Global Oil And Gas Drone Market Size, Share Analysis Report By Type (Single Rotor, Multi Rotor, Fixed Wing, Hybrid and Nano), By Applications (Inspection, Security and Emergency Response, Surveying and Mapping), By End-Use (Construction, Agriculture, Mining, Oil and Gas, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173812

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

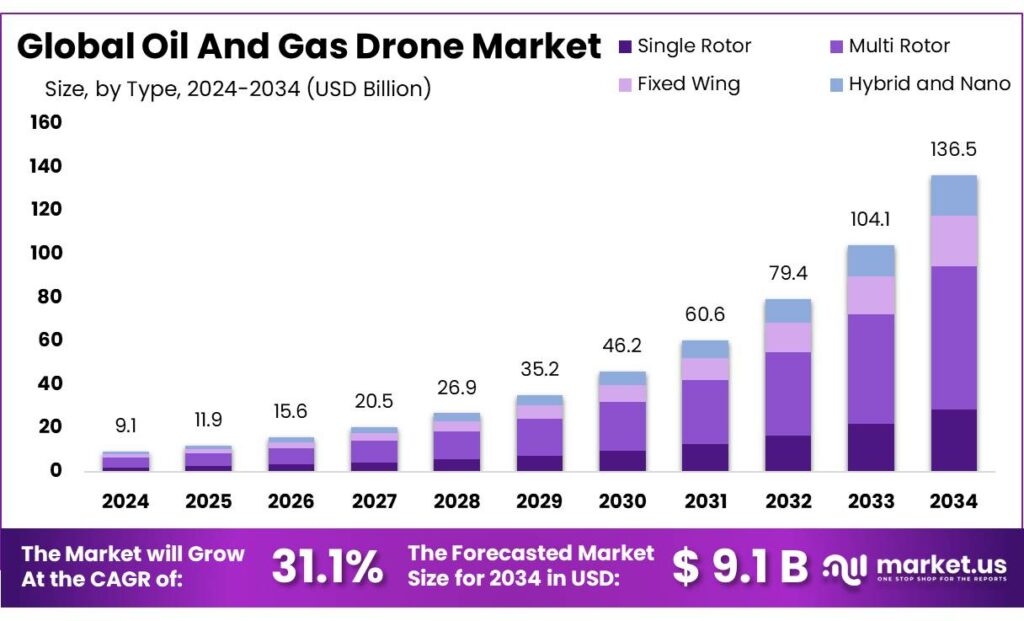

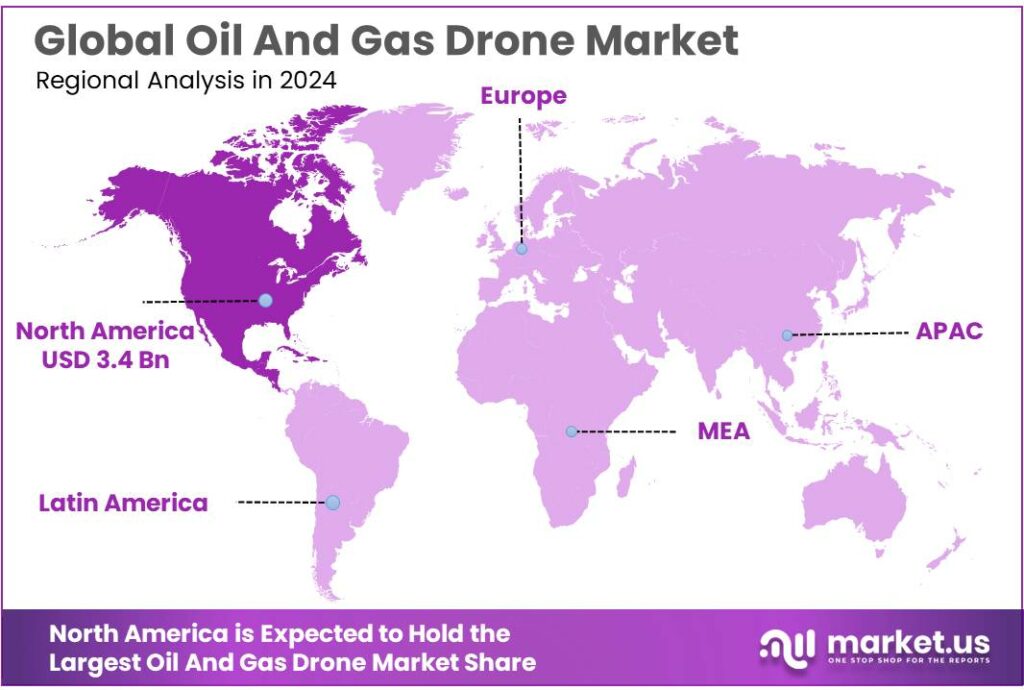

Global Oil And Gas Drone Market size is expected to be worth around USD 136.5 Billion by 2034, from USD 9.1 Billion in 2024, growing at a CAGR of 31.1% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 37.8% share, holding USD 3.4 Billion in revenue.

Oil and gas drones refer to unmanned aerial systems (UAS) used to inspect, survey, and monitor upstream, midstream, and downstream assets—such as well pads, refineries, tank farms, pipelines, and offshore facilities—using payloads like RGB cameras, thermal imaging, LiDAR, and methane-sensing instruments. The industrial backdrop is shaped by the scale and dispersion of infrastructure and the high cost of downtime and safety exposure. In the United States alone, the energy transportation network includes over 2.5 million miles of pipelines, creating a vast, repeat-inspection workload where aerial data collection can be faster and safer than many ground-based methods.

- Industry conditions are supportive because asset footprintsare huge and geographically dispersed. In the United States alone, PHMSA’s annual reporting shows 892,085 miles of onshore natural gas transmission pipeline in 2024, plus 2,370,743 miles of gas distribution mains and services. On a global lens, the Global Gas Infrastructure Tracker reports 1.49 million km of combined gas pipeline length tracked across 4,158 pipelines—illustrating why scalable, remote inspection methods are increasingly attractive.

Operationally, drones are increasingly positioned as “digital inspection” tools that feed maintenance teams with high-frequency visual evidence, 3D models, and hotspot maps. The market’s urgency is amplified by methane management and integrity assurance across aging and expanding assets. The IEA estimates that fossil fuel production and use resulted in close to 120 million tonnes (Mt) of methane emissions in 2023, and notes that oil operations account for around 50 Mt while the natural gas supply chain contributes just under 30 Mt.

Governments are tightening expectations: the U.S. EPA finalized methane standards on December 2, 2023, including requirements that extend to existing sources nationwide and a “Super Emitter Program” designed to use advanced detection technologies and third-party data. In Europe, Regulation (EU) 2024/1787 establishes rules for measurement, monitoring, reporting, verification, and LDAR in oil and gas.

Emissions compliance is another accelerating force, especially for methane. The IEA estimates fossil-fuel production and use generated close to 120 million tonnes (Mt) of methane emissions in 2023 (with energy-sector methane near 130 Mt when including other energy sources), and it breaks out oil operations at around 50 Mt and the natural gas supply chain at just under 30 Mt.

Key Takeaways

- Oil And Gas Drone Market size is expected to be worth around USD 136.5 Billion by 2034, from USD 9.1 Billion in 2024, growing at a CAGR of 31.1%.

- Multi Rotor held a dominant market position, capturing more than a 48.3% share.

- Inspection held a dominant market position, capturing more than a 56.1% share.

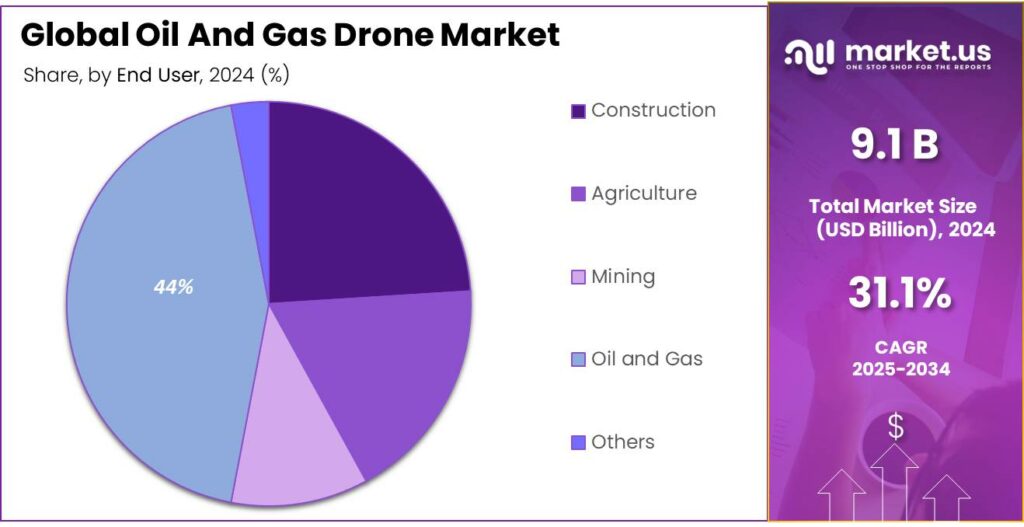

- Oil and Gas held a dominant market position, capturing more than a 44.2% share.

- North America region emerged as the dominant contributor to the global Oil and Gas Drone market, capturing approximately 37.8% of total revenue and achieving an estimated market value of USD 3.4 billion.

By Type Analysis

Multi Rotor dominates with a 48.3% share due to operational flexibility and ease of deployment

In 2024, Multi Rotor held a dominant market position, capturing more than a 48.3% share. This leadership was mainly driven by its strong suitability for oil and gas operations that require stable hovering, vertical take-off and landing, and precise low-altitude inspection. Multi rotor drones were widely used for pipeline monitoring, flare stack inspection, offshore platform surveillance, and leak detection, where controlled movement and high maneuverability were critical.

The segment benefited from faster deployment time and lower training requirements, which supported higher adoption across upstream and midstream activities in 2024. Moving into 2025, demand for multi rotor drones is expected to remain strong as operators continue to prioritize safety, reduce manual inspection risks, and improve real-time data collection across complex oil and gas environments.

By Applications Analysis

Inspection leads with a 56.1% share driven by safety needs and frequent asset monitoring

In 2024, Inspection held a dominant market position, capturing more than a 56.1% share. This strong presence was mainly supported by the growing use of drones for routine inspection of pipelines, refineries, storage tanks, and offshore platforms, where human access is difficult or risky. Inspection applications helped operators reduce downtime, lower maintenance costs, and improve worker safety by limiting manual inspections in hazardous zones.

In 2024, drones were increasingly preferred for visual checks, thermal imaging, and corrosion detection, allowing faster identification of faults before they escalated. Looking ahead to 2025, inspection is expected to remain the leading application as oil and gas companies continue to focus on preventive maintenance, regulatory compliance, and cost-efficient asset management across large and remote operational sites.

By End-Use Analysis

Oil and Gas dominates with a 44.2% share supported by large-scale field operations and safety focus

In 2024, Oil and Gas held a dominant market position, capturing more than a 44.2% share. This leadership was largely linked to the sector’s extensive use of drones across exploration, production, and transportation activities, where continuous monitoring and risk reduction are essential. In 2024, drones were widely applied across onshore fields, offshore platforms, and pipeline networks to support faster inspections, reduce exposure of workers to hazardous environments, and improve operational efficiency.

The end-use segment also benefited from rising investments in digital tools aimed at lowering maintenance costs and preventing unplanned shutdowns. Looking into 2025, the Oil and Gas end-use is expected to maintain its strong position as operators continue to adopt drone-based solutions to enhance asset visibility, comply with safety standards, and manage large infrastructure spread across remote locations.

Key Market Segments

By Type

- Single Rotor

- Multi Rotor

- Fixed Wing

- Hybrid and Nano

By Applications

- Inspection

- Security and Emergency Response

- Surveying and Mapping

By End-Use

- Construction

- Agriculture

- Mining

- Oil and Gas

- Others

Emerging Trends

Autonomous drone-in-a-box flights are becoming the new normal for methane and LDAR work

One of the latest, most practical trends in oil and gas drones is the shift from “a crew flies a drone when needed” to autonomous, repeatable flights that run from a fixed dock at the site. In simple terms, operators are moving toward drones that live on-site, charge in a weatherproof box, launch on a schedule, and send inspection results back to a central team.

What is pushing this trend forward is methane compliance becoming more measurement-driven and more documented. EPA’s Methane Super Emitter Program is designed to use EPA-certified third parties and EPA-approved remote-sensing technologies to identify large methane releases and inform owners/operators so corrections can be made.

A strong signal that automation is moving into the compliance mainstream is EPA’s Alternative Test Method approval for an autonomous optical gas imaging (OGI) drone system. In EPA’s approval and justification document for Percepto’s Air Max OGI System, EPA states the solution meets periodic screening requirements for the 1 kg/hr detection threshold and notes the submission was determined complete on June 25, 2025.

In parallel, aviation policy is starting to catch up with how industry actually wants to fly. The FAA’s proposed BVLOS rulemaking is meant to create a clearer pathway for routine and scalable beyond-visual-line-of-sight operations, and it is directly tied to direction from the FAA Reauthorization Act of 2024 to establish performance-based rules for BVLOS.

Drivers

Methane rules and safety compliance are pushing oil and gas drone use faster

One major driver for oil and gas drones is the growing pressure to find leaks early and prove repairs quickly, especially for methane. Methane is valuable product when it stays in the pipe, but it becomes a climate and safety issue when it escapes. The International Energy Agency (IEA) estimates the global energy sector released nearly 135 million tonnes of methane in 2022.

Drones fit this need because they help teams check large areas without putting people in risky locations. A drone can scan pipelines, tank farms, flare systems, and compressor stations in hours, then deliver photo, thermal, and sensor data that maintenance teams can act on. This matters because the asset base is huge. In the U.S., PHMSA’s annual reporting shows 892,085 miles of onshore natural gas transmission pipeline in 2024. On the distribution side, PHMSA reports 2,370,743 miles of total distribution main and estimated service mileage in 2024, plus 72,699,001 distribution services.

Regulation is also making leak detection more structured and documented. In the European Union, Regulation (EU) 2024/1787 sets out rules for accurate measurement, monitoring, reporting and verification of methane emissions, and it explicitly includes leak detection and repair (LDAR) surveys for the oil and gas sector.

Investment levels reinforce this driver, because operators continue to fund integrity work at scale. The IEA expects overall upstream oil and gas investment for 2025 to be just under USD 570 billion, with around 40% dedicated to slowing production declines at existing fields.

Restraints

Strict flight rules and slow BVLOS approvals still limit large-area oil & gas drone work

A major restraint for oil and gas drones is not the aircraft itself, but the operating permissions around it. Many oil and gas use cases—pipeline patrol, right-of-way checks, and long linear corridor surveys—work best when a drone can fly far beyond the pilot’s eyesight. However, the core U.S. operating rule for most commercial small drones (Part 107) is visual line of sight. The regulation states that the remote pilot must be able to see the drone throughout the entire flight using unaided vision.

Because of this, operators often need waivers, exemptions, or more complex authorizations to do the jobs that create the biggest ROI. The FAA explains that Part 107 waivers allow operators to deviate from certain rules only if they demonstrate they can still fly safely using alternative methods. In real projects, that means building a safety case, mapping airspace, defining detect-and-avoid procedures, documenting lost-link behavior, and proving the team’s training and operational discipline. For smaller service contractors, the time and compliance effort can become a real barrier, especially when project timelines are tight and site conditions change.

- A U.S. Department of Transportation Office of Inspector General report notes that, as of February 2025, the FAA had issued only six Part 135 certificates to drone operators engaged in package delivery (a sign of how limited “air carrier–style” drone approvals remain), and it also notes that, as of April 2024, the FAA issued 44,807 exemptions for agricultural operations covering 38 drone models.

Even when BVLOS is possible, it is frequently handled through narrow, conditional approvals. A widely reported U.S. government proposal to ease long-distance drone restrictions noted that, up to that point, the FAA had already approved 657 waivers allowing BVLOS operations, but the waiver process was still seen as difficult and limited by conditions. For oil and gas teams, the practical impact is that one site may be cleared while another site—only a few hundred kilometers away—may require a fresh application, different mitigations, or additional coordination near controlled airspace.

Opportunity

Methane and flaring reduction programs are creating a big runway for drone-based inspection and measurement

A clear growth opportunity for oil and gas drones is the fast-expanding need to measure methane leaks and verify fixes, not just spot problems. This is moving from “good practice” to “must-have proof” because methane is now a top climate and compliance focus. The International Energy Agency estimates that the production and use of fossil fuels caused close to 120 million tonnes (Mt) of methane emissions in 2023.

The opportunity becomes even bigger when it is linked to flaring and wasted gas. The World Bank’s Global Flaring and Methane Reduction partnership estimates that gas flaring in 2024 released 389 million tonnes of CO₂e, and a World Bank press release also highlights flaring reached 151 billion cubic meters (bcm) in 2024, wasting about $63 billion in lost energy. For operators, this turns methane and flaring reduction into a “value recovery” story, not only a climate story.

Government initiatives are tightening the “find and fix” cycle, which increases demand for frequent surveys. In the EU, the European Commission explains that oil and gas companies are required to survey equipment to detect leaks and, when leaks are found, repair them mostly within 5 or 15 working days, with follow-up monitoring to confirm repairs.

In the United States, another opportunity is the rise of third-party measurement ecosystems. EPA’s Methane Super Emitter Program allows EPA-certified third parties to use EPA-approved remote-sensing technologies to collect data on potential super-emitter events and provide that data to EPA. Scale also matters.

The U.S. pipeline network alone shows why drones can grow into a routine tool rather than a special project. PHMSA reports 892,077 miles of natural gas transmission and gathering mileage in 2024, plus 2,370,743 miles of gas distribution main and estimated service mileage in 2024.

Regional Insights

North America leads with 37.8% share, valued at USD 3.4 Bn, driven by advanced infrastructure and strong tech adoption

In 2024, the North America region emerged as the dominant contributor to the global Oil and Gas Drone market, capturing approximately 37.8% of total revenue and achieving an estimated market value of USD 3.4 billion. This commanding position was underpinned by the extensive and mature oil and gas infrastructure present across the United States, Canada, and Mexico, where extensive pipeline networks, offshore platforms, and large refinery complexes have driven early and widespread adoption of unmanned aerial systems.

The United States, in particular, accounted for a disproportionate share of regional demand, supported by regulatory frameworks that facilitate commercial drone operations, and by significant investments in digital transformation across both upstream and midstream sectors. Canada contributed materially to the regional footprint through its adoption of UAV technologies for environmental compliance and Arctic pipeline monitoring. Mexico’s oil and gas modernization efforts further strengthened the regional position.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AeroVironment Inc., with reported revenues of US$820.6 million in FY2025, designs small and medium-sized drones that support remote inspection and monitoring tasks in oil and gas environments. Its resilient UAV solutions improve sensor accuracy and operational response speeds, supporting safer inspection missions across distributed infrastructure, particularly in demanding weather conditions.

DJI Enterprise, part of DJI Technology Co., Ltd., delivers advanced multi-rotor and industrial UAVs widely used for inspection, mapping, and surveillance in oil and gas operations. With an overall company revenue of approximately US$3.83 billion (2021), DJI’s platforms continue to lead in sensor capability, flight stability, and data capture performance, reducing inspection cycle times and enhancing field data quality.

Yamaha Motor Co. Ltd., with a ¥86,100 million capital base as of Sept 2025 and over 54,206 employees (Dec 2024), develops industrial unmanned helicopters and UAVs in its Robotics segment. While historically focused on agriculture, Yamaha’s unmanned aircraft platforms can be adapted for industrial inspection tasks, contributing to early adoption of drone technology in inspection and monitoring of energy infrastructure.

Top Key Players Outlook

- The Boeing Company

- GE Aviation

- BAE Systems plc

- Yamaha Motor Co. Ltd.

- DJI Enterprise

- AeroVironment Inc.

- Skydio Inc.

- XAG Co. Ltd.

- senseFly SA

- Microdrones GmbH

Recent Industry Developments

In February 2024, BAE Systems completed the acquisition of Malloy Aeronautics, gaining UAVs capable of lifting payloads from 68 kg to 300 kg, strengthening its capacity to offer rugged and adaptable uncrewed aircraft that can be used for long-range surveillance and offshore asset inspection.

Report Scope

Report Features Description Market Value (2024) USD 9.1 Bn Forecast Revenue (2034) USD 136.5 Bn CAGR (2025-2034) 31.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Single Rotor, Multi Rotor, Fixed Wing, Hybrid and Nano), By Applications (Inspection, Security and Emergency Response, Surveying and Mapping), By End-Use (Construction, Agriculture, Mining, Oil and Gas, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape The Boeing Company, GE Aviation, BAE Systems plc, Yamaha Motor Co. Ltd., DJI Enterprise, AeroVironment Inc., Skydio Inc., XAG Co. Ltd., senseFly SA, Microdrones GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- The Boeing Company

- GE Aviation

- BAE Systems plc

- Yamaha Motor Co. Ltd.

- DJI Enterprise

- AeroVironment Inc.

- Skydio Inc.

- XAG Co. Ltd.

- senseFly SA

- Microdrones GmbH