Global Optathalmic Viscosurgical Devices Market Analysis By Type (Cohesive, Dispersive, Viscoadaptive), By Source (Animal, Biological, Semi-synthetic), By Application (Glaucoma Surgery, Corneal Grafting, Cataract Surgery, Vitreoretinal Surgery, Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 78037

- Number of Pages: 201

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

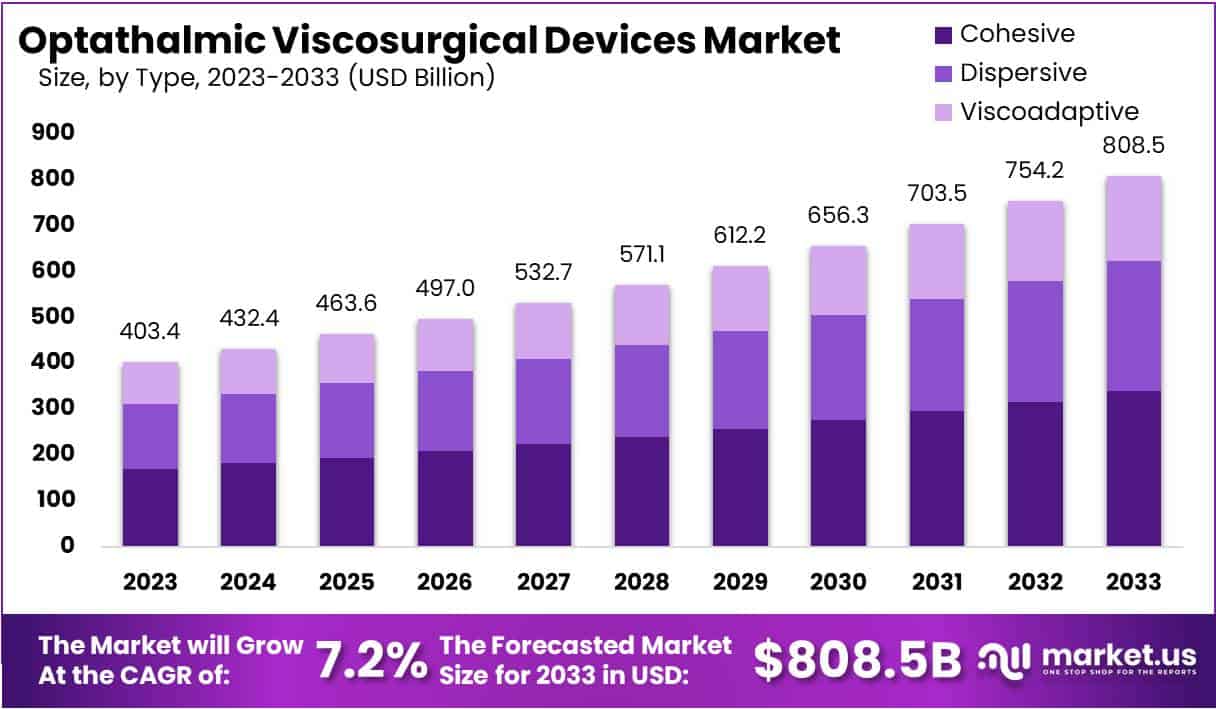

The Global Optathalmic Viscosurgical Devices Market size is expected to be worth around USD 808.5 Billion by 2033, from USD 403.4 Billion in 2023, growing at a CAGR of 7.2% during the forecast period from 2024 to 2033.

Ophthalmic viscosurgical devices (OVDs) are crucial tools used during various ophthalmic surgeries, particularly during cataract surgery. These devices help maintain space within the eye, protect delicate tissues, and facilitate the manipulation of intraocular structures. OVDs come in various forms, such as cohesive and dispersive viscoelastics, and they provide lubrication and protection to the corneal endothelium and other ocular tissues during surgical procedures.

The ophthalmic viscosurgical devices market refers to the industry involved in the manufacturing, distribution, and sales of these devices. This market encompasses a range of products used in ophthalmic surgeries, including both traditional viscoelastics and newer innovations. Factors such as the increasing prevalence of eye disorders, advancements in surgical techniques, and the growing elderly population contribute to the expansion of the ophthalmic viscosurgical devices market.

According to a study by the American Academy of Ophthalmology, cataract surgery stands as the primary application for OVDs, accounting for approximately 90% of procedures globally. Additionally, OVDs find utility across a spectrum of ophthalmic surgeries, including corneal, glaucoma, vitreoretinal, and other specialized procedures, reflecting their versatility and wide-ranging benefits in clinical practice.

Regulatory oversight, spearheaded by esteemed institutions such as the US Food and Drug Administration (FDA), the European Medicines Agency (EMA), and Japan’s Pharmaceuticals and Medical Devices Agency (PMDA), ensures the quality, safety, and efficacy of OVDs. This regulatory framework instills confidence among healthcare providers and patients, fostering a conducive environment for market growth.

In terms of market dynamics, the United States emerges as a significant exporter of OVDs, followed closely by prominent markets in Europe and Japan. However, emerging economies such as China and India are poised for substantial growth in OVD imports, propelled by escalating healthcare expenditures and burgeoning elderly populations.

Government initiatives aimed at enhancing access to ophthalmic care and raising awareness about ocular diseases indirectly contribute to the expansion of the OVD market. Furthermore, robust investments in research and development by leading healthcare companies, supported by venture capitalists, drive innovation in OVD materials, delivery systems, and therapeutic modalities.

Key Takeaways

- Market Size: OVD market to reach USD 808.5 billion by 2033, growing at 7.2% CAGR from 2024, driven by aging population and surgical advancements.

- Type Dominance: Dispersive segment holds 42% market share in 2023, favored for its versatility and effectiveness across eye surgeries.

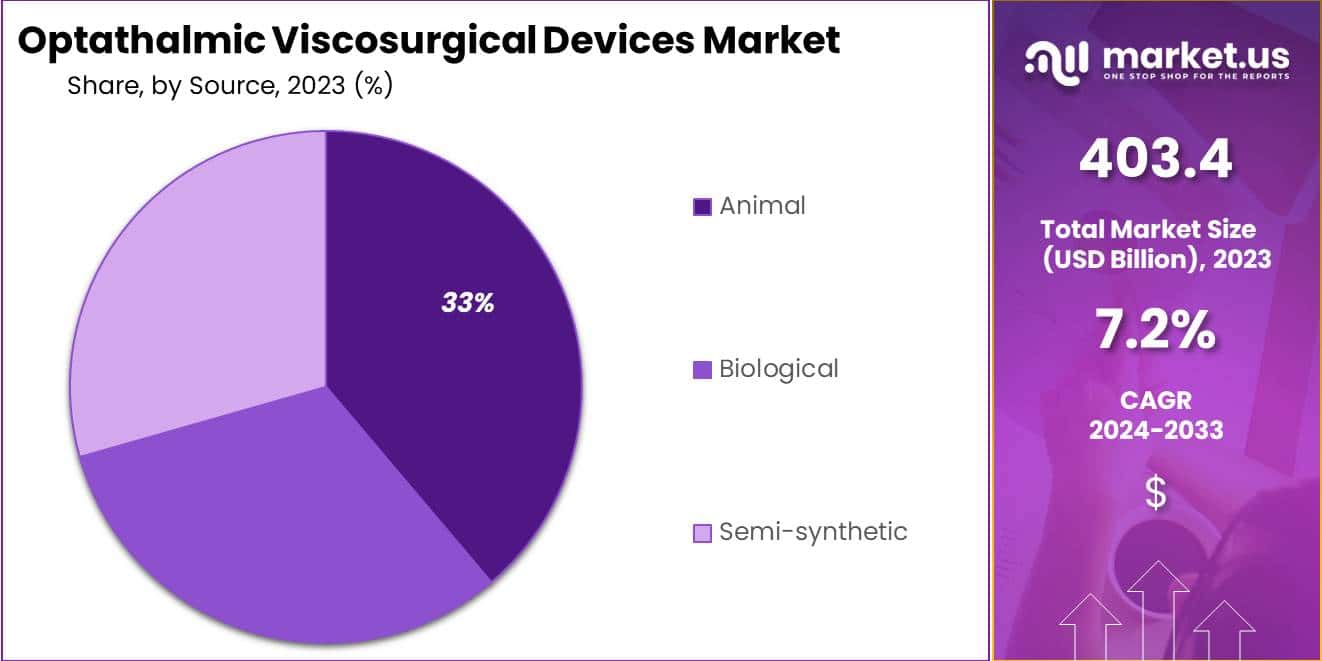

- Source Preference: Animal-derived materials lead with over a third of the market share, valued for biocompatibility in eye surgeries.

- Application Focus: Cataract surgery dominates with over 32% market share in 2023, reflecting increasing demand due to aging population.

- Market Drivers: Aging population and rising eye disorders propel demand for OVDs, especially in cataract surgery.

- Regulatory Challenges: Stringent approval processes hinder market growth, necessitating extensive trials and documentation, increasing costs.

- Technological Opportunities: Innovation in OVD properties fosters adoption rates among surgeons, driving market expansion.

- Minimally Invasive Trend: Shift towards minimally invasive procedures boosts demand for OVDs optimized for these approaches.

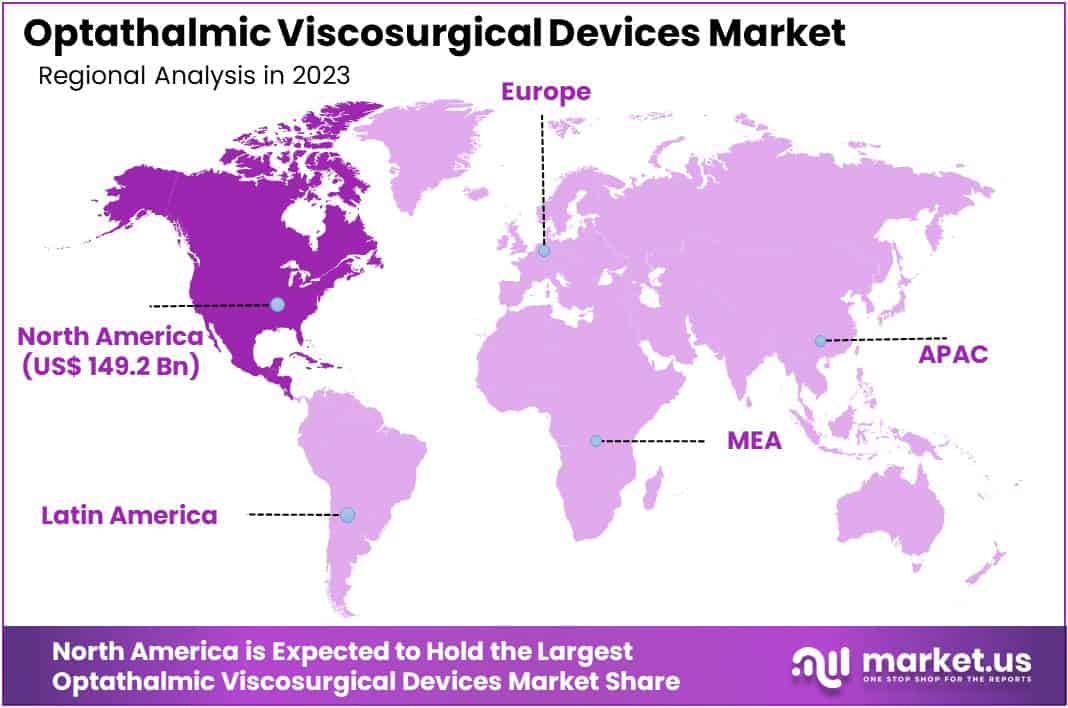

- Regional Dominance: North America leads OVD market with over 37% market share in 2023, followed by Europe and Asia-Pacific.

- Emerging Markets: Asia-Pacific presents growth opportunities fueled by increasing healthcare expenditure and awareness about eye health.

Type Analysis

In 2023, the Ophthalmic Viscosurgical Devices (OVD) Market saw the Dispersive segment taking a significant lead in the Type segment, capturing over 42% of the market share. This segment’s strength lies in its wide application across various eye surgeries like cataract extraction and lens implantation due to its unique properties that aid in tissue manipulation and protection.

Cohesive viscoelastic agents, though also crucial in eye surgeries, held a slightly lower market share compared to the Dispersive segment. These agents are valued for their ability to maintain shape and cohesion, ensuring stability in the eye chamber and safeguarding delicate tissues during surgery.

Meanwhile, the Viscoadaptive segment, though smaller, showed promising growth potential. This growth is fueled by advancements in surgical techniques and the increasing use of premium intraocular lenses, requiring viscoadaptive agents for optimal results.

The dominance of the Dispersive segment is driven by factors like its wide availability, proven effectiveness, and compatibility with various surgical methods. Moreover, factors like an aging population and rising eye disorders contribute to the growing demand for quality OVDs globally.

Looking forward, the Ophthalmic Viscosurgical Devices Market is expected to expand further. This growth will be supported by ongoing product innovations, increased investments in eye care infrastructure, and growing awareness among healthcare providers about the benefits of advanced viscoelastic agents for better surgical outcomes. Collaborations among key players are also expected to enhance market growth, ensuring a competitive landscape with comprehensive solutions for both surgeons and patients.

Source Analysis

In 2023, the animal segment dominated the Ophthalmic Viscosurgical Devices (OVD) Market Source Segment, capturing over a third of the market share. This segment’s leading position is due to various factors, including the widespread availability and proven effectiveness of animal-derived viscosurgical materials in eye surgeries. Surgeons prefer these materials, typically sourced from sources like rooster combs or bovine collagen, because they are biocompatible and well-established in medical practice. Additionally, their familiarity and relatively lower cost compared to other sources contribute to their significant market share.

Biological sources, derived from microbial fermentation or human umbilical cords, also play a role in the OVD market but hold a smaller share. However, they are gaining ground due to advancements in biotechnology, offering materials with enhanced properties like prolonged residence time and reduced immunogenicity.

Semi-synthetic sources, created through chemical modification or a blend of natural and synthetic components, represent a niche but promising segment. These materials provide a unique balance of biocompatibility and viscosity, tailored to specific surgical needs, making them popular for complex procedures.

Looking ahead, the OVD market is expected to grow and innovate across all source segments. Advancements in biotechnology, material science, and surgical techniques will drive the development of next-generation viscosurgical devices with improved safety and performance. Increased investments in research and development will expand the availability of novel materials and address clinical needs, shaping the market’s competitive landscape in the future.

Application Analysis

In 2023, the Ophthalmic Viscosurgical Devices (OVD) Market saw a significant rise in the prominence of cataract surgery, becoming the leading segment with over 32% of the market share. This surge can be attributed to the widespread occurrence of cataract-related conditions globally, alongside the increasing adoption of advanced surgical techniques.

Cataract surgery stands out as one of the most frequently performed eye procedures worldwide, mainly due to the growing number of elderly individuals and the rising prevalence of age-related cataracts. Consequently, there has been a corresponding increase in the demand for OVDs designed specifically for cataract surgery, propelling the growth of this segment.

Technological progress in OVDs, particularly the development of cohesive viscoelastics offering better stability and control during surgery, has notably improved their effectiveness in cataract procedures. The preference for minimally invasive surgical approaches, combined with the introduction of premium intraocular lenses, has further driven the need for OVDs in cataract surgery, solidifying the segment’s market position.

Additionally, the rise in healthcare spending, the broader availability of eye care services, and increased awareness about the advantages of early cataract detection and treatment have all played roles in expanding the cataract surgery segment within the OVD market.

Looking forward, the dominance of the cataract surgery segment is expected to continue, fueled by ongoing innovations in OVD technology, growing patient numbers, and supportive healthcare policies targeting the global burden of cataract-related visual impairment. However, it’s crucial for industry players to persist in their investment in research and development efforts to introduce more advanced and cost-effective OVD solutions, ensuring sustained growth and competitiveness in the evolving field of ophthalmic surgery.

Key Market Segments

Type

- Cohesive

- Dispersive

- Viscoadaptive

Source

- Animal

- Biological

- Semi-synthetic

Application

- Glaucoma Surgery

- Corneal Grafting

- Cataract Surgery

- Vitreoretinal Surgery

- Other Applications

Drivers

Aging Population and Increasing Incidence of Eye Disorders

The aging global population presents a significant driver for the Ophthalmic Viscosurgical Devices (OVD) market. With the rise in age-related eye disorders like cataracts and glaucoma, the demand for OVDs is poised to surge. Cataract surgery, a common procedure among the elderly, frequently relies on OVDs to maintain intraocular pressure and aid in surgical precision. As per the World Health Organization (WHO), cataracts are responsible for 51% of world blindness, affecting approximately 65.2 million people globally. Moreover, with the elderly population projected to reach 2.1 billion by 2050, there is a clear trajectory of increasing demand for OVDs. Consequently, market growth is anticipated to align closely with the aging demographic, highlighting the pivotal role of this demographic trend in shaping the OVD market landscape.

Restraints

Stringent Regulatory Approval Process

The stringent regulatory approval process acts as a significant restraint for the Ophthalmic Viscosurgical Devices (OVD) market. Regulatory bodies such as the FDA in the United States and the CE marking in Europe enforce rigorous standards to ensure the safety and efficacy of OVDs. While these regulations are essential for protecting patient health, they also impose considerable challenges on manufacturers, significantly prolonging the time and increasing the cost of bringing new products to market. The complex regulatory landscape acts as a barrier to entry for new market players, limiting innovation and potentially hindering the pace of market growth. Compliance with regulatory requirements necessitates extensive clinical trials and documentation, adding to the financial burden on companies and potentially delaying product launches.

Opportunities

Technological Advancements and Innovation

Technological advancements in ophthalmic surgery and the development of innovative Ophthalmic Viscosurgical Devices (OVDs) present a substantial opportunity for market expansion. Manufacturers are actively investing in research and development to enhance the properties of OVDs, including viscosity, tissue protection, and durability. The introduction of next-generation OVDs with superior performance characteristics can drive adoption rates among ophthalmic surgeons, leading to increased market growth and generating new revenue streams for industry players. This opportunity is further highlighted by the increasing demand for minimally invasive surgical techniques and the growing prevalence of age-related eye disorders worldwide.

Trends

Shift towards Minimally Invasive Procedures

The ophthalmic industry is witnessing a significant trend towards minimally invasive procedures, fueled by patient preferences for quicker recovery times, reduced risks, and enhanced outcomes. This shift is directly impacting the demand for Ophthalmic Viscosurgical Devices (OVDs), as they play a pivotal role in these procedures. OVDs facilitate improved visualization during surgeries, protect delicate eye structures, and maintain stable intraocular pressure. Particularly, in techniques like phacoemulsification, OVDs optimized for minimally invasive approaches are increasingly sought after. According to data from leading healthcare organizations, the global ophthalmic viscosurgical devices market is projected to grow at a CAGR of over 6% during the forecast period, reflecting the rising demand for these devices in tandem with the trend towards minimally invasive ophthalmic surgeries.

Regional Analysis

In 2023, North America held a dominant market position in the Ophthalmic Viscosurgical Devices (OVD) market, capturing more than a 37% share and holding a market value of USD 149.2 billion for the year. This strong market position can be attributed to several factors, including advanced healthcare infrastructure, high adoption rates of advanced ophthalmic technologies, and a growing geriatric population prone to age-related eye disorders. Moreover, the presence of major market players and ongoing technological innovations further contributed to the region’s market dominance.

In contrast, the Asia-Pacific region is emerging as a lucrative market for OVDs, driven by increasing healthcare expenditure, rising awareness about eye health, and improving accessibility to advanced ophthalmic treatments. Countries such as China and India are witnessing rapid economic growth, leading to a surge in demand for OVDs. Additionally, favorable government initiatives aimed at enhancing healthcare infrastructure and addressing the unmet medical needs of the population are expected to propel market growth in the region.

Europe, on the other hand, also commands a significant market share in the OVD market, owing to factors such as a well-established healthcare system, high prevalence of eye disorders, and increasing investments in research and development activities. Furthermore, strategic collaborations between key market players and healthcare organizations are fostering product innovation and market expansion in the region.

Overall, while North America currently dominates the OVD market, the Asia-Pacific region is poised for substantial growth, presenting attractive opportunities for market players to expand their presence and capitalize on the evolving healthcare landscape. Additionally, Europe continues to be a key market player, with ongoing advancements in healthcare infrastructure and technology driving market growth.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the ophthalmic viscosurgical devices (OVD) market, several key players are making significant contributions. Carl Zeiss Meditec AG is known for its precision and quality in medical technology solutions, including OVDs. Bohus Biotech AB focuses on research and development to create advanced viscosurgical products. Alcon, a leader in eye care, offers a diverse portfolio of ophthalmic products, including OVDs. Johnson & Johnson Surgical Vision Inc. leverages its resources to develop cutting-edge viscosurgical devices. Additionally, other companies play crucial roles in driving competition and innovation in the market. This diverse landscape ensures that surgeons and patients have access to high-quality OVDs tailored to their needs.

Market Key Players

- Carl Zeiss Meditec AG

- Bohus Biotech AB

- Alcon

- Johnson & Johnson Surgical Vision Inc.

- Rayner Intraocular Lenses Ltd.

- Bohus Biotech AB

- Maxigen Biotech Inc.

- Precision Lens

- CIMA Technology Inc.

- Other Key Players

Recent Developments

- In December 2023, Johnson & Johnson Surgical Vision Inc. made a significant move by acquiring TearScience, Inc. This acquisition expands J&J’s offerings in treating dry eye, an increasingly important area in ophthalmology. TearScience brings innovative dry eye technologies like LipiFlow® into J&J’s portfolio.

- In October 2023, Alcon introduced the PanOptix Trifocal IOL with PRESERVE® surface. This new intraocular lens provides a wider range of vision correction and features improved surface technology to reduce glare and dryness. It aims to capture a larger portion of the premium IOL market.

- In September 2023, Carl Zeiss Meditec AG received FDA approval for its VERACITY™ Intraocular Lens, which features an enhanced haptic design. This approval expands Zeiss’ range of IOL offerings, particularly targeting patients with complex anatomical conditions, potentially increasing their market presence.

- In August 2023, CIMA Technology Inc. announced the development of a 3D-printed biocompatible scaffold for sustained drug delivery during ophthalmic surgery. Although not yet available commercially, this innovation holds promise for revolutionizing drug delivery in eye surgery, offering sustained release and potentially improving patient outcomes.

Report Scope

Report Features Description Market Value (2023) USD 403.4 Bn Forecast Revenue (2033) USD 808.5 Bn CAGR (2024-2033) 7.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Cohesive, Dispersive, Viscoadaptive), By Source (Animal, Biological, Semi-synthetic), By Application (Glaucoma Surgery, Corneal Grafting, Cataract Surgery, Vitreoretinal Surgery, Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Carl Zeiss Meditec AG, Bohus Biotech AB, Alcon, Johnson & Johnson Surgical Vision Inc., Rayner Intraocular Lenses Ltd., Bohus Biotech AB, Maxigen Biotech Inc., Precision Lens, CIMA Technology Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Optathalmic Viscosurgical Devices market in 2023?The Optathalmic Viscosurgical Devices market size is USD 403.4 billion in 2023.

What is the projected CAGR at which the Optathalmic Viscosurgical Devices market is expected to grow at?The Optathalmic Viscosurgical Devices market is expected to grow at a CAGR of 7.2% (2024-2033).

List the segments encompassed in this report on the Optathalmic Viscosurgical Devices market?Market.US has segmented the Optathalmic Viscosurgical Devices market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type the market has been segmented into Cohesive, Dispersive, Viscoadaptive. By Source the market has been segmented into Animal, Biological, Semi-synthetic. By Application the market has been segmented into Glaucoma Surgery, Corneal Grafting, Cataract Surgery, Vitreoretinal Surgery, Other Applications.

List the key industry players of the Optathalmic Viscosurgical Devices market?Carl Zeiss Meditec AG, Bohus Biotech AB, Alcon, Johnson & Johnson Surgical Vision Inc., Rayner Intraocular Lenses Ltd., Bohus Biotech AB, Maxigen Biotech Inc., Precision Lens, CIMA Technology Inc., Other Key Players

Which region is more appealing for vendors employed in the Optathalmic Viscosurgical Devices market?North America is expected to account for the highest revenue share of 37% and boasting an impressive market value of USD 149.2 billion. Therefore, the Optathalmic Viscosurgical Devices industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Optathalmic Viscosurgical Devices?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Optathalmic Viscosurgical Devices Market.

Optathalmic Viscosurgical Devices MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Optathalmic Viscosurgical Devices MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Carl Zeiss Meditec AG

- Bohus Biotech AB

- Alcon

- Johnson & Johnson Surgical Vision Inc.

- Rayner Intraocular Lenses Ltd.

- Bohus Biotech AB

- Maxigen Biotech Inc.

- Precision Lens

- CIMA Technology Inc.

- Other Key Players