Global Optical Coating Market By Product (Anti-Reflective Coatings, High Reflective Coatings, Transparent Conductive Coatings, Filter Coatings, Beam Splitter Coatings, Others), By Technology (Vacuum Deposition, E-beam Evaporation, Sputtering Process, Ion-Assisted Deposition), By End-Use(Consumer Electronics, Solar, Medical, Telecommunication, Architecture, Aerospace & Defense, Automotive, Others) As well as by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast: 2023-2033

- Published date: Nov 2023

- Report ID: 44136

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

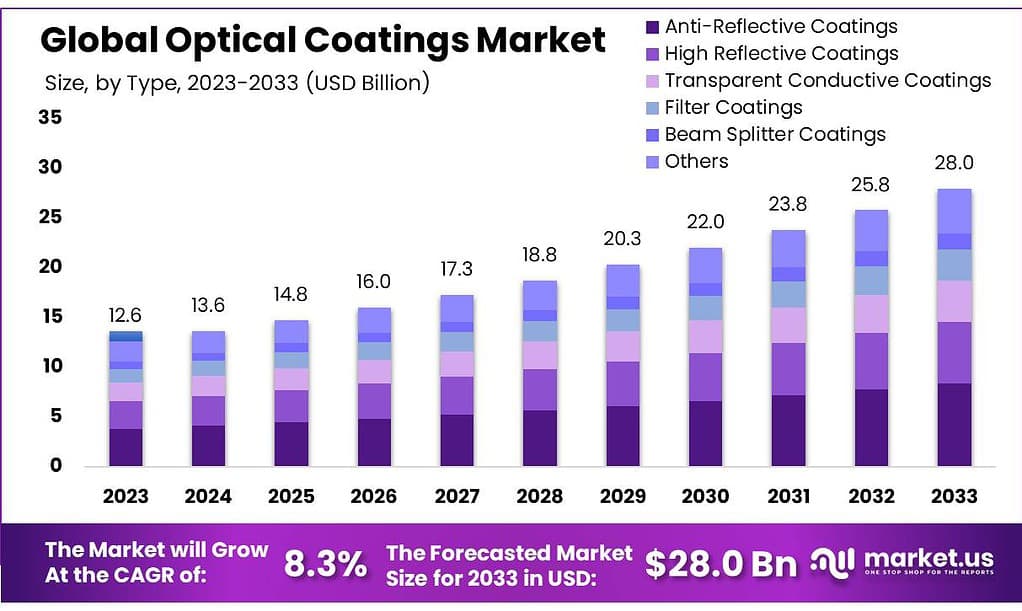

The global Optical Coatings Market size is expected to be worth around USD 28.0 billion by 2033, from USD 12.6 billion in 2023, growing at a CAGR of 8.3% during the forecast period from 2023 to 2033.

This market is projected to experience considerable expansion due to technological developments in optical deposition and fabrication processes as well as increasing end-user demands for more energy-efficient optical devices.

Several areas of application now use optical coatings, such as in architecture, automotive, consumer electronics (solar panels), telecommunication, medical, and military & defense.

Note: Actual Numbers Might Vary In Final Report

Key Takeaways

- Market Growth Projection: The Optical Coatings Market is anticipated to grow significantly, reaching around USD 28.0 billion by 2033 from USD 12.6 billion in 2023, representing a robust CAGR of 8.3%.

- Primary Revenue Contributors: Anti-reflective coatings dominate the market, accounting for over 30.1% of revenue in 2023. These coatings find extensive use in lenses, display screens, and eyeglasses, driving their demand across various industries.

- Rising Demand in Solar Energy: Conductive Coatings are projected to witness substantial growth due to increased focus on solar energy. The surge in investments in solar panels and related technologies, especially in countries like India and China, contributes to this market expansion.

- Technological Advancements Driving Demand: Various deposition technologies like Vacuum Deposition, E-beam Evaporation, Sputtering Process, and Ion-Assisted Deposition cater to specific industry needs. Their precision and versatility in applying coatings contribute to market growth.

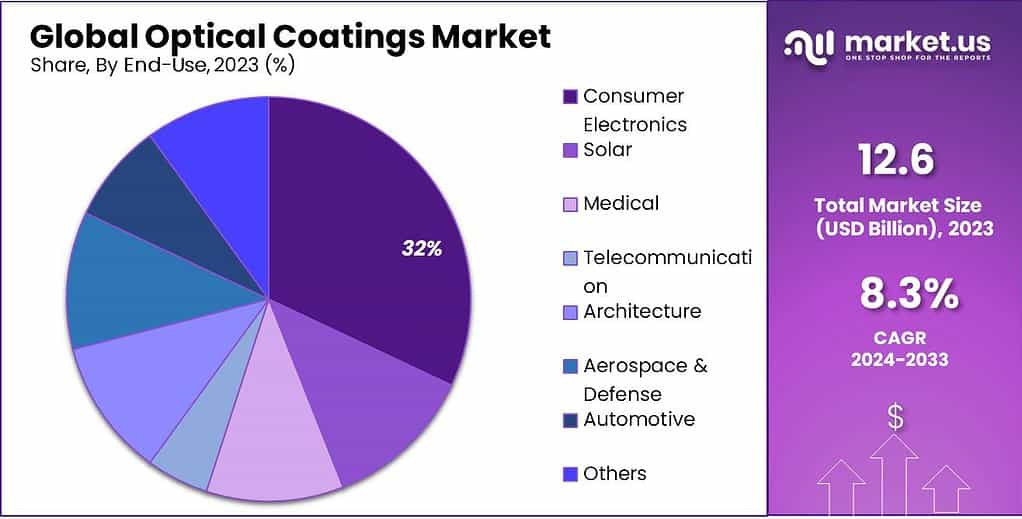

- Consumer Electronics Reigns Supreme: The Consumer Electronics segment leads in application, capturing over 32.0% of the market in 2023. Rising disposable incomes and technological advancements in smart devices, including smartphones and smart TVs, fuel this growth.

- Automotive Industry’s Role: Automotive applications of optical coatings, such as impact and abrasion-resistant coatings for speedometer displays and components like windshields and windows, are expected to drive market growth.

- Challenges of Raw Material Price Volatility: Fluctuations in raw material prices, particularly metals and oxides used in optical coating production, pose challenges and impact manufacturing expenses.

- Opportunities in Automotive Electronics: The transportation industry’s demand for advanced automotive electronics presents a promising avenue for optical coatings. These coatings are crucial for various automotive components, including switches, light guides, and headlamp lenses.

- Impact of Government Regulations: Stringent regulations concerning product safety, environmental sustainability, and performance standards pose hurdles that demand extensive research, development, and investments for compliance.

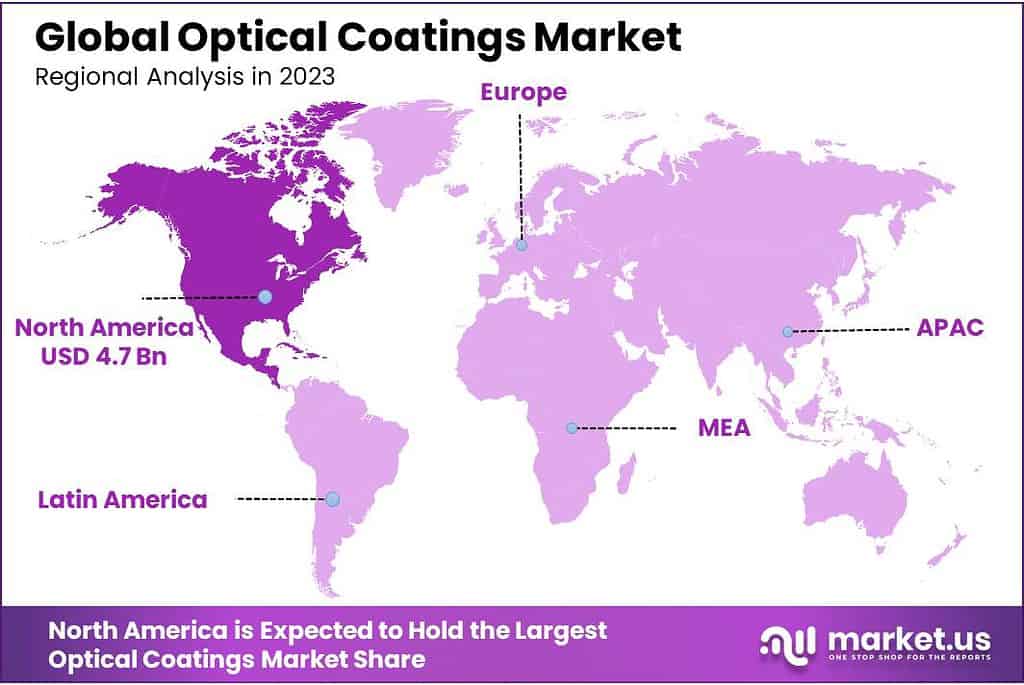

- Regional Market Dynamics: North America currently dominates the market, with the U.S. focusing on its solar industry and witnessing growth in aerospace/defense. The Asia Pacific region is expected to experience significant growth due to a surge in demand for electronic consumer products and a growing youth population.

Product Analysis

On the basis of ‘Product’, the ‘Anti-Reflective Coatings’ segment accounted for the majority revenue share of more than 30.1% in 2023. Thin-film optical coatings that are anti-reflective include multiple layers of coatings, each with a different refractive Index.

Every layer has a thickness that will cause light beams to be reflected off the surface. This makes it ideal for magnifying and display lenses, camera lenses, display screens, and eyeglasses, which are used on both glass and plastic substrates.

Over the forecast period, this market is expected to index a significant increase in the demand for antireflective coatings to be used for the construction of photovoltaic panels, automobile displays, windows, and GPS navigators. Because of the high use of solar panels, the ‘Conductive Coatings’ segment will register significant growth.

Over the coming years, solar energy production will experience exponential growth due to increased focus on alternative sources. Countries like India and China are making large-scale investments in this field while more people turn to using solar panels, heaters, and display windows than ever. This market should see further expansion.

By Technology

Vacuum Deposition: This method dominates due to its versatility in applying coatings in a controlled environment. It finds extensive use in industries requiring precise coatings on surfaces for optical enhancements.

E-beam Evaporation: Recognized for its high precision, this method is favored in applications demanding ultra-thin coatings, particularly in electronic displays and semiconductor industries.

Sputtering Process: Widely adopted across various sectors for its efficiency in producing durable and uniform coatings. Its usage spans from architectural glass to advanced electronics.

Ion-Assisted Deposition: Known for its ability to improve coating adhesion and densification, making it a preferred choice in applications requiring robust and resilient coatings, such as in the aerospace and automotive industries.

Others: This category encompasses a range of emerging and specialized coating methods, each with unique advantages. These methods cater to specific industry needs, showcasing the potential for niche applications.

By End-Use

In terms of ‘Application’, the ‘Consumer Electronics’ segment led this market, accounting for a revenue share greater than 32.0% in 2023. The forecast period will index segment growth due to rising disposable incomes and a rapidly growing demand for smartphones.

Over the forecast period, this market should reap benefits from technological advancements made to smart TVs and consumer devices like smartphones and smartwatches. Furthermore, increased optical coating demand from key players should bolster this growth market.

Due to their superior optical display and impact resistance, infrared and antireflective coatings have become widely utilized within electronics. Due to technological developments and growth within semiconductor industries, forecast periods will witness an increase in demand for optical coatings.

Because of its impact and abrasion resistance, it is commonly used in automotive speedometer displays. This market is expected to grow because of the increased use of optical coatings for many automotive components such as gear knob tops, windshields, and car windows. Additionally, components used in the automotive industry implement UV-resistant and scratch-resistant coatings.

Note: Actual Numbers Might Vary In Final Report

Key Market Segments

By Product

- Anti-Reflective Coatings

- High Reflective Coatings

- Transparent Conductive Coatings

- Filter Coatings

- Beam Splitter Coatings

- Others

By Technology

- Vacuum Deposition

- E-beam Evaporation

- Sputtering Process

- Ion-Assisted Deposition

By End-Use

- Consumer Electronics

- Solar

- Medical

- Telecommunication

- Architecture

- Aerospace & Defense

- Automotive

- Others

Drivers

Rise in demand for optical coatings from electronics & semiconductor industry

Optical coatings find diverse applications across various industries such as semiconductors, high-temperature lamp tubing, telecommunications, optics, and microelectronics. In the realm of electronics and semiconductors, they serve a crucial role in coating printed circuit boards (PCBs), and integrated circuits (ICs), and modifying wafers, enabling these components to endure high-temperature gradients and rapid thermal processing.

Ongoing advancements have spurred the utilization of new-gen wafers, bolstering the demand for high-purity optical coatings that amplify product performance. Moreover, optical coatings are increasingly integrated into smartphones, spanning screens, camera lenses, and semiconductor chips, augmenting touch sensitivity and display capabilities. This upsurge in integrating optical coatings within smart devices significantly propels market expansion.

Restraints

Volatility in raw material prices

Optic coating production utilizes various raw materials, from oxides such as aluminum, zirconium titanium selenium selenium fluorides strontium calcium magnesium fluorides and metals including copper gold silver to produce optical coatings.

Price fluctuations among raw materials like metals and oxides like TiO2, indium, gold, copper and silver can have an unpredictable impact on manufacturing expenses and should always be taken into consideration before budgeting expenses for manufacturing operations.

Fluctuations in raw material prices have a direct influence on the profitability and overall costs within the optical coatings market, potentially constraining its growth. However, recent trends indicate a decrease in metal costs.

Immediate shifts in these prices can impose limitations on market expansion, and alterations in the value of precious metals like gold and platinum significantly affect the overall expenses and demand for high-end applications utilizing optical coatings.

Opportunities

Increasing adoption of advanced automotive electronics

The transportation industry is witnessing increased demand for automotive electronics, driven by factors like higher incomes, a focus on safety, intelligent transport systems, and environmental awareness. Optical coatings are instrumental in powering advanced automotive electronics systems.

The growth of driver assistance systems, communication tech, and entertainment features in vehicles presents promising opportunities for the optical coatings market. These coatings find application in various automotive components like switches, light guides, headlamp lenses, and taillights.

They’re also vital for protecting display windows in public transport vehicles. Key optical coatings used in transportation include anti-reflection (AR), high-reflective coatings, and filter coatings.

Challenges

Stringent government regulations

The optical coatings market faces hurdles due to stringent government regulations centered on product safety, environmental sustainability, and performance standards. Adhering to these regulations demands extensive research, development, and investments to explore alternative materials and processes.

Manufacturers might have to adapt equipment or waste management practices, affecting operational costs. Keeping pace with evolving regulations becomes paramount. Failure to comply can result in penalties and tarnish a company’s reputation.

Achieving regulatory compliance necessitates substantial resources and a fine equilibrium between adherence, cost-effectiveness, and the delivery of high-performance coatings.

Regional Analysis

North America dominated the market for optical coatings and was responsible for 37.8% of this industry’s revenue share in 2023. The U.S. is developing its solar industry, and a greater level of focus on domestic industries are elements driving this market. Strong growth potential exists for reflective coatings in the aerospace/defense segment due to an increase in the U.S. defense budget.

North America is a major manufacturing center for small and medium-sized medical equipment, which in turn is expected to increase the demand for optical coatings over the forecast period. Additionally, there will be a strong demand for optical-coated products due to the presence of several industries, including instrumentation and microelectronics.

Additionally, due to COVID-19, existing patient populations are expected to grow. This will drive the demand for medical components and thereby increase the need for optical coatings in the U.S. Over the forecast period, the Asia Pacific market will also experience significant growth.

The regional market is expected to expand further due to the surging youth population and growing demand for electronic consumer products like mobiles, tablet cameras, LED screens, consoles, and personal computers.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Several market players have integrated their raw material production and distribution to ensure product quality and greater regional reach. This gives companies a competitive advantage through cost savings and increases their given profit margins.

Companies invest in research and development initiatives to develop new products to address market competition and evolving customer requirements. This industry is expected to foster research activities that combine multiple properties in the future.

Key Market Players

- Reynard Corporation

- Sigmakoki Co. Ltd

- SCHOTT

- Quantum Coating

- JENOPTIK

- PPG Industries Inc.

- Materion

- Inrad Optics

- Newport Corporation

- ZEISS International

- DuPont

- Nippon Sheet Glass Co. Ltd

- Optimax Systems, Inc.

- Optical Coatings Technologies

- Gelest Inc.

Recent Development

- June 29, 2023: Partnership between PPG Industries Ohio, Inc and Satys for aircraft component electrocoating: PPG Industries Ohio, Inc partnered with Satys, a French industrial group specializing in aircraft sealing, painting, and surface treatment, to provide electrocoating (e-coat) services for original equipment manufacturer (OEM) aircraft components.

- May 23, 2023: Collaboration between PPG and Entrotech Inc. for advanced paint films: PPG and Entrotech Inc. joined forces to establish a joint venture dedicated to delivering paint films with multi-layered coatings, featuring at least one paint layer.

- June 21, 2023: DuPont and JetCool collaboration for liquid cooling technology: DuPont and JetCool Technologies Inc., known as JetCool, formed a collaboration to promote advanced liquid cooling technology. Focused on enhancing thermal management solutions for high-power electronic applications like semiconductors, data centers, and high-performance computing systems, this partnership aims to drive innovation and facilitate the adoption of more efficient cooling techniques in demanding sectors.

Report Scope

Report Features Description Market Value (2023) USD 12.6 Billion Forecast Revenue (2033) USD 28.0 Billion CAGR (2023-2032) 8.3% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Anti-Reflective Coatings, High Reflective Coatings, Transparent Conductive Coatings, Filter Coatings, Beam Splitter Coatings, Others), By Technology (Vacuum Deposition, E-beam Evaporation, Sputtering Process, Ion-Assisted Deposition), By End-Use(Consumer Electronics, Solar, Medical, Telecommunication, Architecture, Aerospace & Defense, Automotive, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Reynard Corporation, Sigmakoki Co. Ltd, SCHOTT, Quantum Coating, JENOPTIK, PPG Industries Inc., Materion, Inrad Optics, Newport Corporation, ZEISS International, DuPont, Nippon Sheet Glass Co. Ltd, Optimax Systems, Inc., Optical Coatings Technologies, Gelest Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is optical coating market?Optical coating refers to a thin layer of material applied to an optical surface to enhance its performance, such as increasing transmission, reducing reflection, or altering the surface's properties.

What industries benefit from optical coatings market?Optical coatings find applications in various industries, including telecommunications, electronics, automotive, aerospace, healthcare (medical devices), and architectural sectors for lenses, displays, mirrors, and more.

How do optical coatings impact product performance and cost?

-

-

- Reynard Corporation

- Sigmakoki Co. Ltd

- SCHOTT

- Quantum Coating

- JENOPTIK

- PPG Industries Inc.

- Materion

- Inrad Optics

- Newport Corporation

- ZEISS International

- DuPont

- Nippon Sheet Glass Co. Ltd

- Optimax Systems, Inc.

- Optical Coatings Technologies

- Gelest Inc.