Global Oven Toaster Grill Market Size, Share, Growth Analysis By Product Type (Electric, Gas), By Power Rating (1000W-1500W, Below 1000W, Above 1500W), By Application (Residential, Commercial Kitchens, Hotels, Restaurants), By Distribution Channel (Online Stores, Supermarkets/Hypermarkets, Specialty Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177091

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

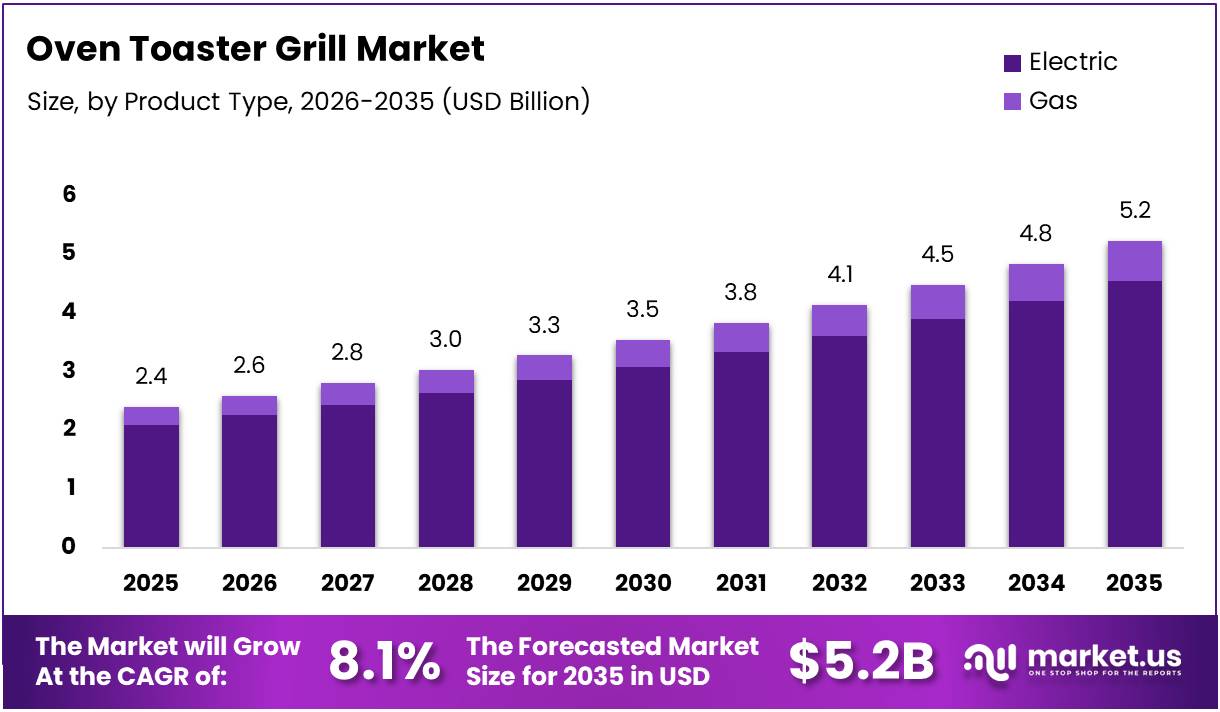

The Global Oven Toaster Grill Market size is expected to be worth around USD 5.2 Billion by 2035 from USD 2.4 Billion in 2025, growing at a CAGR of 8.1% during the forecast period 2026 to 2035.

The oven toaster grill market encompasses compact, multifunctional kitchen appliances designed for toasting, baking, grilling, and reheating food. These versatile devices combine the capabilities of traditional ovens and grills in space-efficient formats. Consequently, they have become essential appliances in modern residential and commercial kitchens worldwide.

Rising urbanization and changing consumer lifestyles drive significant market expansion. Modern households increasingly prioritize convenience, energy efficiency, and space optimization in kitchen design. Moreover, the growing middle-income population seeks affordable yet advanced cooking solutions that deliver restaurant-quality results at home.

The market benefits from widespread adoption of compact multi-function household kitchen appliances across urban households. Consumers value the ability to prepare diverse meals using a single device. Additionally, the energy-saving potential compared to conventional ovens makes these appliances economically attractive for cost-conscious buyers seeking sustainable cooking alternatives.

E-commerce platforms and organized retail channels facilitate broader market accessibility and consumer education. Online stores enable customers to compare features, read reviews, and make informed purchasing decisions. Furthermore, digital marketing and influencer endorsements significantly impact consumer preferences and drive product awareness among younger demographics.

Product innovation focuses on smart controls, preset cooking programs, and health-oriented features. Manufacturers integrate digital displays, touch controls, and advanced heating technologies to enhance user experience. Therefore, premium aesthetic designs in stainless steel finishes appeal to consumers seeking modern kitchen aesthetics alongside functional performance.

According to Energy Star, cooking a meal in a toaster oven has the potential to save over 50% of the energy used to cook the same meal in a conventional electric oven. This substantial energy efficiency drives environmentally conscious consumers toward adoption. Moreover, approximately 27% of households use their toaster oven for only toasting, while 7% use it exclusively for baking.

According to Lifetips Alibaba research, preheating typical toaster ovens often takes 3-5 minutes at full power, adding approximately 0.06-0.09 kWh to overall energy per session before cooking starts. However, users who load multiple items in a single cycle see per-item energy efficiency improvements of roughly 33-49% compared to sequential use, demonstrating significant optimization potential.

Key Takeaways

- The global Oven Toaster Grill Market is projected to grow from USD 2.4 Billion in 2025 to USD 5.2 Billion by 2035 at a CAGR of 8.1%.

- Electric products dominate the market with 87.5% share due to convenience and widespread household electricity access.

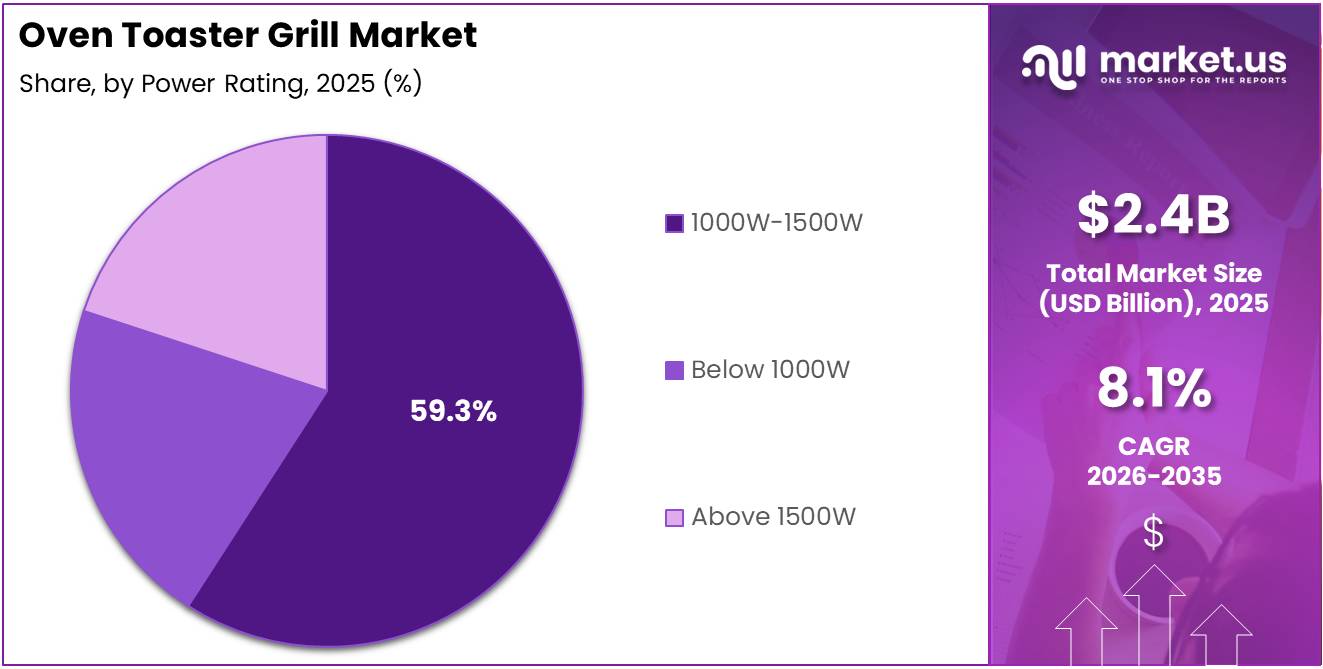

- The 1000W-1500W power rating segment leads with 59.3% share, balancing cooking performance and energy consumption.

- Residential applications account for 69.4% of market demand driven by urban household adoption.

- Online stores capture 44.7% of distribution channels reflecting growing e-commerce penetration.

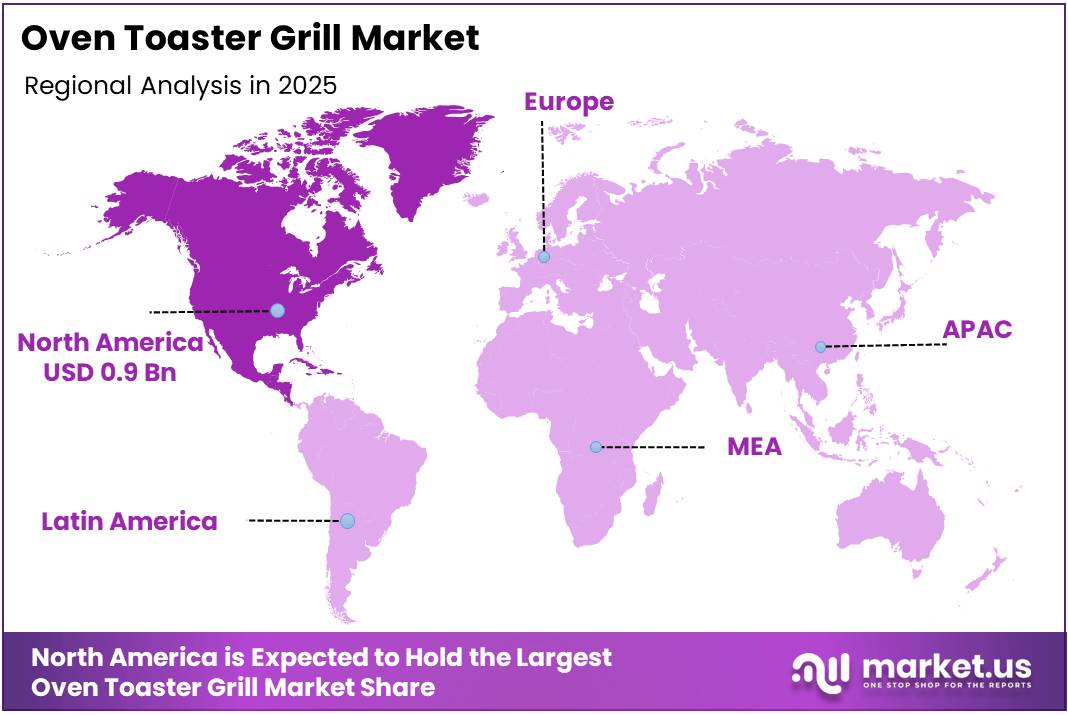

- North America dominates with 38.90% market share valued at USD 0.9 Billion in 2025.

Product Type Analysis

Electric dominates with 87.5% due to widespread household electrification, ease of operation, and consistent heating performance.

In 2025, Electric held a dominant market position in the By Product Type segment of Oven Toaster Grill Market, with a 87.5% share. Electric models offer superior temperature control, automated settings, and user-friendly interfaces that appeal to modern consumers. Additionally, these appliances integrate seamlessly with smart home ecosystems and require minimal maintenance compared to gas alternatives.

Gas variants serve niche markets where electricity access remains limited or expensive. These models appeal to professional chefs and specific commercial applications requiring open-flame cooking characteristics. However, their market share remains constrained due to installation complexity, safety regulations, and declining preference for gas-powered household appliances in developed markets.

Power Rating Analysis

1000W-1500W dominates with 59.3% due to optimal balance between cooking efficiency, energy consumption, and household electrical capacity compatibility.

In 2025, 1000W-1500W held a dominant market position in the By Power Rating segment of Oven Toaster Grill Market, with a 59.3% share. This power range delivers sufficient heat for diverse cooking tasks while maintaining reasonable energy costs. Moreover, these models fit standard household electrical circuits without requiring specialized wiring or upgrades.

Below 1000W models cater to budget-conscious consumers and small households with basic cooking needs. These compact units consume minimal electricity and occupy limited counter space. However, their lower wattage extends cooking times and limits capacity for preparing meals for larger families or entertaining guests.

Above 1500W appliances target premium segments seeking professional-grade performance and faster cooking capabilities. These high-powered models reduce preheating time and handle heavy-duty commercial applications effectively. Nevertheless, higher energy consumption and electrical infrastructure requirements restrict their adoption primarily to commercial kitchens and affluent residential buyers.

Application Analysis

Residential dominates with 69.4% due to increasing urban household adoption, compact living spaces, and growing preference for convenient home cooking solutions.

In 2025, Residential held a dominant market position in the By Application segment of Oven Toaster Grill Market, with a 69.4% share. Urban households increasingly adopt these multifunctional appliances for daily meal preparation, snacking, and baking activities. Furthermore, rising health consciousness drives consumers toward home-cooked meals prepared using energy-efficient appliances with precise temperature controls.

Commercial Kitchens utilize heavy-duty models for high-volume food preparation in institutional settings. These applications require durable construction, consistent performance, and easy maintenance for professional operations. Consequently, commercial variants feature enhanced power ratings and larger capacities to meet demanding production schedules in catering services and institutional cafeterias.

Hotels deploy compact toaster grills in guest rooms and breakfast service areas. These installations enhance guest convenience while minimizing kitchen infrastructure costs. Additionally, hotel applications prioritize quiet operation, compact design, and self-cleaning features that reduce maintenance requirements and operational disruptions.

Restaurants incorporate specialized models for appetizer preparation, reheating, and finishing touches on plated dishes. These units complement main cooking equipment without overwhelming limited kitchen space. Moreover, restaurant applications value rapid heating, precise temperature control, and consistent results that maintain food quality standards across service periods.

Distribution Channel Analysis

Online Stores dominate with 44.7% due to convenient comparison shopping, competitive pricing, extensive product variety, and doorstep delivery services.

In 2025, Online Stores held a dominant market position in the By Distribution Channel segment of Oven Toaster Grill Market, with a 44.7% share. E-commerce platforms provide detailed product specifications, customer reviews, and comparison tools that facilitate informed purchasing decisions. Additionally, online retailers offer promotional discounts, flexible payment options, and hassle-free return policies that enhance customer confidence.

Supermarkets/Hypermarkets provide physical product demonstration and immediate purchase gratification for consumers preferring tactile evaluation. These retail formats leverage high foot traffic and cross-selling opportunities with other kitchen products. However, limited shelf space restricts product variety compared to online platforms, and higher operational costs often result in less competitive pricing.

Specialty Stores offer expert guidance and premium product selections targeting discerning buyers. These retailers provide personalized service, product demonstrations, and after-sales support that build customer loyalty. Nevertheless, their limited geographic presence and higher price points restrict market accessibility to affluent urban consumers seeking specialized appliance expertise.

Others include direct manufacturer sales, television shopping networks, and institutional procurement channels. These distribution methods serve niche markets with specific requirements or purchasing processes. Consequently, they maintain modest market share while addressing specialized customer segments not adequately served by mainstream retail channels.

Key Market Segments

By Product Type

- Electric

- Gas

By Power Rating

- 1000W-1500W

- Below 1000W

- Above 1500W

By Application

- Residential

- Commercial Kitchens

- Hotels

- Restaurants

By Distribution Channel

- Online Stores

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

Drivers

Rising Urban Household Adoption of Compact Multi-Function Kitchen Appliances Drives Market Growth

Urbanization trends and shrinking living spaces increase demand for versatile kitchen appliances. Modern consumers prioritize multifunctional devices that replace multiple single-purpose tools. Consequently, oven toaster grills gain traction as space-efficient alternatives combining toasting, baking, grilling, and reheating capabilities in compact formats.

Growing middle-income populations across developing economies upgrade kitchen infrastructure with modern appliances. These consumers seek affordable yet advanced cooking solutions delivering convenience and performance. Moreover, increasing preference for quick, energy-efficient home cooking solutions aligns with busy lifestyles and rising food delivery costs.

Expansion of organized retail and e-commerce appliance sales channels enhances product accessibility. Online platforms provide extensive product information, competitive pricing, and doorstep delivery that simplify purchasing decisions. Additionally, digital marketing campaigns and influencer endorsements significantly boost consumer awareness and drive adoption among younger demographics seeking modern kitchen solutions.

Restraints

Limited Consumer Awareness About Advanced OTG Features and Functions Limits Market Expansion

Many consumers remain unfamiliar with the full capabilities and operational advantages of modern oven toaster grills. This knowledge gap restricts purchase decisions as buyers default to familiar appliances. Furthermore, inadequate product demonstrations in retail environments and insufficient educational marketing materials prevent consumers from recognizing value propositions.

Space constraints in small kitchens present significant placement challenges for potential buyers. Urban apartments and compact housing units offer limited counter space for additional appliances. Therefore, consumers must choose between oven toaster grills and other essential kitchen equipment, often prioritizing items perceived as more necessary.

Higher upfront costs compared to basic toasters deter price-sensitive consumers despite long-term energy savings. Budget-conscious households hesitate to invest in multifunctional appliances when single-purpose alternatives cost significantly less. Additionally, economic uncertainty and competing household expenses further constrain discretionary spending on kitchen appliance upgrades.

Growth Factors

Integration of Smart Controls and Preset Cooking Technologies Accelerates Market Expansion

Technological advancements enable manufacturers to incorporate smart features, digital displays, and automated cooking programs. These innovations enhance user experience through precise temperature control and simplified operation. Consequently, tech-savvy consumers increasingly adopt advanced models that integrate with smart home ecosystems and mobile applications.

Rising demand from small food businesses and home-based bakers creates new market opportunities. Entrepreneurs operating cottage food industries require reliable, cost-effective equipment for small-batch production. Moreover, social media platforms showcasing home baking and cooking fuel aspirational purchases among consumers seeking professional-quality results.

Untapped penetration in tier-2 and tier-3 urban markets represents significant growth potential. These emerging cities experience rapid economic development and rising disposable incomes. Additionally, product innovation focused on health-oriented and oil-free cooking addresses growing wellness trends, attracting health-conscious consumers seeking nutritious meal preparation methods without compromising taste.

Emerging Trends

Shift Toward Stainless Steel and Premium Aesthetic Designs Reshapes Market Landscape

Consumer preferences increasingly favor appliances with modern aesthetics that complement contemporary kitchen designs. Stainless steel finishes and sleek profiles enhance visual appeal and perceived product quality. Therefore, manufacturers invest in industrial design improvements that differentiate premium products from budget alternatives, commanding higher price points.

Increasing popularity of digital display and touch-control interfaces modernizes user interaction. These features provide intuitive operation, precise settings, and enhanced functionality compared to traditional knob controls. Moreover, digital interfaces enable integration of preset cooking programs and smart connectivity features.

Growing consumer preference for compact, space-saving models drives product miniaturization efforts. Manufacturers develop smaller footprints without compromising cooking capacity through engineering innovations. Additionally, rising influence of online reviews and influencer-led appliance purchases transforms marketing strategies, as brands leverage social proof and content creators to build credibility.

Regional Analysis

North America Dominates the Oven Toaster Grill Market with a Market Share of 38.90%, Valued at USD 0.9 Billion

North America leads the global market with 38.90% share, valued at USD 0.9 Billion in 2025, driven by high disposable incomes, established kitchen appliance culture, and strong preference for multifunctional cooking devices. Advanced retail infrastructure and robust e-commerce penetration facilitate widespread product availability. Moreover, energy efficiency awareness and sustainability concerns drive adoption of toaster ovens over conventional ovens.

Europe Oven Toaster Grill Market Trends

Europe demonstrates strong market presence supported by mature household appliance markets and premium product preferences. Consumers prioritize energy-efficient appliances meeting stringent environmental regulations and quality standards. Additionally, growing interest in home baking and artisanal food preparation fuels demand for versatile cooking equipment.

Asia Pacific Oven Toaster Grill Market Trends

Asia Pacific exhibits rapid growth potential driven by urbanization, rising middle-class population, and increasing Western lifestyle adoption. Expanding retail networks and growing e-commerce platforms enhance product accessibility across diverse markets. Furthermore, affordability-focused product variants cater to price-sensitive consumers in developing economies.

Middle East & Africa Oven Toaster Grill Market Trends

Middle East & Africa represents emerging opportunities with growing urban populations and rising disposable incomes in Gulf nations. Hospitality sector expansion drives commercial segment demand for compact cooking equipment. However, market development remains constrained by limited retail infrastructure in certain regions.

Latin America Oven Toaster Grill Market Trends

Latin America shows moderate growth supported by increasing urbanization and expanding middle-income households. Economic fluctuations and currency volatility impact consumer purchasing power and appliance investment decisions. Nevertheless, growing organized retail presence and appliance financing options support gradual market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Breville maintains premium market positioning through innovative product design and advanced cooking technologies. The company’s focus on user experience and quality construction attracts discerning consumers willing to invest in high-performance appliances. In October 2025, Breville introduced the Eye Q Auto Smart Toaster using optical sensor technology for color-based toasting, demonstrating continued innovation leadership. Their premium pricing strategy targets affluent households seeking professional-grade kitchen equipment.

Cuisinart combines competitive pricing with reliable performance, capturing significant market share across residential segments. The brand’s extensive product portfolio offers options spanning entry-level to premium categories, addressing diverse consumer needs. Moreover, strong distribution partnerships with major retailers ensure widespread product availability and brand visibility. Cuisinart’s reputation for durability and consistent quality fosters customer loyalty and repeat purchases.

Black & Decker leverages brand recognition and affordable pricing to dominate budget-conscious consumer segments. The company’s focus on functional simplicity and accessible price points makes kitchen appliances attainable for mass-market consumers. Additionally, Black & Decker’s extensive service network provides after-sales support that builds consumer confidence. Their value proposition emphasizes reliability and practicality over advanced features.

Oster targets mid-range markets with balanced feature sets and competitive pricing strategies. The brand emphasizes versatility and ease-of-use, appealing to mainstream households seeking dependable multifunctional appliances. Furthermore, Oster’s established presence in both online and offline retail channels ensures consistent market visibility. Their product development focuses on addressing common consumer pain points through practical design improvements.

Key players

- Breville

- Cuisinart

- Black & Decker

- Oster

- Hamilton Beach

- Panasonic

- GE

- Kenmore

- Smeg

- LG Electronics

Recent Developments

- December 2025 – CFS Brands Acquires Cornerstone Foodservice Group, expanding its commercial kitchen equipment portfolio and strengthening distribution capabilities across North American foodservice markets through strategic consolidation.

- October 2025 – Breville introduced the Eye Q Auto Smart Toaster using optical sensor technology for color-based toasting, representing an innovative advanced toaster launch that enhances precision and user control through automated visual monitoring systems.

- June 2025 – Grand Appliance and The Appliance Barn Join Forces, creating expanded retail presence and enhanced customer service capabilities through merged operations, strengthening their competitive position in regional appliance markets.

- March 2025 – Panasonic launched updated toaster oven models FlashXpress Toaster Oven NB-G200 and FlashXpress Air Fry Toaster Oven NB-G211, expanding its modern countertop appliance lineup with enhanced multifunction cooking features including air-fry capabilities for health-conscious consumers.

Report Scope

Report Features Description Market Value (2025) USD 2.4 Billion Forecast Revenue (2035) USD 5.2 Billion CAGR (2026-2035) 8.1% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Electric, Gas), By Power Rating (1000W-1500W, Below 1000W, Above 1500W), By Application (Residential, Commercial Kitchens, Hotels, Restaurants), By Distribution Channel (Online Stores, Supermarkets/Hypermarkets, Specialty Stores, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Breville, Cuisinart, Black & Decker, Oster, Hamilton Beach, Panasonic, GE, Kenmore, Smeg, LG Electronics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Breville

- Cuisinart

- Black & Decker

- Oster

- Hamilton Beach

- Panasonic

- GE

- Kenmore

- Smeg

- LG Electronics