North America Semiconductor Market Size, Share, Industry Analysis Report By Component (Discrete Semiconductors, Optoelectronics, Sensors, ICs (Analog, Micro, Logic, Memory, MPU, MCU, Others)), By Application (Networking & Communications (Ethernet Controllers, Adapters & Switches, & Routers & Others), Data Centers, Industrial (Power Controls & Motor Drives, Intelligent Systems, & Industrial Automation & Others), Consumer Electronics (Home Appliances, Personal Devices, & Other Devices), Automotive (Telematics & Infotainment, Safety Electronics, Chassis, and Others), & Government), By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Sept. 2025

- Report ID: 159706

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

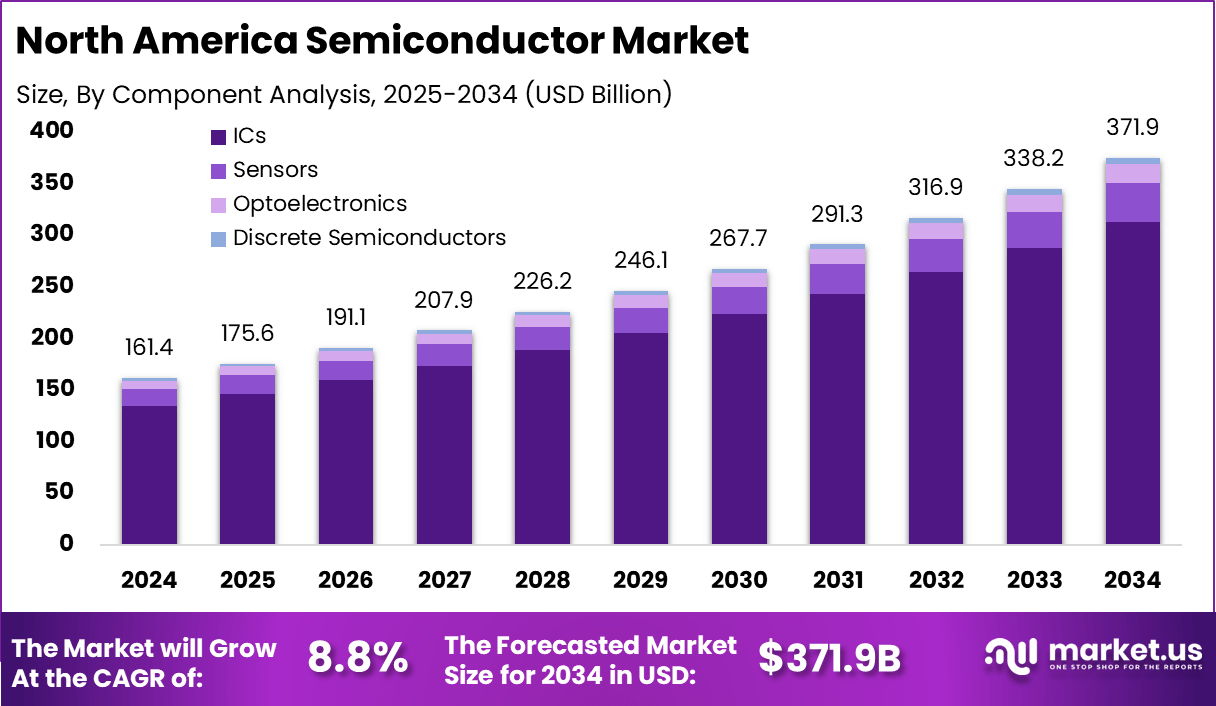

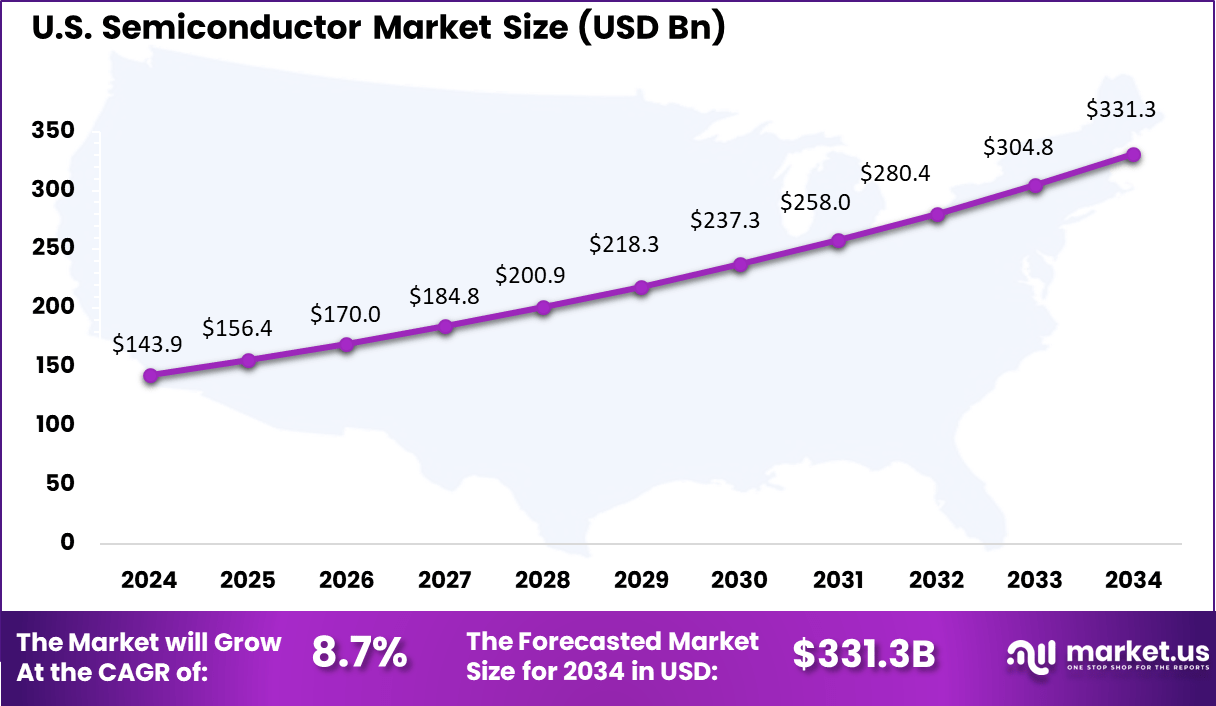

The North America Semiconductor Market size is expected to be worth around USD 371.9 Billion By 2034, from USD 161.4 billion in 2024, growing at a CAGR of 8.8% during the forecast period from 2025 to 2034. In 2024, U.S. held a dominan market position, capturing more than a 8.7% share, holding USD 143.9 Billion revenue.

The North America Semiconductor Market refers to design, manufacturing, testing, and supply of semiconductor devices and components within the North American region, primarily the United States, Canada, and Mexico. It includes logic chips, memory, analog devices, discrete semiconductors, sensors, and related components used in consumer electronics, data centers, automotive, industrial, communications, and defense applications.

Top driving factors for the North American semiconductor market include rapid expansion in AI applications, deployment of 5G networks, and a growing automotive sector focusing on electric and autonomous vehicles. These sectors require increasingly sophisticated integrated circuits and wafers, spurring investments in advanced chip fabrication technologies.

Semiconductor Industry Association (SIA) today reported that global semiconductor sales totaled USD 62.1 billion in July 2025, up 20.6% from USD 51.5 billion in July 2024 and 3.6% higher than USD 59.9 billion in June 2025. The data, compiled by the World Semiconductor Trade Statistics organization, is based on a three-month moving average. SIA represents 99% of the U.S. semiconductor industry by revenue and nearly two-thirds of non-U.S. chip companies worldwide.

Key Insight Summary

- ICs held 83.5% share of the semiconductor market, confirming their central role as the backbone of the region’s electronic ecosystem.

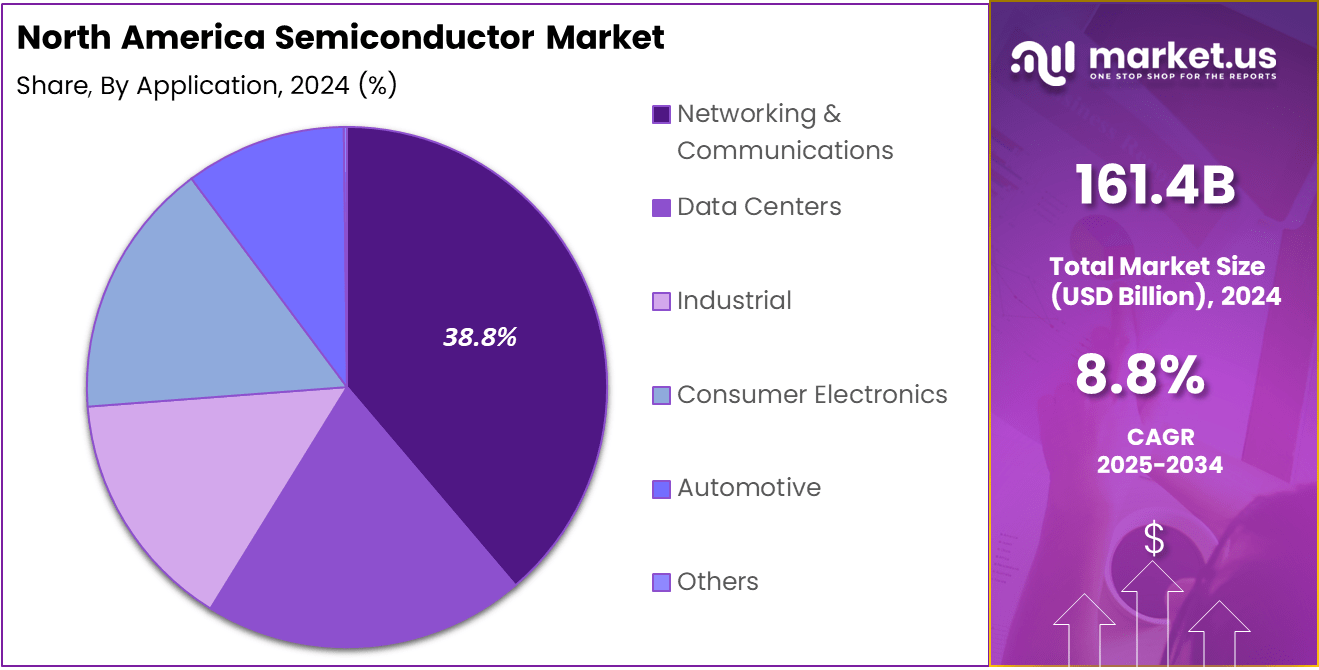

- Networking and Communications contributed 38.8%, highlighting strong demand from data-driven applications, 5G infrastructure, and cloud connectivity.

- United States led with USD 143.87 billion, reflecting its dominance in advanced chip design, R&D, and large-scale production capabilities.

- CAGR of 8.7% in the U.S. shows steady and sustained growth, driven by AI integration, automotive electronics, and government-backed semiconductor initiatives.

- Canada reached USD 17.53 billion, representing a smaller but fast-growing segment supported by emerging design hubs and supportive industrial policies.

- CAGR of 9.9% in Canada indicates faster relative expansion, showing its increasing role in niche applications and collaborative projects with U.S. firms.

Analysts’ Viewpoint

Demand is high across multiple verticals. In the U.S., cloud providers and hyperscale data centers consume large volumes of server processors, accelerators, memory, and networking chips. Consumer electronics – smartphones, wearables, PCs – remain a major demand source. In automotive, North American manufacturers are integrating more semiconductors in EVs, driver assistance systems, and vehicle connectivity.

The industrial sector also uses semiconductors in robotics, automation, industrial IoT, and control systems. Defense, aerospace, and government applications further demand specialized, high‐reliability chips. Mexico and Canada play roles in regional supply chains and assembly operations under trade agreements such as USMCA, facilitating component flows across borders.

In North America, semiconductor firms are adopting advanced process nodes (for example sub-5 nm or extreme ultraviolet lithography), 3D packaging, chip stacking, and heterogeneous system integration. Integration of AI/ML into chip design is becoming more standard to optimize performance, power, and yield. Also, secure and resilient fabrication, test, and packaging solutions are gaining importance, especially given the geopolitical pressures.

US Market Size

The U.S. Semiconductor Market was valued at USD 143.9 Billion in 2024 and is anticipated to reach approximately USD 331.3 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 8.7% during the forecast period from 2025 to 2034.

The U.S. continues to be a global leader in semiconductor design, advanced research, and innovation, particularly in high-performance computing, AI chips, and emerging technologies like quantum computing. Its dominance in intellectual property, combined with a concentration of world-leading chip design companies, underpins steady revenue growth even as large-scale manufacturing remains more concentrated in Asia.

By Country Analysis (2020-2024)

By Country 2020 2021 2022 2023 2024 US 89.6% 89.5% 89.4% 89.3% 89.1% Canada 10.4% 10.5% 10.6% 10.8% 10.9% U.S. growth is fueled by strong demand from consumer electronics, data centers, automotive, aerospace, and defense, along with opportunities from 5G, cloud computing, and electric vehicles. Government support through the CHIPS and Science Act is further boosting domestic manufacturing and supply chain resilience.

By Component

In 2024, Integrated Circuits (ICs) dominated the North America semiconductor market with 83.5% share. The high presence of ICs reflects their role as the backbone of computing and electronics, powering devices from consumer electronics to advanced data centers. With growing reliance on digital systems, ICs remain central to innovation in areas such as machine learning and automation.

The adoption of more compact, high-performance ICs is also being driven by demand for miniaturized devices and efficient power management. The growing presence of smart devices, wearables, and automotive electronics continues to push manufacturers to invest in IC-based solutions that combine speed, scalability, and reduced energy consumption.

North Semiconductor Market Share By Component (%), 2020-2024

By Component 2020 2021 2022 2023 2024 Discrete Semiconductors 5.5% 5.4% 5.3% 5.2% 5.1% Optoelectronics 9.1% 8.9% 8.6% 8.3% 8.1% Sensors 3.4% 3.4% 3.4% 3.3% 3.3% ICs 82.0% 82.4% 82.8% 83.1% 83.5% Analog 15.6% 15.4% 15.2% 15.1% 14.9% Logic 32.8% 33.1% 33.4% 33.7% 33.9% Memory 32.5% 32.5% 32.5% 32.5% 32.6% MPU 14.4% 14.4% 14.3% 14.2% 14.1% MCU 4.2% 4.1% 4.1% 4.0% 3.9% Others 0.6% 0.5% 0.5% 0.5% 0.5% By Application

In 2024, Networking and communications held the lead with 38.8% of the market. This dominance is tied to the rapid migration towards high-speed networks, 5G rollouts, and expanding fiber infrastructure. Semiconductors with low latency and high bandwidth capabilities are critical to enabling seamless connectivity in these advanced systems.

The shift to cloud computing and edge infrastructure has also fueled adoption, as these technologies depend heavily on semiconductors for data transmission and storage. With enterprises and consumers demanding faster and more reliable data flow, the communications segment continues to act as one of the strongest growth engines for the semiconductor market in the region.

North Semiconductor Market Share By Application, 2020-2024

By Application 2020 2021 2022 2023 2024 Networking & Communications 37.5% 37.8% 38.1% 38.5% 38.8% Smartphones 72.2% 72.5% 72.8% 73.0% 73.3% Data Centers 9.2% 9.2% 9.1% 9.0% 8.9% Ethernet Controllers 4.0% 3.9% 3.8% 3.7% 3.6% Adapters & Switches 6.2% 6.1% 6.0% 5.9% 5.8% Routers 5.2% 5.1% 5.0% 5.0% 4.9% Others 3.2% 3.2% 3.2% 3.2% 3.2% Industrial 12.6% 12.5% 12.4% 12.3% 12.1% Power Controls & Motor Drives 19.0% 18.9% 18.8% 18.7% 18.6% Intelligent Systems 30.4% 30.3% 30.2% 30.1% 30.1% Industrial Automation 39.1% 39.2% 39.2% 39.2% 39.2% Others 11.4% 11.5% 11.6% 11.7% 11.8% Consumer Electronics 31.8% 31.7% 31.6% 31.5% 31.4% Home Appliances 11.7% 11.7% 11.7% 11.7% 11.6% PC/Laptops/Tablets 70.2% 70.4% 70.6% 70.9% 71.1% Other Devices 18.0% 17.9% 17.7% 17.6% 17.5% Automotive 11.3% 11.3% 11.4% 11.4% 11.4% Telematics & Infotainment 48.3% 48.3% 48.3% 48.3% 48.3% Safety Electronics 30.7% 30.9% 31.0% 31.2% 31.3% Chassis 9.7% 9.6% 9.5% 9.4% 9.3% Others 11.3% 11.3% 11.3% 11.2% 11.1% Others 6.8% 6.7% 6.6% 6.4% 6.3% Emerging Trends

Emerging trends in the North America semiconductor market include the rise of AI-driven design automation, where machine learning enhances the accuracy and speed of chip simulations and verifications. There is a growing focus on application-specific integrated circuits to meet vertical market needs such as automotive electronics and healthcare devices.

Industry movement towards modular chiplet architectures is increasing, allowing flexible designs that mix and match technology blocks to meet varying performance and size requirements. Sustainability is also shaping trends with a push for energy-efficient chips, greener materials, and manufacturing processes. These trends are supported by 22.9% market share growth in North America, fueled by innovation in AI accelerators and heterogeneous integration strategies.

Growth Factors

Growth factors in North America’s semiconductor industry strongly tie to the surge in AI-related technology demand. The presence of hyperscale data centers, the expansion of 5G networks, and the rise in autonomous and electric vehicle technology all contribute to increased semiconductor consumption.

Government support plays a vital role, with policies encouraging domestic semiconductor production and innovation. The CHIPS Act, for example, has spurred billions in new investments, fostering manufacturing and research development.

The availability of skilled workforce, collaborative ecosystems between academia and industry, and strong intellectual property protections also underpin steady growth. Approximately $600 billion in private investment projects across 28 states have been announced, supporting 500,000 American jobs in the semiconductor ecosystem.

Key Market Segments

By Component Analysis

- Discrete Semiconductors

- Optoelectronics

- Sensors

- ICs

- Analog

- Micro

- Logic

- Memory

- MPU

- MCU

- Others

By Application

- Networking & Communications

- Ethernet Controllers

- Adapters & Switches

- Routers

- Others

- Data Centers

- Industrial

- Power Controls & Motor Drives

- Intelligent Systems

- Industrial Automation

- Others

- Consumer Electronics

- Home Appliances

- Personal Devices

- Other Devices

- Automotive

- Telematics & Infotainment

- Safety Electronics

- Chassis

- Others

- Others

Driver

Growing Demand for AI and Data Center Technologies

The North America semiconductor market is driven strongly by increasing demand for chips used in artificial intelligence and data center applications. AI technologies require specialized processors such as GPUs and high-bandwidth memory to handle intensive computing tasks.

Large cloud service providers are expanding their data center infrastructure rapidly, leading to increased chip consumption. This growth in AI workloads pushes semiconductor manufacturers to develop advanced, high-performance chips, fueling the regional market’s expansion.

For instance, in 2025, AI-related semiconductor sales are expected to contribute significantly to overall growth, with North America showing one of the fastest market expansions in semiconductor demand. The region benefits from an ecosystem rich in innovation and production capabilities, supported by strong local technology development.

Restraint

Supply Chain Disruptions and Global Dependencies

A key restraint facing the North America semiconductor market is its ongoing reliance on global supply chains, especially for critical raw materials and manufacturing capacity. While the region excels in design and innovation, much of the fabrication depends on overseas foundries, mainly in East Asia.

Geopolitical tensions, shipping delays, and natural events can severely disrupt the supply of components and materials essential for chip production. For instance, over 65% of semiconductor components used in the U.S. come from countries like Taiwan and South Korea.

Any interruption from these suppliers can lead to delays in production and increased costs. Despite efforts to onshore manufacturing, the dependency on external supply chains remains a significant limitation that restricts the market’s growth potential and flexibility.

Opportunity

Expansion in Semiconductor Manufacturing for Electric Vehicles

The rise of electric vehicles (EVs) opens a major opportunity for the North America semiconductor market. EVs require sophisticated semiconductor components for battery management, autonomous driving, and power electronics, significantly increasing chip demand.

With government policies promoting green energy and transportation electrification, investments in semiconductor manufacturing equipment tailored for EVs are accelerating. For example, the North American EV market is projected to grow strongly in 2025, fueling demand for advanced semiconductor fabrication tools.

As automakers and tech companies develop more EV models, the semiconductor industry stands to benefit from this ongoing expansion. This growing sector represents a strategic avenue for manufacturers and equipment providers to capture new revenue streams beyond traditional consumer electronics.

Challenge

Shortage of Skilled Semiconductor Workforce

One major challenge limiting the North America semiconductor market is the shortage of skilled professionals in the industry. The complexity of chip design and manufacturing requires specialized engineers, but the current supply of experienced talent is insufficient to meet demand.

This workforce gap threatens to slow innovation and delay production expansions. For instance, the U.S. is forecasted to face a shortage of tens of thousands of semiconductor professionals by 2030. This shortage impacts various roles, including design engineers, process technicians, and quality assurance experts.

Competitive Analysis

The Semiconductor Market is dominated by Taiwan Semiconductor Manufacturing Co. Ltd. (TSMC) and Samsung, both serving as major global foundries. TSMC leads in advanced process nodes for high-performance computing and mobile chips, while Samsung combines memory and logic chip production with vertical integration.

Firms like NVIDIA, Intel Corp., AMD, and Qualcomm Inc. are central to semiconductor design innovation. NVIDIA dominates in AI and GPU segments, Intel focuses on x86 CPUs and data center chips, and AMD offers competitive processors across gaming and enterprise markets. Qualcomm remains strong in mobile SoCs and 5G chipsets.

Supporting the hardware ecosystem are memory suppliers such as SK Hynix and Micron, along with equipment providers like Applied Materials, Inc.. These firms ensure consistent supply of DRAM, NAND, and semiconductor fabrication tools. Broadcom Inc. strengthens the market through connectivity and custom chip solutions.

Top Key Players in the Market

- Taiwan Semiconductor Manufacturing Co. Ltd. (TSM)

- Company Overview

- Product Portfolio

- Financial Performance

- Recent Developments/Updates

- Strategic Overview

- SWOT Analysis

- Samsung

- NVIDIA

- Intel Corp.

- Broadcom Inc.

- Qualcomm Inc.

- SK Hynix

- Applied Materials, Inc.

- Advanced Micro Devices (AMD)

- Micron

- Other key players

Note (*): Similar analysis will be provided for other companies as well.

Recent Developments

- August 2025: Applied Materials reported record revenue of $7.30 billion for Q3 2025, up 8% year-over-year, driven by strong demand. The company is navigating near-term supply chain challenges while confident in long-term semiconductor growth.

- February 2025: Intel showed resilience with a 19% surge in 2024, supported by US CHIPS Act investments expected to triple US semiconductor manufacturing capacity by 2032. The company also attracted a $5 billion investment from Nvidia to support its turnaround and growth plans.

Report Scope

Report Features Description Market Value (2024) USD 161.4 Bn Forecast Revenue (2034) USD 371.9 Bn CAGR(2025-2034) 8.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Discrete Semiconductors, Optoelectronics, Sensors, ICs (Analog, Micro, Logic, Memory, MPU, MCU, Others)), By Application (Networking & Communications (Ethernet Controllers, Adapters & Switches, & Routers & Others), Data Centers, Industrial (Power Controls & Motor Drives, Intelligent Systems, & Industrial Automation & Others), Consumer Electronics (Home Appliances, Personal Devices, & Other Devices), Automotive (Telematics & Infotainment, Safety Electronics, Chassis, and Others), & Government) Competitive Landscape Taiwan Semiconductor Manufacturing Co. Ltd. (TSM), Samsung, NVIDIA, Intel Corp., Broadcom Inc., Qualcomm Inc., SK Hynix, Applied Materials, Inc., Advanced Micro Devices (AMD), Micron, and `Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  North America Semiconductor MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

North America Semiconductor MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Taiwan Semiconductor Manufacturing Co. Ltd. (TSM)

- Samsung

- NVIDIA

- Intel Corp.

- Broadcom Inc.

- Qualcomm Inc.

- SK Hynix

- Applied Materials, Inc.

- Advanced Micro Devices (AMD)

- Micron

- Other key players