North America Freight Railcar Parts Market Size, Share, Growth Analysis By Type (Covered Hopper, Box Car, Autocar, Center Beam, Coil Car, Flat Car, Gondola, Open to Hopper, Refrigerant Boxcar, Tank Cars, Others), By Component (Wheels, Axles and Bearings, Gears, Side Frames, Draft Systems, Others), By Distribution Channel (Aftermarket, OEM), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168961

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

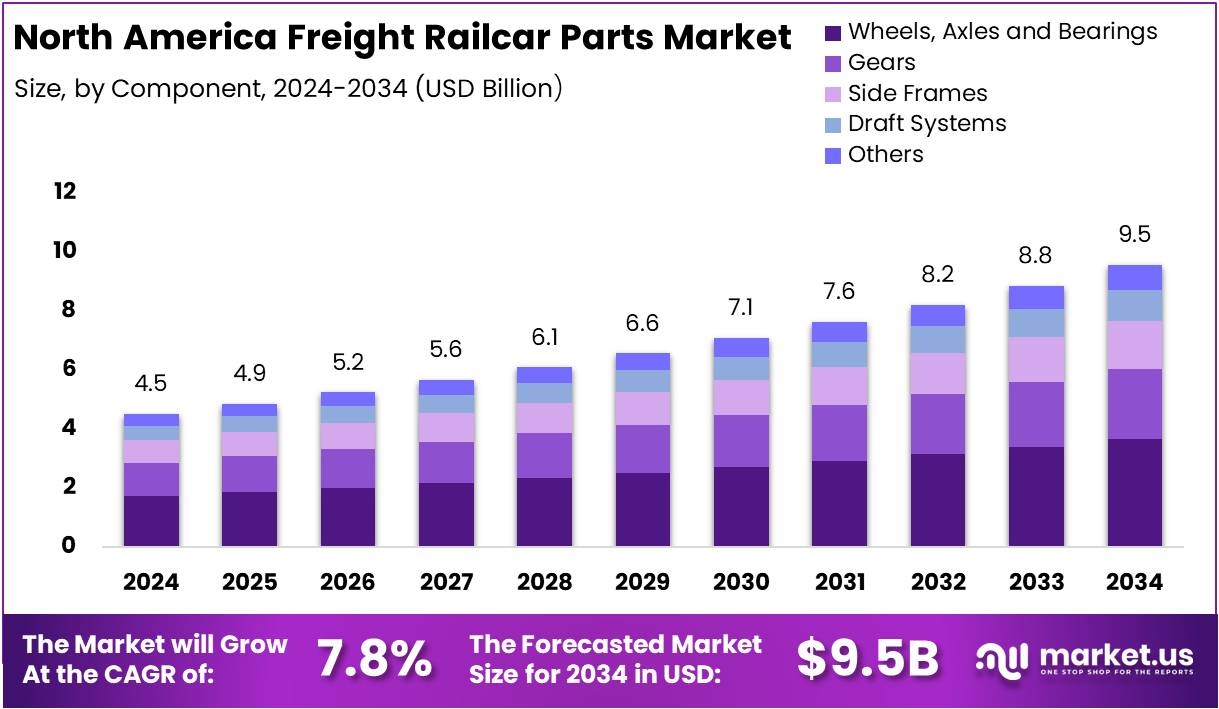

The North America Freight Railcar Parts Market size is expected to be worth around USD 9.5 Billion by 2034, from USD 4.5 Billion in 2024, growing at a CAGR of 7.8% during the forecast period from 2025 to 2034.

The North America Freight Railcar Parts Market is critical for ensuring efficient freight transportation across the region. Key components such as wheels, axles, bearings, gears, and draft systems drive operational reliability. Growing industrial activity and increasing logistics demand support consistent replacement, maintenance, and aftermarket opportunities for railcar parts suppliers.

Market expansion is driven by rising freight volumes and cross-border trade. Increasing investments in rail infrastructure and fleet modernization create opportunities for durable and high-performance components. Suppliers focusing on innovation and quality can capitalize on the growing demand for optimized railcar maintenance and reliable freight components in North America’s expanding rail network.

Government investment and regulatory support reinforce market growth. Policies emphasizing safety, emission control, and technical standardization promote adoption of advanced components. Compliance with these frameworks ensures operational efficiency, reduces downtime, and improves lifecycle performance. Rail operators increasingly rely on modern parts to maintain regulatory standards and enhance cargo transportation safety.

Technological innovation is transforming the market landscape. Predictive maintenance systems, smart sensors, and advanced materials improve railcar reliability and reduce operational risks. Suppliers adopting these innovations can deliver value-added solutions, strengthen their competitive position, and meet growing demand for high-quality freight railcar components in both aftermarket and OEM segments.

Freight movement recently reached nearly 1.8 billion metric tons across a 140,000-mile rail network, highlighting the critical need for reliable railcar parts. Rising transborder freight, which increased by 8.2%, further underscores opportunities for maintenance, replacement, and modernization of railcar components to support uninterrupted cargo operations and efficiency.

North America’s railroads operate 1,471,736 freight cars and 31,875 locomotives, employing 215,985 personnel, with total equipment reaching 2,110,061 units. These figures indicate strong demand for replacement parts, maintenance solutions, and aftermarket support, ensuring long-term opportunities for suppliers catering to freight railcar efficiency and sustainability.

Recent fleet expansion, reflected in 1,250 new wagons ordered, signals ongoing investment in rail operations. Overall, rising freight volumes, regulatory compliance, technological adoption, and infrastructure funding continue to drive growth in the North America Freight Railcar Parts Market, offering sustainable opportunities for suppliers and stakeholders.

Key Takeaways

- The North America Freight Railcar Parts Market will grow from USD 4.5 Billion in 2024 to USD 9.5 Billion by 2034.

- The market expands at a 7.8% CAGR across all key segments in North America.

- The Covered Hopper segment leads the Type category with a 21.3% share in 2024.

- Wheels, Axles, and Bearings dominate the Component segment with a 38.2% share.

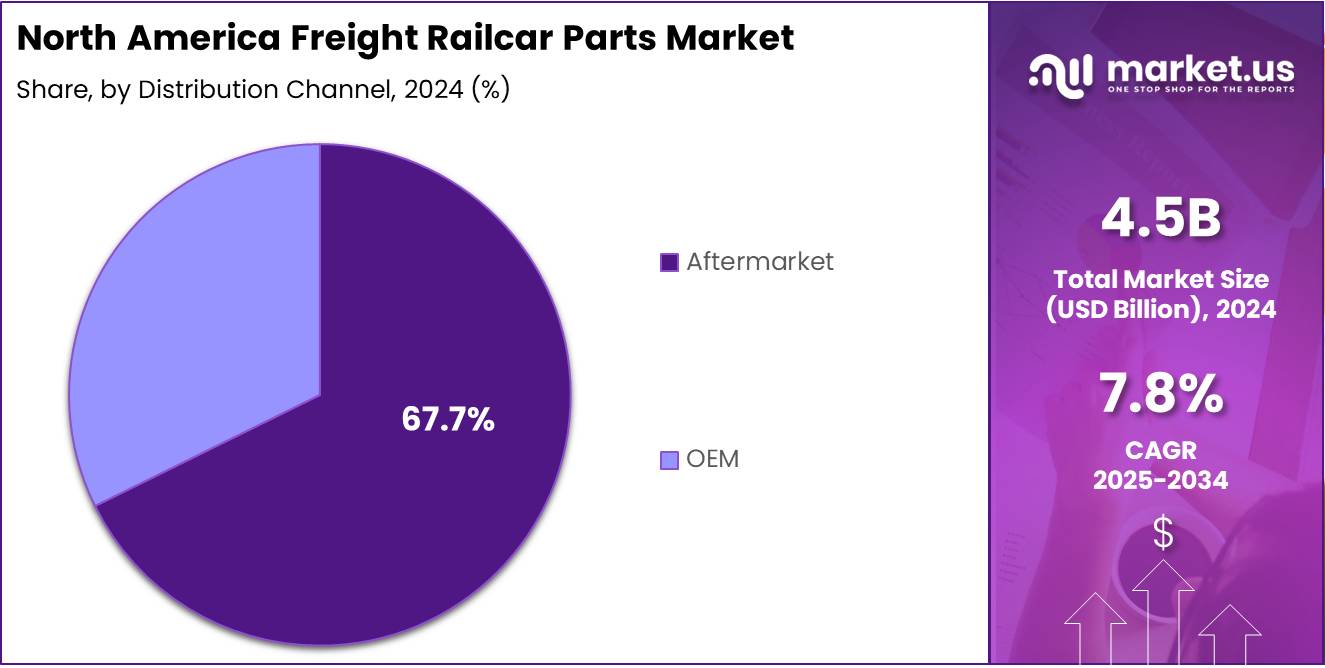

- The Aftermarket channel holds a strong 67.7% share due to high replacement needs.

By Type Analysis

Covered Hopper held a dominant market position in the By Type segment of the North America Freight Railcar Parts Market, with a 21.3% share.

In 2024, Covered Hopper railcars dominated with a 21.3% share because they support bulk commodity transport across agriculture and chemicals. Their durability, strong load capacity, and demand for frequent maintenance drive consistent replacement-part consumption. Additionally, operators rely on aftermarket support to ensure uptime, strengthening this sub-segment’s impact across major North American freight corridors.

Box Cars remain essential for general freight, offering flexible loading and secure transport. They require regular servicing of wheels, doors, and frame components due to constant utilization. As industries move diverse product categories, the need for reliable parts increases steadily. Their operational resilience ensures consistent parts consumption and sustained relevance within the regional freight ecosystem.

Autocar units handle specialized heavy-duty loads, encouraging demand for sturdy mechanical components. Their structure ensures safe movement of oversized freight, requiring frequent maintenance of wheels, bearings, and coupler systems. As industrial supply chains expand, operators seek durable replacement parts to maintain operational continuity, contributing to stable growth within this technically focused railcar category.

Center Beam railcars support the transport of lumber and building materials, relying heavily on strong side frames and draft components. Their specialized design demands rigorous maintenance to support heavy loads. With construction activities expanding, demand for reliable replacement parts increases steadily, reinforcing the segment’s continuing presence within North America’s freight rail supply network.

Coil Cars are designed for steel coil and metal product movement, requiring enhanced structural strength. Their components must tolerate concentrated weight, driving demand for durable wheels, axles, and bearings. As manufacturing output increases, operators rely on timely aftermarket replacements to ensure safe transport, positioning this sub-segment as a key market contributor.

Flat Cars remain vital for oversized freight and machinery transport. Their open design demands durable frames, axles, and coupling systems. Consistent industrial shipments increase wear, creating stable aftermarket parts demand. Operators prioritize high-strength components to maintain reliability during heavy loading, ensuring ongoing relevance within the broader freight railcar parts landscape.

Gondola railcars move bulk materials such as scrap metal and minerals, requiring strong side frames and brake systems. Heavy use leads to steady replacement cycles for core components. Their versatility across industries amplifies consistent aftermarket reliance. This sub-segment supports high-volume transport, keeping parts consumption elevated across multiple industrial applications.

Open to Hopper cars enable efficient unloading of granular commodities, relying on robust discharge systems and structural frames. Their frequent loading cycles contribute to continuous wear, increasing the need for regular parts replacement. Strong demand from mining and agriculture strengthens this segment’s relevance, supporting broader aftermarket growth across North America.

Refrigerant Boxcars transport temperature-sensitive goods, increasing reliance on reliable mechanical components and insulation structures. While more specialized, they require consistent upkeep to protect cargo integrity. Growth in cold-chain distribution drives steady demand for replacement parts. Operators prioritize precision-engineered systems to maintain stable cooling performance throughout rail transit.

Tank Cars transport liquid and gaseous materials, requiring reinforced wheels, axles, and safety systems. Regulatory compliance drives routine maintenance, increasing part replacement frequency. Industrial chemical demand supports consistent fleet utilization, making durable components essential. This sub-segment remains strategically important as safety and reliability influence operational decisions across all tank-based freight operations.

Other railcar types serve niche applications requiring customized components, supporting industries with unique loading needs. Their specialized nature drives demand for tailored parts solutions. While smaller in volume, they contribute meaningful aftermarket activity. Operators depend on reliable component supply to maintain continuous operations within less standardized freight movements across regional networks.

By Component Analysis

Wheels, Axles and Bearings held a dominant market position in the By Component segment, with a 38.2% share.

In 2024,Wheels, Axles, and Bearings dominated with a 38.2% share as they represent critical safety and mobility components. High stress during operations increases wear, generating frequent replacement cycles. Consistent fleet activity across North America strengthens aftermarket consumption. Operators prioritize durable, high-performance systems to maintain efficiency, reinforcing this segment’s leading position in the regional market.

Gears support core mechanical systems, enabling smooth motion transfer within railcars. Their involvement in key operational functions increases the demand for precision engineering. Regular maintenance schedules encourage recurring part consumption. As freight activity intensifies, operators focus on reliable gear systems to maintain uninterrupted operations across varied industrial applications.

Side Frames provide structural stability, distributing load evenly during transit. Heavy usage creates stress, leading to routine inspections and part replacements. Their importance in maintaining safe railcar operation drives consistent aftermarket demand. Industries rely on high-strength materials to sustain performance across challenging freight conditions, ensuring steady market relevance.

Draft Systems manage coupling forces between railcars, absorbing stress during motion and braking. Their reliability directly influences operational safety, increasing demand for high-quality parts. Frequent inspection requirements contribute to stable replacement cycles. As freight networks expand, this sub-segment supports smooth train assembly and operational stability across extensive rail operations.

Others include various supporting components vital for daily operations. These parts ensure integration of mechanical, structural, and safety systems. Specialized requirements among different railcar types generate diverse aftermarket demand. Operators depend on consistent supply to address unique maintenance needs, maintaining overall fleet efficiency across North America’s freight rail industry.

By Distribution Channel Analysis

Aftermarket held a dominant market position in the By Distribution Channel segment, with a 67.7% share.

In 2024,Aftermarket distribution dominated with a 67.7% share due to frequent maintenance cycles across diverse railcar fleets. Operators rely on accessible replacement parts to reduce downtime. The wide availability, cost advantages, and rapid service support strengthen aftermarket preference. This channel ensures reliable supply, sustaining operational continuity throughout the North American freight network.

OEM channels support new railcar production and integrated component installation. Although smaller, they remain essential for ensuring original quality and compliance. Collaboration with manufacturers enables precise fit and performance. Operators rely on OEM components for new asset deployment, reinforcing long-term reliability across railcar systems and complementing robust aftermarket activity.

Key Market Segments

By Type

- Covered Hopper

- Box Car

- Autocar

- Center Beam

- Coil Car

- Flat Car

- Gondola

- Open to Hopper

- Refrigerant Boxcar

- Tank Cars

- Others

By Component

- Wheels, Axles and Bearings

- Gears

- Side Frames

- Draft Systems

- Others

By Distribution Channel

- Aftermarket

- OEM

Drivers

Strong Growth in Cross-Border Freight Movement Elevates Parts Replacement Needs

The North America freight railcar parts market is benefiting from increasing cross-border freight movement. As trade between countries rises, rail operators require frequent replacement and maintenance of parts to ensure smooth operations. This trend is driving consistent demand across key components like wheels, axles, and draft systems.

Expansion of intermodal transport infrastructure is another key factor. Growing rail networks and upgraded terminals support efficient cargo movement. This expansion increases wear and tear on railcars, leading to higher demand for replacement parts. Operators are investing in durable components to improve reliability and reduce downtime.

Rail safety compliance requirements are also boosting the market. Regulatory authorities enforce strict safety standards for freight operations. Railcar owners are upgrading parts and systems to meet these regulations. This ensures operational safety and helps avoid penalties, creating steady demand for certified components.

Restraints

Challenges in Standardization and Maintenance Affecting Market Growth

The North America freight railcar parts market faces limitations due to the lack of uniform standards across component specifications. Different rail operators and manufacturers often use varying designs, which complicates parts compatibility. This inconsistency increases inventory requirements and slows down the replacement process for railcar components.

Limited standardization also raises maintenance costs. Rail operators may need to keep multiple versions of the same component to ensure availability. This leads to higher capital investment and operational inefficiencies, affecting overall market growth.

Another restraint is the slow turnaround times in railcar refurbishment and overhaul cycles. Railcars often remain out of service for extended periods during maintenance or retrofitting. Delays in refurbishment reduce the frequency of parts replacement and limit the overall demand for new components.

These slow maintenance cycles also affect rail operators’ ability to respond quickly to increasing freight volumes. The delay in bringing railcars back into operation impacts service efficiency and revenue potential.

Growth Factors

Expansion of Predictive Maintenance Parts Supported by IoT Sensor Adoption

The North America freight railcar parts market is witnessing significant growth opportunities through the expansion of predictive maintenance solutions. Rail operators are increasingly adopting IoT sensors to monitor railcar components in real time. This trend enables timely replacement of parts, reducing unexpected breakdowns and operational delays.

Modernization programs across bulk and intermodal fleets are also driving demand for updated railcar components. Operators are retrofitting older railcars with advanced parts to improve efficiency, safety, and compliance. This creates a consistent need for replacement parts and technical upgrades in the market.

Additionally, there is a rising preference for lightweight and high-durability materials in railcar components. Manufacturers are introducing innovative alloys and composites to reduce railcar weight while enhancing performance. This trend supports fuel efficiency and lowers maintenance costs.

Overall, the combination of IoT-enabled maintenance, modernization initiatives, and advanced material adoption presents substantial growth potential. Companies focusing on these areas are better positioned to meet evolving market requirements and strengthen their competitive advantage in North America.

Emerging Trends

Accelerated Adoption of Digital Inspection Tools for Parts Quality Assessment

Digital inspection technologies are transforming the railcar parts market by improving the accuracy of quality assessments. Rail operators are adopting advanced tools to quickly identify defective components, reducing operational risks and downtime. This creates higher demand for compatible replacement parts and monitoring equipment.

The use of 3D-printed components is also gaining traction. Rapid prototyping allows manufacturers to produce railcar parts faster, reducing lead times and costs. This trend is especially useful for customized or hard-to-source components, enabling more agile supply chains.

Integration of smart coupler and automated monitoring systems is further enhancing railcar operations. These technologies allow real-time tracking of component performance, alerting operators to maintenance needs before failures occur. Such innovations drive demand for technologically advanced parts and solutions.

Together, digital inspection, 3D printing, and smart monitoring systems are shaping the future of North America’s freight railcar parts market. Companies leveraging these trends can improve operational efficiency, reduce costs, and stay competitive in a rapidly evolving industry.

Key North America Freight Railcar Parts Company Insights

The North American freight railcar parts market continues to benefit from accelerating replacement cycles, regulatory-driven safety upgrades, and an ongoing shift toward higher‑durability materials. The following firms are particularly well positioned to capture share in this environment.

Wabtec Corporation: As an established provider of braking systems and control subsystems, Wabtec leverages a broad installed base across Class I and regional railroads. Its long-standing service network enables efficient aftermarket support — a critical differentiator in a parts‑intensive segment where uptime matters.

ABB Ltd.: ABB has increasingly focused on advanced power-electronics and drive systems for newer locomotive and railcar models. Its emphasis on modular, energy-efficient components resonates with operators investing in long-term lifecycle cost reductions.

Alstom SA: Alstom’s legacy in railcar manufacturing gives it a strong vertical integration advantage. It tends to internalize parts supply for its builds — helping ensure quality and traceability, which appeals to customers wary of third‑party component variability.

CIMC Group Limited: Although relatively newer to the North American aftermarkets, CIMC brings global scale and cost-efficient production. It has gained traction by offering competitively priced chassis and underframe components, making it an attractive supplier for budget‑sensitive fleet owners undertaking mass refurbishments.

Top Key Players in the Market

- Wabtec Corporation

- ABB Ltd.

- Alstom SA

- CIMC Group Limited

- Faiveley Transport

- GATX Corporation

- General Electric Company

- Greenbrier Companies

- Knorr-Bremse AG

- Progress Rail Services Corporation

Recent Developments

- In August 2024, Sojitz Corporation of America acquired full ownership of the U.S. company BW Services. This acquisition strengthened their presence in the North American freight services market and expanded operational capabilities.

- In October 2024, Genesee & Wyoming Inc. (G&W) acquired independent ownership of Central Gulf Railcar Services (CGRS). This move allowed G&W to streamline operations and enhance service efficiency across its regional rail network.

- In January 2025, Union Tank Car Company (UTLX) announced a strategic partnership with 225 Rail. The collaboration aimed to improve fleet management solutions and optimize maintenance processes for bulk and hazardous material transport.

Report Scope

Report Features Description Market Value (2024) USD 4.5 Billion Forecast Revenue (2034) USD 9.5 Billion CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Covered Hopper, Box Car, Autocar, Center Beam, Coil Car, Flat Car, Gondola, Open to Hopper, Refrigerant Boxcar, Tank Cars, Others), By Component (Wheels, Axles and Bearings, Gears, Side Frames, Draft Systems, Others), By Distribution Channel (Aftermarket, OEM) Competitive Landscape Wabtec Corporation, ABB Ltd., Alstom SA, CIMC Group Limited, Faiveley Transport, GATX Corporation, General Electric Company, Greenbrier Companies, Knorr-Bremse AG, Progress Rail Services Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  North America Freight Railcar Parts MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

North America Freight Railcar Parts MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Wabtec Corporation

- ABB Ltd.

- Alstom SA

- CIMC Group Limited

- Faiveley Transport

- GATX Corporation

- General Electric Company

- Greenbrier Companies

- Knorr-Bremse AG

- Progress Rail Services Corporation