Global One Wheel Electric Scooter Market Size, Share, Growth Analysis By Product Type (Electric Unicycle, Electric One-Wheel Hoverboard), By Speed Limit (30 Kmph - 50 Kmph, 20 Kmph - 30 Kmph, More than 50 Kmph), By Application (Off-road Activities, Daily Commute), By Sales Channel (Online Sales, Offline Sales), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167669

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

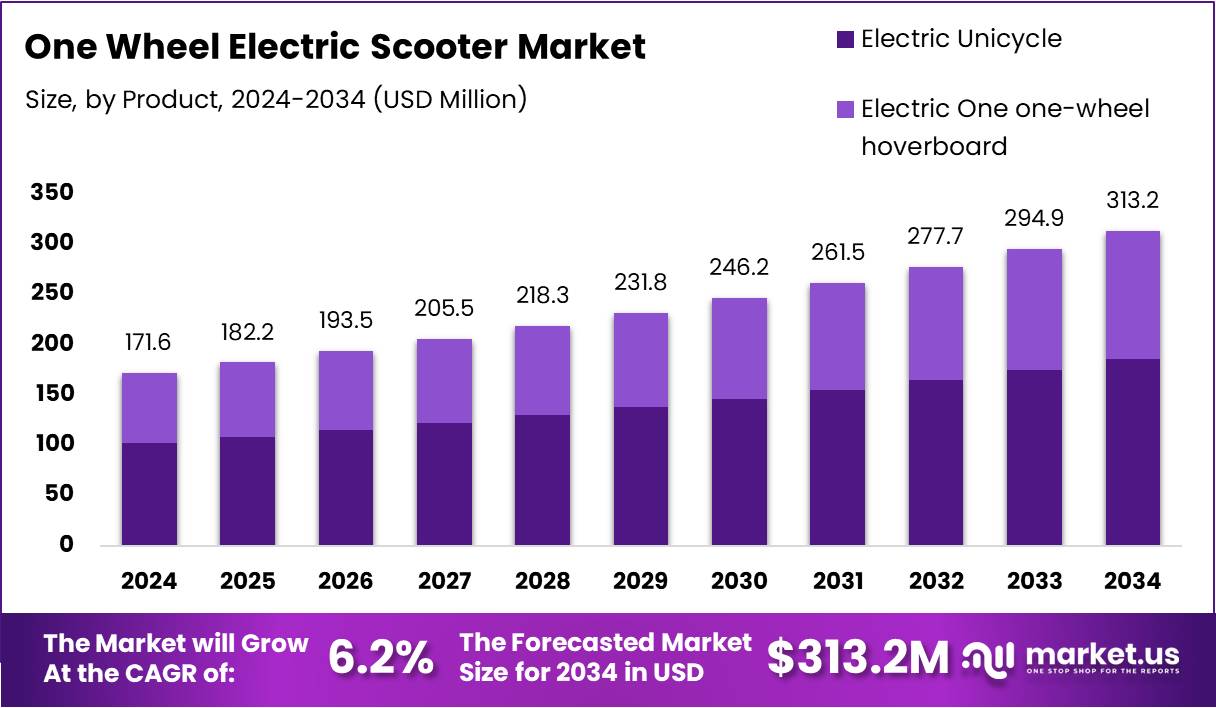

The Global One Wheel Electric Scooter Market size is expected to be worth around USD 313.2 Million by 2034, from USD 171.6 Million in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034.

The One Wheel Electric Scooter Market represents a specialized micromobility segment delivering single-wheel, self-balancing electric scooters used for short commutes and recreational travel. This category is gaining traction as consumers shift toward compact, sustainable mobility options that reduce congestion and provide a modern, lifestyle-driven riding experience for urban users.

Moving ahead, the market is expanding as riders increasingly prefer portable and eco-friendly transport. Rising urban density and higher commuting costs continue encouraging younger consumers to adopt one-wheel electric scooters. Additionally, improving charging access and better durability standards reinforce market confidence and support consistent adoption across diverse regions.

Furthermore, government investments in clean mobility are accelerating growth. Incentives promoting lightweight electric vehicles and new regulations governing personal transport devices are creating a more structured operating environment. These policy efforts are enabling one-wheel scooters to integrate more smoothly into short-distance commuting networks across cities.

In addition, significant opportunities are emerging as manufacturers enhance safety, stability, and battery performance. Advancements in motors and smart connectivity features are improving overall ride quality. Growing interest among adventure-driven and tech-oriented riders further strengthens demand, especially in markets prioritizing sustainable and innovative micromobility solutions.

Toward the end, the market’s performance is supported by key usage statistics. Lithium-ion batteries generally last 3 to 5 years, ensuring practical ownership value. A typical one-wheel scooter delivers 20–32 miles of range and reaches 20 miles per hour. Moreover, most riders fall within the 18-44 age group, reinforcing strong alignment with core demand demographics.

Key Takeaways

- Global market size expected to reach USD 313.2 Million by 2034, growing from USD 171.6 Million in 2024.

- Market expands at a steady CAGR of 6.2% during the forecast period 2025–2034.

- Electric Unicycle leads the product segment with a dominant share of 59.4% in 2024.

- The 30–50 Kmph speed limit category dominates the speed segment with a 49.2% share.

- Off-road Activities account for a leading 66.9% share in the application segment.

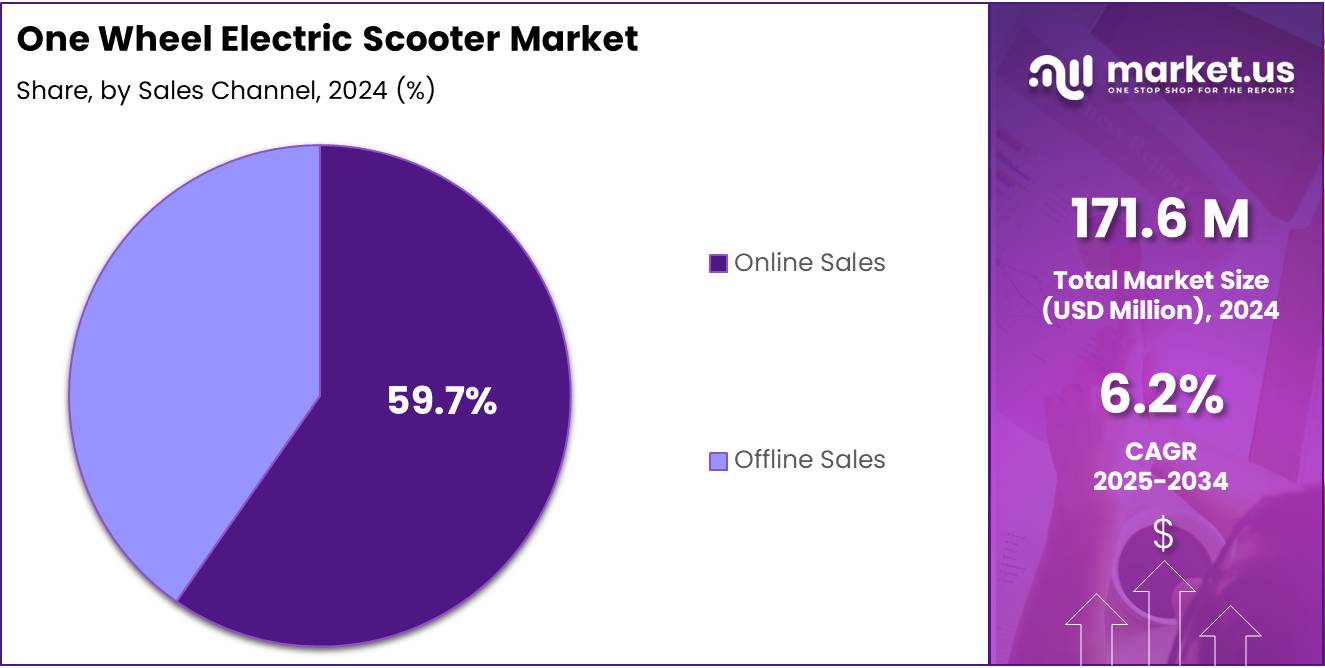

- Online Sales represent the largest sales channel with a share of 59.7% in 2024.

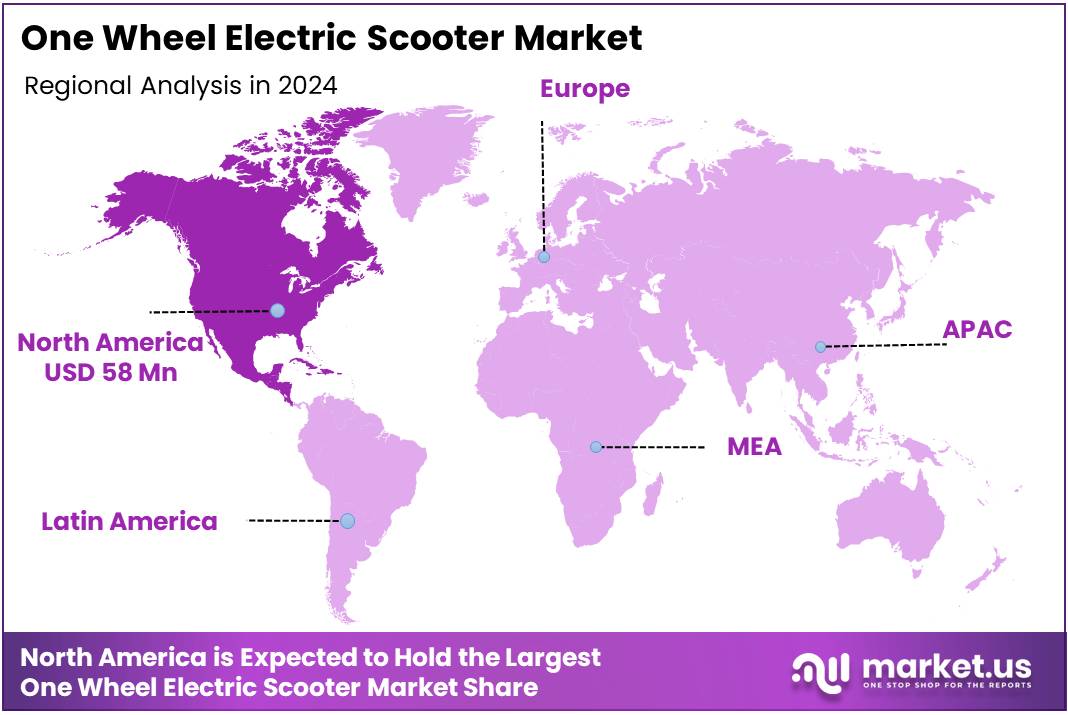

- North America leads regionally with a market share of 33.8%, valued at USD 58 Million in 2024.

By Product Type Analysis

Electric Unicycle dominates with 59.4% due to rising demand for compact personal mobility.

In 2024, Electric Unicycle held a dominant market position in the By Product Type segment of the One Wheel Electric Scooter Market, with a 59.4% share. It offers strong maneuverability and better balance support. Additionally, its compact structure appeals to urban riders seeking easy transportation for short and mid-range personal mobility.

Electric One-Wheel Hoverboard continued gaining traction in the By Product Type segment. This model attracts younger consumers seeking a recreational and trendy mobility solution. Moreover, its lightweight profile and customizable styling further support adoption, especially among users prioritizing casual riding experiences over long-range performance.

By Speed Limit Analysis

30 Kmph – 50 Kmph dominates with 49.2% due to balanced performance and safety.

In 2024, the 30 Kmph – 50 Kmph segment held a dominant position in the By Speed Limit category, capturing a 49.2% share. This range appeals to riders needing efficient daily commuting speed with controlled stability. The balance between velocity and safety encourages broader usage across recreational and semi-professional riders.

The 20 Kmph – 30 Kmph segment maintained a stable presence within the By Speed Limit analysis. This range suits beginners and casual riders seeking safe and predictable speed capabilities. Its moderate pace enables comfortable navigation in urban areas with higher pedestrian movement and traffic constraints.

The More than 50 Kmph segment attracted performance-focused consumers in the By Speed Limit category. Riders in this group prefer advanced power output and extended travel range. Although niche, this segment appeals to adventure users participating in high-speed recreational activities requiring enhanced torque and stability.

By Application Analysis

Off-road Activities dominate with 66.9% due to growing interest in adventure riding.

In 2024, Off-road Activities held a dominant position in the By Application segment, securing a 66.9% share. Rising interest in adventure sports, rugged trail exploration, and outdoor recreation significantly boosts this segment. Its demand is driven by performance-oriented riders seeking stability, durability, and enhanced torque for challenging terrains.

Daily Commute remained a growing sub-segment within the By Application category. Increasing congestion in urban areas encourages individuals to adopt compact one-wheel electric mobility. This segment appeals to office workers, students, and city riders seeking faster, eco-friendly, and hassle-free travel options for short-distance mobility.

By Sales Channel Analysis

Online Sales dominate with 59.7% driven by strong digital retail adoption.

In 2024, Online Sales held a dominant position in the By Sales Channel segment with a 59.7% share. Consumers increasingly prefer digital platforms for comparing models, accessing discounts, and reading user reviews. The convenience of doorstep delivery further strengthens this segment’s growth across both urban and semi-urban markets.

Offline Sales continued contributing significantly to the By Sales Channel category. Physical stores attract buyers who prefer hands-on testing and professional guidance before purchase. Many customers value direct product demonstrations and after-sales support, which strengthens the role of retail outlets in brand visibility and customer trust.

Key Market Segments

By Product Type

- Electric Unicycle

- Electric One-Wheel Hoverboard

By Speed Limit

- 30 Kmph – 50 Kmph

- 20 Kmph – 30 Kmph

- More than 50 Kmph

By Application

- Off-road Activities

- Daily Commute

By Sales Channel

- Online Sales

- Offline Sales

Drivers

Urban Shift Toward Low-Emission Short-Distance Transportation Drives Market Growth

The One Wheel Electric Scooter Market is gaining strong momentum as cities continue shifting toward cleaner and low-emission mobility options. Growing traffic congestion and rising fuel costs encourage commuters to adopt compact electric solutions for short trips. This trend is especially visible in urban centers where consumers prefer lightweight, portable, and energy-efficient travel choices for daily movement.

Moreover, advancements in self-balancing gyroscope systems are significantly improving user experience. Modern sensors, enhanced stability algorithms, and faster response mechanisms help riders maintain better balance even on uneven surfaces. These innovations make the scooters safer and easier to use, attracting both beginners and experienced users. As technology evolves, manufacturers focus on delivering smoother and more intuitive riding performance.

Additionally, improvements in durability and weather-resistant materials are enhancing product reliability. New engineering practices allow scooters to withstand harsh outdoor conditions, including rain, dust, and temperature fluctuations. Stronger frames, waterproof casings, and impact-resistant components extend product life and reduce maintenance needs. As a result, consumers view one-wheel scooters as a dependable and long-lasting mobility option.

Restraints

Limited Battery Endurance Affecting Long-Distance Commuting

Limited battery endurance remains a major restraint for the One Wheel Electric Scooter Market. Many scooters offer short ride ranges, making them unsuitable for long-distance daily travel. This limitation reduces user confidence, especially for commuters who rely on consistent performance. As a result, buyers often compare battery life before making a purchase decision.

Additionally, restricted speed regulations across urban mobility zones further slow market expansion. Many cities impose strict speed limits to ensure safety in crowded areas. These rules limit the riding experience and reduce the appeal of high-performance models. As regulatory frameworks tighten, manufacturers face constraints when designing faster or more advanced scooters.

Battery performance issues also increase overall maintenance needs, which can further lower adoption among new users. Riders often face slower charging times or reduced efficiency in extreme weather, adding to operational challenges. This creates hesitation among potential consumers who prefer hassle-free mobility solutions.

Together, limited battery endurance and speed restrictions shape purchasing behavior and influence brand strategies. Companies must continue improving battery technology while aligning with evolving urban mobility rules. These restraints slow market penetration but also encourage innovation aimed at achieving better range, safer performance, and regulatory compliance.

Growth Factors

Expansion of Smart Connectivity Features Drives Market Growth

The market is witnessing strong opportunities as brands expand smart connectivity features in one wheel electric scooters. These innovations allow riders to track performance, battery status, and ride insights through mobile apps. As users prefer more control and visibility, connected features strengthen product value and support long-term adoption across urban mobility users.

Moreover, the rising demand for compact micro-mobility solutions in dense cities is creating new growth avenues. Growing congestion and limited parking spaces encourage commuters to choose ultra-compact vehicles. One wheel electric scooters fit this need because they are small, lightweight, and highly portable. This shift supports broader acceptance among students, short-distance commuters, and city-based riders.

Additionally, the integration of swappable battery systems is creating an important opportunity for improving ride continuity. Users can replace depleted batteries within seconds, reducing downtime and increasing convenience. This feature is especially useful for frequent riders and rental operators who require consistent performance throughout the day. As battery technology advances, this opportunity is expected to accelerate market expansion.

Emerging Trends

Increasing Popularity of Minimalist One-Wheel Personal Mobility Gadgets

The One Wheel Electric Scooter Market is witnessing strong traction as minimalist mobility gadgets gain wider acceptance. Consumers are increasingly looking for compact vehicles that offer style, convenience, and smooth movement in busy urban settings. This trend is encouraging brands to refine lightweight designs that appeal to daily commuters and hobby riders.

Aesthetic upgrades are becoming a major trend, especially the growing use of LED lighting and customizable add-ons. Riders now prefer scooters that not only perform well but also reflect their personal style. This shift is making visual customization a core selling point and pushing manufacturers to introduce more color, lighting, and accessory options.

In addition, the market is observing a sharp rise in smart safety wearables that connect with scooter performance data. Features such as real-time alerts, ride stability insights, and helmet-based notifications are improving ride safety. This trend is building trust among new users and expanding the rider base, especially in urban regions where safety concerns are high.

Regional Analysis

North America Dominates the One Wheel Electric Scooter Market with a Market Share of 33.8%, Valued at USD 58 Million

North America leads the One Wheel Electric Scooter Market, supported by strong consumer acceptance of compact personal mobility devices. The region accounted for 33.8% market share in 2024, reaching USD 58 million in value. Demand continues to rise as users prioritize last-mile convenience, improved riding stability, and advanced safety-focused designs.

Europe One Wheel Electric Scooter Market Trends

Europe shows steady growth driven by urban policies promoting low-emission micro-mobility adoption. The region benefits from increasing commuter interest in self-balancing mobility tools and improved roadway infrastructure. Environmental awareness and city-level sustainability commitments continue supporting wider adoption across major European cities.

Asia Pacific One Wheel Electric Scooter Market Trends

Asia Pacific is emerging as a high-potential market due to rising urban density and the expanding popularity of electric personal transport devices. Countries in this region are witnessing rapid adoption of compact, energy-efficient solutions for short-distance travel. Growing disposable income and supportive mobility innovation ecosystems also contribute to faster market penetration.

Middle East & Africa One Wheel Electric Scooter Market Trends

The Middle East & Africa region is experiencing gradual interest in one-wheel scooters, supported by infrastructure development and consumer inclination toward premium mobility devices. Adoption remains moderate, but demand is expanding as smart city programs integrate modern micro-mobility options. The region is expected to gain traction as awareness increases.

Latin America One Wheel Electric Scooter Market Trends

Latin America is witnessing rising adoption of electric micro-mobility as urban populations seek affordable and efficient travel alternatives. Interest in one-wheel scooters is growing particularly in densely populated cities aiming to reduce congestion. Government initiatives promoting cleaner mobility and the increasing presence of modern transport solutions are supporting the market outlook.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key One Wheel Electric Scooter Company Insights

Dongguan Begode Intelligent Technology Co., Ltd. strengthened its position in the global One Wheel Electric Scooter Market in 2024 by focusing on high-performance models and advanced motor engineering. The company continued improving ride stability and durability, helping attract performance-centric urban riders. Its consistent innovation supported steady adoption across emerging mobility markets.

Segway Inc. remained a prominent participant due to its established product ecosystem and strong global distribution networks. In 2024, the company emphasized safety features and refined control systems, aligning with rising consumer expectations for stable and user-friendly one-wheel mobility. Its ability to scale production efficiently enhanced its competitive standing.

Airwheel Holding Limited maintained market relevance by offering accessible pricing and diversified personal mobility solutions. The brand focused on improving battery efficiency and lightweight body structures during 2024, making its models suitable for short-distance commuters. Its broad product portfolio helped expand presence in cost-sensitive regions.

Ninebot Asia Pte Ltd. continued gaining visibility in 2024 by integrating smart connectivity upgrades and compact form factors into its mobility devices. The company capitalized on growing interest in mobile-app-based ride monitoring and enhanced safety controls. Its balanced approach to design, performance, and affordability supported consistent global market penetration.

Top Key Players in the Market

- Dongguan Begode Intelligent Technology Co., Ltd.

- Segway Inc.

- Airwheel Holding Limited

- Ninebot Asia Pte Ltd.

- SWAGTRON

- King Song Intell Co., LTD.

- INMOTION Technologies Co., Ltd.

- Inventist, Inc.

Recent Developments

- In Aug 2025 – Future Motion launched the Onewheel Rally XL, its largest and most powerful board to date.It strengthens the brand’s premium lineup with higher torque, extended range, and enhanced off-road performance.

- In September 2024 – Future Motion introduced the Onewheel Pint S, an upgraded compact model with performance-treaded features.This version targets urban riders seeking improved stability, agility, and everyday portability.

- In Nov 2024 – Future Motion revamped its best-selling Onewheel XR, adding next-gen enhancements for a retro-inspired comeback.

Report Scope

Report Features Description Market Value (2024) USD 171.6 Million Forecast Revenue (2034) USD 313.2 Million CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Electric Unicycle, Electric One-Wheel Hoverboard), By Speed Limit (30 Kmph – 50 Kmph, 20 Kmph – 30 Kmph, More than 50 Kmph), By Application (Off-road Activities, Daily Commute), By Sales Channel (Online Sales, Offline Sales) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Dongguan Begode Intelligent Technology Co., Ltd., Segway Inc., Airwheel Holding Limited, Ninebot Asia Pte Ltd., SWAGTRON, King Song Intell Co., LTD., INMOTION Technologies Co., Ltd., Inventist, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  One Wheel Electric Scooter MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

One Wheel Electric Scooter MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Dongguan Begode Intelligent Technology Co., Ltd.

- Segway Inc.

- Airwheel Holding Limited

- Ninebot Asia Pte Ltd.

- SWAGTRON

- King Song Intell Co., LTD.

- INMOTION Technologies Co., Ltd.

- Inventist, Inc.