Optical Coherence Tomography Market By Product Type (Tabletop, Handheld, Doppler, and Catheter Based), By Technology (Spectral Domain OCT, Time Domain OCT, and Swept-Source OCT), By Application (Ophthalmology, Oncology, Dermatology, Cardiology, and Others), By End-user (Hospitals, Ambulatory Surgical Centers, Diagnostic Imaging Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 50691

- Number of Pages: 204

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

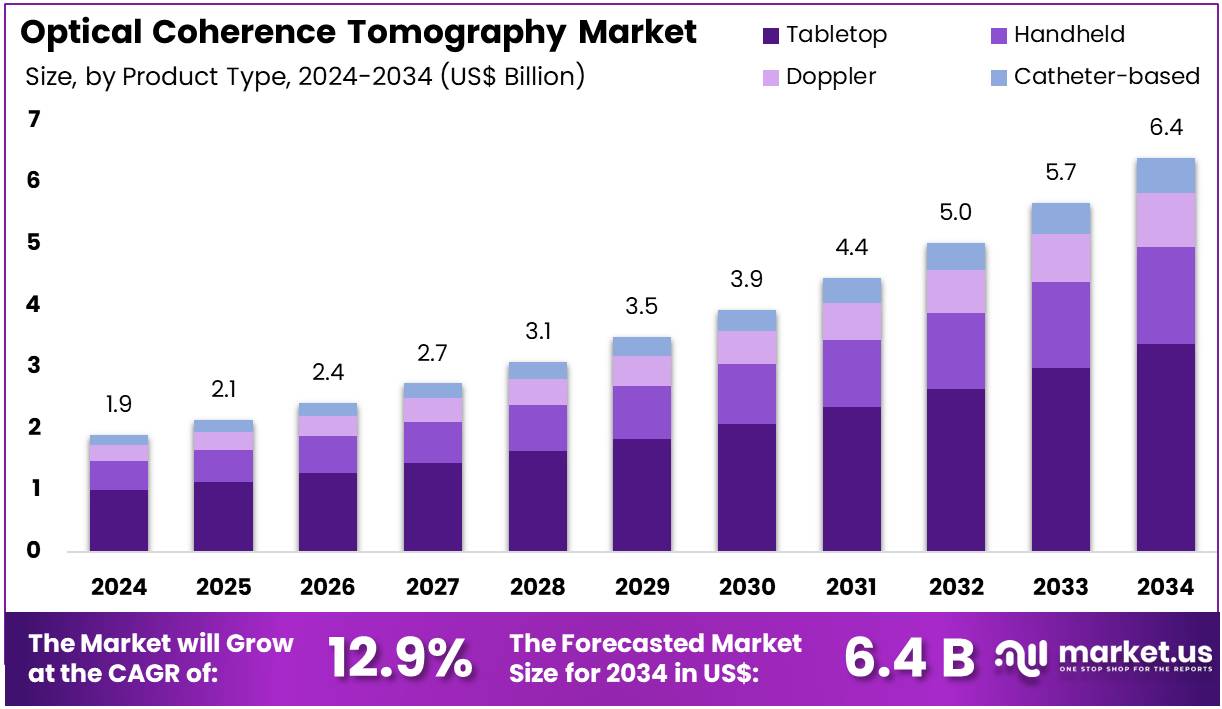

The Optical Coherence Tomography Market size is expected to be worth around US$ 6.4 billion by 2034 from US$ 1.9 billion in 2024, growing at a CAGR of 12.9% during the forecast period 2025 to 2034.

Increasing prevalence of retinal disorders propels the Optical Coherence Tomography market, as ophthalmologists depend on high-resolution cross-sectional imaging to guide precise therapeutic decisions. Manufacturers refine swept-source and spectral-domain systems that deliver micron-level visualization of retinal layers and choroidal vasculature.

Clinicians apply OCT extensively for diabetic retinopathy grading through edema quantification, glaucoma progression monitoring via nerve fiber layer thinning, age-related macular degeneration subtype classification using drusen morphology, and intraoperative anterior segment assessment during cataract procedures.

Government-backed initiatives create opportunities to democratize access through compact, cost-effective devices suitable for primary care integration. The ARPA-H US$ 20 million program launched in February 2024 exemplifies this commitment by funding development of affordable, portable OCT platforms that extend early detection capabilities far beyond traditional ophthalmology practices. This strategic investment accelerates preventive screening and strengthens market expansion into underserved healthcare settings.

Growing demand for miniaturized diagnostic tools accelerates the Optical Coherence Tomography market, as engineers transition from benchtop consoles to handheld and chip-based architectures. Startups leverage photonic integrated circuits to shrink optical engines while preserving diagnostic-grade image quality. These compact systems enable retinal screening in neurology for multiple sclerosis optic neuritis evaluation, dermatology for non-invasive skin lesion depth mapping, cardiology for intravascular plaque characterization, and dentistry for periodontal pocket visualization.

Semiconductor-based innovations open avenues for at-home monitoring devices and telemedicine-enabled remote consultations. Siloton secured US$ 1.06 million in October 2024 to advance its Akepa chip technology specifically for AMD management, demonstrating how photonic integration can dramatically reduce system cost and footprint. This breakthrough propels the market toward consumer-friendly, subspecialty-grade imaging solutions.

Rising collaboration between clinical research organizations invigorates the Optical Coherence Tomography market, as specialized entities enhance trial design and endpoint validation using quantitative OCT metrics. Strategic mergers consolidate expertise in oncology imaging protocols that incorporate microvascular flow assessment and structural biomarkers. Researchers employ OCT angiography for tumor neovascularization studies, corneal tomography in refractive surgery outcome prediction, and neurodegenerative disease tracking through retinal nerve fiber analysis as surrogate markers.

Strengthened CRO capabilities create opportunities for faster regulatory clearance of novel OCT-derived endpoints in pharmaceutical development. The May 2024 merger of Palleos Healthcare GmbH and OCT Global SA formed a robust oncology-focused CRO that directly supports advanced OCT applications in clinical trials and translational research. This consolidation drives innovation and regulatory confidence across the expanding OCT ecosystem.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.9 billion, with a CAGR of 12.9%, and is expected to reach US$ 6.4 billion by the year 2034.

- The product type segment is divided into tabletop, handheld, doppler, and catheter based, with tabletop taking the lead in 2024 with a market share of 52.8%.

- Considering technology, the market is divided into spectral domain OCT, time domain OCT, and swept-source OCT. Among these, spectral domain OCT held a significant share of 54.3%.

- Furthermore, concerning the application segment, the market is segregated into ophthalmology, oncology, dermatology, cardiology, and others. The ophthalmology sector stands out as the dominant player, holding the largest revenue share of 61.9% in the market.

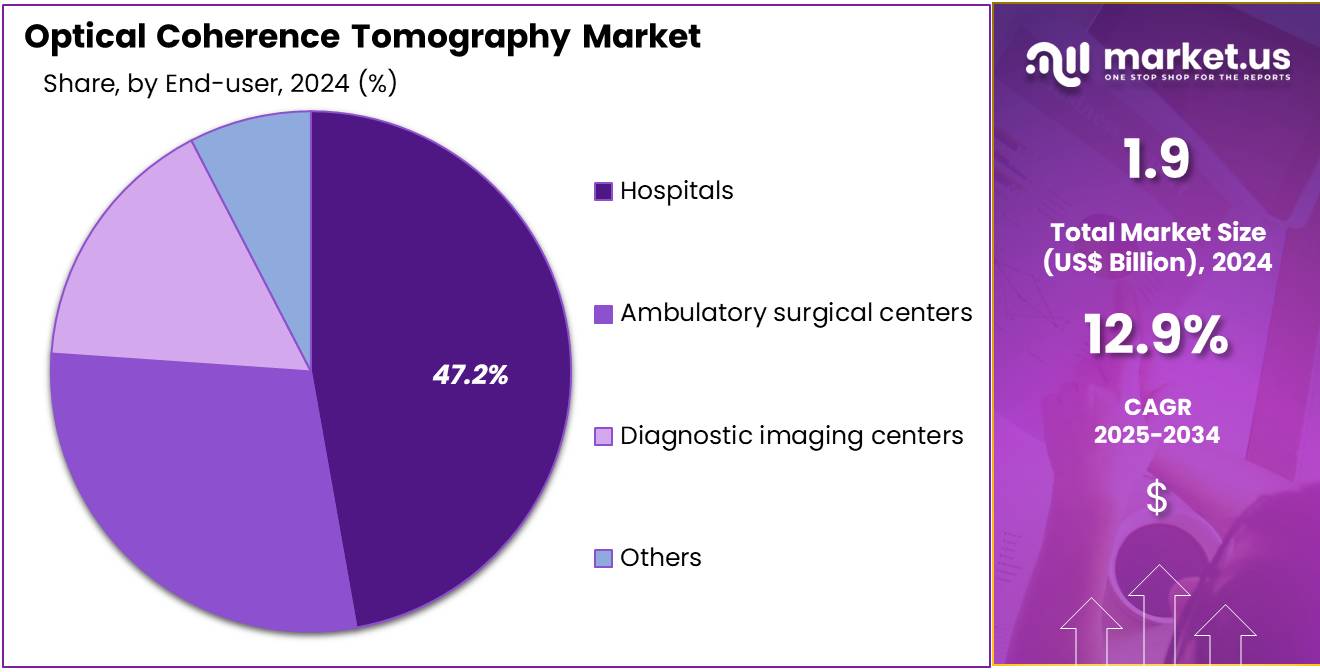

- The end-user segment is segregated into hospitals, ambulatory surgical centers, diagnostic imaging centers, and others, with the hospitals segment leading the market, holding a revenue share of 47.2%.

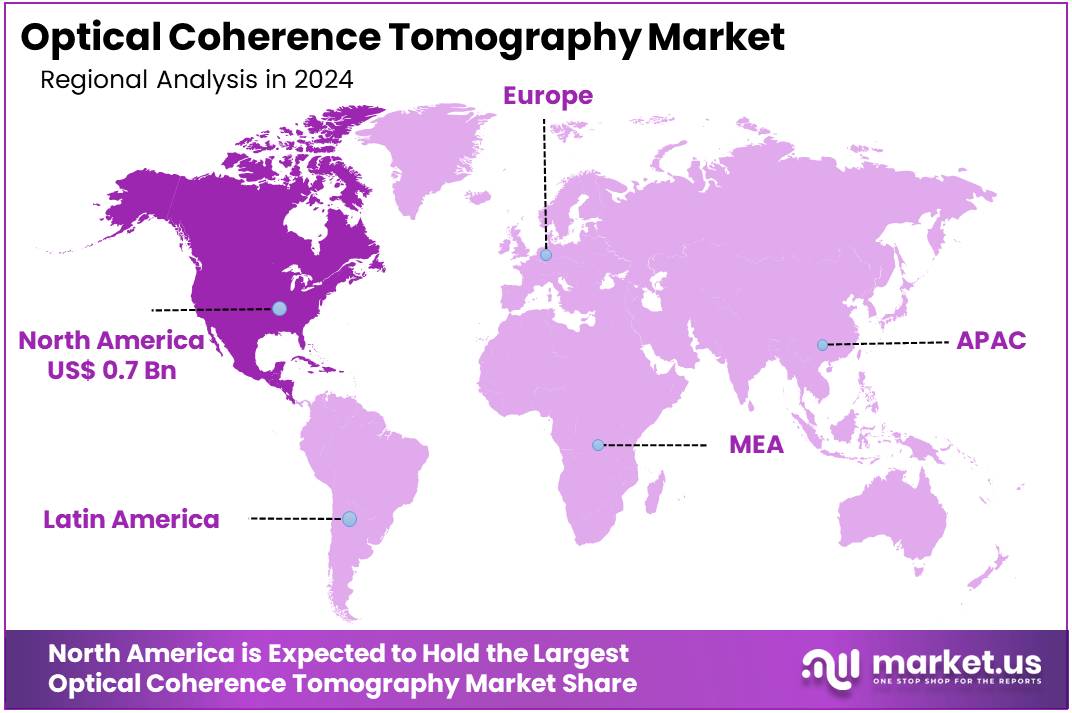

- North America led the market by securing a market share of 37.2% in 2024.

Product Type Analysis

Tabletop systems account for 52.8% of the Optical Coherence Tomography (OCT) market and are anticipated to dominate due to their high precision, stability, and widespread clinical adoption in ophthalmology and diagnostic imaging. These devices offer superior image resolution and consistent performance, making them the preferred choice for retinal, corneal, and macular assessments. The growing prevalence of age-related macular degeneration (AMD) and diabetic retinopathy across Europe and Asia is accelerating demand for tabletop OCT systems in specialized eye care settings.

Leading manufacturers such as ZEISS, Topcon, and Heidelberg Engineering are enhancing product accuracy through AI-driven image analysis and automated segmentation algorithms. Hospitals and research centers are increasingly adopting these systems for large-scale clinical trials and longitudinal studies. Integration of tabletop OCT with fundus imaging and angiography improves diagnostic workflows and reduces patient turnaround time. As healthcare facilities modernize imaging infrastructure, tabletop OCT is expected to remain the gold standard for detailed structural visualization and disease progression monitoring.

Technology Analysis

Spectral domain OCT dominates the technology segment with 54.3% market share and is projected to sustain its lead due to its fast scanning speed, superior axial resolution, and broad applicability in clinical imaging. This technology enables real-time visualization of retinal layers, facilitating accurate detection of microstructural changes in early disease stages.

The growing shift from time-domain to spectral-domain OCT across hospitals and diagnostic centers is driving market transformation. Spectral domain systems are increasingly being used in glaucoma, diabetic eye disease, and oncology imaging due to their enhanced sensitivity and reproducibility.

Continuous improvements in light source and detector technology are extending use cases into cardiology and dermatology. Moreover, compact design and software integration with electronic medical record (EMR) systems are improving clinical efficiency. As clinicians prioritize non-invasive, high-resolution imaging, spectral domain OCT is expected to experience sustained adoption across multiple specialties, reinforcing its position as the preferred OCT platform globally.

Application Analysis

Ophthalmology holds 61.9% of the Optical Coherence Tomography market and is expected to remain the leading application area due to the rising global incidence of vision-threatening disorders. OCT has become a cornerstone in the diagnosis and management of glaucoma, macular edema, and diabetic retinopathy, offering unparalleled visualization of ocular microstructures. Increasing geriatric populations and lifestyle-related risk factors are driving higher patient screening volumes in ophthalmic clinics.

Technological advancements such as swept-source OCT angiography and adaptive optics are expanding capabilities in vascular and retinal imaging. Integration of AI-based algorithms enables automated disease detection, significantly improving diagnostic accuracy and workflow efficiency.

Major ophthalmic device manufacturers are investing in portable and hybrid OCT systems to improve accessibility in outpatient and teleophthalmology settings. Moreover, ongoing clinical trials evaluating OCT biomarkers for therapeutic response monitoring are enhancing its clinical utility. As personalized eye care evolves, ophthalmology remains the most significant contributor to OCT market expansion.

End-User Analysis

Hospitals dominate the end-use segment with 47.2% of the Optical Coherence Tomography market and are anticipated to retain their leadership due to the expanding use of OCT systems in advanced diagnostics and surgical guidance. Multispecialty hospitals increasingly integrate OCT for ophthalmic, dermatologic, and cardiovascular imaging, ensuring comprehensive patient evaluation. The rise in cataract, diabetic eye disease, and retinal disorder cases has led to large-scale hospital-based screening programs supported by OCT technology.

Hospitals benefit from economies of scale, enabling procurement of high-end spectral and swept-source OCT systems. Additionally, the adoption of intraoperative OCT in neurosurgery and oncology enhances precision in tissue differentiation and margin assessment.

Continuous investments in healthcare digitization and imaging infrastructure across Europe and Asia-Pacific are improving OCT accessibility in tertiary care centers. The growing collaboration between hospitals and imaging technology providers for AI-assisted diagnostics is further elevating efficiency. As hospitals expand diagnostic capabilities, OCT integration is projected to remain central to modern medical imaging workflows.

Key Market Segments

By Product Type

- Tabletop

- Handheld

- Doppler

- Catheter based

By Technology

- Spectral domain OCT

- Time domain OCT

- Swept-source OCT

By Application

- Ophthalmology

- Oncology

- Dermatology

- Cardiology

- Others

By End Use

- Hospitals

- Ambulatory surgical centers

- Diagnostic imaging centers

- Others

Drivers

Increasing Prevalence of Glaucoma is Driving the Market

The escalating prevalence of glaucoma worldwide has solidified its role as a major driver for the optical coherence tomography market, given the technology’s pivotal function in non-invasive retinal nerve fiber layer assessment for early detection. As populations age and risk factors like hypertension proliferate, the demand for precise imaging intensifies, compelling healthcare providers to integrate OCT into routine ophthalmic evaluations. This surge necessitates investments in advanced spectral-domain systems capable of quantifying structural changes with micrometer resolution.

Regulatory endorsements for OCT-guided monitoring protocols further embed the modality within clinical guidelines, enhancing diagnostic confidence. Manufacturers are compelled to innovate in software algorithms that automate glaucoma progression tracking, streamlining workflows in busy clinics. Collaborative research initiatives between eye institutes and device developers accelerate validations, ensuring compatibility with diverse patient demographics. The financial implications of untreated glaucoma, including irreversible vision loss, justify expanded reimbursements for OCT procedures across public health systems.

Training programs for optometrists emphasize OCT interpretation, broadening its application beyond specialized centers. This driver not only elevates procedure volumes but also spurs hybrid devices combining OCT with fundus photography for comprehensive exams. In 2022, an estimated 4.2 million Americans of all ages were living with glaucoma, including 1.5 million people with vision loss from glaucoma. These statistics from the Centers for Disease Control and Prevention highlight the growing clinical imperative. Consequently, the market experiences robust traction as OCT becomes indispensable for preserving visual health.

Restraints

High Cost of OCT Devices is Restraining the Market

The substantial upfront and maintenance expenses associated with optical coherence tomography devices persist as a formidable restraint on market accessibility, particularly in underfunded healthcare environments. Entry-level systems often exceed tens of thousands of dollars, deterring adoption by small practices and public facilities in developing regions. Ongoing calibration, software upgrades, and consumable disposables compound these financial pressures, straining operational budgets.

Reimbursement variations across payers create unpredictability, with some jurisdictions capping coverage for non-essential imaging. This cost barrier disproportionately impacts low-income patients, perpetuating diagnostic disparities in glaucoma and macular degeneration management. Developers face dilemmas in balancing feature-rich designs with affordability, often delaying launches in price-sensitive markets. Global supply chain disruptions have further inflated component prices, exacerbating the issue post-pandemic.

Policy advocates push for subsidies, yet bureaucratic delays hinder relief efforts. The restraint fosters reliance on alternative, less precise modalities, potentially compromising patient outcomes. Optical coherence tomography devices typically range in price from US$8,000 to US$70,000 depending on model and features. Such pricing, as cataloged on medical equipment platforms, underscores the economic hurdles. Mitigating these requires innovative financing models to democratize access.

Opportunities

Expansion into Cardiovascular Applications is Creating Growth Opportunities

The diversification of optical coherence tomography into cardiovascular diagnostics is unveiling promising growth corridors, leveraging its high-resolution imaging for intravascular plaque characterization. Intracoronary OCT enables real-time visualization of stent apposition and vessel wall integrity, surpassing traditional angiography in detail. This shift attracts investments from cardiology device firms, fostering hybrid systems integrable with catheterization labs.

Regulatory pathways for these adaptations expedite validations, aligning with interventional cardiology standards. Opportunities emerge in training alliances with heart associations, equipping interventionalists with OCT-specific competencies. The technology’s potential in vulnerable plaque detection promises preventive cardiology advancements, reducing acute event risks. Market entry strategies target high-volume cath labs, where procedural reimbursements support adoption.

Collaborative trials demonstrate superior outcomes, bolstering evidence for guideline inclusions. These developments extend OCT’s footprint beyond ophthalmology, diversifying revenue for established players. On October 22, 2024, the U.S. Food and Drug Administration granted 510(k) clearance to the Gentuity HF-OCT Imaging System for pre- and post-coronary intervention imaging. This clearance exemplifies the burgeoning non-ocular utility. Overall, cardiovascular integration heralds a multifaceted expansion phase.

Impact of Macroeconomic / Geopolitical Factors

Rising healthcare expenditures and supply shortages amid economic slowdowns compel ophthalmology clinics to postpone OCT system upgrades, limiting access in underserved urban areas. Growing telemedicine adoption and preventive screening campaigns, however, boost equipment sales as providers integrate OCT for remote retinal assessments. Border closures tied to Baltic Sea disputes hinder laser diode shipments from Eastern European vendors, extending assembly timelines and elevating component fees for device makers.

These hurdles, in turn, encourage Western firms to forge resilient intra-EU supply pacts, slashing transit risks and refining product customization. Current U.S. tariffs under Section 232 impose 25% duties on non-exempt imported OCT scanners from Asian origins, inflating acquisition prices for American hospitals and eroding competitive bids from overseas suppliers. Importers navigate this adeptly by expanding U.S. warehousing and qualifying for duty relief via reshoring initiatives that curb exposure.

Latest Trends

Adoption of Home-Based OCT Systems is a Recent Trend

The proliferation of patient-initiated optical coherence tomography devices has crystallized as a noteworthy trend in 2024, empowering remote monitoring for chronic retinal conditions like wet AMD. These compact units facilitate daily scans with AI-assisted analysis, alerting clinicians to fluid accumulation via cloud connectivity. Regulatory focus on user safety and data security has streamlined approvals, emphasizing ergonomic designs for elderly users. This trend aligns with teleophthalmology surges, minimizing clinic visits and optimizing resource allocation.

Developers prioritize intuitive interfaces and rechargeable batteries, enhancing compliance in home settings. Integration with wearable tech previews seamless data ecosystems for longitudinal tracking. Clinical studies affirm equivalence to clinic-based OCT, validating efficacy in progression management. The approach reduces healthcare burdens, particularly in geographically isolated areas.

Pharmaceutical partners explore linkages to therapy adherence, refining personalized dosing. On May 16, 2024, the U.S. Food and Drug Administration granted de novo marketing authorization to Notal Vision’s SCANLY Home OCT system for self-imaging in neovascular AMD patients. This authorization marks a pivotal step in decentralized diagnostics. The trend’s trajectory suggests transformative shifts toward proactive, patient-centric care models.

Regional Analysis

North America is leading the Optical Coherence Tomography Market

The Optical Coherence Tomography market in North America captured 37.2% of the global share in 2024, attributed to escalating demand for non-invasive diagnostic tools amid surging incidences of retinal disorders and cardiovascular conditions. Leading manufacturers such as Carl Zeiss Meditec and Leica Microsystems introduced swept-source iterations with enhanced axial resolution, facilitating precise visualization of choroidal neovascularization in age-related macular degeneration patients.

The National Eye Institute channeled resources into multi-modal integration projects, combining OCT with fundus autofluorescence to refine glaucoma progression monitoring in community-based screenings. Healthcare providers in urban centers like New York and Los Angeles adopted portable units for bedside assessments, reducing diagnostic delays in emergency ophthalmology cases. Venture capital firms funneled investments into AI-augmented analysis software, automating lesion segmentation to support telemedicine consultations across remote provinces.

Reimbursement frameworks from the Centers for Medicare & Medicaid Services encompassed expanded indications for dermatological applications, spurring adoption in private practices. Collaborative consortia between universities and device firms accelerated validation studies for intravascular OCT in stent optimization, yielding superior patency rates in interventional cardiology. Policy incentives under the 21st Century Cures Act expedited breakthrough designations, shortening review cycles for next-generation probes.

Regional training academies certified over 2,500 specialists in advanced OCT interpretation, elevating procedural confidence and utilization rates. The National Institutes of Health awarded US$1.6 million to NYU Langone Health in 2024 to investigate changes in the eye that may indicate progression of Alzheimer’s and Parkinson’s diseases through optical coherence tomography imaging.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Experts project the non-invasive imaging diagnostics sector in Asia Pacific to expand substantially during the forecast period, as authorities prioritize ophthalmic surveillance in rapidly aging societies. China allocates substantial resources through the National Health Commission to deploy wide-field systems in tier-2 cities, targeting diabetic retinopathy screenings among 140 million at-risk adults.

Japan engineers ultra-high-speed scanners via the Japan Agency for Medical Research and Development, enabling intraoperative guidance for vitreoretinal surgeries in high-volume hospitals. India equips rural eye camps under the National Programme for Control of Blindness with cost-effective handheld variants, addressing cataract comorbidities in underserved districts. South Korea fosters local innovation through the Ministry of Trade, Industry and Energy, developing hybrid OCT-SLO platforms for pediatric amblyopia assessments.

Governments streamline import tariffs on core components, encouraging assembly lines in Vietnam and Thailand to lower unit costs by 20%. Bioengineering institutes in Taiwan integrate spectral-domain upgrades with electronic health records, streamlining data flow for longitudinal studies on myopia epidemics. Regional health alliances promote cross-nation proficiency workshops, standardizing protocols for cardiovascular plaque characterization.

Pharmaceutical developers partner with device suppliers to embed OCT endpoints in phase III trials for anti-VEGF agents, accelerating evidence generation. The Singapore National Eye Centre awarded S$50,000 to Dr. Tin Aung Tun for a study utilizing optical coherence tomography in fiscal year 2021-2022, exemplifying targeted investments in advanced retinal diagnostics.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the high-resolution biomedical imaging sector drive expansion by launching AI-powered swept-source systems that deliver micron-level vascular mapping, securing preferred vendor status in premium cardiology and ophthalmology suites. They acquire niche photonic startups to integrate adaptive optics and expand into intraoperative neurosurgery applications, while forging EHR-embedded partnerships with hospital chains to lock in recurring consumables revenue.

Executives prioritize MDR-compliant localized assembly in Asia-Pacific hubs to accelerate emerging-market penetration and counter tariff risks. Carl Zeiss Meditec AG, headquartered in Jena, Germany and part of the Zeiss Group since 2002, leads the field through its CIRRUS and PLEX Elite platforms, combining diagnostic visualization with microsurgical precision tools that empower clinicians worldwide with integrated, data-driven workflows for retinal, glaucoma, and anterior-segment management.

Top Key Players in the Optical Coherence Tomography Market

- OPTOPOL Technology

- Novacam Technologies

- NIDEK

- Michelson Diagnostics

- Heidelberg Engineering

- Danaher

- Carl Zeiss Meditec

- Canon Medical Systems

- Agfa-Gevaert

- Abbott Laboratories

Recent Developments

- In June 2024: NIDEK CO., LTD. launched the RS-1 Glauvas OCT system, featuring deep-learning analytics and ultra-fast 250 kHz scan speeds. The combination of speed, image quality, and AI integration reinforces NIDEK’s position in next-generation ophthalmic imaging. This development enhances diagnostic precision in glaucoma and retinal disease detection, driving competitive advancement in the OCT Market’s high-performance segment.

- In May 2024: ZEISS Medical Technology unveiled the CIRRUS 6000 with a data-driven workflow backed by the largest OCT reference database in the U.S. This integration of AI-enabled analytics, enhanced connectivity, and cybersecurity features establishes a new standard for clinical efficiency and digital imaging safety. ZEISS’s innovation strengthens the OCT Market by supporting scalable, secure, and interoperable imaging solutions tailored to modern ophthalmology practices.

Report Scope

Report Features Description Market Value (2024) US$ 1.9 billion Forecast Revenue (2034) US$ 6.4 billion CAGR (2025-2034) 12.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Tabletop, Handheld, Doppler, and Catheter Based), By Technology (Spectral Domain OCT, Time Domain OCT, and Swept-Source OCT), By Application (Ophthalmology, Oncology, Dermatology, Cardiology, and Others), By End-user (Hospitals, Ambulatory Surgical Centers, Diagnostic Imaging Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape OPTOPOL Technology, Novacam Technologies, NIDEK, Michelson Diagnostics, Heidelberg Engineering, Danaher, Carl Zeiss Meditec, Canon Medical Systems, Agfa-Gevaert, Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Optical Coherence Tomography MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Optical Coherence Tomography MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Carl Zeiss AG

- Alcon

- Abbott Laboratories

- Terumo Corporation

- Koninklijke Philips N.V.

- Braun Melsungen AG

- Boston Scientific Corporation

- Topcon Corporation

- Nidek Co. Ltd

- Novacam Technologies Inc

- Agfa Healthcare

- Heidelberg Engineering Gmbh

- Imalux Corp

- Michelson Diagnostics

- Optopol Technology S.A.

- Thorlabs, Inc.

- Optovue Inc.

- Moptim Imaging Technique

- Sonostar Technologies Co. Limited

- Canon Medical Systems

- Excelitas Technologies Corp

- Other Key Players