Global Off-Highway Vehicle (OHV) Telematics Market Size, Share, Growth Analysis By Technology (Cellular, Satellite), By Application (Fleet management, Vehicle tracking, Fuel management, Safety & security, Others), By End Use (Construction, Agriculture, Mining, Forestry, Others), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171005

- Number of Pages: 283

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

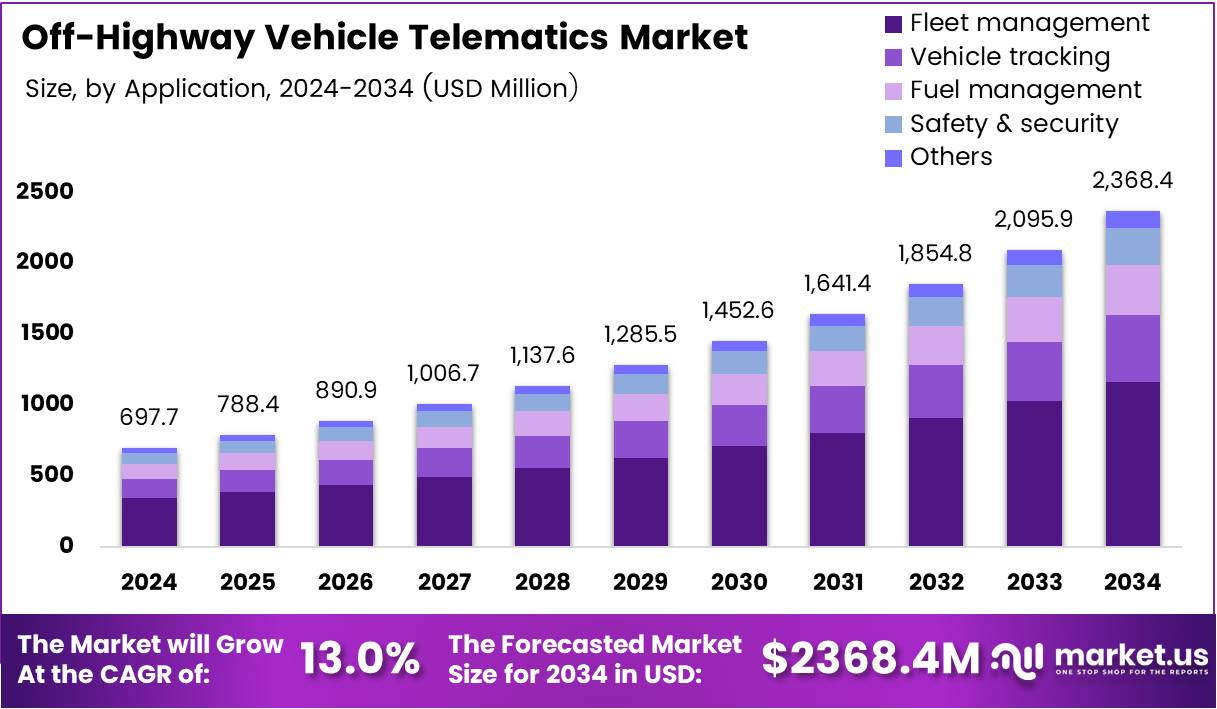

The global Off-Highway Vehicle (OHV) Telematics Market is projected to reach USD 2,368.4 Million by 2034, expanding from USD 697.7 Million in 2024. This represents a robust compound annual growth rate of 13% throughout the forecast period. The market’s expansion reflects the accelerating digitalization of heavy equipment operations across construction, mining, agriculture, and forestry sectors.

OHV telematics encompasses integrated communication systems that enable remote monitoring, diagnostics, and management of off-road heavy machinery. These solutions combine GPS tracking, onboard diagnostics, and wireless connectivity to deliver actionable intelligence. Fleet operators increasingly depend on telematics for optimizing equipment utilization, reducing operational costs, and ensuring regulatory compliance across diverse industrial applications.

Market growth stems from the critical need for enhanced fleet productivity and asset protection. Heavy equipment downtime directly impacts project timelines and profitability, driving demand for predictive maintenance capabilities. Additionally, telematics solutions address rising fuel costs through idle-time monitoring and route optimization. The technology has evolved from basic location tracking to comprehensive fleet management ecosystems that integrate real-time performance analytics.

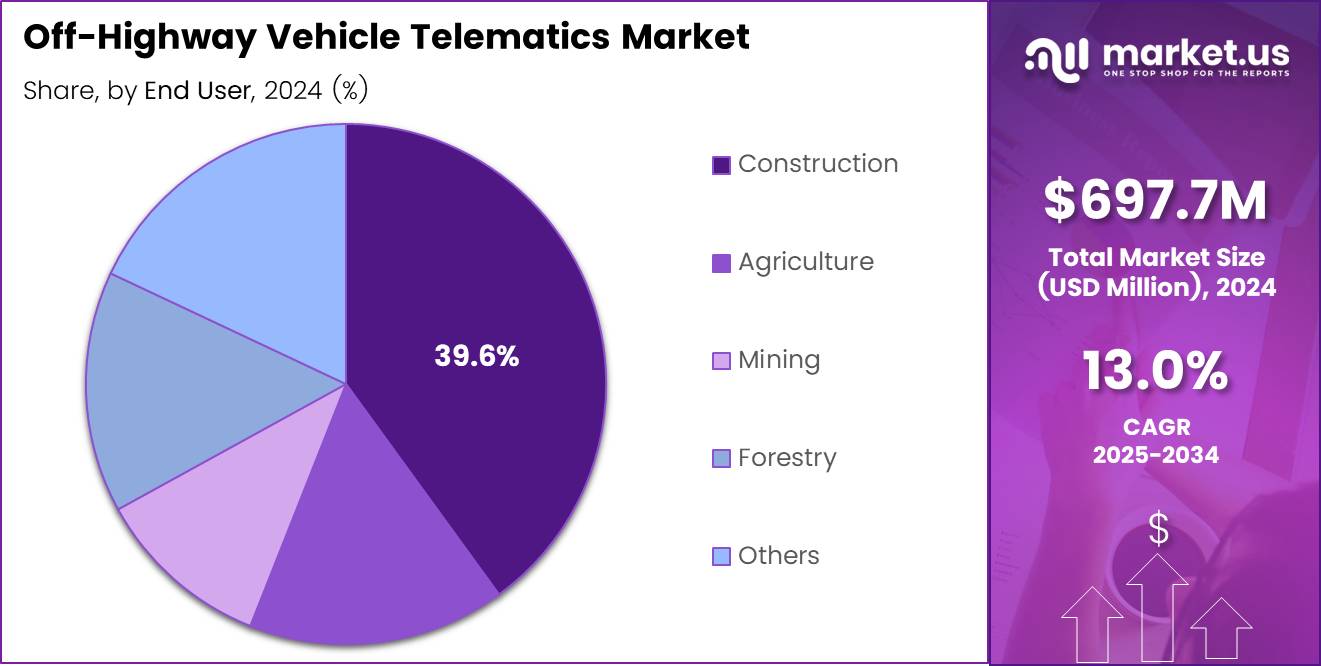

Cellular technology dominates connectivity infrastructure, capturing 69.2% of the market, as 4G and emerging 5G networks expand coverage. Fleet management applications lead end-use adoption with 39.4% market share, reflecting operational efficiency priorities. Construction equipment represents the largest end-use segment at 39.6%, driven by complex project requirements and high asset values requiring continuous monitoring.

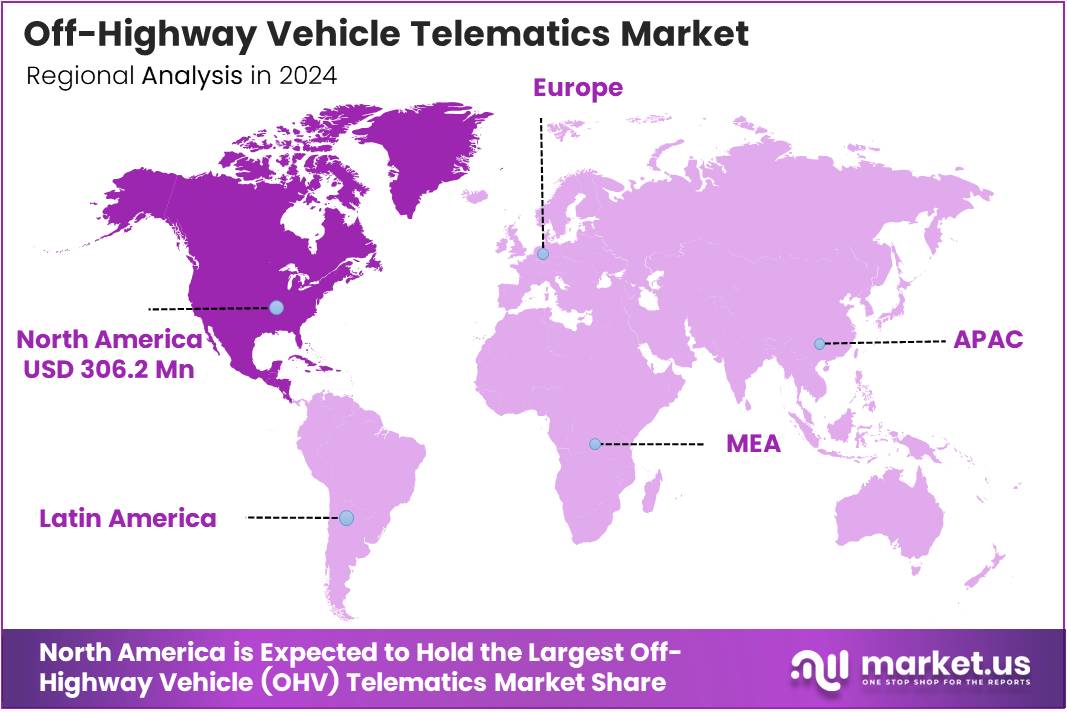

North America maintains market leadership with 43.9% share, valued at USD 306.2 Million, supported by advanced infrastructure and stringent safety regulations. OEM sales channels account for 62.3% of installations as manufacturers integrate telematics as standard equipment. According to Fleetio’s 2025 State of Fleet Management report, the global installed base of active construction equipment OEM telematics systems reached 6.8 million units worldwide in 2023.

Furthermore, the same source indicates that 72% of fleets utilized dedicated fleet maintenance software in recent years, demonstrating widespread adoption of digital fleet management tools. This integration of telematics within broader fleet IT ecosystems signals a fundamental shift toward data-driven equipment management. Industry consolidation continues as major players expand capabilities through strategic acquisitions and partnerships to deliver comprehensive telematics platforms.

Key Takeaways

- Global Off-Highway Vehicle Telematics Market projected to reach USD 2,368.4 Million by 2034 from USD 697.7 Million in 2024.

- Market growing at a CAGR of 13% during the forecast period 2025 to 2034.

- Cellular technology dominates with 69.2% market share in technology segment.

- Fleet management leads application segment with 39.4% market share.

- Construction equipment accounts for 39.6% of end-use segment.

- OEM sales channel holds 62.3% market share.

- North America dominates regional market with 43.9% share, valued at USD 306.2 Million.

Technology Analysis

Cellular technology dominates with 69.2% market share due to widespread network coverage and cost-effective data transmission capabilities.

In 2024, Cellular technology held a dominant market position in the Technology segment of the Off-Highway Vehicle Telematics Market, with a 69.2% share. This leadership stems from the rapid expansion of 4G LTE networks into rural and industrial areas where off-highway equipment operates.

Cellular connectivity offers real-time data transmission with lower latency compared to satellite alternatives, making it ideal for fleet management applications. Moreover, cellular infrastructure continues improving with 5G deployment, enabling higher bandwidth for video streaming and advanced diagnostics. The lower hardware costs and straightforward installation processes further accelerate cellular adoption across construction and agricultural fleets.

Satellite technology serves as a complementary solution for operations in remote locations beyond cellular coverage. This technology proves essential for mining operations in isolated regions and forestry equipment working in dense woodland areas. Despite higher subscription costs, satellite telematics ensures uninterrupted connectivity regardless of terrestrial infrastructure limitations. Additionally, hybrid systems combining cellular and satellite connectivity are emerging to provide seamless coverage transitions as equipment moves between coverage zones.

Application Analysis

Fleet management dominates with 39.4% market share driven by operational efficiency requirements and asset utilization optimization needs.

In 2024, Fleet management held a dominant market position in the Application segment of the Off-Highway Vehicle Telematics Market, with a 39.4% share. Fleet operators prioritize comprehensive management systems that consolidate equipment data, operator behavior, and maintenance schedules into unified dashboards.

These platforms enable managers to optimize asset allocation across multiple job sites while monitoring utilization rates. Furthermore, integration with enterprise resource planning systems streamlines operations from equipment deployment to billing processes, creating measurable return on investment for fleet owners.

Vehicle tracking applications provide critical location intelligence for theft prevention and geofencing capabilities. Equipment theft represents significant financial losses in construction and agriculture sectors, making GPS tracking a fundamental security measure. Real-time location data also supports logistics planning and ensures equipment availability aligns with project schedules.

Fuel management solutions address one of the largest operational expenses through idle-time monitoring and fuel consumption analytics. Telematics systems identify inefficient equipment operation patterns and quantify fuel waste from excessive idling. These insights enable targeted operator training and equipment right-sizing decisions that reduce fuel costs substantially.

Safety and security applications encompass operator behavior monitoring, collision avoidance alerts, and compliance documentation for regulatory requirements. Telematics data provides objective evidence for safety audits and insurance claims while promoting safer operating practices through performance feedback.

Other applications include maintenance scheduling, warranty management, and performance benchmarking across equipment portfolios. These specialized functions continue gaining adoption as telematics platforms expand capabilities beyond core tracking and management features.

End Use Analysis

Construction equipment dominates with 39.6% market share reflecting high asset values and complex project coordination requirements.

In 2024, Construction held a dominant market position in the End Use segment of the Off-Highway Vehicle Telematics Market, with a 39.6% share. Construction projects demand precise equipment coordination across multiple contractors and job sites, making telematics essential for operational visibility.

The high capital investment in excavators, bulldozers, and cranes justifies telematics costs through improved utilization and maintenance optimization. Additionally, construction equipment faces diverse operating conditions that accelerate wear, making predictive maintenance particularly valuable for preventing costly breakdowns during critical project phases.

Agriculture equipment operators adopt telematics for precision farming applications and seasonal equipment management. Telematics data supports harvest timing decisions, field mapping accuracy, and equipment sharing arrangements among farming cooperatives. The integration with precision agriculture platforms creates comprehensive farm management ecosystems.

Mining operations utilize telematics for safety compliance in hazardous environments and maximizing production from expensive specialized equipment. Remote monitoring capabilities prove particularly valuable for underground operations where direct supervision presents challenges. Equipment operating in extreme conditions benefits from continuous health monitoring to prevent failures.

Forestry applications focus on equipment tracking in remote locations and sustainable harvesting documentation for environmental compliance. Telematics enables efficient log transport coordination and ensures equipment operates within designated harvest areas. The harsh operating conditions in forestry make maintenance optimization critical.

Other end uses include port operations, waste management, and specialty industrial applications requiring customized telematics solutions. These niche segments continue expanding as telematics technology becomes more adaptable to specific operational requirements.

Sales Channel Analysis

OEM sales channel dominates with 62.3% market share as manufacturers integrate telematics as standard equipment offerings.

In 2024, OEM held a dominant market position in the Sales Channel segment of the Off-Highway Vehicle Telematics Market, with a 62.3% share. Equipment manufacturers increasingly embed telematics as factory-installed systems rather than optional accessories, creating recurring service revenue streams. This integration ensures seamless compatibility with vehicle control systems and access to proprietary diagnostic data.

Moreover, OEM telematics enables manufacturers to offer comprehensive service contracts and uptime guarantees backed by real-time equipment monitoring. The bundling of telematics with equipment financing packages accelerates adoption among customers who might otherwise delay technology investments.

Aftermarket solutions serve existing equipment fleets and customers seeking vendor-neutral telematics platforms. These systems offer flexibility for mixed fleets containing multiple equipment brands and enable customization for specific operational requirements. Aftermarket providers compete through lower costs, open integration capabilities, and specialized features not available in OEM systems. However, aftermarket adoption faces challenges from installation complexity and potential warranty concerns on newer equipment.

Key Market Segments

By Technology

- Cellular

- Satellite

By Application

- Fleet Management

- Vehicle Tracking

- Fuel Management

- Safety & Security

- Others

By End Use

- Construction

- Agriculture

- Mining

- Forestry

- Others

By Sales Channel

- OEM

- Aftermarket

Drivers

Fleet Productivity Optimization Through Real-Time Monitoring Drives Market Expansion

Equipment health monitoring and predictive maintenance analytics fundamentally transform fleet management economics. Real-time diagnostics identify potential failures before they cause downtime, enabling scheduled repairs during non-productive hours. This proactive approach significantly reduces emergency service costs and extends equipment lifespan through timely interventions.

Data-driven fuel efficiency programs deliver measurable cost reductions across mining and construction operations. Telematics systems quantify idle time, identify fuel-wasting behaviors, and optimize equipment deployment to minimize unnecessary operation. Fleet managers leverage these insights to implement targeted efficiency improvements that directly impact profitability.

Safety compliance requirements for heavy equipment operations continue intensifying across hazardous worksites. Telematics provides automated documentation for regulatory audits and enables real-time safety interventions through operator alerts. This compliance capability reduces liability exposure while promoting safer operating practices throughout organizations.

OEM integration of embedded telematics enables lifecycle service contracts and uptime guarantees that differentiate equipment offerings. Manufacturers utilize continuous monitoring to deliver proactive maintenance and rapid response support. These service innovations create competitive advantages while generating recurring revenue streams beyond initial equipment sales.

Restraints

High Upfront Costs and Connectivity Limitations Challenge Market Penetration

Retrofitting telematics hardware across legacy off-highway fleets requires substantial capital investment that many operators struggle to justify. Older equipment may need additional sensors and integration work beyond basic telematics installation. These costs become particularly challenging for small contractors operating on thin margins who cannot easily absorb technology investments.

Limited connectivity infrastructure in remote mining and construction locations undermines telematics reliability and value proposition. Equipment operating beyond cellular coverage requires expensive satellite connectivity or experiences data gaps. These reliability challenges create skepticism about telematics benefits among operators in isolated regions where connectivity cannot support real-time applications.

Data security concerns and integration complexity with existing fleet management systems slow adoption decisions. Organizations worry about cybersecurity vulnerabilities and proprietary data exposure through connected equipment. Additionally, integrating telematics data with legacy enterprise systems often requires custom development work that extends implementation timelines and increases total costs.

Growth Factors

AI-Powered Analytics and Sustainability Requirements Accelerate Market Growth

AI-powered predictive analytics for component failure prevention represent the next evolution in telematics capabilities. Machine learning algorithms analyze historical failure patterns across equipment populations to predict specific component failures. This precision enables targeted interventions that maximize uptime for high-value off-highway assets while optimizing maintenance spending.

Carbon emission tracking and sustainability reporting requirements drive telematics adoption among heavy equipment fleets. Environmental regulations increasingly mandate emission documentation, which telematics automates through fuel consumption and operational data. Corporate sustainability commitments further accelerate demand as organizations seek verifiable data for environmental reporting.

Subscription-based telematics platforms tailored for small and mid-sized contractors lower barriers to adoption. These flexible pricing models eliminate large upfront investments while providing scalable solutions that grow with fleet size. Cloud-based delivery reduces IT infrastructure requirements, making enterprise-grade telematics accessible to smaller operators.

Integration with autonomous and semi-autonomous vehicle control systems positions telematics as foundational technology for next-generation equipment. Autonomous operations require continuous connectivity and sensor fusion that telematics infrastructure supports. This convergence creates long-term growth opportunities as automation adoption accelerates across off-highway applications.

Emerging Trends

Factory-Installed Solutions and Cloud Platforms Transform Telematics Landscape

The shift from aftermarket devices toward factory-installed OEM-native telematics solutions restructures market dynamics. Manufacturers design telematics integration at the engineering stage, enabling deeper system integration and enhanced functionality. This trend reduces aftermarket opportunities while creating stronger OEM ecosystem lock-in through proprietary platforms.

Cloud-based dashboards for cross-site fleet visibility enable centralized decision-making across geographically dispersed operations. Modern platforms aggregate data from hundreds of machines into unified interfaces accessible from any device. This visibility transforms regional fleet management into enterprise-wide optimization opportunities that improve capital efficiency.

Usage-based maintenance scheduling driven by real-time duty-cycle data replaces traditional time-based service intervals. Telematics systems track actual operating conditions and component stress to determine optimal maintenance timing. This approach prevents both premature servicing and unexpected failures through data-driven scheduling.

The convergence of telematics with IoT sensors and digital twin technologies creates comprehensive equipment simulation capabilities. Digital twins combine telematics data with physics-based models to predict performance under various scenarios. This convergence enables sophisticated what-if analysis and optimization that extends beyond traditional monitoring applications.

Regional Analysis

North America Dominates the Off-Highway Vehicle Telematics Market with 43.9% Share, Valued at USD 306.2 Million

North America leads the global telematics market with a 43.9% share, valued at USD 306.2 Million, driven by advanced infrastructure and stringent regulatory frameworks. The region benefits from mature cellular networks providing reliable connectivity across most industrial areas. Additionally, safety regulations mandate equipment monitoring in many jurisdictions, accelerating telematics adoption. Major equipment manufacturers headquartered in North America drive OEM integration initiatives that establish regional leadership.

Europe Off-Highway Vehicle Telematics Market Trends

Europe demonstrates strong growth through environmental regulations requiring emission documentation and sustainability reporting. The region’s emphasis on precision agriculture drives agricultural telematics adoption across farming operations. Additionally, mature construction markets prioritize fleet optimization and efficiency improvements. European privacy regulations influence telematics design and data handling practices industry-wide.

Asia Pacific Off-Highway Vehicle Telematics Market Trends

Asia Pacific represents the fastest-growing regional market fueled by infrastructure development and mining expansion. China’s construction boom and agricultural modernization create substantial equipment fleets requiring management solutions. However, diverse connectivity infrastructure and fragmented regulatory environments create market complexity. Local telematics providers compete aggressively with global players through cost-effective solutions.

Middle East and Africa Off-Highway Vehicle Telematics Market Trends

The Middle East and Africa region shows growing adoption in mining operations and large-scale construction projects. Oil and gas infrastructure development drives demand for heavy equipment monitoring. However, connectivity limitations in remote areas constrain real-time applications. International contractors operating across the region drive telematics standardization.

Latin America Off-Highway Vehicle Telematics Market Trends

Latin America exhibits increasing telematics penetration within mining and agriculture sectors that dominate regional economies. Brazil’s agricultural mechanization and Chile’s mining operations represent primary growth drivers. Economic volatility influences investment decisions, creating cyclical adoption patterns. Equipment theft concerns elevate the importance of tracking capabilities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Off-Highway Vehicle Telematics Company Insights

Caterpillar maintains industry leadership through comprehensive telematics platforms integrated across its equipment portfolio and extensive dealer service network. The company leverages machine data to deliver predictive maintenance services and operational analytics that enhance customer productivity.

Deere & Company dominates agricultural telematics with precision farming solutions that integrate equipment data with agronomic intelligence. Their subscription-based platforms create recurring revenue while enabling data-driven farming practices across global agricultural operations.

Trimble provides vendor-neutral telematics solutions serving mixed fleets across construction, agriculture, and transportation sectors. Their open platform approach and extensive third-party integrations attract customers seeking unified fleet management across multiple equipment brands.

Komatsu differentiates through autonomous hauling systems that rely on advanced telematics infrastructure for coordinated mining operations. Their technology integration extends beyond monitoring to enable actual equipment control and autonomous functionality in controlled environments.

Key Market Players

- Caterpillar

- Deere & Company

- Hitachi Construction Machinery

- Komatsu

- Orbcomm

- Topcon Corporation

- Trackunit

- Trimble

- Zonar Systems

Recent Developments

- In September 2024, Platform Science announced plans to acquire Trimble’s global telematics business, giving Trimble a 32.5% stake in Platform Science. This strategic transaction is expected to close in 2025 and represents significant industry consolidation within the telematics sector.

- In April 2025, Geotab partnered with Macnica to launch a telematics solution focused on the U.S. logistics sector. This collaboration expands off-highway connectivity offerings and demonstrates the convergence of on-road and off-road telematics platforms.

Report Scope

Report Features Description Market Value (2024) USD 697.7 Million Forecast Revenue (2034) USD 2368.4 Million CAGR (2025-2034) 13% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Cellular, Satellite), By Application (Fleet management, Vehicle tracking, Fuel management, Safety & security, Others), By End Use (Construction, Agriculture, Mining, Forestry, Others), By Sales Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Caterpillar, Deere & Company, Hitachi Construction Machinery, Komatsu, Orbcomm, Topcon Corporation, Trackunit, Trimble, Zonar Systems Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Off-Highway Vehicle (OHV) Telematics MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Off-Highway Vehicle (OHV) Telematics MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Caterpillar

- Deere & Company

- Hitachi Construction Machinery

- Komatsu

- Orbcomm

- Topcon Corporation

- Trackunit

- Trimble

- Zonar Systems