Global Nutraceutical Excipients Market Size, Share Analysis Report By Type (Binders, Fillers And Diluents, Disintegrants, Coating Agents, Flavouring Agents And Sweeteners, Lubricants, Others), By Functionality (Taste Masking, Stabilizers, Modified Release, Solubility And Bioavailability Enhancers, Others), By Form (Dry Excipients, Liquid Excipients), By Application (Dietary Supplements, Functional Foods, Pharmaceuticals, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171205

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

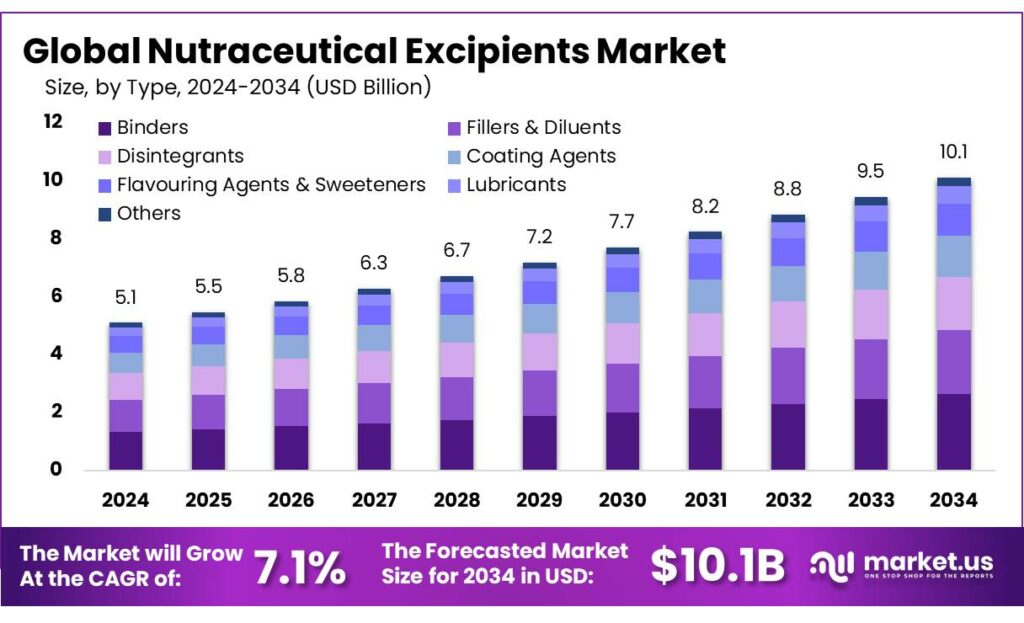

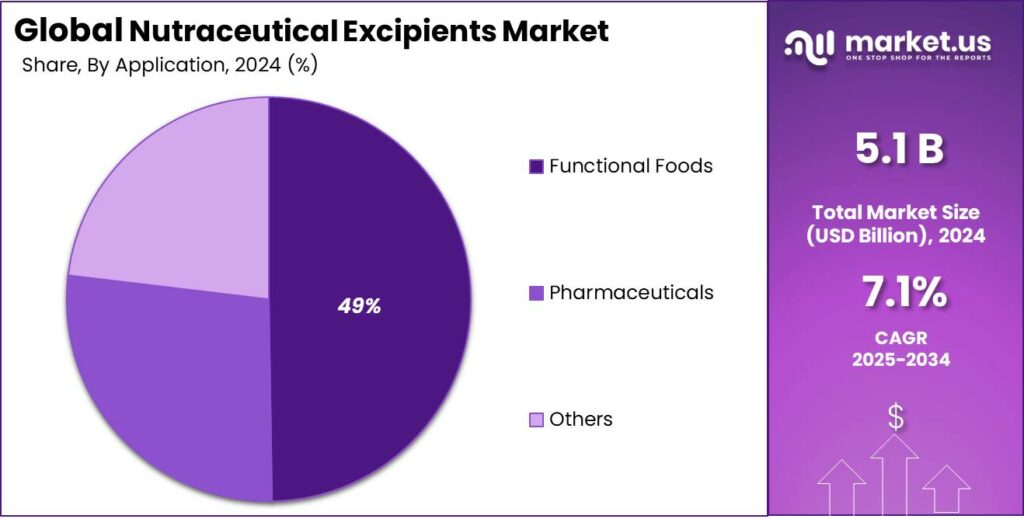

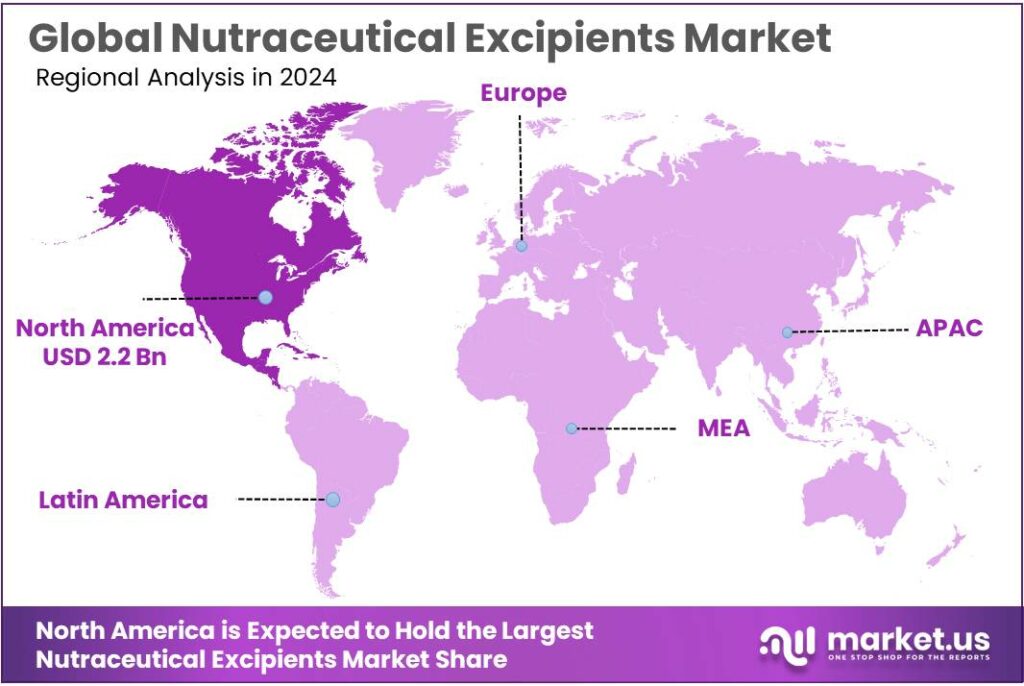

The Global Nutraceutical Excipients Market size is expected to be worth around USD 10.1 Billion by 2034, from USD 5.1 Billion in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 44.90% share, holding USD 2.2 Billion in revenue.

Nutraceutical excipients are the “functional helpers” that turn active nutrients (vitamins, minerals, botanicals, probiotics, omega-3s, etc.) into stable, consumer-friendly products—tablets, capsules, powders, sachets, gummies, and liquids. They include diluents/fillers, binders, disintegrants, lubricants, coatings, sweeteners, flavors, and stabilizers. In practice, excipients decide whether a product flows on a high-speed line, survives humidity and heat, tastes acceptable, and delivers a consistent dose through shelf life.

The industrial scenario is being shaped by a large and growing consumer base and by tighter expectations for quality systems. In the U.S., 57.6% of adults reported using a dietary supplement in the prior 30 days (NHANES 2017–2018), highlighting how mainstream supplements have become—and why repeatable manufacturing matters.

On the quality side, FDA’s dietary supplement cGMP framework (21 CFR Part 111) requires controls across manufacturing, packaging, labeling, and holding—pushing brands and contract manufacturers to use well-characterized, traceable excipients and documented processes. In India, the FSSAI (Nutra) Regulations 2022 define categories, reinforcing the need for compliant ingredient and excipient choices that fit defined product classes.

- Commercially, the category also matters at a macro level: an economic impact study funded by the Council for Responsible Nutrition (CRN) estimates the U.S. dietary supplement industry’s overall economic impact at $159 billion in 2023, supporting more than 615,000 jobs and generating $6.76 billion in state/local taxes plus $10.7 billion in federal taxes.

Key driving factors for nutraceutical excipients are performance, compliance, and trust. On performance, brands need better taste-masking, moisture/oxygen barriers, and shelf-life support as gummies, powders, and mixed-format SKUs proliferate. On compliance and trust, quality expectations have moved closer to pharmaceutical-style discipline. In the U.S., FDA’s dietary supplement cGMP final rule set manufacturing, packaging, labeling, and holding requirements aimed at identity, purity, strength, and composition controls—pushing manufacturers toward more consistent, well-characterized excipient systems.

Key Takeaways

- Nutraceutical Excipients Market size is expected to be worth around USD 10.1 Billion by 2034, from USD 5.1 Billion in 2024, growing at a CAGR of 7.1%.

- Binders held a dominant market position, capturing more than a 26.3% share.

- Solubility & Bioavailability Enhancers held a dominant market position, capturing more than a 31.2% share.

- Dry Excipients held a dominant market position, capturing more than a 72.8% share.

- Dietary Supplements held a dominant market position, capturing more than a 49.5% share.

- North America held a commanding position in the global nutraceutical excipients market, accounting for 44.90% of total share and generating approximately USD 2.2 billion.

By Type Analysis

Binders lead with 26.3% as they support tablet strength and consistent dosage

In 2024, Binders held a dominant market position, capturing more than a 26.3% share. This leadership was supported by their essential role in holding nutraceutical ingredients together and ensuring uniform tablet and capsule formation. Binders were widely used in dietary supplements, functional foods, and herbal formulations, where product stability and dose accuracy are critical. The growth of vitamins, minerals, and plant-based supplements in 2024 increased the need for reliable binding agents that improve manufacturability without affecting nutrient absorption.

Manufacturers continued to prefer binders due to their compatibility with clean-label and natural formulations, which aligned well with consumer demand for safer and more transparent nutraceutical products. In 2025, demand for binders is expected to remain steady, supported by rising supplement consumption among aging populations and health-focused consumers. Their consistent performance, ease of processing, and ability to enhance product shelf life kept binders positioned as a core excipient type across global nutraceutical production.

By Functionality Analysis

Solubility & bioavailability enhancers dominate with 31.2% as they improve nutrient absorption

In 2024, Solubility & Bioavailability Enhancers held a dominant market position, capturing more than a 31.2% share. This strong presence was driven by their critical role in improving how well nutrients dissolve and are absorbed by the body. Many nutraceutical ingredients, such as vitamins, minerals, and botanical extracts, naturally have low solubility, which limits their effectiveness. These enhancers helped overcome that challenge by increasing absorption efficiency and supporting faster nutrient uptake.

In 2024, rising consumer awareness around product efficacy pushed manufacturers to adopt advanced excipient solutions that could deliver better health outcomes without increasing dosage size. The segment also benefited from growing demand for premium supplements and personalized nutrition products. Looking into 2025, the use of solubility and bioavailability enhancers is expected to remain strong, supported by continued innovation in delivery formats and a focus on maximizing nutritional value in daily health supplements.

By Form Analysis

Dry excipients lead with 72.8% due to ease of handling and wide use in solid supplements

In 2024, Dry Excipients held a dominant market position, capturing more than a 72.8% share. This clear leadership was supported by their extensive use in tablets, capsules, and powdered nutraceutical products. Dry excipients were preferred by manufacturers because they offer better stability, longer shelf life, and easier storage compared to liquid forms.

In 2024, the continued growth of solid-dose supplements, including multivitamins and herbal capsules, strengthened demand for dry excipients across global production lines. Their compatibility with high-speed manufacturing and reduced risk of microbial growth also improved processing efficiency. Moving into 2025, dry excipients are expected to maintain strong demand as nutraceutical companies focus on cost control, product consistency, and scalable manufacturing. These advantages kept dry excipients positioned as the most widely adopted form in the nutraceutical excipients market.

By Application Analysis

Dietary supplements dominate with 49.5% driven by rising daily nutrition intake

In 2024, Dietary Supplements held a dominant market position, capturing more than a 49.5% share. This leadership was mainly supported by the strong consumer shift toward preventive healthcare and routine nutrient intake. Vitamins, minerals, proteins, and herbal products continued to record high consumption across all age groups in 2024, which directly increased the use of excipients for formulation stability, taste masking, and dosage consistency.

The large volume of tablet, capsule, and powder supplements manufactured during the year strengthened demand for excipients used in dietary supplements. Moving into 2025, steady growth is expected as daily supplementation becomes more common among urban populations and aging consumers. The consistent demand for standardized, easy-to-consume supplement formats kept dietary supplements as the largest application area in the nutraceutical excipients market.

Key Market Segments

By Type

- Binders

- Fillers & Diluents

- Disintegrants

- Coating Agents

- Flavouring Agents & Sweeteners

- Lubricants

- Others

By Functionality

- Taste Masking

- Stabilizers

- Modified Release

- Solubility & Bioavailability Enhancers

- Others

By Form

- Dry Excipients

- Liquid Excipients

By Application

- Dietary Supplements

- Functional Foods

- Pharmaceuticals

- Others

Emerging Trends

Personalized Supplements Push Smarter Excipient Systems

A clear latest trend in nutraceutical excipients is the move toward personalized, condition-focused supplements, where brands want the same product to feel “made for me” while still being stable, pleasant to take, and easy to manufacture. This is not only about new actives. It changes the excipient job too—because once formulas become more complex (multiple minerals, botanicals, sleep or stress blends, microbiome ingredients), you need excipients that can keep the dose even, improve taste, and protect sensitive ingredients through processing and shelf life.

A Council for Responsible Nutrition (CRN) survey reported that 69% of supplement users say a personalized regimen is important when choosing a dietary supplement. The same survey found 71% of users report brand loyalty, and the median monthly spend rose from $48 in 2023 to $50 in 2024 (with users buying from healthcare professionals reporting a median $100 monthly outlay). When people spend like that, they notice small problems—bad aftertaste, chalky mouthfeel, capsules that upset the stomach, powders that clump, gummies that sweat. Fixing those issues is mostly an excipient problem, not an active-ingredient problem.

This personalization wave also shows up in what people are adding to their routines. CRN reported magnesium use rose from 19% in 2023 to 23% of supplement users in 2024, while prebiotic use increased to 7% (from 5%). These are exactly the kinds of ingredients that often need excipient support: minerals can be bitter or hard on the stomach, and microbiome-related ingredients can be moisture sensitive or tricky to keep stable.

Government expectations reinforce this trend because “more complex products” usually bring “more quality questions.” In the U.S., dietary supplement makers must follow 21 CFR Part 111 (cGMP), which requires controlled manufacturing and specifications—especially for materials that contact the product and for label/packaging controls. As brands add more blends and formats, they increasingly prefer excipients that come with clean documentation, clear specifications, and reliable supplier change control, because that reduces audit stress and shortens the path from lab formula to full-scale production.

Drivers

High Supplement Use Forces Better Quality, Stable Formats

A major driver for nutraceutical excipients is simple: more people are taking supplements more often, and they expect them to be easy to use, consistent, and safe. Excipients are the behind-the-scenes materials that help powders flow, tablets hold together, capsules fill evenly, gummies keep their texture, and sensitive nutrients stay stable on the shelf. When consumer use is broad, manufacturers cannot rely on “good enough” formulations; they need excipients that deliver repeatable performance at scale, batch after batch.

The numbers show why this matters. In the United States, 57.6% of adults aged 20+ reported using at least one dietary supplement in the past 30 days. Use rises sharply with age—up to 67.3% among men aged 60+ and 80.2% among women aged 60+. A consumer base this large creates industrial pressure for higher throughput and fewer production surprises. That pushes demand for excipients that improve content uniformity, reduce segregation, prevent sticking during compression, and protect actives from moisture, oxygen, heat, and light.

For example, the Council for Responsible Nutrition (CRN) highlighted rising use of specialty products: magnesium increased from 19% (2023) to 23% (2024) among supplement users, while prebiotic usage rose to 7% (from 5%). As more products include minerals, botanicals, and microbiome-focused ingredients, brands lean on excipients for taste masking, dispersibility, and stability—especially in formats like powders, chewables, and gummies where sensory performance can make or break repeat purchase.

Regulation and enforcement expectations amplify this driver, because high usage brings higher scrutiny. In the U.S., manufacturers that manufacture, package, label, or hold dietary supplements are subject to 21 CFR Part 111 (dietary supplement cGMP), which sets expectations for controlled processes, records, and quality systems.

Government frameworks outside the U.S. also push excipient discipline as nutraceutical categories formalize. In India, FSSAI’s direction tied to the nutraceutical framework describes foods formulated for specific nutritional or dietary purposes and sets compliance expectations around how these products are positioned and controlled.

Restraints

Quality Risk From Adulteration Raises Costs

One major restraining factor for nutraceutical excipients is the quality risk created by adulterated or “tainted” supplement products, which forces brands and manufacturers to add more testing, tighten supplier controls, and redesign formulations. Excipients are not the headline ingredient on the label, but they sit in the same quality system as the actives. When regulators or consumers lose trust in a product category, excipients get pulled into deeper audits, higher documentation needs, and slower qualification timelines.

Government quality frameworks amplify this restraint. In the U.S., firms that manufacture, package, label, or hold dietary supplements must follow 21 CFR Part 111 (dietary supplement cGMP), which drives the need for documented specifications, controls, and traceability across the full bill of materials—including excipients. Practically, that means more QA staffing, more recordkeeping, and more frequent investigations when anything looks “off” in incoming materials. For smaller brands, these fixed compliance costs can be a barrier to launching new products quickly or switching excipient systems to improve taste and stability.

The scale of the issue is not small. The U.S. FDA says it has identified “over a thousand” products marketed as dietary supplements or conventional foods that contained hidden drugs and chemicals, often tied to categories like sexual enhancement, weight loss, and bodybuilding. The FDA also continues to publish public notifications on health-fraud and tainted products, reinforcing that this is an ongoing compliance pressure, not a one-time event.

Opportunity

Non-Pill Formats Create a Big Formulation Opening

A major growth opportunity for nutraceutical excipients is the fast shift from “just tablets and capsules” to non-pill formats that people actually enjoy taking—especially gummies, powders, chewables, and ready-to-mix sticks. These formats are tougher to formulate than they look. They need excipients that can mask bitter tastes, keep texture stable, prevent clumping, protect sensitive actives from moisture and oxygen, and hold a consistent dose even when production volumes are high. When a brand wins on taste and stability, repeat purchases follow—and excipients are usually the reason it works.

Industry sources also show how quickly formats are reshaping shelves. One supplement industry analysis reported that non-pill formats now account for 65% of dietary supplement market share, with gummies at 25.1%, powders at 17%, and softgels at 13.1%. Each of these formats depends heavily on excipients: gummies rely on gelling systems, acidulants, sweeteners, and moisture control; powders depend on anti-caking agents and dispersants; softgels need plasticizers and shell materials that stay intact through distribution and storage. The opportunity is clear: suppliers who can offer excipient “platforms” tuned for these formats become partners in product expansion, not just material vendors.

Government and trusted standards frameworks support this opportunity because they reward better-controlled manufacturing. In the U.S., dietary supplement cGMP requirements under 21 CFR Part 111 encourage stronger process control and documented specifications—making well-characterized excipients easier to adopt across multiple SKUs without reworking the whole quality system.

Regional Insights

North America leads with 44.90% share and US$2.2 Bn in 2024, supported by high supplement consumption and strong manufacturing base

In 2024, North America held a commanding position in the global nutraceutical excipients market, accounting for 44.90% of total share and generating approximately USD 2.2 billion in value. This dominance was driven by strong demand for dietary supplements, functional foods, and personalized nutrition products across the United States and Canada. High consumer awareness of health and wellness, coupled with the widespread adoption of preventive care practices, fueled steady growth in daily supplement intake.

In 2024, North American supplement manufacturers continued to innovate with formats such as tablets, capsules, and powdered blends, relying on excipients that improve stability, taste, and absorption. Robust regulatory frameworks under agencies such as the U.S. Food and Drug Administration (FDA) ensured quality and safety, further strengthening consumer confidence and driving category growth. Additionally, the region’s advanced ingredient supply chain and strong presence of contract manufacturers helped reduce lead times and supported scalable production of excipient-enabled formulations.

E-commerce and direct-to-consumer channels also played an important role in expanding market reach, with online sales capturing a significant portion of supplement distribution in 2024. Looking into 2025, continued investment in research and development, coupled with rising interest in personalized and condition-specific nutrition, is expected to sustain North America’s leading market position. The region’s combination of high per-capita supplement consumption, well-established manufacturing infrastructure, and active innovation pipeline underpins its dominance in the nutraceutical excipients market.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Roquette Frères continued to supply plant-based nutraceutical excipients such as microcrystalline cellulose and plant-derived binders that enhance tablet integrity and processability. The company reported global sales of approximately €4.4 billion, with nutraceutical and food ingredient segments accounting for an estimated €920 million. Roquette’s focus on clean-label solutions supports demand for natural excipient systems.

In 2024, Kerry Group PLC provided functional excipients and formulation technologies used in capsules, tablets, and functional powders designed for enhanced stability and palatability. Kerry posted total revenue of about €9.7 billion, with its taste & nutrition segment contributing roughly €2.8 billion. The company’s excipient portfolio supports a wide range of dietary supplement formats.

In 2024, Ingredion Incorporated remained active in the nutraceutical excipients market with solutions such as specialty starches, natural binders, and delivery-enhancing ingredients. The company reported revenue of approximately USD 7.6 billion, with specialty ingredients comprising an estimated USD 1.1 billion. Ingredion’s plant-derived excipients support clean-label and functional supplement formulations.

Top Key Players Outlook

- BASF SE

- DuPont de Nemours, Inc.

- Roquette Frères

- Kerry Group PLC

- Ingredion Incorporated

- Cargill, Incorporated

- Ashland Global Holdings Inc.

- Croda International PLC

- Colorcon Inc.

- Evonik Industries AG

Recent Industry Developments

In 2024, BASF SE continued to support the nutraceutical excipients sector through its broad range of specialty ingredients that enhance formulation performance in dietary supplements and functional foods. The company’s Nutrition And Care segment—which includes ingredients used in health and nutrition applications such as stabilisers, coatings, and bioavailability enhancers—reported sales of €6,729 million in 2024, with the Nutrition And Health portion contributing €1,978 million toward products serving food, feed, and pharmaceutical markets.

In 2024, DuPont’s substantial operating EBITDA of USD 3.14 billion underscored its financial capacity to sustain innovation and serve complex ingredient markets.

Report Scope

Report Features Description Market Value (2024) USD 5.1 Bn Forecast Revenue (2034) USD 10.1 Bn CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Binders, Fillers And Diluents, Disintegrants, Coating Agents, Flavouring Agents And Sweeteners, Lubricants, Others), By Functionality (Taste Masking, Stabilizers, Modified Release, Solubility And Bioavailability Enhancers, Others), By Form (Dry Excipients, Liquid Excipients), By Application (Dietary Supplements, Functional Foods, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, DuPont de Nemours, Inc., Roquette Frères, Kerry Group PLC, Ingredion Incorporated, Cargill, Incorporated, Ashland Global Holdings Inc., Croda International PLC, Colorcon Inc., Evonik Industries AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Nutraceutical Excipients MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Nutraceutical Excipients MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- DuPont de Nemours, Inc.

- Roquette Frères

- Kerry Group PLC

- Ingredion Incorporated

- Cargill, Incorporated

- Ashland Global Holdings Inc.

- Croda International PLC

- Colorcon Inc.

- Evonik Industries AG