Global NOR Flash Market Size, Share, Trends Analysis Report By Type (Serial NOR Flash, Parallel NOR Flash), By Application (Consumer Electronics, Communication, Automotive, Industrial, Other Applications), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: November 2024

- Report ID: 132037

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

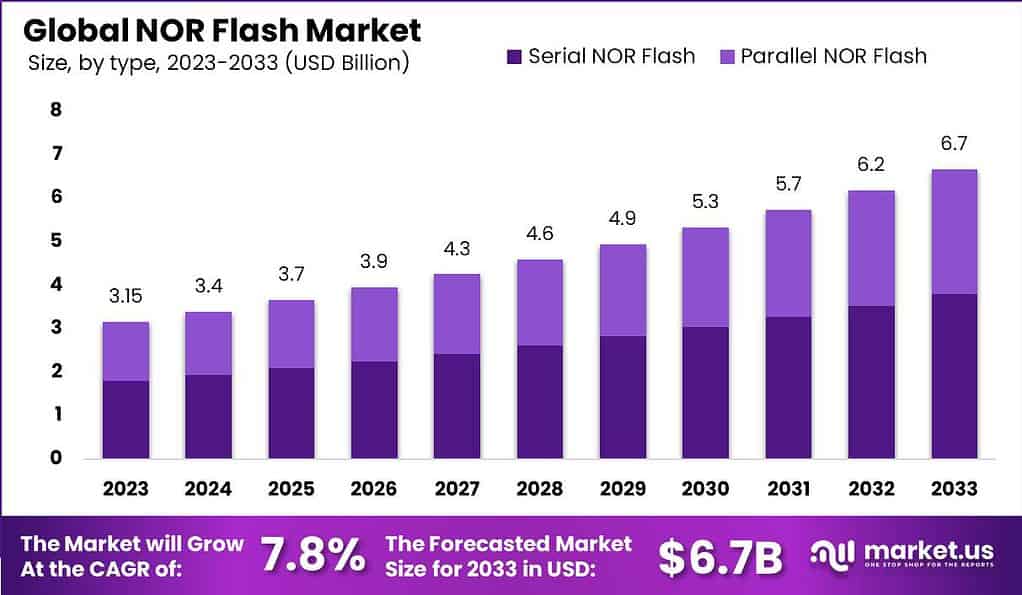

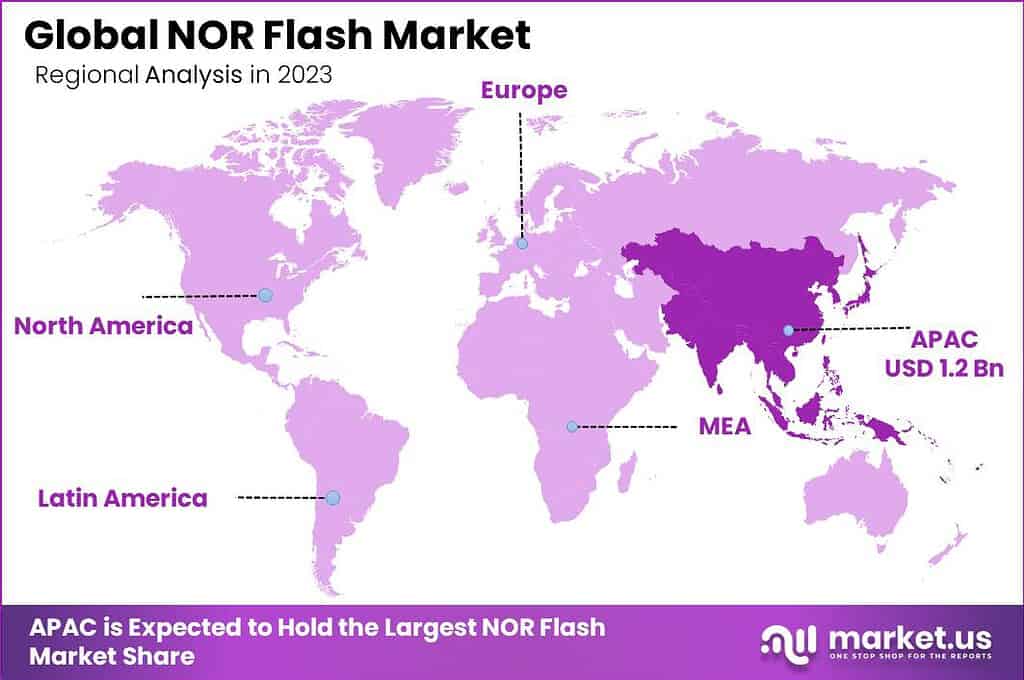

The Global NOR Flash Market size is expected to be worth around USD 6.7 Billion By 2033, from USD 3.15 Billion in 2023, growing at a CAGR of 7.80% during the forecast period from 2024 to 2033. In 2023, APAC held a dominant market position, capturing more than a 37% share, holding USD 1.2 Billion revenue.

NOR Flash is a type of non-volatile storage technology that retains data without the need for power. It enables quick read operations, making it an excellent choice for storing the firmware and configuration settings in various electronic devices. The architecture of NOR Flash allows for full address and data buses to be directly accessed by the microprocessor, offering random access capabilities similar to DRAM.

The NOR Flash market is experiencing growth driven by the increasing demand for high-performance memory solutions across various industry sectors. As industries continue to advance technologically, the need for reliable and durable memory that can operate under extreme conditions without data degradation is critical. NOR Flash memory serves this need effectively, thus gaining traction in applications where long-term data integrity and instant boot-up capabilities are essential.

Demand in the NOR Flash market is underpinned by its widespread use in consumer electronics, automotive systems, and telecommunications equipment. The technology’s ability to provide fast read speeds and execute code in-place makes it indispensable for applications requiring high-speed boot-up and firmware execution.

For instance, In April 2024, Micron Technology Inc. unveiled its latest product, the Micron Serial NOR Flash Memory. This new memory solution is designed to enhance the performance and reliability of a wide range of devices, from automotive and industrial to consumer electronics. It offers significant improvements in reading and writing speeds, increased storage capacity, and better endurance. These features make it ideal for high-demand applications where fast and reliable data storage and retrieval are crucial.

Recent technological advancements in NOR Flash include the development of products with improved read and write speeds, higher densities, and better durability. Innovations such as MirrorBit technology have also enhanced the cost-effectiveness of NOR Flash solutions. These advancements are crucial as they address the increasing market demands for higher performance and greater memory capacity in various electronic devices.

Opportunities within the NOR Flash market are linked to technological advancements and the growing needs of sectors like automotive, where more sophisticated user interfaces and advanced driver-assistance systems (ADAS) are becoming standard. Additionally, the ongoing development in smart industrial applications and IoT devices presents new opportunities for NOR Flash solutions, given their reliability and performance benefits.

Based on data from TechTarget, write throughput in storage devices generally trends lower than read speeds, averaging around 1 MB/s but varying widely with implementation specifics and usage scenarios. Some Multi-Level Cell (MLC) devices can even have throughput rates as low as 0.47 MB/s under certain conditions.

In terms of flash memory performance, NOR Flash has noticeably slower erase times than NAND Flash, often taking several hundred milliseconds for a single sector. For instance, erasing a 128KB sector on NOR Flash can require around 520 ms, which can impact performance for applications needing rapid updates.

A distinct advantage of NOR Flash, however, lies in its data retention capabilities. Under standard conditions, NOR Flash can retain data for up to 20 years, enduring approximately 1,000 program/erase cycles before wear begins to affect performance. This longevity makes it a reliable choice for applications needing long-term data stability.

Key Takeaways

- The Global NOR Flash Market is projected to grow from USD 3.15 billion in 2023 to approximately USD 6.7 billion by 2033, with a CAGR of 7.80% during the forecast period from 2024 to 2033.

- In 2023, the Serial NOR Flash segment dominated the market, capturing over 57% of the share.

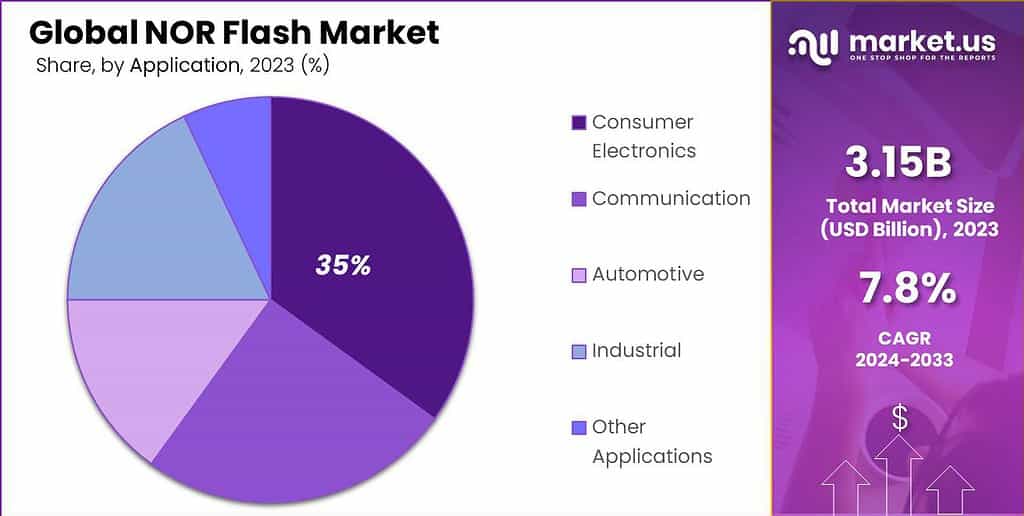

- The Consumer Electronics segment also held a significant position in 2023, accounting for more than 35% of the NOR Flash market.

- The Asia-Pacific (APAC) region led the NOR Flash market in 2023, holding over 37% of the market share and generating approximately USD 1.2 billion in revenue.

Type Analysis

In 2023, the Serial NOR Flash segment emerged as a dominant force in the NOR Flash market, accounting for over 57% of the market share. This leadership position can be attributed to several factors that underscore the segment’s widespread adoption and technological suitability across a range of applications.

Serial NOR Flash is highly favored for its fast read capabilities, which are crucial for applications where speed and immediate access to data are paramount. Its ability to execute code directly from the flash memory without needing to copy it into RAM makes it an ideal choice for critical applications in the automotive and industrial sectors, where reliability and performance are key requirements.

Moreover, Serial NOR Flash supports a wide range of densities and form factors, enhancing its adaptability across various consumer electronics. The demand for Serial NOR Flash is primarily driven by its use in consumer electronics and embedded systems. Its reliability and robustness make it suitable for storing firmware and boot code, which are essential for the stable operation of many devices.

As the IoT and connected devices continue to proliferate, the need for reliable and quick access memory solutions like Serial NOR Flash grows, reinforcing its market position. Recent technological improvements in Serial NOR Flash, such as increased memory density and reduced power consumption, have broadened its applicability.

Innovations in packaging and integration have allowed manufacturers to offer more compact solutions that fit the shrinking form factors of modern electronic devices without sacrificing performance. These advancements not only cater to the current market demands but also align with future technological trends, ensuring sustained growth in its adoption.

The combination of performance efficiency, enhanced reliability, and continuous improvements in technology keeps the Serial NOR Flash at the forefront of the NOR Flash market, underpinning its dominant market position. As industries like automotive and telecommunications continue to evolve, the relevance and utility of Serial NOR Flash are expected to increase, maintaining its leading status in the market

Application Analysis

In 2023, the Consumer Electronics segment held a dominant market position in the NOR Flash market, capturing more than a 35% share. This prominence is largely due to several pivotal factors that align with the current technology consumption trends and product developments in consumer electronics.

Consumer electronics, encompassing devices like smartphones, tablets, smartwatches, and other portable gadgets, continue to demand high-performance memory solutions. NOR Flash is particularly favored in this segment due to its ability to offer fast read speeds and reliable performance, which are crucial for the user experience.

The persistent innovation in consumer gadgets, which increasingly require more sophisticated firmware and boot code storage, also significantly contributes to the robust demand for NOR Flash memory. The dominance of NOR Flash in the consumer electronics sector is bolstered by the ongoing advancements in technology that necessitate enhanced memory capabilities.

As devices become smarter and more connected, the requirement for NOR Flash to support instantaneous boot-up processes and real-time application execution grows. Furthermore, the trend towards more integrated and compact device designs encourages the adoption of NOR Flash, which is known for its small form factor and low power consumption.

Technological synergies between NOR Flash and emerging consumer technologies, such as augmented reality (AR) and wearable tech, further reinforce its market position. As these technologies evolve, they rely heavily on NOR Flash for their memory solutions because of its reliability and efficiency in accessing and storing critical data. This ongoing evolution in the consumer electronics market is expected to sustain, if not increase, the reliance on NOR Flash, ensuring its continued market dominance.

Key Market Segments

By Type

- Serial NOR Flash

- Parallel NOR Flash

By Application

- Consumer Electronics

- Communication

- Automotive

- Industrial

- Other Applications

Driver

Growing Demand for High-Speed Data Storage in Consumer Electronics

The demand for high-speed data storage in consumer electronics is one of the key drivers propelling the NOR Flash market. In today’s digital age, smartphones, wearables, and IoT devices are rapidly evolving, requiring robust memory solutions that can handle data swiftly and reliably.

NOR Flash, known for its fast read speeds and reliability, has become indispensable in these applications. Unlike other types of memory, NOR Flash provides instant data access and better stability, making it ideal for consumer electronics where quick boot-up times and rapid data access are essential.

The growing integration of NOR Flash across consumer electronics and automotive sectors is shaping the market’s trajectory. With ongoing innovations in smart devices and the automotive industry’s shift toward smart vehicles, demand for NOR Flash is set to climb.

Restraint

High Cost Compared to Other Flash Memory Types

A notable restraint in the NOR Flash market is its relatively higher cost compared to other flash memory types like NAND Flash. NAND Flash offers higher storage capacity at a lower cost, making it a preferred choice for many applications, particularly in sectors where large data storage is required, such as data centers and solid-state drives (SSDs).

To remain competitive, NOR Flash manufacturers face the challenge of optimizing costs without compromising performance. Innovations that could lower production costs or increase capacity without significant price hikes may help NOR Flash capture a broader market. However, until cost issues are addressed, NOR Flash will likely continue to face adoption challenges against NAND Flash and other more cost-efficient storage solutions.

Opportunity

Rising Application in Industrial and Automotive Sectors

NOR Flash memory presents significant opportunities, particularly in the industrial and automotive sectors, where durability, reliability, and high-speed data access are essential.

In the industrial domain, NOR Flash is used in various applications such as programmable logic controllers (PLCs), sensors, and human-machine interfaces (HMIs). These applications often operate in harsh environments, requiring memory solutions like NOR Flash that can withstand extreme temperatures and physical conditions without data loss.

Automotive electronics, especially autonomous vehicles, in particular, depend on reliable data storage for navigation, sensor data processing, and real-time decision-making, making NOR Flash invaluable. With the automotive industry’s shift towards smart, connected vehicles, NOR Flash is poised to become a critical component, enhancing vehicle safety, functionality, and user experience.

Challenge

Competition from Emerging Memory Technologies

A significant challenge for the NOR Flash market is the competition from emerging memory technologies, such as 3D NAND, MRAM (Magnetoresistive RAM), and ReRAM (Resistive RAM). These advanced memory types are gaining attention due to their ability to offer high storage densities, speed, and cost-efficiency.

For NOR Flash manufacturers, the challenge lies in innovating to stay competitive with these emerging technologies. They must find ways to improve the capacity, speed, and cost-efficiency of NOR Flash to retain relevance in a market that’s quickly shifting towards newer memory solutions. As companies continue to explore alternative memory technologies, NOR Flash needs to adapt by focusing on niche applications.

Emerging Trends

NOR Flash memory, known for its fast read speeds and data reliability, is evolving to meet modern demands in automotive, industrial, and IoT applications. A significant trend is the development of high-density, low-power NOR Flash, responding to the need for faster and more energy-efficient memory.

Another trend is the growing use of NOR Flash in automotive electronics, especially as advanced driver-assistance systems (ADAS) and autonomous vehicle technologies gain momentum. Automotive-grade NOR Flash is designed to endure extreme conditions, offering reliability in temperature-sensitive environments.

The rise of 3D NAND technologies initially overshadowed NOR Flash, but NOR has found renewed importance in critical sectors like aerospace and defense, where data retention and reliability are non-negotiable.

Business Benefits

NOR Flash offers key advantages for businesses, particularly in industries needing reliable, non-volatile memory with instant data access. For IoT and embedded device manufacturers, NOR Flash is a dependable choice for code storage and execution, making it possible to produce smart devices that are both power-efficient and capable of swift data retrieval.

In the automotive industry, NOR Flash provides business value through its high endurance and robust performance in extreme environments. For companies in this sector, NOR Flash’s capacity for remote updates means new features or security patches can be delivered to customers’ vehicles without a service visit.

For sectors like aerospace, industrial, and medical, NOR Flash’s reliability in data retention is invaluable. The robust nature of NOR Flash ensures critical systems operate reliably even in demanding environments, aligning with stringent safety standards. Its long-term data retention capability helps businesses in these sectors create solutions that require minimal maintenance and high reliability.

Regional Analysis

In 2023, the APAC region held a dominant market position in the NOR Flash market, capturing more than a 37% share with revenues amounting to USD 1.2 billion. This leadership is largely driven by several key factors that highlight the region’s strategic importance in the global electronics market.

APAC is home to several leading economies that are pivotal in the electronics manufacturing sector, including China, South Korea, and Taiwan. These countries host some of the world’s largest semiconductor manufacturing facilities, where NOR Flash is a critical component. The concentration of these manufacturing capabilities significantly contributes to the high volume of NOR Flash production and consumption within the region.

The APAC region has witnessed a surge in demand for consumer electronics, which often incorporate NOR Flash for efficient operation. This includes a wide range of products from mobile phones to home appliances and personal gadgets. The rapid urbanization and growing middle class in countries like India and China have expanded the consumer base, further propelling the demand for NOR Flash embedded devices.

According to the State Council, China’s consumer electronics industry has shown steady growth over recent years, driven by strong demand and manufacturing advances. In the first seven months of 2023, the sector saw significant profitability, with computer, communications, and electronic device manufacturers achieving profits totaling CNY 276.32 billion (about USD 38.39 billion). This rise in profits underscores the robust performance of the sector amid evolving global markets.

The production of mobile phones in China remains substantial, with output hitting 810 million units in 2023. Among these, 593 million were smartphones, highlighting the strong demand for high-tech devices and the continued expansion of the smartphone segment.

Governments in the APAC region have been actively supporting the semiconductor industry through various initiatives and investments, particularly in areas like chip development and IoT integration. These efforts are aimed at fostering innovation and securing a supply chain that increasingly relies on high-performance NOR Flash memory. Moreover, the region’s push towards smart cities and automotive advancements provides additional impetus for the NOR Flash market.

The automotive and industrial sectors in APAC are undergoing rapid growth and modernization, which extensively uses NOR Flash for applications ranging from advanced driver-assistance systems (ADAS) to industrial automation. The reliability and speed of NOR Flash make it ideal for these applications, ensuring APAC’s lead in its market share.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The NOR Flash memory market features several key players that drive innovation and growth in the industry. These companies focus on enhancing performance, expanding product offerings, and meeting the evolving needs of various sectors.

Infineon Technologies AG stands as a prominent leader in the NOR Flash market. Known for its innovation and quality, Infineon has carved out a significant presence worldwide. The company’s focus on reliability and the ability to meet the stringent demands of automotive and industrial applications have bolstered its market position.

Micron Technology Inc. is another influential name in the NOR Flash industry. With a broad portfolio of memory solutions, Micron caters to a diverse range of market segments, including consumer electronics, computing, and automotive industries. Micron’s NOR Flash memories are especially notable for their high-speed interface and low-power consumption, which are critical features for modern electronic devices.

GigaDevice Semiconductor Inc., based in China, is rapidly emerging as a key player in the NOR Flash sector. The company has made significant inroads in the global market with its competitive pricing and rapid innovation cycle. GigaDevice’s NOR Flash products offer a range of densities and speeds, catering to both consumer electronics and industrial applications.

Top Key Players in the Market

- Infineon Technologies AG

- Micron Technology Inc.

- GigaDevice Semiconductor Inc.

- Macronix International Co. Ltd

- Winbond Electronics Corporation

- Integrated Silicon Solution Inc.

- Microchip Technology Inc.

- Renesas Electronics Corporation

- Elite Semiconductor Microelectronics Technology Inc.

- Wuhan Xinxin Semiconductor Manufacturing Co. Ltd (XMC)

- Other Key Players

Recent Developments

- May 2023: GigaDevice introduced the GD25LE128EXH, a new 128Mb SPI NOR Flash. This memory is housed in a notably compact 3x3x0.4mm FO-USON8 package, making it ideal for applications in IoT, wearables, healthcare, and networking that demand high functionality with minimal power usage.

- June 19, 2023: Winbond Electronics Corporation announced the release of the W25Q80RV, an 8Mb 3V NOR Flash memory. This product is the first in a new series of serial flash devices that offer enhanced read performance in a small form factor.

- August 2024: Infineon launched the SEMPER X1 LPDDR Flash, marking a significant advancement in automotive electronics. This innovative LPDDR Flash memory is engineered for modern automotive electronic/electrical architectures, enhancing both safety and performance.

Report Scope

Report Features Description Market Value (2023) USD 3.15 Bn Forecast Revenue (2033) USD 6.7 Bn CAGR (2024-2033) 7.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Serial NOR Flash, Parallel NOR Flash), By Application (Consumer Electronics, Communication, Automotive, Industrial, Other Applications) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Infineon Technologies AG, Micron Technology Inc., GigaDevice Semiconductor Inc., Macronix International Co. Ltd, Winbond Electronics Corporation, Integrated Silicon Solution Inc., Microchip Technology Inc., Renesas Electronics Corporation, Elite Semiconductor Microelectronics Technology Inc., Wuhan Xinxin Semiconductor Manufacturing Co. Ltd (XMC), Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Infineon Technologies AG

- Micron Technology Inc.

- GigaDevice Semiconductor Inc.

- Macronix International Co. Ltd

- Winbond Electronics Corporation

- Integrated Silicon Solution Inc.

- Microchip Technology Inc.

- Renesas Electronics Corporation

- Elite Semiconductor Microelectronics Technology Inc.

- Wuhan Xinxin Semiconductor Manufacturing Co. Ltd (XMC)

- Other Key Players