Global Off-Road Vehicle Braking System Market Size, Share, Growth Analysis By Vehicle Type (Sport Utility Vehicles, Utility Task Vehicles, All-Terrain Vehicles, Others), By Brake Type (Hydraulic Brakes, Pneumatic Brakes, Disc Brakes, Others), By Component Material (Steel, Carbon Composite, Others), By Application, By Brake System Operations, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154530

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Vehicle Type Analysis

- Brake Type Analysis

- Component Material Analysis

- Application Analysis

- Brake System Operations Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Off-Road Vehicle Braking System Company Insights

- Recent Developments

- Report Scope

Report Overview

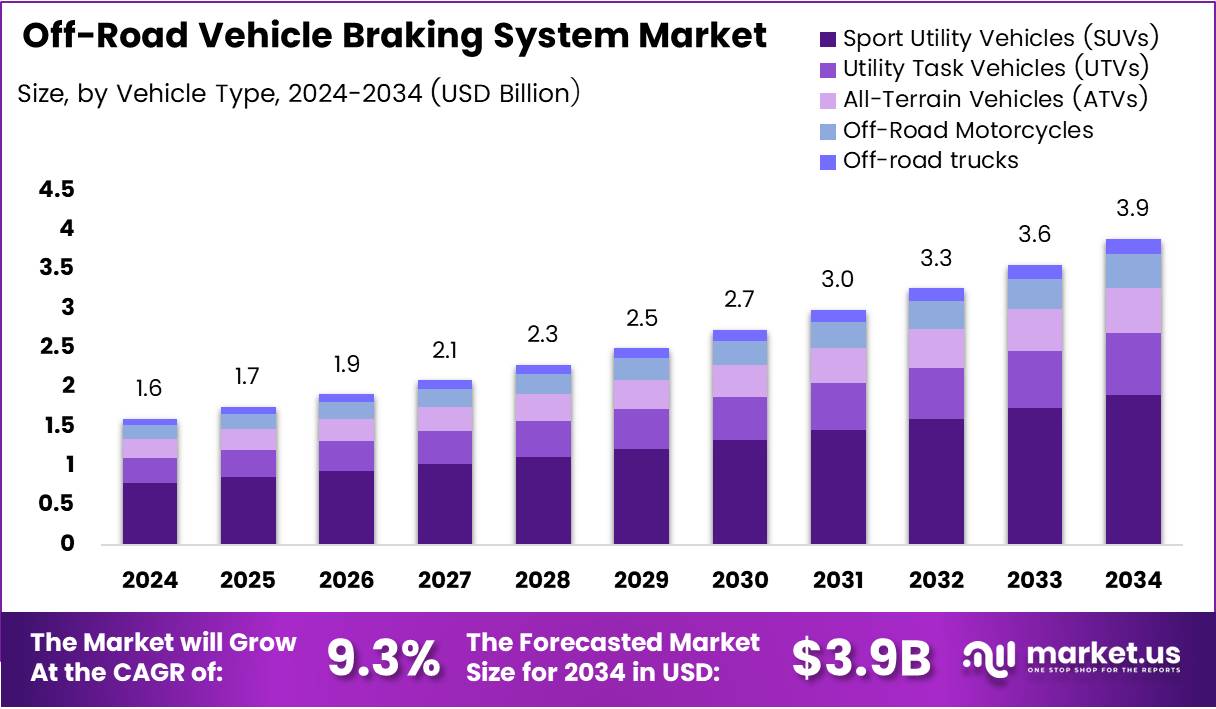

The Global Off-Road Vehicle Braking System Market size is expected to be worth around USD 3.9 Billion by 2034, from USD 1.6 Billion in 2024, growing at a CAGR of 9.3% during the forecast period from 2025 to 2034.

The Off-Road Vehicle Braking System Market is gaining momentum due to the growing demand for high-performance braking technologies across agriculture, construction, defense, and recreational applications. These braking systems are engineered to deliver reliability in rugged terrains and extreme environmental conditions, where conventional systems often fail. As safety regulations tighten, OEMs are integrating advanced brake assemblies with electronic assistance.

Off-road vehicle braking systems include hydraulic disc brakes, drum brakes, regenerative braking (for electric models), and ABS specifically calibrated for off-road dynamics. These components are crucial in ensuring not just driver safety but also optimal performance on unpredictable surfaces. Market trends now lean toward lightweight and corrosion-resistant materials to improve system life and fuel efficiency.

The off-road vehicle braking system is a core enabler in enhancing maneuverability and control in tough terrains. The increasing use of electric and hybrid off-road vehicles also influences braking technology innovation. Regenerative braking is emerging as a new segment, helping improve energy efficiency while maintaining vehicle stability.

Moreover, consumer demand for safety-enhancing features such as hill descent control, traction-optimized ABS, and intelligent brake force distribution is increasing. Tier-1 manufacturers are responding by embedding sensors and electronics that monitor brake wear, temperature, and hydraulic pressure in real-time.

Supply chain dynamics are shifting toward local manufacturing hubs to reduce lead times. The market is also seeing a rise in private-label braking systems for aftermarket demand, especially in South America and Africa. These trends reflect growing product diversification and cost-sensitive consumer preferences.

R&D investment in advanced materials like ceramic-composite rotors and e-brake modules is increasing. These developments offer reduced brake fade and longer service intervals—key requirements for heavy-duty off-road use in mining and construction fleets.

Digitalization is also reshaping the industry. OEMs are integrating predictive maintenance software and telemetry data to extend brake life and reduce total cost of ownership. Connected braking systems, once rare in off-road applications, are now becoming mainstream in premium segments.

Simultaneously, environmental regulations are pushing OEMs toward sustainable brake pads and fluid technologies. Non-asbestos materials and eco-friendly lubricants are in high demand, especially in Europe and Japan, which have stringent safety and environmental norms.

Key Takeaways

- The Global Off-Road Vehicle Braking System Market is projected to reach USD 3.9 Billion by 2034 from USD 1.6 Billion in 2024, growing at a CAGR of 9.3%.

- In 2024, SUVs held the largest share in the vehicle type segment with 31.8%, driven by their multifunctional utility across terrains.

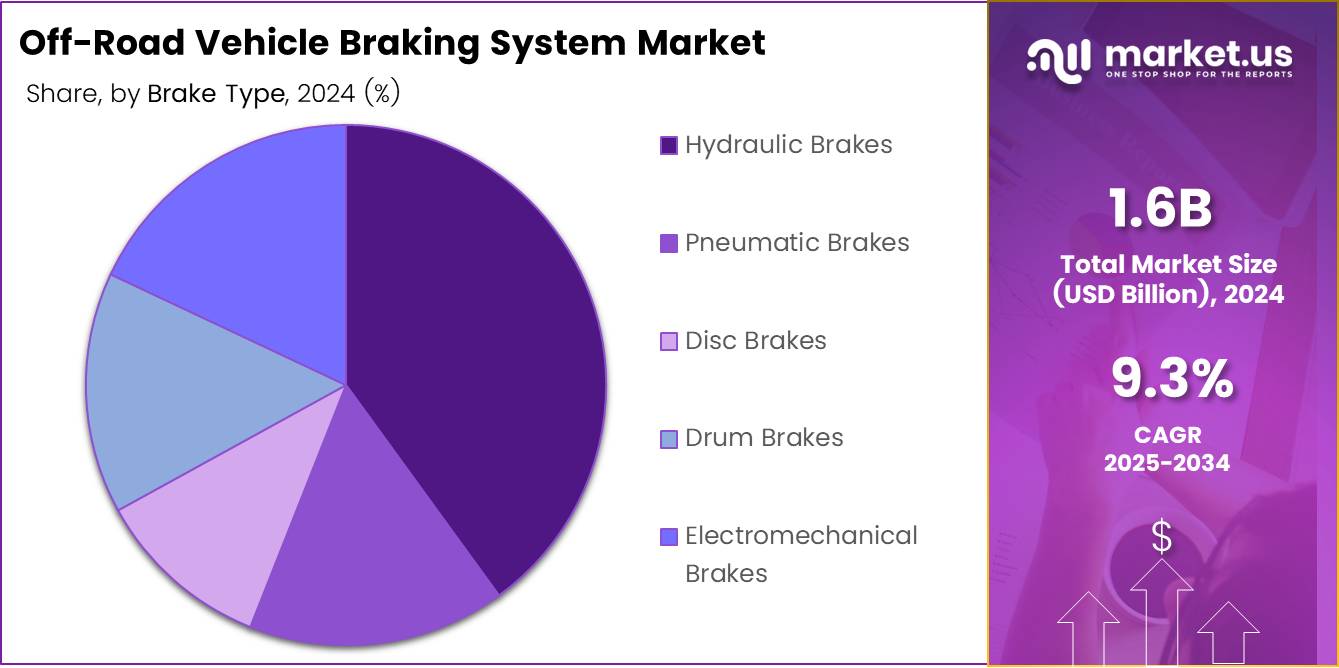

- Hydraulic Brakes dominated the Brake Type segment in 2024, favored for their superior stopping power and responsive control.

- Steel led the Component Material segment in 2024, due to its strength, availability, and resistance to deformation in rugged environments.

- The Agricultural Off-Roading Application segment held the top position in 2024, fueled by increased mechanized farming and UTV adoption.

- Manual Brake Systems dominated in 2024 under Brake system operations, valued for their mechanical simplicity and terrain reliability.

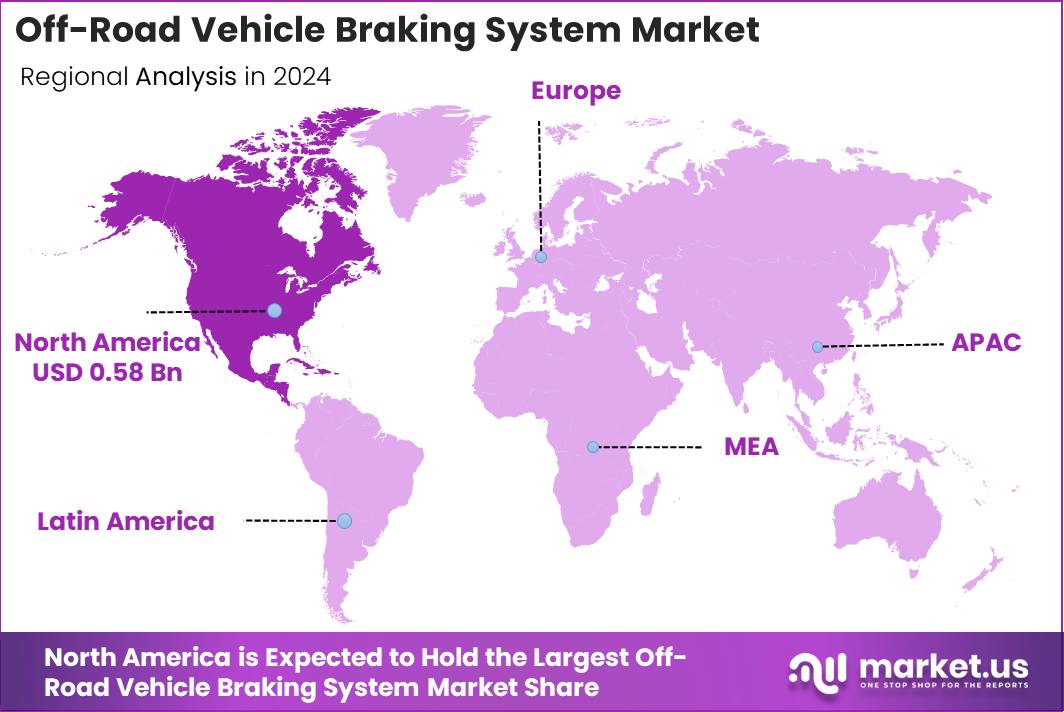

- North America led the global market in 2024 with a 36.1% share valued at USD 0.58 Billion, driven by high consumer spending and stringent safety norms.

Vehicle Type Analysis

Sport Utility Vehicles (SUVs) lead with 31.8% due to high versatility and market penetration.

In 2024, Sport Utility Vehicles (SUVs) held a dominant market position in By Vehicle Type Analysis segment of Off-Road Vehicle Braking System Market, with a 31.8% share. The significant traction for SUVs stems from their multifunctional capabilities across various terrains and wide consumer adoption for both recreational and utilitarian purposes.

Utility Task Vehicles (UTVs) followed closely, gaining popularity among agricultural and industrial users due to their compact size and performance flexibility. Meanwhile, All-Terrain Vehicles (ATVs) continue to attract outdoor enthusiasts for sports and leisure, contributing modestly to the overall segment.

Off-Road Motorcycles cater to a niche but loyal consumer base, with growing demand in motorsports. Lastly, off-road trucks remain critical in heavy-duty applications like construction and remote transport, although their market share remains more limited compared to SUVs.

Brake Type Analysis

Hydraulic Brakes dominate with % due to their superior control and braking efficiency.

In 2024, Hydraulic Brakes held a dominant market position in By Brake Type Analysis segment of Off-Road Vehicle Braking System Market. Their superior stopping power, responsive control, and adaptability across diverse vehicle types make them the preferred choice for manufacturers and users alike.

Pneumatic Brakes maintain a strong presence in larger off-road trucks and commercial vehicles where air systems are already integrated. Their robustness in heavy-load scenarios supports their consistent demand.

Disc Brakes are steadily gaining attention for their heat resistance and performance in high-speed applications, especially among ATVs and motorcycles. In contrast, Drum Brakes remain in use due to cost-efficiency but are gradually being phased out in favor of modern alternatives. Electromechanical Brakes are emerging as a tech-forward solution, especially in newer electric off-road vehicles, though adoption is still at an early stage.

Component Material Analysis

Steel dominates with % due to its durability and cost efficiency.

In 2024, Steel held a dominant market position in By Component Material Analysis segment of Off-Road Vehicle Braking System Market. The material’s widespread availability, strength, and resistance to deformation make it ideal for rugged off-road applications.

Carbon Composite materials are gaining attention in high-performance and premium off-road vehicles for their lightweight nature and heat resistance. However, their high cost restricts broader adoption. Metal-ceramic Composites offer a balanced performance in terms of wear resistance and thermal stability, making them suitable for advanced applications, although their market share remains modest.

Cast-Iron remains a traditional choice due to its cost-effectiveness and machinability, especially in utility-focused segments. However, concerns over weight and corrosion limit its future potential. Aluminum components are appreciated for their lightness and corrosion resistance, increasingly used in lightweight vehicles, though still secondary to steel in volume.

Application Analysis

Agricultural Off-Roading dominates with % as mechanization drives rural demand.

In 2024, Agricultural Off-Roading held a dominant market position in By Application Analysis segment of Off-Road Vehicle Braking System Market. The ongoing global shift toward mechanized farming and increasing adoption of UTVs and off-road tractors have amplified demand in this sector.

Commercial Off-Roading is another significant segment, driven by construction, logistics, and industrial transport applications that require reliable braking systems across varied terrains. Mining and Extraction applications continue to rely heavily on robust off-road braking solutions due to the demanding environments and safety considerations involved in underground and open-pit operations.

Recreational Off-Roading is gaining momentum with the rise in adventure tourism and leisure sports, although it remains seasonal and geography-dependent. Military and Defense applications demand high-performance, rugged systems, but budget allocations and procurement cycles lead to fluctuating market contributions in this segment.

Brake System Operations Analysis

Manual Brake Systems held a dominant 2024 market share due to cost efficiency and rugged performance in off-road conditions.

In 2024, Manual Brake Systems held a dominant market position in the By Brake System Operations Analysis segment of the Off-Road Vehicle Braking System Market. Their mechanical simplicity, ease of maintenance, and reliability in extreme terrains make them ideal for off-road applications like agriculture and mining.

Automatic Brake Systems are gaining steady acceptance due to convenience and improved operator comfort. While they require more complex integration, their potential in precision-dependent applications such as construction equipment is increasingly recognized by OEMs.

Anti-lock Braking Systems (ABS) have seen increasing interest, especially as off-road vehicle safety standards evolve. ABS helps maintain steering control during emergency braking, making it valuable in terrains where traction varies significantly.

Traction Control Systems (TCS) are being progressively adopted in modern off-road vehicles. Their ability to regulate wheel slip enhances control on loose surfaces, contributing to safer and more efficient operations in forestry, snow, and sand conditions.

Electronic Stability Control (ESC) remains in the early stages of off-road integration. However, as electronic adoption accelerates, ESC’s role in reducing rollovers and improving directional stability will likely drive its future market presence.

Key Market Segments

By Vehicle Type

- Sport Utility Vehicles (SUVs)

- Utility Task Vehicles (UTVs)

- All-Terrain Vehicles (ATVs)

- Off-Road Motorcycles

- Off-road trucks

By Brake Type

- Hydraulic Brakes

- Pneumatic Brakes

- Disc Brakes

- Drum Brakes

- Electromechanical Brakes

By Component Material

- Steel

- Carbon Composite

- Metal-ceramic Composites

- Cast-Iron

- Aluminum

By Application

- Agricultural Off-Roading

- Commercial Off-Roading

- Mining and Extraction

- Recreational Off-Roading

- Military and Defense

By Brake System Operations

- Manual Brake Systems

- Automatic Brake Systems

- Anti-lock Braking Systems (ABS)

- Traction Control Systems (TCS)

- Electronic Stability Control (ESC)

Drivers

Integration of Advanced Braking Technologies in Heavy-Duty Off-Road Vehicles Drives Market Growth

Off-road vehicles are becoming more powerful, and that means they need stronger, smarter braking systems. Advanced braking technologies like anti-lock braking systems (ABS) and electronic brake-force distribution (EBD) are now being used in heavy-duty off-road machines. These systems improve control and safety, especially on rough terrains. As more industries adopt off-road vehicles, the demand for high-tech braking solutions is growing.

Another major driver is the increasing use of recreational off-road vehicles in rural areas. More people are exploring trails, deserts, and forests, which puts pressure on manufacturers to offer better braking performance for safety. The market is responding with upgraded braking features tailored to outdoor enthusiasts.

Off-road vehicles are also heavily used in industries like mining and forestry. These environments are harsh and dangerous, making safety a top priority. As these sectors expand, they require braking systems that can handle heavy loads and rough terrains, boosting the demand for durable and efficient brake systems.

Additionally, the construction industry is demanding safer equipment. Governments and organizations are introducing stricter safety standards for off-road machinery, which includes advanced braking systems. This push for higher safety measures is fueling market growth and encouraging innovation in brake system design.

Restraints

High Maintenance Costs Associated with Off-Road Braking Systems Restrain Market Expansion

One key challenge is the high cost of maintaining off-road braking systems. These brakes are built to handle tough conditions, but that also means they wear out faster and need specialized parts and services. For companies with large fleets, this leads to high operational costs.

In remote areas, getting replacement parts is also a major issue. Many off-road vehicles are used in rural or undeveloped locations where aftermarket brake components are not easily available. This causes delays in repair and maintenance, reducing efficiency and increasing downtime.

Compact off-road vehicles also face space and weight limitations. Adding complex or heavy braking systems to small vehicles is difficult. This restricts the use of advanced braking technologies in such vehicles, limiting their performance and safety enhancements.

Another issue is the difficulty in customizing braking systems for different terrains. Off-road vehicles may operate on sand, mud, rocks, or snow. Designing one braking system to work well in all these conditions is complex and costly. This complexity slows down innovation and increases production time and cost.

Growth Factors

Development of Regenerative Braking Systems for Electric Off-Road Vehicles Offers Growth Opportunities

As electric off-road vehicles gain popularity, regenerative braking systems are emerging as a key opportunity. These systems convert braking energy into electrical power, improving energy efficiency. They are especially valuable for electric vehicles used in mining, agriculture, or construction.

The market is also seeing rising investments in autonomous off-road mobility. Companies are developing self-driving technologies for off-road vehicles used in industrial applications. These autonomous machines need smart braking systems that can react quickly and safely, opening doors for innovation.

In the defense and military sector, vehicle fleet modernization is becoming a top priority. New off-road military vehicles require strong and reliable braking systems for harsh and unpredictable terrains. This modernization effort is creating demand for cutting-edge brake technology.

Strategic partnerships between original equipment manufacturers (OEMs) and brake technology companies are increasing. These collaborations help develop new, high-performance braking systems tailored to specific vehicle needs. This trend will likely lead to more product launches and better market penetration.

Emerging Trends

Adoption of AI-Driven Predictive Braking Systems in Off-Road Applications Shapes Market Trends

Artificial Intelligence (AI) is becoming a big part of off-road vehicle braking systems. Predictive braking systems use AI to analyze driving patterns and terrain, helping the vehicle apply brakes more efficiently and safely. This technology reduces accidents and improves user confidence.

IoT sensors are also being integrated into braking systems. These sensors track real-time performance and provide data on brake temperature, pressure, and wear. Fleet operators and individual users can use this data for predictive maintenance, reducing unexpected failures.

Modular brake kits are another trending factor. These kits are designed to work on various terrains and can be adjusted depending on the environment. This flexibility is useful for rental services or multi-purpose off-road vehicles that move across different types of terrain.

Sustainability is gaining attention too. Manufacturers are using low-emission and eco-friendly materials in braking components. These materials help reduce environmental impact without compromising performance. The trend aligns with global efforts to lower carbon footprints and improve vehicle sustainability.

Regional Analysis

North America Dominates the Off-Road Vehicle Braking System Market with a Market Share of 36.1%, Valued at USD 0.58 Billion

North America leads the off-road vehicle braking system market, capturing a significant 36.1% share, and is valued at USD 0.58 Billion. The dominance is driven by the region’s advanced off-road vehicle infrastructure, high consumer spending on recreational and utility vehicles, and stringent vehicle safety regulations. The increasing demand for technologically advanced braking systems further contributes to the market’s expansion across the United States and Canada.

Europe Off-Road Vehicle Braking System Market Trends

Europe holds a substantial share of the off-road vehicle braking system market due to the growing emphasis on environmental sustainability and safety in vehicle components. Countries such as Germany, France, and the UK are witnessing increased demand for braking systems in agricultural and construction machinery. Strict EU regulations also compel manufacturers to adopt high-performance, efficient braking solutions.

Asia Pacific Off-Road Vehicle Braking System Market Trends

Asia Pacific is emerging as a rapidly growing market owing to increasing industrialization and infrastructural development, especially in China and India. The demand for construction and utility vehicles is escalating, leading to greater adoption of reliable and efficient braking systems. The presence of several OEMs and component manufacturers also contributes to market growth in the region.

Middle East and Africa Off-Road Vehicle Braking System Market Trends

The Middle East and Africa region is gradually adopting off-road vehicle braking systems due to expanding construction activities and mining operations. Growth is also supported by the region’s efforts to diversify economies and invest in large-scale infrastructure projects. However, market maturity remains relatively lower compared to other regions.

Latin America Off-Road Vehicle Braking System Market Trends

Latin America shows steady growth potential in the off-road vehicle braking system market, driven by agricultural mechanization and regional infrastructure initiatives. Brazil and Mexico are key contributors to market development, with rising investments in heavy-duty vehicles for farming and industrial operations. Technological awareness is growing, fostering increased adoption.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Off-Road Vehicle Braking System Company Insights

In 2024, the global Off-Road Vehicle Braking System Market is witnessing significant developments led by key players bringing innovation and reliability to rugged applications.

Robert Bosch GmbH continues to dominate the braking systems landscape with its focus on robust, electronic braking solutions designed for all-terrain vehicles. Their integration of advanced driver-assistance technologies into braking systems enhances both performance and safety in off-road environments.

ZF Friedrichshafen AG maintains a competitive edge through its hydraulic braking solutions tailored for heavy-duty off-road applications. The company’s strategic investments in electrification and automation ensure their offerings remain relevant in the evolving off-road vehicle sector.

Hitachi Astemo, Ltd. is making strides with compact, high-performance braking modules suited for both recreational and commercial off-road vehicles. Their emphasis on energy efficiency and reduced system weight makes them a preferred choice for manufacturers targeting enhanced fuel economy.

Knorr-Bremse AG brings its legacy in braking systems for commercial vehicles into the off-road domain with durable, high-pressure brake technologies. Their strong R&D backing enables continuous upgrades that support the performance demands of challenging terrains.

These companies play a crucial role in shaping the market by aligning their innovations with the increasing demand for safe, durable, and environmentally responsive braking systems in off-road vehicles. Their strategic advancements are helping define the standards for reliability and control in the off-road segment globally.

Top Key Players in the Market

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Hitachi Astemo, Ltd.

- Knorr-Bremse AG

- Brembo S.p.A.

- Aisin Corporation

- Continental AG

- Wabtec Corporation

- Mando Corporation

Recent Developments

- In Jan 2025, Powersports closed 2024 with a strong revenue of €30 million, reflecting a robust performance in the motorcycle components sector. With this acquisition, ADVIK Group gains access to advanced brake and clutch systems for both on-road and off-road motorcycles, including high-end and racing segments.

- In Jul 2024, the European Investment Bank (EIB) approved a €425 million promotional loan to ZF Friedrichshafen AG, a leading German automotive supplier. This funding supports ZF’s broader investment of €1.3 billion in R&D focused on next-generation braking and steering technologies.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Billion Forecast Revenue (2034) USD 3.9 Billion CAGR (2025-2034) 9.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type (Sport Utility Vehicles (SUVs), Utility Task Vehicles (UTVs), All-Terrain Vehicles (ATVs), Off-Road Motorcycles, Off-road trucks), By Brake Type (Hydraulic Brakes, Pneumatic Brakes, Disc Brakes, Drum Brakes, Electromechanical Brakes), By Component Material (Steel, Carbon Composite, Metal-ceramic Composites, Cast-Iron, Aluminum), By Application (Agricultural Off-Roading, Commercial Off-Roading, Mining and Extraction, Recreational Off-Roading, Military and Defense), By Brake System Operations (Manual Brake Systems, Automatic Brake Systems, Anti-lock Braking Systems (ABS), Traction Control Systems (TCS), Electronic Stability Control (ESC)) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Robert Bosch GmbH, ZF Friedrichshafen AG, Hitachi Astemo, Ltd., Knorr-Bremse AG, Brembo S.p.A., Aisin Corporation, Continental AG, Wabtec Corporation, Mando Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Off-Road Vehicle Braking System MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Off-Road Vehicle Braking System MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Hitachi Astemo, Ltd.

- Knorr-Bremse AG

- Brembo S.p.A.

- Aisin Corporation

- Continental AG

- Wabtec Corporation

- Mando Corporation