Global Organic Goji Berries Market Size, Share and Report Analysis By Product Type (Whole, Powder, Juice, Others), By End Use (Food and Beverage, Pharmaceuticals, Nutraceuticals, Personal Care and Cosmetics, Others), By Distribution Channel (Hypermarkets/Supermarkets, Specialty Stores, Convenience Stores, Online Retail, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175934

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

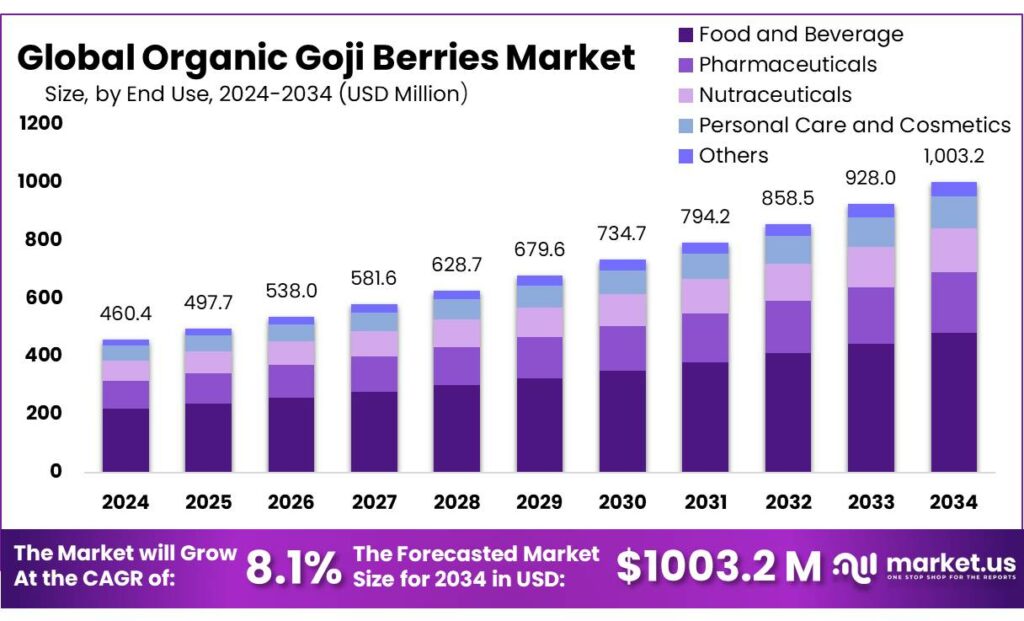

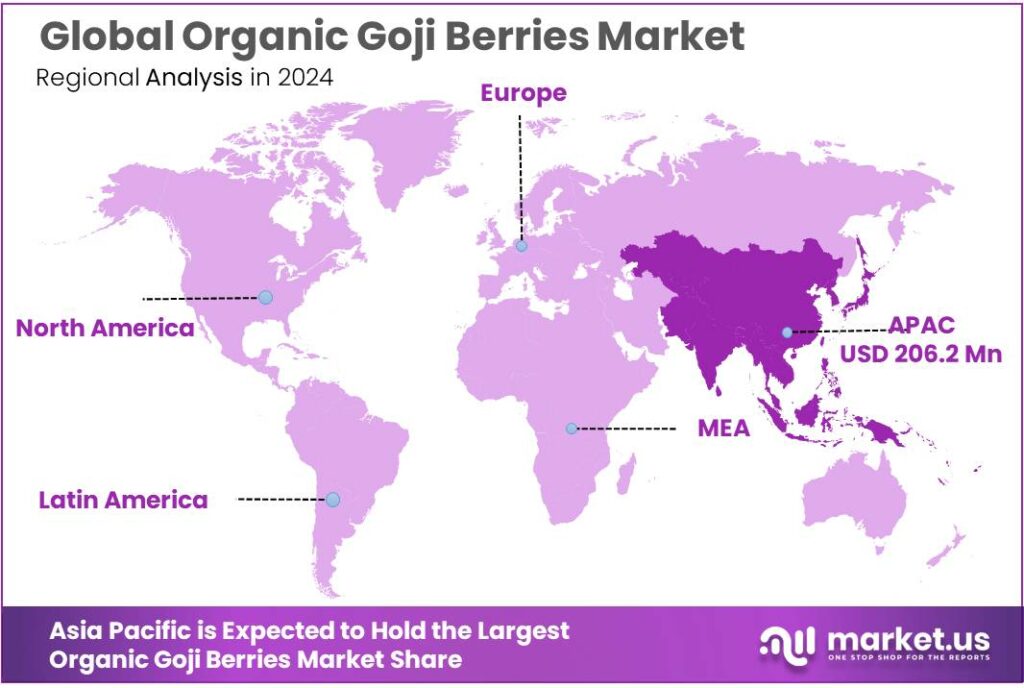

Global Organic Goji Berries Market size is expected to be worth around USD 1003.2 Million by 2034, from USD 460.4 Million in 2024, growing at a CAGR of 8.1% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 44.8% share, holding USD 206.2 Million in revenue.

Organic goji berries sit at the intersection of “better-for-you” snacking, functional ingredients, and certified organic agriculture. In market terms, the category is defined less by fresh fruit turnover and more by shelf-stable formats—dried berries, powders, extracts, and blend inclusions for teas, cereals, bars, and supplements—where provenance, residue compliance, and certification credibility shape purchase decisions as much as taste and appearance.

- For example, Ningxia’s goji cultivation area has been cited at 325,000 mu, alongside an annual fresh output figure of 320,000 tonnes. This concentration supports scale in harvesting, drying, grading, and deep processing, but it also amplifies buyer focus on traceability, pesticide monitoring, and certification integrity—especially for organic lots destined for the U.S., EU, and premium Asian retail channels.

Export momentum, while variable by season and trade conditions, is a notable support pillar for the category. China Daily reported that the export value of goji berries from Ningxia increased 16.9% year-on-year in the first four months of 2024, highlighting active cross-border demand for processed and packaged shipments, including organic dried goji consignments inspected for export clearance. In parallel, the broader organic foods backdrop remains constructive: IFOAM reported global organic food sales at nearly €136 billion in 2023, and global organic farmland at almost 99 million hectares in 2023—a demand environment that tends to lift premium organic ingredients used in packaged foods and supplements.

Key driving factors are therefore twofold. First, wellness-forward consumption continues to pull organic, antioxidant-positioned fruits into daily routines, pushing manufacturers to use recognizable ingredients in blends and ready-to-mix formats. Second, policy and institutional signals that expand organic farming and organic purchasing norms help normalize price premiums.

- In Europe, the target is to reach 25% of EU agricultural area under organic farming by 2030, while the organic share was 10.8% in 2023—a policy direction that supports long-term category legitimacy for organic ingredients.

Government initiatives and standards are also shaping the industrial scenario by turning “organic” into a measurable compliance advantage rather than a marketing slogan. On the production side, leading organic-land countries include India at 4.5 million hectares of organic farmland (2023), which matters for future organic ingredient sourcing and processing partnerships beyond China-centric supply.

Key Takeaways

- Organic Goji Berries Market size is expected to be worth around USD 1003.2 Million by 2034, from USD 460.4 Million in 2024, growing at a CAGR of 8.1%.

- Whole held a dominant market position, capturing more than a 67.2% share.

- Food and Beverage held a dominant market position, capturing more than a 48.4% share.

- Online Retail held a dominant market position, capturing more than a 39.3% share.

- Asia Pacific stands as the leading region in the Organic Goji Berries Market, holding a dominant 44.8% share and reaching a valuation of USD 206.2 million.

By Product Type Analysis

Whole Organic Goji Berries Lead the Market with a Strong 67.2% Share

In 2024, Whole held a dominant market position, capturing more than a 67.2% share, reflecting their strong acceptance across global retail and bulk ingredient channels. Whole berries continue to serve as the most familiar and convenient format for consumers who prefer minimally processed organic products. Their popularity is reinforced by their versatility—used in snacks, breakfast mixes, teas, and home wellness preparations—making them the most commercially stable segment in the organic goji category.

By End Use Analysis

Food and Beverage Segment Leads the Category with a Strong 48.4% Share

In 2024, Food and Beverage held a dominant market position, capturing more than a 48.4% share, driven by rising interest in nutrient-rich ingredients and the growing shift toward natural superfoods in everyday diets. Organic goji berries have become a preferred choice for manufacturers looking to enhance product appeal across cereals, herbal teas, smoothies, snack bars, and functional beverages. Their clean-label profile and antioxidant-rich composition make them an easy fit for modern health-focused formulations.

By Distribution Channel Analysis

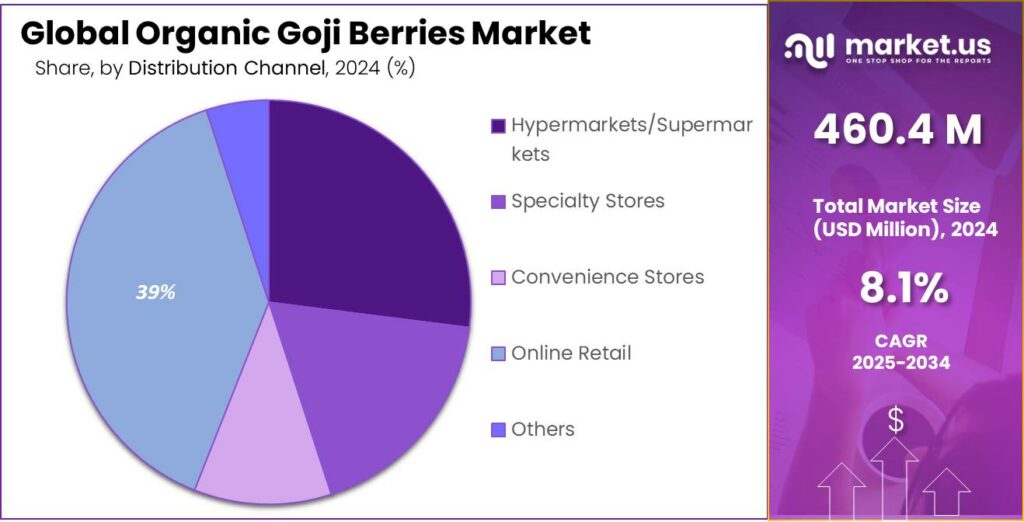

Online Retail Leads the Market with a Solid 39.3% Share

In 2024, Online Retail held a dominant market position, capturing more than a 39.3% share, reflecting the rapid consumer shift toward digital purchasing channels for organic and specialty foods. Easy access to a wider range of certified organic goji berry brands, transparent product reviews, and doorstep delivery convenience have made e-commerce the preferred buying route for many health-focused shoppers. Online platforms also allow consumers to compare quality, sourcing claims, and pricing more effectively, strengthening this segment’s leadership.

Key Market Segments

By Product Type

- Whole

- Powder

- Juice

- Others

By End Use

- Food and Beverage

- Pharmaceuticals

- Nutraceuticals

- Personal Care and Cosmetics

- Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Convenience Stores

- Online Retail

- Others

Emerging Trends

Organic Goji Berries Are Moving Fast Toward Digital-First Sales and Traceable Supply

A clear 2024–2025 trend in organic goji berries is the shift from “traditional wholesale + retail shelf” toward digital-first selling backed by stronger traceability expectations. Buyers increasingly want proof—origin, inspection records, lot-level testing, and consistent grading—before they commit to repeat orders. This is pushing suppliers to professionalize packaging, standardize product specs, and communicate quality in a way that works online, where consumers compare products in seconds and importers demand paperwork upfront.

This digital shift is no longer small. A Xinhua-linked report on China’s goji e-commerce price index stated that online retail sales value of goji berries produced in Ningxia reached 1.53 billion yuan in 2024, accounting for 61.3% of China’s national online market share. That level of concentration shows how quickly goji berries—especially premium and organic lots—are becoming an e-commerce-led category rather than a store-only purchase. As more trade happens online, competitive advantage moves to sellers who can prove certification authenticity, maintain stable supply, and deliver consistent customer experience.

At the same time, the product mix is widening to fit digital consumption habits. In Ningxia, the goji ecosystem now includes more than 120 product types, and these products have been exported to more than 50 countries and regions. This matters because online shoppers often buy by format and convenience—whole berries for snack use, powders for smoothies, juices for functional positioning. More formats allow brands to target different price points and use-cases without relying only on bulk dried berries. The result is a category that looks less like a commodity and more like a flexible “ingredient platform” for food, beverage, and wellness applications.

Export activity is also reinforcing the same trend. In the first four months of 2024, Ningxia’s goji berry export value rose 16.9% year over year, based on local customs statistics cited by China Daily. Growth like this encourages suppliers to invest in export-grade processing and documentation systems, because the fastest-growing channels tend to be the most compliance-heavy. In parallel, industry scale remains large: by the end of 2023, Ningxia’s goji planting area reached 325,000 mu ut around 320,000 tonnes, providing the base volume needed to support both domestic e-commerce growth and international demand.

Drivers

Rising Demand for Certified Organic Ingredients is the Core Growth Driver

In 2024–2025, the biggest force pushing the organic goji berries category forward is simple: more shoppers are buying certified organic foods more often, and brands are responding by upgrading ingredients in everyday products. Organic goji berries fit neatly into this shift because they are easy to position as a clean-label, plant-based “add-in” for snacks, breakfast mixes, teas, and functional blends—without changing the base recipe too much. When retailers and food brands expand organic assortments, niche organic ingredients like goji berries gain a wider route to market and faster product adoption.

This demand is visible in the size of the organic economy itself. In the United States, certified organic sales reached $69.7 billion in 2023, up 3.4% year over year, showing that organic spending is not limited to a small premium segment anymore. Globally, organic food and drink sales reached about €136.4 billion in 2023, backed by 98.9 million hectares managed organically and around 4.3 million organic producers—an ecosystem large enough to support consistent ingredient supply and more rigorous certification expectations.

Government direction also strengthens this same driver by encouraging more organic acreage and clearer rules. The EU’s Farm to Fork direction includes a goal to reach 25% of agricultural land under organic farming by 2030, and EU-level efforts encourage member states to build national organic plans to support that trajectory. Even when goji berries are imported, policy targets like this increase demand for certified organic ingredients across the region, because brands want to align with the direction of travel in regulation and public procurement.

On the supply side, the industry’s ability to meet rising demand is increasingly tied to scale and processing capability at origin. Public reporting from China highlights the depth of the goji supply chain in Ningxia: in 2023, planting area was reported at 325,000 mu with annual fresh output of roughly 320,000 tonnes, alongside an expanding range of goji-derived products and exports to 50+ countries/regions.

Restraints

Strict residue compliance and food-safety risk remain the key restraint for Organic Goji Berries

For organic goji berries, the biggest brake on growth is not demand—it is compliance risk. The category depends heavily on consumer trust, yet dried berries are routinely scrutinized for pesticide residues, labeling accuracy, and occasional safety concerns. When buyers fear a shipment could fail residue limits or trigger corrective action, they respond by tightening specifications, requiring more frequent lab tests, and favoring suppliers with stronger traceability.

Independent public-lab testing history shows why this remains sensitive. A German state laboratory presentation on dried goji berries reported that in 2010, 38 different pesticides were found across samples, with an average of 11 pesticide residues per sample. It also stated that only 6 out of 26 samples met the then-current legal provisions for pesticide residues, and that 83% of conventionally grown samples had MRL violations.

Regulatory complexity makes the situation harder, not easier. The same laboratory note referenced how goji berries were being grouped under EU pesticide rules (Regulation (EC) No. 396/2005) in a way that could change the applicable limit for specific substances—for example, it described an acetamiprid MRL shift from 0.01 mg/kg to 0.1 mg/kg under an amendment approach. This kind of moving-target compliance means brands often set internal limits stricter than legal limits, simply to reduce the risk of a border issue or a retailer delisting.

Government food agencies also document that residues are not hypothetical in imported goji berries. Food Standards Australia New Zealand (FSANZ) stated that six different agricultural chemical residues had been detected in imported goji berries over the previous 5 years, naming compounds such as chlorpyrifos and difenoconazole. It further provided “highest residue” examples, including 0.28 mg/kg (chlorpyrifos, dried) and 0.29 mg/kg, which illustrates why importers treat routine testing as a non-negotiable cost.

Opportunity

Scaling Organic Goji Berries Through Mainstream Organic Food Growth and Value-Added Ingredients

One major growth opportunity for organic goji berries is their ability to “ride the wave” of expanding organic food demand and then move up the value chain through convenient, value-added formats. When consumers buy more organic food overall, brands look for recognizable organic ingredients that can upgrade everyday products without making them complicated. Organic goji berries fit that need well because they can be used whole in snack mixes and cereals, or converted into powders and extracts for beverages and functional blends.

The organic market itself is a strong tailwind. In the United States, certified organic sales reached $69.7 billion in 2023, growing 3.4% year over year, which signals that organic buying is still expanding even in a tight consumer spending environment. This matters for organic goji berries in 2024–2025 because growth in total organic sales typically leads to more shelf space for organic ingredients, more private-label launches, and more “organic-first” product reformulations—especially in snacks, breakfast foods, and wellness beverages where berries are an easy add-in.

Globally, the runway is also clear. Organic food and drink sales exceeded €136 billion in 2023, supported by 98.9 million hectares farmed organically and around 4.3 million organic producers. For organic goji berries, this broader expansion helps in two ways. First, it normalizes organic labeling and certification expectations across retailers and consumers. Second, it encourages larger manufacturers to source more certified organic ingredients at scale, which can pull organic goji berries into more mainstream product lines rather than keeping them limited to niche wellness brands.

Policy direction reinforces this opportunity. The EU’s Farm to Fork strategy aims to increase organic production toward 25% of EU agricultural land by 2030, while encouraging member states to develop national organic plans. Even though goji berries are often imported, this type of policy target raises organic demand throughout the EU’s food system. As more finished products shift to organic positioning, brands become more willing to pay for certified organic fruit ingredients that support clean-label claims and premium placement.

Regional Insights

Asia Pacific Dominates the Organic Goji Berries Market with a 44.8% Share, Valued at USD 206.2 Million

Asia Pacific stands as the leading region in the Organic Goji Berries Market, holding a dominant 44.8% share and reaching a valuation of USD 206.2 million in 2024. The region’s strong leadership is rooted in its large-scale cultivation capacity, advanced processing ecosystem, and rising adoption of organic-certified ingredients across major consumer markets. China remains the heart of global goji production, particularly the Ningxia region, which reported a planting area of 325,000 mu and a fresh output of nearly 320,000 tonnes by the end of 2023—creating a dependable, high-volume supply base suitable for both whole berries and value-added organic formats.

The region’s influence is further strengthened by structural growth in organic agriculture. According to FiBL/IFOAM’s 2023 organic farming overview, Asia now manages 9.1 million hectares of organically certified farmland, giving manufacturers a broad foundation for sourcing compliant raw materials and meeting international certification expectations.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

CXD Goji LLC operates as a specialized supplier of organically grown goji berries, managing farms and contracted growers across the United States. The company emphasizes small-batch processing, offering products with standardized moisture levels of 10–12% and antioxidant scores above 3,000 ORAC units. CXD distributes to more than 150 natural food retailers and online buyers annually.

Gojix LTD operates as an import-distribution specialist, sourcing certified organic goji berries primarily from Chinese growing hubs. The company handles annual volumes exceeding 1,000 tonnes, distributing to more than 12 countries across North America and Europe. Its product catalog includes 5+ standardized formats, supported by batch-level testing with microbiological limits under 10,000 CFU/g.

Pure Healing Foods supplies organic goji berries through a curated wellness product line of 20+ items. The company ships nationwide, fulfilling more than 10,000 online orders per year. Its goji products maintain a moisture specification of 8–12%, and the brand sources from audited farms producing batches tested to meet pesticide limits of <0.01 mg/kg for key residues.

Top Key Players Outlook

- CXD Goji LLC

- Goji Farm USA

- Gojix LTD

- Navitas Organics

- Pure Healing Foods,

- Purely Organic Foods

- Sunfood Superfoods

- Tibetan Goji Berry Company

Recent Industry Developments

In 2024, CXD Goji LLC (CXD Ltd) positioned itself as a vertically integrated organic goji supplier, running a 6,000-acre self-built growing base along the Yellow River and controlling the chain from planting to processing and export.

In 2024, Navitas Organics continued to strengthen its role in the organic goji berries sector as part of a broad superfood portfolio offered from its base in Novato, California, USA, where it operates as a Certified B Corporation with a strong mission toward sustainable and regenerative organic farming practices.

Report Scope

Report Features Description Market Value (2024) USD 460.4 Mn Forecast Revenue (2034) USD 1003.2 Mn CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Whole, Powder, Juice, Others), By End Use (Food and Beverage, Pharmaceuticals, Nutraceuticals, Personal Care and Cosmetics, Others), By Distribution Channel (Hypermarkets/Supermarkets, Specialty Stores, Convenience Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape CXD Goji LLC, Goji Farm USA, Gojix LTD, Navitas Organics, Pure Healing Foods,, Purely Organic Foods, Sunfood Superfoods, Tibetan Goji Berry Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Organic Goji Berries MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Organic Goji Berries MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- CXD Goji LLC

- Goji Farm USA

- Gojix LTD

- Navitas Organics

- Pure Healing Foods,

- Purely Organic Foods

- Sunfood Superfoods

- Tibetan Goji Berry Company