Global Outdoor Commercial Grills Market Size, Share, Growth Analysis By Category (Gas Grill, Charcoal Grill, Pellet Grill, Electric Grill), By Mobility (Stationary Outdoor Grills, Portable Outdoor Grills, Towable Outdoor Grills), By Grilling Fuel (Propane Tanks, Lump Charcoal, Wood Chips, Wood Pellets, Smoker Pellets), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170436

- Number of Pages: 229

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

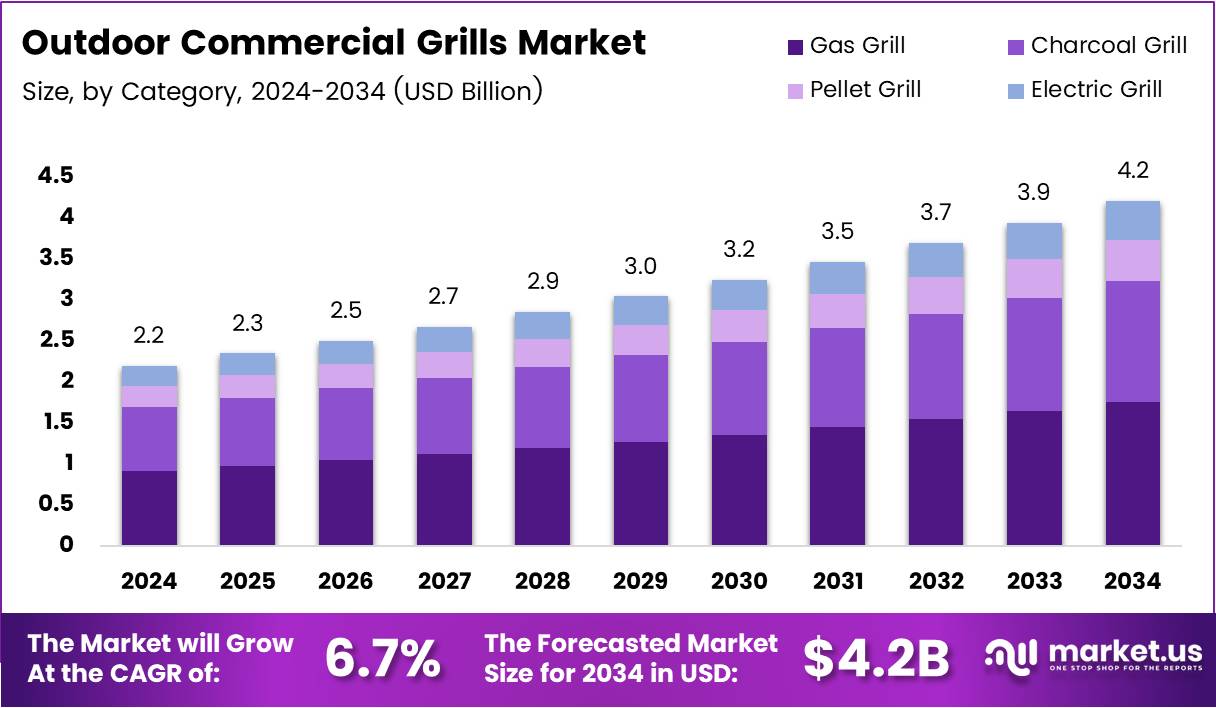

The global Outdoor Commercial Grills Market is projected to reach approximately USD 4.2 Billion by 2034, up from USD 2.2 Billion in 2024. This expansion reflects a robust CAGR of 6.7% during the forecast period from 2025 to 2034. The outdoor commercial grills market encompasses professional-grade cooking equipment designed for restaurants, hotels, catering services, and food trucks.

Market growth is primarily driven by the expanding quick-service restaurant sector and rising consumer preference for grilled food experiences. Additionally, the hospitality industry continues investing in outdoor dining infrastructure to enhance customer experiences. These establishments increasingly seek durable, high-capacity grilling solutions that can withstand commercial demands.

The foodservice industry has witnessed significant transformation in recent years, particularly regarding outdoor dining formats. Live grilling stations and open-kitchen concepts have become popular attractions in upscale dining venues. Furthermore, the trend toward experiential dining drives restaurants to invest in premium commercial grilling equipment that showcases culinary craftsmanship.

Government regulations around emissions and safety standards continue shaping product development in this sector. Meanwhile, manufacturers focus on creating energy-efficient models that comply with environmental guidelines. Innovation in multi-fuel systems and smart temperature controls represents key technological advancements attracting commercial operators.

The mobile food business segment presents substantial growth opportunities for portable and towable grill systems. Food trucks and outdoor catering services require flexible, transportable equipment that maintains professional performance standards. According to the National Restaurant Association, 65% of restaurant operators offered on-premises outdoor dining, highlighting strong commercial demand for outdoor cooking solutions.

Market dynamics also reflect changing consumer preferences toward authentic grilling experiences and barbecue cuisine. Moreover, destination dining concepts and outdoor event venues increasingly incorporate commercial grills as central features. According to industry data, approximately 20 million grills were sold in the United States in 2020 alone, demonstrating robust market demand.

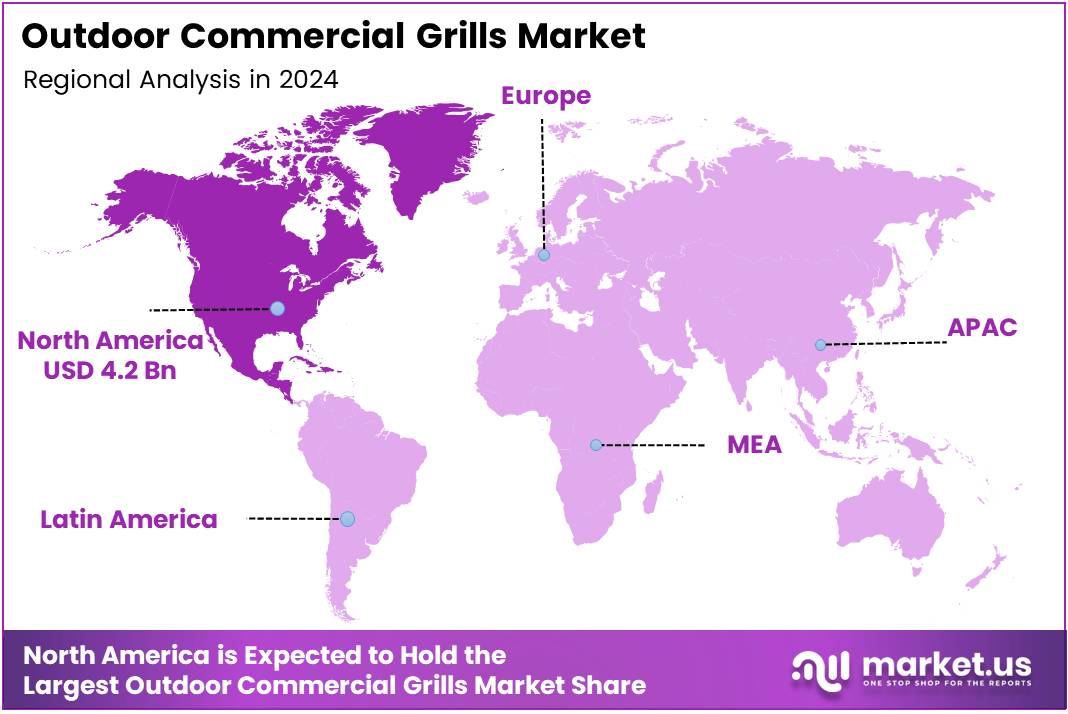

Regional variations in grilling culture and outdoor dining adoption influence market penetration across different geographies. North America maintains leadership due to established barbecue traditions and extensive foodservice infrastructure. However, emerging markets show promising growth potential as tourism and hospitality sectors expand globally.

Investment in sustainable materials and eco-friendly fuel technologies shapes future product development strategies. Manufacturers prioritize corrosion-resistant designs and weatherproof construction to ensure longevity in outdoor environments. The shift toward modular and customizable grill systems enables operators to configure equipment based on specific operational needs.

Key Takeaways

- Global Outdoor Commercial Grills Market valued at USD 2.2 Billion in 2024, projected to reach USD 4.2 Billion by 2034.

- Market growing at a CAGR of 6.7% during the forecast period 2025-2034.

- Gas Grill segment dominates by category with 44.8% market share.

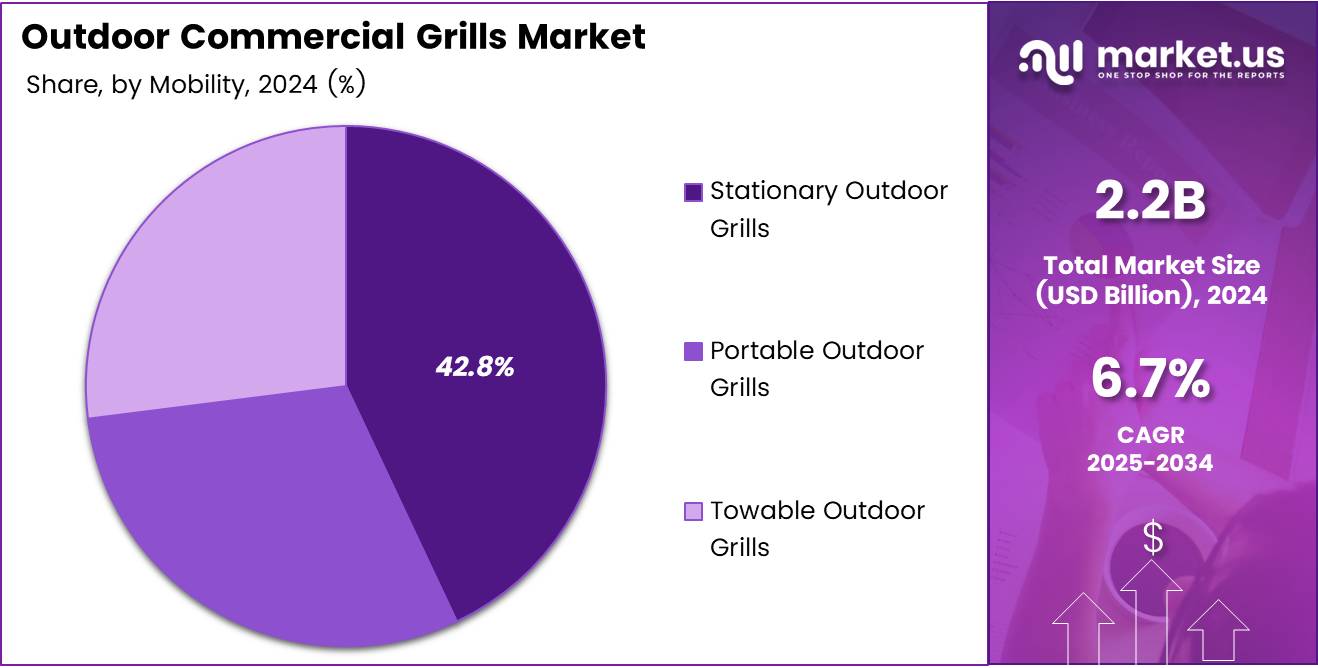

- Stationary Outdoor Grills lead by mobility segment with 48.1% share.

- Propane Tanks segment holds 42.3% share in grilling fuel category.

- North America dominates regional market with 43.9% share, valued at USD 0.9 Billion.

By Category Analysis

Gas Grill dominates with 44.8% due to its operational efficiency and consistent heat control.

In 2024, Gas Grill held a dominant market position in the By Category segment of Outdoor Commercial Grills Market, with a 44.8% share. Gas grills offer superior temperature control and quick ignition, making them ideal for high-volume commercial operations. These units provide consistent cooking results across extended service periods. Additionally, gas-powered systems require minimal cleanup and maintenance compared to alternative fuel types. Commercial kitchens value the reliability and predictability that gas grills deliver during peak service hours.

Charcoal Grills maintain significant presence in establishments prioritizing authentic smoky flavors and traditional grilling methods. These grills appeal to barbecue restaurants and specialty dining venues seeking distinctive taste profiles. Moreover, charcoal grilling creates visual appeal through live fire cooking demonstrations. The segment serves operators who emphasize artisanal cooking techniques and customer engagement through open-kitchen formats.

Pellet Grills represent an emerging segment combining wood-fired flavor with automated temperature management systems. These units attract operators seeking premium grilling experiences with reduced manual intervention. Furthermore, pellet technology enables precise heat control while delivering natural wood smoke flavoring. The segment grows as commercial operators discover benefits of consistent results with authentic taste characteristics.

Electric Grills serve establishments with strict emission regulations or limited ventilation infrastructure for combustion-based cooking. These units provide clean operation without producing smoke or requiring fuel storage. Additionally, electric models suit indoor-outdoor hybrid spaces and locations with environmental restrictions. The segment appeals to urban venues and facilities prioritizing safety and compliance requirements.

By Mobility Analysis

Stationary Outdoor Grills dominate with 48.1% due to their heavy-duty construction and permanent installation benefits.

In 2024, Stationary Outdoor Grills held a dominant market position in the By Mobility segment of Outdoor Commercial Grills Market, with a 48.1% share. Stationary systems offer maximum durability and cooking capacity for permanent outdoor kitchen installations. These units feature robust construction designed to withstand continuous commercial use and weather exposure. Moreover, permanent installations allow for integrated utility connections and custom configuration options. Restaurants and hotels invest in stationary grills for long-term outdoor dining programs and dedicated grilling stations.

Portable Outdoor Grills cater to businesses requiring flexibility in equipment placement and operational versatility. These units enable operators to relocate grilling stations based on event layouts or seasonal changes. Furthermore, portable models suit catering companies and venues hosting varied outdoor functions. The segment benefits from growing demand for adaptable foodservice equipment that accommodates changing business needs.

Towable Outdoor Grills serve mobile food businesses and catering operations requiring transportation between locations. These specialized systems mount on trailers for easy towing and rapid deployment at different venues. Additionally, towable grills provide self-contained cooking solutions for outdoor events and festivals. The segment grows alongside expansion of food truck operations and mobile catering services requiring professional-grade portable equipment.

By Grilling Fuel Analysis

Propane Tanks dominate with 42.3% due to their convenience, availability, and cost-effectiveness.

In 2024, Propane Tanks held a dominant market position in the By Grilling Fuel segment of Outdoor Commercial Grills Market, with a 42.3% share. Propane fuel offers excellent portability combined with high heat output for commercial cooking applications. These fuel sources provide consistent performance regardless of outdoor temperature conditions. Moreover, propane tanks feature standardized connections and widespread distribution networks ensuring reliable supply. Commercial operators appreciate the balance between operational efficiency and fuel cost management that propane delivers.

Lump Charcoal attracts establishments emphasizing traditional grilling methods and natural wood-fired cooking experiences. This fuel type produces high heat with minimal ash generation compared to briquette alternatives. Furthermore, lump charcoal creates authentic smoky flavors valued in specialty barbecue and steakhouse operations. The segment serves premium dining venues where grilling authenticity differentiates the culinary offering.

Wood Chips provide flavor enhancement options for operators using gas or electric grills seeking wood-smoke characteristics. These supplementary fuel sources enable customization of taste profiles through different wood varieties. Additionally, wood chips offer cost-effective flavor infusion without requiring dedicated wood-fired equipment. The segment appeals to restaurants expanding menu diversity while maintaining existing grill infrastructure.

Wood Pellets combine convenience of automated feeding systems with natural wood flavor profiles for commercial operations. These compressed fuels deliver consistent burn rates and temperature control through pellet grill technology. Moreover, pellets produce clean combustion with reduced ash output compared to traditional wood fuels. The segment grows as commercial kitchens adopt automated grilling solutions that maintain artisanal flavor characteristics.

Smoker Pellets represent specialized fuel products designed for low-temperature smoking and slow-cooking applications in commercial settings. These pellets enable extended cooking processes while delivering distinct smoke flavors for barbecue operations. Furthermore, smoker pellets suit establishments offering traditional smoking techniques and specialty meat preparations. The segment serves niche barbecue restaurants and catering operations focused on authentic regional smoking styles.

Key Market Segments

By Category

- Gas Grill

- Charcoal Grill

- Pellet Grill

- Electric Grill

By Mobility

- Stationary Outdoor Grills

- Portable Outdoor Grills

- Towable Outdoor Grills

By Grilling Fuel

- Propane Tanks

- Lump Charcoal

- Wood Chips

- Wood Pellets

- Smoker Pellets

Drivers

Expansion of Quick-Service Restaurants and Outdoor Dining Formats Drives Market Growth

The rapid expansion of quick-service restaurants significantly boosts demand for commercial outdoor grilling equipment. These establishments increasingly incorporate outdoor cooking stations to enhance customer experiences and menu offerings. Fast-casual dining concepts particularly embrace live grilling formats that showcase food preparation transparency. Consequently, operators invest in durable commercial grills capable of handling high-volume operations throughout extended service hours.

Rising popularity of barbecue menus and open-kitchen dining experiences creates sustained demand for professional grilling equipment. Consumers increasingly seek authentic grilled food experiences that deliver visual and culinary appeal. Moreover, live grilling stations serve as entertainment features attracting customers to dining venues. Restaurants leverage outdoor grills as differentiation tools in competitive foodservice markets.

Growth of hospitality infrastructure including hotels, resorts, and event venues expands the commercial grills market. These facilities develop outdoor dining spaces and poolside grilling stations to enhance guest amenities. Additionally, event venues require flexible grilling solutions for banquets, weddings, and corporate gatherings. Hospitality operators recognize outdoor cooking equipment as essential investments for comprehensive guest service offerings.

Restraints

High Initial Capital Investment and Regulatory Compliance Limit Market Adoption

High initial capital investment for commercial-grade grills presents significant barriers for small foodservice operators. Professional outdoor grilling systems require substantial upfront costs beyond standard kitchen equipment budgets. Installation expenses including utility connections, ventilation, and structural modifications increase total investment requirements. Consequently, many establishments delay or avoid outdoor grill installations due to financial constraints.

Strict emission, safety, and fire regulations limit outdoor grill installations in various jurisdictions. Municipal codes often restrict open-flame cooking in urban areas or require expensive compliance measures. Furthermore, ventilation requirements and fire suppression systems add complexity to outdoor kitchen projects. Operators must navigate varying regulatory frameworks across different locations, complicating expansion plans.

Maintenance and operational costs for commercial outdoor grills impact long-term ownership economics. Professional equipment requires regular servicing, part replacements, and fuel expenses that accumulate over time. Additionally, weather exposure accelerates wear on outdoor units compared to indoor kitchen equipment. These ongoing costs influence purchasing decisions and return on investment calculations for foodservice businesses.

Growth Factors

Rising Adoption of Mobile Food Businesses and Energy-Efficient Solutions Creates Opportunities

Rising adoption of outdoor catering, food trucks, and mobile food businesses generates strong demand for portable grilling equipment. These operations require professional-grade grills designed for transportation and deployment at various locations. Mobile foodservice businesses prioritize equipment durability, fuel efficiency, and rapid setup capabilities. Consequently, manufacturers develop specialized towable and portable grill systems serving this expanding market segment.

Growing demand for energy-efficient and low-emission commercial grilling solutions drives product innovation. Environmental consciousness among operators and regulatory pressures encourage adoption of cleaner cooking technologies. Moreover, energy-efficient equipment reduces operational costs while supporting sustainability initiatives. Manufacturers respond by developing advanced combustion systems and alternative fuel options meeting environmental standards.

Expansion of tourism, outdoor events, and destination dining concepts creates diverse market opportunities. Popular tourist destinations invest in outdoor dining infrastructure to capitalize on pleasant weather and scenic locations. Additionally, festivals, concerts, and sporting events require temporary grilling solutions for large-scale food service. This segment benefits from growing experiential dining trends and outdoor entertainment popularity.

Emerging Trends

Smart Technology Integration and Sustainable Design Shape Market Evolution

Increasing use of smart and IoT-enabled temperature-controlled commercial grills transforms operational capabilities. These advanced systems offer remote monitoring, automated temperature adjustment, and data logging for quality control. Connected grills enable operators to manage multiple units simultaneously and maintain consistent cooking standards. Furthermore, digital integration supports inventory management and preventive maintenance scheduling, improving operational efficiency.

Shift toward stainless steel, corrosion-resistant, and weatherproof grill designs extends equipment lifespan. Manufacturers prioritize materials and construction methods that withstand harsh outdoor environments and frequent cleaning. Moreover, premium finishes enhance aesthetic appeal for visible installations in upscale dining venues. Durability improvements reduce replacement frequency and total cost of ownership for commercial operators.

Growing preference for hybrid and multi-fuel outdoor grilling equipment provides operational flexibility. These versatile systems allow operators to switch between fuel types based on availability, cost, or desired cooking characteristics. Additionally, multi-fuel capability appeals to establishments seeking menu diversity and cooking technique versatility. Innovation in modular and customizable grill systems enables configuration matching specific operational requirements and space constraints.

Regional Analysis

North America Dominates the Outdoor Commercial Grills Market with a Market Share of 43.9%, Valued at USD 0.9 Billion

North America maintains market leadership with a commanding 43.9% share, valued at USD 0.9 Billion, driven by established barbecue culture and extensive foodservice infrastructure. The region benefits from strong consumer demand for grilled food and outdoor dining experiences across diverse establishment types. Additionally, favorable weather conditions in many areas support year-round outdoor cooking operations. Regulatory frameworks in North America generally accommodate commercial outdoor grilling with clear compliance pathways.

Europe Outdoor Commercial Grills Market Trends

Europe demonstrates steady growth as Mediterranean regions and urban centers embrace outdoor dining culture. The region emphasizes sustainability and emission controls, driving adoption of cleaner grilling technologies. Moreover, tourism-dependent economies invest in outdoor hospitality infrastructure to enhance visitor experiences. European operators increasingly recognize outdoor grills as valuable assets for seasonal business optimization and al fresco dining traditions.

Asia Pacific Outdoor Commercial Grills Market Trends

Asia Pacific represents the fastest-growing regional market, fueled by expanding hospitality sectors and rising middle-class dining preferences. Rapid urbanization and tourism development create demand for modern foodservice equipment across the region. Furthermore, international dining concepts entering Asian markets introduce commercial grilling practices and equipment standards. The region shows particular strength in coastal areas and metropolitan centers with developed outdoor dining infrastructure.

Middle East and Africa Outdoor Commercial Grills Market Trends

Middle East and Africa exhibit growing adoption driven by luxury hospitality developments and outdoor entertainment venues. The region’s climate naturally supports outdoor dining throughout most of the year, encouraging infrastructure investments. Additionally, international hotel chains and resort developments introduce commercial grilling standards and premium equipment. Traditional grilling cultures in certain markets blend with modern commercial equipment adoption.

Latin America Outdoor Commercial Grills Market Trends

Latin America shows promising growth potential based on strong grilling traditions and expanding foodservice sectors. The region’s cultural affinity for grilled meats and outdoor social dining creates natural market demand. Moreover, tourism growth in coastal and urban destinations drives hospitality infrastructure investments. Economic development and rising disposable incomes support commercial foodservice equipment modernization across major markets.

Key Outdoor Commercial Grills Company Insights

The global Outdoor Commercial Grills Market features diverse manufacturers offering specialized equipment for commercial foodservice operations. Leading companies focus on durability, performance, and innovative features that address evolving operator requirements. These manufacturers maintain strong distribution networks and service capabilities supporting commercial customers nationwide.

Backyard Pro specializes in affordable commercial grilling solutions targeting small to medium-sized foodservice operations. The company offers diverse product lines including gas, charcoal, and specialty grills designed for outdoor commercial use. Their equipment emphasizes value pricing while maintaining professional performance standards suitable for restaurants and catering businesses.

Crown Verity delivers premium portable and stationary grilling systems widely adopted by event venues and catering operations. The company earned reputation for heavy-duty construction and reliable performance in demanding commercial environments. Crown Verity products feature innovative designs accommodating high-volume cooking requirements and frequent transportation needs.

Louisiana Grills focuses on wood pellet grilling technology combining automated temperature control with authentic wood-fired flavor profiles. The company targets establishments seeking premium grilling experiences with reduced manual intervention requirements. Louisiana Grills emphasizes versatility through products capable of grilling, smoking, and slow-cooking applications.

Blackstone has gained significant market presence through flat-top griddle systems and versatile outdoor cooking platforms. The company addresses growing demand for multi-functional commercial cooking equipment suitable for diverse menu applications. Blackstone products appeal to operators seeking equipment flexibility and high-capacity cooking surfaces for outdoor foodservice.

Key Companies

- Backyard Pro

- Crown Verity

- Holstein Manufacturing

- Louisiana Grills

- Magikitch’n

- Meadow Creek

- Blackstone

- R&V Works

- Southern Pride

- Dyna Glo

Recent Developments

- In September 2025, BBQGuys acquired Mont Alpi, significantly expanding its portfolio of modular outdoor kitchens and premium commercial grills. This strategic acquisition strengthens BBQGuys’ position in the high-end outdoor cooking equipment market and enhances product offerings for commercial customers.

- In January 2025, Weber LLC introduced its 2025 outdoor grill and accessory lineup including reimagined SPIRIT gas grills and the WEBER SMOQUE wood pellet smoker. These new products incorporate advanced features addressing commercial operator demands for reliability and performance.

- In June 2025, Smoque BBQ filed a trademark challenge against Weber over the use of the Smoque name on its new pellet smoker product. This legal development highlights competitive tensions in the expanding wood pellet grill segment as manufacturers vie for market positioning.

- In September 2025, Miele unveiled its first outdoor modular kitchen range Dreams, featuring the intelligent Fire Pro IQ outdoor gas grill at IFA 2025. This launch represents Miele’s entry into the commercial outdoor cooking market with premium technology-integrated grilling systems.

Report Scope

Report Features Description Market Value (2024) USD 2.2 Billion Forecast Revenue (2034) USD 4.2 Billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Category (Gas Grill, Charcoal Grill, Pellet Grill, Electric Grill), By Mobility (Stationary Outdoor Grills, Portable Outdoor Grills, Towable Outdoor Grills), By Grilling Fuel (Propane Tanks, Lump Charcoal, Wood Chips, Wood Pellets, Smoker Pellets) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Backyard Pro, Crown Verity, Holstein Manufacturing, Louisiana Grills, Magikitch’n, Meadow Creek, Blackstone, R&V Works, Southern Pride, Dyna Glo Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Outdoor Commercial Grills MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Outdoor Commercial Grills MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Backyard Pro

- Crown Verity

- Holstein Manufacturing

- Louisiana Grills

- Magikitch'n

- Meadow Creek

- Blackstone

- R&V Works

- Southern Pride

- Dyna Glo