Global Organic Electronics Market Size, Share Analysis Report By Material (Conductive, Semiconductor, Dielectric, Substrate), By Vertical (Healthcare & Medical, Military & Defence, Industrial Automation, Consumer Electronics, Others), By Application (Display, Lighting, System Components, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 105598

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

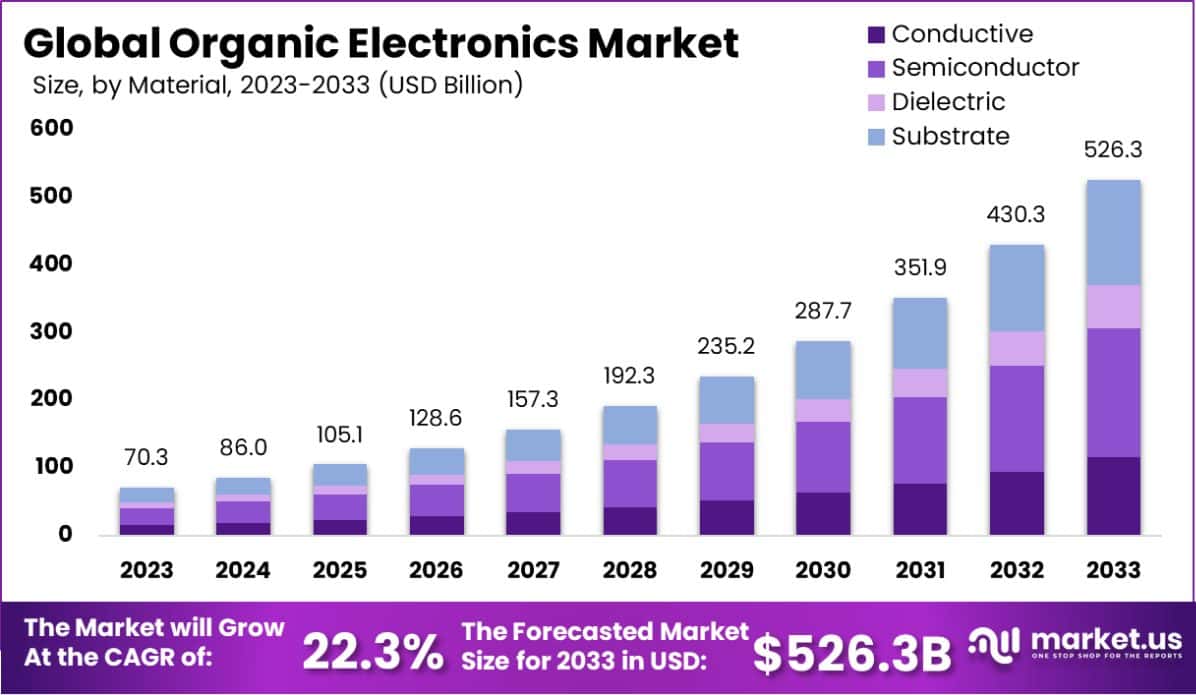

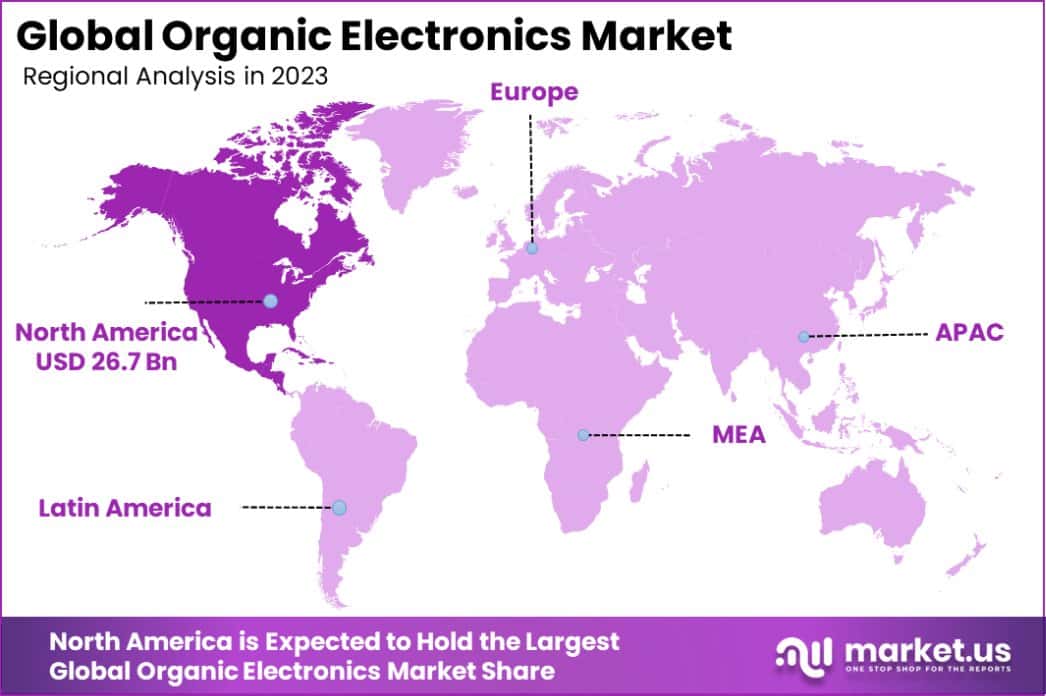

The Global Organic Electronics Market size is expected to be worth around USD 526.3 Billion by 2033, from USD 70.3 Billion in 2023, growing at a CAGR of 22.3% during the forecast period from 2024 to 2033. North America dominated a 38.1% market share in 2023 and held USD 26.7 Billion in revenue from the Organic Electronics Market.

Organic electronics represent a branch of electronics that uses organic materials with carbon-based molecules to create flexible, lightweight, and highly efficient electronic components. These materials include polymers and small organic molecules that are capable of conducting electricity.

Organic electronics have the potential to transform industries like lighting, display manufacturing, and photovoltaic cells, offering a more sustainable alternative to traditional silicon-based technologies due to their biodegradable nature and the potential for lower production costs.

The Organic Electronics Market is experiencing significant growth due to the rising demand for flexible and wearable electronics. As consumers seek more portable and versatile devices, manufacturers are turning to organic materials to create thinner, lighter, and more bendable products.

Additionally, the market is benefiting from advancements in organic light-emitting diodes (OLEDs), which are increasingly used in smartphones, TVs, and lighting solutions. These developments are making organic electronics more accessible and appealing across various applications.

Key factors driving the growth of the organic electronics market include the ongoing advancements in OLED technology and the increasing adoption of sustainable and green technologies. Consumer electronics companies are continuously exploring new ways to incorporate organic components that offer better display quality and energy efficiency.

Market trends show a significant rise in the integration of organic electronics in wearable devices and flexible displays, indicating a shift towards more ergonomic and eco-friendly electronics. The demand for organic electronics is fueled by the consumer electronics sector, where there is a strong push for devices that combine functionality with sleek, durable design.

Market opportunities are expanding with the development of organic photovoltaics and organic RFID tags, which open new avenues in energy solutions and tracking applications. These innovations present a promising outlook for the organic electronics market, with potential expansions into sectors like healthcare, where flexible medical devices and sensors are increasingly in demand.

The organic electronics market is poised for significant expansion, driven by robust investment and a conducive research environment. Notably, the National Science Foundation (NSF) is set to inject $4,250,000 into research focused on organic electronics, photonics, and magnetics.

This funding is designated for small interdisciplinary groups, with each potentially receiving up to $600,000 over three years, as part of NSF’s initiative to support between 12 to 15 projects under its solicitation for Technological Challenges in Organic Electronics.

Such substantial financial backing underscores the strategic importance of advancing organic electronics technologies, reflecting a growing recognition of their potential across various applications.

Additionally, the National Centre for Flexible Electronics (NCFlexE) in India represents another pivotal development, with a substantial allocation of approximately ₹132.99 crore (about $17.8 million) over five years. This funding, primarily provided by the Ministry of Electronics and Information Technology, highlights the global commitment to nurturing innovations within this field.

These investments are anticipated to catalyze advancements in flexible electronics, further fueled by increasing applications in consumer electronics, healthcare, and automotive industries.

The strategic infusion of capital and resources into organic electronics promises to accelerate technological advancements and market expansion, reinforcing its trajectory toward becoming a cornerstone of modern electronic applications.

Key Takeaways

- The Global Organic Electronics Market size is expected to be worth around USD 526.3 Billion by 2033, from USD 70.3 Billion in 2023, growing at a CAGR of 22.3% during the forecast period from 2024 to 2033.

- In 2023, Semiconductor held a dominant market position in the By Material segment of the Organic Electronics Market, with a 36.3% share.

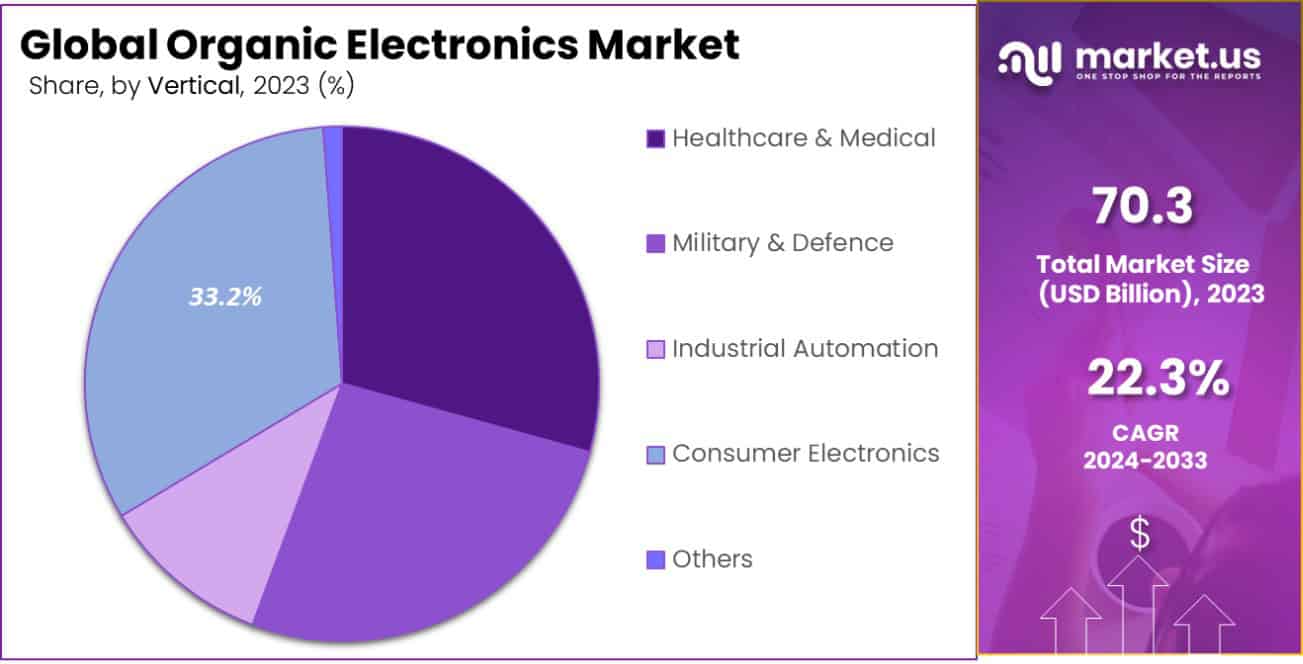

- In 2023, Consumer Electronics held a dominant market position in the vertical segment of the Organic Electronics Market, with a 33.2% share.

- In 2023, Display held a dominant market position in the By Application segment of the Organic Electronics Market.

- North America dominated a 38.1% market share in 2023 and held USD 26.7 Billion in revenue from the Organic Electronics Market.

By Material Analysis

In 2023, Semiconductor held a dominant market position in the By Material segment of the Organic Electronics Market, capturing a 36.3% share. This segment’s prominence is driven by the critical role semiconductors play in the functionality of organic electronic devices, where they are essential for the charge transport that powers OLEDs, organic transistors, and other components.

Following closely, Conductive materials accounted for a 29.7% market share, underpinned by their extensive use in creating pathways for electricity in devices such as organic solar cells and flexible electronics.

Dielectric materials also made a significant impact, comprising 18.5% of the market. These materials are vital for insulation and efficiency, enhancing the performance of electronic devices by maintaining charge separation and supporting intricate circuit designs. Substrates, which provide the physical base for organic electronics components, held a 15.5% share.

They are fundamental in supporting the structural integrity and integration of organic materials into usable forms, particularly in applications requiring flexibility and lightweight characteristics.

Together, these segments underscore the diverse material requirements in the organic electronics sector, reflecting a market that is both vibrant and responsive to the advancing technological landscape.

By Vertical Analysis

In 2023, Consumer Electronics held a dominant market position in the By Vertical segment of the Organic Electronics Market, with a 33.2% share. This sector’s leadership is attributed to the escalating demand for flexible, lightweight, and highly efficient devices such as smartphones, wearable technology, and OLED TVs, which increasingly incorporate organic electronic components for enhanced display and functionality.

Healthcare & Medical followed with a 24.8% share, driven by the adoption of organic electronics in medical devices and sensors, offering cutting-edge solutions for patient monitoring and diagnostics. Military & Defence accounted for 19.1% of the market, where the use of organic electronics is growing in applications requiring lightweight, flexible, and low-power electronics for advanced communication systems and surveillance.

Industrial Automation captured a 14.7% market share, utilizing organic electronics to enhance the flexibility and efficiency of control systems and smart sensors in smart manufacturing environments. The Others category, which includes sectors like automotive and energy, held an 8.2% share, exploring the integration of organic electronics into novel applications such as smart windows and flexible smart solar panels.

These diverse applications highlight the expanding influence of organic electronics across various industries, driven by ongoing technological advancements and sector-specific demands.

By Application Analysis

In 2023, the Display segment of the Organic Electronics Market held a commanding market position, capturing more than a 55% share. This segment’s dominance can be primarily attributed to the increasing adoption of organic light-emitting diode (OLED) technology in various consumer electronics such as smartphones, televisions, and wearable devices.

OLED displays are favored for their advanced attributes like higher contrast ratios, improved viewing angles, and flexibility, which have driven consumer preference and industry adoption. The surge in demand for energy-efficient and lightweight electronic products has further fueled the growth of the Display segment.

Organic electronics offer significant advantages in terms of energy consumption and material usage, aligning with the global push towards sustainable and eco-friendly technologies. As manufacturers and consumers increasingly prioritize sustainability, the appeal of organic displays has grown, reflecting in their market share dominance.

Additionally, advancements in material science and manufacturing techniques have enhanced the performance and reduced the costs of organic electronic displays. Innovations in organic photovoltaics (OPVs) and organic light-emitting transistors (OLETs) are pivotal, making these technologies more accessible and affordable. These developments have enabled broader commercial applications and integration into mainstream electronics, solidifying the Display segment’s lead in the Organic Electronics Market.

This focus on innovation, combined with market demands for better display technologies, suggests a continued strong market presence. Looking forward, the Display segment is expected to maintain its lead, driven by technological advancements and growing consumer demand for high-quality, sustainable display solutions.

Key Market Segments

By Material

- Conductive

- Semiconductor

- Dielectric

- Substrate

By Vertical

- Healthcare & Medical

- Military & Defence

- Industrial Automation

- Consumer Electronics

- Others

By Application

- Display

- Lighting

- System Components

- Others

Drivers

Key Drivers in Organic Electronics

Organic electronics is a rapidly expanding field due to several compelling drivers. Primarily, the demand for lightweight, flexible, and eco-friendly electronic products is pushing the growth of this market.

Organic materials, like conductive polymers and small molecules, are essential because they can be easily processed into thin films, offering significant advantages over traditional inorganic materials in terms of flexibility and cost.

These materials enable the production of electronic devices that can bend and stretch, opening up applications in wearable technology and flexible displays. Additionally, the manufacturing processes associated with organic electronics tend to be more environmentally friendly compared to conventional electronic manufacturing, aligning with global sustainability efforts to reduce harmful environmental impacts.

This shift is supported by ongoing technological advancements that enhance the performance and durability of organic electronic devices, making them increasingly competitive with their inorganic counterparts.

Restraint

Challenges Facing Organic Electronics

Despite the promising growth of the organic electronics market, several restraints hinder its broader adoption. The primary challenge is the durability and performance of organic electronic devices compared to traditional inorganic electronics.

Organic materials often show lower electrical conductivity and can be less stable under environmental stresses like heat, light, and moisture, which may lead to shorter lifespans and degraded performance over time. This raises concerns about the practicality of using organic electronics in long-term applications or harsh environments.

Additionally, the field of organic electronics is still developing, meaning that technological standards and processes are not yet fully established, which can complicate manufacturing scalability and integration with existing electronic systems. These factors currently limit the market’s expansion and the wider application of organic technologies in everyday electronic products.

Opportunities

Expanding Opportunities in Organic Electronics

The organic electronics market presents numerous opportunities that could revolutionize various industries. One of the most significant opportunities lies in the development of next-generation displays and lighting solutions.

Organic light-emitting diodes (OLEDs) are already popular in consumer electronics for their superior color quality and flexibility, allowing for innovative product designs such as curved or bendable screens. Further advancements in organic photovoltaics (OPVs) offer potential for lightweight, flexible solar cells that can be integrated into clothing or used as window coatings, promoting renewable energy use in everyday applications.

Additionally, the inherent biocompatibility of organic materials opens new prospects in medical devices, such as biodegradable sensors and health monitoring systems. These applications demonstrate the market’s potential to penetrate a broad range of sectors, driving demand for organic electronics as technology advances and production costs decrease.

Challenges

Overcoming Hurdles in Organic Electronics

The organic electronics market faces notable challenges that can impede its growth and broader adoption. One significant hurdle is the sensitivity of organic materials to environmental factors such as moisture, oxygen, and heat.

This sensitivity can lead to shorter device lifespans and reduced reliability, which are critical drawbacks for consumer electronics that demand long-term durability. Additionally, achieving high levels of electrical performance with organic materials remains challenging compared to conventional inorganic semiconductors, which are more efficient at conducting electricity.

These performance gaps pose a barrier to replacing existing technologies in high-performance applications. Moreover, the organic electronics industry lacks fully developed standard manufacturing processes, leading to higher production costs and variability in quality.

Addressing these issues is crucial for the future success and scalability of organic electronic products in competitive markets.

Growth Factors

Driving Growth in Organic Electronics

The organic electronics market is set for substantial growth, fueled by several key factors. Innovations in material science are continuously improving the electrical properties and stability of organic materials, making them more attractive for commercial applications.

The growing interest in sustainable and environmentally friendly technology also propels the adoption of organic electronics, as these devices can be produced with less environmental impact compared to traditional electronics. Consumer demand for lightweight, flexible, and wearable technology is another significant driver.

Organic electronics can be used to create thin, bendable displays and sensors that integrate seamlessly into everyday objects and textiles, enhancing user experience and offering new functionalities. Additionally, advancements in manufacturing processes have reduced costs and improved the efficiency of production lines, making organic electronic devices more accessible and appealing to a broader market.

Emerging Trends

New Trends in Organic Electronics

Emerging trends in the organic electronics market are shaping its future trajectory. Notably, there is an increasing shift towards integrating organic electronic components into the Internet of Things (IoT) devices, which allows for the development of smarter, interconnected consumer products that are energy efficient and capable of complex functionalities.

Wearable technology is also seeing a surge in innovation, with organic electronics at the core of developing flexible, lightweight devices that can monitor health or enhance connectivity while being comfortably worn on the body. Another exciting trend is the evolution of organic sensors and circuits in biomedical applications, providing new ways to deliver healthcare through biocompatible and disposable electronics.

Additionally, advancements in organic transistor technology are enabling faster, more efficient devices, further broadening the applications and appeal of organic electronics in markets ranging from smart textiles to advanced medical devices.

Regional Analysis

The Organic Electronics Market is experiencing varied levels of growth across different regions, reflecting diverse industrial landscapes and adoption rates. North America leads with a commanding 38.1% market share, translating to a market value of USD 26.7 billion, driven by significant investments in technological innovations and a robust ecosystem of research institutions and leading tech companies.

This region benefits from a high degree of consumer acceptance of advanced technologies, particularly in flexible electronics and OLED displays.

Europe follows, with a strong focus on sustainability and renewable energy, influencing the adoption of organic photovoltaics and wearable devices. The European Union’s regulatory support for eco-friendly innovations further bolsters this growth.

Asia Pacific is witnessing rapid expansion, fueled by manufacturing capabilities and increasing R&D investments in countries like Japan, South Korea, and China. The region is poised to challenge North America’s dominance, particularly through advancements in consumer electronics and organic sensors.

Meanwhile, the Middle East & Africa and Latin America are emerging markets in the organic electronics sector, each displaying potential growth due to increasing urbanization and digital transformation initiatives that drive demand for innovative technologies.

These regions, however, hold smaller shares of the global market but are expected to grow as technology penetration increases and local industries develop.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the global Organic Electronics Market, key players like FUJIFILM Holdings America Corporation, Bayer AG, and C. Starck GmbH are pivotal in driving innovation and market growth in 2023.

FUJIFILM Holdings America Corporation has capitalized on its extensive expertise in chemical processes and photographic films to pioneer developments in organic semiconductors and OLED materials.

The company’s commitment to R&D has enabled it to enhance the performance and durability of organic electronics, which are critical to applications in displays and medical devices. FUJIFILM’s strategic partnerships with technology giants and its robust patent portfolio ensure it remains at the forefront of the market.

Bayer AG, traditionally known for its prowess in pharmaceuticals and life sciences, has made significant strides in organic electronics through its high-performance materials division. Bayer’s research in conductive polymers and organic photovoltaics (OPVs) is part of its broader strategy to integrate sustainable solutions into its product offerings.

By leveraging its global presence and industrial expertise, Bayer is well-positioned to innovate in organic electronic applications that require high durability and flexibility.

C. Starck GmbH, though smaller compared to its counterparts, plays a crucial role in the supply of specialty chemicals critical for the production of organic electronic components. The company’s focus on tailored solutions and high-purity process technology is essential for the production of reliable and efficient organic electronic devices. C. Starck’s emphasis on sustainable production techniques and its strategic collaborations with technology developers underscores its commitment to advancing the organic electronics sector.

Together, these companies underscore a diverse yet interconnected approach to expanding the organic electronics market, each leveraging their unique strengths to address the evolving demands of technology and sustainability in 2023.

Top Key Players in the Market

- FUJIFILM Holdings America Corporation,

- Bayer AG

- C. Starck GmbH

- AGC SEIMI CHEMICAL CO. LTD.

- BASF SE

- DuPont

- Merck & Co. Inc.

- Evonik Industries AG

- Sumitomo Corporation

- Heliatek GmbH

- Other Key Players

Recent Developments

- In August 2023, DuPont secured a $50 million investment to develop its next-generation flexible electronic materials. This funding will bolster their capabilities in creating more durable and efficient organic electronic components.

- In July 2023, AGC Seimi Chemical Co. Ltd. announced the expansion of its production facilities for organic electronic materials. This strategic move aims to meet the surging demand for advanced materials used in OLED technologies and sensors.

- In May 2023, BASF SE launched a new range of conductive polymers designed to enhance the performance of organic photovoltaics and wearable electronics. This product line represents BASF’s commitment to supporting sustainable and efficient energy solutions.

Report Scope

Report Features Description Market Value (2023) USD 70.3 Billion Forecast Revenue (2033) USD 526.3 Billion CAGR (2024-2033) 22.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Conductive, Semiconductor, Dielectric, Substrate), By Vertical (Healthcare & Medical, Military & Defence, Industrial Automation, Consumer Electronics, Others), By Application (Display, Lighting, System Components, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape FUJIFILM Holdings America Corporation, Bayer AG, C. Starck GmbH, AGC SEIMI CHEMICAL CO. LTD., BASF SE, DuPont, Merck & Co. Inc., Evonik Industries AG, Sumitomo Corporation, Heliatek GmbH, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Organic Electronics MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Organic Electronics MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- FUJIFILM Holdings America Corporation,

- Bayer AG

- C. Starck GmbH

- AGC SEIMI CHEMICAL CO. LTD.

- BASF SE

- DuPont

- Merck & Co. Inc.

- Evonik Industries AG

- Sumitomo Corporation

- Heliatek GmbH

- Other Key Players