Osteoporosis Drug Market By Drug Class (Bisphosphonates, Parathyroid Hormone Therapy Drugs), By Route Administration (Oral and injectable), and By Distribution Channel (Retail Pharmacies, Hospital Pharmacies), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Oct 2024

- Report ID: 22087

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

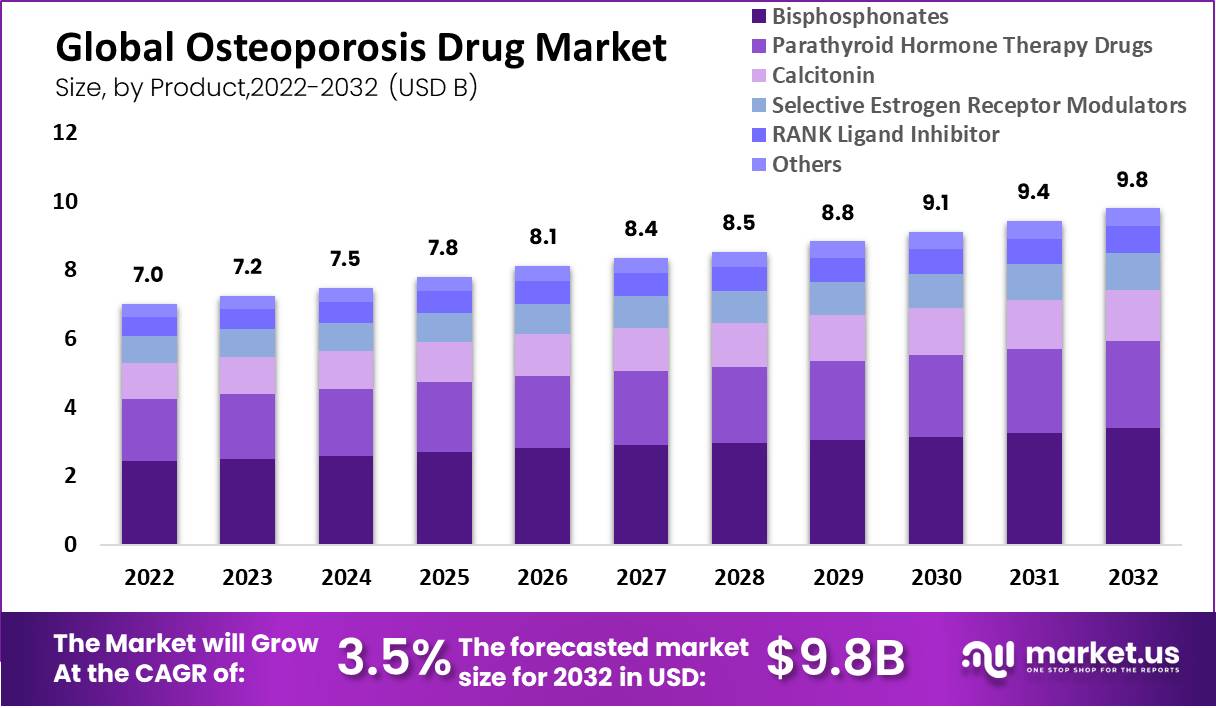

Osteoporosis Drugs Market size is expected to be worth around USD 9.8 Billion by 2032 from USD 7 Billion in 2022, growing at a CAGR of 3.5% during the forecast period from 2023 to 2032.

A medical condition known as osteoporosis is identified by small bone density, which affects the bones and makes them more porous, making them more vulnerable to fractures. Overproduction of the hormone known as parathyroid results in osteoporosis condition. The condition can result in implacable fractures, which can be harmful to the patient’s health.

As a result, treatment, including osteoporosis medications, is necessary, such as Bisphosphonates, selective estrogen inhibitors modulator, parathyroid hormone therapy, calcitonin, and RANK ligand inhibitors of the drugs on the market, which are used to treat osteoporosis condition. These medications can be administrated into the body in a variety of ways.

Key Takeaways

- The global osteoporosis drugs market size is expected to reach USD 9.8 Bn by 2032 from USD 7.0 Bn in 2022, growing at a CAGR of 3.5% during the forecast period.

- The Bisphosphonates segment dominated the market growth during the forecast period.

- The rank ligand inhibitors market is anticipated to expand at the fastest rate during the forecast period.

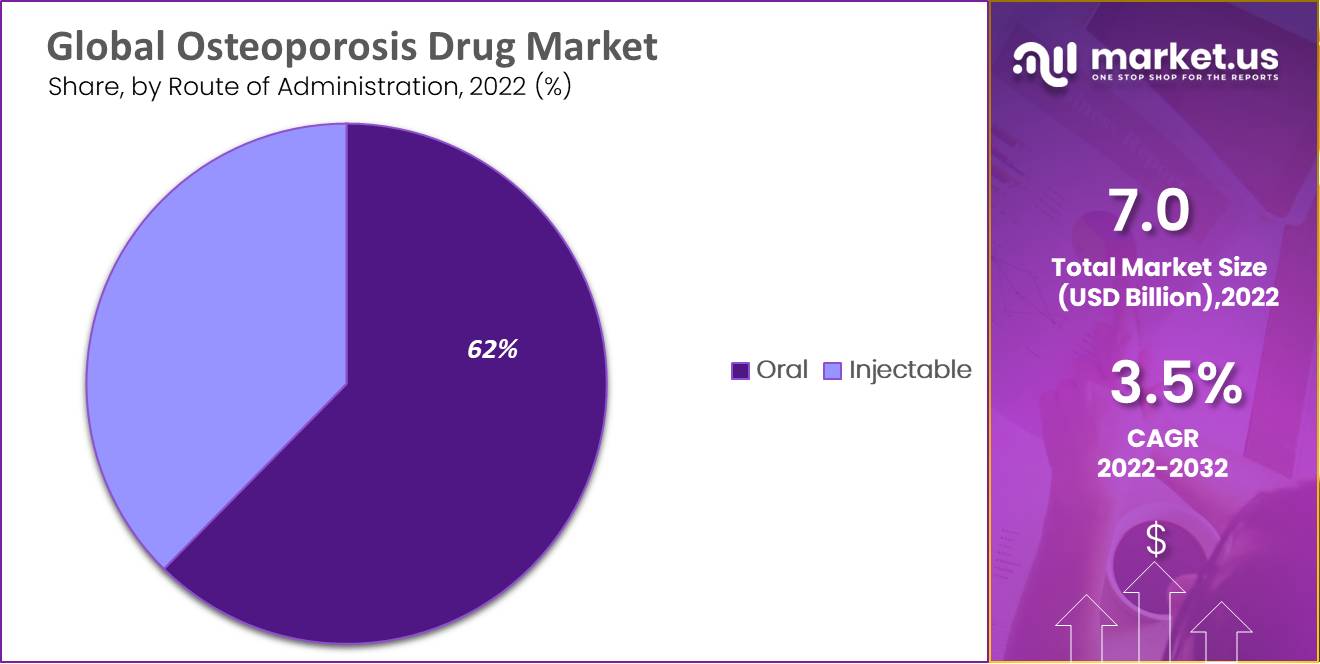

- The oral route of administration dominates the global osteoporosis market.

- The hospital pharmacies segment is expected to grow at a faster rate during the forecast period.

- Increasing healthcare expenditure is a major driver of the osteoporosis drug market.

- The market’s expansion is being hampered by the adverse effects of anti-inflammatory medications.

- The osteoporosis drug industry is also growing because of the expanding healthcare sectors in a number of emerging economies.

- New and effective diagnostic methods for screening for osteoporosis have emerged as a result of advancements in technology.

- Injectable osteoporosis medications are anticipated to experience faster growth during the forecast period.

- COVID-19 has disturbed or delayed many osteoporosis patients’ treatment.

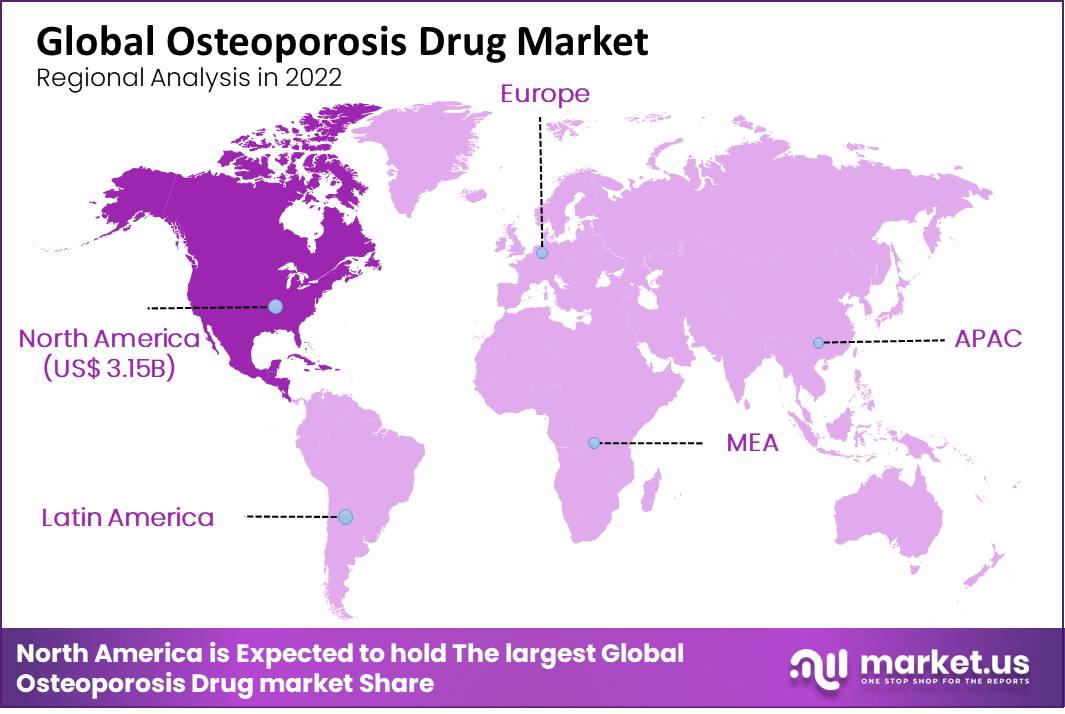

- North America region dominates the largest shares in the market.

Drug Class Analysis

The Bisphosphonates Segment Dominated the Market Growth During the Forecast Period. The global osteoporosis Drug market is segmented into various drug classes that made the market growth such as bisphosphonates, selective estrogen inhibitors, modulators, parathyroid hormone therapy, calcitonin, rank ligand inhibitors, and others. Bisphosphonates accounted for the majority of shares in the osteoporosis drugs market as a result, major players increased investments in research and development of innovative novel bisphosphonates.

The market expansion is also driven by the widespread use of bisphosphonates to treat osteoporosis. The rank ligand inhibitors market is anticipated to expand at the fastest rate during the forecast period due to their use to manage bone transformation by acting as a chemoattractant to the bone for tumor cells that accelerate their RANK receptor.

The RANK ligand inhibitor category is anticipated to expand at the highest CAGR over the forecast period. Osteoporosis is treated with rank ligand inhibitors in patients at risk of fracture. The rising the growth development of rank ligand inhibitors is assisted by favorable patient outcomes. Positive patient outcomes can be authorized to fundamental changes in bone metabolism. Rank ligand inhibitors can be combined with other medications to produce a synergistic effect across the complete treatment plan.

Distribution Analysis

An increased Number of Patient Visits in Hospitals for Osteoporosis Treatment Drives the Hospital Pharmacies Segment. The market is segmented into hospitals pharmacies, retail pharmacies, and online pharmacies according to the distribution channel.

Increased in the number of osteoporosis patients demanding treatment in hospitals. Support from the government for the development of hospital pharmacies and other factors that fuel their growth.

Route Administration

On the basis of the route of administration, the osteoporosis drug is segmented into oral and injectable drugs. Due to the rise in oral drug use, the oral route of administration dominates the market. In addition, the rise in oral medication use is having a positive impact on larger production, which has contributed to the market’s expansion over time.

In contrast, it is anticipated that the injectable route of administration segment will experience faster growth during the forecast period due to the introduction of a new biosimilar that is safer and more user-friendly for osteoporosis treatment.

Key Market Segments

By Product

- Bisphosphonates

- Parathyroid Hormone Therapy Drugs

- Calcitonin

- Selective Estrogen Receptor Modulators

- RANK Ligand Inhibitor

- Others

By Route of Administration

By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Sales

Driver

Increasing Healthcare Expenditure

Rising healthcare costs globally, spurred by increasing disease prevalence and enhanced healthcare infrastructure, make treatments more accessible and affordable. This has led to improved market penetration and the introduction of innovative products targeting women’s health, further driving market growth.

Restraint

Adverse Effects and Increased Risk of Osteoporosis Drugs

The growth of the osteoporosis drug market is constrained by the adverse effects associated with anti-inflammatory and osteoporosis medications, including severe side effects like hot flashes, leg cramps, vomiting, and diarrhea. Additionally, patent expirations and increasing risk factors further hinder market expansion.

Opportunity

Expanding Healthcare Sectors in Emerging Economies

The osteoporosis drug market benefits from growing healthcare expenditures in emerging economies such as China, India, Brazil, and South Africa, coupled with an aging population and increased public health awareness. Investments in healthcare infrastructure by governments in these regions provide significant opportunities for market expansion through regional growth and new product developments.

Trend

Dominance of Injectable Osteoporosis Drugs

Technological advancements in diagnostics have improved osteoporosis screening, increasing the diagnosed patient pool and treatment rates. Injectable drugs, favored for their ease of administration and lower gastrointestinal impact, are expected to dominate the market, particularly benefiting patients unable to take oral bisphosphonates due to conditions like impaired kidney function.

Regional Analysis

North America Region accounts for Largest Share During Forecast Period

In North America, the osteoporosis drugs market dominates the largest shares in the market. This is because the number of elderly people, obesity, lifestyle-related diseases, and osteoporosis are all rising in the region. For instance, approximately 10 million people in the United States have osteoporosis, and 34 million people in the United States have low bone density, which increases their risk of fracture due to rising awareness of osteoporosis treatment, and changing lifestyles.

High healthcare costs and drug use for osteoporosis are common in North America. The growing population, shifting lifestyles, rapid urbanization, and rising awareness are all contributing factors to the expansion of the osteoporosis care market in Europe. Compared to hypertension and rheumatoid arthritis, osteoporotic fractures account for slightly more disability-adjusted life years in Europe.

Key Regions

- North America

- The US

- Canada

- Mexico

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

There are a number of major players in the osteoporosis medication market, which is comparatively determined by Pfizer Inc., Eli Lily and Company, F. Hoffmann La Roche, Merck & Co. Inc., Amgen Inc., Radius Health Inc., Teva Pharmaceutical Industries Ltd., GlaxoSmithKline PLC, Novartis International AG, and Actavis PLC are among the market leaders at the moment.

Due to the growing combination of common strategies by key players to maintain their competitive position, this industry is anticipated to experience intense competition during the forecast period. High R&D expenditures, unions and achievements, and contracts for drug advancements are additional strategies incorporated.

With the presence of many local and regional players, the market for companion diagnostics is fragmented. Market players are subject to intense competition from top market players, particularly those with strong brand recognition and high distribution networks. To stay on top of the market, companies have gained various expansion strategies such as partnerships and product launches. The following are some of the major players in the global osteoporosis drug Market.

Market Key Players

- Amgen Inc.

- Eli Lilly and Company

- Hoffmann-La Roche AG

- Mark and Co. Inc.

- Novartis AG

- Pfizer Inc.

- Radius Health Inc.

- Teva Pharmaceutical Industries Ltd.

- Novo Nordisk A\S

- UCB

- Other key players

Recent Development

- In October 2024: Eli Lilly announced a major investment of $4.5 billion in a new facility named the Lilly Medicine Foundry, aimed at driving innovation in drug production, including medications for osteoporosis. This new complex is part of a broader expansion in Indiana, which also includes significant investments in manufacturing capabilities that contribute to the production of various therapies, potentially encompassing osteoporosis treatments.

- In December 2023: Pfizer completed the acquisition of Seagen Inc., significantly enhancing its oncology pipeline which includes multiple modalities potentially applicable to osteoporosis through novel biologic combinations. This acquisition, valued at $229 per share for all outstanding common stock, reflects a strategic expansion aimed at developing transformative cancer and potentially osteoporosis treatments.

Report Scope

Report Features Description Market Value (2022) USD 7.0 Bn Forecast Revenue (2032) USD 9.8 Bn CAGR (2023-2032) 3.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Bisphosphonates, Parathyroid Hormone Therapy Drugs, Calcitonin, Selective Estrogen Receptor Modulators, RANK Ligand Inhibitor and Others); By Distribution Channel (Retail Pharmacies, Hospital Pharmacies and Online Sales); Route Administration (Oral and Injectable) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Amgen Inc., Eli Lilly and Company, F. Hoffmann-La Roche AG, Mark and Co. Inc., Novartis AG, Pfizer Inc., Radius Health Inc., Teva Pharmaceutical Industries Ltd., Novo Nordisk A\S, UCB, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amgen Inc.

- Eli Lilly and Company

- Hoffmann-La Roche AG

- Mark and Co. Inc.

- Novartis AG

- Pfizer Inc.

- Radius Health Inc.

- Teva Pharmaceutical Industries Ltd.

- Novo Nordisk A\S

- UCB

- Other key players