Global Online Alternative Finance Market Size, Share, Statistics Analysis Report By Type (Peer-to-Peer Lending, Crowdfunding, Invoice Trade, Others), By End-Use (Individual, Businesses), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: November 2024

- Report ID: 133532

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

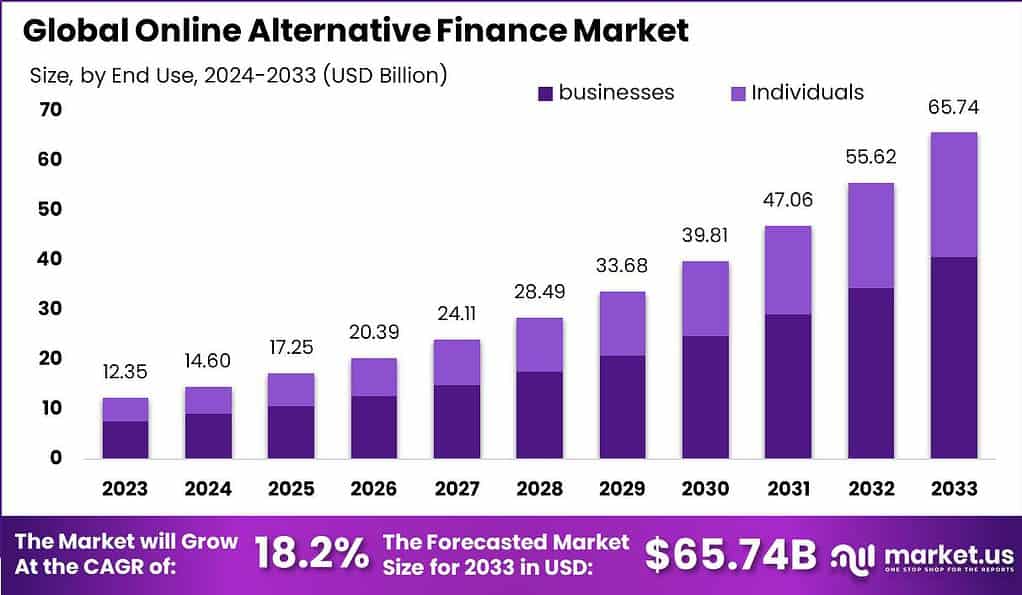

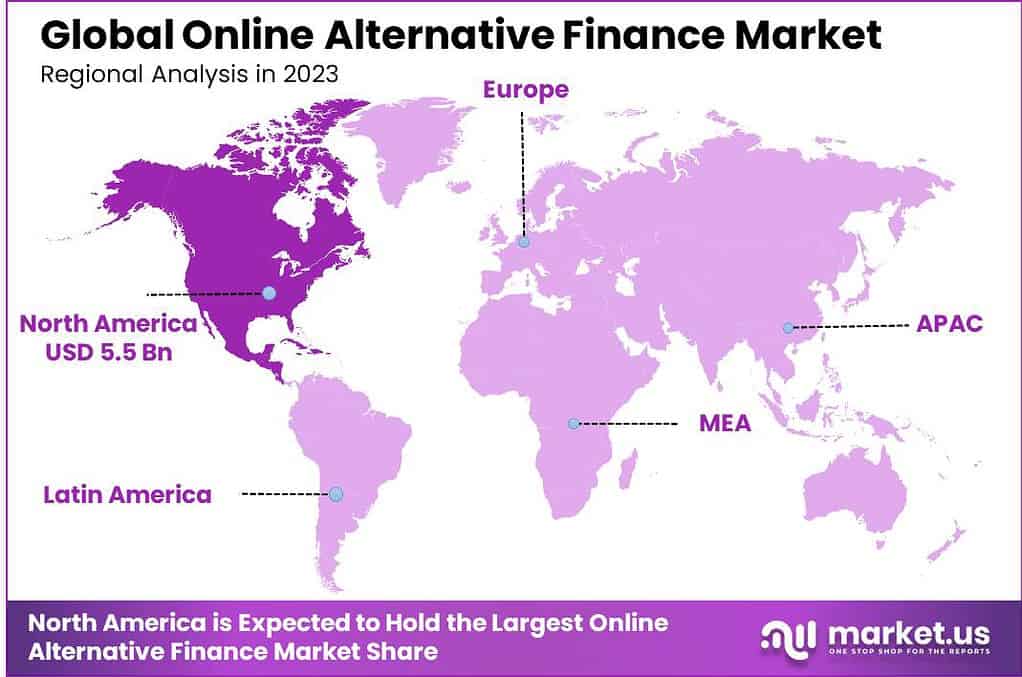

The Global Online Alternative Finance Market size is expected to be worth around USD 65.74 Billion By 2033, from USD 12.35 Billion in 2023, growing at a CAGR of 18.20% during the forecast period from 2024 to 2033. In 2023, North America led the online alternative finance sector, securing over 45% of the market share and generating approximately USD 5.5 billion in revenue.

Online Alternative Finance refers to financial services and products that operate outside of traditional banking and capital markets through digital platforms. This sector includes various innovative financing forms such as peer-to-peer lending, crowdfunding, invoice trading, and cryptocurrency-based services. These platforms connect funders directly with fundraisers, bypassing traditional financial intermediaries and thereby reducing costs and increasing efficiency for users.

The online alternative finance market is experiencing significant growth globally, driven by the expanding digital economy and the broader acceptance of fintech solutions. As traditional banks tighten their lending criteria, small businesses and individual entrepreneurs increasingly turn to online platforms for their financing needs. This market is characterized by a diverse range of services offering quicker, more user-friendly, and often less costly access to funds than conventional financial systems.

The expansion of the online alternative finance market is largely driven by the limitations of traditional financial institutions, which often fail to meet the varied needs of modern businesses and individual borrowers. Factors such as easier access to capital for those with lower credit scores or limited credit history, more flexible repayment terms, and the rapid approval processes of digital platforms fuel the growth of this sector.

Moreover, the increasing trust and popularity of fintech solutions, which leverage data-driven insights and user-friendly interfaces, also play a crucial role. Market demand within the online alternative finance sector is driven by the need for more accessible and less restrictive financial services. Small businesses and individual borrowers, who may not meet the stringent requirements set by traditional financial institutions, find these platforms more accommodating.

The demand is also supported by investors and lenders looking for higher returns on their investments compared to what is typically available through traditional channels. The market for online alternative finance is ripe with opportunities, particularly in developing regions where traditional banking infrastructure is limited or in markets where the regulatory environment is becoming more favorable towards fintech solutions.

Additionally, as more data becomes available, these platforms can leverage advanced analytics to improve risk assessment capabilities, thus attracting a broader user base by offering more tailored and competitively priced financial products. Technological advancements play a pivotal role in shaping the online alternative finance industry. Innovations in blockchain, artificial intelligence, and machine learning enhance the operational efficiencies of these platforms, improving transaction speeds and security.

Key Takeaways

- The Global Online Alternative Finance Market is projected to reach USD 65.74 billion by 2033, up from USD 12.35 billion in 2023, growing at a CAGR of 18.20% from 2024 to 2033.

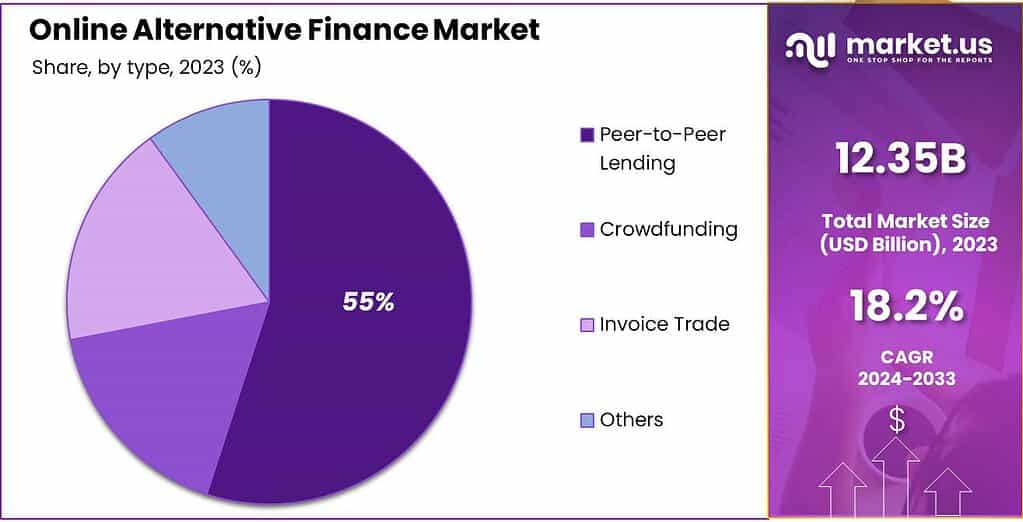

- In 2023, the Peer-to-Peer (P2P) Lending segment dominated the market, accounting for over 55% of the share. This significant share is driven by the rising preference among consumers and businesses for direct borrowing and lending, bypassing traditional financial intermediaries.

- The Businesses segment led the online alternative finance market in 2023, holding a commanding 62% share, reflecting the growing demand for alternative financing solutions among companies.

- North America was the leading region in the online alternative finance market in 2023, capturing more than 45% of the market share, equivalent to approximately USD 5.5 billion in revenue.

Type Analysis

In 2023, the Peer-to-Peer (P2P) Lending segment held a dominant market position within the online alternative finance market, capturing more than a 55% share. This substantial market share can be attributed to the increasing consumer and business preference for direct borrowing and lending platforms that bypass traditional financial intermediaries.

The growth of the P2P lending segment is further propelled by technological advancements that enhance platform reliability and user experience. Enhanced risk assessment capabilities through AI and machine learning have improved the credit scoring models used by these platforms, reducing the risk for lenders and attracting more participants to the sector.

Regulatory developments have also played a crucial role in the growth of P2P lending. As governments and financial authorities establish clearer regulations for online lending, there is increased legitimacy and trust in these platforms. This regulatory environment helps mitigate risks associated with online financial transactions and protects both borrowers and lenders.

Moreover, the economic shifts driven by global events have led individuals and businesses to seek alternative financing solutions that offer more accessibility than what is typically available through conventional banking channels. P2P lending platforms have capitalized on this demand by providing tailored financing solutions that meet the unique needs of diverse borrowers.

End-Use Analysis

In 2023, the Businesses segment held a dominant market position in the online alternative finance market, capturing more than a 62% share. This prominence is primarily attributed to the growing need among small and medium enterprises (SMEs) for flexible and accessible financing options.

Traditional banking methods often pose significant barriers for SMEs, including stringent credit requirements and lengthy approval processes. Online alternative finance platforms, by contrast, offer quicker, less conventional routes to funding, which are particularly appealing to businesses in their early stages or those looking to scale quickly.

The leadership of the Businesses segment is further reinforced by the innovative financing models that these platforms support, such as invoice trading and supply chain financing. These models provide vital cash flow solutions for businesses, allowing them to manage their operational costs more effectively without the need for traditional collateral.

Moreover, the digital nature of these platforms aligns well with the digital transformation strategies that many businesses are undertaking. As companies continue to integrate digital solutions across their operations, the seamless and integrated services offered by online alternative finance platforms become increasingly attractive.

Key Market Segments

By Type

- Peer-to-Peer Lending

- Crowdfunding

- Invoice Trade

- Others

By End-Use

- Individual

- Businesses

Driver

Technological Advancements

The rapid evolution of technology has been a significant catalyst for the growth of online alternative finance. The proliferation of smartphones and widespread internet access have democratized financial services, enabling individuals and businesses to engage with financial platforms from virtually anywhere.

Digital platforms have streamlined processes such as loan applications, credit assessments, and fund disbursements, making them more efficient and user-friendly. Additionally, the integration of artificial intelligence and machine learning has enhanced risk assessment models, allowing for more accurate credit evaluations and personalized financial products.

Restraint

Regulatory Uncertainty

Despite its growth, the online alternative finance sector faces significant challenges due to regulatory uncertainty. The rapid pace of innovation often outstrips the development of corresponding regulatory frameworks, leading to ambiguities that can hinder the sector’s expansion.

In many jurisdictions, existing financial regulations were designed with traditional banking models in mind and may not adequately address the unique aspects of online alternative finance. This mismatch can result in compliance challenges for fintech companies, as they navigate a complex landscape of legal requirements that may not be fully applicable to their operations.

Opportunity

Financial Inclusion

Online alternative finance presents a significant opportunity to enhance financial inclusion, particularly in underserved and unbanked populations. Traditional banking systems often have stringent requirements and limited reach, leaving many individuals and small businesses without access to essential financial services.

Digital platforms can bridge this gap by offering accessible and affordable financial products. For example, mobile-based lending applications can reach individuals in remote areas, providing them with credit facilities that were previously inaccessible.

Moreover, the use of alternative data sources, such as mobile phone usage and social media activity, allows for more inclusive credit scoring models. This approach can assess the creditworthiness of individuals without formal credit histories, thereby extending financial services to a broader audience.

Challenge

Cybersecurity Risks

As online alternative finance platforms handle sensitive financial data, they are prime targets for cyberattacks. The increasing sophistication of cyber threats poses a significant challenge to the security and integrity of these platforms.

Data breaches can lead to financial losses, identity theft, and erosion of consumer trust. For instance, unauthorized access to user accounts can result in fraudulent transactions, causing direct financial harm to users. Additionally, the exposure of personal information can have long-term repercussions, including reputational damage and legal liabilities for the platform operators.

Emerging Trends

The landscape of online alternative finance is rapidly evolving, driven by technological advancements and changing consumer behaviors. One significant trend is the integration of artificial intelligence (AI) into financial services. AI enhances fraud detection by identifying unusual patterns, streamlines credit scoring through comprehensive data analysis, and automates customer services.

Another notable development is the rise of peer-to-peer (P2P) lending platforms. These platforms connect borrowers directly with lenders, offering an alternative to traditional banking. P2P lending provides borrowers with access to funds at potentially lower interest rates and offers lenders opportunities for higher returns.

The emergence of embedded finance is also reshaping the industry. This trend involves integrating financial services into non-financial platforms, allowing consumers to access services like loans or insurance directly within e-commerce or social media applications.

Business Benefits

Online alternative finance offers businesses a range of benefits that can significantly enhance their financial health and operational efficiency. One of the primary advantages is improved access to capital. Alternative financing platforms provide more flexible options, enabling businesses to secure funds more quickly and with less bureaucracy.

Another notable benefit is the potential for more favorable terms. Alternative lenders often offer competitive interest rates and repayment schedules tailored to the specific needs of a business. This customization can lead to cost savings and better cash flow management.

Furthermore, alternative financing can serve as a valuable tool for businesses looking to diversify their funding sources. Relying solely on traditional banks can be risky, especially during economic downturns. By exploring alternative options like peer-to-peer lending or crowdfunding, businesses can mitigate this risk and ensure a more stable financial foundation.

Regional Analysis

In 2023, North America held a dominant market position in the online alternative finance sector, capturing more than a 45% share, which equated to a revenue of approximately USD 5.5 billion.

This leading stance is primarily due to the region’s robust technological infrastructure and a developed digital economy, which provide an ideal environment for online finance platforms to thrive. The high level of tech adoption among both consumers and businesses in North America facilitates a greater acceptance and utilization of non-traditional financial services, such as peer-to-peer lending and crowdfunding.

Clear and supportive regulatory landscape have helped mitigate risks associated with online transactions, building trust among users. These regulations have also encouraged innovation within the sector, allowing new entrants to provide diverse financial services that cater to underserved or niche markets.

Additionally, North America’s strong entrepreneurial culture drives significant demand for alternative financing. Startups and small businesses, which depended on traditional banks, turn to online platforms to meet their funding needs. The prevalence of venture capital and a mindset geared towards innovation further stimulate this demand, positioning online alternative finance as a critical resource for business growth in the region.

The ongoing advancements in financial technology in North America also contribute to its dominance in the market. With significant investments in fintech and continuous technological innovations, such as the integration of blockchain and artificial intelligence in finance, the region remains at the forefront of the online alternative finance market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the landscape of online alternative finance, several key players have established themselves as leaders. Each of these companies has carved out a significant presence in the market through innovative strategies and strong customer engagement.

Lending Club stands out as a pioneer in the peer-to-peer lending space. It operates an online lending platform that connects borrowers with investors, offering personal loans, business loans, and auto refinancing. Lending Club has gained prominence by providing a streamlined, user-friendly platform that simplifies the borrowing process.

Prosper Marketplace is another player in the sector. It was one of the first platforms to offer a peer-to-peer lending mechanism in the United States. Prosper Marketplace distinguishes itself by offering personal loans for a variety of uses, such as debt consolidation, home improvements, and medical expenses.

SoFi, short for Social Finance, has broadened its offerings beyond just lending to include wealth management and insurance products, thereby positioning itself as a full-service finance company. Its approach to offering membership benefits, such as career coaching and financial planning, adds value to its services, making it appealing to a broad demographic, particularly millennials.

Top Key Players in the Market

- Lending Club

- Prosper Marketplace

- SoFi

- ZOPA

- StreetShares

- Upstart

- Peerform

- Funding Circle

- Kiva

- Kickstarter

- Other Key Players

Recent Developments

- In March 2024, Prosper has earned the Fintech Breakthrough Award for Best Peer-to-Peer Lending Platform in Consumer Lending, celebrating its groundbreaking impact on the industry.

- In April 2024, UK digital bank Zopa reported a pre-tax profit of £15.8 million for 2023, marking its first profitable year and indicating readiness for a potential Initial Public Offering (IPO).

- In June 2024, Private credit firm Castlelake agreed to purchase up to $1.2 billion in consumer installment loans from Upstart, bolstering Upstart’s funding and loan origination capacity.

- In October 2024, SoFi announced a $2 billion deal with Fortress Investment Group affiliates to sell personal loans, enhancing its lending capabilities.

Report Scope

Report Features Description Market Value (2023) USD 12.35 Bn Forecast Revenue (2033) USD 65.74 Bn CAGR (2024-2033) 18.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Peer-to-Peer Lending, Crowdfunding, Invoice Trade, Others), By End-Use (Individual, Businesses) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Lending Club, Prosper Marketplace, SoFi, ZOPA, StreetShares, Upstart, Peerform, Funding Circle, Kiva, Kickstarter, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Online Alternative Finance MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Online Alternative Finance MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Lending Club

- Prosper Marketplace

- SoFi

- ZOPA

- StreetShares

- Upstart

- Peerform

- Funding Circle

- Kiva

- Kickstarter

- Other Key Players