Oligonucleotide Synthesis Market By Product Type (Oligonucleotide-Based Drugs, Synthesized Oligonucleotides, Reagents, and Equipment), By Applications (Therapeutic Applications, Research Applications, and Diagnostic Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Sep 2024

- Report ID: 129468

- Number of Pages: 332

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

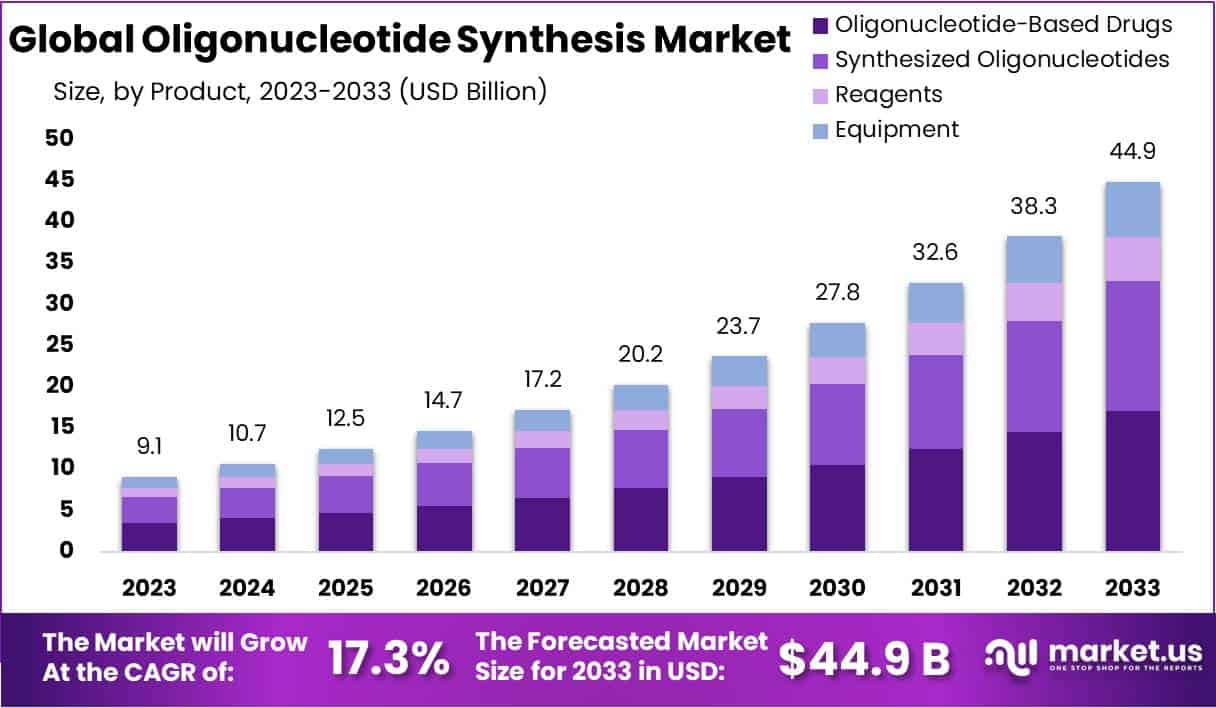

The Global Oligonucleotide Synthesis Market size is expected to be worth around USD 44.9 Billion by 2033, from USD 9.1 Billion in 2023, growing at a CAGR of 17.3% during the forecast period from 2024 to 2033.

Oligonucleotide synthesis refers to the chemical process used to produce oligonucleotides, which are short sequences of nucleic acids. This technique is foundational in genetic research and biotechnology, enabling advancements in areas such as diagnostics, therapeutics, and synthetic biology. The oligonucleotide synthesis market is driven by the increasing demand for customized oligonucleotides in therapeutic applications and research settings.

Recent developments within this sector highlight significant progress in therapeutic applications and strategic partnerships aimed at expanding the scope and impact of oligonucleotide therapies. For example, in July 2023, Alnylam Pharmaceuticals and Roche formed a partnership to co-develop and co-commercialize zilebesiran, a treatment for hypertension. This collaboration could potentially yield up to $2.8 billion, underscoring the economic and medical potential of innovative oligonucleotide therapies.

Another key partnership involves Ionis Pharmaceuticals and Biogen, focusing on the development of therapies for central nervous system (CNS) disorders, such as spinal muscular atrophy and amyotrophic lateral sclerosis. These collaborations demonstrate the sector’s commitment to addressing rare and challenging diseases through advanced genetic technologies.

Furthermore, the U.S. Food and Drug Administration (FDA) has issued guidelines for the development of oligonucleotide therapeutics. These guidelines emphasize the importance of thorough clinical evaluations, including assessments of potential QTc interval prolongation, immunogenicity risks, and the impacts on hepatic and renal functions. Such regulatory frameworks are essential for ensuring the safety and efficacy of treatments based on oligonucleotide synthesis.

The oligonucleotide synthesis market is also benefiting from increased investments from both private and governmental entities, aimed at supporting the development and commercialization of oligonucleotide drugs. These initiatives are part of a broader strategy to advance medical research and improve public health outcomes through cutting-edge therapeutic solutions. This dynamic industry continues to evolve, marked by strategic partnerships and rigorous regulatory standards that aim to harness the therapeutic potentials of oligonucleotides for a variety of medical conditions.

Key Takeaways

- Market Size: Valued at USD 9.1 billion in 2023, the global oligonucleotide synthesis market is set to grow at a 17.3% CAGR.

- Oligonucleotide-Based Drugs: This segment held 38.1% of the market in 2023, driven by demand for targeted therapies.

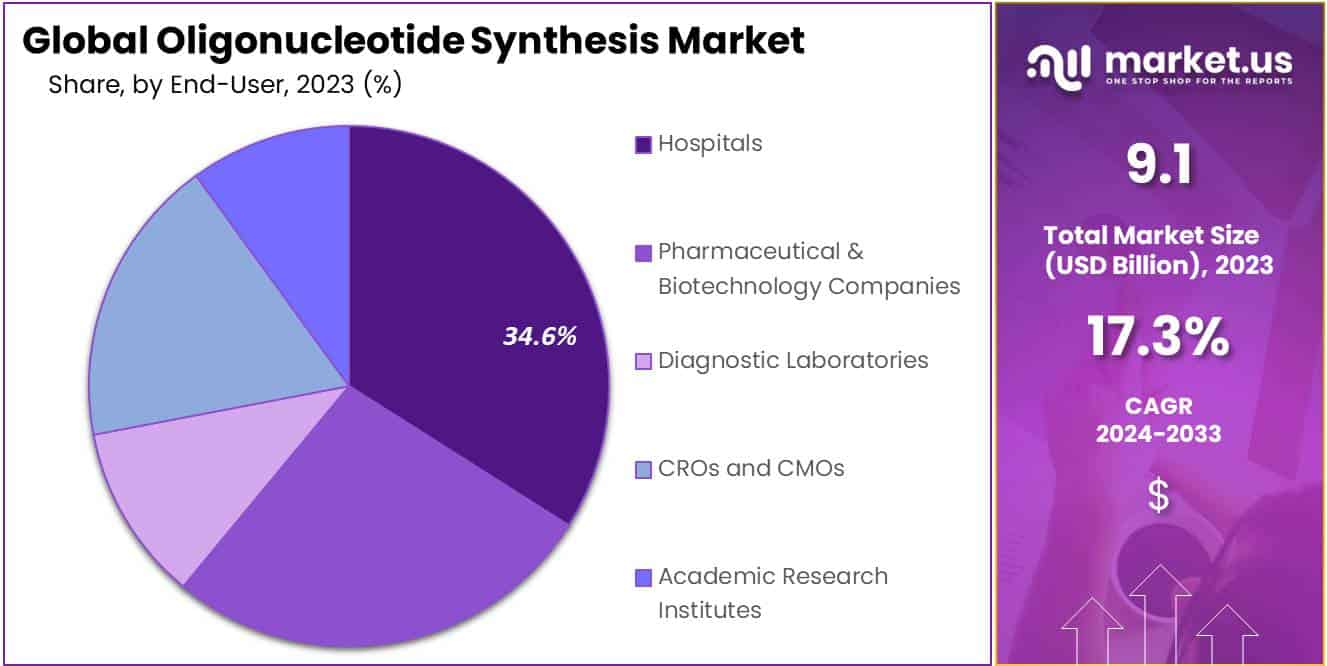

- Pharma & Biotech Dominance: Pharmaceutical and biotechnology companies accounted for 34.6% of the market’s revenue in 2023.

- Therapeutic Growth: Oligonucleotide therapies for disorders like cancer and neurological conditions are expected to drive significant revenue growth and hold a 42.2% market share.

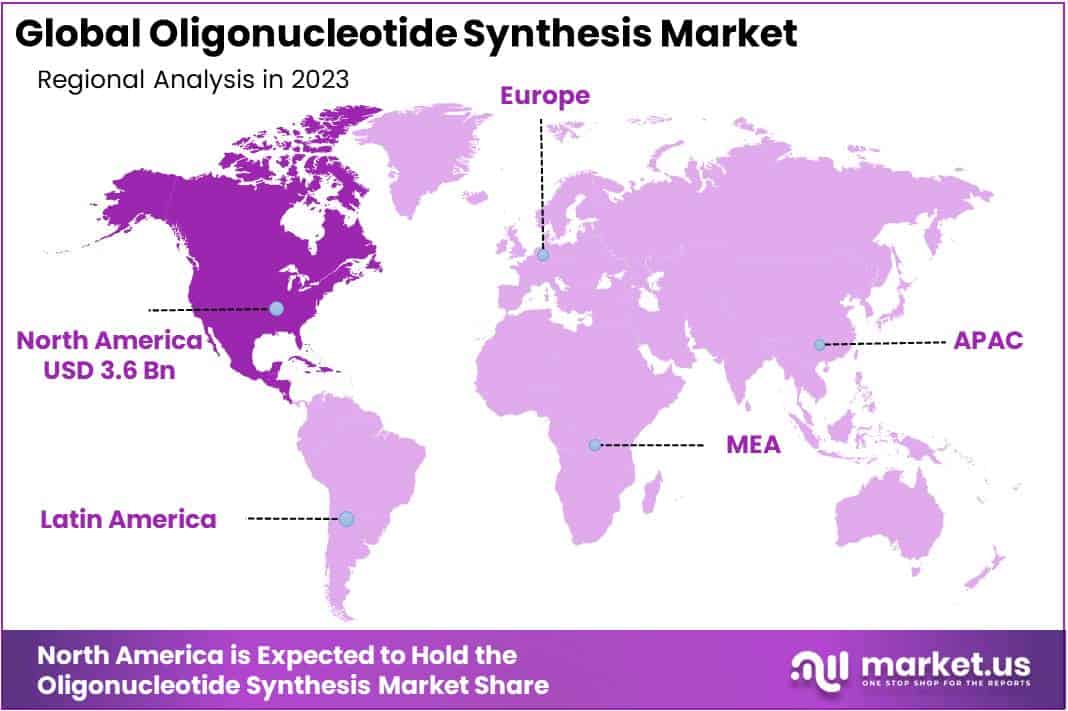

- North American Leadership: North America led the market with a 40.2% revenue share in 2023.

- Asia-Pacific’s Rapid Growth: The Asia-Pacific region is the fastest-growing market, with Japan and China making substantial investments.

- Key Players: Leading market players include Thermo Fisher Scientific, Merck & Co., and GE Healthcare.

Product Analysis

In 2023, the oligonucleotide-based drugs segment led the global market. This segment accounted for the largest market share at 38.1%. The significant market share of this segment is attributed to the rising demand for targeted therapies.

Moreover, the advancements in technologies, such as CRISPR/Cas9 gene editing and RNA interference (RNAi), have expanded the applications of oligonucleotide-based drugs. These technological advancements have increased the segment’s potential.

Regulatory agencies, like the FDA, have also created a more streamlined approval process for oligonucleotide-based drugs. This regulatory support is expected to further drive the segment’s growth.

Additionally, the growing focus on precision medicine and personalized treatments is contributing to the expansion of the global oligonucleotide synthesis market. The market is divided into four segments: oligonucleotide-based drugs, synthesized oligonucleotides, reagents, and equipment.

End-User Analysis

In 2023, the pharmaceutical and biotechnology companies accounted for the largest revenue share of 34.6% in the global oligonucleotide synthesis market.

The oligonucleotide synthesis market is divided into various end-user segments, including hospitals, pharmaceutical & biotechnology companies, diagnostic laboratories, CROs and CMOs, and academic research institutes. The high value of major pharmaceutical & biotechnology companies’ investments in R&D projects is a significant driver of market revenue growth.

With 14 oligonucleotide therapies now approved by the FDA and EMA, an increasing number of businesses are focusing on treating rare diseases. Pharmaceutical and biotechnology companies are becoming more involved in developing and manufacturing new oligo-based therapies that are expected to transform patients’ lives. Approximately 200 clinical studies and over 600 preclinical trials for oligo-based products are currently underway.

The increasing focus on rare disease treatment and the growing number of approved oligonucleotide therapies suggest a promising outlook for the pharmaceutical and biotechnology companies’ segment within the global oligonucleotide synthesis market. The significant investments and research activities in this field indicate the segment’s potential for further growth and innovation.

Application Analysis

In 2023, the oligonucleotide-based drugs segment led the global market. The global oligonucleotide synthesis market has four main segments: oligonucleotide-based drugs, synthesized oligonucleotides, reagents, and equipment. Oligonucleotide-based drugs held the largest market share at 38.1% in 2023.

The high market share of this segment is due to the rising demand for targeted therapies. New technologies like CRISPR/Cas9 gene editing and RNA interference (RNAi) have expanded the applications of oligonucleotide-based drugs. These advancements increase the potential of this segment.

Regulatory agencies like the FDA have created a more streamlined approval process for oligonucleotide-based drugs. This regulatory support is expected to drive further growth in this segment. The growing focus on precision medicine and personalized treatments also contributes to the market expansion.

Additionally, oligonucleotide-based drugs offer a high degree of specificity and efficacy, making them a preferred choice for various medical conditions. The ongoing research and development in this field are likely to bring more innovative solutions to the market. As a result, the oligonucleotide-based drugs segment is poised for significant growth in the coming years.

Key Market Segments

By Product

- Oligonucleotide-Based Drugs

- Synthesized Oligonucleotides

- Reagents

- Equipment

By End-User

- Hospitals

- Pharmaceutical & Biotechnology Companies

- Diagnostic Laboratories

- CROs and CMOs

- Academic Research Institutes

By Applications

- Therapeutic Applications

- Research Applications

- Diagnostic Applications

Drivers

Government Investments Boosting Oligonucleotide Synthesis in Genetic Research

Significant government funding in genetic research is propelling advancements in the pharmaceutical and biotechnology sectors, especially in oligonucleotide synthesis, which is critical for developing new genetic-based therapies.

In 2024, the U.S. investment in human genetics and genomics research delivered nearly a 5:1 return on federal funding, demonstrating substantial economic and healthcare benefits. The UK committed over £175 million to expand genomic medicine, aiming to integrate cutting-edge genomic technologies into healthcare, improving diagnostics and treatments (GOV.UK).

Canada also made a notable investment of $15 million to establish a pan-Canadian Genome Library, promoting inclusive and ethical genomic research. This initiative supports the development of precision health tools tailored to diverse genetic backgrounds, reflecting a global trend towards personalized medicine.

Restraints

Concerns regarding the complexity of therapeutic oligos

Therapeutic oligonucleotides offer promising gene-specific therapies but face major challenges such as limited pharmacokinetics and poor cellular uptake. These issues largely prevent their effective delivery to non-hepatic tissues, thus restricting their therapeutic potential.

Furthermore, the required chemical modifications to enhance stability and targeting can introduce toxicological concerns that complicate their clinical application. Despite these barriers, the global oligonucleotide therapeutics market is expected to reach approximately $7 billion by 2024, reflecting a growing interest in their potential across various diseases.

Additionally, the research and development sector for these drugs is hindered by a shortage of skilled professionals and the lack of adequate funding, particularly in developing countries. This has stalled advancements in the field, further impacting the availability and improvement of these therapeutic agents.

Opportunity

Emerging economies are offering a number of opportunities in the oligonucleotide synthesis market

The oligonucleotide synthesis market is undergoing significant expansion, particularly in emerging economies such as China and India, driven by advancements in healthcare infrastructure and a growing demand for genetic research. Historically led by developed nations, this market shift is fueled by increased government and private investments in genetic research, which bolsters the demand for custom oligonucleotide synthesis used in various genetic studies and drug development processes.

China, in particular, has become a pivotal player due to its large-scale adoption of oligonucleotide synthesis, catering to diverse applications from basic research to therapeutic development.

Trends

Rapid Adoption Of Antisense Oligonucleotides As Anticancer Drugs

Antisense oligonucleotides (ASOs) are gaining traction in cancer treatment due to their precise ability to modify RNA involved in tumor growth. These agents bind to specific mRNA sequences, preventing protein synthesis crucial for cancer cell survival. This method targets unique genetic markers of tumors, potentially offering more effective treatments with reduced side effects compared to traditional therapies.

Recent advancements show that chemical modifications in ASOs, such as alterations in the sugar backbone, enhance their target RNA affinity, boosting therapeutic efficacy. The FDA supports these innovations by outlining studies to better understand the pharmacokinetics and pharmacodynamics of ASOs, which is crucial for their safe and effective clinical use.

Ongoing FDA guidance and regulatory frameworks are poised to propel the development of ASOs, especially for rare cancers, marking significant progress toward personalized medicine.

Regional Analysis

In 2023, North America led the oligonucleotide synthesis market, holding a 40.2% revenue share. This dominance is primarily attributed to the approval of oligonucleotide-based drugs by the FDA and robust R&D activities in the region. Factors such as advanced healthcare infrastructure, extensive use of oligonucleotides by pharmaceutical companies, and strategic collaborations are set to drive further growth. The market benefits from governmental initiatives and a strong healthcare system that supports innovative treatments.

Meanwhile, Asia Pacific is emerging as the fastest-growing region in the oligonucleotide synthesis market. This rapid growth is fueled by advancements in genomic studies and the widespread adoption of sequencing and PCR technologies. Japan and China, in particular, are making significant investments in genomics, which enhances their market potential. The region is also experiencing an increase in product launches and approvals, contributing to its market expansion.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The oligonucleotide synthesis market is characterized by its fragmented nature, with numerous players employing diverse strategies to strengthen their market positions. Key tactics include acquiring companies in emerging markets, forging distribution partnerships, and collaborating on new technology developments. These strategies enhance the competitive dynamics among leading firms.

Additionally, industry players are actively expanding and innovating their product portfolios, further driving market growth. This expansion not only contributes to the scale of operations but also intensifies the competition within the sector. Prominent companies in the oligonucleotide synthesis industry are pivotal in shaping this competitive landscape, pushing for advancements and greater market share through strategic initiatives.

Market Key Players

- Thermo Fisher Scientific, Inc.

- Merck – Co., Inc.

- GE Healthcare Dharmacon Inc.

- Agilent Technologies

- Bio-synthesis

- Kaneka Eurogentec S.A.

- Integrated DNA Technologies, Inc.

- BioAutomation

- LGC Biosearch Technologies

- Other Key Players

Recent Developments

- In January 2024, Integrated DNA Technologies (IDT) expanded, opening a new facility in Europe to meet the rising demand for synthetic oligonucleotides, indicating market growth and increased competition.

- In October 2023, Thermo Fisher Scientific strengthened its qPCR tools by acquiring Bio-Rad’s High Throughput PCR Systems business.

- In August 2023, Agilent Technologies introduced the HaloPlex™ G4 system, utilizing microfluidic tech and custom oligonucleotides for advanced gene expression analysis.

- In June 2023, Merck expanded research, focusing on oligonucleotide therapies to address unmet medical needs, signaling potential new products and partnerships.

Report Scope

Report Features Description Market Value (2023) USD 9.1 Bn Forecast Revenue (2033) USD 44.9 Bn CAGR (2024-2033) 17.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type – Oligonucleotide-Based Drugs, Synthesized Oligonucleotides, Reagents, and Equipment; By End-User – Hospitals, Pharmaceutical & Biotechnology Companies, Diagnostic Laboratories, CROs and CMOs, Academic Research Institutes; By Applications – Therapeutic Applications, Research Applications, and Diagnostic Applications Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Thermo Fisher Scientific, Inc., Merck – Co., Inc., GE Healthcare, Dharmacon Inc., Agilent Technologies, Bio-synthesis, Kaneka Eurogentec S.A., Integrated DNA Technologies, Inc., BioAutomation, LGC Biosearch Technologies, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Oligonucleotide Synthesis MarketPublished date: Sep 2024add_shopping_cartBuy Now get_appDownload Sample

Oligonucleotide Synthesis MarketPublished date: Sep 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific, Inc.

- Merck - Co., Inc.

- GE Healthcare Dharmacon Inc.

- Agilent Technologies

- Bio-synthesis

- Kaneka Eurogentec S.A.

- Integrated DNA Technologies, Inc.

- BioAutomation

- LGC Biosearch Technologies

- Other Key Players