market, as investigators combine PSP with cytokines and cell-free DNA to generate comprehensive sepsis signatures for personalized interventions. Technology providers launch automated analyzers that process PSP alongside lactate and presepsin from microliter sample volumes.

These panels support surgical recovery monitoring to preempt anastomotic leaks, transplant recipient evaluations for early rejection versus infection, cardiogenic shock differentiation from septic cardiomyopathy, and research applications in novel immunomodulatory drug trials. Multi-analyte approaches create opportunities for machine learning algorithms that predict deterioration trajectories with greater precision.

Collaborative consortia actively validate these integrated systems against clinical endpoints to establish guideline recommendations. This synergistic evolution positions PSP testing as a cornerstone of advanced critical care diagnostics.

Key Takeaways

- In 2024, the market generated a revenue of US$ 2.3 Billion, with a CAGR of 2.4%, and is expected to reach US$ 2.9 Billion by the year 2034.

- The product type segment is divided into PSP testing kits, point of care (POC) PSP devices, and laboratory-based PSP assays, with PSP testing kits taking the lead in 2024 with a market share of 47.1%.

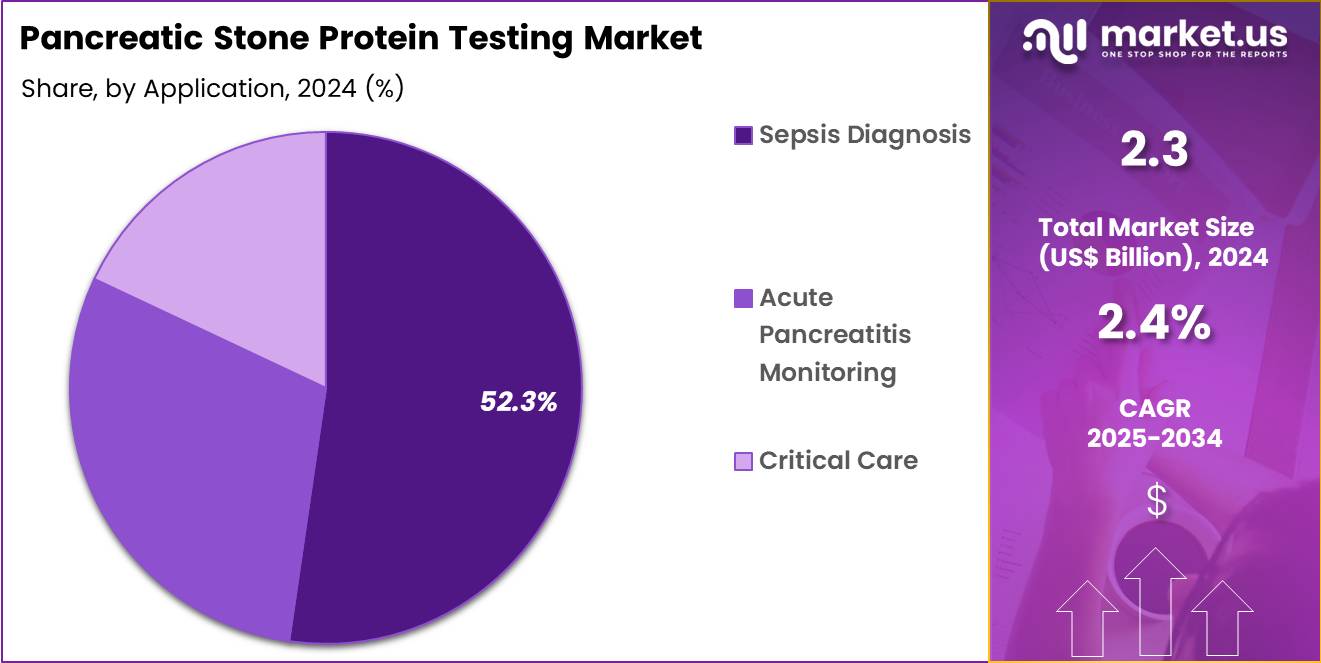

- Considering application, the market is divided into sepsis diagnosis, acute pancreatitis monitoring, critical care. Among these, sepsis diagnosis held a significant share of 52.3%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, specialty clinics, diagnostic laboratories. The hospitals sector stands out as the dominant player, holding the largest revenue share of 50.6% in the market.

- North America led the market by securing a market share of 42.1% in 2024.

Product Type Analysis

PSP Testing Kits, holding 47.1%, are expected to dominate due to their high demand for detecting pancreatic stone protein levels, especially in emergency and clinical settings. These kits offer a cost-effective and easy-to-use solution for detecting biomarkers associated with pancreatitis, making them a preferred choice for both routine and acute testing. The rise in acute pancreatitis and sepsis cases, along with the increasing need for early detection and monitoring, strengthens the market for PSP testing kits.

Their compatibility with both centralized laboratories and point-of-care settings enhances accessibility and speeds up diagnosis. Technological advancements in test sensitivity and accuracy further drive adoption, particularly in hospitals and clinics. As healthcare systems prioritize early disease detection to reduce complications, the demand for these kits is expected to continue rising. These factors keep PSP testing kits anticipated to remain the most widely used product in the market.

Application Analysis

Sepsis diagnosis, holding 52.3%, is anticipated to dominate the application segment due to the rising global burden of sepsis, particularly in critically ill and immunocompromised patients. The need for accurate and timely biomarkers to identify sepsis early strengthens the demand for PSP testing as part of sepsis diagnosis. Hospitals increasingly use PSP levels in conjunction with other diagnostic markers to monitor sepsis progression and guide treatment decisions.

Growing healthcare awareness about the importance of early sepsis detection further drives the adoption of PSP tests. As the clinical focus on improving sepsis outcomes intensifies, the use of biomarkers like PSP for diagnosis and monitoring is projected to grow. The continued push for reducing sepsis-related mortality rates increases the use of PSP testing in sepsis diagnosis. These trends keep sepsis diagnosis projected to remain the most dominant application in the pancreatic stone protein testing market.

End-User Analysis

Hospitals, holding 50.6%, are expected to remain the dominant end-user segment due to their role in managing critical patients with acute pancreatitis and sepsis. Hospital laboratories and emergency departments rely on PSP testing kits for timely diagnosis, helping clinicians make informed decisions about patient care. The high patient volume, especially in emergency and ICU settings, drives continued demand for PSP tests.

Hospitals implement PSP testing as part of their broader strategy to enhance early detection of pancreatic dysfunction and sepsis, improving patient outcomes. Increased hospital admissions due to chronic and acute diseases requiring continuous monitoring strengthens PSP testing demand. Moreover, the adoption of automated diagnostic systems in hospitals improves test accuracy and turnaround time. These factors ensure that hospitals remain the leading end-user segment in the pancreatic stone protein testing market.

Key Market Segments

By Product Type

- PSP Testing Kits

- Point‑of‑Care (POC) PSP Devices

- Laboratory‑based PSP Assays

By Application

- Sepsis Diagnosis

- Acute Pancreatitis Monitoring

- Critical Care

By End‑user

- Hospitals

- Specialty Clinics

- Diagnostic Laboratories

Drivers

The High Incidence of Sepsis Among Hospitalized Adults Is Driving the Market

The high incidence of sepsis among hospitalized adults represents a primary driver for the pancreatic stone protein testing market, as it intensifies the demand for rapid, reliable biomarkers to facilitate early detection and intervention. Sepsis, characterized by a dysregulated immune response to infection, progresses swiftly to organ dysfunction, underscoring the urgency for diagnostics that outperform traditional markers like C-reactive protein and procalcitonin.

Pancreatic stone protein emerges as a superior indicator due to its acute-phase response, enabling clinicians to differentiate infection from sterile inflammation with greater precision. This capability is crucial in intensive care units, where timely therapy can avert septic shock and reduce mortality. According to the Centers for Disease Control and Prevention, approximately 1.7 million adults in the United States develop sepsis annually, contributing to at least 350,000 deaths. Such staggering figures compel healthcare systems to integrate advanced assays into protocols, particularly for high-risk surgical and trauma patients.

Manufacturers are scaling production of point-of-care platforms to align with these needs, ensuring compatibility with automated analyzers for high-throughput environments. The economic burden of sepsis, including prolonged hospitalizations, further justifies investments in PSP testing to optimize resource allocation. As global health organizations advocate for enhanced surveillance, adoption extends to emergency departments, broadening market penetration. This driver ultimately positions PSP as a pivotal tool in transforming sepsis management from reactive to proactive.

Restraints

Limited Regulatory Approvals for Routine Clinical Use Are Restraining the Market

Limited regulatory approvals for routine clinical use continue to restrain the pancreatic stone protein testing market, confining its deployment to research and select investigational settings despite promising data. While point-of-care devices show potential, the absence of broad endorsements from agencies like the Food and Drug Administration hampers widespread integration into standard care pathways. This regulatory lag stems from requirements for extensive validation across diverse populations, delaying commercialization and reimbursement eligibility.

Consequently, clinicians rely on established but less specific biomarkers, perpetuating diagnostic delays in ambiguous cases. The Centers for Disease Control and Prevention highlights that sepsis affects 1.7 million adults annually, yet innovative tests like PSP face barriers that slow their contribution to reducing the 350,000 associated deaths. Resource constraints in underfunded laboratories exacerbate this issue, as initial costs for unapproved assays deter procurement.

Variability in assay standardization across studies further erodes confidence, complicating guideline incorporation. Payer hesitancy to cover experimental diagnostics limits accessibility, particularly in community hospitals serving vulnerable demographics. Educational deficits among providers also impede advocacy for PSP, as familiarity remains low outside specialized centers. Addressing this restraint necessitates streamlined approval processes to unlock PSP’s full diagnostic potential.

Opportunities

Superior Diagnostic Accuracy of PSP Over Conventional Biomarkers Is Creating Growth Opportunities

Superior diagnostic accuracy of pancreatic stone protein over conventional biomarkers is generating significant growth opportunities in the testing market by offering enhanced sensitivity and specificity for sepsis identification. Meta-analyses confirm PSP’s pooled sensitivity at 0.88 and specificity at 0.78, surpassing procalcitonin and C-reactive protein in distinguishing septic from non-septic states. This edge enables earlier therapeutic decisions, particularly in postoperative and immunocompromised cohorts where ambiguity prevails. Opportunities arise from multiplexing PSP with existing panels, amplifying utility in syndromic testing for rapid triage.

Developers can leverage these metrics to secure partnerships with hospital networks, targeting high-volume ICUs for pilot implementations. The area under the curve of 0.90 in summary receiver operating characteristic analyses underscores its prognostic value, attracting investments in validation trials. Expansion into neonatal and pediatric applications presents untapped avenues, given PSP’s comparable performance in vulnerable groups.

Cost-effectiveness models project reductions in unnecessary antibiotics, appealing to stewardship programs amid resistance concerns. As evidence accumulates, guideline committees may endorse PSP, catalyzing reimbursement reforms. These factors collectively foster a pathway for market diversification and equitable deployment.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic strength fuels the Pancreatic Stone Protein Testing market as rising healthcare budgets and the growing burden of sepsis push hospitals to adopt superior biomarkers that catch infections earlier than traditional markers. Companies respond quickly by launching rapid point-of-care platforms that deliver results in minutes and improve patient outcomes in critical care units. Unfortunately, inflation and economic slowdowns tighten hospital finances, forcing many facilities to delay analyzer purchases and limit the use of specialized sepsis tests.

Geopolitical tensions and trade conflicts disrupt the steady flow of reagents and consumables, leaving manufacturers to manage longer delays and unpredictable costs. Current US tariffs sharply raise the price of imported diagnostic components and finished kits, placing extra pressure on laboratories that rely on overseas suppliers and threatening higher charges for healthcare providers. These added costs also create concerns about access in smaller or rural centers with already thin margins.

On the brighter side, these challenges accelerate local manufacturing and drive development of smarter, multiplex assays that combine several markers on one platform, cutting overall expenses. The Pancreatic Stone Protein Testing market remains resilient and continues its steady expansion, reinforcing its essential role in modern sepsis care.

Latest Trends

The FDA Clearance of Abionic’s CAPSULE PSP Assay in 2024 Is a Recent Trend

The FDA clearance of Abionic’s CAPSULE PSP assay on October 30, 2024, signifies a landmark recent trend toward point-of-care sepsis diagnostics with nanofluidic technology for whole-blood analysis. This approval validates the assay’s ability to quantify PSP levels in under 20 minutes, supporting early risk stratification in emergency and critical care environments. The device achieves a limit of detection below 10 ng/mL, aligning with clinical thresholds for infection onset and progression.

This innovation addresses gaps in traditional lab-dependent testing, enabling bedside decisions that could avert 24-48 hours of diagnostic delay. Integration with the abioSCOPE platform enhances portability, facilitating use in resource-variable settings without sample preprocessing. Early validations demonstrate equivalence to enzyme-linked immunosorbent assays, with coefficients of variation under 15% for precision.

The clearance coincides with heightened sepsis awareness, as the Centers for Disease Control and Prevention reports 1.7 million annual U.S. cases, amplifying the assay’s relevance. Collaborations, such as Fapon’s exclusive licensing in China, signal global scalability through chemiluminescent adaptations. Post-clearance deployments in U.S. hospitals emphasize its role in reducing empirical therapy durations. This 2024 advancement heralds a shift to accessible, actionable biomarkers in sepsis care.

Regional Analysis

North America is leading the Pancreatic Stone Protein Testing Market

North America accounted for 42.1% of the overall market in 2024, and the region saw significant growth as the early detection of pancreatic diseases, including pancreatitis and pancreatic cancer, became a priority in clinical settings. Hospitals and diagnostic laboratories expanded the use of Pancreatic Stone Protein (PSP) assays to assess inflammation and tissue damage in patients with suspected pancreatic disorders.

The rise in chronic pancreatitis and the increased incidence of pancreatic cancer in high-risk populations, including those with a history of smoking and heavy alcohol use, contributed to the demand for reliable diagnostic tests. The National Cancer Institute reported an estimated 64,050 new cases of pancreatic cancer in the U.S. in 2023, highlighting the urgent need for better diagnostic tools. The increasing availability of PSP testing through both hospital and outpatient settings, along with advancements in biomarker discovery, supported the market’s expansion in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to experience substantial growth in the Pancreatic Stone Protein Testing market during the forecast period as the region faces a growing burden of pancreatic diseases, particularly in rapidly urbanizing and aging populations. Countries with high smoking rates, unhealthy diets, and increasing alcohol consumption, such as China and India, experience a higher incidence of pancreatitis and pancreatic cancer. Healthcare systems are focusing more on early detection through non-invasive diagnostic methods like PSP testing.

The World Health Organization (WHO) reported that the incidence of pancreatic cancer in India has been rising steadily, with over 50,000 new cases diagnosed in 2022, further emphasizing the demand for early diagnostic tools. Governments are strengthening national cancer-control programs, encouraging the use of PSP tests to detect pancreatic disease early and improve patient outcomes. These trends, coupled with increasing healthcare access and awareness, are expected to drive market growth in the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key organisations in the pancreatic‑stone protein (PSP) diagnostics space push growth by advancing assay technologies that improve sensitivity, enable faster detection of sepsis and inflammatory conditions, and reduce time to result this positions PSP‑based diagnostics as a reliable early‑warning tool for critical care. They expand reach by forging alliances with hospitals, intensive‑care units and reference laboratories in both developed and emerging regions to capture growing demand for early sepsis and pancreatitis detection.

They broaden application scope of PSP assays beyond pancreatic disorders to systemic infection monitoring and inflammatory disease screening, thereby increasing total addressable market. They strengthen credibility by conducting clinical validation studies, aligning with international diagnostic guidelines, and obtaining regulatory clearances to support wide clinical adoption.

They complement core offerings by bundling PSP assay kits with automated immunoassay platforms or multiplex panels, improving laboratory throughput and reducing manual workload. One key firm, Abionic SA, specialises in ultra‑rapid in‑vitro diagnostics, markets a CE‑marked point‑of‑care PSP test, leverages its nanofluidic platform and global distribution footprint, and uses its sepsis‑focused diagnostic reputation to drive PSP adoption among critical‑care providers worldwide.

Top Key Players

- Siemens Healthineers

- Abbott Laboratories

- Roche Diagnostics

- Thermo Fisher Scientific, Inc.

- DiaSorin S.p.A.

- Danaher Corporation

- Bio‑Rad Laboratories, Inc.

- Ortho Clinical Diagnostics

Recent Developments

- On October 29, 2025, Thermo Fisher Scientific confirmed a deal to acquire Clario Holdings, Inc. for US$8.875 billion. This acquisition enhances Thermo Fisher’s capabilities in digital and data solutions for clinical trials, which are essential for validating new biomarkers, such as PSP, and integrating them into advanced sepsis diagnostic algorithms.

- On January 7, 2025, Russ Lebovitz, CEO of Amprion, predicted a pivotal year ahead for neurodegenerative diagnostics. He highlighted the simultaneous advancements in fluid biomarkers and AI/ML technologies, which will provide deeper insights, particularly for PSP. The effective use of machine learning platforms will be critical in interpreting PSP’s predictive value for sepsis accurately.

Report Scope

Report Features Description Market Value (2024) US$ 2.3 Billion Forecast Revenue (2034) US$ 2.9 Billion CAGR (2025-2034) 2.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (PSP Testing Kits, Point of Care (POC) PSP Devices, and Laboratory-based PSP Assays), By Application (Sepsis Diagnosis, Acute Pancreatitis Monitoring, and Critical Care), By End-user (Hospitals, Specialty Clinics, and Diagnostic Laboratories) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens Healthineers, Abbott Laboratories, Roche Diagnostics, Thermo Fisher Scientific, Inc., DiaSorin S.p.A., Danaher Corporation, Bio‑Rad Laboratories, Inc., Ortho Clinical Diagnostics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pancreatic Stone Protein Testing MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Pancreatic Stone Protein Testing MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens Healthineers

- Abbott Laboratories

- Roche Diagnostics

- Thermo Fisher Scientific, Inc.

- DiaSorin S.p.A.

- Danaher Corporation

- Bio‑Rad Laboratories, Inc.

- Ortho Clinical Diagnostics