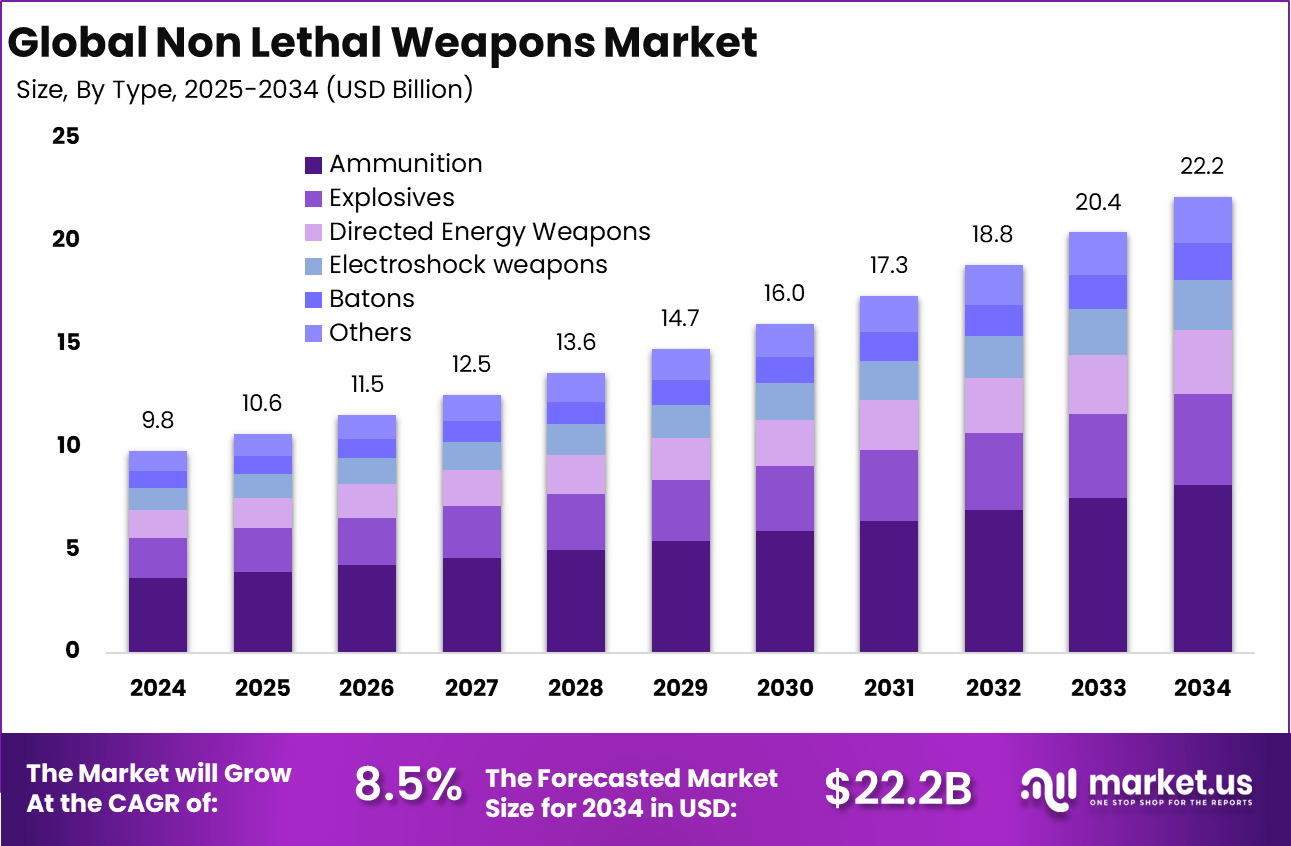

Global Non Lethal Weapons Market Size, Share, Industry Analysis Report By Type (Ammunition, Explosives, Directed Energy Weapons, Electroshock weapons, Batons, Others), By End-user (Law enforcement, Military, Civilian self-defense, Corrections facilities, Private security firms), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 157701

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

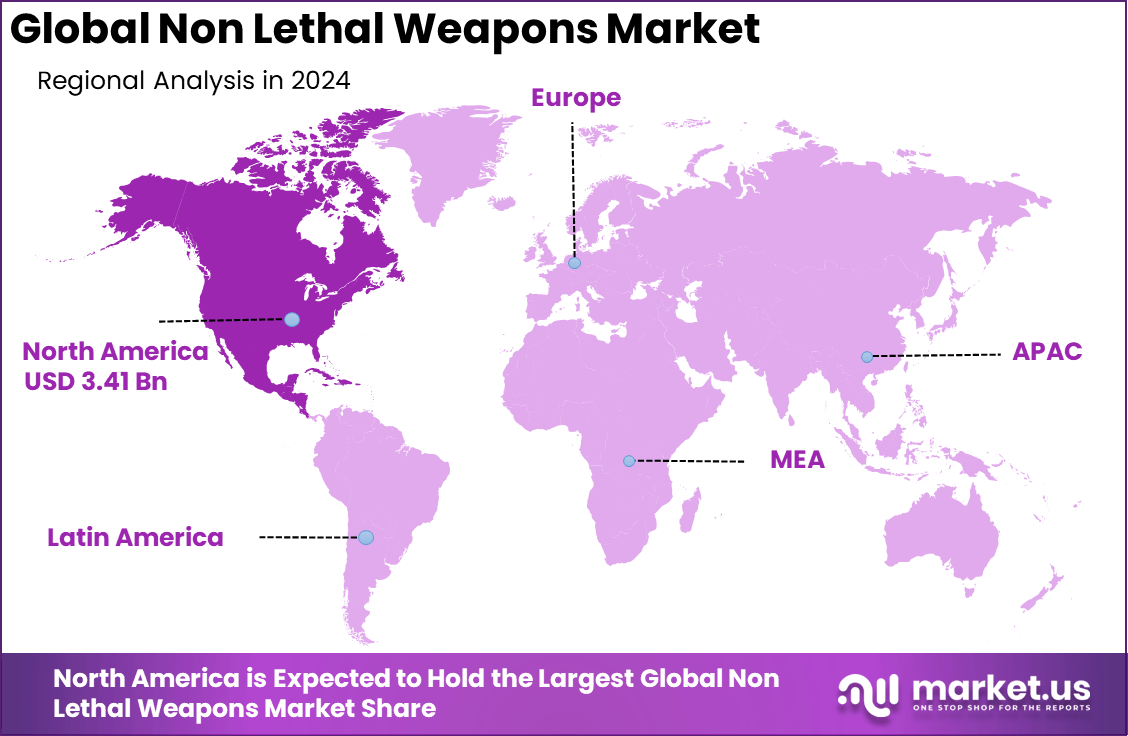

The Global Non Lethal Weapons Market size is expected to be worth around USD 22.2 billion by 2034, from USD 9.8 billion in 2024, growing at a CAGR of 8.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34.8% share, holding USD 3.41 billion in revenue.

The market for non-lethal weapons has gained significance in recent years as governments, law enforcement agencies, and military groups seek reliable instruments for crowd control and public safety without causing fatalities or permanent injuries. Non-lethal weapons are designed to incapacitate or deter individuals, commonly used in riot situations, protests, and urban security operations.

The growth of the non-lethal weapons market is driven by increasing demand for safer alternatives to lethal force in law enforcement and military operations. In response to rising concerns over human rights and public safety, governments and security agencies are seeking to reduce fatalities during crowd control, arrest procedures, and counter-terrorism operations.

The market is experiencing growing adoption of innovative technologies including directed-energy weapons, electromagnetic pulse modules, AI-powered “smart guns” and acoustic restraint devices. These instruments offer better precision, reduced risk of permanent harm, and can be swiftly deployed in large-scale urban operations. Integration of artificial intelligence and imaging sensors is helping tailor force levels and minimize accidental injuries during interventions.

For instance, in May 2024, EDGE, a leading advanced technology and defense group, announced the acquisition of 51% of Brazil-based CONDOR Non-Lethal Technologies. This acquisition aims to boost EDGE’s capabilities and propel the group to become a global leader in the highly specialized domain of non-lethal technologies.

Key Takeaway

- In 2024, the Ammunition segment led the market, holding 36.8% share.

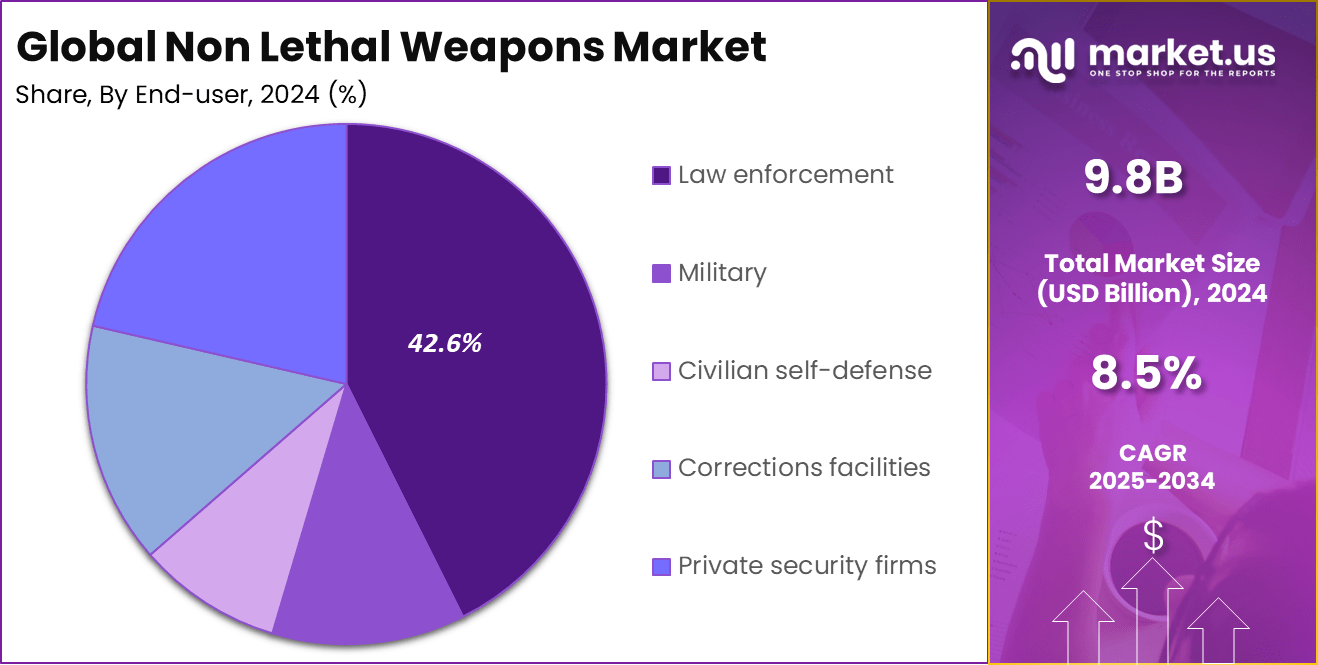

- The Law Enforcement segment was the top end-user, capturing 42.6% share.

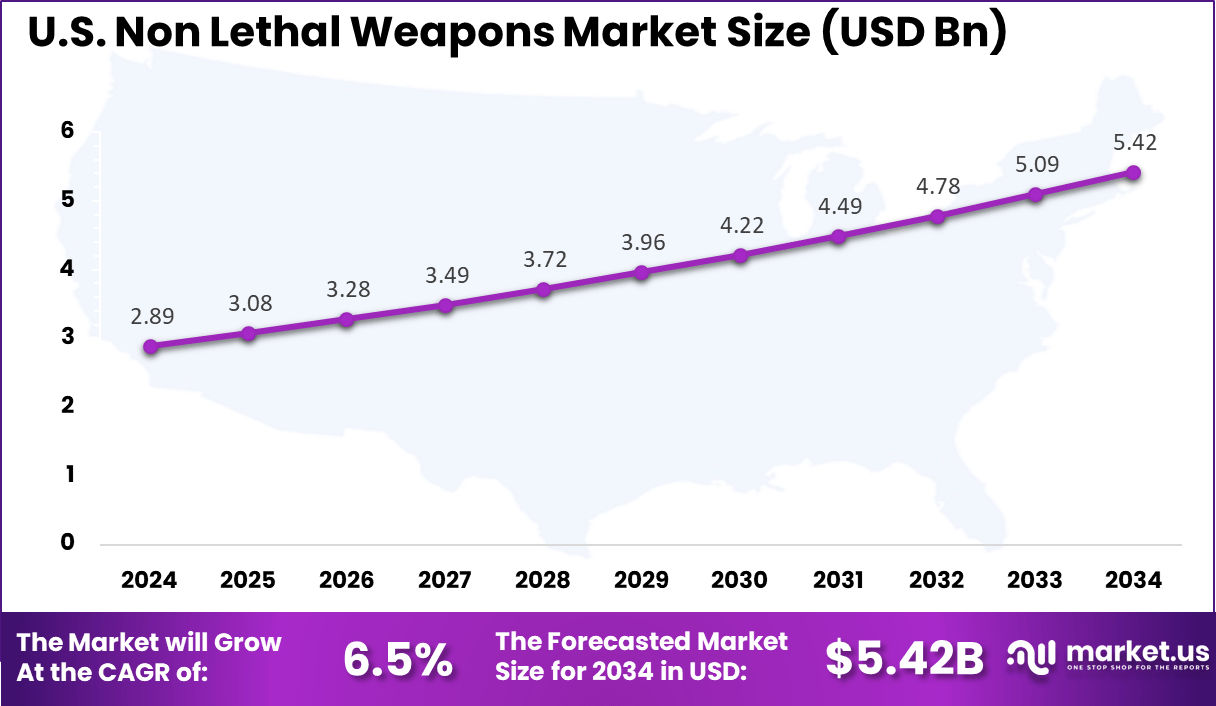

- The U.S. market reached USD 2.89 Billion in 2024, expanding at a steady 6.5% CAGR.

- North America dominated globally, securing 34.8% share of the market in 2024.

Analysts’ Viewpoint

The market for non-lethal weapons is experiencing rapid technological advancements. Improvements in directed-energy weapons, such as laser and microwave technologies, are offering more precise and effective means of incapacitation without physical harm. Additionally, innovations in taser technology, stun guns, and non-lethal projectiles, such as rubber bullets and bean bags, are enhancing the accuracy and reliability of these weapons.

For instance, In March 2024, the Maldives entered an agreement with China to secure free non-lethal military equipment and training, a move designed to reinforce the nation’s independence and operational autonomy. Alongside the deal, Maldives’ leaders engaged with Chinese military and financial officials to explore broader cooperation.

Non-lethal weapons are adopted for several key reasons, including the need to minimize fatalities during law enforcement interventions, enhance security protocols, and reduce the potential for legal ramifications associated with the use of deadly force. They are increasingly seen as essential tools for law enforcement agencies seeking to improve public safety while adhering to human rights standards.

Investment and Business Benefits

Investment opportunities in this sector are robust. Rising security concerns, regulatory mandates, and social advocacy for responsible policing have led to an influx of public and private capital into research and development of next-generation non-lethal solutions. There is strong interest in advanced materials, data-driven systems, and AI-powered restraint technologies, creating openings for manufacturers and solution developers to participate in tenders and pilot programs.

Business benefits include reduced operational risks, lower liability exposure for public safety agencies, and fewer negative outcomes in crowd-control scenarios. By embracing non-lethal systems, operators can meet compliance targets, protect officers and civilians, and maintain positive public opinion during high-profile incidents.

The regulatory environment surrounding non-lethal weapons is marked by the need for balance between security requirements and human rights protections. Global norms emphasize the minimization of harm and mandates for clear usage guidelines. Different countries maintain strict controls on deployment protocols, training standards, and product certification, which manufacturers must navigate to access new markets.

U.S. Market Size

The market for Non Lethal Weapons within the U.S. is growing tremendously and is currently valued at USD 2.89 billion, the market has a projected CAGR of 6.5%. The market is growing tremendously due to increasing concerns over police use of force and the need for safer crowd control methods.

The rising demand for tools that can de-escalate tense situations without causing fatalities has led law enforcement agencies to adopt non-lethal technologies like tasers, rubber bullets, and directed-energy systems. Additionally, stricter regulations and public scrutiny are driving the push for alternatives to deadly force, fostering widespread adoption of non-lethal solutions in both urban and military settings.

For instance, in April 2024, the U.S. Air Force Security Forces Center (AFSFC) explored updated non-lethal weapon options to enhance the capabilities of the U.S. defender force. This initiative underscores the ongoing commitment within the U.S. military to maintain its leadership in non-lethal weapon development.

In 2024, North America held a dominant market position in the Global Non Lethal Weapons Market, capturing more than a 34.8% share, holding USD 3.41 billion in revenue. This dominance is due to increasing investments in law enforcement and military modernization.

The region’s growing focus on enhancing public safety, reducing police brutality, and improving crowd control techniques has driven demand for advanced non-lethal technologies. Additionally, the region’s strong defense sector and significant government spending on research and development in non-lethal solutions, alongside strict regulations on the use of force, further fueled growth.

For instance, in August 2025, Next Dynamics completed the acquisition of Integrated Launcher Solutions, expanding its portfolio of non-lethal weapon systems. This acquisition strengthens North America’s dominance in the global non-lethal weapons market by enhancing the region’s capacity to develop and deploy advanced launcher systems for crowd control and law enforcement operations.

By Type: Ammunition (36.8%)

Ammunition products make up 36.8% of the Non Lethal Weapons Market, reflecting their crucial role in modern security operations. This segment mainly includes rubber bullets, bean bag rounds, paintballs, and other projectiles designed to incapacitate or deter targets without causing fatal injuries.

The widespread use of non-lethal ammunition is driven by its effectiveness in de-escalating volatile encounters, managing civil unrest, and crowd control situations. Law enforcement and military agencies prefer these options since they can subdue suspects or control protest activities with minimal risk of permanent harm.

For Instance, in June 2025, discussions around the use of rubber bullets in crowd control gained renewed attention following protests in Los Angeles. Rubber bullets, a form of non-lethal ammunition, have been widely used by law enforcement for crowd control.

Technological innovation continues to enhance the capabilities of non-lethal ammunition. Advancements in design are focusing on precision impact, reduced injury risk, and improved delivery systems, making these tools more adaptable for different operating scenarios. The need for reliable, cost-effective, and safer alternatives to conventional ammunition further boosts demand, especially as global trends shift toward minimizing casualties during public safety incidents.

By End-user: Law Enforcement (42.6%)

Law enforcement agencies account for 42.6% of the Non Lethal Weapons Market, underscoring their reliance on these solutions to uphold safety and order. Non-lethal weapons have become indispensable for police forces in protests, riots, and crowd management, supporting the goal of minimizing fatalities and reducing the use of lethal force.

Tools such as stun guns, tear gas, tasers, and acoustic devices offer law enforcement a versatile toolkit for various operational needs, from criminal apprehension to civil disturbance resolution. The rising incidence of public demonstrations and social unrest worldwide has amplified the demand for non-lethal weapons among law enforcement bodies.

Agencies increasingly invest in training, technology integration, and the procurement of diverse non-lethal devices to address evolving security challenges. Ethical and legal considerations, public scrutiny, and the requirement for proportional force drive ongoing development in this segment. Law enforcement is expected to remain the leading end-user group as governments and communities advocate for safer policing solutions and improved outcomes in public security events.

For instance, in March 2025, the Los Angeles Police Department (LAPD) expanded its use of non-lethal weapons, including advanced tasers and pepper ball launchers, for crowd control and suspect apprehension. This move reflects the increasing trend among law enforcement agencies to adopt non-lethal solutions as part of their efforts to reduce fatalities and minimize the use of deadly force.

Key Market Segments

By Type

- Ammunition

- Rubber bullets

- Bean bag rounds

- Plastic bullets

- Wax bullets

- Flash bang rounds

- Others

- Explosives

- Gases and sprays

- Water cannons

- Scent-based weapons

- Teargas

- Pepper spray

- Others

- Directed Energy Weapons

- High Energy Lasers (HEL)

- Millimeter wave weapons

- High power microwave weapons

- Particle beam weapons

- Electroshock weapons

- Tasers

- Stun guns

- Batons

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

By End-user

- Law enforcement

- Military

- Civilian self-defense

- Corrections facilities

- Private security firms

Drivers

Law Enforcement Adoption

Law enforcement agencies are increasingly adopting non-lethal weapons as a safer alternative to lethal force. These tools enable officers to subdue suspects without causing fatal injuries, reducing the risk of legal liability and public backlash.

Non-lethal weapons, such as tasers and rubber bullets, provide a way to control dangerous situations while minimizing harm, making them vital for modern policing strategies. This adoption helps build trust with the public by showing a commitment to using less lethal means of enforcement.

For instance, in April 2025, Senators Hagerty and Gallego reintroduced bipartisan legislation aimed at supporting the increased use of non-lethal weapons for law enforcement. The proposed legislation highlights the growing emphasis on providing law enforcement agencies with non-lethal tools, such as advanced tasers, directed energy devices, and other technologies, to help manage public safety more effectively.

Restraint

Ethical and Legal Concerns

While non-lethal weapons are designed to minimize harm, their use can still raise serious ethical and legal concerns. There’s always a risk of misuse, overuse, or unintended injuries, which could spark public backlash or lead to lawsuits.

In some cases, non-lethal weapons may still cause severe harm, or they could be perceived as tools for oppression, particularly in politically sensitive contexts. This ethical dilemma complicates their widespread acceptance and raises questions about the responsibility of their use.

For instance, in March 2023, Amnesty International reported that dozens were killed and thousands maimed globally due to the police misuse of rubber bullets. The widespread misuse of non-lethal weapons like rubber bullets has raised serious ethical and legal concerns. While designed to minimize fatalities, these weapons have been linked to unintended harm, including fatalities and severe injuries, when not deployed properly.

Opportunities

Advancements in Technology

The rapid advancements in non-lethal weapon technology offer exciting opportunities for market growth. Innovations like more powerful tasers, directed-energy weapons, and acoustic devices are making non-lethal options safer, more effective, and more versatile.

These advancements allow for more precise control in managing crowds or subduing suspects, reducing the likelihood of injury while improving operational efficiency. As research and development continue, new technologies will likely emerge, broadening the scope of non-lethal weapons and expanding their use across various sectors, including law enforcement and military.

For instance, in January 2025, PepperBall launched “The Burst,” a game-changing non-lethal tool for crowd control. This new device offers a highly effective means of subduing crowds and individuals while minimizing harm. It combines precision, efficiency, and non-lethal force, making it an essential tool for law enforcement agencies handling volatile situations.

Challenges

Dependence on Training and Operational Expertise

Non-lethal weapons, while effective, require careful handling and proper training to ensure their safe and appropriate use. Effective deployment requires thorough training and operational expertise, as improper use can lead to unintended consequences.

The deployment of non-lethal weapons without sufficient knowledge and skill may escalate situations or cause harm, potentially undermining their intended purpose. Therefore, the success of these weapons heavily relies on comprehensive training programs for law enforcement and military personnel.

For instance, In June 2025, the U.S. Marines carried out specialized training in Los Angeles that focused on non-lethal weapons for urban operations. The exercises highlighted the need for soldiers to develop the right skills to handle these weapons safely and effectively. This approach was aimed at reducing the chances of excessive force and limiting civilian harm during crowd control and urban combat scenarios.

Key Players Analysis

In the non lethal weapons market, several manufacturers play a central role in shaping global demand. Companies such as AMTEC Less-Lethal Systems Inc., Axon Enterprise, Inc., BAE Systems, and Byrna Technologies Inc. are recognized for their advanced product lines, including electroshock devices, impact munitions, and chemical irritants.

Another group of key players includes Combined Systems, Inc., Condor Non-Lethal Technologies, Fiocchi Munizioni S.p.A., FN Herstal, and Genasys Inc. These companies have expanded portfolios covering tear gas, rubber bullets, acoustic devices, and less lethal launchers. Their competitive edge lies in the ability to customize solutions for military and police agencies worldwide.

In addition, firms such as ISPRA, Lamperd Less Lethal, NonLethal Technologies, Inc., PepperBall Technologies, Inc., Raytheon Technologies, Rheinmetall AG, RTX Corporation, RUAG Ammotec, Safariland, LLC, Taser International, UTS United Tactical Systems, LLC, and Zarc International, Inc. collectively contribute to market expansion. Their expertise ranges from pepper-based projectiles to advanced launch systems and smart targeting technologies.

Top Key Players in the Market

- AMTEC Less-Lethal Systems Inc.

- Axon Enterprise, Inc.

- Bae Systems

- Byrna Technologies Inc.

- Combined Systems, Inc.

- Condor Non-Lethal Technologies

- Fiocchi Munizioni S.p.A.

- FN Herstal

- Genasys Inc

- ISPRA

- Lamperd Less Lethal

- NonLethal Technologies, Inc.

- PepperBall Technologies, Inc

- Raytheon Technologies

- Rheinmetall AG

- RTX Corporation

- RUAG Ammotec

- Safariland, LLC

- Taser International

- UTS United Tactical Systems, LLC (Pepperball)

- Zarc International, Inc.

- Others

Recent Developments

- In August 2025, Condor Non-Lethal Technologies partnered with Hungary’s 4iG S&D to establish a hub for advanced non-lethal solutions. This collaboration aims to enhance the development, manufacturing, and distribution of innovative non-lethal technologies, focusing on improving security systems and crowd control solutions.

- In March 2025, Byrna Technologies was recognized as a growing leader in non-lethal launchers. The company has seen significant growth due to the increasing demand for non-lethal weapons, especially its Byrna launchers, which are designed for self-defense and crowd control.

- In February 2024, AARDVARK entered into a new partnership with Combined Systems, Inc. to distribute less-lethal products and Penn arms launchers. This development ended its 25-year exclusive relationship with another manufacturer, marking a clear shift in strategy. The move reflects the company’s intent to diversify its portfolio and strengthen its position in the evolving less-lethal weapons market.

- In March 2024, Axon announced that its TASER 10 won the 2023 Good Design Award in the Safety and Security category. This recognition highlighted not only the product’s advanced design but also its role in improving public safety standards. By integrating innovation with functionality, the TASER 10 demonstrates how less-lethal solutions are gaining acceptance as reliable tools for law enforcement.

Report Scope

Report Features Description Market Value (2024) USD 9.8 Bn Forecast Revenue (2034) USD 22.2 Bn CAGR(2025-2034) 8.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Ammunition, Explosives, Directed Energy Weapons, Electroshock weapons, Batons, Others), By End-user (Law enforcement, Military, Civilian self-defense, Corrections facilities, Private security firms) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AMTEC Less-Lethal Systems Inc., Axon Enterprise, Inc., Bae Systems, Byrna Technologies Inc., Combined Systems, Inc., Condor Non-Lethal Technologies, Fiocchi Munizioni S.p.A., FN Herstal, Genasys Inc., ISPRA, Lamperd Less Lethal, NonLethal Technologies, Inc., PepperBall Technologies, Inc., Raytheon Technologies, Rheinmetall AG, RTX Corporation, RUAG Ammotec, Safariland, LLC, Taser International, UTS United Tactical Systems, LLC (Pepperball), Zarc International, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Non Lethal Weapons MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Non Lethal Weapons MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AMTEC Less-Lethal Systems Inc.

- Axon Enterprise, Inc.

- Bae Systems

- Byrna Technologies Inc.

- Combined Systems, Inc.

- Condor Non-Lethal Technologies

- Fiocchi Munizioni S.p.A.

- FN Herstal

- Genasys Inc

- ISPRA

- Lamperd Less Lethal

- NonLethal Technologies, Inc.

- PepperBall Technologies, Inc

- Raytheon Technologies

- Rheinmetall AG

- RTX Corporation

- RUAG Ammotec

- Safariland, LLC

- Taser International

- UTS United Tactical Systems, LLC (Pepperball)

- Zarc International, Inc.

- Others