Global Organic Cheese Powder Market Size, Share, Growth Analysis By Type (Cheddar, Mozzarella, Parmesan, and Romano), By Application (Bakery Products, Sauces And Dips, Ready-to-eat Meals, Savory Snacks, Seasonings And flavorings, and Others), By Distribution Channel (Online Retail and Offline Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167790

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

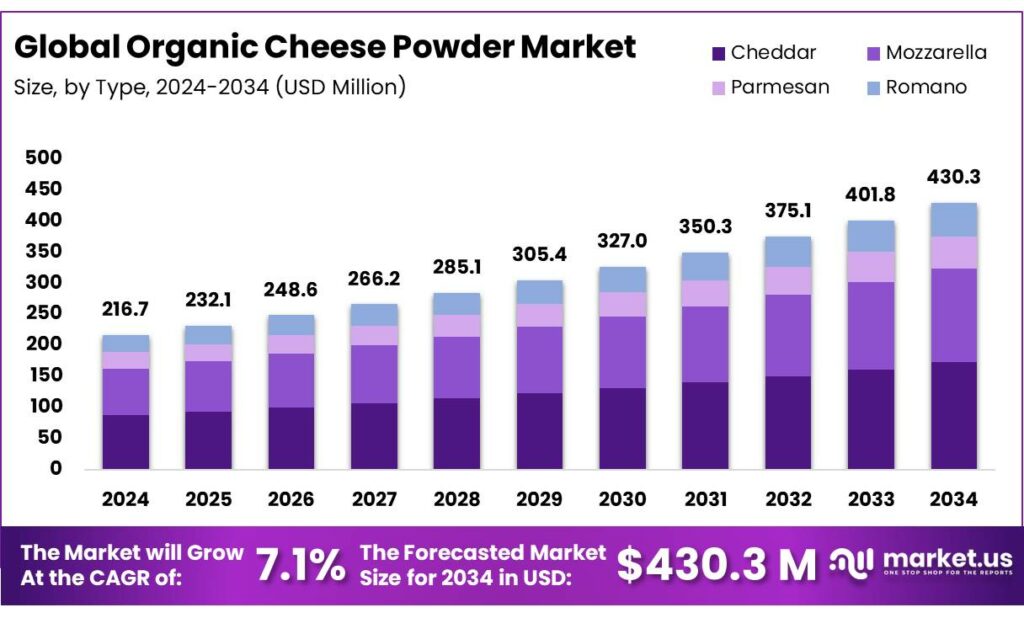

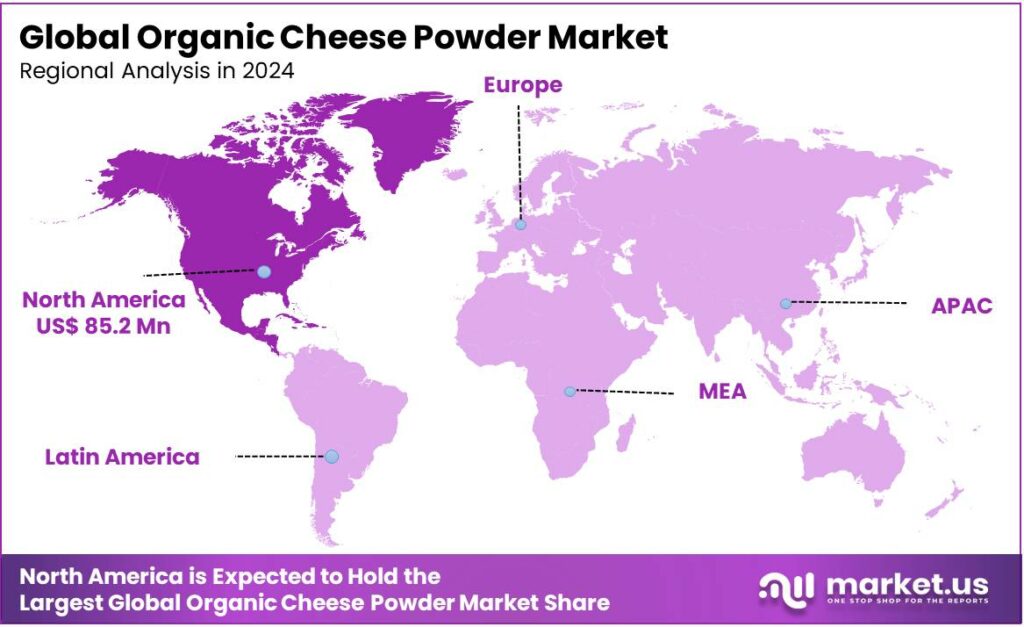

The Global Organic Cheese Powder Market size is expected to be worth around USD 430.3 Million by 2034, from USD 216.7 Million in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 42.9% share, holding USD 456.7 Million revenue.

The organic cheese powder market is growing steadily, driven by rising health consciousness, demand for clean-label ingredients, and the expanding popularity of packaged foods. Consumers increasingly prefer organic products free from synthetic additives, boosting the usage of organic cheese powder in bakery items, snacks, seasonings, and convenience meals. Cheddar-based powder dominates the market due to its strong flavor, versatility, and cost-effectiveness compared to varieties such as mozzarella or parmesan.

Additionally, North America leads the market due to high organic food consumption, established dairy infrastructure, and strong demand for ready-to-eat products. However, supply volatility in organic milk and geopolitical disruptions pose a challenge for the market, affecting pricing and production stability. Despite these pressures, innovation in diverse flavor profiles and growing interest in organic, premium-quality foods continue to create opportunities across both food manufacturing and retail channels.

- According to the United States Department of Agriculture, in 2025, the U.S. produced more than 1,200 million pounds of cheese in May alone. Similarly, according to the National Health Institute, in 2023, annual cheese consumption in the EU was over 9 million.

- According to NASS surveys, in 2021, organic milk production reached around 5.2 billion pounds in the United States alone, an increase of 1% from 2019.

Key Takeaways

- The global organic cheese powder market was valued at USD 216.7 million in 2024.

- The global organic cheese powder market is projected to grow at a CAGR of 7.1% and is estimated to reach USD 430.3 million by 2034.

- Based on the types of organic cheese powders, cheddar cheese dominated the market, with 40.2% of the total global market.

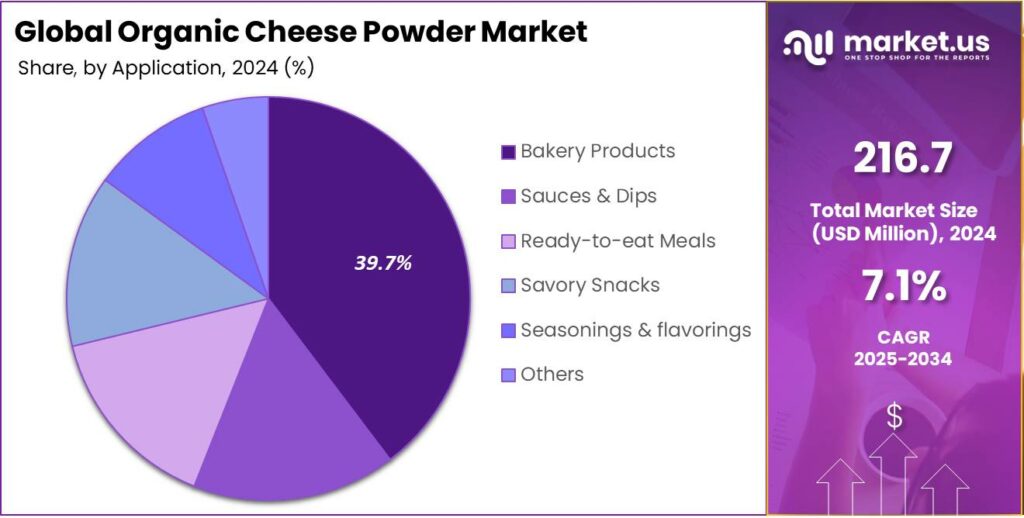

- Based on applications of the organic cheese powder, bakery products held a major share of the market with 39.7%.

- Among the distribution channels, offline retail stores emerged as a major segment in the organic cheese powder market, with 71.3% of the market share.

- In 2024, North America was the most dominant region in the organic cheese powder market, accounting for 39.3% of the total global consumption.

Type Analysis

Organic Cheddar Cheese Powders Dominated the Market in 2024.

The organic cheese powder market is segmented based on the cheese types into cheddar, mozzarella, parmesan, and romano. The organic cheddar cheese powders dominated the market, comprising around 40.2% of the market share. It is more widely utilized than mozzarella, parmesan, or romano, primarily because cheddar has a stronger, more versatile flavor profile that translates well across a broad range of packaged foods. Its sharp and recognizable taste remains stable during drying and rehydration, making it ideal for snacks such as popcorn, chips, and instant macaroni dishes, which are consumed in high volumes in markets such as North America.

In addition, cheddar melts and blends consistently, allowing manufacturers to use it in sauces, seasoning mixes, and bakery applications without altering texture. In contrast, mozzarella has a milder flavor that becomes less distinctive when powdered, while parmesan and romano are sharper and more expensive due to the higher cost of production. This necessity to balance cost and flavor makes cheddar the economical and impactful choice for large-scale food formulations.

Application Analysis

Bakery Products are a Prominent Segment in the Organic Cheese Powder Market.

The organic cheese powder market is segmented on the basis of application into bakery products, sauces & dips, ready-to-eat meals, savory snacks, seasonings & flavorings, and others. The bakery products led the organic cheese powder market, constituting about 39.7% of the market share. Organic cheese powders are most widely used in bakery products as they offer excellent flavor stability, easy incorporation into dry mixes, and longer shelf life, the qualities that align closely with bakery manufacturing requirements. When added to items such as cheese breads, crackers, biscuits, and savory muffins, organic cheese powder disperses evenly, enhances color, and provides a consistent cheesy taste without adding moisture that could affect dough structure.

In addition, bakery manufacturers prefer powdered cheese as it allows precise portion control, essential for large-scale production. While sauces, dips, and ready-to-eat meals often rely on fresh or liquid cheese for smoother textures, and snacks or seasonings may use a wider range of flavor blends, bakery formulations benefit most from dry, shelf-stable ingredients. This suitability makes organic cheese powder a convenient, cost-efficient, and reliable choice for creating distinctive, cheese-forward bakery products.

Distribution Channel Analysis

The Offline Stores Emerged as a Leading Segment in the Organic Cheese Powder Market.

On the basis of distribution channel, the organic cheese powder market is segmented into online retail and offline stores. Approximately 71.3% of the organic cheese powder market revenue is generated through the offline stores. According to a study by the National Health Institute, the majority of cheese in the United States is obtained from grocery stores. The organic cheese powders are more frequently purchased from offline stores as customers often prefer to evaluate freshness, packaging quality, and product authenticity in person, particularly for organic items, where trust plays a major role in buying decisions. Supermarkets and specialty organic stores often offer clearer labeling, in-store assistance, and opportunities to compare brands side by side.

Additionally, several consumers make spontaneous purchases while buying other baking or snack ingredients, which boosts in-store sales. Similarly, organic cheese powder can have higher shipping costs due to its weight and need for careful handling, making online orders less economical for small quantities. In regions where online grocery adoption is still developing, customers rely heavily on brick-and-mortar stores for convenient access to certified-organic products, reinforcing the dominance of offline purchasing. However, according to a 2025 report published by the Organic Trade Association, the share of organic food sold to consumers via the internet has grown from 2% in 2012 to 6.7% in 2024, which indicates a growing adoption of online groceries.

Key Market Segments

By Type

- Cheddar

- Mozzarella

- Parmesan

- Romano

By Application

- Bakery Products

- Sauces & Dips

- Ready-to-eat Meals

- Savory Snacks

- Seasonings & flavorings

- Others

By Distribution Channel

- Online Retail

- Offline Stores

Drivers

Rising Health and Sustainability Awareness Drives the Organic Cheese Powder Market.

Growing consumer focus on health, clean labels, and environmentally responsible food production is significantly boosting demand for organic cheese powder.

- According to the Organic Trade Association, the sales of organic food products reached US$65.4 billion in 2024 in the United States alone. As more consumers scrutinize ingredient lists, organic dairy products that are free from synthetic pesticides, antibiotics, and genetically modified feed are gaining traction.

- For instance, according to the USDA, 6-8 ounce sliced organic cheese advertisements increased 10%, with the average price of the product being US$4.53. The organic cheese is the second most commoditized dairy product in the market.

This shift is mirrored globally as younger consumers, particularly millennials and Gen Z, increasingly choose snacks and meal kits containing certified-organic ingredients. Organic cheese powder aligns with the trend as it offers the familiar flavor of cheese in a convenient, shelf-stable form for products such as ready-to-eat pasta and baked snacks.

Similarly, sustainability concerns encourage customers to support farming systems that promote soil health and animal welfare. Organic dairy farms, which emphasize pasture-based feeding and reduced chemical inputs, align with these values. The food manufacturers are reformulating products with organic cheese powder to appeal to health-conscious, eco-minded consumers, reinforcing strong market momentum.

Restraints

Organic Milk Supply Volatility Poses a Significant Challenge in the Organic Cheese Powder Market.

Volatility in the supply of organic milk presents a major challenge for the organic cheese powder market, as fluctuations in availability directly influence production stability and pricing. Organic dairy farming requires strict certification standards, pasture-based feeding, and avoidance of synthetic inputs, which limits the number of farms able to meet demand. In many countries, organic milk accounts for only a small share of total milk production, often less than 5%, making the supply base inherently narrow. Seasonal variations further compound the issue; for instance, organic milk output often dips in winter months when pasture access is limited, leading to temporary shortages.

Additionally, rising feed costs pressure farmers, occasionally prompting some to revert to conventional production. When organic milk supplies tighten, manufacturers face higher input prices, which can significantly increase the cost of organic cheese powder and reduce profit margins. This volatility affects downstream sectors such as snack foods, sauces, and ready-to-eat meal producers, who rely on consistent ingredient costs to maintain stable retail pricing. As demand for organic products continues to grow, balancing supply through better farmer incentives, expanded organic dairy infrastructure, and improved year-round feed management becomes increasingly essential.

Opportunity

Demand for Packaged Foods Creates Opportunities in the Organic Cheese Powder Market.

Rising consumption of packaged and convenience foods is creating strong opportunities for the organic cheese powder market, as consumers increasingly seek quick meal solutions without compromising on ingredient quality. In various regions, working households spend less time cooking. Surveys in the U.S. and Europe show that a significant share of adults prepare meals in under 45 minutes, driving the popularity of ready-to-eat snacks, instant pasta, and seasoning mixes. Organic cheese powder fits seamlessly into this shift, offering a clean-label, shelf-stable flavoring option for manufacturers of chips, popcorn, sauces, and bakery mixes.

For instance, the global snack industry continues to expand, with yearly per-capita snack consumption rising in countries such as India, Brazil, and China, where urbanization and busy lifestyles are accelerating packaged food purchases. Furthermore, consumers show a growing preference for organic alternatives. For instance, the organic food sales in various countries have grown steadily over the last decade, reflecting increasing willingness to pay for healthier ingredients. As brands compete by upgrading their formulations, organic cheese powder becomes a valuable tool for delivering authentic dairy flavor while appealing to customers who prioritize natural, minimally processed components in packaged foods.

Trends

Focus Towards Diverse Flavors.

A growing focus on diverse and adventurous flavors is becoming a prominent trend in the organic cheese powder market, driven by consumer demand for novelty and premium taste experiences. In recent years, many surveys across different regions of the United States and Europe have concluded that customers are readily experimental, particularly younger consumers, with flavor profiles creating a demand for new and unconventional flavor combinations. This consumer behavior is influencing food manufacturers to explore organic cheese powder variations beyond the traditional cheddar profile.

For instance, brands are increasingly incorporating organic Parmesan, Gouda, blue cheese, smoked cheddar, and even spicy blends into popcorn seasonings, pasta sauces, and bakery mixes to differentiate their products on crowded shelves. In regions such as Asia-Pacific, where fusion cuisine is expanding rapidly, organic cheese powders infused with herbs, chili, or garlic cater to growing interest in Western-style snacks with localized twists.

In addition, the premiumization of packaged foods is supporting this trend, as consumers are willing to pay more for gourmet flavors that offer both indulgence and organic assurance. As manufacturers innovate with multi-layered and globally inspired cuisines and taste profiles, diverse organic cheese powder blends are becoming a key driver of product differentiation and market growth.

Geopolitical Impact Analysis

Geopolitical Tensions Cause Price Volatility in the Organic Cheese Powder Market.

The geopolitical tensions have significantly disrupted the organic cheese powder market by affecting supply chains, trade flows, and production costs. Several countries rely on cross-border movement of organic milk, cheese, and processing ingredients, and political conflicts often lead to stricter trade regulations, tariffs, or sanctions that complicate these exchanges.

For instance, when tensions rise near the major shipping routes, they may be rerouted or shipments get delayed, increasing transportation costs and extending delivery times for perishable organic dairy inputs. Similarly, energy price spikes, common during geopolitical instability such as the Russia-Ukraine conflict, raise operating expenses for dairy processors, as milk drying and spray-drying technologies used to produce cheese powder are energy-intensive.

Organic dairy farming is particularly vulnerable to geopolitical tensions as it has a smaller supply base and stricter certification standards, for which even minor disruptions can create notable shortages. Furthermore, during instability such as the trade war between the United States and China, farmers may struggle to access organic feed, which can account for a significant share of their production costs. This induces a reduction in organic milk output, directly impacting cheese powder availability.

Moreover, as governments prioritize food security, they may impose export controls on dairy commodities, further tightening global supply. The geopolitical tensions create uncertainty across the organic cheese powder value chain, leading to price volatility and encouraging manufacturers to diversify sourcing and build more resilient supply networks.

Regional Analysis

North America Held the Largest Share of the Global Organic Cheese Powder Market.

In 2024, North America dominated the global organic cheese powder market, holding about 39.3% of the total global consumption. The region has historically held the largest share of the global organic cheese powder market, supported by high consumer awareness of organic products and strong purchasing power. The U.S. remains one of the world’s leading markets for organic foods, with millions of households buying organic dairy products regularly and organic dairy ranking among the top organic categories sold in retail stores.

- In addition, according to a study by the National Institute of Health, cheese accounts for approximately half of the per capita availability of dairy in the U.S. And, overall, 68% of adults consume cheese, alone or as an ingredient, on any given day. Similarly, according to the producers’ association Consorzio Tutela Grana Padano, in 2024, Italy exported 51.2% of its total production of 5.6 million wheels of Grana Padano to the United States, which implies the large amount of consumption of cheese in the region.

Furthermore, customers in the region are heavy consumers of packaged snacks, ready-to-eat meals, and convenience sauces, product segments where organic cheese powder is widely used. For instance, the popularity of organic popcorn, macaroni-and-cheese kits, and flavored snack mixes has grown notably over the past decade as consumers seek indulgent yet clean-label options.

Additionally, North America benefits from a relatively well-established organic dairy farming network, enabling a more consistent supply of certified-organic milk compared to many other regions. Combined with high demand for diverse cheese flavors such as organic cheddar, parmesan, and spicy blends, these factors reinforce the region’s dominant position in the organic cheese powder market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Companies in the organic cheese powder market employ several strategies to boost sales and market presence. The major focus is on product innovation, with firms introducing diverse flavors, specialty cheese types, and blends that cater to evolving consumer tastes. Branding and clean-label messaging emphasize organic certification, natural ingredients, and sustainability, appealing to health-conscious and eco-minded shoppers. In addition, firms focus on expanding distribution through both offline retail chains and selective online platforms to increase accessibility.

Similarly, collaborations with food manufacturers to incorporate organic cheese powder into bakery items, snacks, sauces, and ready-to-eat meals help drive bulk demand. Furthermore, some companies invest in supply chain reliability and farmer partnerships to ensure consistent quality and availability, strengthening consumer trust and repeat purchases. Additionally, various companies emphasize mergers and acquisitions to enhance their product profile and business expansion.

The Major Players in The Industry

- Lactosan A/S

- Kerry Group plc

- Bluegrass Ingredients, Inc.

- Land O’Lakes, Inc.

- Arla Foods

- Frontiers Co-op

- Commercial Creamery Company

- Cheesepop Food Group

- All American Foods, Inc.

- Lactalis Ingredients

- Agropur Ingredients

- ManHar Organics

- Minimal Market

- Terra Spice

- Rosebud’s Real Food

- Other Key Players

Key Development

- In August 2022, Kerry Group, the global taste & nutrition company, announced the acquisition of the business-to-business (B2B) powdered cheese business and related assets of The Kraft Heinz Company for US$107.5 million.

- In July 2022, Bluegrass Ingredients, Inc., a leading R&D-based specialty food ingredients supplier, announced the launch of 20 dairy concentrate product offerings, including a first-of-its-kind vegan-friendly ‘cheez’ concentrate product.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Bn Forecast Revenue (2034) USD 2.4 Bn CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Twin-wall Sheets, Triple-wall Sheets, and Others), By Category (Clear and Coloured), By Application Method (Building and Construction, Automotive, Electronics, Agriculture, Aerospace and Defence, Advertising, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Lactosan A/S, Kerry Group plc, Bluegrass Ingredients, Land O’Lakes, Arla Foods, Frontiers Co-op, Commercial Creamery Company, Cheesepop Food Group, All American Foods, Lactalis Ingredients, Agropur Ingredients, ManHar Organics, Minimal Market, Terra Spice, Rosebud’s Real Food, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Organic Cheese Powder MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Organic Cheese Powder MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Lactosan A/S

- Kerry Group plc

- Bluegrass Ingredients, Inc.

- Land O’Lakes, Inc.

- Arla Foods

- Frontiers Co-op

- Commercial Creamery Company

- Cheesepop Food Group

- All American Foods, Inc.

- Lactalis Ingredients

- Agropur Ingredients

- ManHar Organics

- Minimal Market

- Terra Spice

- Rosebud’s Real Food

- Other Key Players