Global Oat Milk Market Size, Share, Report Analysis By Source (Organic, Conventional), By Category (Regular/Full-Fat, Reduced-Fat Products), By Flavor ( Unflavored, Flavored), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 156693

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

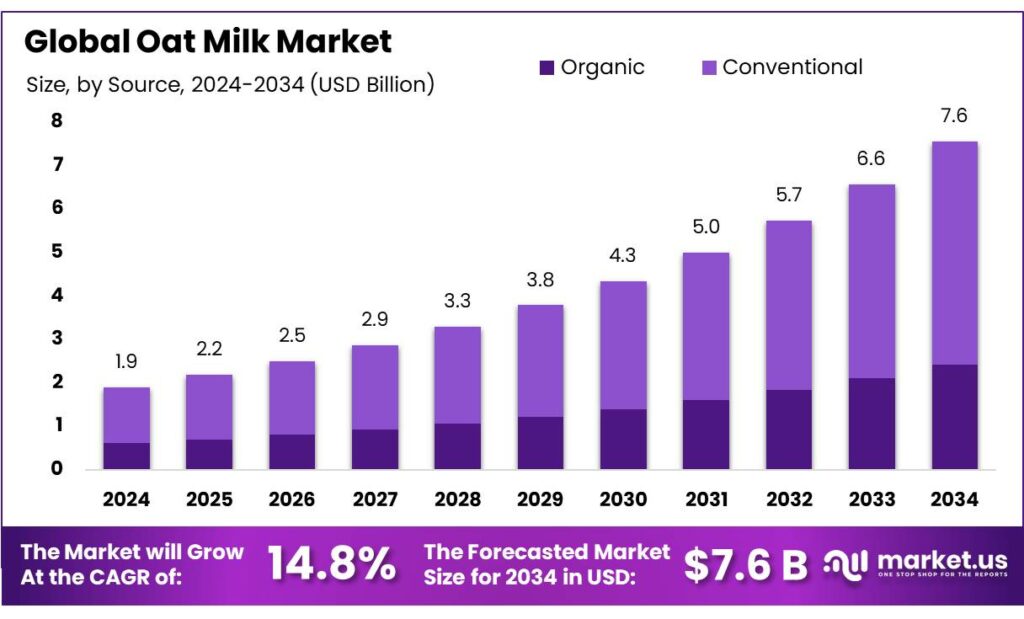

The Global Oat Milk Market size is expected to be worth around USD 7.6 Billion by 2034, from USD 1.9 Billion in 2024, growing at a CAGR of 14.8% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 46.80% share, holding USD 0.8 Billion revenue.

Oat milk, a plant-based alternative made by extracting liquid from oats, has seen a substantial rise in acceptance in India’s dairy alternatives space. While India remains the world’s largest milk producer—generating around 190 million tonnes of milk from over 300 million bovines—the steady rise in lactose intolerance and growing urban health consciousness are catalyzing a shift toward beverages like oat milk. Despite dairy’s cultural and economic dominance—supported by strong institutions such as the National Dairy Development Board (NDDB) and the Department of Animal Husbandry & Dairying—the oat milk segment is carving its own niche within the broader plant-based market.

Several factors contribute to the rising demand for oat milk. Health-conscious consumers are opting for oat milk due to its low fat content, high fiber, and absence of lactose and dairy proteins. Additionally, oat milk production has a lower environmental impact compared to cow’s milk, requiring 60% less energy and 80% less land, and emitting 80% fewer carbon emissions. This aligns with the growing emphasis on sustainability and ethical consumption.

Government initiatives have further supported the industry’s growth. In the United States, the Department of Agriculture expanded its Small Grains Crop Provisions in late 2022 to offer revenue protection for spring oats, addressing the historical lack of subsidies for oat planting. Similarly, in Scotland, organic farming incentives, including subsidies of up to £400 per hectare, have encouraged farmers to cultivate organic oats, meeting the rising demand for plant-based products.

Key Takeaways

- Oat Milk Market size is expected to be worth around USD 7.6 Billion by 2034, from USD 1.9 Billion in 2024, growing at a CAGR of 14.8%.

- Conventional held a dominant market position, capturing more than a 67.3% share of the oat milk.

- Regular/Full-Fat held a dominant market position, capturing more than a 59.6% share of the oat milk market.

- Flavored oat milk held a dominant market position, capturing more than a 58.7% share of the category.

- Supermarkets & Hypermarkets held a dominant market position, capturing more than a 44.8% share of the oat milk market.

- Asia Pacific region emerged as the dominant market for oat milk, accounting for an impressive 46.80%, equivalent to USD 0.8 billion.

By Source Analysis

Conventional Oat Milk dominates with 67.3% share

In 2024, Conventional held a dominant market position, capturing more than a 67.3% share of the oat milk industry. This strong lead reflects the high consumer preference for affordable and easily available oat-based beverages, particularly in markets where plant-based milk is rapidly replacing dairy. Conventional oat milk has been favored by households and foodservice chains due to its balanced price point and broad retail penetration. Its wide acceptance also comes from its adaptability in everyday consumption, ranging from use in coffee and smoothies to baking and cooking needs.

Looking ahead to 2025, the conventional segment is expected to maintain its strong grip, supported by steady demand from mainstream consumers who continue to prioritize affordability and accessibility over premium variants. Supermarkets and convenience stores are likely to drive this momentum further, ensuring conventional oat milk remains the go-to option for mass-market consumption. The segment’s scale and availability in both developed and emerging markets will keep its share secure, even as organic and specialty oat milk options gradually gain niche traction.

By Category Analysis

Regular/Full-Fat Oat Milk leads with 59.6% share

In 2024, Regular/Full-Fat held a dominant market position, capturing more than a 59.6% share of the oat milk market. This dominance comes from strong consumer demand for creamier, fuller-bodied alternatives that closely replicate the taste and texture of dairy milk. The category has gained wide acceptance in households and cafés, especially for use in lattes, smoothies, and cooking, where a richer consistency is preferred. Its versatility and ability to provide a satisfying mouthfeel have kept it the preferred option for everyday use compared to lighter or reduced-fat variations.

Moving into 2025, Regular/Full-Fat oat milk is expected to continue leading the market, as consumers increasingly look for plant-based beverages that don’t compromise on flavor or functionality. Growth in urban populations, along with the rising café culture, will further strengthen its demand in foodservice channels. While low-fat and specialty versions are making inroads among health-conscious buyers, the mainstream market still values the indulgence and balanced nutrition of regular/full-fat oat milk. This ensures that the segment retains its strong share across both developed and emerging regions.

By Flavor Analysis

Flavored Oat Milk captures 58.7% share with growing taste appeal

In 2024, Flavored oat milk held a dominant market position, capturing more than a 58.7% share of the category. Consumers have increasingly turned to flavored variants such as vanilla, chocolate, and coffee blends, as these provide both nutritional benefits and a more enjoyable taste experience. This preference has been especially strong among younger demographics and families, who see flavored oat milk as a healthier alternative to sugary soft drinks while still offering indulgence. Foodservice outlets and cafés have also driven the trend, with flavored oat milk becoming a popular base for lattes, smoothies, and specialty drinks.

Looking ahead to 2025, the flavored segment is expected to retain its strong momentum, supported by continuous product innovation and seasonal limited-edition releases that keep consumer interest high. With retail shelves offering a wider range of flavors, from fruity infusions to dessert-inspired options, the category is well-positioned to maintain its leadership. The growing demand for variety and taste-driven health products ensures that flavored oat milk will remain the preferred choice for a majority of buyers, even as unflavored versions continue to serve a niche market focused on minimal processing and cooking uses.

By Distribution Channel Analysis

Supermarkets & Hypermarkets lead with 44.8% share in oat milk sales

In 2024, Supermarkets & Hypermarkets held a dominant market position, capturing more than a 44.8% share of the oat milk market. Their leadership comes from being the most accessible and trusted retail platforms for everyday grocery shopping. These large-format stores provide consumers with wide product visibility, extensive brand choices, and frequent promotional offers that encourage bulk buying. The convenience of one-stop shopping, coupled with the assurance of quality and freshness, has made supermarkets and hypermarkets the preferred choice for families and individuals purchasing oat milk.

By 2025, the dominance of this distribution channel is expected to remain strong, as supermarkets and hypermarkets continue to expand their shelf space for plant-based alternatives. Partnerships with oat milk producers to launch exclusive deals, discounts, and loyalty-driven promotions will further enhance sales. Additionally, the growing presence of private-label oat milk options in these outlets will reinforce their competitive edge, offering affordability without compromising quality. While online platforms are rising steadily, supermarkets and hypermarkets are likely to maintain their leadership due to their direct consumer engagement and immediate product availability.

Key Market Segments

By Source

- Organic

- Conventional

By Category

- Regular/Full-Fat

- Reduced-Fat Products

By Flavor

- Unflavored

- Flavored

- Fruit

- Chocolate

- Vanilla

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retail

- Others

Emerging Trends

Innovation in Oat Milk Offerings

In the United States, oat milk has gained significant traction, with sales reaching approximately $700 million in 2024. This growth is attributed to the beverage’s versatility and appeal, particularly in coffee applications. Notably, oat milk’s share of the plant-based milk market increased from 22% in 2022 to 25% in 2024, while almond milk’s share declined from 58% to 54% over the same period. This shift underscores the growing consumer preference for oat milk over other plant-based options.

In the United Kingdom, oat milk has become the leading plant-based milk alternative, comprising about 40% of the market by volume. Annual sales of oat milk in the UK totaled £275 million in 2024, marking a 77% increase from five years prior. This surge is driven by factors such as oat milk’s superior taste, health benefits, and suitability for coffee beverages. Brands like Alpro have responded to this demand by introducing smaller, more affordable packaging options, making oat milk accessible to a broader consumer base.

These innovations are not only responding to consumer preferences but are also supported by industry initiatives. In the United States, major coffee chains like Dunkin’ and Starbucks have eliminated additional charges for plant-based milk alternatives, including oat milk, in response to customer feedback and to promote inclusivity for individuals with dietary restrictions. This move reflects a broader trend towards making plant-based options more accessible and appealing to a wider audience.

Drivers

Health and Nutritional Benefits

One of the primary drivers behind the surge in oat milk consumption is its perceived health benefits. Oat milk is naturally free from dairy, nuts, and soy, making it an appealing choice for individuals with allergies or dietary restrictions. It is also lactose-free, catering to the growing number of people with lactose intolerance. Additionally, oat milk is often fortified with essential nutrients such as calcium, vitamin D, and B12, enhancing its nutritional profile and making it a viable alternative to cow’s milk.

The nutritional composition of oat milk contributes to its popularity. It is a good source of fiber, particularly beta-glucan, which has been shown to support heart health by lowering cholesterol levels. Oat milk also contains a moderate amount of protein and is lower in fat compared to whole dairy milk. These attributes align with the increasing consumer preference for plant-based, health-conscious products.

- In terms of market impact, the health benefits associated with oat milk have translated into significant sales growth. For instance, in the United States, weekly sales of oat milk grew by 4,150% from 2018 to 2022, highlighting the rapid adoption of this beverage among health-conscious consumers .

Moreover, government initiatives have supported the growth of plant-based products, including oat milk. In the United States, the Department of Agriculture has extended crop insurance to oat farmers, recognizing oats as a viable crop for revenue protection. This policy shift is expected to enhance oat supply and stabilize production costs, facilitating the scaling of oat milk manufacturing .

Restraints

Supply Chain Constraints and Price Volatility

One of the significant challenges facing the oat milk industry is the volatility in oat supply and pricing. Oat milk production is heavily reliant on a consistent and affordable supply of oats. However, factors such as adverse weather conditions, fluctuating crop yields, and competition with other agricultural products have led to instability in oat availability and costs.

In 2022, North American oat production experienced a 39% decline from the previous year, attributed to drought conditions and reduced harvested acreage. Similarly, Canada reported its smallest oat crop since 2010, exacerbating supply shortages. These disruptions have had a cascading effect on the oat milk industry, leading to increased production costs. For instance, in 2023, export prices for oat milk ranged from $0.99 to $31.87 per kilogram, reflecting significant price fluctuations.

The price volatility is further compounded by the intricate production processes involved in creating oat milk. Unlike traditional dairy, which has standardized production methods, oat milk requires specialized equipment and additives to achieve desired taste, texture, and shelf stability. This complexity adds to the overall cost, making oat milk more expensive than both dairy and other plant-based milk alternatives .

These supply chain challenges and cost pressures have implications for both producers and consumers. Manufacturers face difficulties in maintaining consistent product pricing, which can affect their competitiveness in the market. Consumers, on the other hand, may experience higher prices, potentially limiting the widespread adoption of oat milk as a mainstream alternative to dairy.

Opportunity

Expansion into Emerging Markets

One of the most promising growth opportunities for the oat milk industry lies in expanding into emerging markets, particularly in Asia-Pacific regions such as India, China, and Southeast Asia. These areas are experiencing rapid urbanization, rising disposable incomes, and a growing awareness of health and environmental issues, which collectively create a fertile ground for plant-based products like oat milk.

To capitalize on these opportunities, companies can focus on localizing their products to suit regional tastes and preferences. For example, offering flavored oat milk variants that cater to local palates or fortifying products with additional nutrients to meet specific dietary needs can enhance market acceptance. Moreover, establishing local production facilities can help reduce costs, improve supply chain efficiency, and ensure product freshness.

Government initiatives play a crucial role in supporting the growth of plant-based industries. In the United States, the Department of Agriculture has extended crop insurance to oat farmers, recognizing oats as a viable crop for revenue protection . Such policies not only stabilize oat supply but also encourage farmers to invest in oat cultivation, ensuring a steady raw material supply for oat milk producers.

Furthermore, international trade agreements and reduced tariffs on plant-based products can facilitate the entry of oat milk into new markets. For instance, the Comprehensive Economic Partnership Agreement between India and Australia, signed in 2022, aims to reduce trade barriers and increase the flow of goods, including plant-based products, between the two countries. Such agreements can open doors for oat milk producers to expand their reach and tap into the growing demand in these regions.

Regional Insights

Asia Pacific leads with a commanding 46.80% share (USD 0.8 billion) of the global oat milk market

In 2024, the Asia Pacific region emerged as the dominant market for oat milk, accounting for an impressive 46.80%, equivalent to USD 0.8 billion in regional revenue. This powerhouse position reflects not only the fast adoption of plant-based alternatives but also a shifting dietary landscape across countries like China, India, Japan, Australia, and South Korea.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Elmhurst, a historic U.S. dairy company turned plant-based innovator, has built a strong oat milk presence by using a patented HydroRelease™ method that preserves nutrients without emulsifiers or gums. This clean-label positioning has won consumer trust. The company emphasizes transparency and simplicity, using minimal ingredients and recyclable packaging. Elmhurst’s oat milk is widely used in barista settings and household kitchens alike, known for its rich texture and nutritional quality. It also continues to expand into global markets.

Pacific Foods, an Oregon-based brand now under the Campbell Soup Company umbrella, is known for its organic and natural oat milk. The brand has long emphasized sustainability and health, offering shelf-stable oat milk suitable for cooking and drinking. Pacific’s strong U.S. distribution and established consumer trust have helped it stay competitive. Its oat milk is often favored for recipes due to its neutral flavor profile. The company also contributes to responsible sourcing and environmental practices.

Califia Farms, based in California, is a prominent name in the plant-based beverage industry, offering a diverse oat milk product range including barista blends, creamers, and flavored options. The company emphasizes sustainability, using renewable energy and eco-friendly packaging. Known for its bold branding and culinary versatility, Califia has achieved wide retail distribution across North America. Its oat milk is particularly popular in cafés and among consumers seeking high-performance alternatives for coffee and smoothies.

Top Key Players Outlook

- Oatly

- Rise Brewing

- Happy Planet Foods

- Califia Farms

- Elmhurst

- Pacific Foods

- Danone

- HP Hood LLC

- RISE Brewing Co.

- The Hain Celestial Group Inc

Recent Industry Developments

In 2024, Oatly posted a revenue of USD 823.67 million, marking a 5.15% increase from the previous year (2023) when revenue stood at USD 783.35 million.

In 2024, Pacific Foods, part of Campbell’s portfolio, doesn’t break out oat milk revenue separately but is a key plant‑based beverage player within its meals & beverages business, which saw net sales reach approximately USD 2.4 billion in Q3 of fiscal 2024.

Report Scope

Report Features Description Market Value (2024) USD 1.9 Bn Forecast Revenue (2034) USD 7.6 Bn CAGR (2025-2034) 14.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Organic, Conventional), By Category (Regular/Full-Fat, Reduced-Fat Products), By Flavor (Unflavored, Flavored), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Oatly, Rise Brewing, Happy Planet Foods, Califia Farms, Elmhurst, Pacific Foods, Danone, HP Hood LLC, RISE Brewing Co., The Hain Celestial Group Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Oatly

- Rise Brewing

- Happy Planet Foods

- Califia Farms

- Elmhurst

- Pacific Foods

- Danone

- HP Hood LLC

- RISE Brewing Co.

- The Hain Celestial Group Inc