Global Oleanolic Acid Market Size, Share and Report Analysis By Type (Natural and Synthetic), By Purity (Up to 90%, 90% to 95%, and Above 95%), By Application (Pharmaceuticals, Nutraceuticals, Personal Care And Cosmetics, Food And Beverages, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175402

- Number of Pages: 283

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

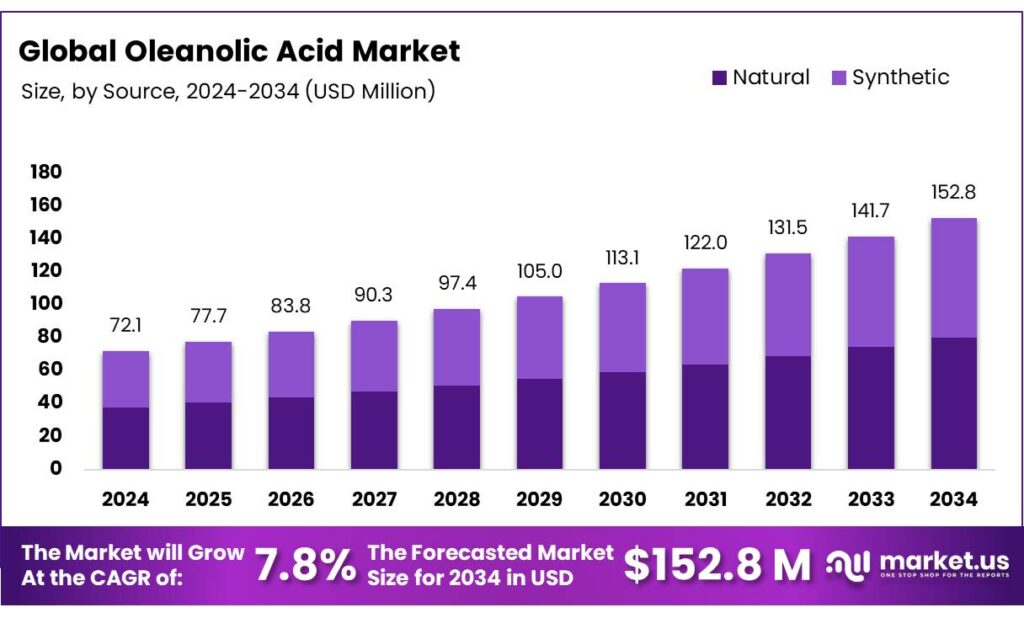

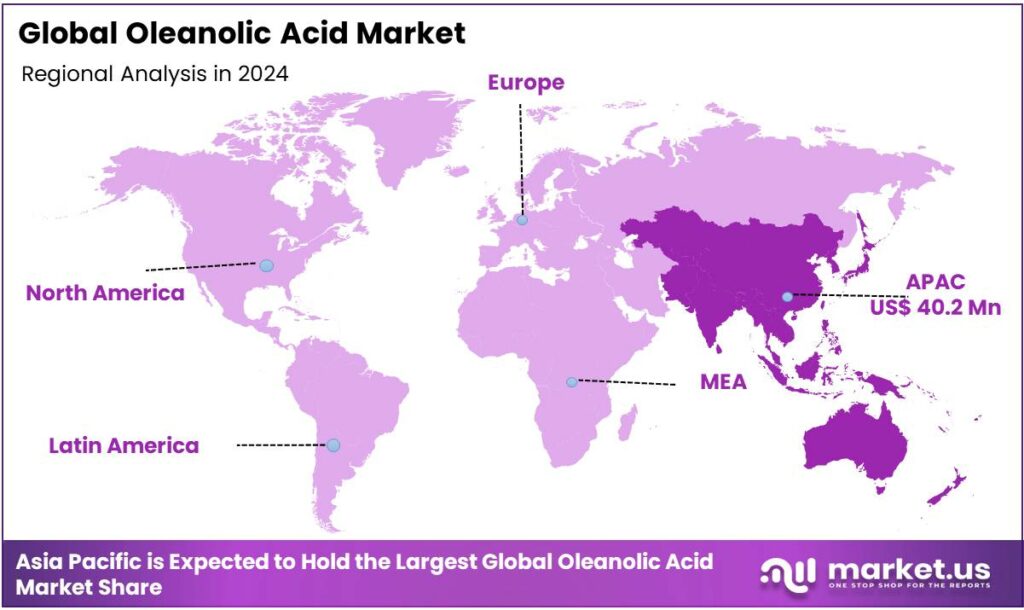

Global Oleanolic Acid Market size is expected to be worth around USD 152.8 Million by 2034, from USD 72.1 Million in 2024, growing at a CAGR of 7.8% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 38.7% share, holding USD 1.6 Billion in revenue.

Oleanolic acid is a pentacyclic triterpenoid widely found in plants, including olive leaves and certain medicinal plants. Its market is driven by the growing demand for natural and effective therapeutic agents, particularly in pharmaceuticals, where the compound is prized for its anti-inflammatory, hepatoprotective, and anti-cancer properties.

This compound, predominantly derived from olive trees’ leaves, is extensively used in treatments for chronic conditions such as liver diseases, diabetes, and cardiovascular issues. While it finds applications in nutraceuticals, personal care, and cosmetics, its primary use remains in pharmaceutical products due to stringent efficacy requirements and regulatory standards.

- China, Spain, and India are the major exporters of olive leaves, which are a primary source of commercial production of oleanolic acid, while the United States is the only major importer of the leaves.

Furthermore, the market faces challenges related to the high cost of extraction and the limited availability of high-purity oleanolic acid, as extraction methods remain complex and often involve toxic solvents. However, its appeal in natural and organic formulations, combined with ongoing research into its benefits and derivatives, supports continued interest in oleanolic acid across multiple industries.

Key Takeaways

- The global oleanolic acid market was valued at USD 72.1 million in 2024.

- The global oleanolic acid market is projected to grow at a CAGR of 7.8% and is estimated to reach USD 152.8 million by 2034.

- On the basis of product type, natural oleanolic acid dominated the market, constituting 52.4% of the total market share.

- Based on the purity, oleanolic acid, which is more than 95% pure, dominated the market, with a market share of around 40.6%.

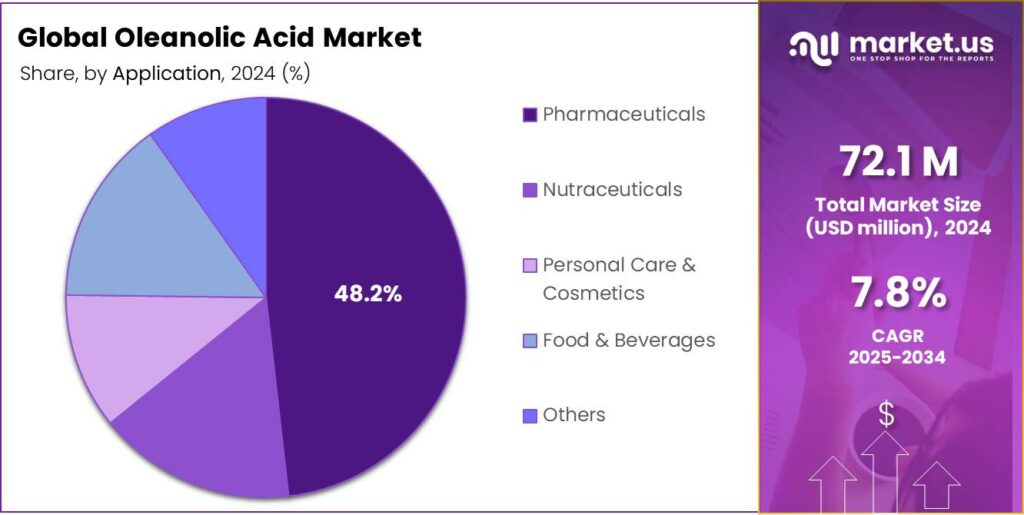

- Among the applications, the pharmaceuticals sector held a major share in the oleanolic acid market, 48.2% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the oleanolic acid market, accounting for 55.7% of the total global consumption.

Product Type Analysis

Natural Oleanolic Acid is a Prominent Segment in the Market.

The oleanolic acid market is segmented based on product type into natural and synthetic. The natural oleanolic acid led the market, comprising 52.4% of the market share, primarily due to its higher safety profile and better consumer acceptance. Derived from olive oil and other plant sources, natural OA is seen as a more sustainable and eco-friendly option, aligning with the growing global demand for natural and organic products.

Additionally, it is perceived as less likely to cause adverse effects compared to its synthetic counterpart, which may contain impurities or by-products from chemical synthesis processes. Similarly, it gives companies a better standpoint in the market, as consumers are increasingly inclined to choose plant-based ingredients that support their health and environmental values.

Purity Analysis

Oleanolic Acid That is More Than 95% Pure Dominated the Market.

On the basis of purity, the oleanolic acid market is segmented into up to 90%, 90% to 95%, and above 95%. The oleanolic acid that has purity above 95% dominated the market, comprising 40.6% of the market share, due to its higher efficacy and reliability in formulations, as it ensures higher efficacy and consistency in therapeutic and cosmetic applications. Higher purity levels, tending to fewer impurities, result in a more potent and reliable active ingredient.

In pharmaceuticals and nutraceuticals, a higher purity ingredient is crucial to ensure the precise dosage and effectiveness of the compound. Similarly, in skincare, the purity level directly impacts the product’s safety and performance, as lower purity versions may introduce undesirable side effects due to contaminants. Additionally, high-purity OA aligns better with consumer demand for premium, high-quality natural ingredients, driving its preference in the market.

Application Analysis

Oleanolic Acid Products Are Mostly Utilized for the Manufacturing of Pharmaceutical Products.

Based on the applications, the oleanolic acid market is segmented into pharmaceuticals, nutraceuticals, personal care & cosmetics, food & beverages, and others. Among the applications of the oleanolic acid, 64.9% of the chemical consumed globally is from pharmaceuticals industry, due to its well-established therapeutic benefits and stronger regulatory framework in the medical sector. OA is primarily recognized for its potent anti-inflammatory, antioxidant, and hepatoprotective properties, making it highly valuable in the treatment of chronic diseases such as diabetes, liver disorders, and cardiovascular conditions.

In contrast, while OA is used in nutraceuticals and cosmetics, these industries face less stringent regulatory oversight, and OA’s role is often less critical compared to its proven therapeutic applications. Pharmaceutical products, with their higher standards for active ingredients, often demand higher purity levels and more focused applications, making them the primary market for OA.

Key Market Segments

By Product Type

- Natural

- Synthetic

By Purity

- Up to 90%

- 90% to 95%

- Above 95%

By Application

- Pharmaceuticals

- Nutraceuticals

- Personal Care & Cosmetics

- Food & Beverages

- Others

Drivers

Booming Pharmaceutical Industry Drives the Oleanolic Acid Market.

Oleanolic acid has been the subject of extensive research due to its promising therapeutic potential in treating various chronic diseases, including diabetes, cardiovascular conditions, and liver disorders. The compound exhibits anti-inflammatory, antioxidant, and anti-cancer properties, making it a preferred option for addressing chronic conditions such as non-alcoholic fatty liver disease (NAFLD) and atherosclerosis. The acid has demonstrated the ability to reduce lipid accumulation in the liver, suggesting its utility in managing liver-related diseases.

- According to the American Liver Foundation, about 100 million individuals, around 25%, in the United States alone are estimated to have NAFLD. Similarly, according to the Centers for Disease Control and Prevention, in 2023, 919,032 people died from cardiovascular disease in the country.

Additionally, it has been found to modulate insulin sensitivity, offering therapeutic implications for diabetes management. Furthermore, beyond its direct effects, oleanolic acid has become a foundation for the development of semi-synthetic derivatives, which are being explored for enhanced efficacy and targeted action.

- According to the International Diabetes Federation, in 2024, nearly 589 million adults, 1 in 9, globally lived with diabetes, which caused 3.4 million deaths in the same year.

Restraints

Extraction Challenges Might Dampen the Growth of the Oleanolic Acid Market.

The extraction and synthesis of oleanolic acid present significant challenges that could hinder its widespread use in the pharmaceutical and nutraceutical markets. The process of obtaining the acid from plant materials often requires the use of hazardous solvents such as chloroform and hexane. For instance, chloroform is highly toxic, carcinogenic, and difficult to handle safely, posing risks to human health and the environment.

Furthermore, non-polar solvents such as hexane extract a wide range of undesired compounds, including waxes and long-chain alcohols, complicating the purification of oleanolic acid and increasing production costs. This inefficient extraction process leads to higher prices for the compound, which can range from US$300 to US$400 per gram at 97% purity, further rising to up to US$900 per gram at 99% purity.

This inability of current extraction methods to isolate oleanolic acid in a pure form limits its scalability and increases operational risks, ultimately posing a barrier to the expansion of its applications in various industries.

Opportunity

Growing Application in the Nutraceutical Industry Creates Opportunities in the Oleanolic Acid Market.

Oleanolic Acid has garnered attention for its diverse applications in the nutraceutical industry, particularly in the treatment of benign prostatic hyperplasia (BPH), hair care, type II diabetes, hyperlipidemia, and obesity. For instance, in the case of BPH, it has been observed to inhibit the growth of prostate cells, potentially reducing symptoms associated with the condition, which affects a significant portion of the aging male population.

- Annually, approximately 220,000 BPH procedures are performed in the U.S. alone.

Furthermore, in diabetes management, the compound has been observed to improve insulin sensitivity and reduce blood glucose levels, benefiting those with type II diabetes. Similarly, the impact of the compound on hyperlipidemia is notable, as it has been found to reduce elevated cholesterol and triglyceride levels in animal models.

- According to a study by the US Centers for Disease Control and Prevention, from August 2021 to August 2023, the prevalence of high total cholesterol was 11.3% in adults in the US alone.

Moreover, the chemical plays a role in regulating fat metabolism, supporting weight management efforts, and reducing the risk of obesity-related complications. These varied benefits highlight the expanding role of OA in nutraceutical formulations aimed at improving overall health and managing chronic conditions.

Trends

Application of Oleanolic Acid in Beauty Products.

Oleanolic acid offers a range of skin-benefiting properties, making it an increasingly popular ingredient in beauty and skincare products. It has been shown to inhibit fat production, contributing to healthier skin by reducing excess oil, which is particularly beneficial for individuals with acne-prone skin. The potential anti-inflammatory effects of the compound reduce skin inflammation and help alleviate conditions such as eczema and psoriasis.

- According to the US National Eczema Association, eczema affects approximately 10% to 20% of children and 2% to 10% of adults worldwide.

- According to the Psoriasis Day consortium, 125 million individuals of the total population worldwide, 2% to 3%, have psoriasis.

Furthermore, it strengthens the skin’s natural barrier function, improving epidermal permeability, which is crucial for maintaining skin hydration and protection. In recent years, the South Korean beauty trend tending towards hydration has further surged the demand for products such as oleanolic acid. Moreover, the compound activates PPAR-alpha receptors in keratinocytes, promoting cell differentiation and accelerating the recovery of skin barrier functions, particularly after environmental stressors. Similarly, it protects the skin from particulate matter (PM) exposure, which is a significant cause of oxidative stress and premature aging. Its ability to reduce inflammation and wrinkles, coupled with the increase of ceramides in the epidermis, positions OA as an ideal ingredient in formulations aimed at combating aging and environmental damage, making it a prominent trend in the skincare market.

Geopolitical Impact Analysis

Geopolitical Tensions Have Led to Disruption in the Production of Oleanolic Acid.

The ongoing geopolitical tensions surrounding olive cultivation, particularly in regions such as Palestine and Spain, pose significant challenges to the global supply of oleanolic acid (OA), which is primarily derived from olive plants. Since 1967, the Israel-Palestine conflict has led to the destruction of nearly 800,000 olive trees in Palestine, targeting one of the region’s most important agricultural assets. This has disrupted local traditions and communities and has limited the potential supply of oleanolic acid.

In addition, the Spanish olive industry, a major source of black olives and olive-based products, including oleanolic acid, faces substantial economic pressures due to the imposition of tariffs by the United States. These tariffs, which have increased by 15% as part of the EU-US trade deal, have already led to a dramatic drop in Spain’s black olive market share in the US, from 49% in 2017 to just 19% in 2024.

These geopolitical tensions, coupled with trade barriers, affect the broader olive oil and olive product markets, including the availability of raw materials for OA extraction. Consequently, the rising costs and reduced availability of olives could dampen the growth prospects of the oleanolic acid market, driving up prices and limiting access to this valuable compound in industries such as pharmaceuticals, nutraceuticals, and cosmetics.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Oleanolic Acid Market.

In 2024, the Asia Pacific dominated the global oleanolic acid market, holding about 55.7% of the total global consumption, due to its rich tradition of using herbal medicine and plant-based compounds in healthcare and skincare. Countries such as China and India, with their deep-rooted history in traditional medicine, are key contributors to the demand for the acid, as it is utilized in therapeutic and cosmetic formulations.

In China, the acid’s role in promoting liver health and reducing inflammation aligns with growing consumer interest in natural remedies. Moreover, India, with its significant herbal industry, has seen increased incorporation of OA in anti-aging and skincare products. For instance, according to a study by the National Institutes of Health (NIH), in India, more than 70% of the population uses herbal drugs. Additionally, the expanding middle class in these countries has led to a surge in demand for nutraceuticals and organic skincare products, further propelling the popularity of the chemical.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Manufacturers of oleanolic acid focus on investing in research and development to enhance extraction processes, aiming to improve yields while reducing costs. This includes exploring more sustainable and efficient extraction methods, such as enzyme-assisted or water-based extractions, to mitigate the use of harmful solvents. Additionally, many manufacturers are focusing on product innovation, such as developing semi-synthetic derivatives of oleanolic acid to offer more targeted therapeutic benefits. Furthermore, these players focus on expanding geographic presence, particularly in emerging markets in Asia and Latin America, to tap into the growing demand for natural health products.

The Major Players in The Industry

- Focusherb Corp

- SimSon Pharma Limited

- LEO-HB Technology

- Anhui Keynovo Biotech Co., Ltd.

- Xi’an Bioway Organic Ingredients Co., Ltd.

- BENEPURE Corporation

- Fengchen Group Co., Ltd

- Xi’an Fengzu Biological Technology Co., Ltd

- Nutragreenlife Biotechnology Co., Ltd

- Chemicea Pharma

- Shaanxi Fruiterco Biotechnology Co., Ltd.

- Xi’an Sost Biotech Co., Ltd

- Nanjing NutriHerb BioTech Co., Ltd

- Xi’an Angel Biotechnology Co., Ltd

- Xi’an Chen Lang Biological Technology Co., Ltd.

- Shaanxi Inhealth Nature Industry Co., Ltd.

- Other Key Players

Key Development

- In April 2025, Sabinsa launched “Olepent,” an innovative pentapeptide combined with plant-sourced oleanolic acid, developed to enhance collagen synthesis, reduce enzymatic breakdown, and promote skin renewal in high-performance cosmetic applications.

Report Scope

Report Features Description Market Value (2024) US$72.1 Mn Forecast Revenue (2034) US$152.8 Mn CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Natural and Synthetic), By Purity (Up to 90%, 90% to 95%, and Above 95%), By Application (Pharmaceuticals, Nutraceuticals, Personal Care & Cosmetics, Food & Beverages, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Focusherb Corp., SimSon Pharma Limited, LEO-HB Technology, Anhui Keynovo Biotech Co., Ltd., Xi’an Bioway Organic Ingredients Co., Ltd., BENEPURE Corporation, Fengchen Group Co., Ltd., Xi’an Fengzu Biological Technology Co., Ltd., Nutragreenlife Biotechnology Co., Ltd., Chemicea Pharma, Shaanxi Fruiterco Biotechnology Co., Ltd., Xi’an Sost Biotech Co., Ltd., Nanjing NutriHerb BioTech Co., Ltd., Xi’an Angel Biotechnology Co., Ltd., Xi’an Chen Lang Biological Technology Co., Ltd., Shaanxi Inhealth Nature Industry Co., Ltd., and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Focusherb Corp

- SimSon Pharma Limited

- LEO-HB Technology

- Anhui Keynovo Biotech Co., Ltd.

- Xi'an Bioway Organic Ingredients Co., Ltd.

- BENEPURE Corporation

- Fengchen Group Co., Ltd

- Xi'an Fengzu Biological Technology Co., Ltd

- Nutragreenlife Biotechnology Co., Ltd

- Chemicea Pharma

- Shaanxi Fruiterco Biotechnology Co., Ltd.

- Xi'an Sost Biotech Co., Ltd

- Nanjing NutriHerb BioTech Co., Ltd

- Xi'an Angel Biotechnology Co., Ltd

- Xi'an Chen Lang Biological Technology Co., Ltd.

- Shaanxi Inhealth Nature Industry Co., Ltd.

- Other Key Players