Global Oil Storage Terminal Market By Type (Strategic Reserve, Commercial Reserve), By Tank Type (Open Top, Fixed Roof, Floating Roof, Bullet Tank, Spherical Tank, Others), By Material (Steel, Carbon Steel, Fiberglass-reinforced Plastic, Others), By Product (Diesel, Petrol, Aviation Fuel, Crude Oil, Kerosene, Middle Distillates, Others), By Application (Refineries, Commercial Use, Residential/Industrial Heating, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 130261

- Number of Pages: 307

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

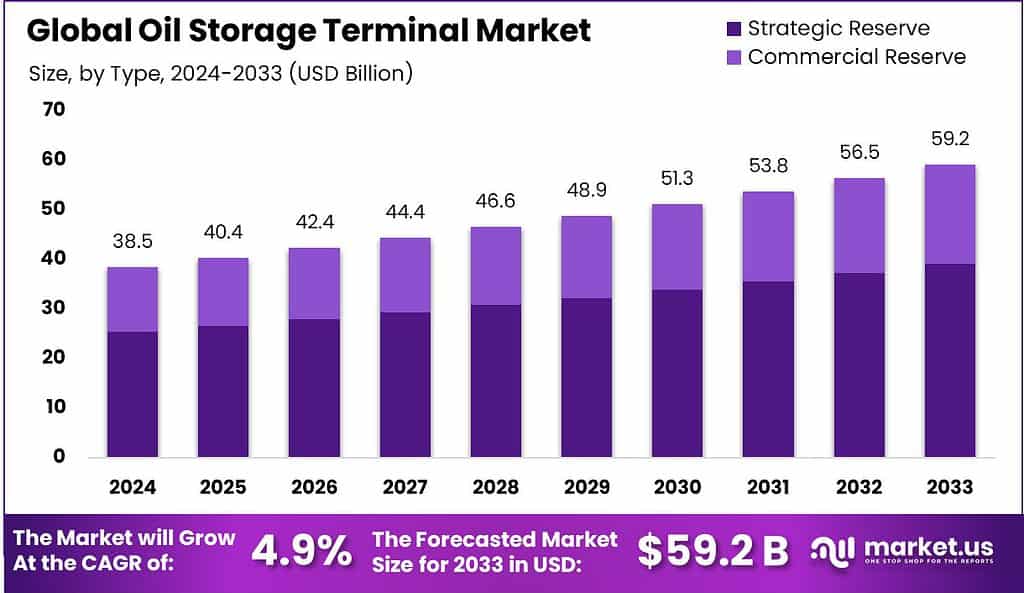

The Global Oil Storage Terminal Market size is expected to be worth around USD 59.2 Billion by 2033, from USD 38.5 Billion in 2023, growing at a CAGR of 4.9% during the forecast period from 2024 to 2033.

The oil storage terminal market is a critical component of the global oil supply chain, providing the infrastructure necessary to store large quantities of oil before distribution to various sectors such as refineries and retail distributors. These facilities are essential for managing the balance between oil supply and demand, ensuring that fluctuations in oil consumption do not disrupt the market.

Significantly, this market is closely tied to the dynamics of global oil trade, where regions like the Middle East and North America play pivotal roles. The United States, for instance, has seen a marked increase in crude oil exports, reaching a record 3.6 million barrels per day in 2022. This surge has necessitated the expansion of storage capacities, particularly at Gulf Coast terminals, to handle the increased volume efficiently.

The demand for oil storage terminals is influenced by several factors, including volatile oil prices and the strategic need for stockpiling to safeguard against potential supply disruptions. As global energy consumption continues to rise, the requirement for substantial storage facilities becomes more pronounced. This has spurred significant investment in both the expansion of existing storage facilities and the construction of new terminals to accommodate growing needs.

Overall, the oil storage terminal market is experiencing growth driven by the essential need to maintain adequate reserves and manage the logistical aspects of oil distribution. This growth is a direct response to the evolving needs of the global economy and the intrinsic link between oil storage capacity and market stability.

Key Takeaways

- The Global Oil Storage Terminal Market size is expected to be worth around USD 59.2 Billion by 2033, from USD 38.5 Billion in 2023, growing at a CAGR of 4.9% during the forecast period from 2024 to 2033.

- Strategic Reserves dominated the Oil Storage Terminal Market with a 66.5% share.

- Fixed Roof tanks dominated the Oil Storage Terminal Market with a 37.6% share.

- Steel dominated the Oil Storage Terminal Market by material with a 48.8% share.

- Diesel dominated the Oil Storage Terminal Market by Product segment with a 26.4% share.

- Refineries dominated the Oil Storage Terminal Market with a 43.3% share.

- The Asia Pacific dominates the oil storage terminal market with a 42% share, valued at USD 16.2 billion.

By Type Analysis

In 2023, Strategic Reserves dominated the Oil Storage Terminal Market with a 66.5% share.

In 2023, Strategic Reserve held a dominant market position in the By Type segment of the Oil Storage Terminal Market, capturing more than a 66.5% share. Strategic Reserves are primarily government-controlled facilities designed to safeguard a country’s fuel supply during supply disruptions or economic instability. The substantial share held by Strategic Reserves can be attributed to increased geopolitical tensions and governmental strategies to enhance energy security, influencing significant investments in these facilities.

Conversely, Commercial Reserves, which include storage facilities operated by private entities, are utilized to manage inventory levels, hedge against price volatility, and ensure continuous supply for operational needs. While Commercial Reserves hold a smaller market share, they play a critical role in the oil supply chain by accommodating the excess oil not required for immediate consumption.

By Tank Type Analysis

In 2023, Fixed Roof tanks dominated the Oil Storage Terminal Market with a 37.6% share.

In 2023, The Fixed Roof segment held a dominant market position in the By Tank Type category of the Oil Storage Terminal Market, capturing more than a 37.6% share. This type of storage tank is preferred for its durability and cost-effectiveness, making it a prime choice for storing non-volatile liquids such as crude oil and refined products that do not emit significant vapor at ambient temperatures. Fixed roof tanks are characterized by a permanently attached roof which can be either cone-shaped or flat.

Following closely, Floating Roof tanks, which are particularly designed to reduce the evaporation loss of stored liquids, accounted for substantial market engagement. These tanks are ideal for volatile liquids and feature a roof that rises and falls with the liquid level, minimizing vapor space.

The Open Top tanks, commonly used for water, fuel, and certain chemicals, offer ease of access but are less common in oil storage due to their open nature and susceptibility to contamination. Bullet Tanks, cylindrical in shape and horizontally placed, are utilized for storing pressurized gases and also noted a significant presence in the market due to their safety features and efficient use of space.

Spherical Tanks, known for their ability to contain high pressure and uniform stress distribution, are primarily used for gas storage like propane and butane. Their unique shape and design engineering make them a critical asset in high-pressure applications.

By Material Analysis

In 2023, Steel dominated the Oil Storage Terminal Market by material with a 48.8% share.

In 2023, Steel held a dominant market position in the By Material segment of the Oil Storage Terminal Market, capturing more than a 48.8% share. This substantial market share can be attributed to steel’s durability and resistance to corrosion, making it highly suitable for the storage of crude oil and petroleum products. As a material, steel ensures longevity and safety, which are critical factors in the storage infrastructure of oil terminals.

Following steel, Carbon Steel emerges as the second most utilized material, noted for its cost-effectiveness and robustness in storing high-volume petroleum products. Carbon steel’s properties allow for handling varying temperatures and pressures, which is essential for maintaining the integrity of stored oil in fluctuating environmental conditions.

Fiberglass-reinforced Plastic (FRP) holds a niche but significant position in the market. FRP’s resistance to corrosion and its lightweight nature make it an attractive alternative for companies looking to reduce maintenance costs and enhance operational efficiency. Its usage is increasingly favored in new installations where advanced materials are prioritized.

By Product Analysis

In 2023, Diesel dominated the Oil Storage Terminal Market by Product segment with a 26.4% share.

In 2023, Diesel held a dominant market position in the by-product segment of the Oil Storage Terminal Market, capturing more than a 26.4% share. This segment’s prominence is underscored by its critical role in various industrial and transportation sectors, where diesel is the preferred fuel due to its energy efficiency and cost-effectiveness.

Following closely, Petrol accounted for a substantial portion of the market, utilized predominantly in the automotive sector. Its demand is driven by the high number of gasoline-powered vehicles, particularly in emerging economies experiencing rapid motorization.

Aviation Fuel also represents a significant share, propelled by its indispensable use in air transport. The recovery of the aviation industry post-pandemic has positively influenced this segment, with increased global air traffic bolstering fuel storage demands.

Crude Oil storage remains crucial, serving as the foundational bulk storage that feeds into various petroleum processing and distribution networks. This segment’s stability is crucial for managing supply chains and price volatility in global oil markets.

Kerosene and Middle Distillates, including heating oil and diesel, are essential for both residential heating and as a fuel in industries and agriculture. These segments are sensitive to seasonal demand fluctuations and geopolitical factors affecting supply chains.

By Application Analysis

In 2023, Refineries dominated the Oil Storage Terminal Market with a 43.3% share.

In 2023, Refineries held a dominant market position in the “By Application” segment of the Oil Storage Terminal Market, capturing more than a 43.3% share. This significant market share can be attributed to the essential role refineries play in the processing and distribution of oil and petroleum products. The demand for oil storage at refineries is driven by the need to ensure a stable supply of crude oil for processing and to balance fluctuations in oil supply and prices.

Following refineries, the Commercial Use category constitutes another critical segment, leveraging storage facilities to manage supply chains and support operations, particularly in sectors heavily reliant on fuel, such as transportation and manufacturing.

The Residential/Industrial Heating segment also relies on these storage facilities, primarily in regions with significant heating oil use, to secure energy supplies against seasonal demands and price volatility.

Key Market Segments

By Type

- Strategic Reserve

- Commercial Reserve

By Tank Type

- Open Top

- Fixed Roof

- Floating Roof

- Bullet Tank

- Spherical Tank

- Others

By Material

- Steel

- Carbon Steel

- Fiberglass-reinforced Plastic

- Others

By Product

- Diesel

- Petrol

- Aviation Fuel

- Crude Oil

- Kerosene

- Middle Distillates

- Others

By Application

- Refineries

- Commercial Use

- Residential/Industrial Heating

- Others

Driving factors

Falling Crude Oil Prices: Stimulating Storage Demand

The decline in crude oil prices often increases demand for oil storage. When oil prices fall, market participants, including trading companies and refinery operators, tend to buy and store oil, anticipating a price rebound that will enhance profitability. This speculative storage, driven by lower oil prices, boosts the demand for storage facilities, thus supporting the expansion of the oil storage terminal market. The dynamic also encourages the development of new storage terminals and the expansion of existing facilities to accommodate increased capacity.

Rising Demand for Crude Oil Products: Fueling Expansion

The escalating consumption of crude oil products globally, spurred by industries and energy generation, directly correlates with the expansion of storage infrastructure. As more oil is processed to meet energy demands, there is a parallel need for enhanced logistic capabilities, including storage. The increased throughput necessitates larger and more efficient storage solutions, which drives the growth of the oil storage terminal market. This trend is particularly pronounced in emerging economies where industrialization and energy needs are growing rapidly.

Urbanization and Population Growth: Intensifying Storage Requirements

Urbanization and population growth are significant contributors to the increased demand for energy, particularly in developing regions. As urban areas expand, the infrastructure for energy distribution must also evolve, which includes facilities for storing crude oil and its derivatives. The nexus of urban expansion and population increase creates a sustained demand for petroleum products, thereby driving the need for expanded and new oil storage facilities. This factor is closely linked with the rising demand for crude oil products, as both are fueled by global economic and demographic trends.

Strategic Reserves Management: Ensuring Energy Security

Strategic reserve management has become a critical component of national energy policies, especially in countries aiming to enhance their energy security. Establishing and expanding strategic petroleum reserves requires substantial investments in oil storage terminals. This governmental intervention is designed to mitigate the risks associated with supply disruptions and price volatility. By maintaining adequate reserve levels, countries can stabilize the market during supply shortages, thereby underpinning the continuous growth of the oil storage terminal market.

Increased Production Capacity: Amplifying Storage Needs

As oil production capacity increases, particularly in oil-rich regions and countries investing heavily in their extraction capabilities, there is a corresponding rise in the need for storage. The expansion of production capacity, whether through technological advancements or new field developments, necessitates robust storage solutions to manage the output efficiently. This increase not only involves storing the crude oil itself but also handling the intermediate and finished products, which supports sustained growth in the market for oil storage terminals.

Restraining Factors

Impact of Renewable Energy Adoption on Oil Storage Terminal Market

The adoption of renewable energy significantly restrains the growth of the oil storage terminal market. As governments and corporations globally push for a greener energy mix, investment and reliance on oil diminish. The shift reduces the demand for oil storage infrastructure, directly impacting market size and growth potential.

For instance, the report projects that renewable energy capacity is set to expand by 50% between 2019 and 2024, primarily driven by solar and wind energy developments. This shift often correlates with reduced investments in oil infrastructure, influencing long-term market dynamics in the oil storage sector.

High Construction and Maintenance Costs

The high costs associated with constructing and maintaining oil storage terminals act as a significant restraint on market expansion. The initial capital required for constructing large-scale storage facilities, coupled with ongoing maintenance and upgrade costs, deters new entrants and can strain the financial resources of existing players.

This economic burden can be particularly prohibitive in regions where capital investment is limited or where the return on investment becomes less attractive due to fluctuating oil prices. These financial considerations directly limit the market’s ability to expand in both capacity and geographic reach.

Stringent Environmental Regulations

Environmental regulations are increasingly stringent in the oil storage industry, imposing limits on growth. Regulations aimed at preventing spills and minimizing ecological damage require substantial compliance investments from terminal operators.

For example, the U.S. Environmental Protection Agency (EPA) enforces strict requirements for spill prevention, control, and countermeasure (SPCC) plans, which necessitate significant financial outlays for compliance. These regulations not only increase operational costs but also lengthen the timeframes for project approvals, thereby slowing market growth.

Geopolitical Tensions and Market Volatility

Geopolitical tensions significantly influence the oil storage terminal market by introducing volatility and unpredictability. Regions fraught with political instability or conflict can see disruptions in oil supply chains, affecting storage needs and capacity utilization rates.

For instance, conflicts in oil-rich regions like the Middle East can lead to global oil price fluctuations, impacting strategic reserves and storage patterns. This unpredictability can deter investment in storage infrastructure, especially in regions perceived as high-risk, thus restraining market growth.

Technological Advancements in Energy Alternatives

Technological advancements in alternative energy sources present a dual-edged sword for the oil storage terminal market. While innovations in fossil fuel extraction and storage technologies can enhance operational efficiencies and reduce costs, breakthroughs in alternative energy technologies like electric vehicles (EVs) and hydrogen fuel cells diminish the overall oil demand.

As these technologies become more commercially viable and widespread, the long-term necessity for extensive oil storage capacities is called into question, potentially leading to underutilized assets and a reevaluation of investment strategies within the industry.

Growth Opportunity

Strategic Petroleum Reserves Expansion

The expansion of strategic petroleum reserves globally serves as a significant growth driver for the oil storage terminal market. Nations are increasingly focusing on enhancing their energy security, which necessitates substantial investments in additional storage capacities. This expansion directly correlates with an uptick in demand for large-scale storage facilities, positioning storage infrastructure as a critical asset in energy strategy frameworks.

Regulatory Changes Favoring Storage Infrastructure

Recent regulatory changes across various countries are creating favorable conditions for the development and expansion of oil storage facilities. Governments are revising policies to bolster energy reserves, which involves streamlining approval processes and providing financial incentives for storage infrastructure. Such regulatory environments are expected to lower barriers to entry and stimulate market growth.

Increased Production Capacity

As oil production capacity escalates, particularly in the U.S., Russia, and Saudi Arabia, the need for corresponding storage capacity also rises. The synchronization of production increases with storage capacity is critical to manage the supply chain efficiently and stabilize market volatility, presenting substantial opportunities for market expansion.

Integration with Renewable Energy Sources

The integration of oil storage with renewable energy sources is becoming a pivotal aspect of modern energy strategies. This trend is fostering innovations in storage technology, including the development of hybrid systems that enhance energy efficiency and reduce operational costs. Such integrations offer dual benefits of sustainability and market growth.

Investment in Infrastructure Development

Significant investments in infrastructure development, particularly in emerging economies, are projected to propel the oil storage terminal market forward. These investments are not only enhancing existing facilities but also paving the way for the construction of new, state-of-the-art storage terminals. The emphasis on modernizing infrastructure is expected to improve operational efficiencies and boost market growth prospects.

Latest Trends

Increased Storage Capacity

The expansion of storage capacity is projected to be a significant trend in the oil storage terminal market. As global oil consumption stabilizes, the strategic emphasis shifts towards enhancing storage infrastructure. This expansion supports not only operational flexibility but also aids in managing supply chain volatilities, thereby stabilizing oil prices during fluctuating market conditions.

Floating Roof Tanks

Floating roof tanks will gain traction due to their efficiency and environmental benefits. These tanks minimize the evaporation losses of stored hydrocarbons, a critical factor in operational cost reduction and environmental compliance. The adoption of such innovative storage solutions is anticipated to rise as industry standards tighten and technology costs decrease, making them more accessible and cost-effective.

Sustainability Initiatives

Sustainability in the oil storage terminal market is becoming increasingly crucial. The industry is seeing a shift towards incorporating more eco-friendly practices and technologies to mitigate environmental impact. This includes the installation of emissions-control systems, implementation of spill-prevention protocols, and the integration of green technologies. These initiatives not only comply with global environmental regulations but also enhance the corporate image of storage operators, potentially attracting more investment.

Investment in Infrastructure

Substantial investments in infrastructure are critical to supporting the aforementioned trends in the oil storage terminal market. Enhanced connectivity through upgraded port facilities, pipelines, and road networks is essential to optimize the distribution process.

Moreover, investments are not only directed towards physical infrastructure but also towards digitalization and automation technologies to improve operational efficiencies and safety standards.

Regional Analysis

The Asia Pacific dominates the oil storage terminal market with a 42% share, valued at USD 16.2 billion.

The oil storage terminal market exhibits varied growth dynamics across global regions, reflecting differential infrastructure development, regional policies, and economic activities.

North America: This region’s market is characterized by advanced infrastructure and significant investments in strategic petroleum reserves. The U.S. and Canada, with their substantial crude oil production, drive regional demand for storage facilities. Enhanced exploration activities, particularly in shale oil, further support the expansion of oil storage capacities.

Europe: Europe’s market is influenced by stringent regulations and a strong emphasis on renewable energy sources. However, key ports in the Netherlands, Spain, and Italy continue to expand their oil storage capacities to ensure energy security and support trading activities. The region’s focus on sustainability may temper growth relative to other markets.

Asia Pacific (APAC): Dominating the global landscape, APAC accounts for approximately 42% of the market, valued at USD 16.2 billion. Rapid industrialization, increasing oil imports, and strategic reserves in countries like China and India are key growth drivers. This region’s market is expected to expand significantly, supported by both governmental initiatives and private-sector investments.

Middle East & Africa (MEA): The MEA region, rich in hydrocarbon resources, focuses on optimizing existing capacities and developing new infrastructure to cater to both domestic needs and export requirements. The strategic geographical position facilitates the handling and storage of oil, enhancing its global market participation.

Latin America: Latin America is seeing gradual growth in the oil storage terminal market, propelled by countries like Brazil and Venezuela. Despite political and economic challenges, the region is investing in infrastructure to support its oil production capabilities and improve its position in the global oil trade.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global oil storage terminal market will continue to be driven by increasing energy demand, fluctuating oil prices, and the strategic need for reliable storage infrastructure. Key players in this market have positioned themselves through expansions, technological advancements, and geographic diversification to meet the industry’s evolving demands.

Belco Manufacturing and Containment Solutions, Inc. is notable for its focus on manufacturing advanced containment systems, playing a pivotal role in addressing environmental regulations and safety standards. Brooge Energy Limited and Oman Tank Terminal Company have expanded their operational capacities in key regions like the Middle East, catering to the growing demand for oil storage in these energy-dominant areas.

Royal Vopak and Buckeye Partners L.P. remain influential through their global network of terminals, leveraging strategic acquisitions and partnerships to maintain their market presence. Oiltanking GmbH, along with Koole Terminals B.V., has continued to focus on sustainability and innovation, increasingly integrating renewable energy storage solutions into their portfolios, and anticipating future shifts in energy consumption.

Furthermore, Shell Oil Company and Vitol Group capitalize on their vertically integrated operations, benefiting from economies of scale and extensive global market reach. Smaller but agile players, like Olivia Petroleum, S.A.U., and Puma Energy Group, maintain regional strongholds, often focusing on niche markets or emerging economies.

Overall, the global oil storage terminal market remains competitive, with key players adapting through expansions, sustainability initiatives, and technological innovation to meet the sector’s changing landscape.

Market Key Players

- Belco Manufacturing

- Brooge Energy Limited

- Buckeye Partners L.P.

- CIM-CCMP Group

- CLH Group

- Containment Solutions, Inc.

- Ergon International Corp.

- Horizon Terminals Ltd.

- Koole Terminals B.V.

- LBC Tank Terminals

- Odfjell SE

- Oiltanking GmbH

- Olivia Petroleum

- S.A.U.

- Oman Tank Terminal Company

- Puma Energy Group

- Royal Vopak

- Shell Oil Company

- Vitol Group.

Recent Development

- December 2023: The construction of phase one of the oil and refined products terminal in Plaquemines Parish, Louisiana, was announced by NOLA Oil Terminal LLC. This project, spanning 158 acres and costing approximately USD 300 million, includes two deepwater ports capable of handling 170,000-ton tank vessels, enhancing oil storage and logistics in the region.

- May 2024: AltaGas and Vopak announced a partnership to develop an export facility that will include bulk liquids terminal operations with marine and logistics infrastructure. This venture aims to increase North America’s oil export capacities.

Report Scope

Report Features Description Market Value (2023) USD 38.5 Billion Forecast Revenue (2033) USD 59.2 Billion CAGR (2024-2032) 4.9% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Strategic Reserve, Commercial Reserve), By Tank Type (Open Top, Fixed Roof, Floating Roof, Bullet Tank, Spherical Tank, Others), By Material (Steel, Carbon Steel, Fiberglass-reinforced Plastic, Others), By Product (Diesel, Petrol, Aviation Fuel, Crude Oil, Kerosene, Middle Distillates, Others), By Application (Refineries, Commercial Use, Residential/Industrial Heating, Others) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape By Type (Strategic Reserve, Commercial Reserve), By Tank Type (Open Top, Fixed Roof, Floating Roof, Bullet Tank, Spherical Tank, Others), By Material (Steel, Carbon Steel, Fiberglass-reinforced Plastic, Others), By Product (Diesel, Petrol, Aviation Fuel, Crude Oil, Kerosene, Middle Distillates, Others), By Application (Refineries, Commercial Use, Residential/Industrial Heating, Others) Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Oil Storage Terminal MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Oil Storage Terminal MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Belco Manufacturing

- Brooge Energy Limited

- Buckeye Partners L.P.

- CIM-CCMP Group

- CLH Group

- Containment Solutions, Inc.

- Ergon International Corp.

- Horizon Terminals Ltd.

- Koole Terminals B.V.

- LBC Tank Terminals

- Odfjell SE

- Oiltanking GmbH

- Olivia Petroleum

- S.A.U.

- Oman Tank Terminal Company

- Puma Energy Group

- Royal Vopak

- Shell Oil Company

- Vitol Group.