Global Open RAN Market Size, Share, Industry Analysis Report By Component (Hardware, Software, Services), By Network Type(2G/3G Networks, 4G Networks, 5G Networks), By Unit(Radio Unit, Centralized Unit, Distributed Unit), By Frequency(Sub-6 GHz, Millimeter Wave (mmWave)), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 129048

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- Component Analysis

- Network Type Analysis

- Unit Analysis

- Frequency Analysis

- Benefits of Open RAN

- Considerations for Open RAN Implementation

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Players Analysis

- Future of Open RAN

- Recent Developments

- Report Scope

Report Overview

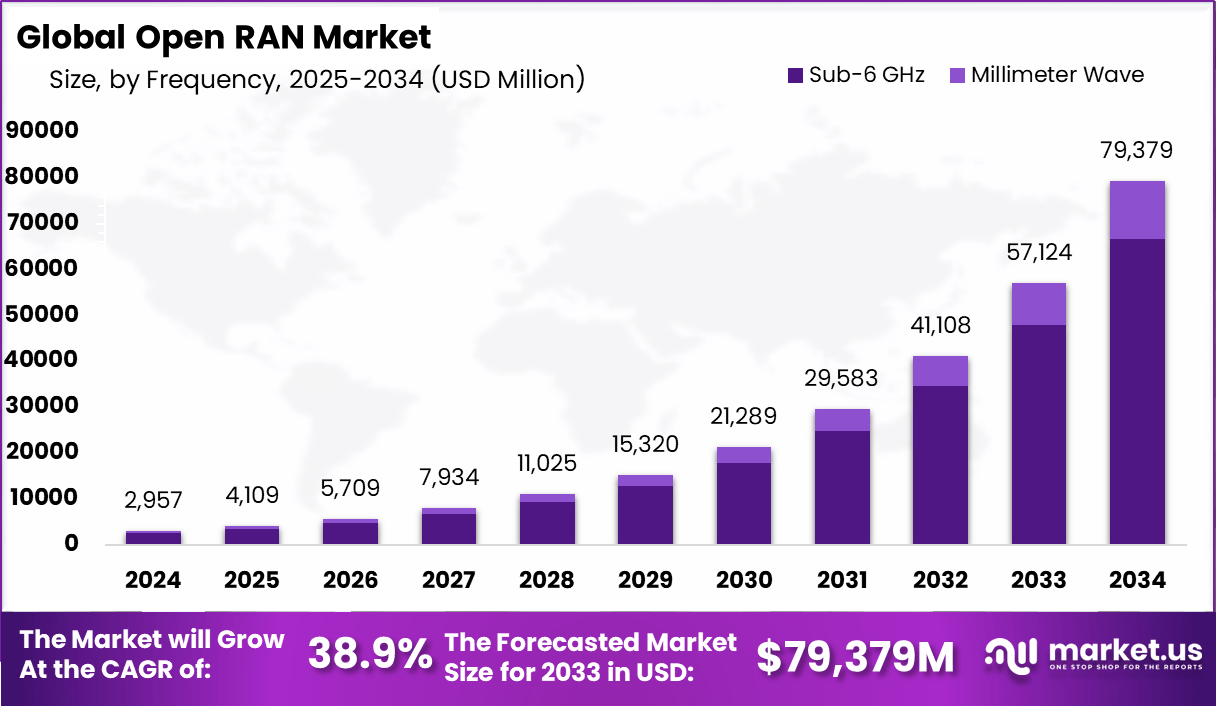

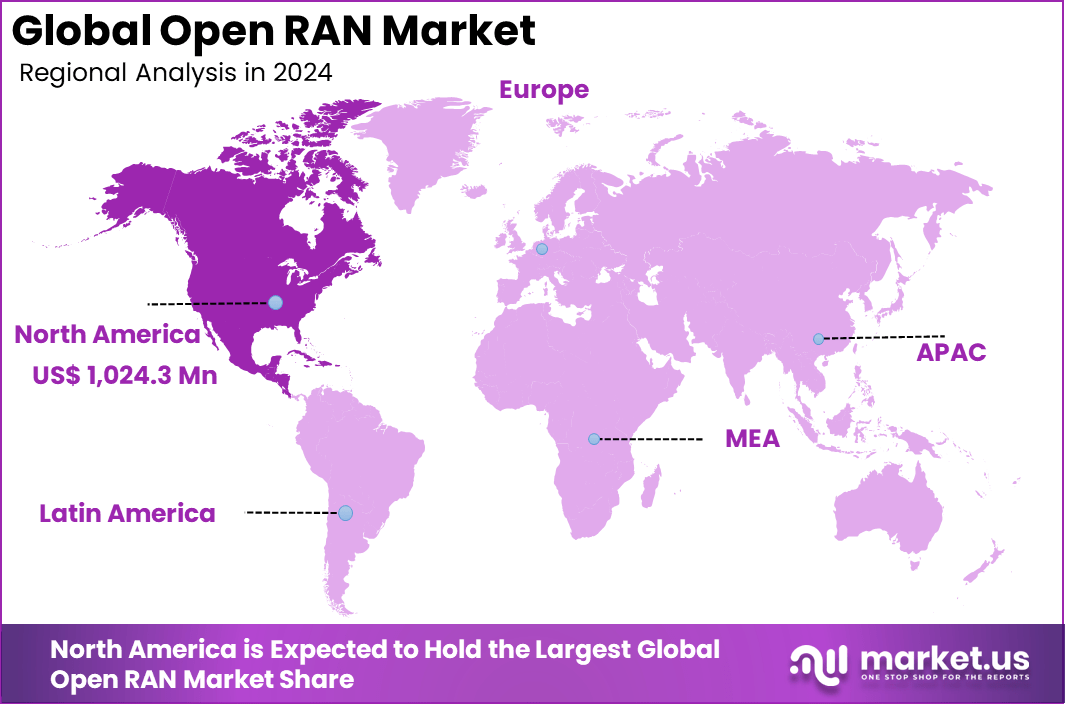

The Global Open RAN Market size is expected to be worth around USD 79,379 Million By 2034, from USD 2,957 Million in 2024, growing at a CAGR of 38.9% during the forecast period from 2025 to 2034. North America dominated a 34.6% market share in 2024 and held USD 1,024.3 Million in revenue from the Open Ran Market.

The market for Open RAN is experiencing significant growth, propelled by its promise to reduce costs and increase system flexibility. With the backing of major telecom operators and the active involvement of a broad array of equipment vendors, the Open RAN ecosystem is rapidly expanding. This market evolution is driven by both technological advancements and strategic partnerships among key industry players, making Open RAN a viable alternative to traditional RAN solutions.

The main drivers of Open RAN adoption include the need for greater network flexibility, reduced vendor lock-in, and lower capital and operational expenditures. These factors are crucial as operators seek more customizable and cost-effective solutions in the face of evolving consumer demands and the ongoing rollout of 5G networks.

Technological advancements such as virtualization, standardized interfaces, and intelligent network management tools are central to the increasing adoption of Open RAN. These technologies enable easier integration of components from multiple vendors, creating a more competitive and innovative market landscape.

Operators are turning to Open RAN primarily to escape the constraints of single-vendor ecosystems, which can stifle innovation and drive up costs. By adopting Open RAN, operators can leverage the best technologies available from a broader supplier base, leading to improved network performance and cost efficiency.

The demand for Open RAN is expected to surge as operators seek to expand 5G networks across varied geographical and market segments. The ability of Open RAN to support diverse network demands and configurations, from dense urban areas to remote locations, is a significant factor driving its adoption.

The UK government’s allocation of £88 million ($109 million) to 19 projects underscores a robust commitment to demonstrating Open RAN’s capabilities in enhancing mobile services nationwide. This initiative is part of a broader strategy to encourage innovation and interoperability within the telecom sector.

Simultaneously, the US has also shown a strong commitment through the National Telecommunications and Information Administration (NTIA), which has earmarked up to $420 million for the development of Open RAN networks. This substantial investment is indicative of a strategic shift towards more open, secure, and competitive wireless network infrastructures.

Additionally, a previous grant of $42 million to a consortium led by telecom giants AT&T and Verizon focuses on enhancing Open RAN interoperability, network performance, and security, further validating the critical role of Open RAN in the future of telecommunications.

Adopting Open RAN can lead to significant business benefits, including lower costs, enhanced service capabilities, and greater operational flexibility. These advantages help telecom operators better respond to market changes and consumer needs.

Key Takeaways

- The Global Open RAN Market is poised for significant growth, projected to reach a value of USD 79,379 Million by 2034, up from USD 2,957 Million in 2024. This surge represents a robust compound annual growth rate (CAGR) of 38.9% over the ten-year forecast period from 2024 to 2033.

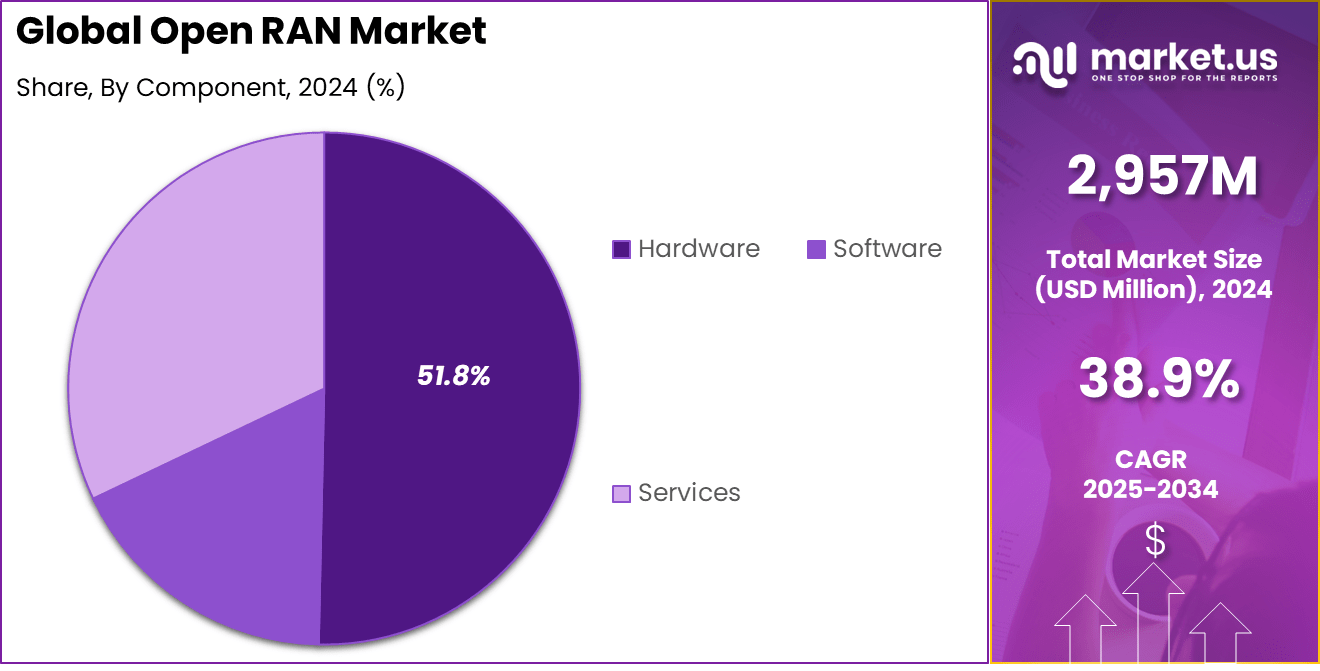

- In the components category, Hardware was the standout in 2023, securing a majority with 51.8% of the market share. This indicates strong demand and deployment of physical infrastructure essential for Open RAN systems.

- Focusing on network types, 4G Networks were predominant in 2023, holding 59.25% of the market. Despite the growing push towards 5G, 4G remains crucial, serving as the backbone for many existing Open RAN deployments.

- When we look at the Open RAN units, the Radio Unit took the lead, capturing over 42.35% of the market in 2023. Radio units are critical as they handle radio frequency signals and are key to the functionality of Open RAN architectures.

- In terms of frequency bands, Sub-6 GHz dominated the scene with a commanding 84.2% market share in 2023. This frequency band is widely used due to its balance between coverage and speed, making it highly favorable for Open RAN setups.

- Geographically, North America led the global market with a significant 34.64% share, translating to revenues of USD 1,024.3 Million in 2024. This region’s leadership underscores its advanced technological infrastructure and early adoption of Open RAN systems.

Analysts’ Viewpoint

The shift towards Open RAN is opening substantial investment opportunities in areas such as RAN component manufacturing, network integration services, and software development for network management and automation solutions. Investors are particularly interested in startups and technology firms that are at the forefront of Open RAN technology and innovation.

Regulatory changes, technological advancements, and shifting market demands are the top impacting factors for the Open RAN market. Regulatory support for open networking standards can accelerate adoption, while continuous technological evolution is necessary to address the growing complexity of network management and security challenges.

The regulatory environment for Open RAN is evolving, with an increasing number of global telecommunications standards organizations and government bodies endorsing open networking principles. This regulatory shift is aimed at fostering innovation and competition in the telecommunications equipment market, which supports the broader deployment and acceptance of Open RAN solutions.

Component Analysis

In 2024, Hardware held a dominant market position in the By Component segment of the Open RAN Market, capturing more than a 51.80% share. The hardware segment’s prominence is primarily driven by the escalating demand for advanced network infrastructure, which enables improved connectivity and faster data transfer rates.

This surge is particularly fueled by the global push towards 5G deployment, where Open RAN hardware plays a crucial role in facilitating flexible and scalable network solutions. Following Hardware, the Software segment accounted for a significant portion of the market. This segment is gaining traction due to the increasing need for software-based network solutions that offer enhanced network management and efficient resource utilization.

Software solutions in the Open RAN market allow for more agile and cost-effective network operations, appealing to service providers aiming to optimize their networks for better performance and reduced operational costs.

Open RAN Market Share, By Component Analysis, 2019-2024 (%)

Component 2019 2020 2021 2022 2023 2024 Hardware 52.67% 52.50% 52.32% 52.14% 51.94% 51.80% Software 32.97% 33.00% 33.04% 33.07% 33.07% 33.16% Services 14.36% 14.50% 14.64% 14.78% 14.99% 15.03% Lastly, the Services segment also plays a vital role in the Open RAN market. It supports the deployment and maintenance of Open RAN systems. As networks become more complex and the adoption of Open RAN technologies grows, the demand for professional services, including consulting, implementation, and ongoing support, continues to rise, ensuring the seamless integration of Open RAN solutions into existing telecommunications infrastructure.

Network Type Analysis

In 2024, 4G Networks held a dominant market position in the By Network Type segment of the Open RAN Market, capturing more than a 59.25% share. This dominance is largely due to the extensive existing infrastructure for 4G, which continues to be the backbone for mobile connectivity in numerous regions.

The maturity of 4G technology allows for robust Open RAN implementations, which are pivotal in driving innovations such as network slicing and cloud RAN, enabling more efficient network operations and lower capital expenditures.

Following 4G, 5G Networks are rapidly gaining market share, driven by the ongoing global rollout of 5G networks and the technology’s potential to transform various industries through unprecedented connectivity speeds and lower latency.

Open RAN’s flexibility and scalability are particularly advantageous in 5G deployments, facilitating quicker and more cost-effective network upgrades and expansions as operators look to capitalize on new business opportunities provided by 5G technologies.

Open RAN Market Share, By Network Type Analysis, 2019-2024 (%)

Network Type 2019 2020 2021 2022 2023 2024 2G/3G Networks 14.41% 14.23% 14.04% 13.85% 13.66% 13.45% 4G Networks 58.57% 58.78% 58.72% 58.90% 59.11% 59.25% 5G Networks 27.01% 26.98% 27.24% 27.26% 27.23% 27.31% Lastly, 2G/3G Networks, while gradually phasing out, still account for a notable segment in the Open RAN market, especially in emerging markets where these networks remain prevalent. In these regions, Open RAN can offer a cost-effective solution for operators to maintain and slowly transition their existing network infrastructures towards more advanced technologies.

Unit Analysis

In 2024, the Radio Unit held a dominant market position in the By Unit segment of the Open RAN Market, capturing more than a 42.35% share. This significant market share is attributed to the critical role that Radio Units play in Open RAN architecture, where they are essential for managing radio frequency signals and ensuring reliable communication over mobile networks.

The scalability and flexibility offered by Open RAN Radio Units enable telecom operators to efficiently upgrade and expand their network capabilities, particularly important in regions undergoing rapid mobile connectivity growth.

Following the Radio Unit, the Centralized Unit represents another key component within the Open RAN ecosystem. Centralized Units are integral for processing data and controlling the baseband functions in a centralized manner, which simplifies network management and enhances operational efficiencies. Their deployment is crucial for supporting advanced network functionalities, including real-time analytics and network slicing, which are vital for 5G operations.

Open RAN Market Share, By Unit Analysis, 2019-2024 (%)

Unit 2019 2020 2021 2022 2023 2024 Radio Unit 43.46% 43.24% 43.01% 42.78% 42.48% 42.35% Centralized Unit 34.45% 34.47% 34.49% 34.52% 34.51% 34.59% Distributed Unit 22.09% 22.29% 22.50% 22.70% 23.01% 23.06% Lastly, the Distributed Unit completes the Open RAN setup by facilitating the distribution of network functions closer to the edge of the network. This proximity enhances network performance by reducing latency and increasing the speed of data processing, making it especially beneficial for applications requiring immediate data analysis and response, such as autonomous vehicles and IoT solutions.

Frequency Analysis

In 2023, Sub-6 GHz held a dominant market position in the By Frequency segment of the Open RAN Market, capturing more than a 84.12% share. This predominant share stems from the Sub-6 GHz band’s ability to offer a balanced mix of coverage and capacity, making it ideal for a wide range of mobile communication applications from urban to rural settings.

The frequency’s extensive use in existing telecommunications infrastructure also facilitates easier integration and deployment of Open RAN solutions, ensuring compatibility and cost-effectiveness for network operators seeking to enhance their network flexibility and efficiency.

Open RAN Market Share, By Frequency Analysis, 2019-2024 (%)

Frequency 2019 2020 2021 2022 2023 2024 Sub-6 GHz 84.81% 84.68% 84.54% 84.40% 84.29% 84.12% Millimeter Wave 15.19% 15.32% 15.46% 15.60% 15.71% 15.88% On the other hand, the Millimeter Wave (mmWave) segment, while smaller in current market share, is rapidly gaining attention due to its potential to provide extremely high data speeds and capacity over short distances. It is particularly poised for growth in densely populated urban areas and in applications requiring high data throughput, such as in high-definition video streaming and augmented reality.

Benefits of Open RAN

- Vendor Neutrality and Interoperability: Open RAN supports the use of standardized interfaces between network components, enabling telecom operators to mix and match hardware and software from various vendors. This increases competition and drives innovation by allowing operators to select the best options for their needs.

- Enhanced Security: By adopting technologies used in other industries and promoting an open and interoperable framework, Open RAN improves security. This is achieved by allowing better visibility and control over the network, which helps in identifying and mitigating potential vulnerabilities more efficiently.

- Cost Reduction: Open RAN can lower total cost of ownership by utilizing more standardized and less expensive hardware and reducing reliance on specific vendors. This leads to competitive pricing and lowers the cost of network deployment and maintenance.

- Increased Innovation: The open ecosystem of Open RAN fosters a competitive environment that encourages rapid development of new technologies and services. This not only improves the network’s capabilities but also enhances the overall user experience.

- Future-Proof Networks: Open RAN’s flexible and modular architecture supports easy scaling and upgrading of network components, which helps operators stay abreast with evolving technologies without extensive overhauls.

Considerations for Open RAN Implementation

- Complexity in Integration: Transitioning to an Open RAN architecture involves integrating diverse components from multiple vendors, which can complicate network management and operations. Ensuring compatibility and performance across these varied elements requires careful coordination.

- Need for Skilled Resources: Implementing and managing an Open RAN network demands a higher level of expertise and more specialized knowledge in areas such as software-defined networking and virtualization technologies.

- Security Concerns: While Open RAN improves security through openness and interoperability, it also increases the threat surface by involving multiple vendors. This necessitates stringent security measures and continuous monitoring to protect against vulnerabilities.

- Economic and Scale Considerations: Although Open RAN reduces costs in many areas, the initial setup and transition can be costly and complex, particularly for large-scale deployments. This might require significant upfront investment.

- Regulatory and Standard Compliance: Navigating the regulatory landscape and ensuring compliance with emerging standards is crucial for Open RAN deployment. Operators must stay updated with policy developments and actively engage in standardization processes.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Network Type

- 2G/3G Networks

- 4G Networks

- 5G Networks

By Unit

- Radio Unit

- Centralized Unit

- Distributed Unit

By Frequency

- Sub-6 GHz

- Millimeter Wave (mmWave)

Drivers

Key Drivers Boosting Open RAN Market

In the telecommunications landscape, it’s clear that the Open Radio Access Network (Open RAN) market is gaining significant momentum, driven primarily by the increasing demand for more flexible and cost-effective network solutions.

Telecommunications companies are rapidly adopting Open RAN to reduce reliance on single vendors, which lowers costs and boosts innovation. Furthermore, the surge in mobile data traffic requires scalable network solutions that Open RAN provides by enabling more straightforward integration of multi-vendor hardware and software.

Governments and regulatory bodies worldwide are also endorsing Open RAN for its potential to enhance network security and resilience, encouraging further investments and deployments across the sector. This industry-wide shift towards more open, interoperable architectures is paving the way for a new era of mobile network technology.

Restraint

Challenges Facing Open RAN Adoption

One significant restraint in the Open RAN market is the technical complexity and interoperability issues associated with integrating diverse components from multiple vendors. Traditional RAN systems, designed and maintained by single vendors, offer seamless integration and reliability that Open RAN systems struggle to match initially.

This integration challenge can lead to potential delays and increased costs during deployment, making some telecom operators hesitant. Additionally, the current lack of mature standards and the need for significant investments in training and development pose further barriers.

These factors slow down the widespread adoption of Open RAN technology, as operators weigh the benefits against the risks and complexities of transitioning to a more open and modular infrastructure.

Opportunities

Expanding Opportunities in Open RAN

Significant opportunities in the Open RAN market, particularly as this technology enables more innovative and adaptable network infrastructures. The push towards 5G and beyond creates a vast landscape for Open RAN to thrive by facilitating faster and more cost-effective network deployments compared to traditional RAN systems.

This adaptability attracts not only established telecom operators but also new entrants who see a chance to disrupt the market with flexible and scalable solutions. Additionally, the increasing support from governments worldwide for open network architectures promises enhanced funding and regulatory backing, which could accelerate adoption.

Open RAN’s potential to integrate seamlessly with emerging technologies like artificial intelligence and machine learning for network optimization and maintenance further enhances its appeal, positioning it as a cornerstone for future mobile network developments.

Challenges

Navigating Open RAN Complexities

Analyzing the Open RAN market, it’s evident that while there are many advantages, several challenges could hinder its widespread adoption. A primary concern is the security risks associated with open interfaces and the multi-vendor environment, which could increase vulnerability to cyber attacks. Operators must invest significantly in securing these new networks, adding layers of complexity and cost.

Another challenge is the existing infrastructure investments by telecom operators; transitioning to Open RAN requires not just new hardware but also significant changes to network management practices. The skill gap presents another hurdle, as the current workforce may not have the expertise required to implement and maintain these advanced network systems effectively.

These challenges underscore the need for careful planning and robust security measures as the telecommunications industry moves towards more open and flexible network solutions.

Growth Factors

Driving Growth in Open RAN

The growth factors for the Open RAN market are closely tied to its potential to revolutionize telecommunications. The driving force behind this growth is the ongoing global rollout of 5G networks, which necessitates advanced, scalable, and cost-effective network solutions that Open RAN provides.

This technology allows operators to break free from the limitations of single-vendor systems, fostering competition, lowering costs, and promoting innovation. Moreover, the flexibility and scalability of Open RAN enable telecom companies to rapidly deploy and upgrade their networks to meet increasing data demands.

Another significant growth driver is the support from various governments and alliances promoting the adoption of open network architectures, which further validates the market’s potential and encourages investment. Together, these factors are propelling the Open RAN market towards a future of more open and efficient network infrastructures.

Emerging Trends

Emerging Trends in Open RAN

The Open RAN market is marked by several emerging trends that signify its transformative impact on telecommunications. One of the most prominent trends is the increasing collaboration between telecom operators and technology providers to develop and standardize Open RAN solutions, ensuring more robust and interoperable network architectures.

Additionally, there’s a growing shift towards virtualization and cloud-native technologies, which integrate seamlessly with Open RAN, offering enhanced flexibility and scalability for network management and deployment. The trend toward artificial intelligence and machine learning in optimizing network operations and maintenance within Open RAN ecosystems is also gaining momentum.

These technologies are being leveraged to automate processes, enhance performance, and reduce operational costs, which are crucial for the long-term sustainability and efficiency of telecom networks. These trends collectively represent a significant shift towards more open, adaptable, and future-ready telecommunication infrastructures.

Regional Analysis

The Open RAN market is experiencing varied levels of adoption and growth across different regions, reflecting distinct technological, economic, and regulatory landscapes. North America is currently the dominating region, holding a substantial 34.64% market share, valued at USD 1,024.3 Million. This leadership is driven by aggressive policy frameworks supporting 5G infrastructure and the presence of major telecom and technology players pushing for advanced network solutions.

In Europe, the market is steadily growing, fueled by the European Union’s strategic initiatives to enhance mobile network capabilities and security, encouraging the adoption of Open RAN technologies. Meanwhile, the Asia Pacific region is witnessing rapid growth due to significant investments in virtual mobile infrastructure and a high rate of digital transformation, particularly in countries like Japan, South Korea, and China.

The Middle East & Africa, although smaller in scale compared to other regions, are seeing increased interest due to the rising demand for mobile data services and government-backed digitalization efforts.

Latin America, on the other hand, is gradually adopting Open RAN, propelled by the need to modernize aging network infrastructures and enhance connectivity in rural and underserved areas. Each region’s growth is supported by a mix of government incentives, technological readiness, and strategic investments by key market players.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the global Open RAN market in 2023, key players like Rakuten Group, Inc., Nokia Corporation, and Telefonaktiebolaget LM Ericsson are strategically positioned to drive significant advancements and adoption of Open RAN technologies.

Rakuten Group, Inc. stands out as a pioneer, having successfully deployed one of the world’s first fully virtualized cloud-native mobile networks. Rakuten’s approach not only demonstrates the feasibility and benefits of Open RAN architectures but also sets a benchmark for innovation in cost reduction and operational efficiency. Their aggressive expansion and partnerships are pivotal in proving the commercial viability of Open RAN solutions on a global scale.

Nokia Corporation has embraced Open RAN as a core component of its strategic focus, aiming to provide flexible and scalable network solutions that are interoperable with other vendors’ equipment. Nokia’s comprehensive portfolio, which supports Open RAN across various deployment scenarios from rural to urban, showcases its commitment to facilitating a more diverse and competitive supply chain in the telecom sector.

Telefonaktiebolaget LM Ericsson has been instrumental in driving forward the Open RAN initiative by participating in various consortiums and trials that enhance the ecosystem’s maturity. Ericsson’s investments in research and development aim to solve the integration challenges associated with Open RAN, thereby promoting its adoption among operators who seek to benefit from reduced vendor lock-in and enhanced network capabilities.

Overall, these companies are not just participants but essential drivers of the Open RAN movement, each contributing unique insights and technologies that support the broader shift towards more open, flexible, and efficient telecommunications networks. Their efforts in 2023 are crucial in setting the stage for future innovations and deployments in the telecom industry.

Top Key Players in the Market

- Rakuten Group, Inc.

- Samsung Electronics Co., Ltd.

- Nokia Corporation Finland

- Telefonaktiebolaget LM Ericsson

- Fujitsu Limited Japan

- Mavenir

- Parallel Wireless

- Radisys

- NEC Corporation

- 1VIAVI Solutions Inc.

Future of Open RAN

Looking ahead, the future of Open RAN appears promising with expected increases in adoption and technological maturity. As more communication service providers (CSPs) adopt this technology, it is likely to become more robust and widely implemented.

The industry’s shift towards more open, flexible, and cost-effective network solutions predicts a strong trajectory for Open RAN’s growth. This evolution will likely lead to more innovative services and a competitive telecom market, benefiting both providers and consumers.

Recent Developments

- In May 2024, Mavenir secured additional funding of $95 million in May 2024 to expand its Open RAN solutions. This funding will boost Mavenir’s capacity to develop and deploy innovative products, further solidifying its position as a key player in the Open RAN ecosystem.

- In April 2024, Samsung Electronics announced in April 2024 a significant partnership with a European telecom operator to deploy Open RAN solutions across their network. This collaboration highlights Samsung’s role in expanding Open RAN technology globally and their ongoing efforts to transform mobile network infrastructures.

- In February 2024, Fujitsu Limited launched a new Open RAN software product, aiming to enhance network flexibility and reduce operational costs. This launch demonstrates Fujitsu’s commitment to innovating within the telecom sector and promoting more adaptable network solutions.

Report Scope

Report Features Description Market Value (2024) USD 2,957 Million Forecast Revenue (2034) USD 79,379 Million CAGR (2025-2034) 38.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component(Hardware, Software, Services), By Network Type(2G/3G Networks, 4G Networks, 5G Networks), By Unit(Radio Unit, Centralized Unit, Distributed Unit), By Frequency(Sub-6 GHz, Millimeter Wave (mmWave)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Rakuten Group, Inc., Nokia Corporation, Telefonaktiebolaget LM Ericsson, Fujitsu Limited, Samsung Electronics Co., Ltd., Mavenir, Parallel Wireless, NEC Corporation, Radisys, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Rakuten Group, Inc.

- Samsung Electronics Co., Ltd.

- Nokia Corporation Finland

- Telefonaktiebolaget LM Ericsson

- Fujitsu Limited Japan

- Mavenir

- Parallel Wireless

- Radisys

- NEC Corporation

- 1VIAVI Solutions Inc.