Global Organic Sugar Market By Product Type(Cane Sugar, Beet Sugar, Coconut Sugar, Others), By Form(Granulated Sugar, Powdered Sugar, Syrup Sugar, Others), By Application(Bakery and Confectionery Beverages, Dairy and Frozen Desserts, Sweet and Savory Snacks, Others), By Distribution Channel(Hypermarkets/Supermarkets, Retailers, Online Stores, Convenience Stores, Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: April 2024

- Report ID: 25984

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

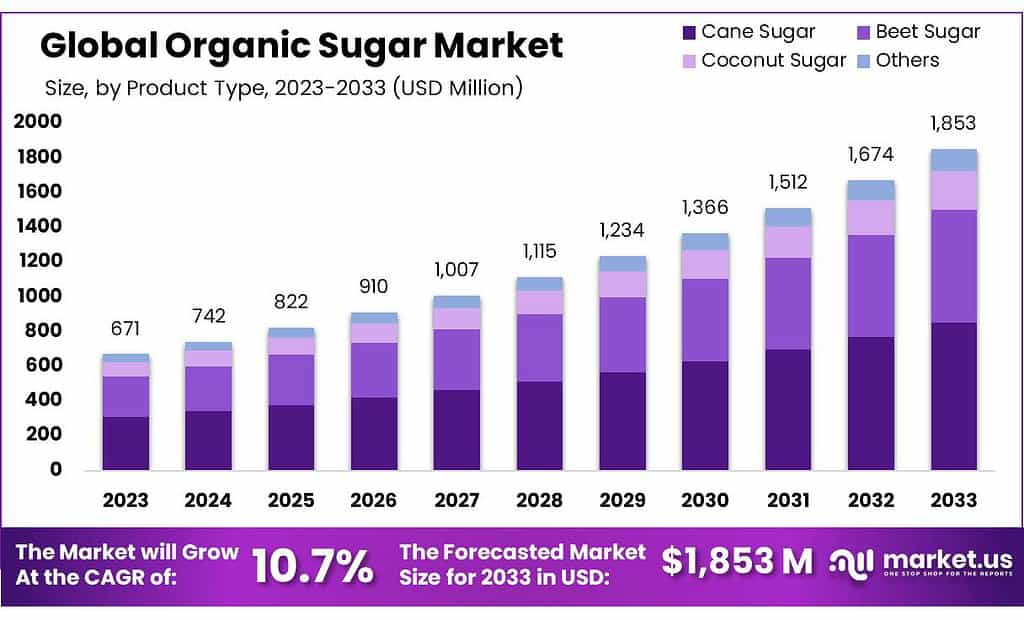

The global Organic Sugar Market size is expected to be worth around USD 1853 Million by 2033, from USD 671 Million in 2023, growing at a CAGR of 10.7% during the forecast period from 2023 to 2033.

The Organic Sugar Market refers to the segment of the global sugar industry that specializes in the production, distribution, and sale of sugar derived from organically grown sugarcane or sugar beets. Unlike conventional sugar, which may be produced using synthetic pesticides and fertilizers, organic sugar is made from crops cultivated according to organic farming practices.

These practices eschew synthetic chemicals, relying instead on natural substances and physical, mechanical, or biologically based farming methods. Organic sugar production emphasizes sustainability, environmental preservation, and soil health, aligning with broader organic agricultural principles.

This market caters to a growing consumer base that prioritizes health, environmental sustainability, and ethical considerations in their purchasing decisions. Organic sugar is perceived as a healthier alternative to conventional sugar by some consumers due to its minimal processing and the absence of chemical additives.

It finds applications across various industries, including food and beverage, pharmaceuticals, and cosmetics, where it is valued not only for its sweetness but also for its organic certification, which can enhance product appeal to health-conscious and environmentally aware customers.

The Organic Sugar Market is characterized by stringent certification processes that ensure the sugar is produced according to established organic agricultural standards. These standards vary by country but generally include restrictions on the use of synthetic pesticides and fertilizers, requirements for soil and water conservation, and adherence to animal welfare standards.

As demand for organic products continues to rise globally, the Organic Sugar Market is experiencing significant growth. This trend is supported by increasing awareness of health issues associated with pesticide residues and a general shift towards more sustainable and ethical consumption patterns. Market players range from small-scale organic farmers to large corporations that have entered the organic space to capitalize on the growing demand for organic sugar and other organic agricultural products.

Key Takeaways

- Market Expected Growth: Organic Sugar Market to reach USD 1853 million by 2033, with a CAGR of 10.7% from 2023’s USD 671 million.

- Dominant Segments: Cane Sugar leads with 46.3% market share, followed by Granulated Sugar with over 68.5% share in 2023.

- Popular Applications: Bakery & Confectionery holds 49.3% market share, followed by Beverages and Dairy & Frozen Desserts.

- Leading Distribution Channels: Hypermarkets/Supermarkets capture 39.5% market share, with Online Stores witnessing rapid growth.

- Regional Analysis: Asia Pacific leads with 46% market share, followed by North America and Europe.

By Product Type

In 2023, Cane Sugar held a dominant market position in the Organic Sugar Market, capturing more than a 46.3% share. This segment’s lead is primarily due to cane sugar’s widespread availability and its traditional use in a variety of culinary applications around the globe.

Organic cane sugar, derived from organically grown sugarcane without the use of synthetic pesticides or fertilizers, is highly sought after for its purity and minimal processing. It is preferred by both consumers and manufacturers for its versatility, being a staple ingredient in baking, beverages, and confectioneries. The growing consumer demand for cleaner, more natural ingredients has further solidified cane sugar’s standing in the market.

Beet Sugar follows as a significant component of the market. Despite a smaller share compared to cane sugar, organic beet sugar has carved a niche due to its environmental sustainability and efficiency in production. Derived from organically farmed sugar beets, this type of sugar offers a sustainable alternative with a lower carbon footprint, appealing to environmentally conscious consumers.

Coconut Sugar is also making notable strides in the market. Its popularity stems from its low glycemic index and nutrient content, including minerals like zinc and iron. Sourced from the sap of coconut palm trees, organic coconut sugar is celebrated for its caramel-like flavor, making it a favored ingredient in health-conscious food and drink formulations. Its rise reflects the broader trend towards healthier, more sustainable sweeteners.

By Form

In 2023, Granulated Sugar held a dominant market position in the Organic Sugar Market, capturing more than a 68.5% share. This form’s popularity is attributed to its fundamental role in everyday cooking and baking, making it a pantry staple in households and commercial kitchens alike.

Organic granulated sugar, with its fine crystals and versatility, is preferred for its ease of use in recipes, from sweetening beverages to creating the perfect cake texture. The demand for this form of organic sugar underscores the ongoing shift towards cleaner, more natural ingredients in both home and professional cooking environments.

Powdered Sugar, also known as confectioners’ sugar, secures a significant place in the market. It is especially valued in the baking industry for its fine, powdery consistency, ideal for icings, frostings, and delicate pastries. Organic powdered sugar, made by grinding organic granulated sugar into a fine powder and often mixed with a small amount of organic cornstarch to prevent caking, appeals to those seeking organic options for refined culinary applications.

Syrup Sugar, including organic agave, maple syrup, and molasses, represents another important segment. These liquid sweeteners offer alternative flavors and consistencies for culinary innovation, catering to consumers and chefs looking for diverse and health-oriented ingredients. Organic syrup sugars are often highlighted for their distinct tastes and potential health benefits, including lower glycemic indices for some varieties.

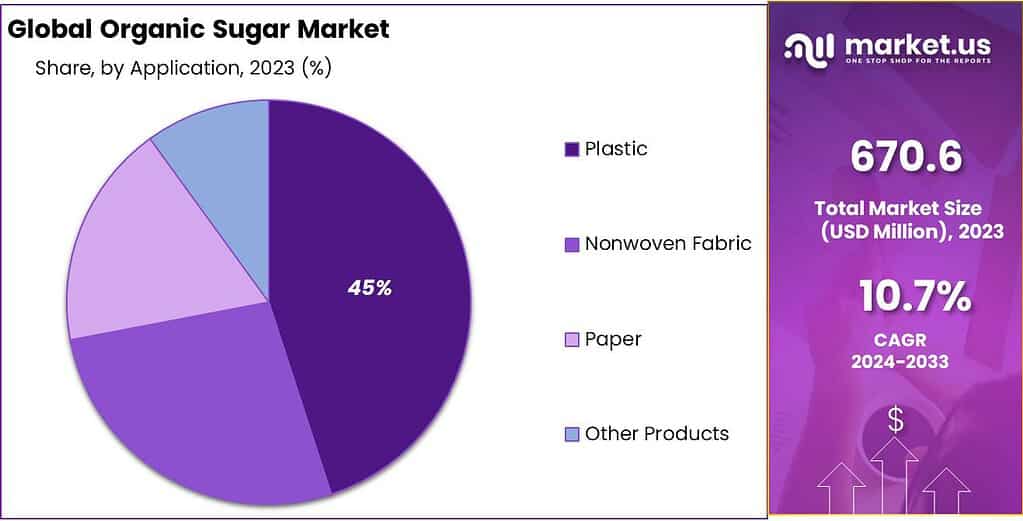

By Application

In 2023, Bakery & Confectionery held a dominant market position in the Organic Sugar Market, capturing more than a 49.3% share. This segment’s prominence is due to the essential role of sugar in baking and sweet-making, where it contributes not just sweetness, but also texture, color, and volume.

Organic sugar, valued for its natural and less processed qualities, has become increasingly popular among bakeries and confectioneries aiming to meet consumer demand for healthier, organic alternatives. The push towards organic ingredients in traditional and artisanal baking practices further cements this segment’s leading position, reflecting the growing consumer preference for products made with organic, sustainably sourced ingredients.

Beverages follow as a significant application area for organic sugar, catering to the rising popularity of organic coffees, teas, soft drinks, and health-oriented drinkable products. The inclusion of organic sugar in beverages appeals to health-conscious consumers seeking natural sweetness without artificial additives, driving innovation in the beverage industry towards more organic, clean-label products.

Dairy & Frozen Desserts constitute another important segment, utilizing organic sugar in products like ice creams, yogurts, and other dairy-based treats. The trend towards organic dairy products, combined with the consumer interest in indulgent yet health-conscious desserts, supports the growth of organic sugar in this category. Manufacturers leverage organic sugar to enhance the appeal of their products, aligning with the increasing scrutiny of ingredient lists by consumers.

Sweet & Savory Snacks is an evolving segment where organic sugar is used to cater to the snacking trends that demand both flavor and health benefits. From granola bars to savory snacks with a hint of sweetness, the use of organic sugar allows brands to position their products as healthier alternatives within the competitive snack market.

By Distribution Channel

In 2023, Hypermarkets/Supermarkets held a dominant market position in the Organic Sugar Market, capturing more than a 39.5% share. This channel’s leading status is due to its ability to offer a wide range of organic sugar products under one roof, catering to the convenience and preference of consumers looking for variety and accessibility. Hypermarkets and supermarkets have become key destinations for consumers seeking organic products, supported by the growing space allocated for organic and health-oriented products within these stores. Their extensive distribution networks and the trust they have built with consumers further enhance their appeal, making them a primary choice for purchasing organic sugar.

Retailers, including specialized health food stores and organic shops, form another crucial distribution channel. These outlets cater to a more health-conscious and discerning consumer base, offering a curated selection of organic sugar products along with expert advice and a personalized shopping experience. The emphasis on quality and sustainability attracts consumers who are willing to pay a premium for products that align with their lifestyle and values.

Online Stores have emerged as a significant and rapidly growing distribution channel for organic sugar. The convenience of home delivery, combined with the ability to easily compare prices and product certifications, has made online shopping an attractive option for many consumers. E-commerce platforms and direct-to-consumer websites from brands are capitalizing on this trend by offering a broad selection of organic sugar products, often with the added appeal of subscription services and bulk purchasing options.

Convenience Stores, while capturing a smaller share of the market, provide essential accessibility to organic sugar in urban and densely populated areas. These stores cater to the immediate needs of consumers, offering a limited but crucial range of organic products for those seeking convenience.

Key Market Segments

By Product Type

- Cane Sugar

- Beet Sugar

- Coconut Sugar

- Others

By Form

- Granulated Sugar

- Powdered Sugar

- Syrup Sugar

- Others

By Application

- Bakery & Confectionery Beverages

- Dairy & Frozen Desserts

- Sweet & Savory Snacks

- Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Retailers

- Online Stores

- Convenience Stores

- Others

Drivers

Growing Awareness and Demand for Healthier Food Alternatives

A pivotal driver propelling the Organic Sugar Market forward is the escalating awareness and demand for healthier food alternatives among consumers globally. In recent years, there has been a significant shift in consumer behavior, with a heightened focus on the nutritional content and health implications of food products.

This shift is largely attributed to the increasing prevalence of health issues such as obesity, diabetes, and heart disease, which have prompted consumers to seek out healthier dietary options. Organic sugar, perceived as a more natural and less processed alternative to conventional sugar, has emerged as a popular choice for health-conscious consumers aiming to reduce their intake of artificial additives and chemicals found in many processed foods.

The allure of organic sugar stems from its production process, which eschews the use of synthetic pesticides and fertilizers, thereby reducing consumers’ exposure to potentially harmful chemicals.

Moreover, organic farming practices prioritize environmental sustainability and soil health, appealing to consumers who are not only concerned about their own health but also about the environmental impact of their food choices. This dual focus on health and sustainability has significantly contributed to the growing appeal of organic products, including sugar.

Additionally, the organic certification process, which requires adherence to strict agricultural and processing standards, adds an extra layer of trust for consumers. The certification serves as a guarantee that the sugar they are consuming is produced in accordance with established organic principles, further boosting consumer confidence in organic sugar as a healthier option.

The rise of the clean eating movement, which emphasizes the consumption of whole and unprocessed foods, has also played a crucial role in driving demand for organic sugar. As consumers become more knowledgeable about food sources and the benefits of organic agriculture, the preference for ingredients like organic sugar that are aligned with these principles has grown. Organic sugar is increasingly being used in the preparation of clean-label products, which promise transparency in ingredient sourcing and minimal processing.

Restraints

Higher Price Point Compared to Conventional Sugar

A significant restraint facing the Organic Sugar Market is the higher price point of organic sugar compared to conventional sugar. This price disparity is rooted in the more labor-intensive and cost-intensive practices associated with organic farming. Organic agriculture prohibits the use of synthetic pesticides and fertilizers, necessitating alternative, often more laborious, methods for pest and disease control as well as soil fertility management.

These practices, while environmentally sustainable and beneficial for long-term soil health, lead to higher production costs. Additionally, the organic certification process itself incurs costs for farmers, including fees for certification and potentially lower yields compared to conventional farming due to the restrictions on synthetic inputs.

The impact of these higher production and certification costs is felt down the supply chain, culminating in a higher retail price for organic sugar. This price difference can be a significant barrier for consumers, particularly those who are price-sensitive or those who do not place a high premium on organic certification. While there is a growing segment of consumers willing to pay more for products they perceive as healthier or more sustainably produced, the price sensitivity in certain demographics can limit the potential market for organic sugar.

Moreover, the economies of scale that benefit large-scale conventional sugar production are less attainable in organic sugar farming, where the emphasis on crop diversity and rotational practices further complicates the ability to reduce costs through large-scale operations. This issue is exacerbated in regions where organic farming is still gaining a foothold, and where the infrastructure and market for organic products are less developed.

Compounding the issue is the challenge of convincing consumers of the value added by organic certification. While awareness of the benefits of organic products is growing, translating this awareness into a willingness to pay a premium for organic sugar requires continuous education and marketing efforts. The perceived health benefits and environmental advantages of organic sugar, while compelling selling points, must be effectively communicated to justify the higher price in the minds of consumers.

Opportunity

Expanding Global Demand for Organic Products

A significant opportunity within the Organic Sugar Market lies in the expanding global demand for organic products. This surge is propelled by increasing consumer awareness of health and wellness, environmental sustainability, and ethical farming practices. As a foundational ingredient in many food and beverage products, organic sugar stands to benefit substantially from this growing demand. Consumers are becoming more conscious of the impact of their dietary choices, not just on their health, but also on the environment and on agricultural communities. This awareness is driving a shift towards products that are perceived to be more natural, less processed, and ethically produced.

The organic label has become a marker of quality and sustainability for many consumers, making organic sugar an appealing ingredient for manufacturers looking to meet this demand. This is evident in the proliferation of organic-labeled products in markets around the world, from developed economies where organic has been a long-standing trend, to emerging markets where the middle class is growing and with it, interest in healthier lifestyles. The opportunity for organic sugar producers is to tap into these expanding markets by positioning organic sugar as a key ingredient in the global movement towards healthier, more sustainable consumption.

Furthermore, regulatory support for organic agriculture in many countries is improving, offering incentives and support for farmers transitioning to organic practices. This regulatory environment, coupled with advancements in organic farming techniques, has the potential to increase the supply of organic sugar, making it more accessible and affordable for a broader range of consumers and manufacturers.

Another avenue of opportunity is the development of value-added organic sugar products, such as flavored sugars, syrup forms, and pre-mixed blends for baking and beverages. These innovations can cater to the diverse needs of consumers and food producers, offering convenience and variety in the use of organic sugar.

The global organic movement is also fostering partnerships along the supply chain, from farmers to retailers, creating a more cohesive market for organic products. By leveraging these partnerships, organic sugar producers can enhance their distribution networks, improve supply chain sustainability, and increase consumer trust in organic certifications.

Trends

The Rise of Clean Label and Transparency in Food Production

A major trend shaping the Organic Sugar Market is the rising consumer demand for clean label products and transparency in food production. This trend reflects a broader shift in consumer preferences towards simplicity, natural ingredients, and a deeper understanding of how food products are sourced, processed, and brought to market.

Organic sugar, with its minimal processing and absence of synthetic chemicals, is perfectly positioned to benefit from this shift. Consumers increasingly scrutinize product labels, seeking out ingredients that are recognizable and deemed safe, with organic sugar often being perceived as a healthier, more ethical choice compared to its conventional counterparts.

This movement towards clean labels is not just a niche market phenomenon but is becoming mainstream, as evidenced by the increasing number of food and beverage manufacturers reformulating products to include organic and naturally sourced ingredients. Organic sugar is being highlighted as a key ingredient in these reformulations, not only for its sweetness but also for the value it adds in terms of product differentiation and appeal to health-conscious consumers.

Moreover, the demand for transparency extends beyond just the ingredients list. Consumers are showing a keen interest in the ethical aspects of production, including the environmental impact of farming practices and the social welfare of agricultural workers. Organic sugar production, which often emphasizes sustainable and fair trade practices, aligns well with these consumer values, offering a compelling narrative for brands to communicate.

The trend is further fueled by digital technology and social media, which have made information more accessible and enabled consumers to share knowledge and opinions about food products more widely than ever before. This has increased consumer awareness and demand for products that align with their values of health, sustainability, and social responsibility.

In response, companies are not only adopting organic ingredients like organic sugar but are also investing in certifications and labels that communicate their commitment to these values, such as organic, fair trade, and non-GMO certifications. This move towards clean labeling and transparency is creating new opportunities for organic sugar producers to market their products not just on the basis of their organic status but also as part of a larger story about health, sustainability, and ethical production.

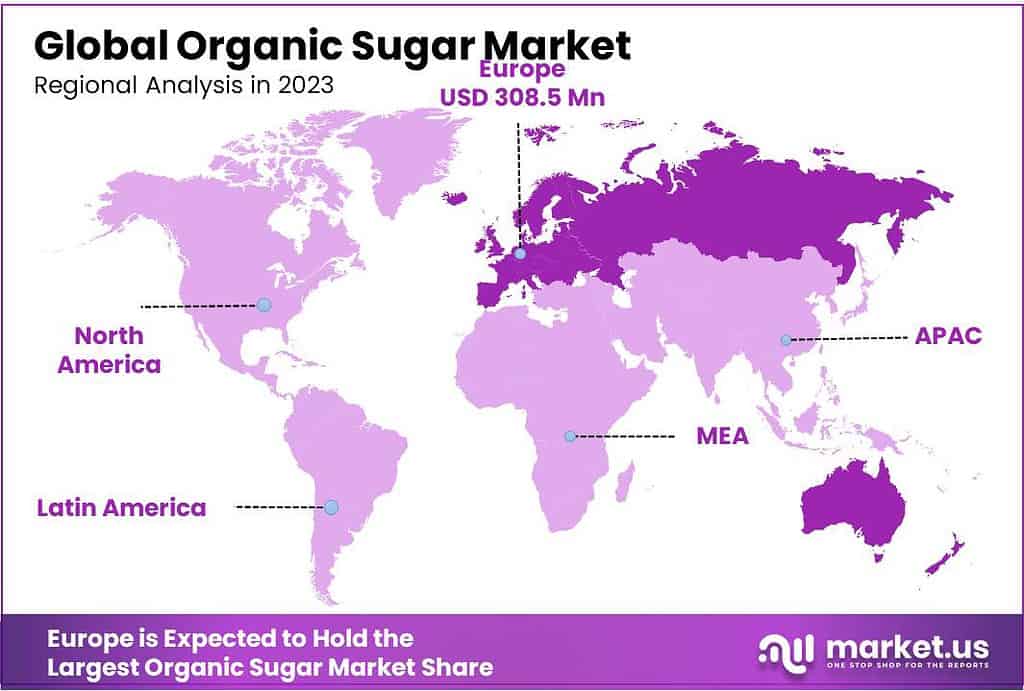

Regional Analysis

The Asia Pacific region is poised to emerge as a frontrunner in the Organic Sugar Market, capturing a significant share of 46%. This growth is fueled by the escalating consumer preference for organic and natural sweeteners, underscored by a burgeoning awareness of health and wellness, particularly in the food and beverage, health-conscious, and vegan demographics.

Considerable investments in innovation and marketing strategies, especially notable in countries such as China, India, and various Southeast Asian nations, are anticipated to propel the market forward. This momentum is supported by the region’s rich agricultural practices and a marked shift towards sustainable and health-oriented food production methods.

In North America, the combination of economic growth and a rising demand from sectors prioritizing nutritious, sustainably sourced organic products is expected to catalyze the Organic Sugar Market. The regional commitment to healthy living and environmental preservation is set to further this trajectory, making North America a pivotal market for organic sugar.

Europe, too, stands on the brink of significant expansion within the Organic Sugar Market. This growth trajectory is driven by changing consumer demands favoring fresh, organic, and locally sourced ingredients, alongside increased interest from the health and wellness, organic food, and eco-tourism sectors. The continent’s focus on healthful living, sustainable agriculture, and environmental care accentuates the shift towards organic sugar, establishing it as an essential ingredient for a myriad of plant-based and organic products.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share Analysis of the Organic Sugar Market reveals a rapidly evolving landscape, underscored by the growing consumer demand for healthier and more sustainable sweetening options. This sector, part of the larger organic food and beverage industry, is experiencing significant growth due to shifts in consumer preferences towards products that not only offer health benefits but also are produced in an environmentally responsible manner.

Key Market Players

- C&H Sugar

- Cosan Ltd

- Domino Sugar

- Florida Crystals Corporation

- Imperial Sugar

- Jalles Machado S/A

- Nordic Sugar

- Nordzucker AG

- NOW Health Group

- Pronatec Ag

- Santushti International

- Südzucker AG

- Taikoo Sugar

- Tate & Lyle

- Tereos SCA, Agrana Beteiligungs AG

- Wholesome Sweeteners

Recent Developments

In 2023, Domino Sugar continued to make strides in the Organic Sugar sector by emphasizing its commitment to offering a range of organic products.

In 2023, C&H Sugar solidified its presence in the Organic Sugar sector by emphasizing its commitment to offering high-quality, organic options for consumers seeking healthier and more sustainable sweetening solutions.

Report Scope

Report Features Description Market Value (2023) USD 671 Mn Forecast Revenue (2033) USD 1853 Mn CAGR (2024-2033) 10.7% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Cane Sugar, Beet Sugar, Coconut Sugar, Others), By Form(Granulated Sugar, Powdered Sugar, Syrup Sugar, Others), By Application(Bakery and Confectionery Beverages, Dairy and Frozen Desserts, Sweet and Savory Snacks, Others), By Distribution Channel(Hypermarkets/Supermarkets, Retailers, Online Stores, Convenience Stores, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape C&H Sugar, Cosan Ltd, Domino Sugar, Florida Crystals Corporation, Imperial Sugar, Jalles Machado S/A, Nordic Sugar, Nordzucker AG, NOW Health Group, Pronatec Ag, Santushti International, Südzucker AG, Taikoo Sugar, Tate & Lyle, Tereos SCA, Agrana Beteiligungs AG, Wholesome Sweeteners Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Organic Sugar Market?Organic Sugar Market size is expected to be worth around USD 1853 Million by 2033, from USD 671 Million in 2023

What CAGR is projected for the Organic Sugar Market?The Organic Sugar Market is expected to grow at 10.7% CAGR (2023-2032).

Name the major industry players in the Organic Sugar Market?C&H Sugar, Cosan Ltd, Domino Sugar, Florida Crystals Corporation, Imperial Sugar, Jalles Machado S/A, Nordic Sugar, Nordzucker AG, NOW Health Group, Pronatec Ag, Santushti International, Südzucker AG, Taikoo Sugar, Tate & Lyle, Tereos SCA, Agrana Beteiligungs AG, Wholesome Sweeteners

-

-

- C&H Sugar

- Cosan Ltd

- Domino Sugar

- Florida Crystals Corporation

- Imperial Sugar

- Jalles Machado S/A

- Nordic Sugar

- Nordzucker AG

- NOW Health Group

- Pronatec Ag

- Santushti International

- Südzucker AG

- Taikoo Sugar

- Tate & Lyle

- Tereos SCA, Agrana Beteiligungs AG

- Wholesome Sweeteners