Global Packaged Milkshakes Market Size, Share Analysis Report By Packaging Material (Paper, Tin, Glass, Plastic), By Flavor (Chocolate, Vanilla, Strawberry, Others), By Distribution Channel ( Offline, Online) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173254

- Number of Pages: 309

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

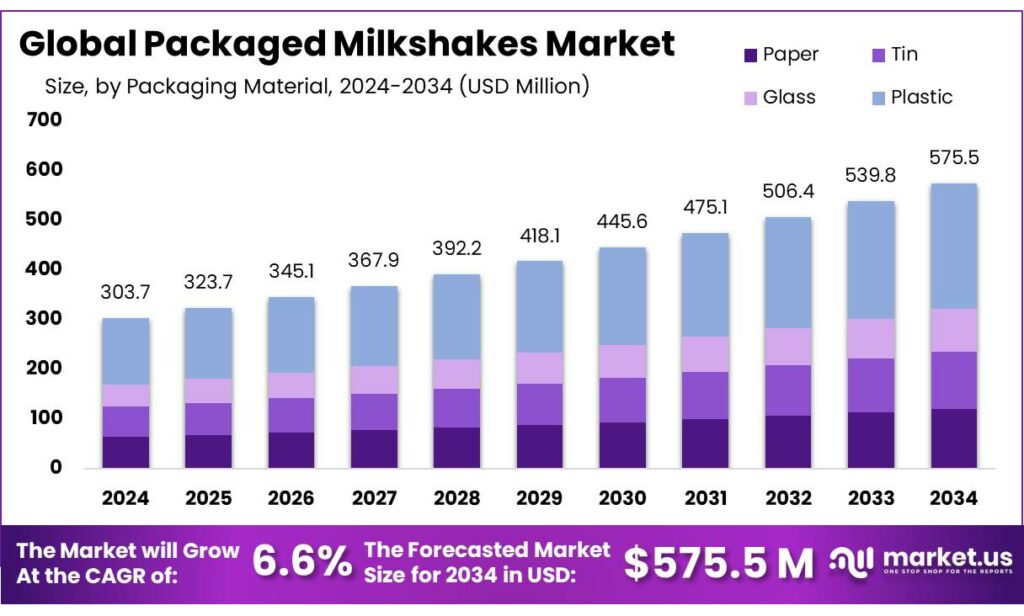

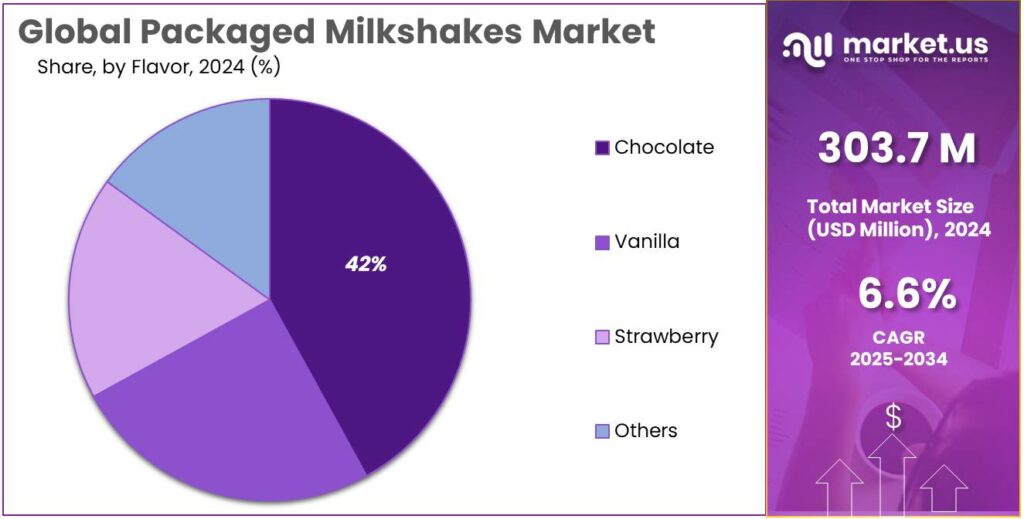

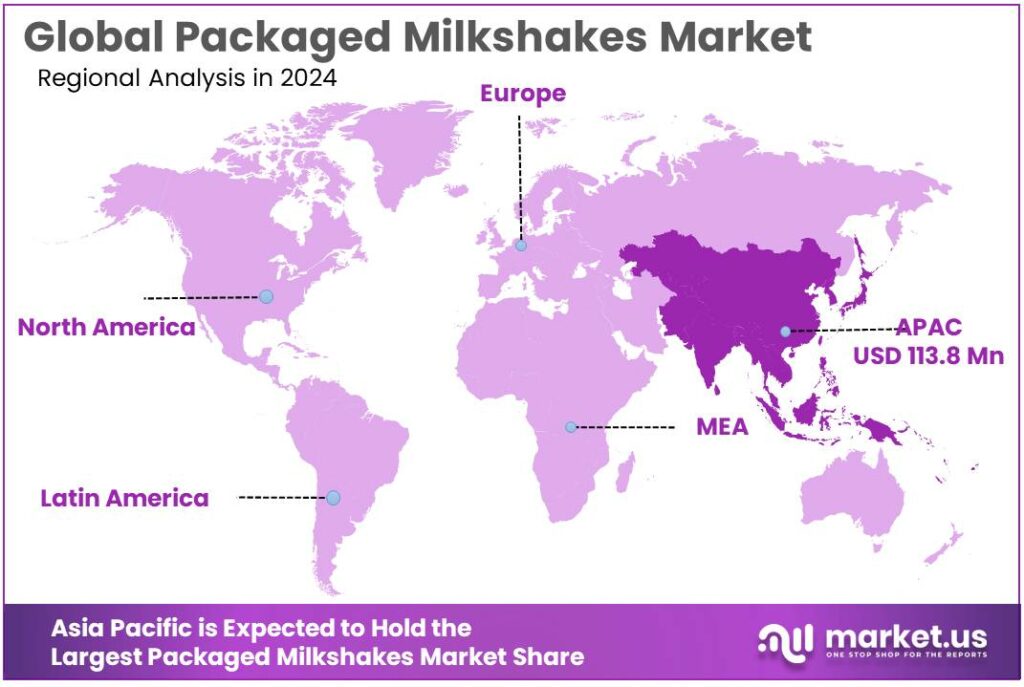

The Global Packaged Milkshakes Market size is expected to be worth around USD 575.5 Million by 2034, from USD 303.7 Million in 2024, growing at a CAGR of 6.6% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 37.5% share, holding USD 113.8 Million in revenue.

Packaged milkshakes sit at the intersection of dairy processing and ready-to-drink (RTD) convenience beverages. They typically use standardized milk (or milk solids), sugar and flavors, then rely on heat treatment, homogenization, and hygienic filling into bottles, cartons, or cans. The industry’s starting point is a large, still-growing milk pool: the IDF estimates global unprocessed milk production reached 964 million tonnes in 2023.

Industrially, packaged milkshakes benefit from the broader shift toward formal dairy channels and higher throughput in plants. IDF data shows 463 million tonnes of cow’s milk (about 59% of cow’s milk production) were delivered to dairy processors in 2023, highlighting the importance of industrial processing and consistent quality systems. IDF also notes that packaged (liquid) milk production rose by 0.9% in 2023, indicating steady momentum in packaged dairy categories that share similar filling lines, cold-chain needs, and retail dynamics with milkshakes.

Demand is being pulled by practical, day-to-day drivers: urban time constraints, on-the-go snacking, and consumers using dairy beverages as a “small meal” for energy and satiety. In India—an important bellwether market for packaged dairy—government statistics indicate total milk production of 230.58 million tonnes in 2022–23, with per-capita availability of 459 grams per day.

Public programs aimed at quality, chilling, and testing infrastructure also shape the operating environment for packaged milkshakes because they reduce spoilage risk upstream and improve consistency of incoming milk. India’s Department of Animal Husbandry & Dairying reports that under NPDD, 5,125 bulk milk coolers totaling 113.30 lakh litres of chilling capacity were installed, alongside 4,267 milk analysers, 47,857 automatic milk collection/data processing units, and 6,266 electronic milk adulteration testing equipment units at village societies.

Key Takeaways

- Packaged Milkshakes Market size is expected to be worth around USD 575.5 Million by 2034, from USD 303.7 Million in 2024, growing at a CAGR of 6.6%.

- Plastic held a dominant market position, capturing more than a 44.8% share in the packaged milkshakes market.

- Chocolate held a dominant market position, capturing more than a 42.9% share in the packaged milkshakes market.

- Offline held a dominant market position, capturing more than a 66.1% share in the packaged milkshakes market.

- Asia Pacific region maintained its status as a key driver of the packaged milkshakes market, capturing 37.5% share with an estimated consumption volume of 113.8 million.

By Packaging Material Analysis

Plastic packaging leads with 44.8% as convenience and cost efficiency shape buying choices

In 2024, Plastic held a dominant market position, capturing more than a 44.8% share in the packaged milkshakes market. This leadership was mainly supported by the widespread use of plastic bottles and cups that offer light weight, easy handling, and strong resistance to breakage during transport and retail handling. Plastic packaging helped manufacturers extend shelf life while maintaining product freshness, which is important for ready-to-drink dairy beverages. During 2024, rising demand for on-the-go consumption and single-serve formats further supported the preference for plastic, especially across convenience stores, supermarkets, and vending channels.

The material also allowed greater flexibility in packaging design, helping brands attract younger consumers through visually appealing shapes and labels. Moving into 2025, plastic continued to remain the preferred packaging choice as producers focused on cost control and efficient large-scale distribution. At the same time, improvements in recyclable and lightweight plastic formats supported continued usage without major shifts in material preference. Overall, plastic packaging remained central to packaged milkshake distribution, reinforcing its leading share across global markets.

By Flavor Analysis

Chocolate flavor leads with 42.9% as familiar taste drives repeat consumption

In 2024, Chocolate held a dominant market position, capturing more than a 42.9% share in the packaged milkshakes market. This strong preference was mainly driven by the wide consumer appeal of chocolate across all age groups, making it a reliable and high-volume flavor choice for manufacturers. Chocolate milkshakes are often seen as both indulgent and comforting, which supported steady demand in retail and on-the-go consumption during 2024.

The flavor also blends well with added ingredients such as protein, malt, and functional nutrients, helping brands expand product ranges without changing core taste expectations. Moving into 2025, chocolate continued to retain its leading position as consumer demand remained stable in both developed and emerging markets. Its consistent performance in terms of taste acceptance and repeat purchases reinforced its role as the most commercially dependable flavor segment. Overall, chocolate remained the cornerstone of flavor portfolios in the packaged milkshakes market, supporting its dominant share.

By Distribution Channel Analysis

Offline channels dominate with 66.1% as in-store visibility and impulse buying remain strong

In 2024, Offline held a dominant market position, capturing more than a 66.1% share in the packaged milkshakes market. This dominance was mainly supported by the strong presence of supermarkets, hypermarkets, convenience stores, and local retail outlets where consumers prefer to purchase ready-to-drink beverages. Physical stores allowed buyers to see packaging, check expiry dates, and benefit from immediate availability, which remained important purchasing factors during 2024.

Offline channels also benefited from impulse buying, especially in high-footfall locations such as malls, transit points, and neighborhood stores. In addition, promotional offers, in-store discounts, and bundled deals continued to influence consumer choices at the point of sale. Moving into 2025, offline distribution maintained its leading role as cold-chain availability and shelf space for dairy beverages expanded further in urban and semi-urban areas. While online sales continued to grow gradually, offline retail remained the primary route for packaged milkshakes, supporting its strong and stable market share.

Key Market Segments

By Packaging Material

- Paper

- Tin

- Glass

- Plastic

By Flavor

- Chocolate

- Vanilla

- Strawberry

- Others

By Distribution Channel

- Offline

- Online

Emerging Trends

Rise of Health-Forward and Functional Milkshake Variants

A clear and meaningful trend shaping the packaged milkshake category today is the shift toward health-forward and functional variants that go beyond simple taste and sweetness. Consumers are increasingly aware of what they put into their bodies, and many want beverages that support their daily nutrition needs rather than simply satisfying a sweet craving. This trend is not superficial—it is grounded in public health signals and nutrition guidance that people are paying attention to, and it is steering how brands develop new products.

At its core, this trend reflects a broader shift in how people think about drinks. Where once a packaged milkshake was primarily seen as a treat or an occasional refreshment, more consumers now expect drinks to offer added value—like protein for muscle support, vitamins for immunity, or lower levels of added sugar for everyday health. This trend aligns quite directly with global health advice. For instance, the World Health Organization (WHO) continues to urge countries to reduce intake of “free sugars” to below 10% of total energy intake, with further benefits suggested at below 5%.

At the same time, the baseline for everyday nutrition still points to dairy as a valuable source. The FAO/WHO/UNU protein requirements framework sets a reference of 0.83 grams of protein per kilogram of body weight per day for healthy adults. Within this context, a packaged milkshake that meaningfully contributes to protein needs—especially for active or busy adults—can be legitimately positioned as part of a balanced diet. Consumers want that clarity rather than ambiguity, and functional variants give brands the language to communicate benefits that are easy to understand.

Evidence of processing scale also supports this trend becoming mainstream rather than niche. The International Dairy Federation’s World Dairy Situation report records that global unprocessed milk production reached 964 million tonnes in 2023, and of that, 463 million tonnes of cow’s milk were delivered to dairy processors, representing around 59% of cow’s milk production.

Drivers

Cold-Chain and Quality Infrastructure Makes Packaged Milkshakes Easier to Trust

One major driving factor for packaged milkshakes is the steady build-out of reliable dairy processing, chilling, and quality testing infrastructure, which makes it easier to produce a consistent drink and move it safely through longer distribution routes. Packaged milkshakes are sensitive: small changes in raw milk quality, temperature control, or hygiene can quickly affect taste, texture, and shelf life. When the industry has better cold-chain reach and stronger testing at the village and plant level, brands can scale beyond local markets and sell milkshakes through modern retail, schools, e-commerce, and on-the-go channels with lower spoilage risk.

The base for this driver is simply scale. In 2023, global unprocessed milk production reached 964 million tonnes (all species), showing how large the raw material pool already is. More importantly for packaged beverages, the same source notes that unprocessed cow’s milk delivered for processing rose to 463 million tonnes in 2023, representing 59% of total cow’s milk production. More importantly for packaged beverages, the same source notes that unprocessed cow’s milk delivered for processing rose to 463 million tonnes in 2023, representing 59% of total cow’s milk production.

India shows how government-backed infrastructure can push this driver faster. Official releases report per-capita milk availability of 459 grams per day in 2022–23 in India, compared with a world average of 322 grams per day in 2022, highlighting both supply depth and the opportunity to convert more milk into branded, higher-value products. Government data states that NPDD interventions included 5,125 bulk milk coolers with 113.30 lakh litres of cooling capacity, plus 47,857 village-level societies equipped with automatic milk collection/data processing units and milk analysers, and 6,266 societies equipped with electronic milk adulteration testing equipment.

The same government note also points to capacity creation that supports value-added dairy categories: 27.53 lakh litres per day of milk processing capacity and 30 metric tonnes of value-added products capacity were created, and around 82 dairy plants were strengthened/refurbished. For milkshake producers, that kind of modernization translates into better uptime, improved hygiene controls, and the confidence to run new SKUs without disrupting core milk operations.

Restraints

High Sugar Scrutiny and New Health Policies Restrain Growth

A major restraining factor for packaged milkshakes is simple: many popular recipes are sugar-heavy, and public health policy is moving steadily in the opposite direction. Packaged milkshakes are often bought as a “treat drink,” but once they sit next to soft drinks and flavored RTD beverages on the same shelf, they also get judged the same way—by how much sugar they carry, how often children consume them, and whether the label looks “too sweet to be everyday.” This shift in perception can slow repeat purchases, force reformulation, and raise compliance costs for brands that built their taste profile around sweetness and indulgence.

Health guidance is already quite direct. The World Health Organization (WHO) recommends that adults and children reduce “free sugars” to less than 10% of total energy intake, and suggests that a further reduction to below 5% brings additional health benefits. In practical terms, WHO’s communication highlights roughly 25 grams per day as a reference point for the stricter level. When a packaged milkshake is positioned as a convenient, ready-to-drink product, this kind of guidance matters because consumers increasingly compare beverages by sugar load—even if they still love the taste. The result is a tension: the product needs to stay “milkshake-like,” but also needs to look reasonable on a nutrition panel.

That tension is turning into policy in some markets, and policy can be a hard brake. In the UK, the government announced an update to the Soft Drinks Industry Levy (SDIL) that lowers the threshold from 5g of total sugar per 100ml to 4.5g per 100ml. Reuters reported that the UK will end the exemption for pre-packaged milk-based drinks (including bottled milkshakes and milky coffees) and that the change is planned to start in January 2028; the same report says the change is expected to raise up to £45 million annually.

Opportunity

High-Protein and Fortified Milkshakes Can Unlock New Demand

One major growth opportunity for packaged milkshakes is to move beyond “only a sweet treat” and become a better-for-you, everyday nutrition drink—especially through high-protein and fortified options. This matters because many shoppers now read labels the way they read a bank statement: they look for value, not just taste. When a milkshake can honestly say it supports protein intake, or adds key vitamins, it earns space in more routines—breakfast on the move, post-work snacks, school tiffins, and even light evening meals. The opportunity is not just in fancy flavors; it is in making the product feel “worth it” for families and working adults.

The demand logic is already there in nutrition guidance. The FAO/WHO/UNU approach used by India’s ICMR-NIN sets a safe protein intake at 0.83 g per kg body weight per day for healthy adults. For a brand, that number becomes a product design target: a packaged milkshake that delivers meaningful protein per serving can be positioned as a practical way to help people meet daily needs, without turning the drink into a supplement. This is also where dairy fits naturally, because milk proteins are widely accepted and familiar—so the marketing does not need to “teach” consumers what the ingredient is.

Fortification is the second lever that can expand the category into more health-led buying occasions. India’s Food Safety and Standards (Fortification of Foods) Regulations allow milk to be fortified (when it undergoes pasteurization/UHT/sterilization) with Vitamin A at 270–450 μg RE per litre and Vitamin D at 5–7.5 μg per litre. Packaged milkshakes can build on the same compliant fortification framework, which helps brands talk about “added nutrition” in a regulated and standardized way rather than vague claims.

This opportunity becomes much more realistic when the supply chain can support consistent quality at scale. Globally, the International Dairy Federation’s “World Dairy Situation” reporting shows global unprocessed milk production reached 964 million tonnes in 2023, and it also notes 463 million tonnes of cow’s milk were delivered to dairy processors in 2023 (about 59% of cow’s milk production).

Regional Insights

Asia Pacific Packaged Milkshakes Market – Leading Region with 37.5 % Share and 113.8 Mn in 2024

In 2024, the Asia Pacific region maintained its status as a key driver of the packaged milkshakes market, capturing 37.5% share with an estimated consumption volume of 113.8 million units. This strong regional performance was supported by growing urbanisation, rising disposable incomes, and increasing westernisation of dietary habits, which together have encouraged greater acceptance of convenience beverages including ready-to-drink milkshakes across countries such as China, India, Japan and South Korea.

Urban lifestyles in Asia Pacific continue to favour on-the-go products, where packaged milkshakes offer quick nutrition and familiar taste profiles that align with busy consumer routines. The region also benefits from expanding retail networks that strengthen accessibility, with supermarkets and convenience stores increasing shelf presence for local and international branded milkshake offerings.

Additionally, shifting consumer preferences toward healthier and fortified dairy beverage variants have encouraged product innovation, further broadening regional appeal. Historical data indicates that Asia Pacific was already the largest packaged milkshakes market prior to 2024, driven by population scale and diverse demographic segments receptive to both traditional and novel flavours.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Dairy Farmers of America, Inc.: Dairy Farmers of America (DFA) is a major U.S. milk marketing cooperative that supplies raw milk and dairy ingredients to branded and private-label packaged milkshake producers. DFA reported approximately US$23 billion in revenue in 2024, illustrating its large role in supplying milk and dairy inputs to the beverage segment.

GCMMF (Amul): The Gujarat Cooperative Milk Marketing Federation Ltd (GCMMF), marketing the Amul brand, remains a dominant Indian dairy cooperative with annual turnover rising to around Rs 65,911 crore (~US$7.3 billion) in FY25, supported by strong dairy and milkshake product growth across domestic markets.

THE HERSHEY COMPANY: The Hershey Company is a major U.S. confectionery and snack producer that also participates in the packaged milkshakes segment with chocolate-flavoured dairy beverages leveraging its strong brand recognition and chocolate expertise. In 2024, the company reported US$2.90 billion in operating income and US$2.22 billion net income, reflecting broad global food and beverage operations that support its milkshake product lines and seasonal offerings.

Top Key Players Outlook

- THE HERSHEY COMPANY

- DANONE

- Müller UK & Ireland

- Dairy Farmers of America, Inc.

- GCMMF

- CavinKare Group

- Mother Dairy Fruit & Vegetable Pvt. Ltd.

- Britannia Industries

- FrieslandCampina

Recent Industry Developments

In 2024, Hershey reported consolidated net sales of USD 11,202.3 million and net income of USD 2,221.2 million, reflecting overall company strength in confectionery, snacks and related beverage segments, including milkshake formats that often pair with its core chocolate-based offerings on retail shelves.

In 2024, Danone reported annual sales of €27.376 billion, driven by growth in its Essential Dairy and Plant-Based (EDP) segment, which includes high-protein and functional dairy products that appeal to health-focused consumers and support on-the-go consumption trends relevant to milkshake formats.

Report Scope

Report Features Description Market Value (2024) USD 303.7 Mn Forecast Revenue (2034) USD 575.5 Mn CAGR (2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Packaging Material (Paper, Tin, Glass, Plastic), By Flavor (Chocolate, Vanilla, Strawberry, Others), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape THE HERSHEY COMPANY, DANONE, Müller UK & Ireland, Dairy Farmers of America, Inc., GCMMF, CavinKare Group, Mother Dairy Fruit & Vegetable Pvt. Ltd., Britannia Industries, FrieslandCampina Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- THE HERSHEY COMPANY

- DANONE

- Müller UK & Ireland

- Dairy Farmers of America, Inc.

- GCMMF

- CavinKare Group

- Mother Dairy Fruit & Vegetable Pvt. Ltd.

- Britannia Industries

- FrieslandCampina