Global Organic Milk Thistle Market Size, Share Analysis Report By Form (Powder Form, Liquid Extracts, Capsules and Tablets, Others), By Application (Nutraceuticals, Cosmetics, Pharmaceuticals, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162506

- Number of Pages: 264

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

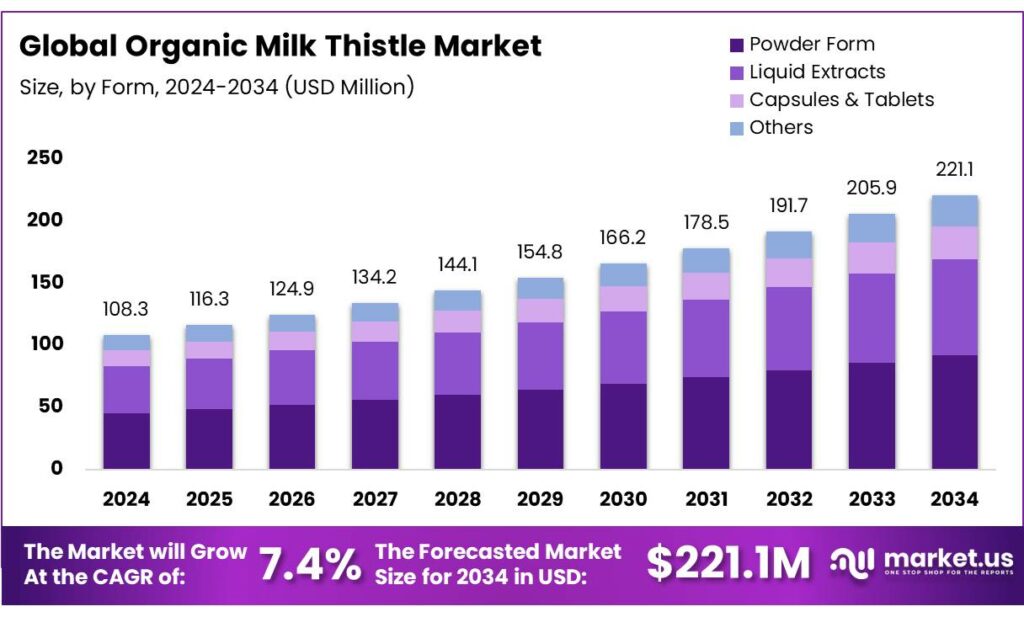

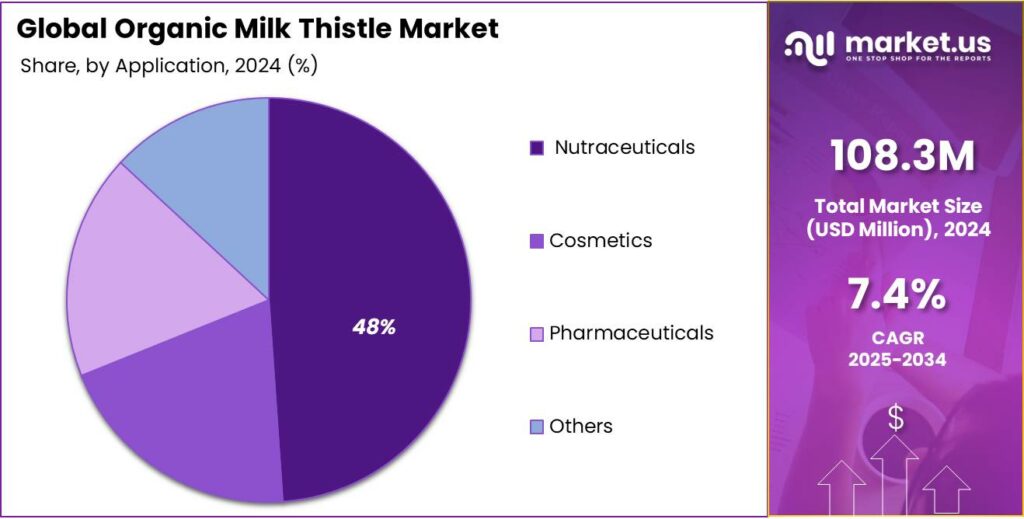

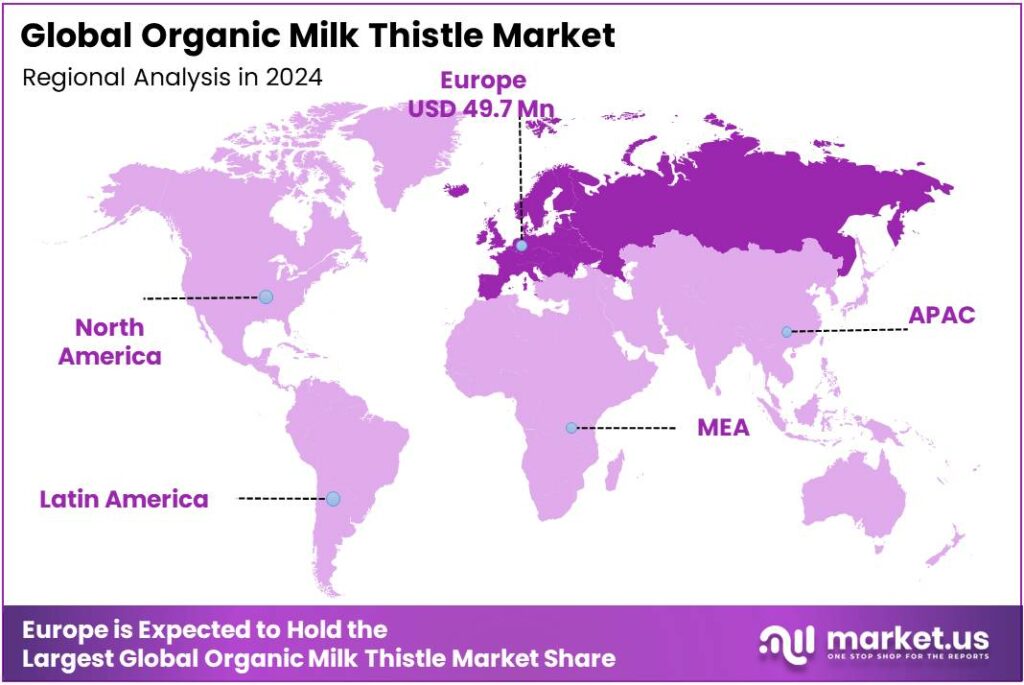

The Global Organic Milk Thistle Market size is expected to be worth around USD 221.1 Million by 2034, from USD 108.3 Million in 2024, growing at a CAGR of 7.4% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 45.90% share, holding USD 49.7 Million in revenue.

Organic milk thistle (Silybum marianum) sits at the intersection of botanical therapeutics and certified-organic supply chains, with demand anchored in liver and digestive health positioning. In the U.S., consumers’ embrace of complementary health approaches has broadened the market base: the share of adults using at least one approach rose from 19.2% (2002) to 36.7% (2022), signaling receptivity to non-pharmaceutical options that include herbal supplements.

- Safety evidence is favorable; NIH’s LiverTox notes human tolerance even at 2.1 g/day of silymarin with mainly mild, transient effects—an important consideration for product development and practitioner guidance.

Industrial momentum is supported by the broad normalization of traditional and complementary medicine and the rapid expansion of organic retail channels. The World Health Organization reports that 170 Member States acknowledge the use of traditional medicine and estimates that ~88% of all countries use it, reinforcing baseline demand for botanicals like milk thistle in regulated markets. On the channel side, the global market for organic products reached €136.4 billion in 2023, while the U.S. organic marketplace accelerated in 2024 to $71.6 billion, creating larger “natural” shelves where organic herbal supplements compete for space and consumer spend.

Key demand drivers include sustained organic food penetration and retailer category growth that cross-merchandise supplements. USDA’s Economic Research Service reports U.S. organic food sales rising from about $11 billion two decades ago to nearly $64 billion, with produce accounting for 33% of U.S. organic food sales in 2024—a proxy for shopper traffic into organic aisles where herbal SKUs are discovered.

Regulatory and policy frameworks also shape the category’s trajectory. In the EU, milk thistle fruit preparations carry an EMA/HMPC traditional-use monograph for relief of dyspepsia and digestive complaints of hepatic origin—useful for labeling consistency in phytomedicines.

- Organic certification itself is guided by the EU’s Regulation (EU) 2018/848 and implementing acts governing production, controls, trade, and labeling; these rules have tightened import rigor and harmonized standards, supporting premium positioning for organic botanicals.

Key Takeaways

- Organic Milk Thistle Market size is expected to be worth around USD 221.1 Million by 2034, from USD 108.3 Million in 2024, growing at a CAGR of 7.4%.

- Powder Form held a dominant market position, capturing more than a 37.4% share in the organic milk thistle market.

- Nutraceuticals held a dominant market position, capturing more than a 48.9% share in the organic milk thistle market.

- Europe held a dominant position in the global organic milk thistle market, capturing more than 45.90% of the market share, equating to an estimated value of USD 49.7 million.

By Form Analysis

Powder Form dominates with 37.4% due to its ease of use and versatility

In 2024, Powder Form held a dominant market position, capturing more than a 37.4% share in the organic milk thistle market. This strong performance can be attributed to its convenience in consumption and formulation, allowing it to be easily incorporated into teas, smoothies, capsules, and dietary supplements. Consumers increasingly prefer the powdered variant for its ability to provide precise dosing and faster absorption of active compounds like silymarin.

The form also supports diverse product innovations, from blended herbal supplements to functional food products, enhancing its appeal across health-conscious and wellness-oriented populations. By 2025, demand for powder form is expected to maintain a steady trajectory, driven by rising awareness of liver health benefits and the growing trend of natural, organic supplement consumption. The segment’s widespread availability across online and retail channels further reinforces its leading position, establishing it as the preferred choice for both manufacturers and end-users seeking versatile and effective milk thistle solutions.

By Application Analysis

Nutraceuticals lead with 48.9% driven by growing health and wellness focus

In 2024, Nutraceuticals held a dominant market position, capturing more than a 48.9% share in the organic milk thistle market. This strong performance is largely driven by increasing consumer awareness of liver health, detoxification, and overall wellness, making milk thistle a preferred ingredient in dietary supplements and functional foods. The nutraceutical segment benefits from the ease of integrating powdered or extract forms of milk thistle into capsules, tablets, and drink mixes, allowing for convenient daily consumption.

Demand in this application is expected to remain robust as more health-conscious consumers and aging populations seek natural preventive solutions. Additionally, the growing trend of preventive healthcare and the rising popularity of plant-based supplements reinforce the segment’s dominant position, positioning nutraceuticals as the primary avenue for market growth and product innovation in organic milk thistle.

Key Market Segments

By Form

- Powder Form

- Liquid Extracts

- Capsules & Tablets

- Others

By Application

- Nutraceuticals

- Cosmetics

- Pharmaceuticals

- Others

Emerging Trends

Surge in e-commerce and direct-to-consumer channels

One of the most telling trends in the organic sector—one that matters for ingredients like organic milk thistle—is the growing role of online and direct-to-consumer (DTC) channels. In the U.S., the share of organic food sold via the internet grew from only 2% in 2012 to roughly 6.7 % in 2024. This shift matters because botanical supplements and specialty herbs like organic milk thistle often fit better in digitally enabled supply chains and niche wellness-retail formats than in mass conventional grocery aisles.

Consumers increasingly buy health-focused ingredients and supplements online, where they can access more product information, compare brands, and value the “story” behind organic certification, sustainable sourcing and transparent identity. For organic milk thistle, this means brands that tell the origin of the silymarin extract, show farm-to-capsule traceability, and offer subscription or direct-ship formats can ride the digital channel momentum. The broader organic marketplace supports this: in 2024 certified-organic product sales in the U.S. reached US$ 71.6 billion, growing +5.2% year-on-year—more than double the growth of the total food marketplace (2.5%).

Policy and institutional support also reinforce this channel shift. For example, the United States Department of Agriculture (USDA) awarded approximately US$ 24.8 million in grants in early 2024 through its Organic Market Development Grant (OMDG) programme to bolster processing-capacity expansion and market access for organic producers, part of broader efforts to connect organic farms with domestic buyers and new channels. For organic milk thistle suppliers this means improved infrastructure and potentially better access to smaller-batch organic herbal processing aligned with DTC formats rather than conventional commodity supply chains.

In practice, for the organic milk thistle ingredient market, this trend highly suggests the following: growers and extractors who build direct supply relationships with wellness brands, and who invest early in digital-brand narratives and DTC fulfilment readiness, can gain disproportionate advantage. Conversely, firms tied exclusively to conventional retail channels may miss faster-growing niche wellness pockets. The online channel growth from 2% to 6.7% for organic food shows the runway is significant—and, given that the online wellness-herb audience is even more digitally native, the opportunity is amplified.

Drivers

Growing consumer preference for certified organic products

One of the key driving factors for the organic milk thistle market is the rising consumer demand for certified organic products, particularly in food and supplement categories. In the United States, retail sales of certified organic products reached USD 71.6 billion in 2024, representing an annual growth rate of 5.2%, which was more than double the growth rate (2.5%) of the overall food marketplace in the same period.

This preference reflects a broader mindset shift: consumers are increasingly conscious about ingredient origins, environmental impact, and production practices. Specifically for botanical supplements like organic milk thistle, this means that buyers are looking for assurance not only of efficacy but also of purity, traceability, and compliance with organic standards. The fact that organic food still captures only around 4-5% of total food sales in the U.S. but is growing faster than conventional categories demonstrates that organic remains a premium niche with meaningful expansion potential.

Another important insight is that online and specialty channels are also supporting this demand. For example, the share of organic food sold via the internet in the U.S. grew from about 2% in 2012 to approximately 6.7% in 2024. This means that consumers comfortable with digital shopping are increasingly gravitating toward organic options, including botanical supplements, which often rely on e-commerce for distribution.

From a supply-side perspective, the institutional backing for organic production also strengthens this driver. The United States Department of Agriculture (USDA) via its National Organic Program and the Economic Research Service provides data, market support and certification frameworks that make it easier for processors and retailers to source organic botanicals.

Restraints

Tightening compliance and limited claims slow adoption

A major restraint for organic milk thistle is the growing cost and complexity of staying compliant while marketing a product whose clinical benefits remain uncertain. In Europe, regulators are sharpening food-chain oversight, and the numbers show how tight the bar is. The European Food Safety Authority’s latest pesticide-residue review found 13,246 samples in the coordinated-program subset, with 1.0% non-compliant; across an additional 132,793 risk-based samples, 2.0% were non-compliant. In total, 98% of samples were within legal limits—good news for consumers, but it also means even small lapses can trigger costly batch rework or lost certification for suppliers of organic botanicals such as milk thistle.

On the U.S. side, the USDA has tightened organic rules through the Strengthening Organic Enforcement (SOE) regulation. The rule expands certification, traceability, and inspection requirements across the supply chain, including more importers and handlers—raising record-keeping and audit demands for processors of organic milk thistle extracts. USDA explains the intent is to improve “farm-to-market” traceability and impose robust enforcement against fraud; this protects the seal but adds overhead for small and mid-sized herb brands. The agency also publishes active enforcement actions and outcomes, underscoring that noncompliance can lead to suspensions or revocations—real business risks when inventories are tight and lead times matter.

At the same time, the evidence base for milk thistle is mixed, which narrows allowable health messaging. The U.S. National Center for Complementary and Integrative Health notes that trials for liver diseases have been conflicting or too limited to draw conclusions. Marketers must therefore avoid disease claims and lean on general structure-function language, limiting the demand pull that strong clinical consensus can create. In Europe, the EMA’s herbal monograph classifies milk thistle fruit preparations for traditional use rather than well-established medicinal use—again curbing the scope of claims and pushing companies toward conservative labeling.

Opportunity

Policy-backed organic expansion unlocks certified supply

A powerful growth opportunity for organic milk thistle is the clear policy push—on both sides of the Atlantic—to expand certified-organic agriculture, which directly improves access to verified organic seed, flowers/fruits, and extracts for supplement and tea manufacturers. Globally, certified organic farmland reached ~98.9 million hectares in 2023, up +2.5 million ha year-on-year, according to FiBL/IFOAM’s latest statistical yearbook; retail organic food sales were ~€136 billion in 2023, signaling resilient consumer pull that organic botanicals can tap.

The European Union has set a concrete market signal: under the Green Deal’s Farm-to-Fork strategy, at least 25% of the EU’s agricultural area should be organic by 2030. Progress is measurable—organic land share rose from 5.9% (2012) to 10.8% (2023)—but reaching the target will require accelerated conversion, which implies further growth in certified acreage available for botanical crops. For brands planning EU-compliant organic milk thistle lines, this trajectory means deeper supply pools and, potentially, more competitive pricing on certified inputs over time.

In the United States, the public sector has committed to expanding organic supply via the Organic Transition Initiative (OTI), a US$300 million program launched in 2022 to help producers overcome barriers to certification through mentoring (TOPP), markets, and risk-management tools. For specialty botanicals, OTI funding can enlarge the pool of domestic contract growers and handlers who meet USDA organic standards, tightening chain-of-custody and reducing import dependence.

These policy moves dovetail with category-specific realities. While clinical conclusions for milk thistle in liver diseases remain conflicting or too limited, the herb’s long safety history and widespread traditional use keep it relevant for wellness-positioned, clean-label products—especially when backed by organic certification and rigorous identity testing. For formulators, the expanding organic acreage in regions like Latin America and Africa creates optionality to diversify agricultural sources, hedge weather and pricing risks, and build resilient, certified supply chains.

Regional Insights

Europe leads with 45.90% share, valued at USD 49.7 million in 2024

In 2024, Europe held a dominant position in the global organic milk thistle market, capturing more than 45.90% of the market share, equating to an estimated value of USD 49.7 million. This leadership is attributed to several key factors. Firstly, the region has a well-established preference for organic and natural health products, driven by increasing consumer awareness of the benefits associated with herbal supplements. Additionally, Europe boasts a robust infrastructure for the cultivation and distribution of organic products, supported by favorable agricultural policies and certifications that ensure product quality and traceability.

The European market is characterized by a diverse consumer base, with significant demand emanating from countries such as Germany, France, and the United Kingdom. These nations have witnessed a steady rise in the adoption of organic supplements, including milk thistle, as part of a broader trend towards preventive healthcare and wellness. The presence of established retail networks and a growing online marketplace further facilitate the accessibility of organic milk thistle products to consumers across the continent.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Primaforce is recognized for its high-quality herbal supplements, including milk thistle, aimed at fitness and wellness consumers. In 2024, the company focused on producing milk thistle extracts and capsules standardized for silymarin content, ensuring consistent efficacy. Its products are widely available across online marketplaces, health stores, and sports nutrition outlets. Primaforce’s emphasis on scientifically backed formulations and adherence to organic and non-GMO standards strengthens consumer trust. Rising awareness of liver health and preventive care continues to drive its growth within the global organic milk thistle market.

Zazzee Naturals is a prominent supplier of herbal and dietary supplements, offering organic milk thistle in capsule and powdered forms. The company emphasizes eco-friendly sourcing, sustainability, and rigorous quality control to ensure high silymarin content. In 2024, Zazzee Naturals expanded distribution through e-commerce platforms and specialty health stores, targeting consumers prioritizing liver health and detoxification. Its focus on clean-label and chemical-free supplements aligns with growing trends toward preventive healthcare. Zazzee Naturals’ commitment to product efficacy and safety reinforces its reputation in the organic milk thistle market.

Pure Co is a specialist in natural herbal supplements, providing certified organic milk thistle products aimed at promoting liver health. In 2024, the company introduced both powder and capsule formats, standardized for active silymarin content to enhance effectiveness. It emphasizes sustainable cultivation, chemical-free processing, and adherence to non-GMO standards. Pure Co distributes through online platforms and retail outlets, catering to health-conscious consumers seeking trusted herbal solutions. Rising consumer preference for organic and plant-based supplements supports its strong positioning in the competitive organic milk thistle market.

Top Key Players Outlook

- Oregon’s Wild Harvest

- Mountain Rose Herbs

- Primaforce

- Zazzee Naturals

- Pure Co

- Nature’s Answer

- XYMOGEN

- OmniBiotics

- Nature’s Way

- Natrol

Recent Industry Developments

In 2024 Zazzee Naturals, offered a range of milk thistle products, including the USDA Organic Milk Thistle 30:1 Extract, which provides 7,500 mg strength per capsule and 120 capsules per bottle, offering up to a four-month supply.

In 2024 Primaforce, introduced its Milk Thistle 180 Capsules, each containing a 4:1 extract equivalent to 1,000 mg of milk thistle per serving, sourced from 250 mg of the extract.

Report Scope

Report Features Description Market Value (2024) USD 108.3 Mn Forecast Revenue (2034) USD 221.1 Mn CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder Form, Liquid Extracts, Capsules and Tablets, Others), By Application (Nutraceuticals, Cosmetics, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Oregon’s Wild Harvest, Mountain Rose Herbs, Primaforce, Zazzee Naturals, Pure Co, Nature’s Answer, XYMOGEN, OmniBiotics, Nature’s Way, Natrol Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Organic Milk Thistle MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Organic Milk Thistle MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Oregon’s Wild Harvest

- Mountain Rose Herbs

- Primaforce

- Zazzee Naturals

- Pure Co

- Nature’s Answer

- XYMOGEN

- OmniBiotics

- Nature’s Way

- Natrol