Operating Room Integration Systems Market By Component (Software, Hardware, Services), By OR Type (Hybrid ORs, Integrated Digital ORs), By Surgery Type (General Surgery, Orthopedic Surgery, Cardiovascular Surgery, Neurosurgery, Urology, Gynecology, Others), By End-User (Hospitals, Ambulatory Surgical Centers, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 40133

- Number of Pages: 385

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

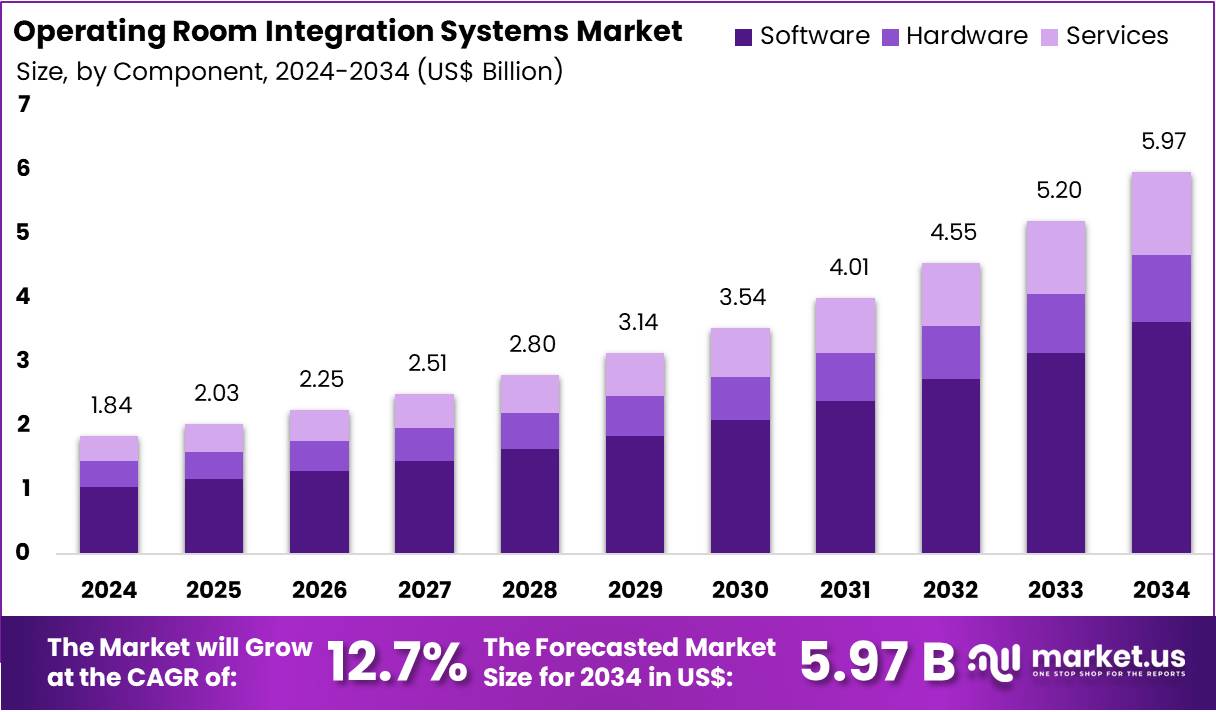

The Operating Room Integration Systems Market size is expected to be worth around US$ 5.97 billion by 2034 from US$ 1.84 billion in 2024, growing at a CAGR of 12.7% during the forecast period 2025 to 2034.

An operating room (OR) integration system is a hardware and software infrastructure installed in a surgical suite that centralizes control, routing and management of the many disparate systems present in the OR (video/AV, imaging, lighting, surgical tables/booms, endoscopic cameras, patient monitoring, documentation/document capture, networked data). The market is evolving rapidly as hospitals shift to the next generation of “digital ORs” including hybrid ORs, enabling minimally invasive and image-guided interventions.

The growth drivers in this market therefore, include the sheer scale of OR infrastructure, the volume and complexity of surgical procedures, hospital renovation and construction investments, and digital workflow demands. On the capital-construction side, the U.S. data shows health-care facility construction spending at about $69.4 billion annually (seasonally adjusted rate for July 2025) for the healthcare sector.

The surgical volume globally is substantial, and increasing transparency in reporting suggests that many more procedures are being tracked and that demand remains high. For OR integration systems, increased volumes translate into more pressure on OR infrastructure (more ORs, more throughput) and corresponding equipment upgrade cycles.

- In Europe, industry reports suggest that in 2023 the number of operation rooms in hospitals per 100,000 persons varied markedly: for example, Cyprus had ~21.12 ORs/100k population, Latvia ~17.99, France ~15.65. Meanwhile Austria had only ~4.85 ORs/100k.

- In the United States, approximately one in nine individuals living in households reported having at least one surgical procedure within the previous year.

- According to World Bank statistics, Hong Kong SAR, China recorded 1,735 surgical procedures per 100,000 population in 2023, reflecting a substantial level of surgical activity relative to population size.

Operating Room Integration Systems Market, Global Analysis, 2020-2024 (US$ Million)

Global 2020 2021 2022 2023 2024 CAGR Revenue 1,139.59 1,263.34 1,436.93 1,677.07 1,843.15 12.7% Initially, OR integration systems focused on consolidating AV and video feeds: routing endoscope/ laparoscope monitors, recording video, switching between sources. The design intent was largely ergonomic and workflow-improvement (less foot-traffic, fewer manual switches). Over time, the emphasis expanded beyond video and control to capture, storage, documentation and connectivity: storing surgical video/images, linking to patient records, sharing with remote sites. Hospitals began to expect OR systems to integrate with hospital information systems, the PACS archive, surgical scheduling, and to feed analytics dashboards.

The latest generation of OR integration systems support hybrid operating rooms (fixed imaging like C-arm/CT/MR), high-definition/4K video routing, IP-based networked video/data, remote collaboration, surgical analytics, real-time device tracking, multi-discipline use. For example, STERIS’s states that an integrated OR connects technology, information and personnel throughout the hospital to create a purpose-built system that reduces dependency on mobile equipment.

Key Takeaways

- In 2024, the market generated a revenue of US$ 84 billion, with a CAGR of 12.7%, and is expected to reach US$ 5.97 billion by the year 2034.

- By Component, Software dominated the market with a share of 57.1% in 2024.

- Based on OR Type, Hybrid ORs held the largest segment share in 2024 with 52.6%.

- Based on Surgery Type, General Surgery generated the maximum revenue of 29.0% share in 2024.

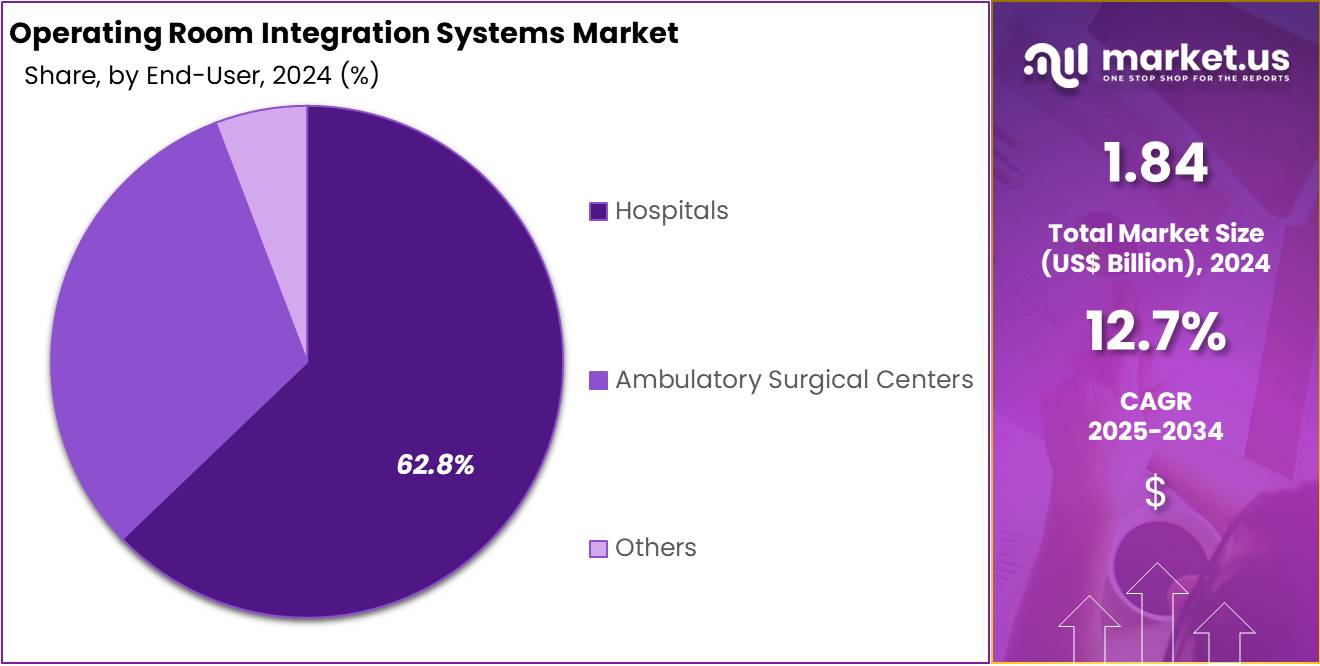

- Among the end-user segment, Hospitals held the largest revenue share of 62.8% in 2024.

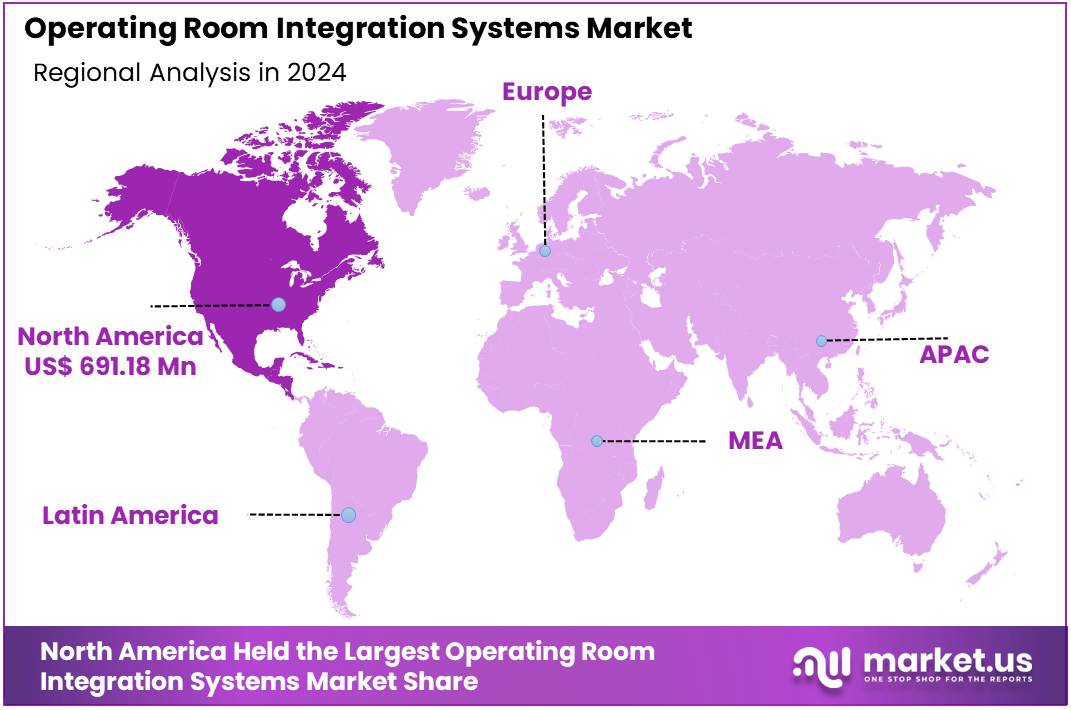

- In 2024, North America dominated the regional market with 37.5% share.

Component Analysis

Software held 57.1% market share in 2024 with growth being propelled by factors such as the rise in minimally invasive surgeries, increasing operating-room complexity (more devices and workflows), pressures on OR throughput and rising patient-safety and documentation demands. Popular examples of software used in OR integration systems include solutions from major medical technology companies that focus on streamlining communication, equipment management, video integration, and workflow in surgical environments.

Recently, in March 2025, e& enterprise, the digital transformation arm of e&, announced its strategic partnership with RAIN Technology, a pioneering leader in AI-powered healthcare solutions. This collaboration marks a significant milestone in transforming OR workflows in hospitals across the Middle East and Africa (MEA) through the introduction of Orva, the world’s first operating room voice assistant.

Advanced systems use computer vision to highlight anatomical structures or suspicious tissues in real time during surgery, enabling the OR integration software to route relevant video feeds or annotations to the surgical team.

Operating Room Integration Systems Market, Component Analysis, 2020-2024 (US$ Million)

Component 2020 2021 2022 2023 2024 Software 634.29 707.69 810.05 951.36 1,052.16 Hardware 264.86 288.54 322.34 369.37 398.90 Services 240.44 267.10 304.54 356.33 392.09 OR Type Analysis

Hybrid ORs elevate the demand for sophisticated hardware (imaging systems, OR tables, ceiling booms), advanced integration software (device orchestration, imaging routing) and services (planning, interoperability, training), thereby making them a focal point of the operating room integration systems market. This segment dominated the market with 52.6% share in 2024. Companies are investing heavily in hybrid operating rooms (HORs) as a strategic priority, driven by growing demand for advanced surgical environments that integrate imaging, diagnostics, and minimally invasive interventions within a single suite.

In October 2024, Deerns completed the commissioning of a state-of-the-art hybrid operating room (OR) at Jeroen Bosch Hospital, marking its second consecutive milestone project. This advanced facility enhances surgical precision and supports faster patient recovery through cutting-edge integration of imaging and surgical technologies. The project follows the earlier successful collaboration between Deerns and Jeroen Bosch Hospital, which resulted in the establishment of one of the Netherlands’ first hybrid operating rooms.

Operating Room Integration Systems Market, OR Type Analysis, 2020-2024 (US$ Million)

OR Type 2020 2021 2022 2023 2024 Hybrid ORs 591.88 658.10 750.74 878.79 968.64 Integrated Digital ORs 547.71 605.24 686.19 798.28 874.50 Surgery Type Analysis

In the context of general surgery, OR-integration systems are increasingly becoming foundational to procedural efficiency, data capture and surgical safety. The general surgery application segment accounted for the largest share of the market in 2024 with 29.0%.

In a typical general surgery suite, integration systems allow consolidation of procedural video feeds, patient data, instrumentation controls and imaging into a central command station, enabling the surgical team to view high-definition laparoscopic or endoscopic images, access patient vitals and medical history, and route device controls without leaving the sterile field. The growing incidence of gastrointestinal disorders, cancers and endocrine procedures drives demand in this segment.

For instance, according to National Institutes of Health, around 60 to 70 million people in the United States are affected by digestive diseases, including various gastrointestinal disorders. From an operational viewpoint, general surgery suites benefit from reduced operative time, fewer equipment errors and improved team coordination, all of which integration systems deliver via streamlined device control, video-routing automation and centralized information access.

Operating Room Integration Systems Market, Surgery Type Analysis, 2020-2024 (US$ Million)

Surgery Type 2020 2021 2022 2023 2024 General Surgery 346.94 379.90 426.77 491.91 534.18 Orthopedic Surgery 162.12 179.61 204.15 238.10 261.51 Cardiovascular Surgery 162.83 183.81 212.87 252.78 282.76 Neurosurgery 150.57 171.47 200.32 239.82 270.67 Urology 78.03 86.75 98.94 115.80 127.61 Gynecology 62.73 69.07 78.02 90.42 98.70 Others 176.37 192.74 215.87 248.24 267.71 End-User Analysis

Hospital segment contributed the maximum share among the end-user category with 62.8% in 2024. A major hospital benefit is the facilitation of minimally invasive surgeries (MIS), which demand high-definition visualization, precise instrument control, and integrated imaging. For example, the Greater Manchester Major Trauma Hospital utilizes Brandon Medical’s Wall of Knowledge system to centralize control and diagnostic imaging, enhancing patient safety and surgical outcomes in trauma and cardiovascular cases. Similarly, Almoosa Specialist Hospital in Saudi Arabia uses imedtac’s iMOR-SDB system to stream 4K surgical video for remote expert consultations, advancing telemedicine collaboration.

Hospitals also benefit from integration through reduced operating times, fewer surgical errors, and enhanced collaboration—both onsite and remotely. Artificial intelligence and AI-driven workflow automation are increasingly embedded within OR integration systems, helping to predict surgical risks, automate documentation, and optimize resource allocation. Hospitals use OR integration systems to centralize surgical controls, streamline complex workflows, improve safety and outcomes, and enable advanced procedures such as minimally invasive and hybrid surgeries, all of which contribute to enhanced operational performance in the modern healthcare landscape.

Operating Room Integration Systems Market, End-User Analysis, 2020-2024 (US$ Million)

End-User 2020 2021 2022 2023 2024 Hospitals 706.23 785.67 896.74 1,050.27 1,158.31 Ambulatory Surgical Centers 356.36 395.29 449.86 525.35 577.72 Others 77.00 82.39 90.32 101.46 107.11 Key Market Segments

By Component

- Software

- Hardware

- Services

By OR Type

- Hybrid ORs

- Integrated Digital ORs

By Surgery Type

- General Surgery

- Orthopedic Surgery

- Cardiovascular Surgery

- Neurosurgery

- Urology

- Gynecology

- Others

By End-User

- Hospitals

- Ambulatory Surgical Centers

- Others

Drivers

Rising Government initiatives to modernize healthcare infrastructure

Government-led investment in healthcare infrastructure is increasingly prominent as nations address aging hospital estates, expand surgical capacity, adopt advanced technologies (such as minimally invasive and robotic surgery) and integrate digital health systems. The push to modernize health facilities, including surgical suites and operating theatres, creates an environment favorable for the deployment of OR integration systems. These systems facilitate enhanced workflows, improved device interoperability, better documentation/analytics and support advanced surgical modalities. Public-sector funding, regulatory support and national programmes that enable hospital upgrades thus act as a direct driver for the OR integration systems market.

In the UK the New Hospital Programme (NHP) has been identified by the government as a major infrastructure initiative. According to the UK government press release dated January 20 2025, the government confirmed funding and a realistic timetable to deliver hospital projects, backed with £15 billion (US$ 19.83 billion) of new investment over consecutive five-year waves (averaging ~£3 billion – US$ 3.97 billion per year) to rebuild and modernize hospitals.

The plan was initiated to address the ageing NHS estate; e.g., a prior report noted under-investment of £37 billion (US$ 48.92 billion) over the 2010s in NHS hospital buildings. The modernization of hospital infrastructure thus, provides the pointer that surgical theatres (ORs) will be part of facility upgrades—creating demand for advanced OR infrastructure including integration systems.

The U.S. Defense Health Agency (DHA) launched an OR Optimization Project aimed at enhancing surgical efficiency within military hospitals. This initiative underscores the government’s focus on advancing operating room functionality, indirectly supporting future improvements in OR infrastructure and system integration. The project’s primary objectives include reducing surgical delays, strengthening communication among surgical teams, and standardizing clinical care practices across the Military Health System (MHS).

Restraints

High capital cost and total cost of ownership

Operating rooms (ORs) are among the most expensive assets in a hospital: high technology, complex workflows, and heavy device and infrastructure demands. When hospitals move toward integrated ORs — i.e., ORs equipped with unified video/data routing, device connectivity, advanced displays, documentation systems and controlled environments — the capital outlay and ongoing costs (maintenance, upgrades, staff training) rise significantly.

When upgrading to an integrated OR, hospitals often face costs beyond the integration system itself: room renovation, new wiring/data network, ceiling booms, imaging integration, HVAC/air handling, structural modifications, etc.

A bottom-up cost analysis of conventional vs hybrid ORs in five Dutch hospitals found that cost per minute of use for a hybrid OR was €19.88 (US$ 23.13) versus €9.45 (US$ 10.99) for a conventional OR. The difference reflects greater inventory (devices), construction and facility costs for hybrid/advanced ORs. Another article quotes that building a modern surgical suite (hybrid OR) can cost upward of US $5 million. The construction of the room itself runs about US $2 million. One hospital study found that 70% of OR costs were contributed by capital expenditure, followed by consumables (15%) and medical staff salary (8%).

Opportunities

The push toward digital transformation and remote collaboration in surgery

Hospitals and surgical centers today face increasing pressure to deliver safer, more efficient, more connected care. At the same time, the surgical suite is transforming; advances in imaging, robotics, connectivity, workflows, data capture and collaboration mean that the operating theatre is no longer a standalone room—it becomes a node in a broader digital care network. This shift — often described as digital transformation — encompasses the integration of real-time data, video and imaging, surgical planning, intraoperative analytics, remote consultation and post-operative review.

Within this trend, remote collaboration (for example peer-consultation, telesurgery support, remote mentoring, multi-site video streaming) is gaining traction, especially post-COVID-19 when physical restrictions accelerated virtual clinical workflows. These twin forces (digital transformation + remote collaboration) open a strong opportunity for OR integration systems, because the infrastructure required for seamless connectivity, high-fidelity imaging and video, device/IT integration and remote workflows is precisely what OR integration systems supply.

Proximie, a rapidly expanding MedTech scale-up, is redefining surgical collaboration both within and beyond the operating room. Its cloud-based digital platform integrates machine learning, artificial intelligence, and augmented reality to allow surgeons to collaborate virtually and share expertise in real time from any location. With operational hubs in London, Boston, San Francisco, and Beirut, Proximie is building a globally connected surgical ecosystem.

The platform is now deployed in over 500 hospitals across more than 50 countries, having facilitated over 18,000 surgical procedures across multiple disciplines. By enabling clinicians to share skills, train, and exchange best practices, Proximie is advancing patient safety and equitable access to high-quality surgical care worldwide.

Impact of Macroeconomic / Geopolitical Factors

Global inflationary pressure raises input costs for hardware-intensive OR-integration solutions (e.g., high-definition displays, integration hubs, specialised software licences). Such cost increases can restrain hospital capital budgets and slow the pace of adoption, particularly in regions with constrained healthcare funding.

Trade policies and tariffs are increasingly relevant for OR-integration suppliers because many of the key components (e.g., display systems, fibre-optic links, sensors, control hardware) are globally sourced. In July 2025, New Delhi raised concerns over the US President’s 25% trade tariff and additional penalties, which Indian medical device manufacturers called troubling. India relies on imports for 80-85% of its medical devices. In FY 2023-24, India exported $714.38 million worth of devices to the US, while importing over double that amount at $1,519 million. The new tariff threatens the cost competitiveness of Indian MedTech exports, especially low-cost, high-volume consumables.

Health systems are major constituents of public procurement. In OECD countries, the health-sector supply chain and procurement of medical goods are central to government spending. For example, the health sector in OECD nations accounted for 73% public funding in 2021, and medical goods form a significant share of supply-chain emissions and purchasing volumes. Thus, procurement policies and budget priorities influence adoption of integrated OR solutions.

Latest Trends

IP-based video and data networking

In traditional OR integration, video routing, device-monitoring, device connectivity and image capture often relied on dedicated hardware (matrix switchers, SDI/HDMI cabling, proprietary connections) and isolated networks. In the IP-based networking model, the video, imaging and data flows instead move across standard Ethernet/network-IP infrastructure (LAN or hospital network), enabling routing, switching, recording, remote access, collaboration and centralization over a shared network.

The transition of video outputs from endoscopes, cameras, imaging platforms, and navigation systems toward IP-based transmission has been described as a shift away from traditional dedicated cabling. It has been noted that high-definition formats, including HD, 4K, and even 8K, can be encoded and carried across standard hospital networks using Internet Protocol. An example cited in this context is the HexaVue IP Integration System offered by STERIS, which has been characterized as employing IP technologies—such as IP conferencing and IP-based video routing—to support the smooth transfer of clinical data throughout the facility’s network infrastructure.

Data from devices (imaging, navigation, monitors) to be integrated via network links into hospital IT systems (PACS, HIS, EMR), and video or image feeds to be streamed or recorded for remote review or teaching. For example, Olympus’s Systems Integration solution says that it connects images and information with the HIS, PACS and VNA systems for collaboration with colleagues inside the room and out. IP-networked systems enable multiple destinations, remote conferencing, sharing of live video/imagery from the OR, and remote monitoring or consultation. According to Barco’s article, IP-based video integration offers a standard architecture that simplifies installation and set-up times in the OR.

Regional Analysis

North America is leading the Operating Room Integration Systems Market

North America held the largest regional share of 37.5% in 2024 due to several factors. These include high healthcare infrastructure spending, early adoption of advanced surgical and information systems, regulatory and reimbursement incentives that encourage digitalization, and mature hospital networks undertaking modernization of ORs. The burden of chronic diseases (e.g., cardiovascular conditions, cancers, musculoskeletal disorders) and the ageing population in the US and Canada drive higher volumes of surgical procedures and demand for more efficient, high-throughput OR environments.

Efficiency in the OR directly affects throughput, cost per case and operating margin for hospitals. For example, studies of OR efficiency in US hospitals show strong attention on scheduling optimization and workflow improvements. As reported by the American College of Rheumatology, approximately 790,000 total knee replacements and 544,000 hip replacements are performed annually in the United States, a figure that continues to rise alongside the nation’s aging population.

The US states are allocating large funds for hospital modernization:

- For example, the University of California, San Francisco’s Children’s Hospital Oakland has secured final approval for a $1.5 billion plan to build a cutting-edge hospital complex. The project aims to replace outdated structures that no longer comply with seismic standards, while expanding capacity and incorporating advanced amenities. The new facility will double the size of the emergency department, triple the number of single-patient rooms, and include a neonatal intensive care unit, seven surgical suites, and a 20-bed inpatient behavioral health unit. This development forms part of a larger $1.62 billion modernization initiative to enhance healthcare infrastructure.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific region is experiencing substantial growth in healthcare infrastructure, hospital modernization, digital health and surgical-suite upgrade activity. A report notes that the APAC healthcare market is projected to hit large scale and that the region will account for a major share of global healthcare spending by 2030.

HKS Singapore, supported by a multidisciplinary team of architects, interior designers, and researchers, has successfully planned and executed over $10 billion worth of healthcare infrastructure projects across China, Hong Kong, Macau, Singapore, India, Pakistan, Australia, and several nations in the Middle East.

Globally, more than 90% of the population lacks timely access to surgical care, with the figure exceeding 95% in South Asia. In North-East India, the estimated surgical need stands at approximately 2.4 million procedures annually, or 5,500 per 100,000 population, of which nearly 300,000 procedures (around one-eighth) are suitable for laparoscopic surgery.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive environment in the OR integration systems space is characterized by a mix of medical-device firms, AV/integration specialists, and surgical-IT players. Key players often highlight theses differentiators: ability to integrate multiple devices and video sources, vendor-neutral architecture, software for workflow/documentation/analytics, retrofit-friendly modules, and full-service offerings (planning, installation, and training).

Prometeks Medikal has entered into a new strategic collaboration within the healthcare sector, bringing together its trusted reputation in Turkey with the world-class quality and expertise of ALVO Medical. Through this partnership, ALVO Medical’s advanced solutions—including operating room tables, hybrid operating rooms, intensive care units, and innovative neonatal ICU technologies—are set to mark a significant milestone in Turkey’s healthcare landscape. By combining Prometeks Medikal’s robust distribution network and specialized team with ALVO’s cutting-edge medical innovations, the collaboration aims to further enhance hospital capabilities and better serve the evolving needs of healthcare institutions across the country.

Top Key Players in the Operating Room Integration Systems Market

- Canon Medical Systems Corporation

- Stryker Corporation

- FUJIFILM Holdings Corporation

- Olympus Corporation

- STERIS Corporation

- Karl Storz SE & Co. KG

- Getinge AB

- Brainlab AG

- Skytron LLC

- Caresyntax Corporation

- Barco

- Drägerwerk AG & Co. KGaA

- Arthrex, Inc.

- ALVO Medical

- Merivaara Corp.

- Richard Wolf GmbH

- Hill-Rom Holdings, Inc.

- OPExPARK

Recent Developments

- In April 2025: It was announced that Dräger introduced the Atlan® A100 anesthesia workstation in India. This next-generation system is designed to enhance patient care and optimize workflows in the operating room. The Atlan® A100 comes equipped with advanced features, including lung-protective ventilation, low-flow anesthesia delivery, and integrated infection prevention measures. These capabilities provide clinicians with the necessary tools to improve perioperative efficiency and achieve the best possible patient outcomes.

- In March 2025: KARL STORZ expanded Mexico’s private healthcare infrastructure through its partnership with Star Médica, installing advanced OR1™ integrated operating rooms and SCENARA® solutions across multiple hospitals. Over 20 ORs are already operational, with more planned. The collaboration includes comprehensive training and technical support to enhance surgical efficiency and patient care standards.

- In February 2025: Getinge and Philips have collaborated to create an integrated anesthesia workstation that combines Getinge’s Flow Family anesthesia machines with Philips IntelliVue patient monitoring. The solution enhances OR efficiency through real-time data exchange, unified interfaces, improved teamwork, and a single service contact, helping clinicians deliver safer, more streamlined patient care.

- In October 2024: Olympus has partnered with Proximie to offer a cloud-based telecollaboration platform for digitizing operating rooms. The solution enables real-time sharing of surgical video and audio to support training, collaboration, and improved clinical practices. The partnership expands Olympus’ digital healthcare capabilities, enhancing global knowledge sharing and supporting better patient outcomes.

Report Scope

Report Features Description Market Value (2024) US$ 1.84 billion Forecast Revenue (2034) US$ 5.97 billion CAGR (2025-2034) 12.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Hardware, Services), By OR Type (Hybrid ORs, Integrated Digital ORs), By Surgery Type (General Surgery, Orthopedic Surgery, Cardiovascular Surgery, Neurosurgery, Urology, Gynecology, Others), By End-User (Hospitals, Ambulatory Surgical Centers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Canon Medical Systems Corporation, Stryker Corporation, FUJIFILM Holdings Corporation, Olympus Corporation, STERIS Corporation, Karl Storz SE & Co. KG, Getinge AB, Brainlab AG, Skytron LLC, Caresyntax Corporation, Barco, Drägerwerk AG & Co. KGaA, Arthrex, Inc., ALVO Medical, Merivaara Corp., Richard Wolf GmbH, Hill-Rom Holdings, Inc., OPExPARK Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Operating Room Integration Systems MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Operating Room Integration Systems MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Canon Medical Systems Corporation

- Stryker Corporation

- FUJIFILM Holdings Corporation

- Olympus Corporation

- STERIS Corporation

- Karl Storz SE & Co. KG

- Getinge AB

- Brainlab AG

- Skytron LLC

- Caresyntax Corporation

- Barco

- Drägerwerk AG & Co. KGaA

- Arthrex, Inc.

- ALVO Medical

- Merivaara Corp.

- Richard Wolf GmbH

- Hill-Rom Holdings, Inc.

- OPExPARK