Pancreatic Elastase Testing Market By Product Type (Immunoassay kits, Stool-based test kits and Rapid/point-of-care test kits), By Indication (Chronic pancreatitis, Type 1 diabetes, Cystic fibrosis and Others), By End-User (Hospitals, Diagnostic laboratories, and Specialty clinics), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168027

- Number of Pages: 220

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

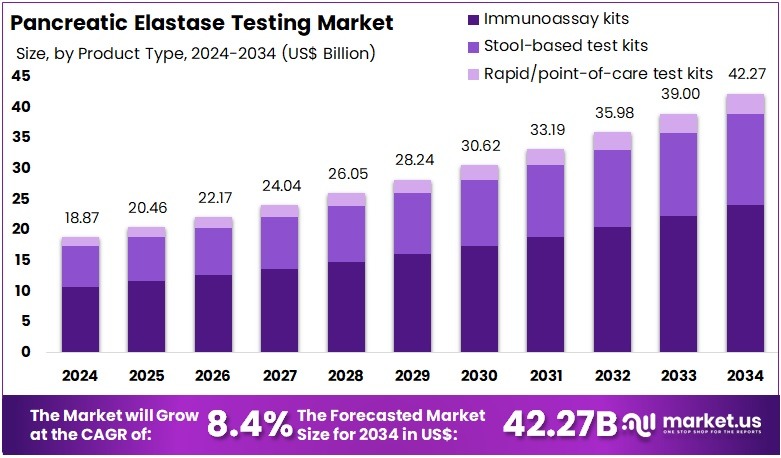

The Pancreatic Elastase Testing Market size is expected to be worth around US$ 42.27 billion by 2034 from US$ 18.87 billion in 2024, growing at a CAGR of 8.4% during the forecast period 2025 to 2034.

Pancreatic elastase testing measures the concentration of elastase, an enzyme produced by the pancreas, in a stool sample to assess exocrine pancreatic function. A low level of pancreatic elastase in the stool indicates that the pancreas is not producing enough enzymes to properly digest food, a condition known as exocrine pancreatic insufficiency (EPI). Symptoms of EPI can include abdominal pain, diarrhea, bloating, and malabsorption.

The Pancreatic Elastase Testing Market plays a critical role in diagnosing exocrine pancreatic insufficiency (EPI) and related disorders affecting digestive enzyme production. The test, primarily performed on stool samples, enables non-invasive evaluation of pancreatic function and assists physicians in detecting chronic pancreatitis, cystic fibrosis-related pancreatic impairment, and malabsorption-linked metabolic disorders.

Pancreatic elastase (PE-1) assays—especially ELISA-based immunoassay kits—are highly preferred due to their stability in stool samples, ease of sample handling, and compatibility with routine laboratory workflows. Rapid stool-based test kits and point-of-care (POC) solutions are expanding access, particularly in outpatient gastroenterology centers.

Growing global incidence of chronic pancreatitis, diabetes-associated pancreatic dysfunction, and rising awareness of malabsorption disorders are expanding adoption. Diagnostics manufacturers are focusing on improving assay sensitivity, automation compatibility, and shorter turnaround times.

Key Takeaways

- In 2024, the market generated a revenue of US$ 18.87 billion, with a CAGR of 8.4%, and is expected to reach US$ 42.27 billion by the year 2034.

- The Product Type segment is divided into Immunoassay kits, Stool-based test kits, and Rapid/point-of-care test kits, with Immunoassay kits taking the lead in 2024 with a market share of 57.1%

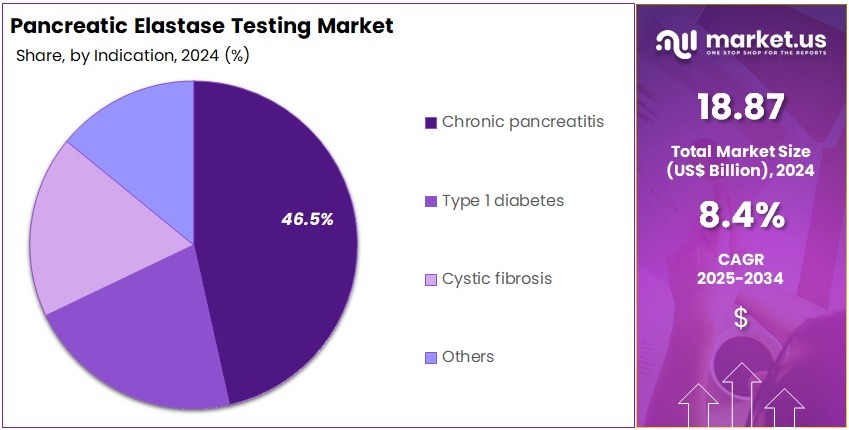

- The Application segment is divided into Infectious diseases testing, Oncology testing, Human genetic testing, Blood screening, Forensic applications, and Others, with Chronic pancreatitis taking the lead in 2024 with a market share of 46.5%.

- The End-User segment is divided into Hospitals and diagnostic centres, Stand-alone diagnostic laboratories, Research laboratories, and Pharmaceutical & biotechnology companies, with Hospitals taking the lead in 2024 with a market share of 51.7%.

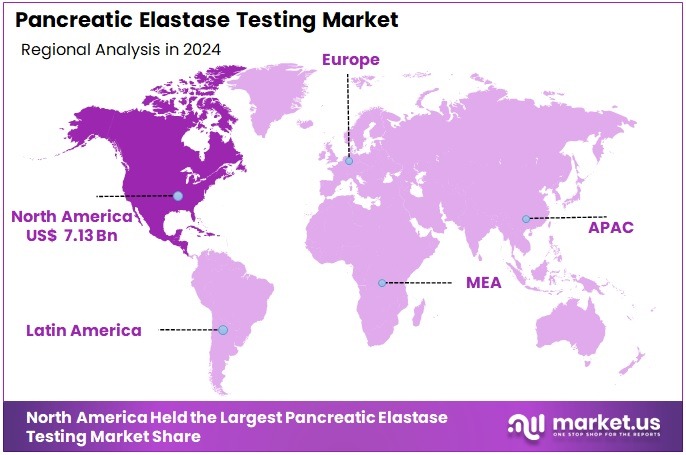

- North America led the market by securing a market share of 37.8% in 2024.

Product Type Analysis

Immunoassay kits dominate the product landscape with about 57.1% share, driven by their high accuracy, validated clinical performance, and integration with automated ELISA analyzers widely used in hospital and reference laboratories. These kits offer consistent detection across a broad concentration range, making them foundational tools for diagnosing EPI in adults and pediatric populations.

Stool-based test kits account for nearly 35.0%, supported by the rising adoption of fecal elastase testing as a preferred first-line procedure for diagnosing chronic pancreatitis and fat-malabsorption disorders. Their non-invasive nature significantly increases patient compliance, particularly in long-term disease monitoring.

Rapid/POC kits represent around 5.0%, gaining traction in outpatient clinics and smaller diagnostic centers seeking faster decision-making for gastrointestinal evaluations. Although still in early adoption, advancements in lateral-flow immunoassay technology are accelerating growth in this segment.

Indication Analysis

Chronic pancreatitis accounts for approximately 46.5% of all test utilization owing to its high global prevalence and the central role of fecal elastase testing in evaluating progressive loss of exocrine function. The test is widely recommended due to its non-invasive nature and strong diagnostic correlation with clinical symptoms.

Type 1 diabetes contributes nearly 20.0% as pancreatic autoimmune destruction increasingly requires screening for EPI to guide dietary and enzyme-replacement interventions. The growing use of pancreatic function testing in diabetic care pathways supports this segment.

Cystic fibrosis represents about 18.0%, with elastase testing routinely used in initial diagnosis and ongoing monitoring of pancreatic function in pediatric and adolescent patients. National newborn screening programs in several countries reinforce test demand.

End-User Analysis

Hospitals maintain the strongest share at 51.7%, driven by their role as primary centers for gastroenterology evaluations, chronic pancreatitis management, and cystic fibrosis monitoring. Their capacity for high-volume ELISA testing keeps them dominant.

Diagnostic laboratories represent nearly 35.0%, benefiting from rising test outsourcing, automation compatibility, and the expansion of centralized stool-testing workflows across global lab networks.

Key Market Segments

By Product Type

- Immunoassay kits

- Stool-based test kits

- Rapid/point-of-care test kits

By Indication

- Chronic pancreatitis

- Type 1 diabetes

- Cystic fibrosis

- Others

By End-User

- Hospitals

- Diagnostic laboratories

- Specialty clinics

Drivers

Growing prevalence of chronic pancreatitis and related exocrine insufficiency

The rising prevalence of chronic pancreatitis (CP) globally is one of the strongest drivers for pancreatic elastase test adoption. Chronic pancreatitis affects an estimated 10–13 cases per 100,000 population annually, with significantly higher rates in Eastern Europe, India, and parts of East Asia.

Long-term inflammation progressively destroys acinar cells and disrupts digestive enzyme secretion, ultimately leading to exocrine pancreatic insufficiency (EPI)—a condition observed in up to 85% of individuals with chronic pancreatitis. This creates continuous demand for non-invasive diagnostic tools such as fecal pancreatic elastase-1 testing, which is widely used as a first-line method because of its convenience and reliability in detecting moderate to severe EPI.

For example, India reports a high burden of tropical pancreatitis, with prevalence up to 10 times higher than Western countries, contributing to significant dependence on stool elastase screening for nutritional and metabolic management. Alcohol-related pancreatitis—accounting for nearly 50% of all CP cases in many Western countries—also increases EPI incidence, supporting repeat testing for disease monitoring.

Restraints

Variability in test sensitivity at mild-to-moderate insufficiency levels

A key restraint for the pancreatic elastase testing market is the reduced diagnostic sensitivity in patients with mild or early-stage exocrine pancreatic insufficiency (EPI). While fecal elastase testing shows high sensitivity (around 90–95%) for severe EPI, accuracy declines to 50–60% for mild-to-moderate insufficiency, often leading to false-negative results. This limitation creates clinical uncertainty and may delay therapeutic decisions in borderline cases, especially for individuals with early chronic pancreatitis, long-standing Type 1 diabetes, mild cystic fibrosis–related pancreatic dysfunction, or early malabsorption disorders.

The accuracy of the test is also heavily influenced by stool consistency. Watery or diluted stools can artificially lower elastase concentration, creating false positives for insufficiency. Conversely, small sample volumes or uneven distribution of elastase in stool can lead to underdiagnosis. Studies have shown that up to 15–20% of borderline samples require repeat testing or secondary confirmation using imaging or direct pancreatic function tests such as secretin stimulation.

Additionally, variations in kit performance across manufacturers—driven by antibody specificity, calibration materials, and assay design—can introduce cross-laboratory inconsistencies. For example, inter-laboratory comparison exercises often detect 10–20% variability in elastase readings, particularly at concentrations between 100–200 µg/g. These accuracy challenges decrease clinician confidence and represent a key barrier to greater test adoption in early disease stages.

Opportunities

Technological advancement in POC stool-elastase platforms

Technological innovation in point-of-care (POC) stool-elastase platforms is creating significant market opportunities by enabling faster, decentralized diagnosis of pancreatic insufficiency. Traditional ELISA-based assays require laboratory infrastructure and can take 4–12 hours, whereas modern POC lateral-flow systems deliver results within 10–20 minutes, making them highly attractive for outpatient clinics, emergency departments, and primary-care settings.

Emerging POC devices use enhanced monoclonal antibody systems, improved membrane flow rates, and semi-quantitative analyzers that increase accuracy and reproducibility. Manufacturers are introducing portable reader devices that objectively interpret lateral-flow tests, reducing observer bias and providing digitally stored readings for clinical integration. In regions with limited lab facilities—such as rural India, Sub-Saharan Africa, and Southeast Asia—rapid stool-elastase testing is increasingly used in diagnosing malnutrition-related pancreatic dysfunction.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical conditions strongly influence the pancreatic elastase testing market by affecting healthcare budgets, supply chain stability, manufacturing costs, and access to diagnostic reagents.

Economic slowdowns often shift healthcare expenditure toward essential diagnostics, which benefits non-invasive and cost-efficient tests such as stool elastase, particularly in public hospitals. However, inflationary pressures can raise the cost of antibodies, plastic consumables, microplates, and transport—components widely used in ELISA-based kits—resulting in higher procurement prices for laboratories. During 2022–2024, global shipping cost fluctuations increased reagent import costs by 15–25% in several developing countries, directly impacting test affordability.

Geopolitical tensions also disrupt the sourcing of monoclonal antibodies, enzyme controls, and lateral-flow membranes, many of which are manufactured in Europe, the US, and East Asia. Restrictions on chemical exports and periodic shutdowns in manufacturing hubs can slow production timelines, causing delays in kit availability. Currency instability further affects purchasing power in Latin America, the Middle East, and parts of Africa, limiting access to advanced immunoassay analyzers.

Latest Trends

Automation of ELISA stool-elastase workflows

Automation is reshaping the pancreatic elastase testing landscape by improving throughput, accuracy, and operational efficiency in diagnostic laboratories. Traditional manual ELISA processing is labor-intensive and prone to human error, whereas automated platforms enable high-volume stool-based testing with consistent performance—critical for hospitals and reference labs processing thousands of GI samples per month. Automated ELISA analyzers can handle 100–300 samples per run, cut labor requirements by 40–60%, and reduce turnaround times from days to under 24 hours.

Major manufacturers now offer elastase test kits compatible with open-channel immunoassay analyzers, allowing integration alongside common assays such as calprotectin, CRP, and celiac screening markers. This consolidation significantly improves workflow efficiency in gastroenterology-focused laboratories. Enhanced robotic pipetting, automated plate washing, and digital result interpretation minimize variability across batches and increase reproducibility, especially at borderline elastase concentrations.

Regional Analysis

North America is leading the Pancreatic Elastase Testing Market

North America represents the largest share of the market with 37.8% due to strong adoption of non-invasive gastrointestinal testing, widespread access to ELISA-based immunoassay platforms, and high prevalence of chronic pancreatitis and diabetes. Extensive insurance coverage for pancreatic function tests and the presence of major diagnostic manufacturers strengthen regional dominance.

In July 2025, QuidelOrtho Corporation and BÜHLMANN Laboratories AG announced the availability of BÜHLMANN’s fCAL turbo (fecal calprotectin) and fPELA turbo (fecal pancreatic elastase) assays on QuidelOrtho’s VITROS clinical chemistry systems via a MicroTip™ partnership assay (MPA). The collaboration enables laboratories to run both gastrointestinal and pancreatic insufficiency biomarker tests on high-throughput VITROS platforms, delivering results in less than 10 minutes, using CALEX® Cap stool extraction for simplified sample prep.

The Europe region is the second largest in the Pancreatic Elastase Testing Market

Europe demonstrates robust uptake due to established clinical guidelines recommending fecal elastase testing as a first-line diagnostic for exocrine pancreatic insufficiency. Countries such as Germany, the UK, and Italy maintain significant test volumes through both hospital and outpatient systems.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include DiaSorin S.p.A.rs, ScheBo Biotech AG, Immundiagnostik AG, Invivo Healthcare, DRG Instruments GmbH, Verisana Laboratories, BÜHLMANN Laboratories AG, CerTest Biotec S.L., R-Biopharm AG, American Laboratory Products Company, Ltd., Vitassay Healthcare, S.L.U., Alpha Laboratories Ltd., and Other key players

DiaSorin offers the LIAISON® Elastase-1 assay, a fully automated CLIA-based test for quantitative fecal pancreatic elastase on its LIAISON analyzers. It targets exocrine pancreatic insufficiency diagnosis in adults and children with simplified stool handling and rapid turnaround. ScheBo Biotech markets the Pancreatic Elastase 1™ stool test, a sandwich ELISA using two monoclonal antibodies, noted for high sensitivity/specificity and stool-based non-invasive assessment of exocrine pancreatic function including in chronic pancreatitis, cystic fibrosis and related disorders.

Immundiagnostik supplies the IDK® Pancreatic Elastase ELISA kit for quantitative measurement of human pancreatic elastase in stool samples, enabling indirect non-invasive evaluation of exocrine pancreatic secretory capacity in conditions such as EPI, chronic pancreatitis, and diabetes-related dysfunction.

Recent Developments

- In October 2025: Immundiagnostik AG (via its U.S. affiliate) entered into a partnership with Epitope Diagnostics, Inc. to offer a comprehensive chemiluminescent immunoassay (CLIA) solution portfolio including more than 14 new assays for gastrointestinal markers—among them pancreatic elastase and pepsinogen. This partnership expands automated GI-function testing options in immunodiagnostic laboratories.

- In June 2020: BÜHLMANN Laboratories AG introduced its fPELA® turbo turbidimetric immunoassay for quantitative stool pancreatic elastase determination, designed to run on standard clinical chemistry analyzers using their CALEX® stool extraction device, achieving around 10-minute turnaround. This launch represented a shift towards faster, high-throughput pancreatic elastase testing.

- In February 2020: DRG Instruments GmbH rolled out its Pancreatic Elastase (stool) enzyme immunoassay on its HYBRiD-XL automated platform, with features like built-in stool extraction, automated dilution, and integrated controls and calibrators. This product broadened the automated testing ecosystem for pancreatic function assessment.

Top Key Players in the Pancreatic Elastase Testing Market

- DiaSorin S.p.A.rs

- ScheBo Biotech AG

- Immundiagnostik AG

- Invivo Healthcare

- DRG Instruments GmbH

- Verisana Laboratories

- BÜHLMANN Laboratories AG

- CerTest Biotec S.L.

- R-Biopharm AG

- American Laboratory Products Company, Ltd.

- Vitassay Healthcare, S.L.U.

- Alpha Laboratories Ltd.

- Other key players

Report Scope

Report Features Description Market Value (2024) US$ 18.87 billion Forecast Revenue (2034) US$ 42.27 billion CAGR (2025-2034) 8.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Immunoassay kits, Stool-based test kits and Rapid/point-of-care test kits), By Indication (Chronic pancreatitis, Type 1 diabetes, Cystic fibrosis and Others), By End-User (Hospitals, Diagnostic laboratories, and Specialty clinics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape DiaSorin S.p.A.rs, ScheBo Biotech AG, Immundiagnostik AG, Invivo Healthcare, DRG Instruments GmbH, Verisana Laboratories, BÜHLMANN Laboratories AG, CerTest Biotec S.L., R-Biopharm AG, American Laboratory Products Company, Ltd., Vitassay Healthcare, S.L.U., Alpha Laboratories Ltd., and Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pancreatic Elastase Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Pancreatic Elastase Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- DiaSorin S.p.A.rs

- ScheBo Biotech AG

- Immundiagnostik AG

- Invivo Healthcare

- DRG Instruments GmbH

- Verisana Laboratories

- BÜHLMANN Laboratories AG

- CerTest Biotec S.L.

- R-Biopharm AG

- American Laboratory Products Company, Ltd.

- Vitassay Healthcare, S.L.U.

- Alpha Laboratories Ltd.

- Other key players