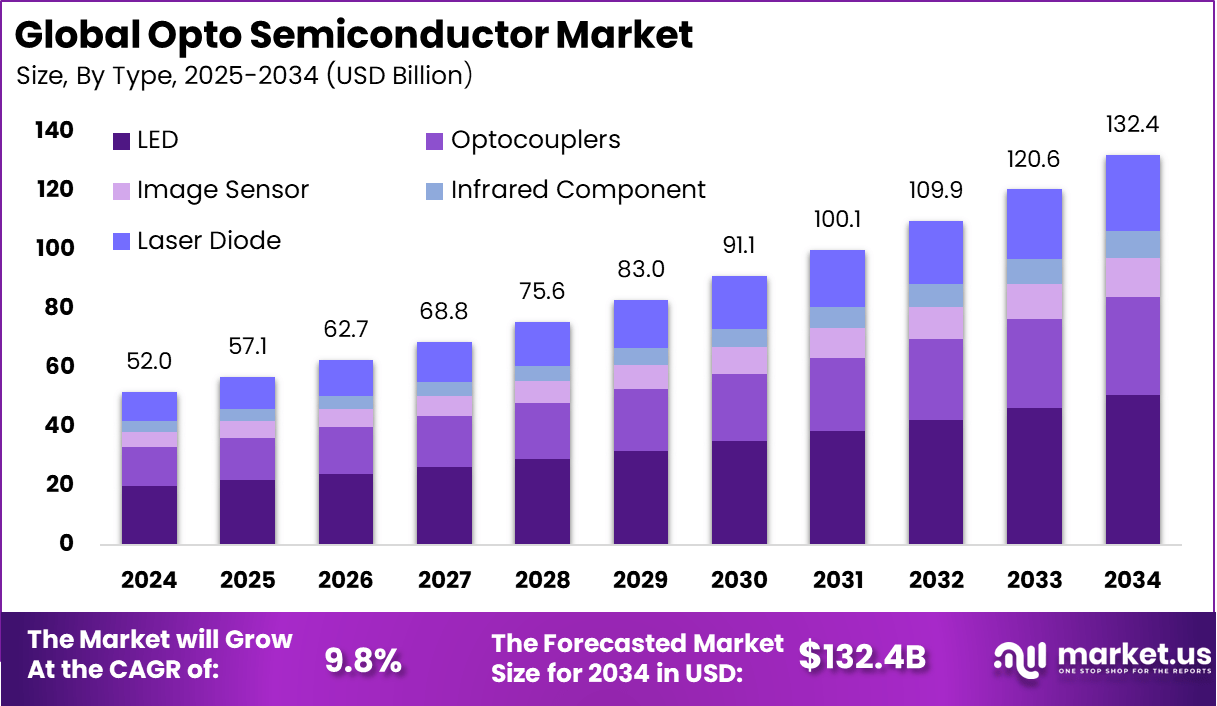

Global Opto Semiconductor Market Size, Share, Industry Analysis Report By Type (Optocouplers, LED, Image Sensor, Infrared Component, Laser Diode), By Application (Residential, Commercial, Industrial), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 168493

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

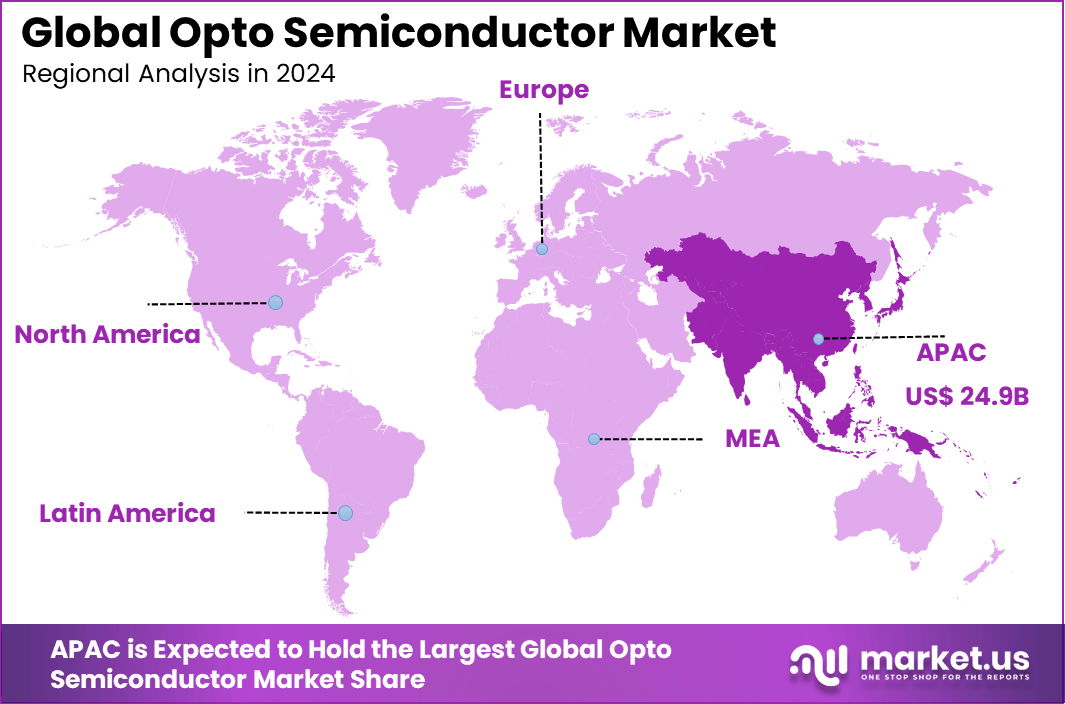

The Global Opto Semiconductor Market generated USD 52 billion in 2024 and is predicted to register growth from USD 57.1 billion in 2025 to about USD 132.4 billion by 2034, recording a CAGR of 9.8% throughout the forecast span. In 2024, Asia Pacific held a dominan market position, capturing more than a 48% share, holding USD 24.9 Billion revenue.

The opto semiconductor market has expanded as industries adopt light based components for sensing, communication, imaging and illumination. Growth reflects rising demand for energy efficient lighting, smart sensing and high quality optical interfaces across consumer electronics, industrial systems and automotive applications. Opto semiconductors are now central to displays, wearable devices, surveillance cameras and advanced driver assistance systems.

Top Market Takeaways

- In 2024, the LED segment accounted for 38.5% of the Opto Semiconductor Market, indicating its strong use across lighting, displays, and signaling applications.

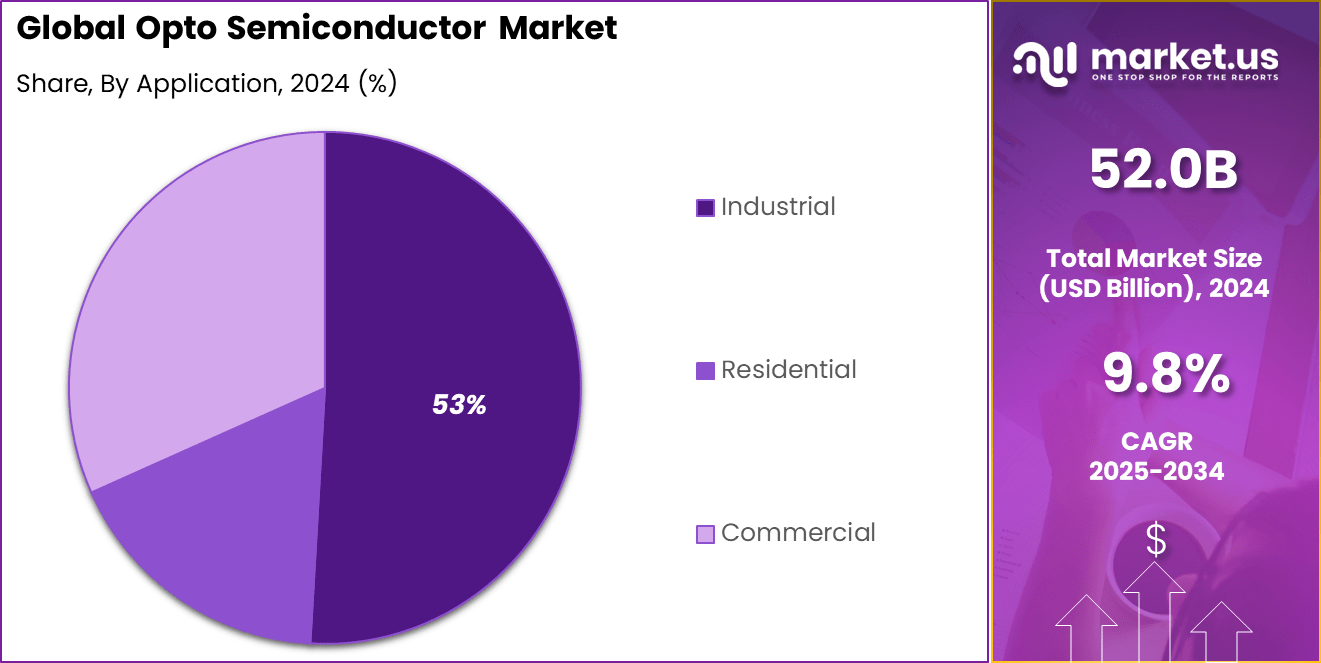

- In 2024, the Industrial segment captured 53%, showing that factory automation, sensing, and power management systems remained the primary demand drivers.

- In 2024, Asia Pacific held 48%, reflecting the region’s strong manufacturing base and rapid integration of opto semiconductor components across electronics and automotive production.

By Type

LEDs claim 38.5% of the opto semiconductor market, standing out for their energy savings and long life in everyday uses. These devices shine in displays, lighting, and signals because they run cool, last years without replacement, and fit into tight spaces like phones or car lights. Engineers pick LEDs for their steady light output and low heat, which cuts down on failures in tough spots like factories or vehicles. Their simple design also makes them cheaper to produce at scale, keeping costs steady for builders worldwide.

Demand keeps climbing as LEDs move into smart homes and outdoor setups where power use matters most. They beat older bulbs by handling vibrations and weather without breaking down quick. Factories and car makers lean on them for precise control in automation lines and safety signals. This hold on the market shows how well they match real-world needs for reliable, green light sources.

By Application

Industrial uses take 53% of the market, pulling ahead with heavy needs in factories, machines, and energy setups. Sensors and lights here spot defects, guide robots, and check equipment without stopping work. The push for smarter plants means more opto parts for real-time checks on production lines and safety systems. Workers value how these tools cut errors and boost output in places like assembly halls or power grids.

Growth ties to tougher rules on efficiency and the rise of connected gear in plants. Opto semiconductors handle harsh light or dust, making them key for monitoring heat or motion in mills. They link up with controls for quick fixes, saving time and materials. This top spot reflects the sector’s focus on tough, dependable tech that keeps operations smooth day in, day out.

Regional Insight: Asia Pacific

In 2024, Asia Pacific holds 48% of the opto semiconductor market, fueled by massive electronics plants and fast tech rollouts. Countries here churn out phones, cars, and gadgets that pack these parts into every device from screens to sensors. Strong supply chains and skilled workers let makers test and tweak designs right on site. The boom in local demand for smart homes and vehicles locks in this lead.

Rapid builds of 5G networks and auto lines add to the pull, needing optical bits for speed and accuracy. Governments back training and factories, drawing global teams to set up shop. Rising middle-class buys mean more home and office gear loaded with these components. The region’s edge comes from blending high volume with quick shifts to new uses like clean energy checks

Emerging Trends

Emerging trends in the opto semiconductor sector include significant advances in photonic integrated chips (PICs) and optical interconnects. These innovations enable faster data transfers and lower power consumption compared to traditional electrical interconnects, addressing the increasing demand for high-speed and energy-efficient data communication.

Coupled with AI-specific processors, these technologies are paving the way for breakthroughs in computing, telecommunications, and consumer electronics such as augmented reality and virtual reality devices. Another key trend is the adoption of new material technologies like gallium nitride and silicon carbide.

These materials offer superior thermal management and wider bandgaps than traditional silicon, leading to higher power densities and better performance in light-emitting diodes and laser diodes. The integration of photonics with AI and machine learning is resulting in smarter sensor systems for real-time environmental analysis, applicable in autonomous vehicles, healthcare diagnostics, and industrial automation.

Growth Factors

Growth factors for the opto semiconductor industry are driven by the rising need for high-speed, reliable, and energy-efficient optical devices across various sectors. Telecommunications infrastructure such as 5G networks, hyperscale data centers, and cloud computing demand advanced optical components to handle increasing data volume.

Automotive and industrial automation are also expanding their use of optical sensors and laser diodes for applications in autonomous driving, safety systems, and smart manufacturing. The geographical landscape influences growth, with Asia-Pacific being prominent due to government support, infrastructure investments, and a strong manufacturing base.

This region leads in wafer fabrication, material innovation, and assembly, while emerging markets in India and Southeast Asia are expanding demand through automotive lighting and medical imaging. North America drives growth through technological advancements and robust research and development, underpinning innovation in optoelectronics and network infrastructure.

Strategic growth is also supported by supply chain diversification and modular product design to increase resilience and speed up time-to-market. Enhanced collaboration across the semiconductor and telecommunications sectors is expected to foster innovation and competition. Overall, the opto semiconductor market benefits from material innovations, new applications, and evolving supply chain strategies that address emerging user requirements and geopolitical influences.

Key Market Segments

By Type

- Optocouplers

- LED

- Image Sensor

- Infrared Component

- Laser Diode

By Application

- Industrial

- Residential

- Commercial

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

A key driver for the opto semiconductor market is the rising demand for high-speed, energy-efficient data transmission. This demand is primarily fueled by the rapid expansion of cloud computing, AI workloads, 5G network rollouts, and hyperscale data centers globally.

Optical interconnects in data centers and telecom infrastructure need advanced optical semiconductors to handle increasing data traffic with low latency and reduced power consumption. The automotive industry’s growth in electric and autonomous vehicles also boosts demand for optical sensors and laser diodes in advanced driver assistance systems (ADAS) and LiDAR technology.

Restraint Analysis

A major restraint for the opto semiconductor sector is the complexity and high cost of manufacturing specialized optical components. Compared to traditional semiconductors, opto semiconductors require precision materials and fabrication processes, which can slow production scaling and raise costs.

Supply chain disruptions and limited availability of advanced materials like gallium nitride affect manufacturing capacity. These cost and production challenges can restrict the pace at which emerging technologies are adopted across end-use industries.

Opportunity Analysis

A significant opportunity lies in the integration of silicon photonics with AI and high-performance computing. Combining optical components on single chips enables faster, low-latency data processing and more energy-efficient communication.

This is particularly critical as electronic interconnects reach physical limits on speed and power efficiency. Silicon photonics can enhance data center performance, reduce operational costs, and support emerging applications such as artificial intelligence, cloud computing, and next-generation telecom networks.

Challenge Analysis

One key challenge is the fragmentation of the opto semiconductor supply chain and the geopolitical uncertainties impacting it. The supply chain involves multiple specialized suppliers for raw materials, foundries, and assembly providers often located in different regions.

Trade tensions, regulatory hurdles, and logistics disruptions can interrupt production flows and affect market stability. Companies face the challenge of balancing innovation speed with supply chain resilience to meet accelerating demand in key sectors like telecom and automotive

Competitive Analysis

Vishay Intertechnology, Ushio America, ROHM Semiconductor, and Mitsubishi Electric lead the opto semiconductor market with strong portfolios of LEDs, photodiodes, infrared devices, and optical sensors. Their components support automotive lighting, industrial automation, consumer electronics, and medical equipment. These companies focus on improving efficiency, durability, and high-speed signal performance.

TT Electronics, Sharp, OSRAM, Fairchild Semiconductor, LITE-ON Technology, Broadcom, Toshiba, and Renesas strengthen the competitive landscape with advanced opto-semiconductor solutions for displays, LiDAR systems, wireless communication, and power electronics. Their offerings emphasize compact packaging, thermal optimization, and high reliability.

Jenoptik, Littelfuse, IPG Photonics, and other participants expand the market with specialized lasers, high-power optical components, and precision sensing technologies. Their products are used in manufacturing, defense, healthcare, and scientific instrumentation. These companies prioritize performance stability, wavelength accuracy, and integration with advanced optical systems.

Top Key Players in the Market

- Vishay Intertechnology Inc.

- Ushio America Inc.

- ROHM Semiconductor

- Mitsubishi Electric Corporation

- TT Electronics plc

- SHARP CORPORATION

- OSRAM

- Fairchild Semiconductor International

- LITE-ON Technology Corporation

- Broadcom Inc

- TOSHIBA Corporation

- Renesas electronics corporation

- JENOPTIK

- Littelfuse Inc.

- IPG Photonics

Recent Developments

- In August 2024, Polymatech announced the acquisition of a US semiconductor equipment firm focused on packaging and testing. The move supports Polymatech’s plan to build an integrated chipmaking operation, strengthening its role in the global opto-semiconductor and IC manufacturing ecosystem.

- Mitsubishi Electric’s semiconductor division continues strong performance in optical devices, focusing on high-speed optical networks for data centers. FY2024 semiconductor revenue was about ¥290 billion, with targets to expand power devices mainly for automotive and renewable energy markets. The company is advancing production capability at the Fukuyama factory to support growing data center demands.

Report Scope

Report Features Description Market Value (2024) USD 52 Bn Forecast Revenue (2034) USD 132.4 Bn CAGR(2025-2034) 9.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Optocouplers, LED, Image Sensor, Infrared Component, Laser Diode), By Application (Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Vishay Intertechnology, Inc., Ushio America, Inc., ROHM Semiconductor, Mitsubishi Electric Corporation, TT Electronics plc, SHARP CORPORATION, OSRAM, Coherent, Inc., Fairchild Semiconductor International, LITE-ON Technology Corporation, Broadcom Inc, TOSHIBA Corporation, Renesas electronics corporation, JENOPTIK, Littelfuse, Inc., IPG Photonics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Vishay Intertechnology Inc.

- Ushio America Inc.

- ROHM Semiconductor

- Mitsubishi Electric Corporation

- TT Electronics plc

- SHARP CORPORATION

- OSRAM

- Fairchild Semiconductor International

- LITE-ON Technology Corporation

- Broadcom Inc

- TOSHIBA Corporation

- Renesas electronics corporation

- JENOPTIK

- Littelfuse Inc.

- IPG Photonics