Opium Tincture Market By Product Type (Deodorized Opium Tincture and Camphorated Opium Tincture), By Application (Diarrhea Management, Pain Management, and Withdrawal Symptoms in Opioid Dependence), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132677

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Opium Tincture Market Size is expected to be worth around US$ 1.5 Billion by 2033, from US$ 0.8 Billion in 2023, growing at a CAGR of 6.2% during the forecast period from 2024 to 2033.

Increasing demand for effective treatments for gastrointestinal disorders drives the growth of the opium tincture market, as healthcare providers seek reliable solutions for conditions such as diarrhea and irritable bowel syndrome.

Opium tincture, known for its ability to slow intestinal motility and improve muscle tone, remains a critical component in managing severe cases of diarrhea, particularly in patients unresponsive to other treatments. In February 2021, Johnson & Johnson collaborated with GlaxoSmithKline to develop new opium-based formulations designed to enhance gastrointestinal muscle tone. This partnership reflects the pharmaceutical industry’s commitment to innovation, aiming to address unmet medical needs and expand therapeutic options in this niche market.

Recent trends indicate a growing focus on refining dosage forms and improving patient safety by reducing the risk of dependence and side effects associated with long-term opium tincture use. Opportunities also arise from the increasing prevalence of chronic gastrointestinal conditions, driving the need for targeted therapies. Additionally, advancements in pharmaceutical manufacturing are enabling the development of more consistent and standardized opium tincture products, ensuring better quality control and therapeutic efficacy.

Key Takeaways

- In 2023, the market for opium tincture generated a revenue of US$ 0.8 billion, with a CAGR of 6.2%, and is expected to reach US$ 1.5 billion by the year 2033.

- The product type segment is divided into deodorized opium tincture and camphorated opium tincture, with deodorized opium tincture taking the lead in 2023 with a market share of 64.7%.

- Considering application, the market is divided into diarrhea management, pain management, and withdrawal symptoms in opioid dependence. Among these, diarrhea management held a significant share of 52.8%.

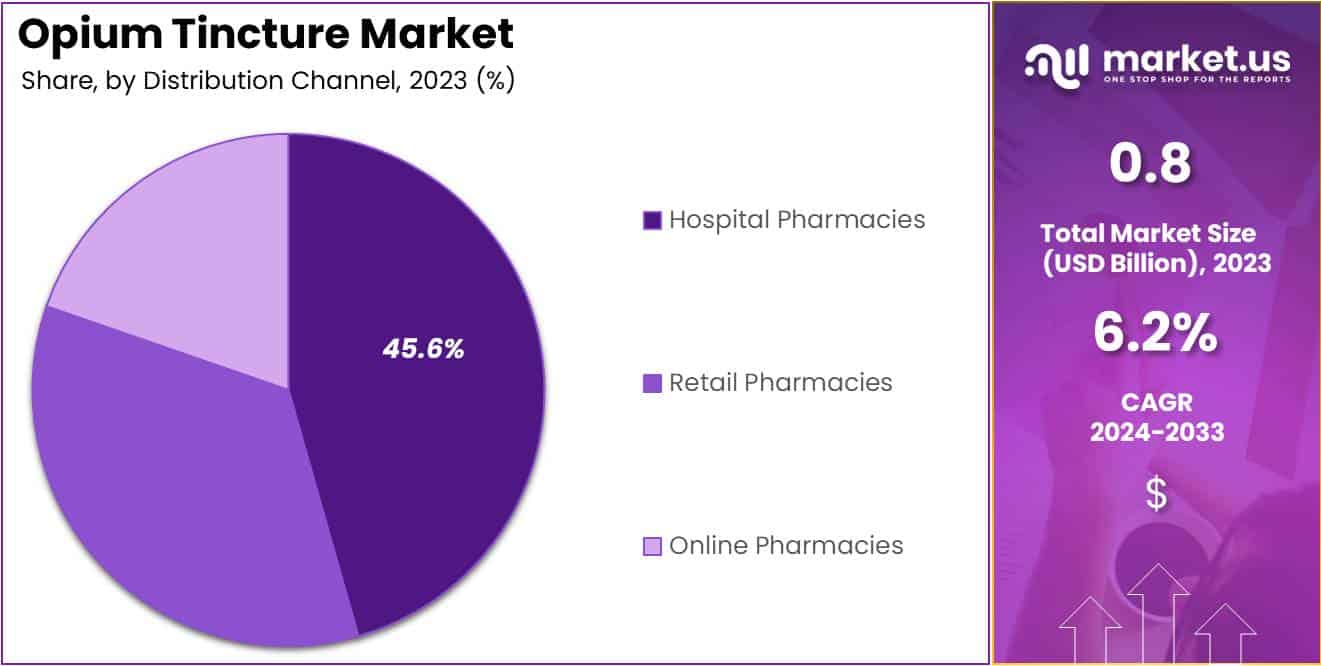

- Furthermore, concerning the distribution channel segment, the market is segregated into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies sector stands out as the dominant player, holding the largest revenue share of 45.6% in the opium tincture market.

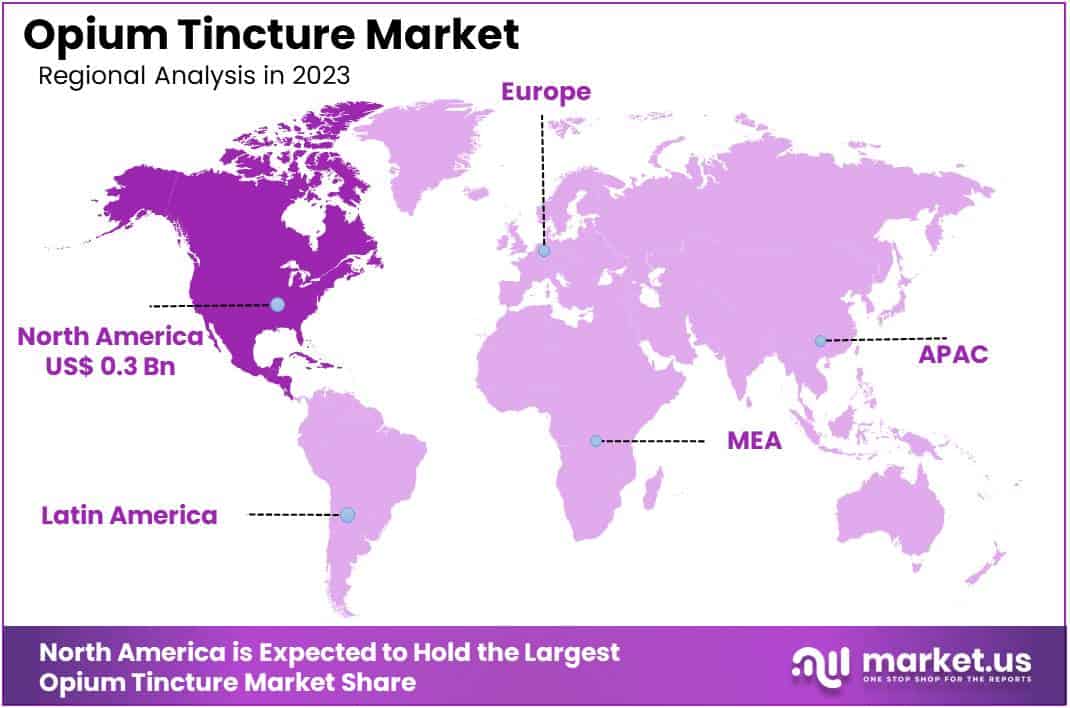

- North America led the market by securing a market share of 40.2% in 2023.

Product Type Analysis

The deodorized opium tincture segment led in 2023, claiming a market share of 64.7% owing to its higher efficacy and broader usage in managing severe diarrhea and other gastrointestinal conditions. Deodorized opium tincture, containing morphine, provides more effective symptom relief, making it a preferred choice among healthcare professionals.

Additionally, its minimal camphor content reduces side effects, enhancing patient tolerance and compliance. Regulatory approvals for its use in multiple regions further boost demand. The rising prevalence of chronic gastrointestinal disorders globally is likely to increase the segment’s market share. As healthcare providers continue to emphasize effective treatments for acute and chronic diarrhea, deodorized opium tincture is anticipated to dominate this market segment.

Application Analysis

The diarrhea management held a significant share of 52.8% due to the rising prevalence of chronic and acute diarrhea, driven by factors such as gastrointestinal disorders and infections. Healthcare providers increasingly prescribe opium tincture for severe cases where conventional anti-diarrheal medications prove ineffective.

The drug’s ability to reduce intestinal motility and alleviate symptoms rapidly makes it a vital treatment option. Additionally, growing awareness about effective diarrhea management, especially in developing regions, contributes to the segment’s expansion. As healthcare systems prioritize controlling severe gastrointestinal conditions, the diarrhea management segment is anticipated to experience robust growth in the opium tincture market.

Distribution Channel Analysis

The hospital pharmacies segment had a tremendous growth rate, with a revenue share of 45.6% owing to the critical role hospital pharmacies play in managing severe gastrointestinal and pain conditions requiring immediate intervention. Hospitals often serve as the first point of care for patients experiencing acute symptoms, ensuring timely access to opium tincture under medical supervision.

The stringent regulatory framework surrounding the prescription and distribution of controlled substances further reinforces the reliance on hospital pharmacies. Additionally, increasing hospital admissions for gastrointestinal disorders and opioid dependence enhance the demand for this distribution channel. With expanding healthcare infrastructure and the growing need for efficient medication management, hospital pharmacies are projected to remain a dominant distribution channel in the opium tincture market.

Key Market Segments

By Product Type

- Deodorized Opium Tincture

- Camphorated Opium Tincture

By Application

- Diarrhea Management

- Pain Management

- Withdrawal Symptoms in Opioid Dependence

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Drivers

Increasing Prevalence of Gastrointestinal Disorders

The rising incidence of gastrointestinal disorders, such as severe diarrhea and irritable bowel syndrome, has led to an increased demand for effective treatments, thereby driving the opium tincture market.

Opium tincture, known for its antidiarrheal properties, is utilized in managing these conditions when other treatments prove ineffective. According to the World Health Organization (WHO), diarrheal diseases remain a leading cause of morbidity worldwide, with millions of cases reported annually. In 2022, the Centers for Disease Control and Prevention (CDC) reported that approximately 179 million cases of acute gastroenteritis occur each year in the United States alone.

This high prevalence underscores the need for potent antidiarrheal medications, contributing to the sustained demand for opium tincture in clinical settings. As gastrointestinal disorders continue to affect a significant portion of the population, the necessity for effective management options like opium tincture is expected to persist.

Restraints

Stringent Regulatory Controls and Risk of Abuse

Stringent regulatory controls and the potential for abuse significantly restrain the opium tincture market. Due to its narcotic nature, opium tincture is classified as a controlled substance in many countries, necessitating strict prescription guidelines and monitoring to prevent misuse. The U.S. Drug Enforcement Administration (DEA) classifies opium tincture as a Schedule II controlled substance, indicating a high potential for abuse, which may lead to severe psychological or physical dependence.

In 2023, the DEA reported over 100,000 drug overdose deaths in the United States, highlighting the critical need for stringent control over opioid-containing medications. These regulatory measures, while essential for public safety, limit the accessibility and prescription of opium tincture, thereby restraining market growth.

Healthcare providers often opt for alternative treatments with lower abuse potential, further impacting the market. The balance between providing effective patient care and mitigating abuse risks continues to challenge the expansion of the opium tincture market.

Opportunities

Expansion into Emerging Markets

The expansion into emerging markets presents a significant opportunity for the opium tincture market. Many developing countries face a high burden of gastrointestinal diseases, with limited access to effective treatments. The World Health Organization (WHO) reported that in 2022, low- and middle-income countries accounted for the majority of the 1.6 million deaths due to diarrheal diseases globally.

Improving healthcare infrastructure and increasing awareness about effective treatments in these regions can drive the demand for opium tincture. Collaborations with local healthcare providers and governments to ensure safe and regulated distribution can facilitate market entry. Additionally, addressing the challenges of affordability and accessibility through cost-effective production and distribution strategies can enhance market penetration.

As healthcare systems in emerging markets continue to develop, the demand for effective gastrointestinal treatments like opium tincture is expected to rise, presenting a substantial growth opportunity.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly impact the opium tincture market by influencing production, distribution, and regulatory frameworks. Economic growth in developed regions drives healthcare investments, increasing the availability of treatments for conditions such as severe diarrhea and pain management where opium tincture is utilized. However, economic instability and inflationary pressures in emerging markets limit healthcare budgets, reducing access to such specialized medications.

Geopolitical tensions and conflicts in regions where poppy cultivation is prevalent disrupt supply chains, leading to fluctuations in raw material availability and pricing. Trade restrictions and stringent regulatory scrutiny further complicate the market, as governments implement tight controls on opioid-based products to prevent misuse and ensure public safety.

Despite these challenges, increasing awareness about effective pain management and supportive healthcare policies in certain regions provide opportunities for growth. Innovations in drug formulation and improved supply chain management also contribute to the market’s positive outlook.

Trends

Shift Towards Non-Opioid Alternatives

A notable trend in the healthcare industry is the shift towards non-opioid alternatives for pain and symptom management, impacting the opium tincture market. Concerns over opioid addiction and the associated public health crisis have led to increased scrutiny and a push for safer treatment options. In 2023, the U.S. Department of Health and Human Services (HHS) reported that over 10 million people misused prescription opioids, underscoring the need for alternative therapies.

Healthcare providers are increasingly adopting non-opioid medications and therapies to mitigate the risks associated with opioid use. This trend is supported by policy initiatives and funding for research into alternative treatments. The shift towards non-opioid alternatives is expected to influence prescribing practices, potentially reducing the demand for opioid-based medications like opium tincture. As the focus on patient safety and addiction prevention intensifies, the market dynamics for opium tincture are likely to be affected by this evolving trend.

Regional Analysis

North America is leading the Opium Tincture Market

North America dominated the market with the highest revenue share of 40.2% owing to increased incidences of chronic diarrhea and irritable bowel syndrome (IBS), conditions for which opium tincture is prescribed. The Centers for Disease Control and Prevention (CDC) reported that in 2022, approximately 3 million adults in the United States were diagnosed with IBS, highlighting a significant patient population requiring effective treatment options.

Additionally, the aging population in North America has contributed to a higher prevalence of gastrointestinal disorders, further driving demand. The U.S. Census Bureau noted that in 2023, individuals aged 65 and older constituted about 17% of the total population, underscoring the growing demographic susceptible to such conditions.

Moreover, healthcare providers have increasingly recognized the efficacy of opium tincture in managing severe diarrhea, leading to its more frequent prescription. Regulatory approvals and the availability of generic formulations have also made the medication more accessible and affordable, contributing to market expansion.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to a rising prevalence of gastrointestinal disorders and expanding healthcare access. The World Health Organization (WHO) reported that in 2022, approximately 40% of the global population resided in the Asia Pacific region, with a significant portion experiencing gastrointestinal issues due to dietary habits and lifestyle changes.

Rapid urbanization and increasing disposable incomes have led to greater healthcare spending, enabling more individuals to seek treatment for conditions like chronic diarrhea. Government initiatives aimed at improving healthcare infrastructure and access to essential medicines are expected to further support market growth.

Additionally, collaborations between local pharmaceutical companies and international firms are likely to enhance the availability and distribution of opium tincture across the region. As awareness of effective treatments for gastrointestinal disorders increases, the Asia Pacific market is projected to see a rise in demand for opium tincture.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the opium tincture market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the opium tincture market focus on maintaining strict compliance with regulatory guidelines to ensure product safety and efficacy.

Companies invest in modernizing manufacturing processes to improve production efficiency and meet quality standards. Expanding distribution networks allows them to reach a broader customer base, particularly in regions with limited access to essential medications. Strategic partnerships with healthcare providers and pharmacies help streamline the supply chain and increase product availability. Additionally, businesses emphasize educational initiatives to inform healthcare professionals about proper usage and benefits, driving adoption in clinical settings.

Top Key Players in the Opium Tincture Market

- Unilever

- Shiseido

- Procter Gamble

- KimberlyClark

- Johnson Johnson

- Henkel

- Beiersdorf

- Amorepacific

Recent Developments

- In August 2022: Johnson & Johnson expanded its pharmaceutical portfolio by acquiring a company specializing in pain management solutions. This strategic acquisition enhances Johnson & Johnson’s capabilities in developing and distributing opioid-based medications, including opium tincture, thereby strengthening its position in the pain management sector.

Report Scope

Report Features Description Market Value (2023) US$ 0.8 billion Forecast Revenue (2033) US$ 1.5 billion CAGR (2024-2033) 6.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Deodorized Opium Tincture and Camphorated Opium Tincture), By Application (Diarrhea Management, Pain Management, and Withdrawal Symptoms in Opioid Dependence), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Unilever, Shiseido, Procter Gamble, KimberlyClark, Johnson Johnson, Henkel, Beiersdorf, and Amorepacific. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Unilever

- Shiseido

- Procter Gamble

- KimberlyClark

- Johnson Johnson

- Henkel

- Beiersdorf

- Amorepacific