Global On Call Scheduling Software Market By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (IT & DevOps Support, Healthcare & Clinical Staff, Field Service & Maintenance, Emergency Response & Public Safety), By End-User Industry (IT & Telecommunications, Healthcare, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 171214

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Deployment Mode Analysis

- Organization Size Analysis

- Application Analysis

- End-User Industry Analysis

- Key Functions and Benefits

- Common Industries Using It

- Examples of Software

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Opportunities & Threats

- Key Challenges

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

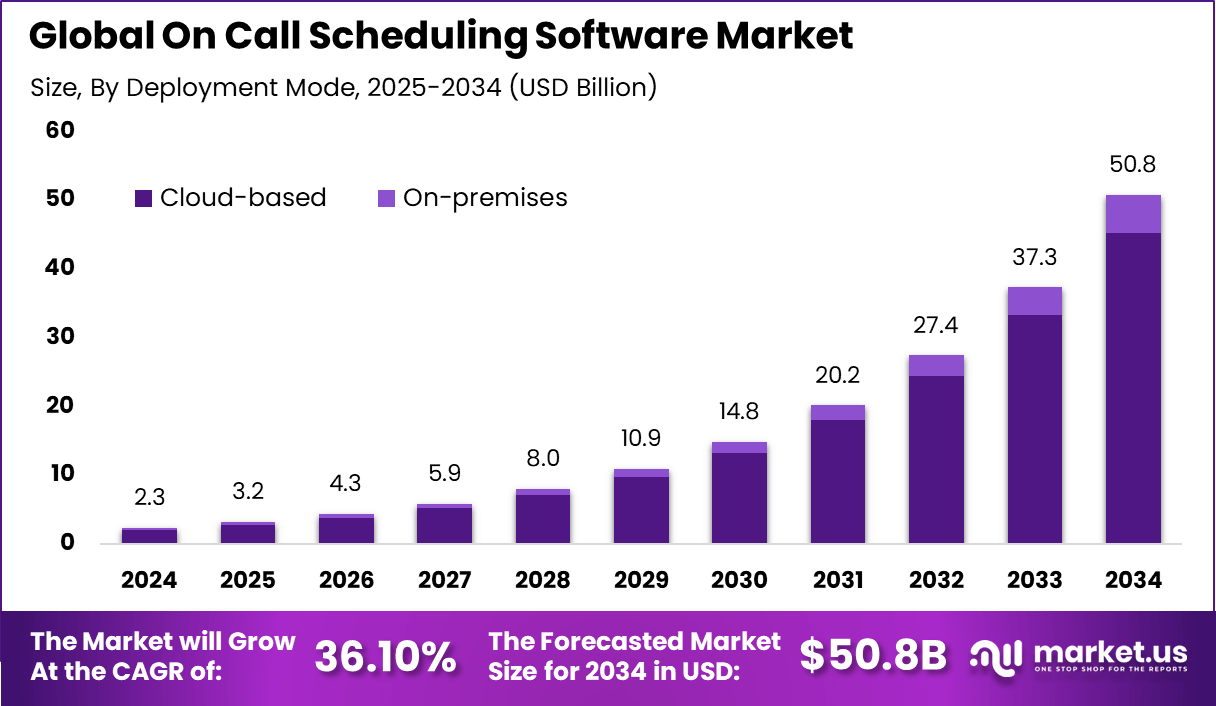

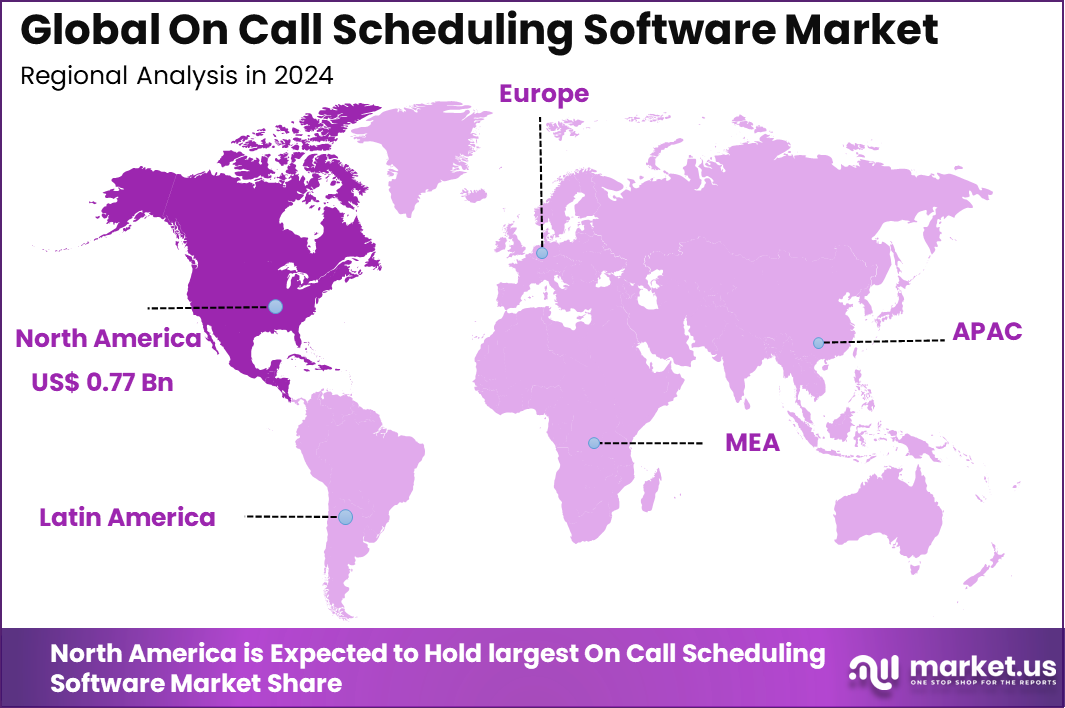

The Global On Call Scheduling Software Market generated USD 2.3 billion in 2024 and is predicted to register growth from USD 3.2 billion in 2025 to about USD 50.8 billion by 2034, recording a CAGR of 36.10% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 33.15% share, holding USD 0.77 Billion revenue.

The on call scheduling software market includes digital solutions that help organizations manage employee availability, shift assignments, and emergency response coverage. These platforms are widely used in sectors such as healthcare, IT operations, public safety, utilities, and field services. The software ensures that the right personnel are available at the right time. It plays an important role in maintaining service continuity.

On call scheduling systems replace manual scheduling methods such as spreadsheets and phone calls. They provide centralized visibility into staff schedules and availability. Organizations use these tools to reduce response delays and scheduling conflicts. As service reliability becomes critical, adoption continues to grow.

Demand for on call scheduling software is increasing across healthcare and IT operations. Hospitals rely on these systems to ensure staff availability during emergencies. IT teams use them to manage incident response and system uptime. Demand is driven by the need for reliability. Other sectors such as utilities and manufacturing are also adopting these solutions.

Top Market Takeaways

- By deployment mode, cloud-based solutions took 89.2% of the on call scheduling software market, as they offer easy access and updates from anywhere.

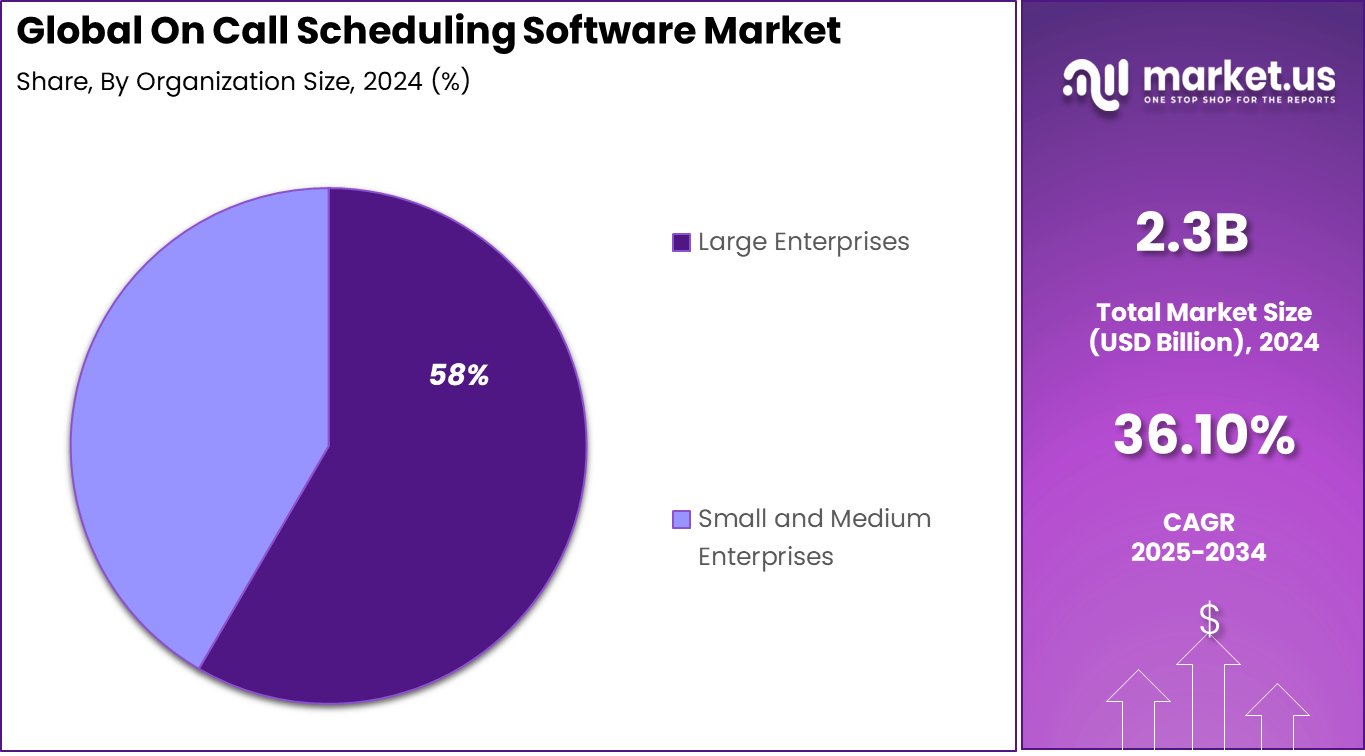

- By organization size, large enterprises held 58.4% share, using tools to manage complex shift rotations for global teams.

- By application, IT and DevOps support led with 37.8%, helping teams handle alerts and incidents around the clock.

- By end-user industry, IT and telecommunications captured 46.7%, needing reliable scheduling for network operations and support.

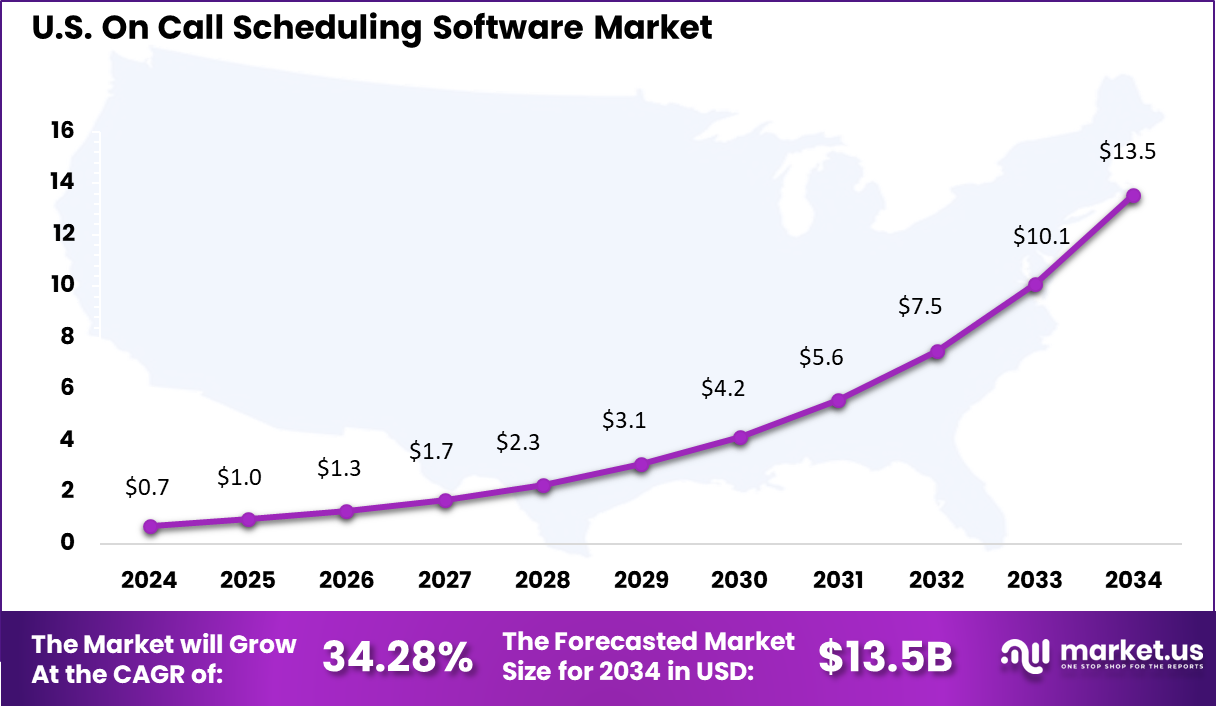

- North America had 33.15% of the global market, with the U.S. at USD 0.71 billion in 2025 and growing at a CAGR of 34.28%

Deployment Mode Analysis

Cloud-based deployment accounts for 89.2% of the On Call Scheduling Software market, showing very strong preference for hosted solutions. Organizations rely on cloud platforms to manage on-call rotations, alerts, and escalation rules without maintaining internal infrastructure. These systems provide real-time updates and ensure that schedule changes are reflected instantly across teams and devices.

From an operational view, cloud-based software supports continuous availability and remote access. Teams can manage schedules, swap shifts, and respond to incidents from any location. The high adoption of cloud deployment reflects the need for flexibility, reliability, and rapid communication in modern on-call environments.

Organization Size Analysis

Large enterprises represent 58% of the market, driven by their complex operational structures and large support teams. These organizations manage multiple on-call groups across regions and time zones. On-call scheduling software helps coordinate coverage, reduce response delays, and maintain accountability during critical incidents.

Large enterprises also use these platforms to standardize workflows and ensure compliance with internal service policies. Automated scheduling reduces manual errors and workload for managers. The strong presence of this segment shows how on-call software has become essential for maintaining service continuity at enterprise scale.

Application Analysis

IT and DevOps support accounts for 37.8% of application demand, making it the most prominent use case for on-call scheduling software. These teams are responsible for maintaining system up time and resolving incidents quickly. On-call tools help assign responsibilities clearly and ensure alerts reach the right engineers at the right time.

In fast-paced IT environments, clear escalation paths and rapid response are critical. Scheduling software supports better coordination between development and operations teams. The strong share of this application segment reflects the ongoing need for reliable incident response management in digital infrastructure operations.

End-User Industry Analysis

The IT and telecommunications sector represents 46.7% of end-user adoption, highlighting strong reliance on on-call scheduling tools in this industry. Telecom networks and IT services require constant monitoring and immediate response to outages. On-call software helps manage round-the-clock coverage and improve service reliability.

These tools also support better communication during service disruptions and maintenance activities. Automated alerts and scheduling reduce downtime and operational risk. The leading share of IT and telecommunications reflects the industry’s dependence on efficient on-call management to meet service level expectations.

Key Functions and Benefits

- Automation: Schedules are created automatically. Work shifts are assigned and staff are notified without manual effort. This helps reduce administrative workload.

- Coordination: The system manages shift rotations, different time zones, and employee preferences. This ensures proper coverage at all times.

- Alerts and Escalations: Notifications are sent to the right person immediately during incidents. If unavailable, alerts move to the next assigned person to avoid delays.

- Integration: The software connects with other systems such as payroll and incident management tools. This helps maintain a smooth and connected workflow.

- Transparency: Clear visibility is provided on who is on call and when. This reduces confusion and improves accountability among teams.

- Mobile Access: Users can view schedules and make updates in real time from mobile devices. This improves flexibility and response time.

Common Industries Using It

- Healthcare

- IT and Site Reliability Engineering

- Call Centers

- Emergency Services

Examples of Software

- For IT and Site Reliability Engineering: Squadcast, OnPage, xMatters, ServiceNow Service Operations Workspace

- For Call Centers and General Business: NICE WFM, Verint, Calabrio ONE, Five9 WFO, Connecteam

- AI Focused: Convin for call center operations

Emerging Trends

Key Trend Description AI Auto Schedules AI analyzes past data to predict the best shift planning and automate swaps. Cloud Real Time Sync Cloud platforms allow teams to view and update on call schedules from anywhere. Mobile Push Alerts Mobile apps send instant alerts to notify staff about urgent incidents. Auto Escalation Alerts are automatically escalated if no response is received within set time limits. Chat Integration Scheduling tools connect with Slack or Microsoft Teams for real time communication. Growth Factors

Key Factors Description IT Teams Grow Fast Rising application complexity increases the need for structured on call coverage. Cloud Use Booms Cloud service failures require rapid response through on call support teams. Worker Burnout Rise Balanced schedules help reduce fatigue and improve staff retention. Remote Work Spread Global teams need tools that manage shifts across multiple time zones. Digital Change Push Organizations invest in scheduling tools to support faster and reliable operations. Key Market Segments

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Application

- IT & DevOps Support

- Healthcare & Clinical Staff

- Field Service & Maintenance

- Emergency Response & Public Safety

By End-User Industry

- IT & Telecommunications

- Healthcare

- Manufacturing & Industrial

- Government & Utilities

- Others

Regional Analysis

North America accounted for 33.15% share, driven by high adoption of digital workforce management solutions across IT, healthcare, emergency services, and enterprise operations. Organizations in the region have increasingly relied on on call scheduling software to manage complex shift patterns, reduce response time, and improve service continuity.

Demand has been supported by the growing need for round the clock operations and incident response, particularly in cloud services and critical infrastructure. Automation of scheduling and alerts has helped reduce manual errors and improve staff coordination.

The U.S. market reached USD 0.71 Bn and is projected to grow at a 34.28% CAGR, reflecting strong demand from technology driven industries and healthcare providers. Adoption has been particularly strong among IT operations and site reliability teams, where rapid incident response is critical. On call scheduling software has helped organizations ensure the right personnel are available at the right time, improving service reliability and customer satisfaction.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Opportunities & Threats

The On Call Scheduling Software market shows strong opportunities as organizations require reliable coverage for critical operations at all times. Industries such as IT services, healthcare, emergency response, and utilities depend on fast incident handling, which increases the need for structured on call schedules.

These platforms help teams assign duties, manage rotations, and send alerts without manual effort. Growing use of digital services and always available systems is increasing demand for automated scheduling and real time notification tools.

The market faces threats related to pricing pressure and software overlap. Some organizations rely on basic calendar tools or built in features from existing IT platforms, which can reduce demand for dedicated scheduling solutions. Budget constraints may also delay adoption, especially among small teams. In sectors with low incident frequency, the perceived need for advanced on call tools may remain limited.

Another threat comes from user experience and adoption issues. Poor interface design or complex setup can lead to low usage and resistance from staff. Data privacy and notification reliability are also concerns, as missed alerts can have serious consequences. Strong competition among vendors makes differentiation difficult and can impact long term customer retention.

Key Challenges

- Ensuring alerts reach the right person at the right time

- Balancing workloads to reduce staff fatigue

- Integration with existing IT and communication systems

- Managing schedules across multiple time zones

- Driving user adoption and consistent usage

Competitive Analysis

The competitive landscape of the on call scheduling software market is led by incident management and communication focused vendors alongside workforce scheduling providers. PagerDuty, Inc., Opsgenie from Atlassian, Splunk On Call previously known as VictorOps, Everbridge, Inc., and xMatters, Inc. hold strong positions due to their deep integration with monitoring, IT service management, and alerting systems.

These platforms are widely adopted in IT operations, DevOps, and critical infrastructure environments where rapid incident response and clear escalation workflows are essential. At the same time, vendors such as OnPage Corporation, Intrado, Ambs Call Center, Call-Em-All, and DokCall compete by offering reliable notification, voice, and SMS based calling solutions suited for healthcare, public safety, and enterprise use.

Top Key Players in the Market

- PagerDuty, Inc.

- Opsgenie (Atlassian)

- Splunk On-Call (VictorOps)

- Everbridge, Inc.

- xMatters, Inc.

- OnPage Corporation

- Intrado (formerly West)

- Ambs Call Center, LLC

- Call-Em-All, LLC

- Klara, Inc.

- TigerConnect, Inc.

- DokCall

- ScheduleAnywhere (Atlassian)

- Humanity.com, Inc.

- Others

Future Outlook

The future outlook for the On Call Scheduling Software market is expected to remain positive as organizations aim to improve service reliability and employee wellbeing. Growing dependence on always available IT systems, healthcare services, and customer support is increasing the need for structured on call management.

These tools help reduce response delays, prevent staff burnout, and ensure fair workload distribution. In the coming years, deeper integration with incident management, communication platforms, and analytics is likely to improve visibility, compliance, and overall operational control.

Opportunities lie in

- Healthcare and emergency service adoption: Hospitals and emergency teams can benefit from clear schedules and faster escalation paths.

- IT and DevOps service continuity: Always on digital services create steady demand for reliable on call coordination tools.

- Analytics driven workforce planning: Usage data can help optimize staffing levels and reduce fatigue risks.

Recent Developments

- October, 2025 – PagerDuty launched H2 2025 Operations Cloud with Flexible Scheduling for on-call rotations, supporting multiple responders per shift, shadow schedules and AI-powered Shift Agent that auto-resolves conflicts by suggesting coverage based on timezone and history.

- March, 2025 – Atlassian announced Opsgenie End of Sale effective June 4, 2025, with full shutdown by April 2027, migrating features to Jira Service Management and Compass while urging customers to transition on-call scheduling to integrated ITSM workflows.

Report Scope

Report Features Description Market Value (2024) USD 2.3 Bn Forecast Revenue (2034) USD 50.8 Bn CAGR(2025-2034) 36.10% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (IT & DevOps Support, Healthcare & Clinical Staff, Field Service & Maintenance, Emergency Response & Public Safety), By End-User Industry (IT & Telecommunications, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape PagerDuty, Inc., Opsgenie (Atlassian), Splunk On-Call (VictorOps), Everbridge, Inc., xMatters, Inc., OnPage Corporation, Intrado (formerly West), Ambs Call Center, LLC, Call-Em-All, LLC, Klara, Inc., TigerConnect, Inc., DokCall, ScheduleAnywhere (Atlassian), Humanity.com, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  On Call Scheduling Software MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

On Call Scheduling Software MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- PagerDuty, Inc.

- Opsgenie (Atlassian)

- Splunk On-Call (VictorOps)

- Everbridge, Inc.

- xMatters, Inc.

- OnPage Corporation

- Intrado (formerly West)

- Ambs Call Center, LLC

- Call-Em-All, LLC

- Klara, Inc.

- TigerConnect, Inc.

- DokCall

- ScheduleAnywhere (Atlassian)

- Humanity.com, Inc.

- Others