Global Oxycodone Market By Formulation (Immediate-Release and Controlled-Release), By Route of Administration (Oral, Intravenous and Others), By Patient Type (Adult and Geriatric), By Distribution Channel (Retail Pharmacies, Hospital Pharmacies and Online Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172669

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Formulation Analysis

- Route of Administration Analysis

- Patient Type Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

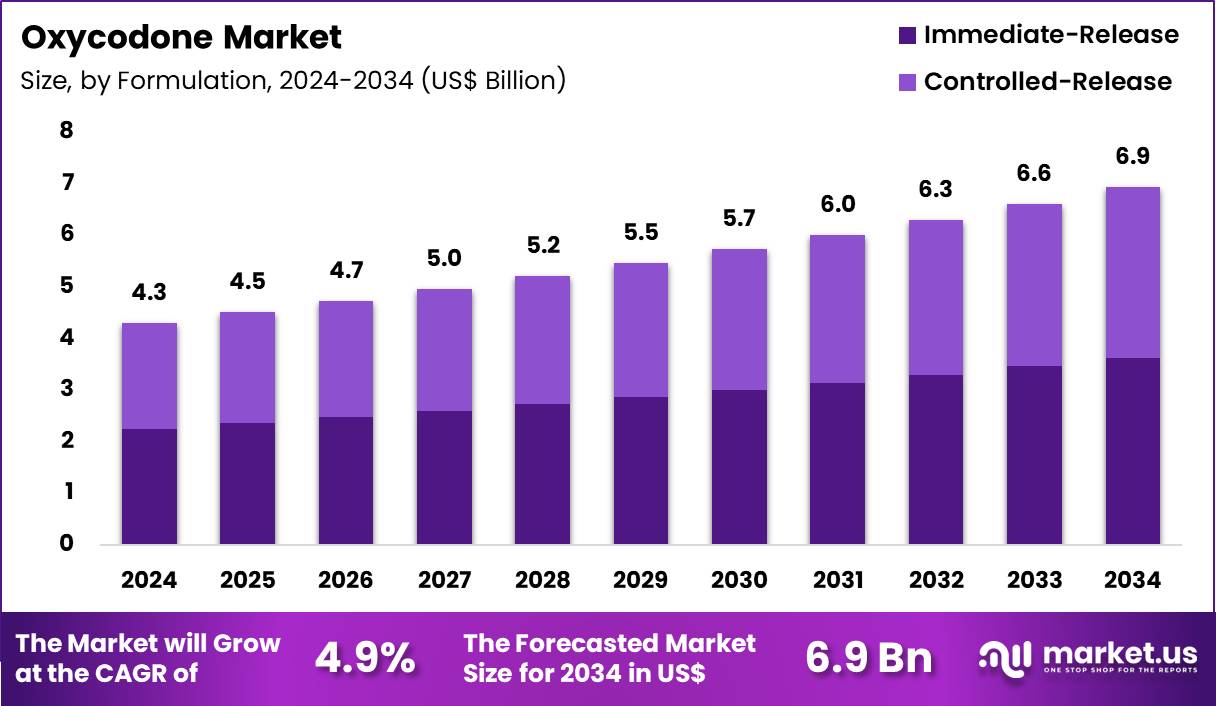

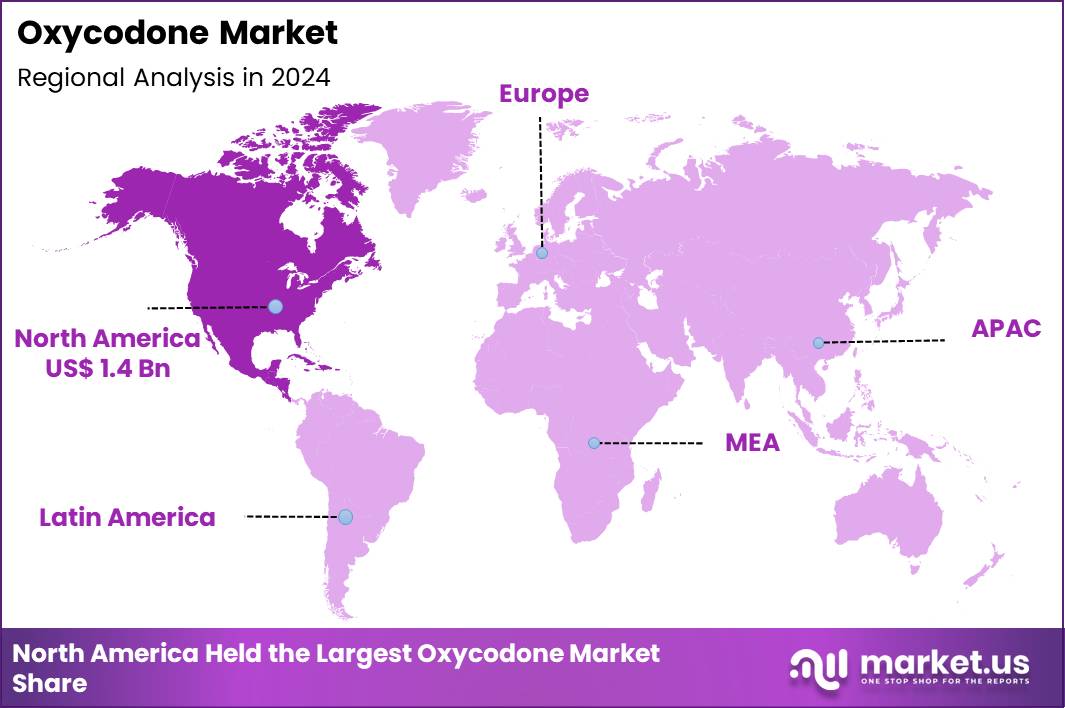

The Global Oxycodone Market size is expected to be worth around US$ 6.9 Billion by 2034 from US$ 4.3 Billion in 2024, growing at a CAGR of 4.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 33.5% share with a revenue of US$ 1.4 Billion.

Growing demand for effective management of moderate to severe pain sustains the oxycodone market as physicians prescribe these potent opioids for conditions unresponsive to non-opioid alternatives. Clinicians frequently administer immediate-release oxycodone formulations to address acute postoperative pain, providing rapid onset relief during recovery phases in surgical patients. These drugs serve palliative care needs by alleviating cancer-related nociceptive and neuropathic pain, improving quality of life in advanced disease stages.

Healthcare providers employ extended-release oxycodone variants for chronic non-malignant pain syndromes, such as osteoarthritis and lower back disorders, ensuring steady plasma levels over extended periods. These medications facilitate breakthrough pain control in opioid-tolerant individuals through supplemental immediate-release doses alongside baseline therapy.

In 2024, Protega Pharmaceuticals received FDA approval for ROXYBOND™, an immediate release oxycodone tablet incorporating abuse deterrent technology for pain management. This approval drives the oxycodone market by reinforcing the shift toward safer opioid formulations that address regulatory and public health concerns.

Abuse deterrent features improve acceptance among prescribers and regulators, supporting continued clinical use of oxycodone while mitigating misuse risks. Such innovations sustain demand for branded and reformulated oxycodone products in a tightly regulated pain management landscape.

Pharmaceutical companies capitalize on opportunities to refine tamper-resistant coatings that hinder extraction for intravenous abuse, expanding applications in high-risk patient populations requiring long-term opioid therapy. Developers integrate novel excipients into oxycodone tablets to resist crushing and snorting, enhancing safety profiles for outpatient management of neuropathic pain from diabetic peripheral neuropathy. These advancements broaden utility in trauma care, where controlled-release preparations maintain analgesia during immobilization and rehabilitation without frequent redosing.

Opportunities arise in combining oxycodone with non-opioid analgesics in fixed-dose products, optimizing multimodal approaches for complex regional pain syndrome treatment. Firms explore patient-specific dosing algorithms supported by abuse-deterrent designs, tailoring regimens for fibromyalgia patients experiencing widespread musculoskeletal discomfort. Enterprises invest in bioequivalent generics with deterrent properties, facilitating cost-effective options for palliative sedation in end-stage organ failure.

Industry participants advance physicochemical barriers in oxycodone formulations that form viscous gels upon solvent exposure, deterring injection in postoperative orthopedic recovery protocols. Developers prioritize extended-release microspheres for subcutaneous delivery, offering prolonged efficacy in sickle cell crisis vaso-occlusive pain episodes.

Market leaders incorporate aversive agents that trigger unpleasant effects when tampered, strengthening safeguards in chronic lower back pain maintenance therapy. Innovators refine oral disintegrating tablets with rapid deterrent activation, supporting elderly patients with dysphagia in managing arthritis flares.

Companies emphasize multilayer tablet architectures that preserve therapeutic release while complicating manipulation for breakthrough cancer pain interventions. Ongoing formulations focus on dual-mechanism deterrents combining physical hardness with chemical inactivation, elevating standards in comprehensive pain stewardship programs.

Key Takeaways

- In 2024, the market generated a revenue of US$ 4.3 Billion, with a CAGR of 4.9%, and is expected to reach US$ 6.9 Billion by the year 2034.

- The formulation segment is divided into immediate-release and controlled-release, with immediate-release taking the lead in 2024 with a market share of 52.3%.

- Considering route of administration, the market is divided into oral, intravenous and others. Among these, oral held a significant share of 64.1%.

- Furthermore, concerning the patient type segment, the market is segregated into adult and geriatric. The adult sector stands out as the dominant player, holding the largest revenue share of 59.5% in the market.

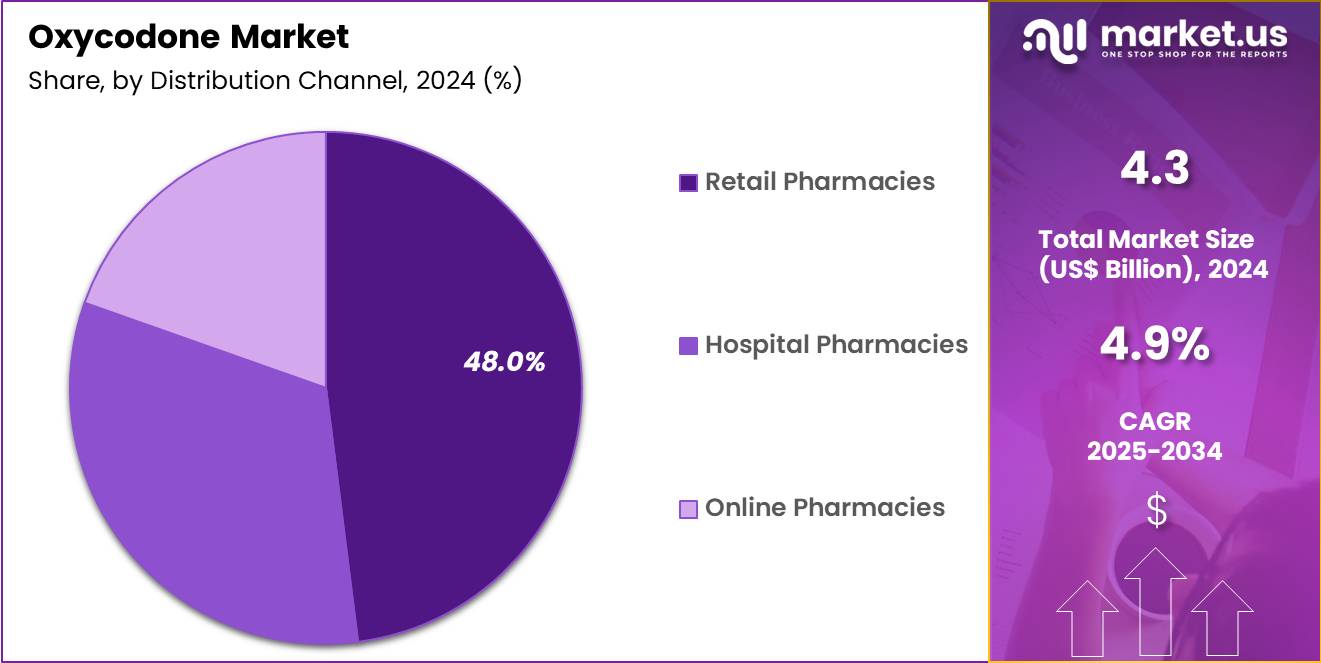

- The distribution channel segment is segregated into retail pharmacies, hospital pharmacies and online pharmacies, with the retail pharmacies segment leading the market, holding a revenue share of 48.0%.

- North America led the market by securing a market share of 33.5% in 2024.

Formulation Analysis

Immediate release formulations accounted for 52.3% of the oxycodone market, reflecting strong demand for rapid onset pain relief in acute and breakthrough pain management. Physicians prefer these formulations for postoperative pain, injury related pain, and short term analgesic needs due to faster absorption and predictable pharmacokinetics. Flexible dosing supports individualized pain control across diverse clinical scenarios.

Emergency care and outpatient procedures continue to rely on immediate release options to manage fluctuating pain intensity. Shorter duration of action aligns with controlled prescribing practices and tapering protocols. Prescribers increasingly select immediate release products to reduce prolonged opioid exposure. Clinical guidelines often recommend starting therapy with immediate release formulations before escalation.

Manufacturing focus on abuse deterrent features further supports adoption. Broad availability across strengths enhances prescribing convenience. This segment is projected to sustain growth due to its clinical versatility and alignment with responsible pain management strategies.

Route of Administration Analysis

Oral administration represented 64.1% of the oxycodone market, driven by ease of use and high patient acceptance across care settings. Oral dosing supports outpatient pain management without the need for specialized medical supervision. Clinicians favor oral formulations for chronic and subacute pain due to predictable absorption profiles. Patient preference for noninvasive administration improves adherence and treatment continuity. Oral oxycodone integrates smoothly into stepwise pain management protocols.

Cost effectiveness compared to parenteral routes strengthens utilization in routine care. Pharmacies maintain consistent stock of oral formulations, ensuring uninterrupted access. Home based recovery trends increase reliance on oral pain medications. Standardized oral dosing simplifies prescribing and monitoring practices. As a result, oral administration is anticipated to remain dominant due to convenience driven demand and broad clinical applicability.

Patient Type Analysis

Adult patients accounted for 59.5% of the oxycodone market, reflecting higher exposure to surgery, trauma, and occupational injuries. Adults represent the largest population receiving short term opioid prescriptions for acute pain episodes. Rising surgical volumes in orthopedics and general surgery contribute to sustained demand.

Physicians prioritize effective pain control in adults to support faster functional recovery. Adult patients typically demonstrate higher tolerance for titrated dosing regimens. Insurance coverage for adult populations improves access to prescription pain therapies. Chronic musculoskeletal conditions in adults further expand treatment needs.

Structured pain management programs often target adult patients for monitored opioid use. Regular follow up enables controlled continuation or discontinuation of therapy. This segment is likely to maintain leadership due to higher treatment incidence and broader clinical exposure.

Distribution Channel Analysis

Retail pharmacies held a 48.0% share of the oxycodone market, supported by widespread geographic presence and dispensing convenience. Patients rely on retail outlets for timely access to prescribed pain medications after hospital discharge. Integrated prescription systems improve dispensing accuracy and monitoring. Retail pharmacies support continuity of care through refill management and patient counseling.

Extended operating hours enhance accessibility for working adults. Insurance reimbursement frameworks frequently favor retail pharmacy distribution. Pharmacist oversight supports adherence to regulatory and safety requirements. Expansion of chain pharmacies increases reach in urban and suburban regions. Electronic prescribing streamlines prescription fulfillment processes. Consequently, retail pharmacies are expected to remain the leading distribution channel due to accessibility, efficiency, and patient preference.

Key Market Segments

By Formulation

- Immediate-Release

- Controlled-Release

By Route of Administration

- Oral

- Intravenous

- Others

By Patient Type

- Adult

- Geriatric

By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

Drivers

Stable demand for short-acting oxycodone prescriptions is driving the market

The oxycodone market maintains growth through stable demand for short-acting formulations, which remain the most frequently dispensed opioid analgesic for acute pain management in clinical settings. Physicians continue to prescribe these for post-operative care and injury-related pain, ensuring consistent utilization despite broader opioid restrictions. Healthcare providers value the rapid onset of short-acting oxycodone for patient comfort in ambulatory environments.

Pharmaceutical distribution channels report steady volumes, reflecting ongoing clinical reliance on established therapies. Regulatory frameworks permit judicious use for legitimate medical needs, supporting market stability. Patient demographics, particularly older adults, contribute to sustained prescription rates due to age-related conditions requiring pain relief. Professional guidelines advocate for short-term prescriptions to balance efficacy and safety.

Supply chain adaptations ensure availability for essential indications amid evolving controls. According to the New York State Department of Health’s Opioid Annual Data Report 2025, the short-acting oxycodone prescription rate per 1,000 population in the last quarter was 119.5 in 2022, 115.6 in 2023, and 120.0 in 2024. This stability underscores the enduring role of oxycodone in addressing targeted pain scenarios within the therapeutic landscape.

Restraints

Increasing diversion and theft of opioid narcotics is restraining the market

The oxycodone market suffers setbacks from escalating diversion and theft incidents, which heighten regulatory scrutiny and disrupt legitimate supply chains. Criminal networks target pharmacies and transportation routes to obtain oxycodone for illicit resale, eroding public trust in prescription systems. Law enforcement agencies intensify monitoring, leading to delays in distribution and higher compliance costs for manufacturers.

Healthcare facilities implement stricter inventory controls, complicating access for authorized users. Insurers adjust policies to limit coverage amid abuse concerns, reducing prescription volumes. Pharmaceutical companies invest in security measures, diverting resources from innovation. Judicial actions against diversion schemes impose legal risks on stakeholders.

Market participants face reputational damage from associated criminal activities. According to the Drug Enforcement Administration’s 2025 National Drug Threat Assessment, unaccounted-for opioid dosage units increased to 6.6 million in 2024 from 5 million in 2023. These dynamics collectively impose operational constraints and limit market expansion potential.

Opportunities

Renewed demand for licit prescription medications amid illicit opioid risks is creating growth opportunities

The oxycodone market explores expansion through renewed patient and provider preference for legitimate prescriptions, driven by fears of contaminated illicit alternatives. Individuals seeking pain relief increasingly opt for regulated sources to avoid adulterated street drugs. Clinicians advocate for prescription monitoring to ensure safe access amid the fentanyl crisis. Pharmaceutical firms position oxycodone as a reliable option in controlled therapeutic regimens.

Health policy initiatives promote education on risks of unregulated markets, boosting demand for verified products. Supply partnerships enhance traceability, appealing to risk-averse consumers. Research into patient behaviors highlights shifts toward pharmacy-sourced medications. Global collaborations address supply integrity to capitalize on this preference.

According to the Drug Enforcement Administration’s 2025 National Drug Threat Assessment, theft and loss of opioid narcotics increased in 2024, linked to distrust of fentanyl-laced street pills and renewing demand for licit medications. This shift presents avenues for strengthened positioning in secure, prescription-based channels.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic trends bolster the oxycodone market as expanding healthcare budgets and persistent chronic pain prevalence drive pharmaceutical firms to increase production of controlled-release formulations for effective long-term management. Leading companies strategically enhance supply chains with innovative delivery systems, capitalizing on aging demographics and rising surgical procedures to sustain demand in mature economies.

Stubborn inflation and economic slowdowns, however, inflate raw material costs for active ingredients and packaging, compelling manufacturers to raise prices and prompting hospitals to limit prescriptions amid tighter reimbursement policies. Geopolitical tensions, particularly U.S.-China trade disputes and regional conflicts in key sourcing areas, routinely disrupt ingredient shipments from India and Latin America, fostering shortages and operational uncertainties for globally dependent suppliers.

Current U.S. tariffs impose substantial duties on imported branded pharmaceuticals, amplifying procurement expenses for American distributors and eroding affordability for patients reliant on overseas generics. These tariffs also incite reciprocal barriers from trading partners that constrain U.S. exports of advanced oxycodone therapies and slow multinational collaborative efforts.

Still, the tariff pressures galvanize substantial commitments to North American manufacturing hubs and diversified sourcing strategies, cultivating fortified infrastructures that promise accelerated innovation and steadfast market progression for the foreseeable future.

Latest Trends

Increase in fraudulent electronic prescriptions for oxycodone is a recent trend

In 2024, the oxycodone market has encountered a notable trend involving the rise in fraudulent electronic prescriptions, exploiting digital systems for unauthorized access and diversion. Criminals compromise prescriber credentials to issue e-scripts for oxycodone, facilitating illicit distribution through pharmacies. Law enforcement documents surges in such schemes across multiple states, prompting enhanced verification protocols.

Healthcare providers adopt multifactor authentication to counter identity theft in prescribing platforms. Pharmaceutical regulators issue alerts on vulnerabilities in e-prescribing networks. Patient safety concerns escalate as fraudulent scripts lead to unintended dispensing. Industry stakeholders collaborate on cybersecurity measures to safeguard prescription integrity. Research analyzes patterns in fraudulent activities to inform preventive strategies.

According to the Drug Enforcement Administration’s 2025 National Drug Threat Assessment, fraudulent electronic prescriptions for oxycodone increased between 2023 and 2024, with cases involving thousands of diverted units. This development signals a shift toward technology-driven abuse, necessitating adaptive responses in market oversight.

Regional Analysis

North America is leading the Oxycodone Market

In 2024, North America held a 33.5% share of the global oxycodone market, fueled by ongoing demands for potent analgesics in managing chronic non-cancer pain and postoperative recovery, amid a landscape shaped by regulatory refinements to balance efficacy with abuse prevention. Physicians continued prescribing extended-release formulations to improve patient adherence in arthritis and neuropathic pain cases, supported by updated guidelines from professional bodies emphasizing individualized dosing.

Hospital systems expanded utilization for acute trauma and orthopedic procedures, leveraging tamper-resistant variants to mitigate diversion risks in high-volume emergency departments. Pharmaceutical manufacturers innovated with combination therapies incorporating naloxone deterrents, aligning with federal initiatives to enhance safety profiles while addressing unmet needs in palliative care.

Demographic factors, such as rising obesity rates contributing to joint disorders, intensified reliance on these agents for long-term symptom control. Insurance expansions facilitated broader access through tiered formularies, encouraging outpatient management to reduce healthcare burdens.

Collaborative monitoring programs between states and prescribers tracked utilization patterns, ensuring sustained availability despite scrutiny. According to a Centers for Disease Control and Prevention report, a total of 352 cases suspected to involve counterfeit M-30 oxycodone pills occurred from 2017 to 2022, underscoring persistent market demand and the challenges of illicit supply infiltration.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts predict substantial advancement in the oxycodone segment across Asia Pacific throughout the forecast period, driven by intensifying healthcare investments to tackle escalating chronic pain burdens from diabetes and musculoskeletal ailments. Clinicians integrate controlled-release options into oncology protocols, optimizing relief for cancer patients in expanding urban treatment hubs.

Governments subsidize essential formulations through national formularies, enabling rural facilities to address postoperative needs amid surgical procedure surges. Pharmaceutical entities localize production of abuse-deterrent versions, complying with regional pharmacovigilance standards to curb non-medical misuse. Community health campaigns educate practitioners on rational prescribing, fostering uptake in geriatric care for age-related degenerative conditions.

Trade agreements facilitate imports of high-quality generics, bridging supply gaps in island nations facing logistical hurdles. Academic collaborations refine dosing guidelines tailored to ethnic pharmacodynamics, enhancing therapeutic outcomes in diverse populations. The United Nations Office on Drugs and Crime reports that nearly half of the world’s non-medical opioid users reside in South Asia and South-West Asia, according to its 2024 World Drug Report.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the oxycodone market pursue growth by emphasizing abuse-deterrent formulations, controlled-release profiles, and strict compliance frameworks that align with evolving opioid stewardship standards. Companies strengthen positioning through close coordination with regulators, healthcare providers, and monitoring programs to ensure appropriate prescribing within pain-management pathways.

Commercial strategies prioritize hospital and specialty-care channels, supported by education on risk mitigation, dosing precision, and patient selection. Manufacturing investments focus on supply reliability, quality controls, and formulation science that supports differentiated delivery characteristics.

Market participants also expand geographically where regulatory clarity and controlled access systems permit responsible commercialization. Purdue Pharma exemplifies a legacy participant with deep expertise in pain therapeutics, established manufacturing and compliance infrastructure, and a focused approach to responsible product management within regulated opioid markets.

Top Key Players

- Purdue Pharma L.P.

- Hikma Pharmaceuticals PLC

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Amneal Pharmaceuticals, Inc.

- Mallinckrodt Pharmaceuticals

- Lannett Company, Inc.

- ANI Pharmaceuticals, Inc.

- VistaPharm, Inc.

- Xanodyne Pharmaceuticals

- KVK‑Tech Inc.

- Lupin

Recent Developments

- In 2025, Elite Pharmaceuticals, Inc. launched a generic version of Percocet® containing oxycodone hydrochloride and acetaminophen for the treatment of moderate to moderately severe pain. This launch drives the oxycodone market by increasing the availability of cost effective generic alternatives, improving patient access across hospital and outpatient settings. Expanded generic supply supports prescription volumes in price sensitive markets and strengthens oxycodone’s role as a widely used analgesic option within combination pain therapies.

- In July 2022, Teva Pharmaceuticals reached an agreement in principle to resolve litigation related to the opioid epidemic involving nearly 2,500 municipal, state, and tribal governments. This development influences the oxycodone market by bringing greater legal clarity and stability to opioid manufacturing and distribution. Resolution frameworks enable manufacturers to continue supplying essential pain medications under defined compliance and monitoring conditions, supporting sustained but controlled oxycodone availability. Increased regulatory oversight following such settlements also drives demand for compliant manufacturing, distribution, and risk management practices within the oxycodone market.

Report Scope

Report Features Description Market Value (2024) US$ 4.3 Billion Forecast Revenue (2034) US$ 6.9 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Formulation (Immediate-Release and Controlled-Release), By Route of Administration (Oral, Intravenous and Others), By Patient Type (Adult and Geriatric), By Distribution Channel (Retail Pharmacies, Hospital Pharmacies and Online Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Purdue Pharma L.P., Hikma Pharmaceuticals PLC, Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Amneal Pharmaceuticals, Inc., Mallinckrodt Pharmaceuticals, Lannett Company, Inc., ANI Pharmaceuticals, Inc., VistaPharm, Inc., Xanodyne Pharmaceuticals, KVK‑Tech Inc., Lupin Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Purdue Pharma L.P.

- Hikma Pharmaceuticals PLC

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Amneal Pharmaceuticals, Inc.

- Mallinckrodt Pharmaceuticals

- Lannett Company, Inc.

- ANI Pharmaceuticals, Inc.

- VistaPharm, Inc.

- Xanodyne Pharmaceuticals

- KVK‑Tech Inc.

- Lupin