Global Organic Photovoltaics (OPV) Market By Type(Dye-sensitized Nano Crystalline Solar Cells, PN Junction Structure), By Application(Building-integrated Photovoltaic (BIPV), Portable Electronics, Defense Application, Conventional Solar, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 117016

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

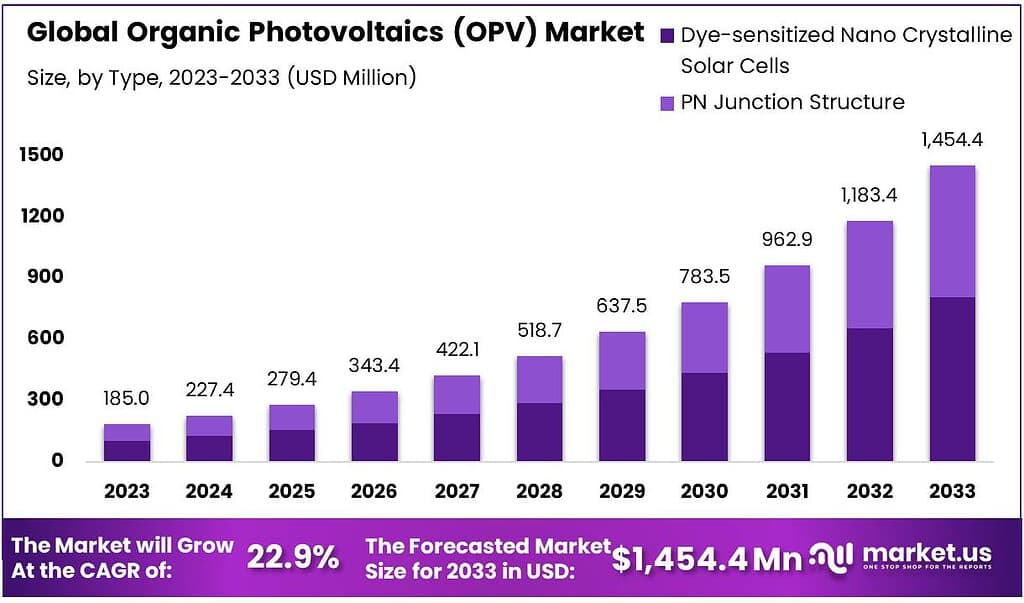

The global Organic Photovoltaics (OPV) Market size is expected to be worth around USD 1454.4 Million by 2033, from USD 185 Million in 2023, growing at a CAGR of 22.9% during the forecast period from 2023 to 2033.

The Organic Photovoltaics (OPV) Market refers to the industry involved in the development, production, and distribution of solar cells that use organic materials to convert sunlight into electricity. These organic materials, such as polymers or small molecules, can be applied in thin layers to create lightweight, flexible, and potentially cost-effective solar cells.

The OPV market encompasses various aspects, including research and development of new materials and manufacturing processes, production of organic photovoltaic modules, distribution and sales of OPV products, and integration of OPV technology into various applications such as building-integrated photovoltaics (BIPV), consumer electronics, and portable power solutions.

The OPV market holds promise for providing renewable energy solutions with unique advantages such as flexibility, lightweight, and potential for low-cost production. However, challenges such as lower efficiency compared to traditional silicon-based solar cells and stability issues in varying environmental conditions are areas of ongoing research and development within the OPV industry.

Key players in the OPV market include manufacturers of organic photovoltaic materials, module producers, equipment suppliers, research institutions, and end-users in industries like construction, electronics, and renewable energy.

Key Takeaways

- Market Growth: OPV market is poised for 22.9% CAGR, reaching USD 1454.4 million by 2033 from USD 185 million in 2023.

- Technology: OPV employs organic materials for lightweight, flexible solar cells converting sunlight into electricity.

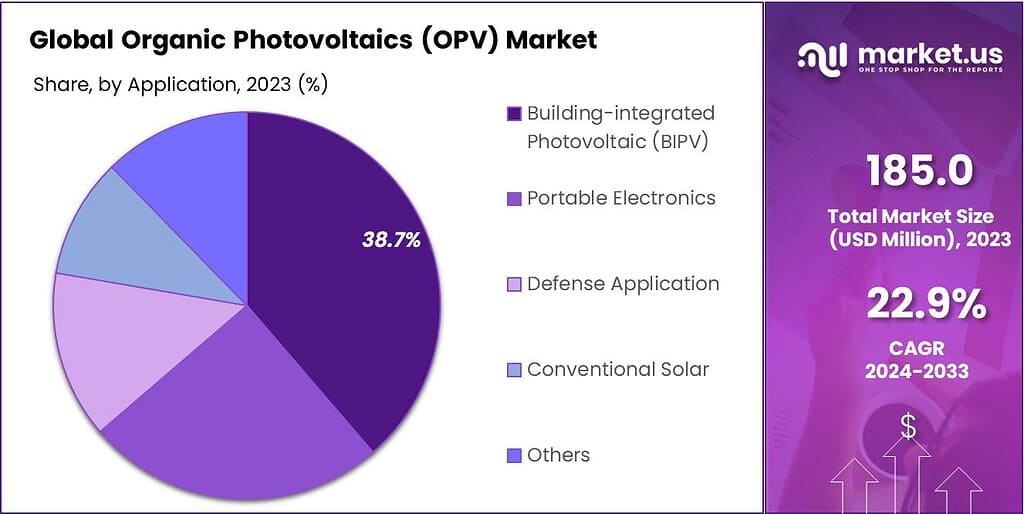

- Dominant Segments: Dye-sensitized cells lead with 55.4% market share; BIPV emerges as top application at 38.7%.

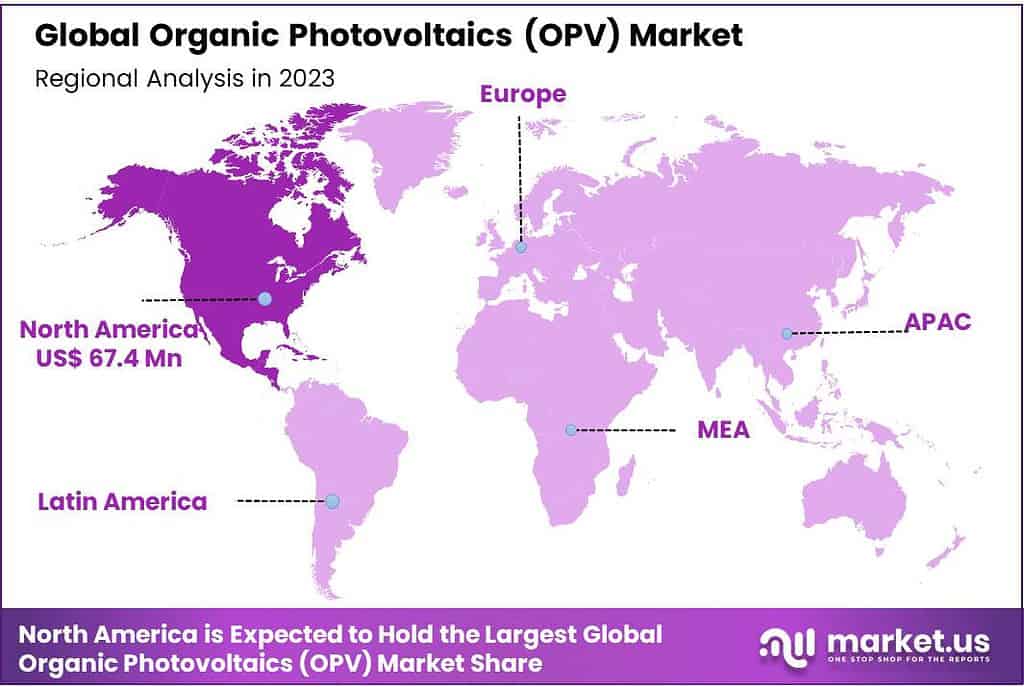

- Regional Leadership: North America leads with 36.4% market share, while Asia Pacific shows rapid growth potential.

- In 2023, it is expected that the efficiency of OPV cells in research labs could reach 20%, driven by advancements in materials and device architectures.

- By 2024, the global OPV market is expected to reach a value of approximately $700 million, with major applications in BIPV, consumer electronics, and wearable devices.

- As of 2022, the highest reported efficiency for OPV cells in research labs is around 18%, achieved by companies like Heliatek and Ubiquitous Energy.

By Type

In 2023, Dye-sensitized Nano Crystalline Solar Cells dominated the Organic Photovoltaics (OPV) Market, seizing over 55.4% of the market share. These cells are known for their cost-effectiveness and reasonable efficiency levels, making them a popular choice across various applications.

Meanwhile, PN Junction Structure, though less prevalent, still captured a substantial market share. These structures are gaining attention due to their potential for higher efficiency and improved stability compared to Dye-sensitized Nano Crystalline Solar Cells.

Moving forward, both segments are expected to see continued growth and innovation. Dye-sensitized Nano Crystalline Solar Cells are likely to maintain their dominance, driven by their affordability and versatility. However, PN Junction Structure is anticipated to gain momentum as advancements in technology lead to enhanced performance and reliability.

Ultimately, the choice between the two types depends on specific application requirements, cost considerations, and technological advancements within the OPV industry. As research and development efforts continue to push the boundaries of organic photovoltaic technology, both segments are poised to contribute significantly to the growth of the OPV market.

By Application

In 2023, Building-integrated Photovoltaic (BIPV) emerged as the leading application segment in the Organic Photovoltaics (OPV) Market, securing over 38.7% of the market share. BIPV systems are gaining popularity due to their ability to seamlessly integrate solar panels into building structures, providing both energy generation and architectural benefits.

Following closely behind is the Portable Electronics segment, which accounted for a significant share. OPV technology is well-suited for portable electronic devices such as smartphones, tablets, and wearable gadgets due to its lightweight and flexible nature.

Additionally, Defense Applications constituted a notable portion of the OPV market. The defense sector is increasingly adopting OPV technology for applications such as portable power generation for soldiers in remote locations and unmanned aerial vehicles (UAVs).

Conventional Solar applications, although a smaller segment, still held a considerable market share. OPV technology is being integrated into traditional solar installations to enhance efficiency and reduce costs.

Other applications, including outdoor signage, off-grid power solutions, and agricultural applications, collectively contributed to the remaining market share. These niche applications showcase the versatility and adaptability of OPV technology to various industries and use cases.

Looking ahead, the Building-integrated Photovoltaic (BIPV) segment is expected to maintain its dominance, driven by increasing demand for sustainable building solutions and government initiatives promoting renewable energy integration. Meanwhile, the Portable Electronics and Defense Applications segments are anticipated to see steady growth, driven by advancements in OPV technology and expanding applications in these sectors.

Market Key Segments

By Type

- Dye-sensitized Nano Crystalline Solar Cells

- PN Junction Structure

By Application

- Building-integrated Photovoltaic (BIPV)

- Portable Electronics

- Defense Application

- Conventional Solar

- Others

Drivers

Growing Demand for Sustainable Energy Solutions

One of the primary drivers of the Organic Photovoltaics (OPV) Market is the increasing global demand for sustainable energy solutions. With growing concerns about climate change and environmental degradation, there is a significant push towards renewable energy sources such as solar power. OPV technology offers a promising alternative to traditional silicon-based solar cells due to its lightweight, flexible, and potentially lower-cost manufacturing processes.

Advancements in OPV Technology

Ongoing research and development efforts have led to significant advancements in organic photovoltaic technology, improving efficiency, stability, and durability. Innovations in materials science, device design, and manufacturing techniques have enabled OPV cells to achieve higher efficiency levels and longer lifespans, making them more competitive with conventional solar cells.

Government Support and Incentives

Government initiatives and policies aimed at promoting renewable energy adoption are driving growth in the OPV market. Many countries have implemented renewable energy targets, feed-in tariffs, tax incentives, and subsidies to encourage investment in solar power generation. Additionally, regulatory mandates for energy-efficient buildings and green construction practices are creating opportunities for Building-integrated Photovoltaic (BIPV) applications, further fueling the demand for OPV technology.

Restraints

Low Efficiency Compared to Silicon-based Solar Cells

One of the primary restraints facing the OPV market is the lower efficiency of organic photovoltaic cells compared to traditional silicon-based solar cells. While OPV technology has made significant advancements in recent years, its efficiency levels still lag behind those of silicon-based solar cells. This performance gap limits the competitiveness of OPV technology in certain applications, particularly large-scale solar power plants where efficiency is critical for economic viability.

Limited Lifespan and Stability

Another challenge for OPV technology is its limited lifespan and stability under real-world operating conditions. Organic materials used in OPV cells are susceptible to degradation from environmental factors such as moisture, heat, and UV radiation, leading to a decline in performance over time. Ensuring long-term stability and durability is essential for the widespread adoption of OPV technology in commercial applications.

High Initial Costs and Scale-up Challenges

The initial costs of OPV technology, including research and development, manufacturing equipment, and materials, can be relatively high compared to conventional solar technologies. Additionally, scaling up production to commercial levels while maintaining quality control and cost-effectiveness presents significant challenges for OPV manufacturers. Overcoming these barriers requires substantial investment, collaboration, and innovation across the value chain.

Opportunity

Emerging Markets and Applications

The OPV market presents significant opportunities for growth in emerging markets and applications. As technology continues to improve and costs decline, OPV technology is becoming increasingly viable for a wide range of applications beyond traditional solar panels. Opportunities exist in sectors such as consumer electronics, automotive, wearable technology, and IoT devices, where lightweight, flexible, and customizable solar solutions are in demand.

Integration into Smart Buildings and IoT Networks

The rise of smart buildings and Internet of Things (IoT) networks presents new opportunities for OPV technology. Integrated with sensors, energy management systems, and connected devices, OPV modules can enable smart energy harvesting, self-powered sensors, and energy-efficient building automation. This integration offers potential cost savings, energy efficiency improvements, and environmental benefits for building owners and operators.

Collaboration and Partnerships

Collaboration and partnerships between academia, industry, and government stakeholders are crucial for driving innovation and market growth in the OPV industry. Joint research initiatives, technology transfer agreements, and strategic alliances can accelerate the development and commercialization of OPV technology, opening up new opportunities for market expansion and differentiation. Additionally, collaboration with end-users and downstream industries can help identify specific application requirements and drive product innovation to meet market demand.

Trends

Rapid Technological Innovations

A significant trend in the OPV market is the rapid pace of technological innovation. Researchers and companies are continually exploring new materials, device architectures, and manufacturing processes to improve the performance and commercial viability of organic photovoltaic technology. Emerging trends include the development of tandem and perovskite-enhanced OPV cells, which promise to further increase efficiency and stability.

Integration into Building Materials

Another notable trend is the integration of OPV technology into building materials, known as Building-integrated Photovoltaics (BIPV). BIPV solutions allow solar panels to be seamlessly integrated into building facades, roofs, windows, and other architectural elements, offering both energy generation and aesthetic benefits. This trend is driven by increasing demand for sustainable building solutions and green construction practices.

Emergence of Flexible and Transparent OPV Modules

With advancements in materials science and manufacturing techniques, flexible and transparent OPV modules are gaining traction in the market. These modules can be integrated into curved surfaces, windows, and even wearable devices, expanding the range of applications for OPV technology. Flexible and transparent OPV modules offer versatility and design flexibility, making them attractive for applications such as portable electronics, automotive, and consumer goods.

Geopolitical Impact Analysis

Geopolitical Factors and Energy Prices Impacting the Organic Photovoltaics (OPV) Market

The geopolitical landscape exerts a notable influence on the Organic Photovoltaics (OPV) Market, particularly concerning government policies and energy prices. Governments’ involvement in energy policies and renewable energy initiatives significantly shapes the market dynamics, affecting both demand and supply factors.

As nations prioritize sustainable energy sources to combat climate change, there’s a heightened focus on promoting renewable energy technologies like OPV. Government incentives, subsidies, and regulatory frameworks play a pivotal role in driving market growth by encouraging investments in OPV research, development, and deployment.

However, geopolitical tensions and trade disputes between countries can disrupt the OPV market by imposing tariffs, trade barriers, and export restrictions on critical raw materials used in OPV production. Such actions can lead to supply chain disruptions, increased costs, and market uncertainties for OPV manufacturers.

Moreover, the OPV market is sensitive to fluctuations in global energy prices, particularly those related to fossil fuels. Changes in oil and gas prices directly impact the cost structure of OPV materials and manufacturing processes. Rising energy prices may increase production costs, thereby affecting the competitiveness of OPV technology compared to conventional energy sources.

To navigate geopolitical challenges and energy price fluctuations, OPV companies must adopt strategic measures. These may include diversifying supply chains to reduce reliance on single suppliers, securing long-term contracts for raw materials, and exploring alternative sourcing options. Additionally, investing in research and development to enhance OPV efficiency and reduce production costs can improve market resilience.

Furthermore, aligning with government energy policies and sustainability initiatives is crucial for OPV companies to capitalize on market opportunities. Participating in renewable energy programs, adhering to regulatory standards, and obtaining certifications can enhance market credibility and facilitate access to government contracts and incentives.

In conclusion, while geopolitical factors and energy prices pose challenges to the OPV market, proactive measures, strategic partnerships, and adherence to sustainability goals can help OPV companies navigate uncertainties and capitalize on emerging opportunities in the renewable energy sector.

Regional Analysis

North America Leads the Way in the Organic Photovoltaics (OPV) Market

North America takes the lead in the global Organic Photovoltaics (OPV) Market, capturing a significant market share of 36.4%. This dominance stems from the region’s robust technological advancements and investments, particularly in industries such as aerospace and defense. Major players like Boeing and Lockheed Martin drive substantial investments in renewable energy solutions, including OPV technology, further boosting the market in North America.

The application scope of OPV extends beyond aerospace and defense, encompassing diverse industries such as agriculture, consumer electronics, and building-integrated photovoltaics (BIPV). In North America, the adoption of OPV technology in these sectors reflects a growing demand for sustainable energy solutions and innovative technological advancements.

Meanwhile, the Asia Pacific region emerges as a key growth market for OPV, poised to witness the highest growth rate. This accelerated expansion is driven by intensified research and development efforts, particularly in countries like China and India. The region’s focus on enhancing renewable energy technologies, including OPV, fuels optimism for significant market growth in the Asia Pacific region during the forecast period.

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

In the Organic Photovoltaics (OPV) Market, several key players are driving innovation and market growth. Companies such as Heliatek GmbH, Solarmer Energy Inc., and Armor Group are prominent players in the OPV industry, known for their expertise in organic photovoltaic technology and significant investments in research and development.

Heliatek GmbH, based in Germany, is a leading manufacturer of organic solar films and modules, known for its lightweight and flexible OPV solutions suitable for various applications, including building-integrated photovoltaics (BIPV) and consumer electronics.

Market Key Players

- Heliatek

- Belectric

- Merck Group

- ARMOR

- Heraeus Group

- Sunew

- Solarmer Energy, Inc.

- DisaSolar

- InfinityPV

- Eight19

- ENI

- OPVius

Recent Developments

2024: Merck Group launched a new line of eco-friendly OPV materials, catering to the growing demand for sustainable energy solutions.

2024: ARMOR invested in research initiatives focused on improving the stability and durability of OPV modules, addressing key challenges in commercial deployment.

2024: Sunew expanded its product portfolio to include customizable OPV solutions for architectural applications, offering architects greater design flexibility.

Report Scope

Report Features Description Market Value (2023) USD 185 Mn Forecast Revenue (2033) USD 1454.4 Mn CAGR (2024-2033) 22.9% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Dye-sensitized Nano Crystalline Solar Cells, PN Junction Structure), By Application(Building-integrated Photovoltaic (BIPV), Portable Electronics, Defense Application, Conventional Solar, Others) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, India, Japan, South Korea, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, and Rest of Middle East & Africa. Competitive Landscape Heliatek, Belectric, Merck Group, ARMOR, Heraeus Group, Sunew, Solarmer Energy, Inc., DisaSolar, InfinityPV, Eight19, ENI, OPVius Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Name the major industry players in the Organic Photovoltaics (OPV) Market?Heliatek, Belectric, Merck Group, ARMOR, Heraeus Group, Sunew, Solarmer Energy, Inc., DisaSolar, InfinityPV, Eight19, ENI, OPVius

What is the size of Organic Photovoltaics (OPV) Market?Organic Photovoltaics (OPV) Market size is expected to be worth around USD 1454.4 Million by 2033, from USD 185 Million in 2023

What CAGR is projected for the Organic Photovoltaics (OPV) Market?The Organic Photovoltaics (OPV) Market is expected to grow at 22.9% CAGR (2024-2033). Organic Photovoltaics (OPV) MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Organic Photovoltaics (OPV) MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Heliatek

- Belectric

- Merck Group

- ARMOR

- Heraeus Group

- Sunew

- Solarmer Energy, Inc.

- DisaSolar

- InfinityPV

- Eight19

- ENI

- OPVius