Global Notebook as a Service Market By Notebook Type (Standard Business Laptops, High-Performance Workstations, Ruggedized & Specialty Laptops), By Organization Size (Small & Medium Enterprises (SMEs), Large Enterprises,Education & Public Sector), By End-User Industry (IT & Telecommunications, Financial Services & Insurance (BFSI), Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Jan. 2026

- Report ID: 172705

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Computational Insights

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- Network Type Analysis

- Organization Size Analysis

- End-User Industry Analysis

- Investment Opportunities

- Business Benefits

- Regulatory Environment

- Investor Type Impact Matrix

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Opportunity

- Challenge

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

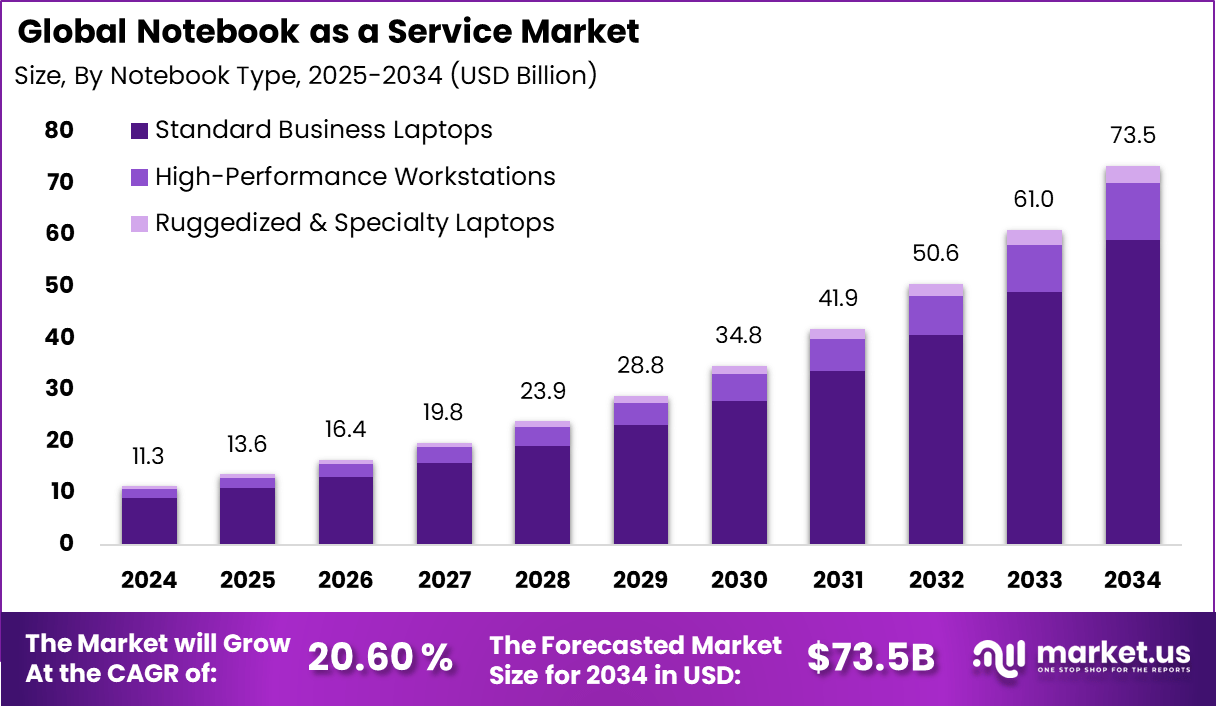

The Global Notebook as a Service Market generated USD 11.3 billion in 2024 and is predicted to register growth from USD 13.6 billion in 2025 to about USD 180.24 billion by 2034, recording a CAGR of 5.94% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 38.7% share, holding USD 1.3 Billion revenue.

The Notebook as a Service market refers to subscription based models where organizations provide laptops or notebooks to users along with lifecycle services such as deployment, maintenance, support, and replacement. Instead of purchasing devices upfront, customers pay a recurring fee that covers hardware, software configuration, and ongoing management. This model is adopted by enterprises, educational institutions, and public organizations seeking predictable IT spending and simplified device management.

Notebook as a Service is part of the broader device as a service ecosystem. Market development has been influenced by changing workplace dynamics and growing demand for flexible IT infrastructure. Remote and hybrid work models require rapid device provisioning and consistent user experience across locations. Notebook as a Service supports these needs by offering standardized devices and centralized management.

One major driving factor of the Notebook as a Service market is the need to reduce upfront capital expenditure on IT hardware. Traditional device procurement requires significant initial investment and long replacement cycles. Subscription based models convert these costs into predictable operating expenses. This financial flexibility is especially attractive to small and medium enterprises.

Demand for Notebook as a Service is shaped by workforce mobility and distributed operations. Employees expect reliable and secure devices that are ready to use regardless of location. Organizations respond by adopting service models that enable fast onboarding and replacement. This demand is strong in sectors with frequent employee turnover or project based staffing.

Cloud based device management platforms are supporting adoption of Notebook as a Service. These platforms enable remote configuration, monitoring, and troubleshooting of devices from centralized dashboards. IT teams can enforce policies and deploy updates without physical access to devices. Cloud management improves scalability and operational efficiency.

Security technologies are also driving adoption. Features such as endpoint protection, identity management, and data encryption are often integrated into service offerings. These technologies help organizations protect sensitive data across distributed workforces. Enhanced security capabilities increase confidence in outsourced device management models.

Top Market Takeaways

- By network type, standard business laptops took 80.4% of the Notebook as a Service market, as they provide reliable performance for daily office work.

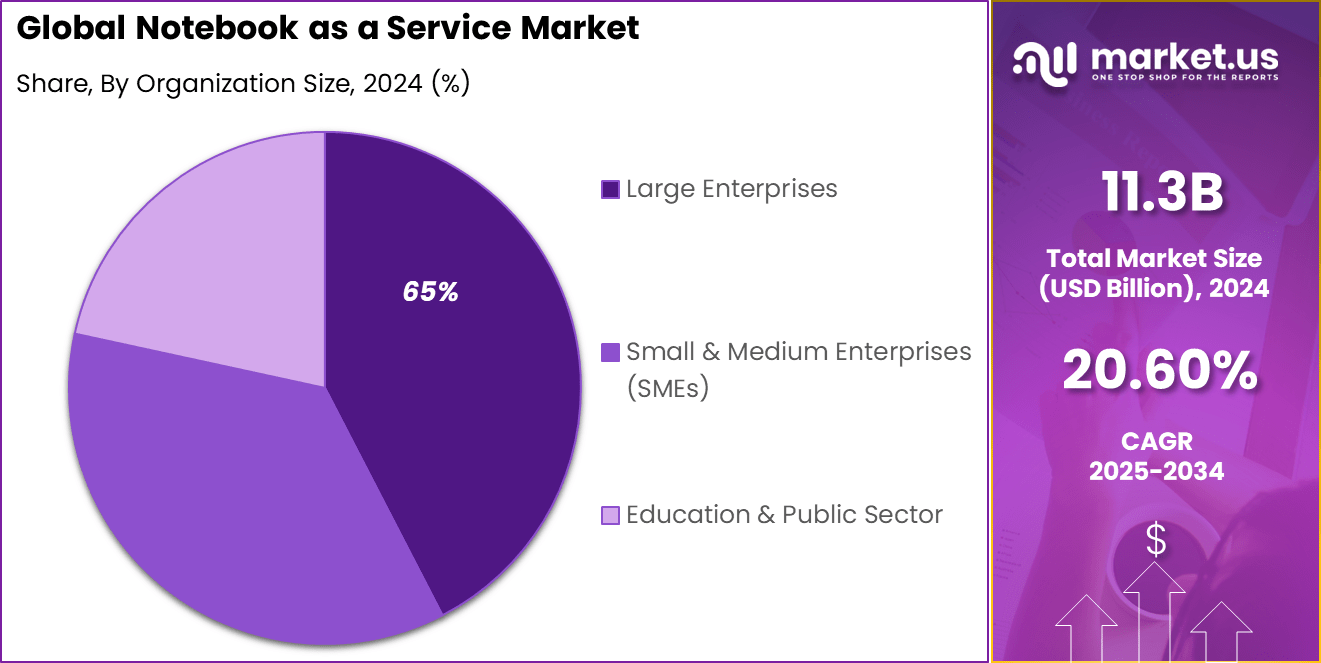

- By organization size, large enterprises held 64.8% share, using NaaS for managing fleets of secure, standardized devices.

- By end-user industry, IT and telecom captured 22.3%, leveraging NaaS for remote teams and high-mobility staff.

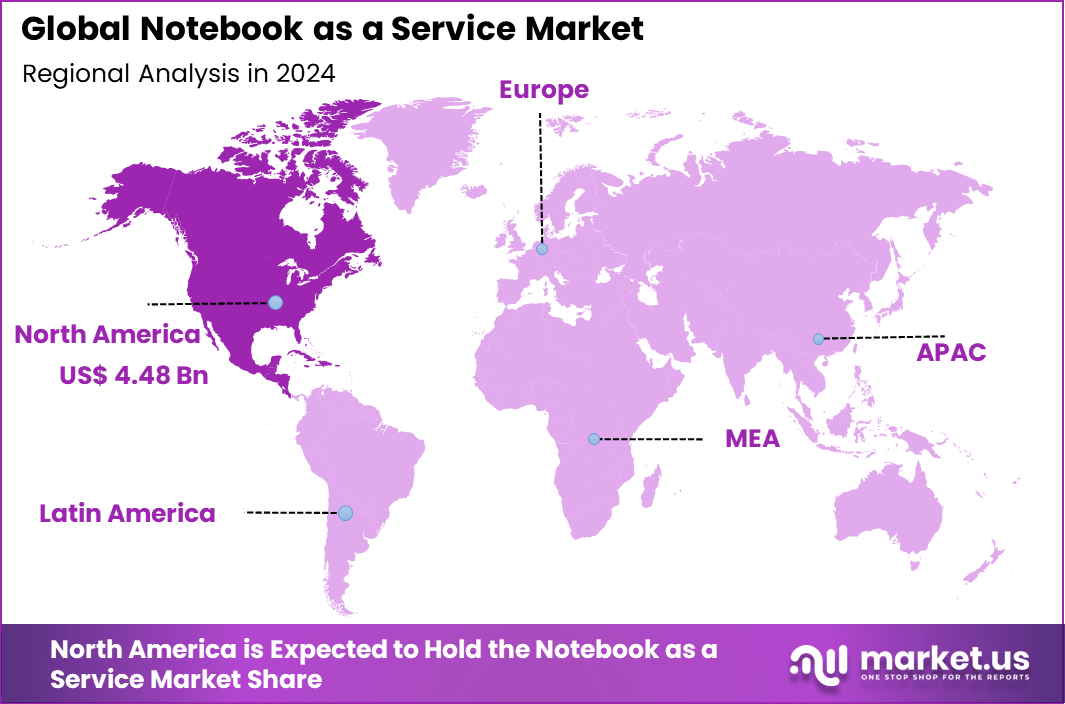

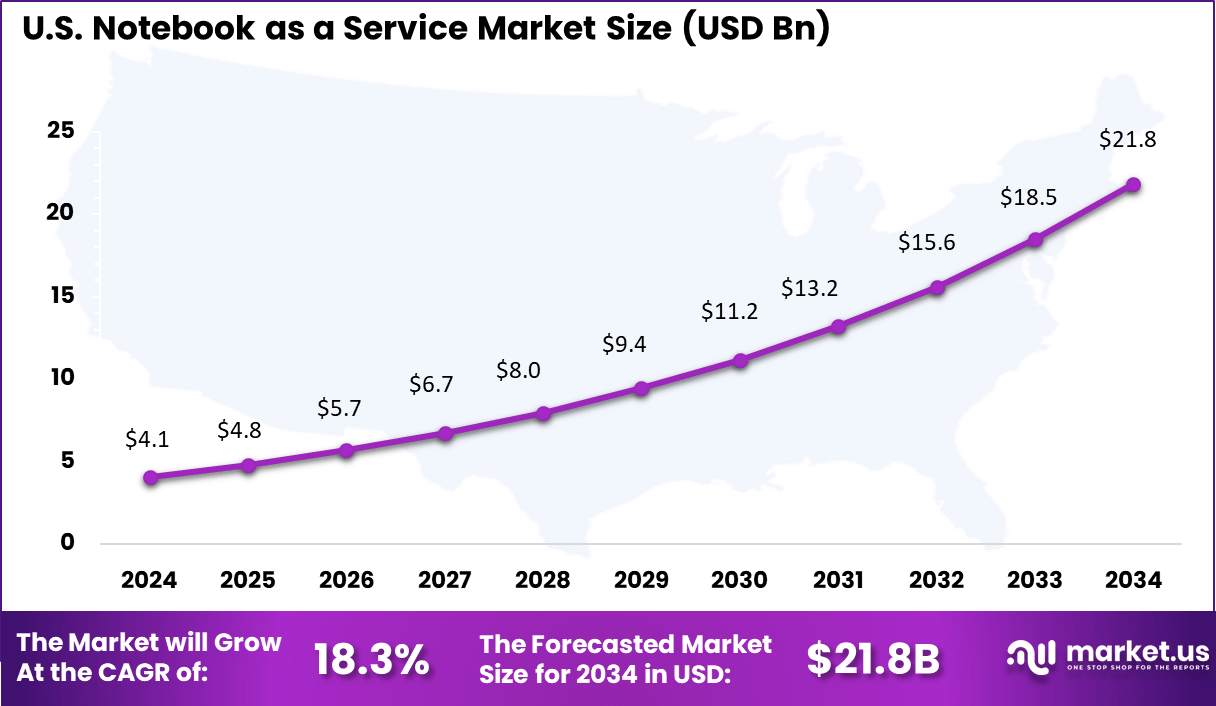

- North America had 39.7% of the global market, with the U.S. at USD 4.07 billion in 2025 and growing at a CAGR of 18.3%.

Computational Insights

- Computational Notebooks as a Service provide fully managed cloud environments that support data science, artificial intelligence, and machine learning workflows. These platforms reduce setup complexity and enable faster experimentation across distributed teams.

- Jupyter notebooks remained the most widely used interface, with 42% of data specialists relying on them for daily analytical tasks. Their popularity was supported by open standards, strong community support, and flexible integration with data pipelines.

- Adoption expanded rapidly over time, as the number of Jupyter notebooks hosted on public repositories increased from about 200,000 in 2015 to nearly 2 million by 2018. Estimates indicated usage exceeding 60 million notebooks by 2019, reflecting mass adoption across academia and enterprises.

- Workload patterns showed clear priorities, with 69% of users focusing on exploratory data analysis. In addition, 68% used notebooks for experimental modeling, while 64% relied on them for data visualization and result interpretation.

- Cloud evolution strengthened this segment, as leading cloud platforms embedded notebook services directly into their ecosystems. This integration enabled scalable compute access, collaborative development, and tighter alignment with production data and machine learning workflows.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Shift to device as a service models Enterprises moving from ownership to subscription IT ~1.9% North America, Europe Short Term Hybrid and remote work expansion Growing need for scalable employee devices ~1.6% Global Short to Mid Term IT cost predictability Preference for fixed monthly hardware costs ~1.2% Global Mid Term Lifecycle management outsourcing Reduced internal IT burden ~0.7% Global Mid Term Security and compliance requirements Centralized control of enterprise endpoints ~0.5% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Vendor lock in Long term contracts limiting flexibility ~1.8% Global Mid Term Asset utilization risk Underused devices during workforce changes ~1.4% Global Short Term Supply chain disruption Delays in notebook availability ~1.1% Global Short Term Data security incidents Risks during device return or reuse ~0.9% Global Long Term Pricing pressure Competitive pricing among service providers ~0.7% Global Mid Term Restraint Impact Analysis

Key Factors Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact Limited SME adoption Smaller firms prefer outright purchase ~2.0% Emerging Markets Short Term Contract complexity Multi year service agreements ~1.6% Global Mid Term Data migration challenges Secure data wipe and transfer concerns ~1.3% Global Mid Term Perceived higher long term cost Subscription viewed as more expensive ~0.9% Global Long Term Regional service gaps Limited availability in developing regions ~0.6% Emerging Markets Long Term Network Type Analysis

Standard business laptops account for 80.4% of the Notebook as a Service market, showing clear preference for reliable and general-purpose devices. These laptops are designed to support everyday business activities such as office productivity, communication, and enterprise applications. Organizations favor standard models because they offer balanced performance, durability, and compatibility with corporate IT environments. Their wide availability also supports faster deployment across large workforces.

From an operational point of view, standard business laptops simplify device management and support. They are easier to configure, maintain, and replace under service-based contracts. The strong dominance of this segment reflects enterprise focus on cost control, uniform device standards, and predictable performance within long-term device subscription models.

Organization Size Analysis

Large enterprises represent 65% of the Notebook as a Service market, driven by their large employee bases and structured IT operations. These organizations require scalable device provisioning, centralized management, and consistent service levels. Notebook as a Service helps large enterprises streamline device lifecycle management, including procurement, maintenance, upgrades, and end-of-life handling.

Large enterprises also benefit from predictable operating expenses and reduced capital investment. Service-based notebook models support workforce mobility and remote work strategies. The strong share of this segment indicates that large organizations view device-as-a-service models as a practical approach to improving IT efficiency and financial planning.

End-User Industry Analysis

The IT and telecommunications sector accounts for 22.3% of end-user demand, making it a leading industry for Notebook as a Service adoption. Companies in this sector employ large numbers of knowledge workers who depend on reliable computing devices for software development, network operations, and customer support. Service-based notebook models help ensure continuous device availability and performance.

IT and telecom organizations also operate in fast-changing technology environments. Notebook as a Service allows them to refresh devices regularly without complex procurement cycles. The strong presence of this industry reflects its focus on workforce productivity, flexibility, and efficient IT asset management.

Investment Opportunities

Investment opportunities in the Notebook as a Service market exist in platforms that integrate hardware provisioning with analytics and lifecycle optimization. Solutions that provide insights into device usage, performance, and refresh timing add value for enterprise customers. Investors may also focus on services that support large scale deployments across regions. These capabilities align with global workforce trends.

Another opportunity lies in vertical specific service offerings. Education, healthcare, and government sectors have unique device and compliance requirements. Providers that tailor Notebook as a Service solutions to these segments can achieve stronger differentiation. Partnerships with managed service providers can further expand market reach.

Business Benefits

Adoption of Notebook as a Service delivers cost predictability and financial transparency. Organizations benefit from fixed monthly pricing that simplifies budgeting and forecasting. Avoidance of large capital outlays improves cash flow management. These financial advantages support long term planning.

Notebook as a Service also improves device standardization and governance. Centralized control ensures consistent configurations and security policies across users. This reduces risk and simplifies audits. Improved governance supports operational resilience and compliance readiness.

Regulatory Environment

The regulatory environment for the Notebook as a Service market is shaped by data protection and information security requirements. Devices used in regulated industries must comply with privacy laws related to personal and organizational data. Service providers are expected to implement safeguards for data storage, access, and device disposal. Compliance with these requirements is essential for adoption.

Labor and workplace regulations also influence device provisioning practices. Organizations must ensure that employee data and monitoring tools are used in line with employment laws. Transparency and consent are important considerations in managed device environments. Alignment with regulatory standards builds trust and supports sustainable growth of Notebook as a Service offerings.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Large enterprises Very High ~42.8% Scalable workforce IT Long term contracts Managed service providers High ~26% Recurring revenue expansion Platform investment IT hardware vendors High ~18% Service based differentiation Bundled offerings Mid sized enterprises Moderate ~9% Cost predictability Phased adoption Startups Low to Moderate ~4% Operational flexibility Short term subscriptions Emerging Trends

Key Trend Description AI Integration AI tools enable auto optimization, code suggestions, and real time analytics within notebooks. Real Time Collaboration Multiple users edit notebooks simultaneously with version control and conflict resolution. Edge and Hybrid Deployments Supports distributed computing that blends cloud and on premise systems for low latency tasks. Enhanced Security Features Role based access, encryption, and audit trails ensure compliance in enterprise environments. Serverless Compute Scaling Elastic resources scale automatically without the need for infrastructure management. Growth Factors

Key Factors Impact Remote and Hybrid Work Enables seamless access to powerful notebook environments from any location. Data Science Democratization Lowers entry barriers for teams experimenting with AI and machine learning. Cost Efficiency Shift Subscription pricing reduces upfront hardware and ongoing maintenance costs. Enterprise AI Adoption Governed platforms support secure and scalable model development pipelines. Cloud Migration Acceleration Integrates with multi cloud strategies to enable flexible and portable data workflows. Key Market Segments

By Notebook Type

- Standard Business Laptops

- High-Performance Workstations

- Ruggedized & Specialty Laptops

By Organization Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

- Education & Public Sector

By End-User Industry

- IT & Telecommunications

- Financial Services & Insurance (BFSI)

- Healthcare

- Education

- Manufacturing & Retail

- Others

Regional Analysis

North America accounted for 39.7% share, supported by strong adoption of device as a service models across enterprises, educational institutions, and public sector organizations. Notebook as a Service has been widely used to simplify device procurement, lifecycle management, and support operations under a single subscription model.

Demand has been driven by hybrid work adoption, frequent device refresh requirements, and the need for predictable IT spending. Organizations in the region have increasingly preferred subscription based notebooks to reduce capital expenditure and operational complexity.

Regional Driver Comparison

Region Primary Growth Driver Regional Share (%) Regional Value (USD Bn, 2024) Adoption Maturity North America Mature enterprise IT outsourcing 38.7% USD 1.3 Bn Advanced Europe Digital workplace modernization 27.4% USD 0.93 Bn Advanced Asia Pacific Rapid enterprise digitization 23.6% USD 0.80 Bn Developing Latin America Growing managed IT adoption 6.1% USD 0.21 Bn Developing Middle East and Africa Early stage DaaS penetration 4.2% USD 0.14 Bn Early The U.S. market reached USD 4.07 Bn and is projected to grow at an 18.3% CAGR, reflecting strong demand from both large enterprises and small to mid sized organizations. Adoption has been driven by rapid expansion of remote and hybrid work models, which require scalable and centrally managed device fleets. Notebook as a Service has enabled U.S. organizations to standardize hardware, improve security controls, and manage device refresh cycles more efficiently.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Opportunity

A clear opportunity exists in the development of domain-specific notebook templates and integrations that support tailored workflows. For example, templates optimised for financial analysis, scientific computing, or marketing analytics can help users start work quickly and follow best practices. Curated integrations with common data sources and tools can further accelerate adoption.

Another opportunity lies in enhancing security and governance features within notebook services. Providers that offer granular access controls, encryption at rest and in transit, and compliance reporting can attract users from regulated sectors such as finance, healthcare, and government, where secure data handling is paramount.

Challenge

One of the main challenges for the notebook as a service market is balancing flexibility with cost efficiency. Scalable cloud environments can incur significant usage costs, especially for heavy computational tasks. Organisations must manage resource allocation carefully to optimise spending while meeting performance needs.

Another challenge involves ensuring seamless integration with enterprise systems and data platforms. Notebook users often need access to internal databases, data warehouses, and analytic engines. Ensuring secure, reliable connectivity without complex configuration requires strong support for standard interfaces and authentication mechanisms.

Competitive Analysis

Microsoft Corporation, Amazon Web Services (AWS), and Google LLC play an enabling role in the notebook as a service market through cloud management and device lifecycle tools. Their platforms support device provisioning, security updates, and remote management. Emphasis is placed on scalability and cost control. These solutions are widely adopted by enterprises with hybrid work models.

Dell Technologies, Lenovo Group Limited, HP Inc., Apple Inc., and Samsung Electronics Co., Ltd. lead device-centric notebook as a service offerings. Their strengths include global supply chains and broad device portfolios. Services cover deployment, maintenance, and refresh cycles. Focus is placed on user experience and security. These vendors benefit from strong enterprise relationships. Their models help organizations reduce upfront hardware investment.

IBM Corporation, Cisco Systems, Inc., and Fujitsu Limited support managed services and enterprise integration. Hardware-focused players such as Acer Inc., ASUS (ASUSTeK Computer Inc.), Toshiba Corporation, Dynabook Inc., and Panasonic Corporation address specialized business needs. These offerings focus on durability and customization. Other players serve niche enterprise segments.

Top Key Players in the Market

- Microsoft Corporation

- Amazon Web Services (AWS)

- Google LLC

- Dell Technologies

- Lenovo Group Limited

- HP Inc.

- Apple Inc.

- Samsung Electronics Co., Ltd.

- IBM Corporation

- Cisco Systems, Inc.

- Fujitsu Limited

- Acer Inc.

- ASUS (ASUSTeK Computer Inc.)

- Toshiba Corporation

- Dynabook Inc.

- Panasonic Corporation

- Others

Future Outlook

Growth in the Notebook as a Service market is expected to remain positive as organizations move toward flexible and predictable IT spending. This model allows businesses to use notebooks through subscription based plans that include devices, support, and lifecycle management.

Rising remote and hybrid work practices are supporting steady demand, as companies aim to equip employees quickly without large upfront costs. Over time, closer integration with device management, security tools, and refresh programs is likely to improve user experience and operational efficiency.

Recent Developments

- March, 2025 – Dell Technologies rolled out fresh subscription-based DaaS packages blending hardware, software, and AI maintenance, aimed squarely at education and healthcare for easier notebook lifecycle handling.

- January, 2025 – Lenovo wrapped up its Microsoft Solutions Partner designations, boosting their joint push into cloud and AI solutions tied to Lenovo TruScale DaaS for notebook deployments.

Report Scope

Report Features Description Market Value (2024) USD 11.3 Bn Forecast Revenue (2034) USD 73.5 Bn CAGR(2025-2034) 20.60% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Notebook Type (Standard Business Laptops,High-Performance Workstations,Ruggedized & Specialty Laptops), By Organization Size (Small & Medium Enterprises (SMEs),Large Enterprises,Education & Public Sector), By End-User Industry (IT & Telecommunications,Financial Services & Insurance (BFSI),Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft Corporation, Amazon Web Services, Google LLC, Dell Technologies, Lenovo Group Limited, HP Inc., Apple Inc., Samsung Electronics Co., Ltd., IBM Corporation, Cisco Systems, Inc., Fujitsu Limited, Acer Inc., ASUS, Toshiba Corporation, Dynabook Inc., Panasonic Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Notebook as a Service MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Notebook as a Service MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft Corporation

- Amazon Web Services (AWS)

- Google LLC

- Dell Technologies

- Lenovo Group Limited

- HP Inc.

- Apple Inc.

- Samsung Electronics Co., Ltd.

- IBM Corporation

- Cisco Systems, Inc.

- Fujitsu Limited

- Acer Inc.

- ASUS (ASUSTeK Computer Inc.)

- Toshiba Corporation

- Dynabook Inc.

- Panasonic Corporation

- Others