Global Online Sports Betting Market Size, Share, Growth Analysis By Sports Type (Football, Basketball, Horse Racing, Baseball, Tennis, Others), By End User (Desktop, Mobile), By Betting Type (Pre-Match/Fixed-Odds, Live/In-Play), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171393

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

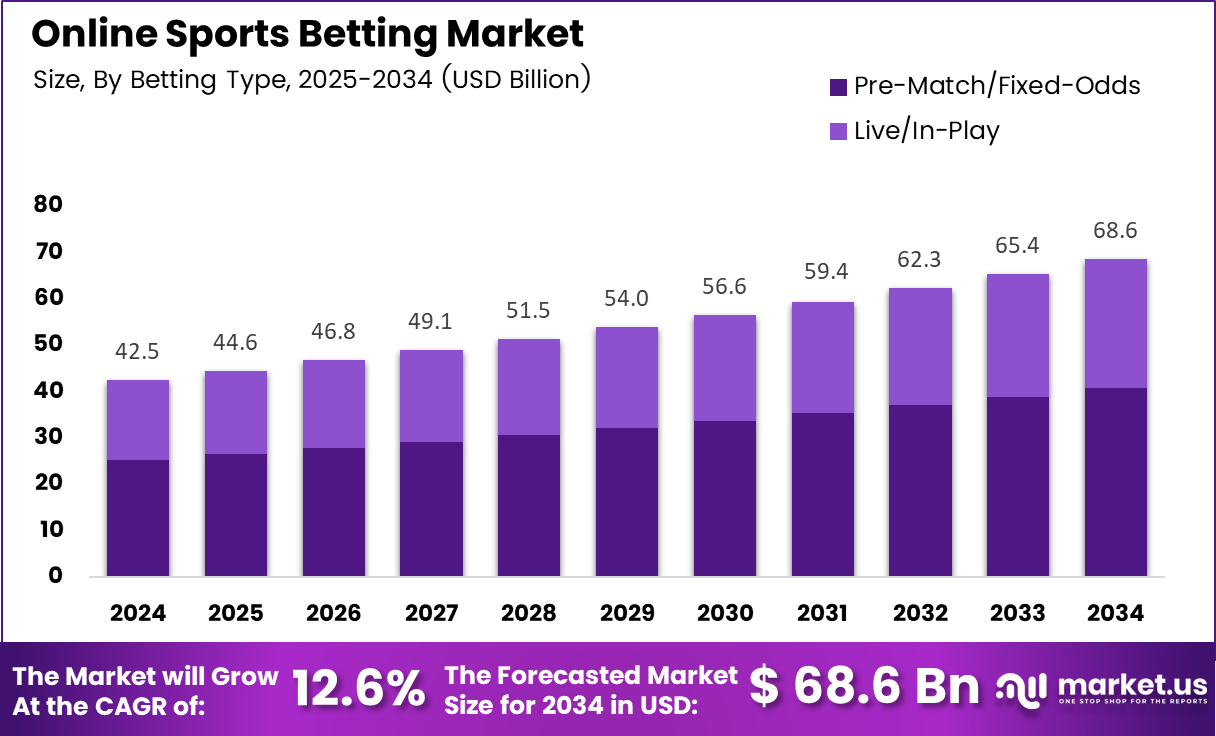

The Global Online Sports Betting Market size is expected to be worth around USD 68.6 billion by 2034, from USD 42.5 billion in 2024, growing at a CAGR of 12.6% during the forecast period from 2025 to 2034.

The online sports betting market refers to digitally enabled platforms that allow users to place wagers on sporting events through mobile applications and web-based interfaces. Broadly, it includes pre-match, live, and in-play betting formats supported by payment gateways, risk management systems, and regulatory oversight. As a result, it represents a convergence of entertainment, technology, and regulated financial activity.

From a market standpoint, growth is driven by changing consumer behavior toward mobile-first entertainment and real-time digital engagement. Moreover, increased access to smartphone, secure online payments, and high-speed connectivity continues to normalize online wagering. Consequently, online sports betting platforms are increasingly positioned as mainstream digital leisure services rather than niche gambling products.

Government policy and regulation play a central role in shaping market development and credibility. Since regulatory reforms began, state governments have focused on licensing frameworks, consumer protection, and tax transparency. In addition, public investment in regulatory infrastructure and compliance monitoring has strengthened trust, encouraged participation, and ensured that betting activity contributes to formal economic channels.

Opportunities within the market are expanding as operators invest in personalization, data-driven odds, and responsible gaming tools. Furthermore, integration with live sports content, analytics dashboards, and localized betting experiences continues to enhance user engagement. As jurisdictions refine legal structures, late-adopting regions represent incremental demand without fundamentally altering market risk profiles.

According to Read Write and state gaming regulator data, the US market illustrates the scale of this expansion through state-level performance. In 2024, New York recorded the highest betting handle at 22,624,505,165, followed by Illinois at 14,016,684,933 and New Jersey at 12,774,039,219, reflecting consistent growth compared with 2022. Virginia and Pennsylvania each exceeded 6,500,000,000, indicating broader geographic adoption.

At a national level, cumulative wagering activity highlights long-term momentum. According to Survey, the total US sports betting handle reached 423,740,350,000 between 2018 and 2024, while total state tax contributions amounted to 6,702,495,897. This demonstrates the market’s fiscal relevance alongside commercial expansion.

From a participation and risk perspective, the market shows both scale and regulatory balance. According to the Survey, the ecosystem supports approximately 58,000,000 active gamblers, while problem gamblers account for only 1% of the population. This balance reinforces the role of regulation in sustaining long-term market viability while supporting responsible growth.

Key Takeaways

- Global Online Sports Betting Market size is projected to reach USD 68.6 billion by 2034, up from USD 42.5 billion in 2024, expanding at a CAGR of 12.6%.

- Football is the leading sports type segment, accounting for a dominant share of 46.8% of total online sports betting activity.

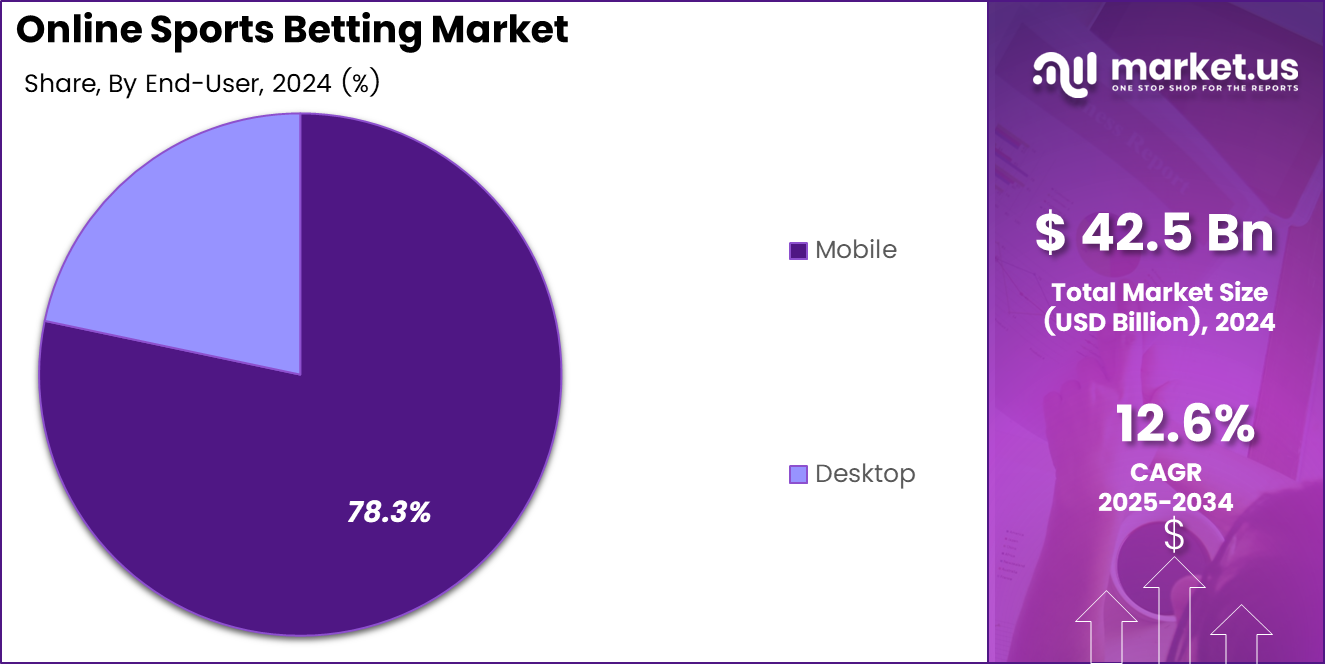

- Mobile platforms represent the largest end user segment with a market share of 78.3%, reflecting strong mobile first betting adoption.

- Live In Play betting is the dominant betting type segment, contributing approximately 59.6% of overall market revenue.

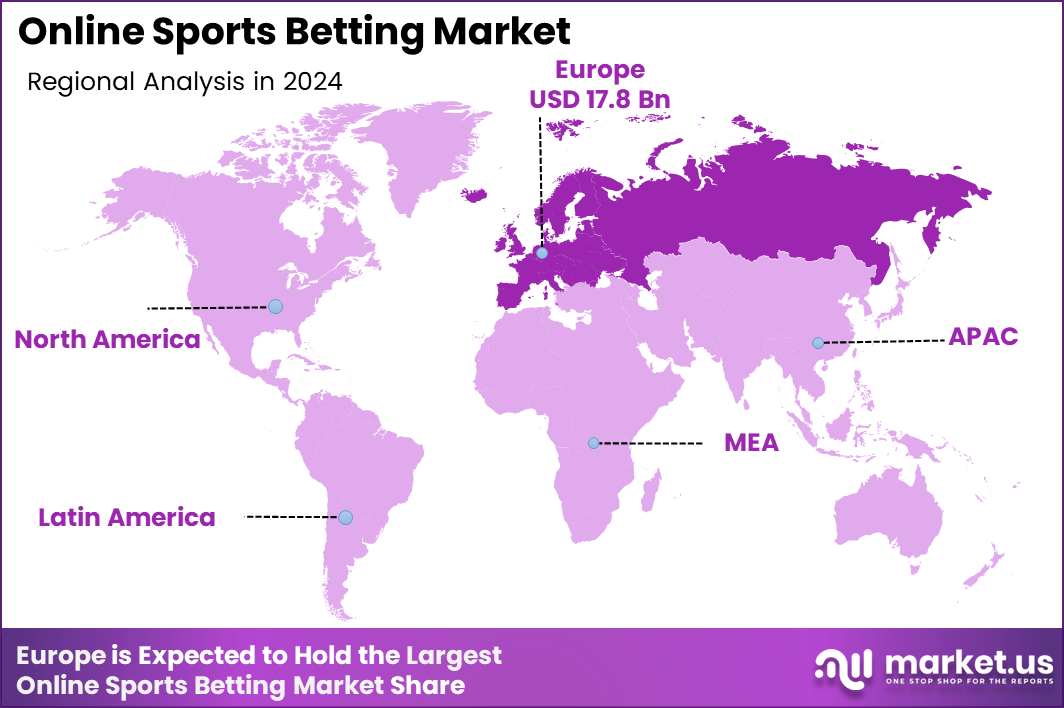

- Europe is the leading regional market, holding a share of 41.9% and valued at around USD 17.8 in 2024.

By Sports Type Analysis

Football dominates with 46.8% due to its massive fan base, frequent fixtures, and high engagement across professional and collegiate leagues.

In 2024, Football held a dominant market position in the By Sports Type Analysis segment of the Online Sports Betting Market, with a 46.8% share. This dominance is supported by year-round tournaments, strong media coverage, and high volumes of live and pre-match wagering activity.

Basketball represents a significant sub-segment, driven by regular seasons, playoffs, and international leagues. Its fast-paced nature supports diverse bet types, including player props and live wagering, which sustain consistent user engagement across digital betting platforms.

Horse Racing continues to maintain a stable presence due to its long-established betting culture and scheduled racing calendars. The segment benefits from traditional bettors transitioning to online platforms for convenience, improved odds visibility, and remote access to race events.

Baseball contributes steadily through seasonal leagues and championship events. Although wagering intensity is lower than football, the high number of games supports repeat betting behavior and sustained handle accumulation throughout the season.

Tennis attracts bettors due to frequent global tournaments and individual match structures. Live betting opportunities during matches enhance engagement, while year-round events help maintain consistent platform activity.

Other sports, including niche and emerging disciplines, collectively support diversification. These options attract casual bettors seeking novelty and contribute incremental volume without challenging dominant sports categories.

By End User Analysis

Mobile dominates with 78.3% due to widespread smartphone usage and preference for on-the-go betting access.

In 2024, Mobile held a dominant market position in the By End User Analysis segment of the Online Sports Betting Market, with a 78.3% share. Growth is driven by app-based interfaces, instant notifications, and seamless payment integration supporting real-time wagering.

Desktop platforms continue to serve a dedicated user base, particularly among bettors preferring detailed analytics, larger displays, and extended betting sessions. Desktop usage remains relevant for account management, research-driven betting, and multi-event wagering strategies.

By Betting Type Analysis

Live/In-Play dominates with 59.6% due to real-time engagement and dynamic odds during ongoing sporting events.

In 2024, Live/In-Play held a dominant market position in the By Betting Type Analysis segment of the Online Sports Betting Market, with a 59.6% share. This growth is supported by real-time data feeds, instant bet settlement, and heightened user engagement during matches.

Pre-Match/Fixed-Odds betting remains an important sub-segment, attracting users who prefer strategic planning before events begin. This format supports accumulator bets, early odds evaluation, and lower-risk wagering approaches for long-term bettors.

Key Market Segments

By Sports Type

- Football

- Basketball

- Horse Racing

- Baseball

- Tennis

- Others

By End User

- Desktop

- Mobile

By Betting Type

- Pre-Match/Fixed-Odds

- Live/In-Play

Drivers

Expanding Legalization of Online Sports Betting Drives Market Growth

The expanding legalization of online sports betting across US states is a major growth driver for the market. As more states approve regulated betting, operators gain access to a wider customer base. Legal clarity improves consumer trust, encourages formal participation, and shifts betting activity from unregulated channels to licensed platforms with safer environments.

The widespread adoption of mobile betting applications and digital wallets further supports market expansion. Users prefer placing bets through smartphones due to convenience, fast transactions, and secure payment options. Digital wallets reduce friction during deposits and withdrawals, improving overall user satisfaction and repeat usage.

High engagement from major professional and collegiate sporting events also fuels demand. Leagues such as football, basketball, and baseball generate consistent betting interest throughout the year. Seasonal tournaments, playoffs, and rivalries drive spikes in user activity and betting volumes.

Strong consumer preference for real time and in play wagering formats adds to growth. Live betting allows users to place wagers while games are ongoing, increasing excitement and time spent on platforms. This format aligns well with mobile usage and keeps users actively engaged during events.

Restraints

Strict Regulatory Compliance Requirements Restrain Market Expansion

Strict regulatory compliance and varying state level licensing requirements create challenges for online sports betting platforms. Each US state follows different rules related to licensing, reporting, and technology standards. Operators must invest heavily to meet these requirements, slowing expansion and increasing operational complexity.

Rising concerns related to gambling addiction also act as a restraint. Governments and regulators mandate responsible betting measures such as self exclusion tools, spending limits, and age verification systems. While necessary, these requirements increase compliance costs and limit aggressive marketing strategies.

High taxation on betting revenue impacts platform profitability. Several states impose substantial tax rates on gross gaming revenue, reducing margins for operators. This limits the ability to invest in promotions, technology upgrades, and customer acquisition initiatives.

Operational costs related to cybersecurity, payment processing, and fraud prevention further pressure profitability. As platforms scale, they must continuously invest in secure systems to protect user data and transactions. These combined factors restrain faster market growth despite rising consumer demand.

Growth Factors

Untapped Potential in Newly Regulated States Creates Growth Opportunities

Untapped potential in newly regulated and late adopting states presents strong growth opportunities for the online sports betting market. As additional states move toward legalization, operators can enter fresh markets with limited competition. Early entry allows platforms to build brand loyalty and capture long term users.

Integration of advanced analytics offers another opportunity. Using data driven insights to improve odds accuracy and personalize recommendations enhances user experience. Better analytics also help operators manage risk more effectively and optimize pricing strategies.

Partnerships with media companies, sports leagues, and streaming platforms can expand audience reach. Integrating betting features with live sports content increases visibility and attracts younger digital first users. These partnerships also improve engagement during live broadcasts.

The development of localized betting content and personalized promotions supports market growth. Tailoring offers based on regional teams, user preferences, and betting history improves conversion rates. Personalized incentives encourage repeat betting and strengthen long term customer relationships.

Emerging Trends

Increased Use of Artificial Intelligence Shapes Market Trends

Increased use of artificial intelligence is a key trend shaping the online sports betting market. AI tools support odds modeling, risk management, and fraud detection. These technologies improve accuracy, reduce losses, and help platforms respond quickly to betting pattern changes.

The growing popularity of micro betting and event based wagering is another trend. Users increasingly prefer placing small bets on specific moments within a game, such as the next score or play outcome. This format increases engagement and betting frequency during live events.

Expansion of cashless and cryptocurrency enabled payments is gaining momentum. Digital payment options offer faster transactions, enhanced privacy, and broader accessibility. This trend aligns with tech savvy users seeking flexible payment methods.

There is also a rising focus on responsible gambling tools and player protection technologies. Platforms are investing in monitoring systems, alerts, and educational features. These tools support sustainable market growth while meeting regulatory and social expectations.

Regional Analysis

Europe Dominates the Online Sports Betting Market with a Market Share of 41.9%, Valued at USD 17.8 Billion

Europe holds the dominant position in the online sports betting market due to its mature regulatory frameworks and long-standing betting culture across several countries. The region benefits from widespread legalization, strong penetration of licensed digital platforms, and high consumer trust in regulated operators. In 2024, Europe accounted for 41.9% of the global market, with an overall valuation of USD 17.8 billion, supported by strong engagement in football, tennis, and in-play betting formats.

North America Online Sports Betting Market Trends

North America represents a rapidly expanding region, driven by the progressive legalization of online sports betting across multiple states. Growing adoption of mobile betting applications and digital payment solutions continues to improve accessibility for users. Strong interest in professional leagues and collegiate sports supports sustained betting activity. Regulatory clarity in several jurisdictions is expected to support stable market expansion.

Asia Pacific Online Sports Betting Market Trends

Asia Pacific shows steady growth, supported by increasing smartphone penetration and rising digital payment adoption. Growing interest in international sporting events and e- sports sponsorship to higher online engagement. While regulatory environments vary significantly across countries, user participation through offshore and regulated platforms remains strong. Urban youth demographics play a key role in driving demand.

Middle East and Africa Online Sports Betting Market Trends

The Middle East and Africa region reflects selective growth, shaped by differing legal frameworks and cultural considerations. In parts of Africa, mobile-first betting models and widespread mobile money usage support rising participation. Sports such as football continue to drive user engagement. Regulatory constraints in certain countries limit broader market expansion.

Latin America Online Sports Betting Market Trends

Latin America is emerging as a high-potential region due to increasing regulatory reforms and strong sports fan bases. Growing internet access and mobile usage support the shift toward online betting platforms. Football-driven betting activity remains a key demand factor. Ongoing regulatory developments are expected to improve market transparency and participation.

U.S. Online Sports Betting Market Trends

The U.S. market continues to expand rapidly as more states approve online sports wagering frameworks. High consumer engagement during major sporting seasons and strong adoption of in-play betting formats support growth. Mobile-first usage patterns dominate user behavior. State-level regulation remains a defining factor shaping market scale and pace.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Online Sports Betting Company Insights

Penn Entertainment Inc. has strengthened its position in the global online sports betting market through strategic partnerships and technology investments, expanding its digital footprint across key North American jurisdictions. The company’s focus on enhancing user experience and cross-platform engagement is expected to support sustainable growth in a competitive environment. Its integrated approach leveraging retail and online assets positions it to capture a larger share of recurring bettors.

PointsBet Holdings Ltd. exhibits differentiated growth with a data-driven wagering model that appeals to niche bettors seeking flexible and dynamic betting options. PointsBet’s emphasis on customer acquisition through tailored promotional offers and localized offerings in emerging markets is projected to augment its market penetration. The company’s operational agility and focus on technology scalability provide a solid foundation for growth despite competitive pressures.

MGM Resorts International (BetMGM JV) leverages its established hospitality ecosystem to drive user acquisition and retention, with BetMGM becoming a formidable contender in key regulated markets. Continuous investments in product innovation, including personalized betting features and in-app experiences, are anticipated to boost engagement metrics. The synergy between MGM’s retail presence and BetMGM’s digital platform creates a compelling omnichannel proposition.

Caesars Entertainment, Inc continues to expand its online sports betting footprint through the Caesars Sportsbook, supported by a strong brand and loyalty ecosystem that enhances player retention. The integration of Caesars Rewards with the betting platform is expected to unlock incremental value by driving cross-sell opportunities and deeper customer relationships. Focused marketing initiatives and strategic market entries are projected to sustain its competitive relevance.

Top Key Players in the Market

- Penn Entertainment Inc.

- PointsBet Holdings Ltd.

- MGM Resorts International (BetMGM JV)

- Caesars Entertainment, Inc

- Kambi Group plc

- Fanatics, Inc.

- Betway

- Mozzart Limited

- SportPesa

- Intralot SA

Recent Developments

- In Nov 2025, Sportradar Group AG announced the completion of its acquisition of IMG ARENA and its global sports betting rights portfolio from Endeavor Group Holdings, Inc. and OB Global Holdings, LLC. This acquisition significantly expands Sportradar’s premium betting rights offerings and strengthens its position across regulated global sports betting markets.

- In Oct 2025, Banijay Group reinforced its leadership in sports betting and online gaming through the acquisition of a majority stake in Tipico Group. The transaction enhances Banijay’s digital gaming portfolio and supports long term growth across European and international betting platforms.

Report Scope

Report Features Description Market Value (2024) USD 42.5 billion Forecast Revenue (2034) USD 68.6 billion CAGR (2025-2034) 12.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Sports Type (Football, Basketball, Horse Racing, Baseball, Tennis, Others), By End User (Desktop, Mobile), By Betting Type (Pre-Match/Fixed-Odds, Live/In-Play) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Penn Entertainment Inc., PointsBet Holdings Ltd., MGM Resorts International (BetMGM JV), Caesars Entertainment, Inc, Kambi Group plc, Fanatics, Inc., Betway, Mozzart Limited, SportPesa, Intralot SA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Online Sports Betting MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Online Sports Betting MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Penn Entertainment Inc.

- PointsBet Holdings Ltd.

- MGM Resorts International (BetMGM JV)

- Caesars Entertainment, Inc

- Kambi Group plc

- Fanatics, Inc.

- Betway

- Mozzart Limited

- SportPesa

- Intralot SA